Has The 2022 Bubble Finished Unwinding?

01/04/26

The Half Decade In Review

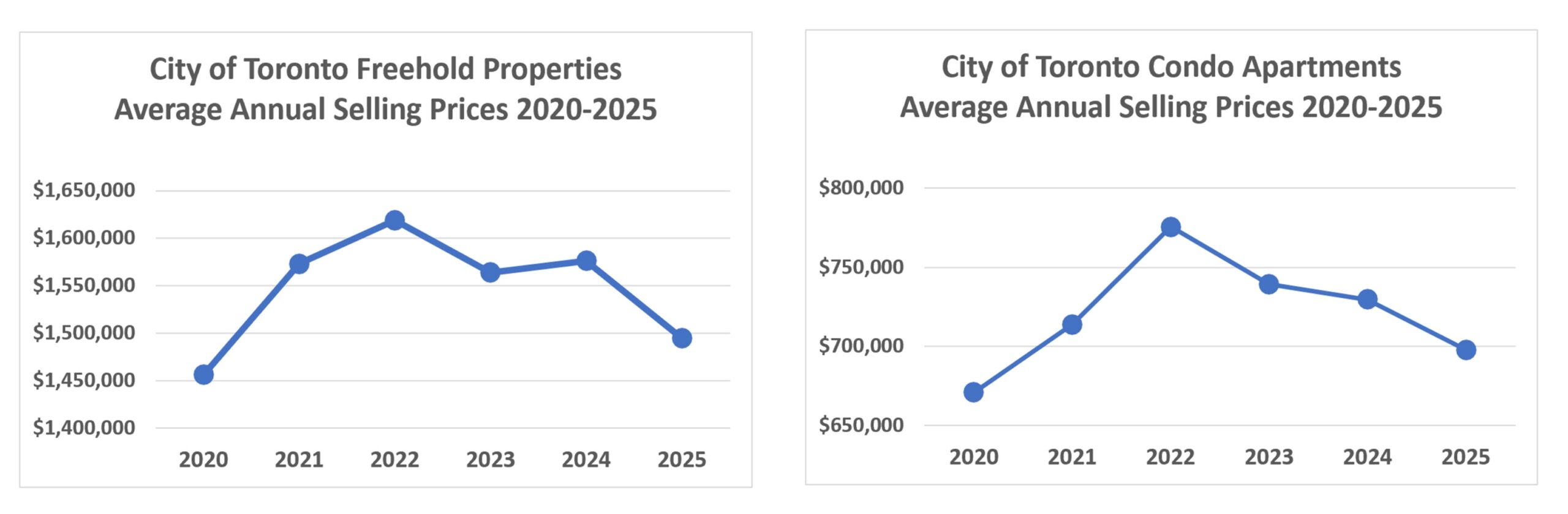

As we close out a challenging 2025, we also mark five years since the onset of COVID in 2020. The first two years of the pandemic saw the formation of a price bubble, which burst in 2022 when interest rates rose sharply to combat inflation. Since then, prices have steadily declined and are now approaching 2020 levels. Conventional wisdom suggests that after a bubble bursts, prices often revert to their starting point before resuming their longer-term trend. If that pattern holds, we could see prices begin to rise again in 2026, albeit modestly.

Houses

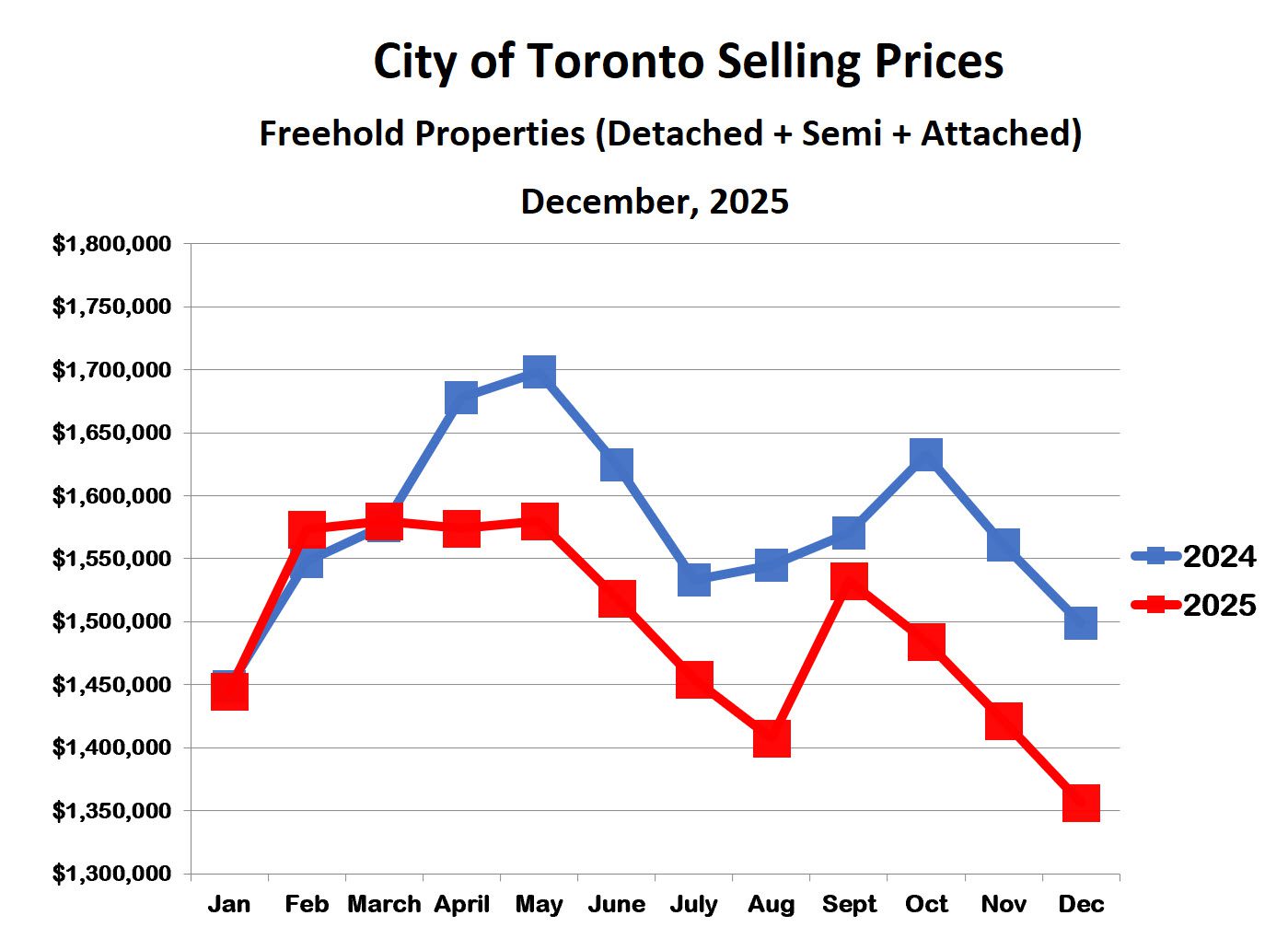

City of Toronto house prices continued the downward trend that began in October, ending 2025 at their lowest point—11% below September levels and 14% below the spring peak. Despite this decline, bidding wars have persisted over the past three months for homes that “check all the boxes,” highlighting strong underlying demand from qualified buyers ready to act when they find the right house. Many buyers, however, remain on the sidelines awaiting clearer signs of a market turnaround. If the market has indeed reached the bottom of the post-bubble adjustment, this could set the stage for a relatively strong spring market in 2026.

Condo Apartments

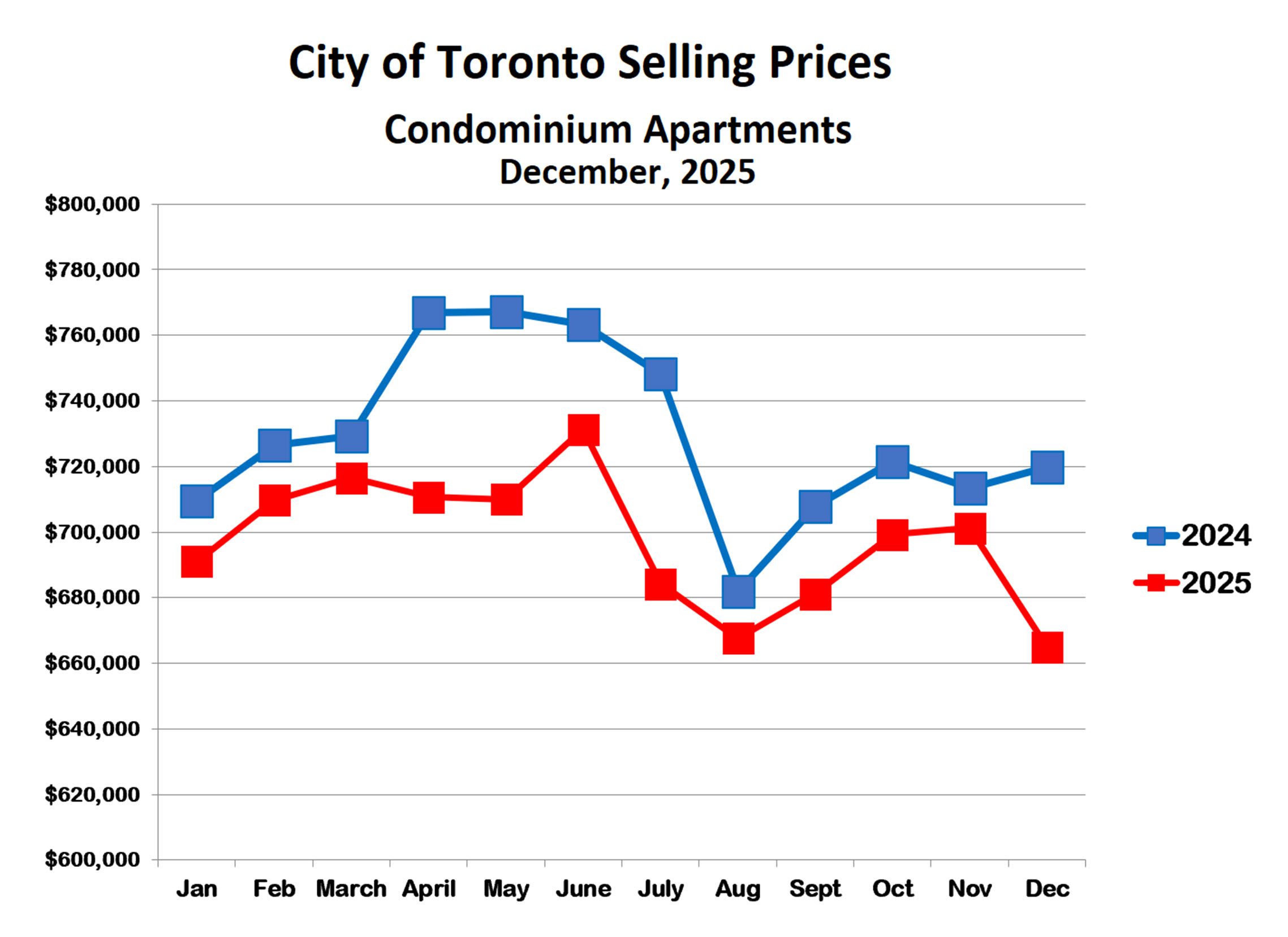

Condo prices in the City of Toronto have followed a different pattern than houses over the past three months. While both rose in September, condo prices continued to climb in October and November before dropping sharply in December. As a result, condos—like houses—ended 2025 at their lowest point of the year. The condo market has been hit hard since COVID. Lockdowns triggered a move to surrounding communities, higher interest rates led many investors to sell rental units, and a wave of new condo completions added further supply. Together, these forces pushed inventory higher and prices lower. With these pressures now easing, the market appears well positioned for a gradual recovery.

Bottom Line

The real estate market has been unusually volatile over the past five years, with intra-year price swings of at least 10%, and nearly 20% in 2020. While prices may find a bottom and begin to rise in 2026, heightened volatility is likely to continue, driven by economic and geopolitical factors and ongoing uncertainty among buyers and sellers. It may be another roller-coaster year ahead.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!