Month: February 2020

Just Sold – Renovated Etobicoke Townhome

02/28/20

Welcome to 102 Resurrection Road, a two bedroom + den townhome in an ideal location close to subway & GO stations, Islington Village shops & restaurants, great schools, parks, and with easy access to major highways, airport and downtown.

This tastefully renovated three level townhome has an open plan living room/dining room/kitchen on the 2nd floor with a walk-out to a balcony (gas BBQ’s allowed!) and pot lighting throughout. There are custom built-in cabinets & entertainment centre in the living/dining area, and the renovated white kitchen has granite counters, a breakfast bar, and pendant lighting.

The upper level has two spacious bedrooms, each with plenty of closet space, and a spa-like bathroom with a soaker tub and a separate shower.

The main floor has a den with custom built-in cabinetry (potential 3rd bedroom), a renovated 2 piece bathroom, and access to the built-in garage.

There are hardwood floors and custom California shutters throughout all three levels.

What a great opportunity for investors or first time buyers!

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Changes Coming To The Mortgage Stress Test

02/22/20

The ‘stress test’ for mortgage qualification in Canada requires that homebuyers must qualify for a mortgage as if the mortgage interest rate were higher than the actual rate they will get. The idea is to determine that the applicant will be able to keep up with the payments if interest rates should rise. That ‘higher rate’ is either the actual interest rate + 2% or the governments “Mortgage Qualification Rate” (MQR), whichever is greater.

Until now, the MQR has been equal to the mode of the chartered banks’ posted rates, however, as of April 6, the MQR will be the weekly median 5-year fixed insured mortgage rate from mortgage insurance applications, plus 2%. This will make the MQR more directly responsive to changes in actual mortgage rates, as the rates posted by the chartered banks are largely for show and do not closely follow the ‘real’ rates they charge to mortgage lenders.

For now, the change in the MQR only applies to insured mortgages, though it seems likely that it will be extended to uninsured mortgages as well.

This is a pretty small tweak to the stress test, and won’t make a significant difference to how much a lender can qualify for. The biggest impact will be on responsiveness – the new MQR will change on a weekly basis as mortgage rates change, not just whenever the banks decide to change their posted rates.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Toronto Market Continues to Accelerate

02/08/20

It’s beginning to look a lot like 2017.

Three years ago we had an insane spring market, with house prices rocketing upward by 20% and then crashing back down to where they started. The entire process only took about five months from beginning to end. The bubble was driven primarily by extremely low inventory of homes for sale and ended because of Ontario government legislation aimed (very successfully) at cooling off the market.

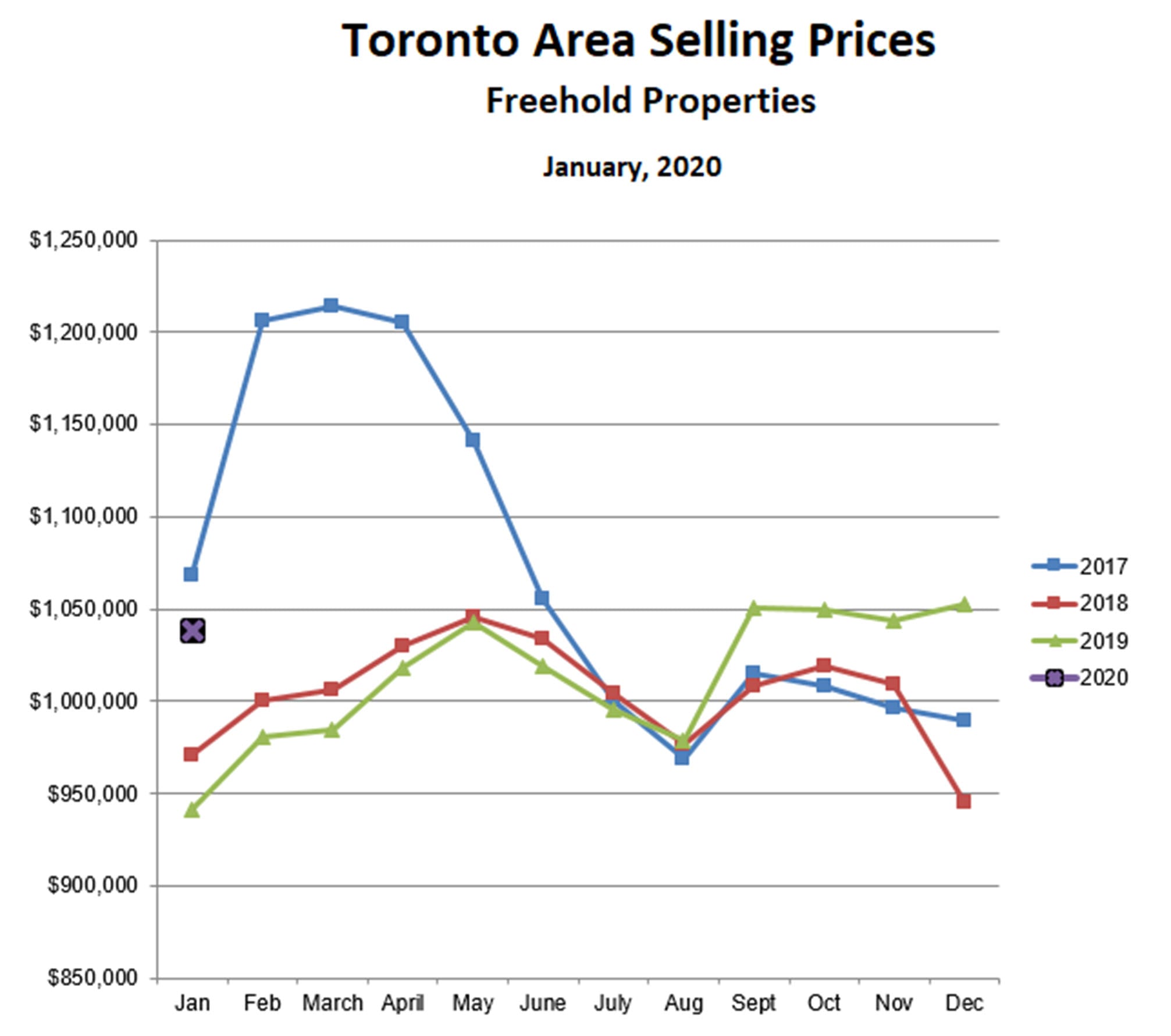

Following the collapse of the 2017 bubble, prices for freehold properties remained flat to slightly declining for the next two years. Then, last September, house prices increased sharply and continued to strengthen right through December, when normally the market sags a bit. The trend is continuing this year. Although January house prices are slightly below December, they are 10% higher than last January, and not far from the average price in January 2017.

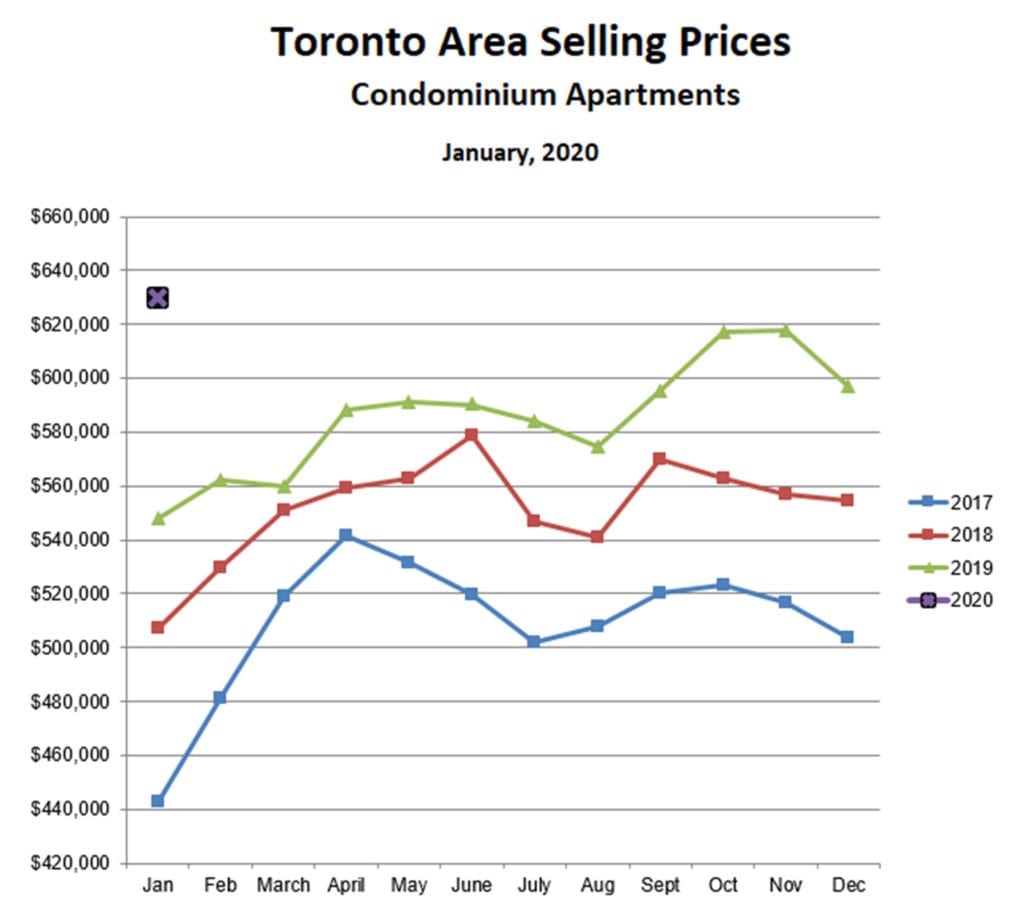

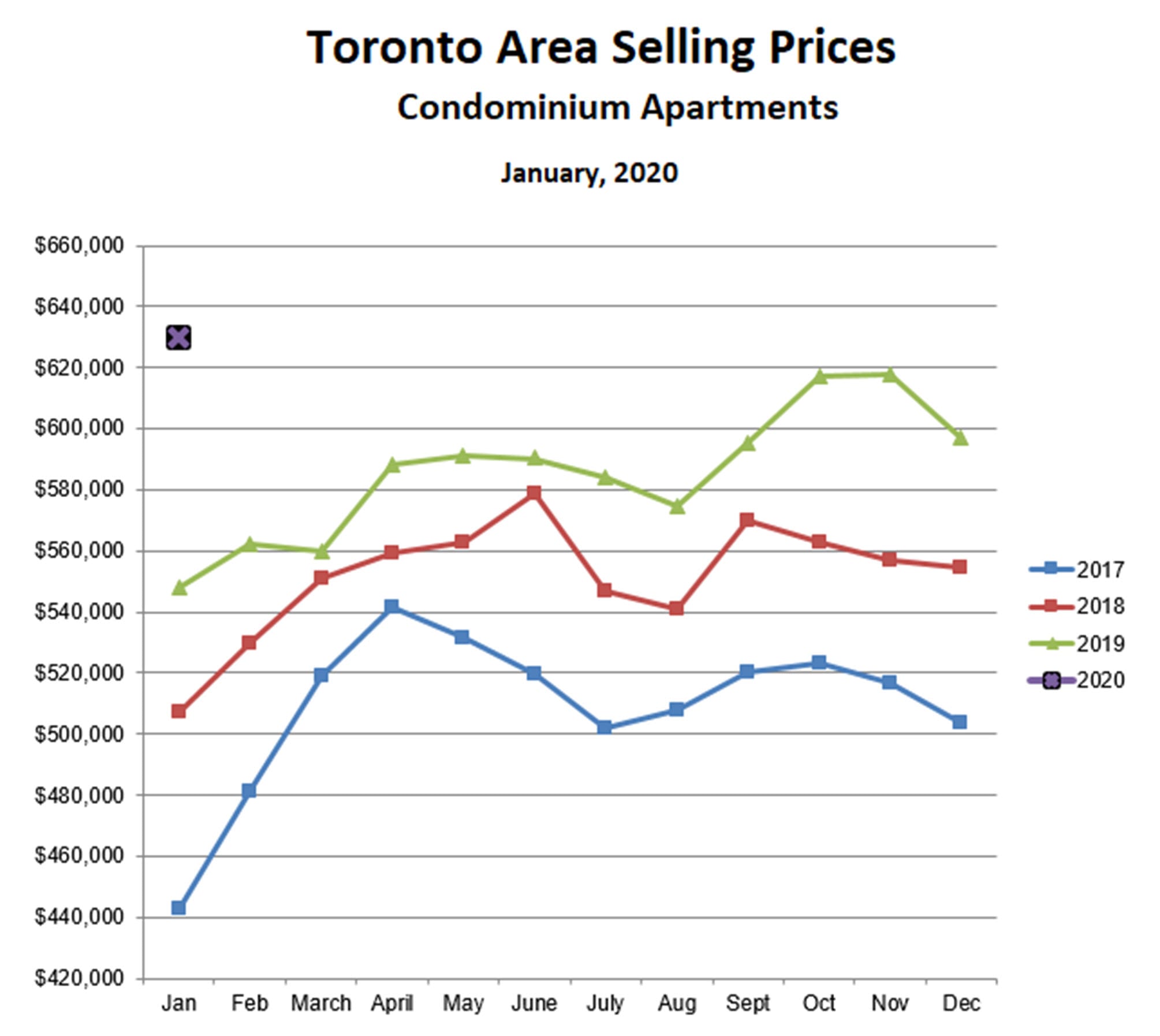

The market for condominium apartments in the GTA is even stronger than for houses. Back in 2017, condo prices also increased dramatically in the spring (by more than 20%) and also pulled back after April. However, condo prices did not collapse all the way back to where they started, and have continued to push higher ever since. Condo prices in January were 5% higher than December, 15% higher than last January, and 16% higher than the ‘bubble peak’ in April of 2017. While affordability (vs houses) is obviously one reason why the condo market is so strong, it is perhaps not the most important reason. The rental market in the GTA is extraordiarily tight and in fact could be described as a crisis situation. There simply aren’t enough rental units available to satisfy the steadily increasing demand. The primary source of new rental units is condominium apartments, and so condos have become very attractive to investors, to the point where they are starting to ‘crowd out’ end users. Also, many move-up buyers who bought condos a few years ago and now want a house are deciding to keep the condo for the rental income instead of putting it up for sale. The bottom line is that the demand for condos is growing faster than the supply.

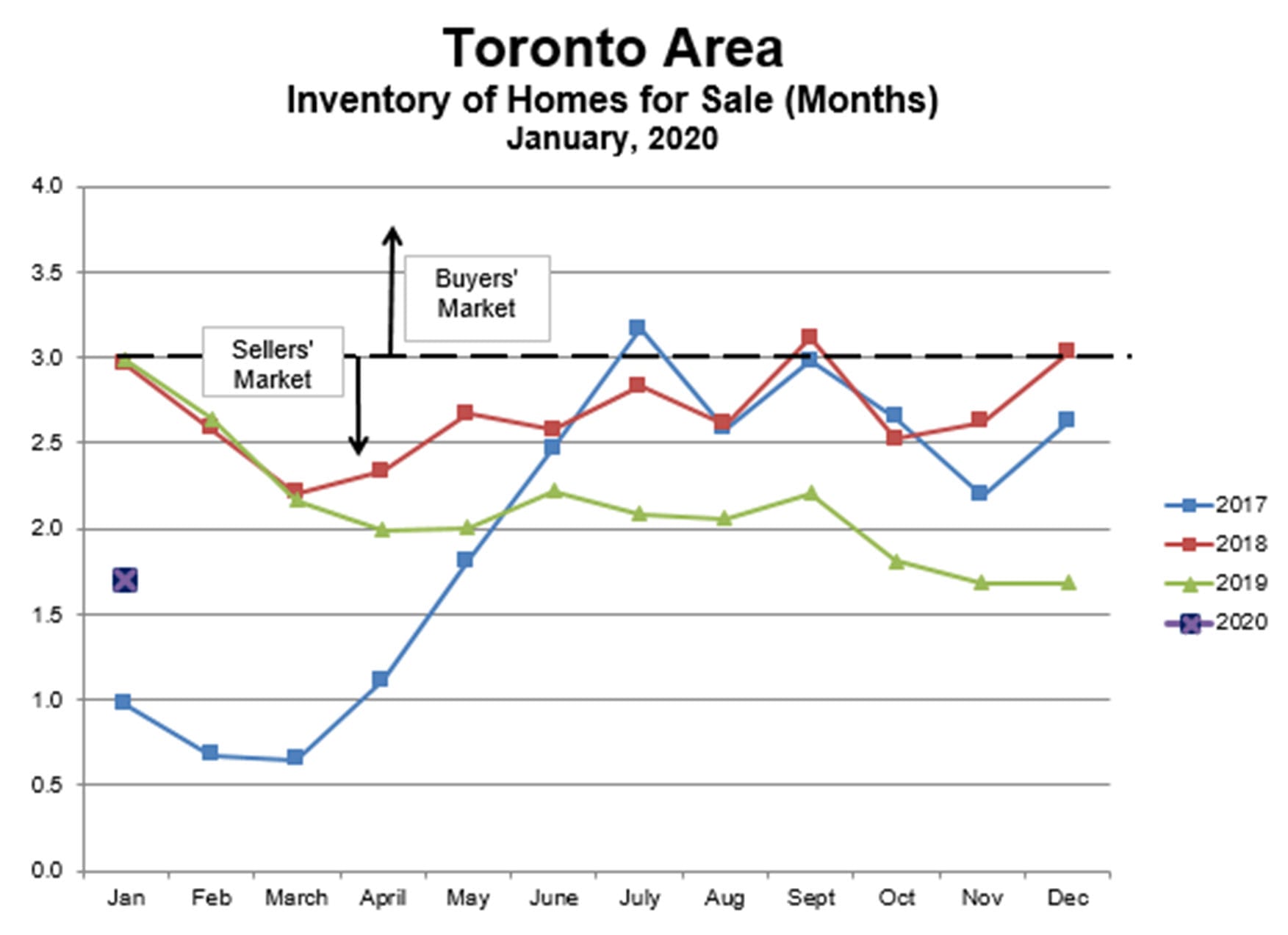

The increasing demand for both houses and condos relative to supply is reflected in the steadily declining inventory of homes for sale. For the past four months, overall inventory has been at less than 2 months’ supply, very deep in ‘sellers’ market’ territory, and lower than at any time since the 2017 bubble. While we still have a ways to go to match the extremely low (less than 1 month’s supply) levels seen in early 2017, we are definitely trending in that direction. We are getting close to the point where the increases in the market become self-reinforcing, if we aren’t already there. As inventory falls, it gets harder to find a house to buy and easier to sell the house you’ve got. So more and more move-up buyers decide to buy first before they put their house up for sale and, since a high proportion of homes for sale belong to move-up buyers, this means that the tighter the market gets, the more it tends to get even tighter.

Unless the government once again decides to intervene to cool off the market… and as long as the coronavirus outbreak soon comes under control… and as long as there are no dramatically negative financial, economic or geopolitical events, the spring market should continue to be very strong for at least the next 3-4 months.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Spacious High Park Detached

02/08/20

Welcome to 280 Keele Street, a spacious three storey home in Toronto’s trendy Junction neighbourhood. This generous property would make a wonderful single-family home, and could also easily be turned into a three-unit residence.

Step into the grand foyer, which boasts beautiful, original wood trim and a massive front hall closet. French doors lead to the living area with a working fireplace and custom, original hardwood flooring in a unique pattern. A second set of French doors open to a large dining room with soaring ceilings. The main floor also features a conveniently located four-piece bathroom, an airy kitchen with a double sink and ample storage, and a bright sunroom that walks out to a deck and a large backyard, perfect for entertaining.

The expansive second level has four bedrooms, including a roomy master with a large closet and a triptych bay window. The second bedroom has a large closet as well. This level also features original hardwood flooring and trim throughout and another four-piece bathroom. The third level has two large, additional rooms with lots of closet space. The third level has rough-in plumbing for a potential kitchen, and it would be easy to convert the 2nd and 3rd floors into a very spacious two level apartment. The main floor could, in turn, serve as a separate one bedroom apartment.

The lower level is already designed as its own unit with a separate entrance. It features a kitchen, four-piece bathroom, living/dining area, bedroom, laundry, and ample storage.

A licensed parking pad at the front of the house makes it easy to park your vehicle, and this home is also steps from the TTC (41 Keele, 89 Weston, and 26 Dupont buses), a short ten-minute walk to Keele station, and is close to the Go and UP Transit’s Bloor Station and the West Toronto Railpath. 280 Keele is in a sought-after school district, falling in the catchment for Annette St. Jr. and Sr. Public, Humberside CI, and Western Tech. The vibrant Junction strip on Dundas is steps away, with its robust collection of restaurants, bars, and shopping.

With its terrific location, ample space, and adaptable layout, this spacious home is just waiting for you to move in!

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Mortgage Rates Are Falling, But This May Not Affect Prices

02/07/20

Largely because of the Novel Coronavirus and the resultant ‘flight to safety’ among investors, Government of Canada bond prices are being bid up, and this means that the corresponding interest rates are falling (bond prices and interest rates move in opposite directions). The major banks’ fixed mortgage rates are tied to these bond rates, and so they are falling too. However, these lower rates don’t automatically mean that homebuyers will be able to qualify for larger mortgages. Here’s why.

The federal government introduced new lending rules two years ago. These rules require that all mortgage lenders qualify based upon either the government of Canada’s ‘benchmark’ rate or the actual mortgage rate plus 2%, whichever is higher. This means that lower mortgage rates will not change lenders’ ability to qualify unless the government’s benchmark rate is also reduced.

Recently TD Canada Trust reduced it’s posted 5 year rate from 5.43% to 4.99%, in line with the reductions in it’s ‘actual’ fixed mortgage rates, and this could lead other major banks to follow suit. If all the major banks lower their posted rates, this could induce the government to reduce it’s benchmark rate by a similar amount. Then, and only then, will homebuyers be able to qualify for larger mortgage loans.

The GTA real estate market has been heating up steadily over the past few months without any change in the benchmark rate, and so it is quite possible that the government will decide to leave the benchmark rate where it is to avoid adding fuel to the fire and potentially causing or facilitating another 2017-like price bubble. It’s also possible that bond prices will retreat once the coronavirus crisis has passed, and the government may want to avoid “yo-yoing” their benchmark rate. For both of these reasons, I’m not expecting a quick reduction in the mortgage qualification rate. It’s even possible that the government rate could be increased if they feel this is needed to cool down the market.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!