COVID-19 Thins Out Toronto Market

04/08/20

Oh what a difference a month has made.

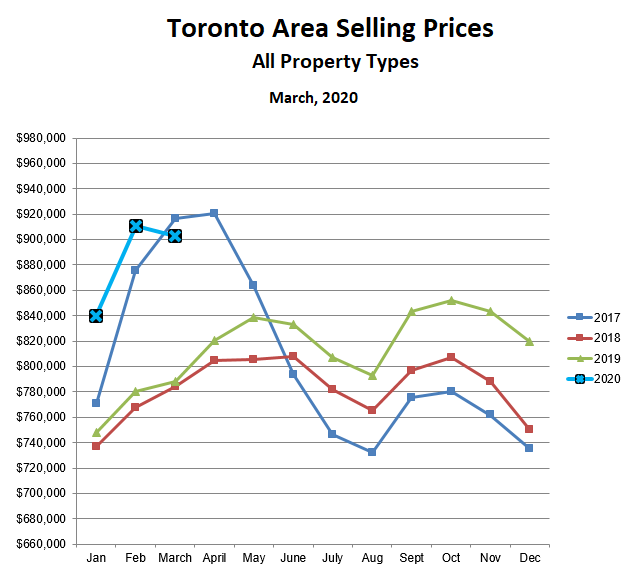

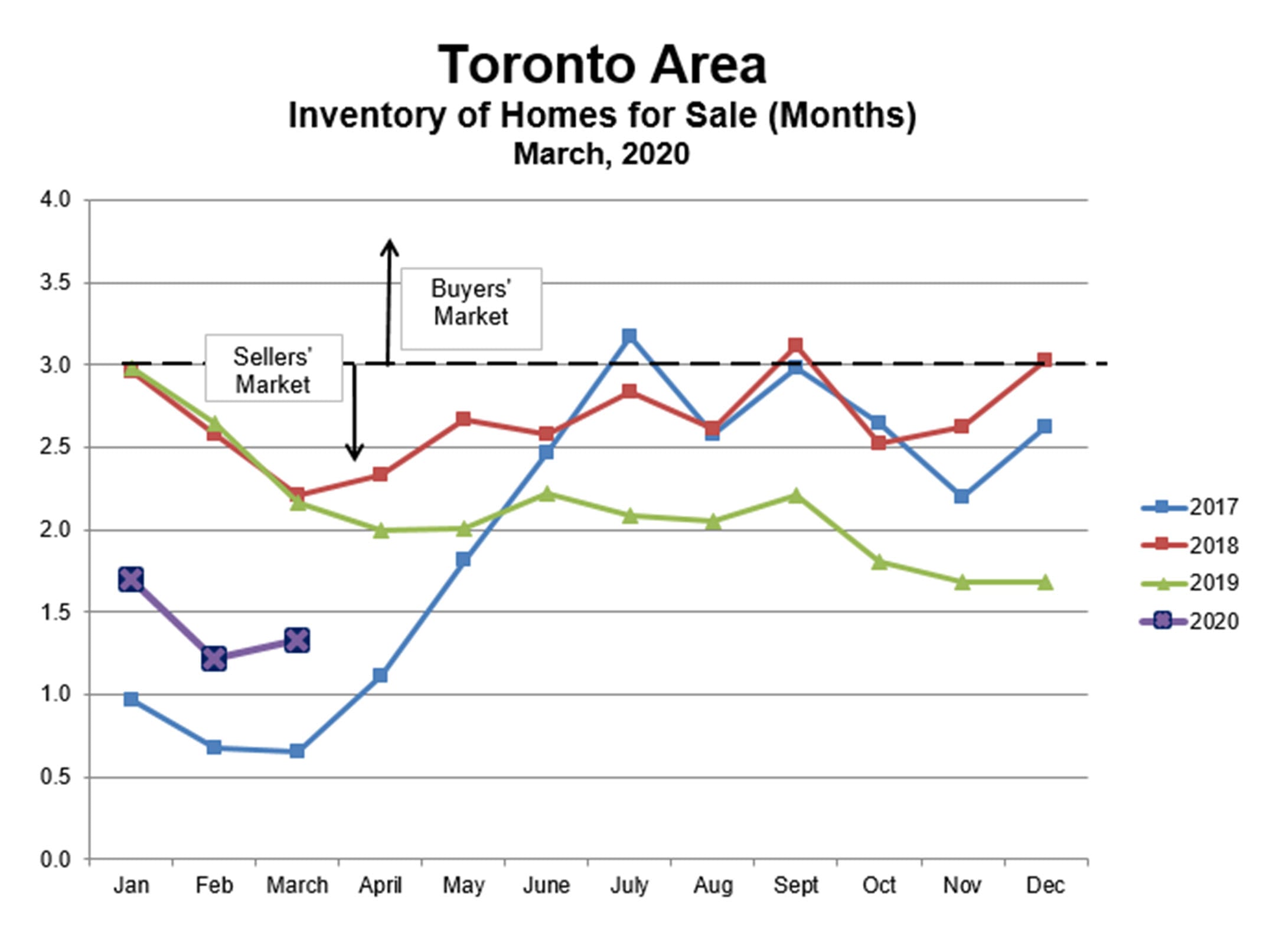

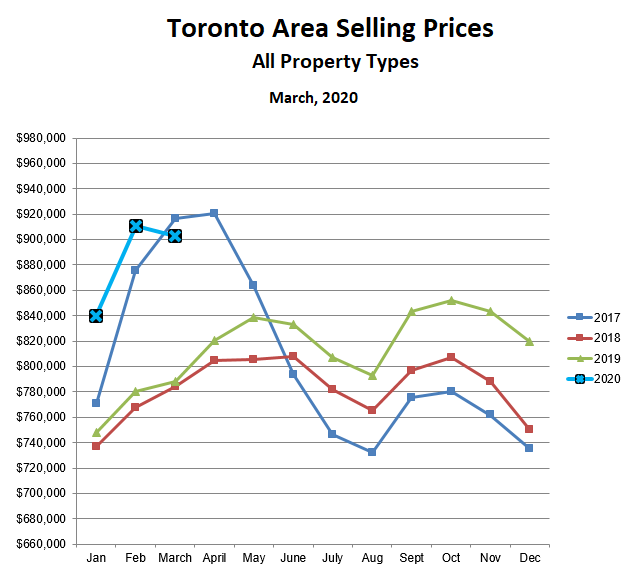

Overall, results for the month of March were very good, though not quite as strong as February. Total sales were up by 10% and, while active listings were up by 20%, the overall inventory of homes for sale was only slightly higher than in February and still comfortably in ‘sellers’ market’ territory.

Prices fell slightly for all property types, but remained well above 2019 levels.

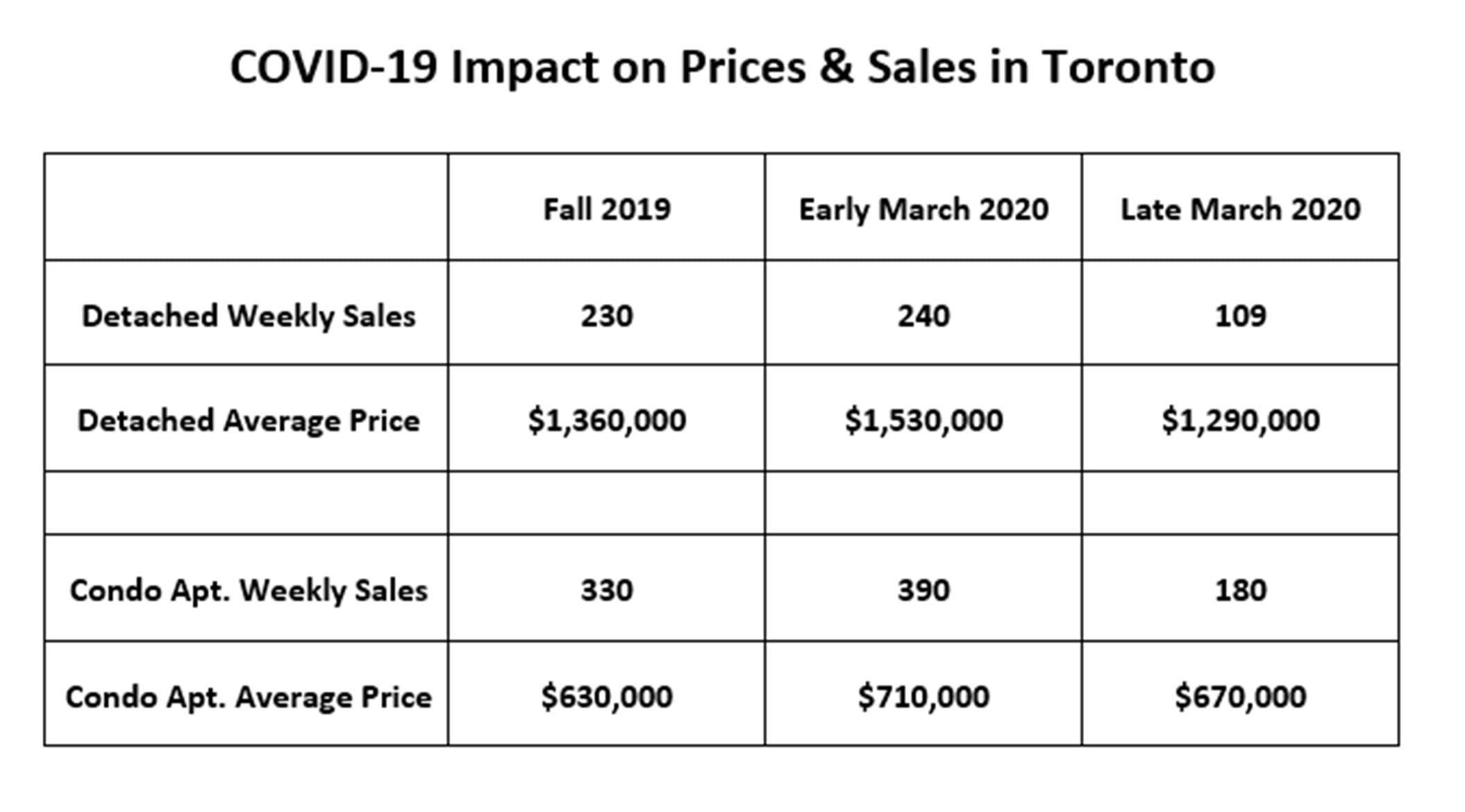

However, the overall results mask what happened to the market in late March when the government of Ontario called a halt to all non-essential businesses and strongly encouraged everyone to stay at home and observe social distancing. Because of these restrictions, real estate activity has fallen steeply, with less than half as many homes being sold per week at the end of March as compared with the beginning of the month.

Prices have also declined since the COVID-19 restrictions came into effect. As shown in the chart above, for example, prices for detached homes in metro Toronto were 12% higher than last fall in early March. However, COVID-19 has taken all of the air out of that emerging bubble, and, as of the last week of March, prices were about 5% below last fall.

For condominium apartments in metro Toronto, sales and prices also fell in late March, however, condo prices are still well above last fall.

The market has thinned out dramatically, with both sellers and buyers moving to the sidelines in large numbers until the COVID-19 crisis has passed. Prices have held up remarkably well under the circumstances, mostly because the inventory of homes for sale remains low. There are fewer buyers and fewer sellers, but still more of the former than of the latter.

How this situation will play out over the next few months is very hard to predict. One school of thought says that, once the “all clear” has sounded on COVID-19 restrictions, both buyers and sellers will return to the market with a vengeance, and both sales and prices will move upward vigorously.

On the other hand, the economy may not be in great shape by the time the virus crisis is past. This could cause buyers to be more cautious at a time when sellers who have delayed their plans decide to rush into the market. That would be a recipe for increasing inventory and a shift toward a buyers’ market as well as falling prices.

Interesting times indeed.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!