2017 Redux Continues in Toronto

03/08/20

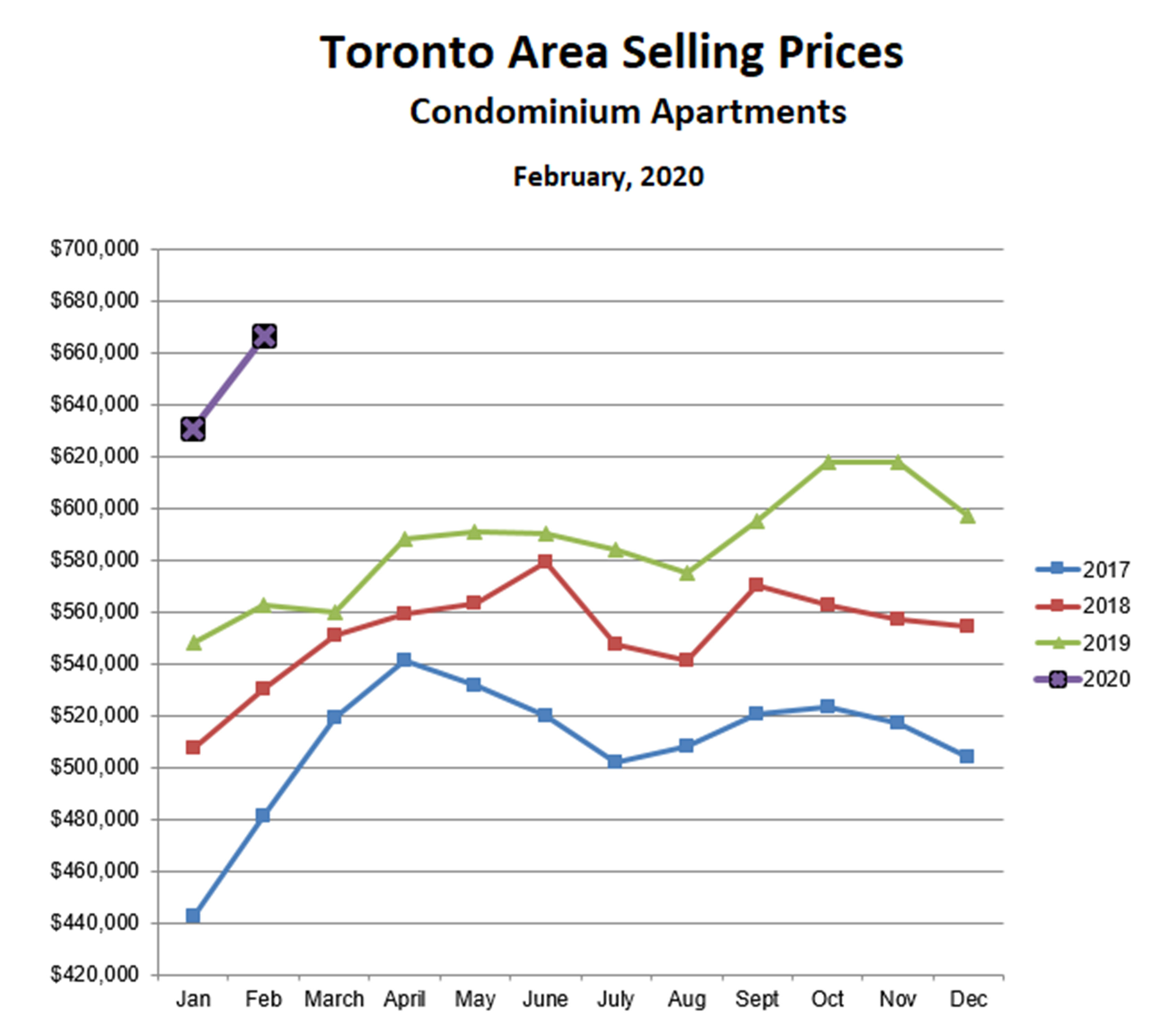

Prices for both condominium and freehold properties continued upward in February, following the trail blazed in early 2017. The market for condominium apartments, in particular, is on fire, with prices 22% higher than last February and 8% higher than the most recent all-time high reached last November.

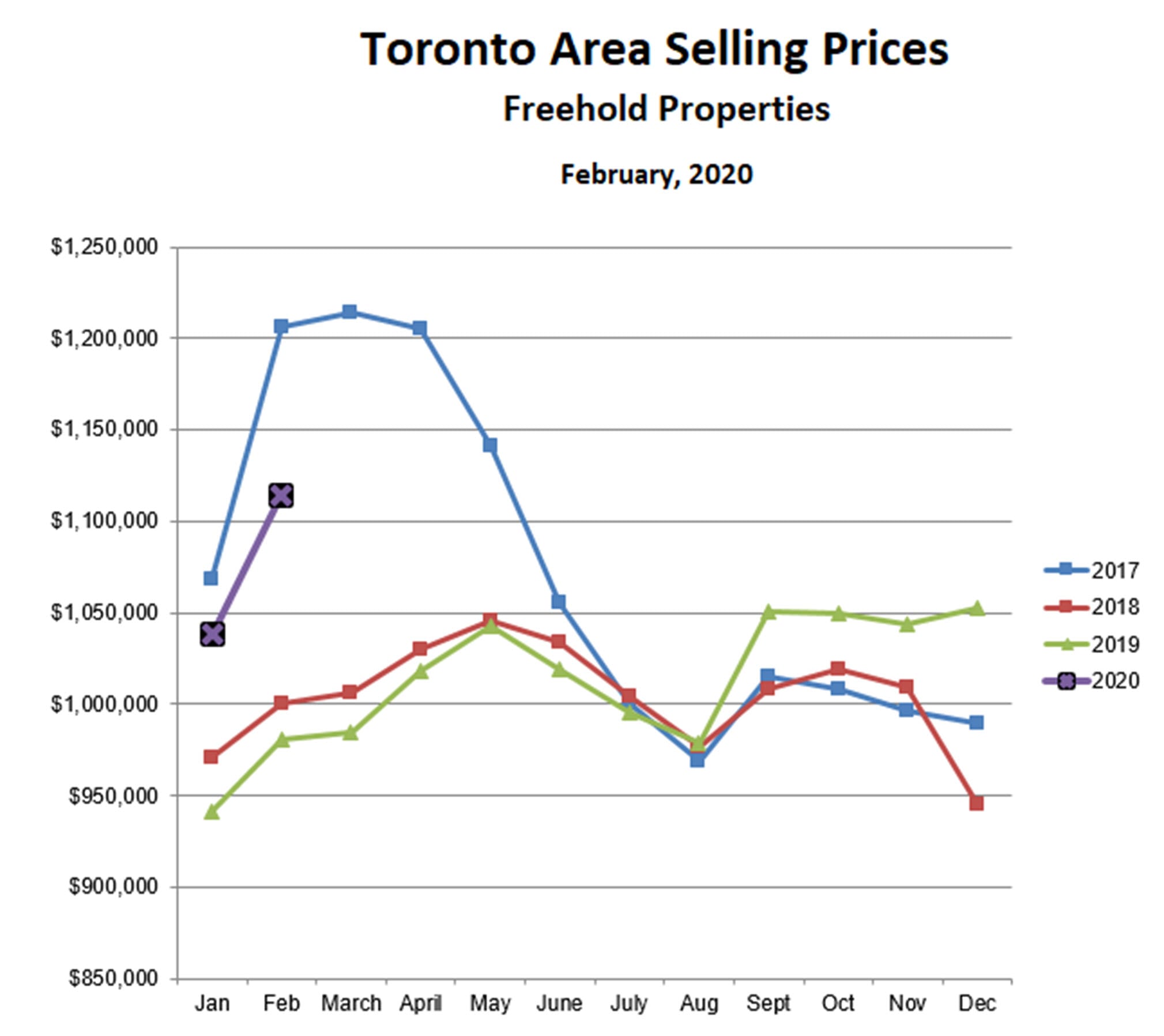

Prices for freehold properties (mostly detached homes) also moved higher in February, to 14% above last year and within 10% of the ‘bubble peak’ reached in March of 2017.

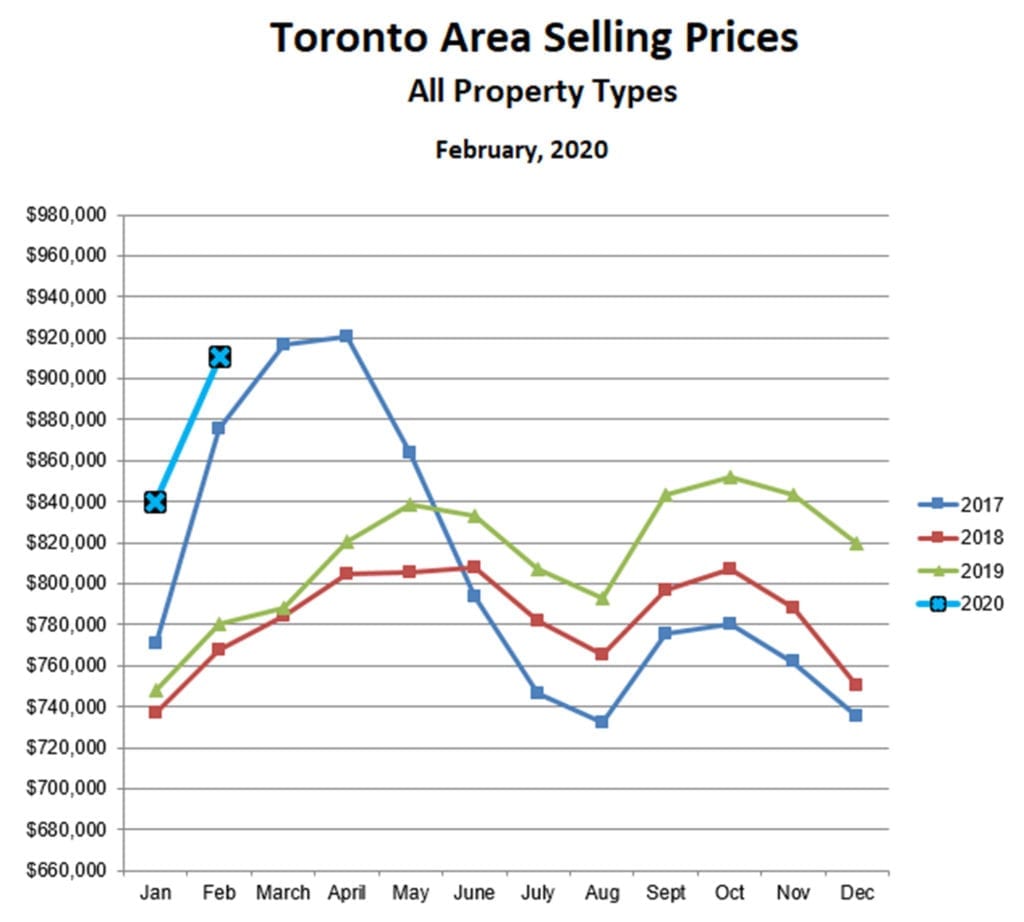

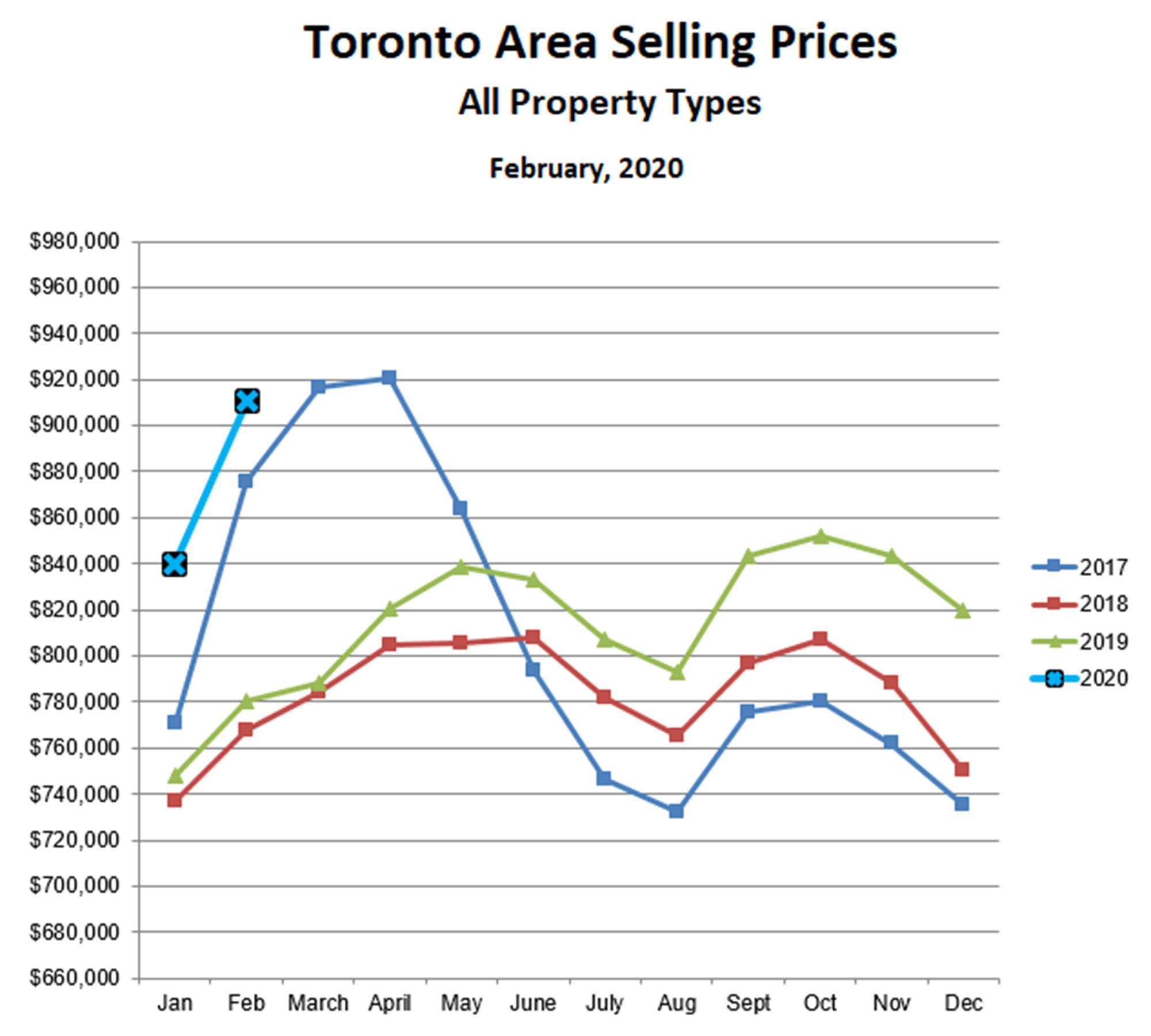

While condominium and freehold prices have followed very different pathways over the past three years since the 2017 bubble collapsed, the 2020 chart for all property types is eerily similar to 2017. Average prices in February for all properties combined were actually 4% higher than in 2017!

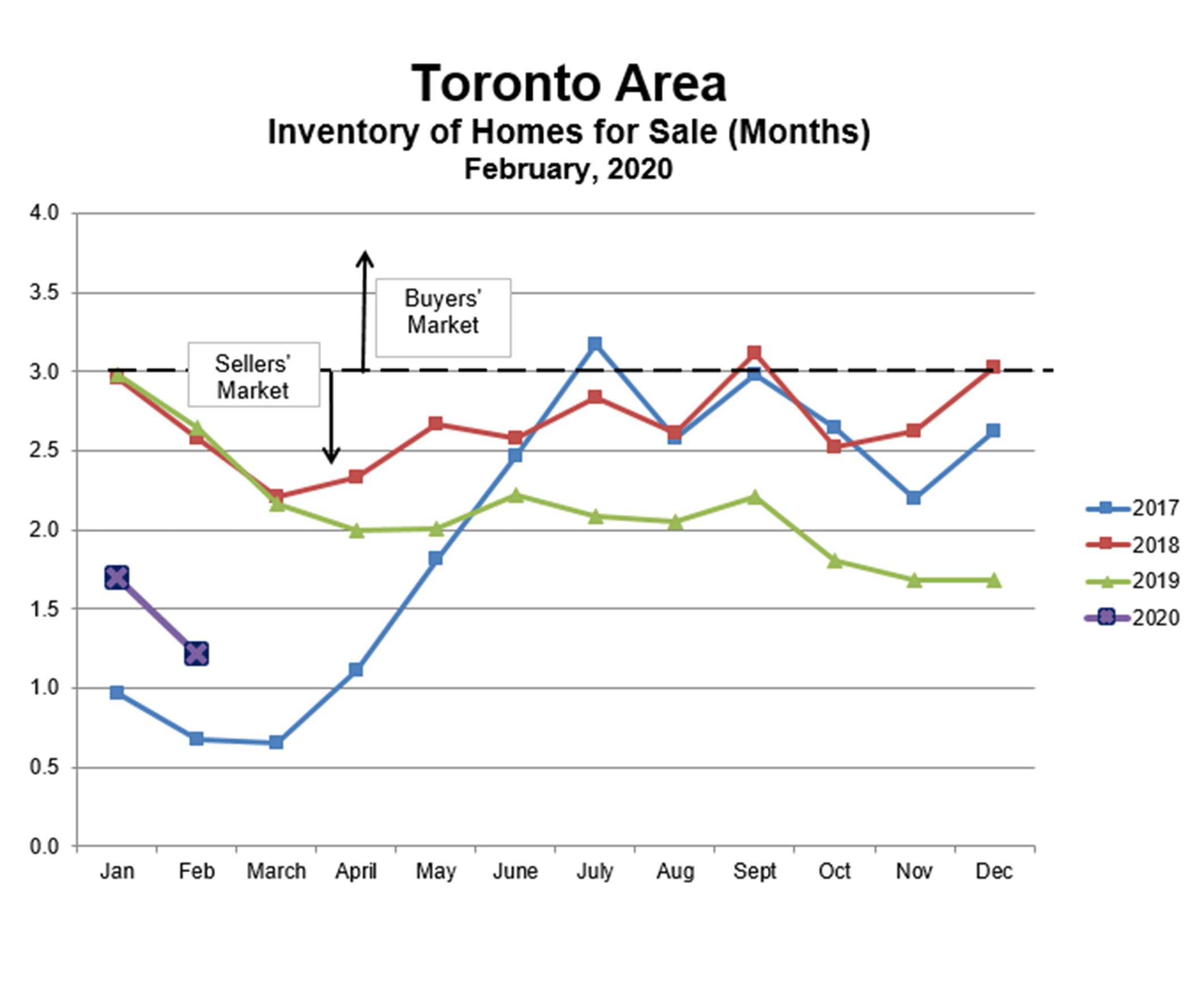

Just like in 2017, the strength of the market corresponds to low and falling inventory of homes for sale. As we have discussed previously, at some point the falling inventory/rising price pattern becomes self-reinforcing and self-accelerating, and we have probably reached that point already.

It seems clear that another 2017-like bubble is forming right before our eyes, and the recent mortgage interest rate reductions will probably add kerosene to the flames. The pin that burst the bubble in 2017 was called the “Ontario Fair Housing Plan”, a 16 point piece of government legislation that included a 15% foreign buyers’ tax. Maybe this year’s pin will be called COVID-19?

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!