House Prices Moderate, Condo Prices Surge Again

05/12/21

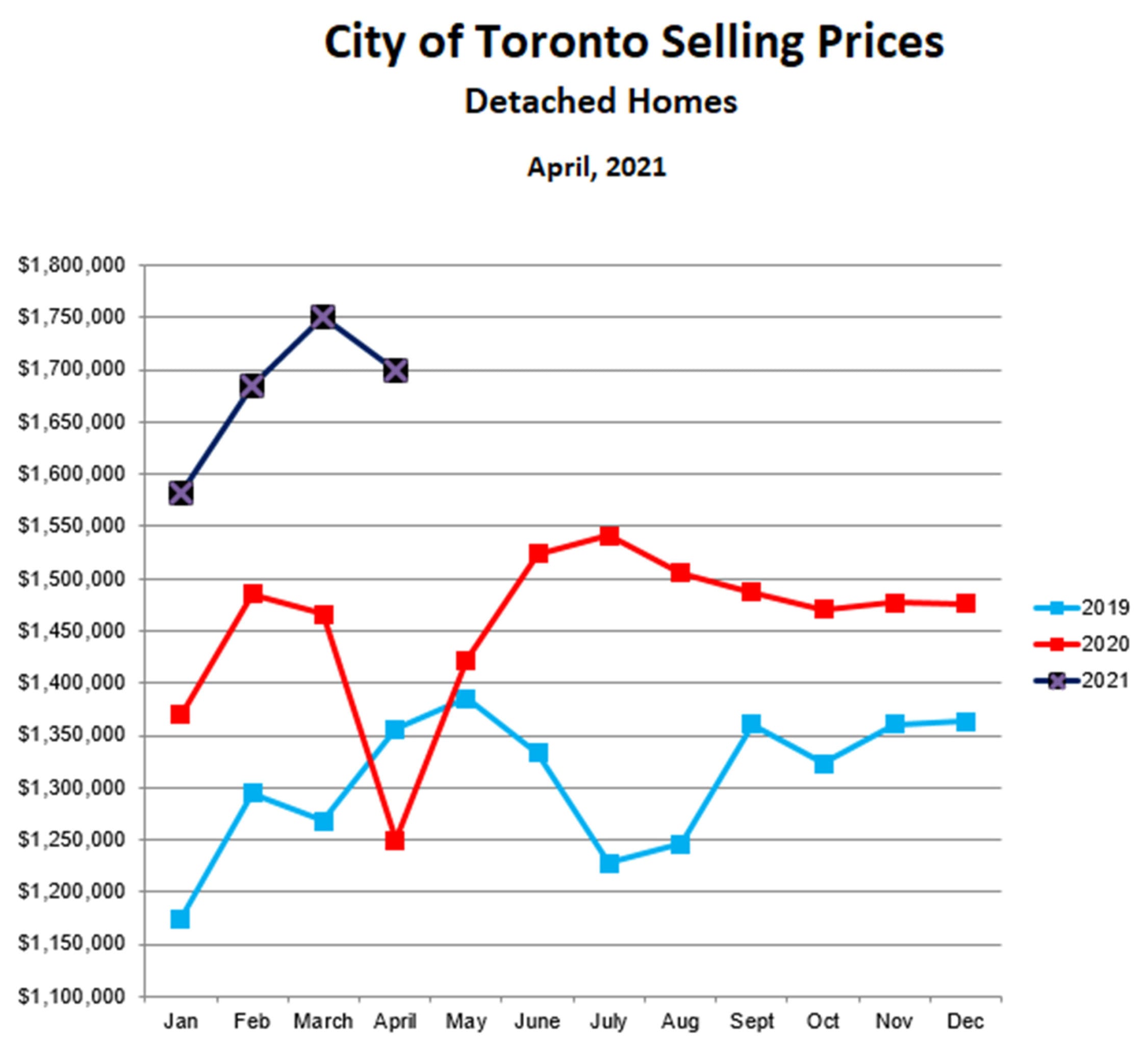

Prices for detached homes in the City of Toronto slipped 3% in April after rising by 19% over the previous three months. It’s very unlikely, however, that this is the beginning of a downtrend. It’s much more likely to be a brief pause in the strong uptrend that began in January. Why do I say this?

First, we have seen this movie before, that is, a brief sag in prices in the middle of the spring market, followed by a resumption in rising prices. In years past, this always happened in March, and we blamed it on March Break, folks taking a breather from real estate to flock to Florida beaches. But perhaps it was just a natural process of consolidation, the market ‘taking a breath’ during an otherwise unbroken rise in prices from February to June. So maybe we are just seeing a brief period of consolidation before prices again move higher.

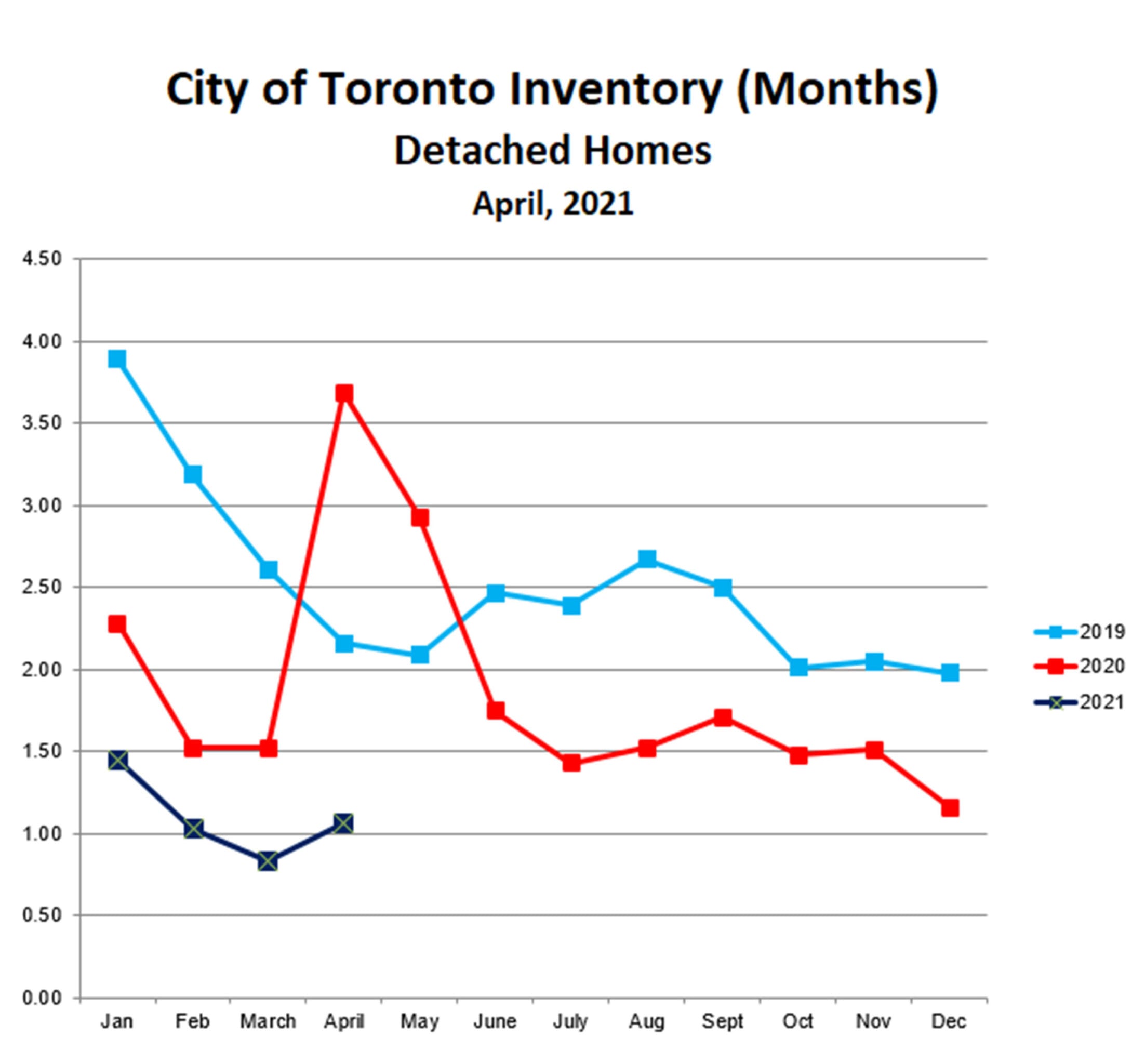

The second reason to believe that this may only be a temporary drop in prices is inventory. We measure inventory as the number of months of supply of homes on the market. For example, if there are 2,000 homes for sale, and homes are selling at the rate of 1,000 homes per month, then the present supply of 2,000 homes would last two months if no other homes came on the market. Hence the inventory is 2,000 homes for sale divided by 1,000 homes sold per month, or 2 months’ inventory.

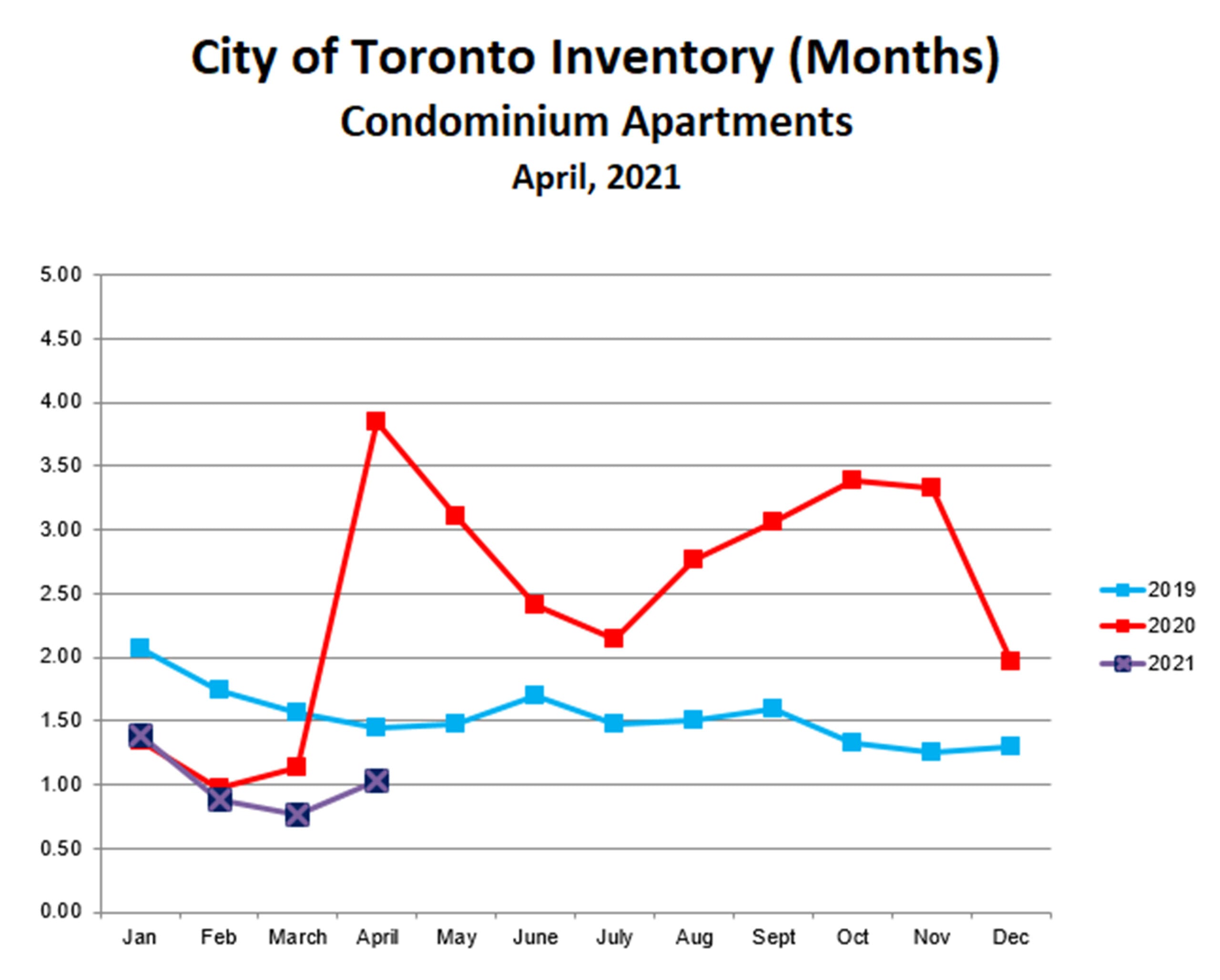

The chart above shows price trends for detached homes in the City of Toronto over the past three years, while the chart below shows inventory trends over the same time period. There is a very strong inverse relationship between the two, that is, as inventory goes down, prices go up, especially when inventory drops to one month’s supply or lower.

This isn’t surprising; an inventory of one month or below basically means that homes are selling as fast as they come on the market or even faster. Bidding wars are a natural consequence of this dearth of supply of homes for sale.

Inventory isn’t the only driver of prices, of course. Historically low interest rates have been the primary enabler of sales, making it possible for homebuyers to afford astronomical prices at surprisingly low monthly carrying cost. However, low inventory is the driver that is creating bidding wars, which tend to ratchet prices ever higher.

In that context, have a look at the inventory level for detached homes in April. While slightly higher than in March, inventory is still extremely low, and such low levels of inventory often tend to be self-sustaining. This is because, with homes for sale so scarce, and with homes selling before the ink on the listing agreement is even dry, most move-up buyers choose to buy first before putting their homes on the market. Since move-up buyers represent the majority of the inventory of homes for sale, it’s easy to see how very low inventory sets up a self-reinforcing pattern.

The bottom line is that a return to rising prices for detached homes over the next few months is very likely.

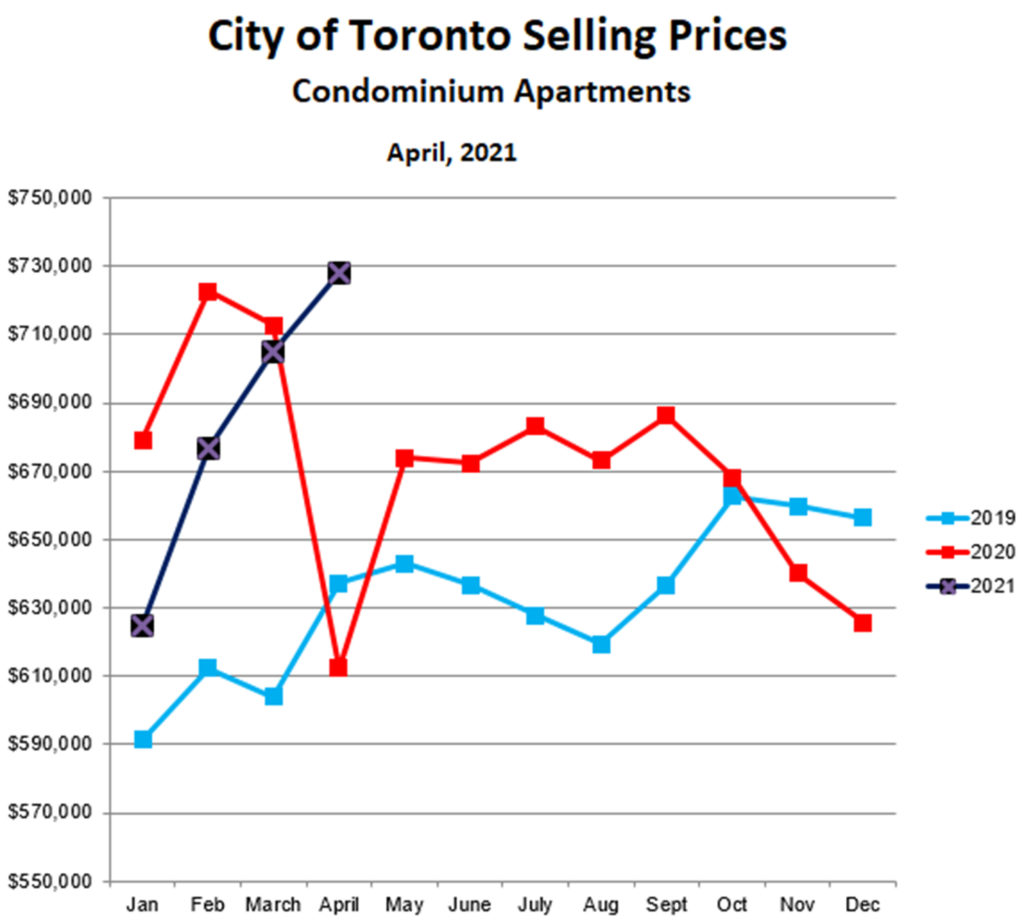

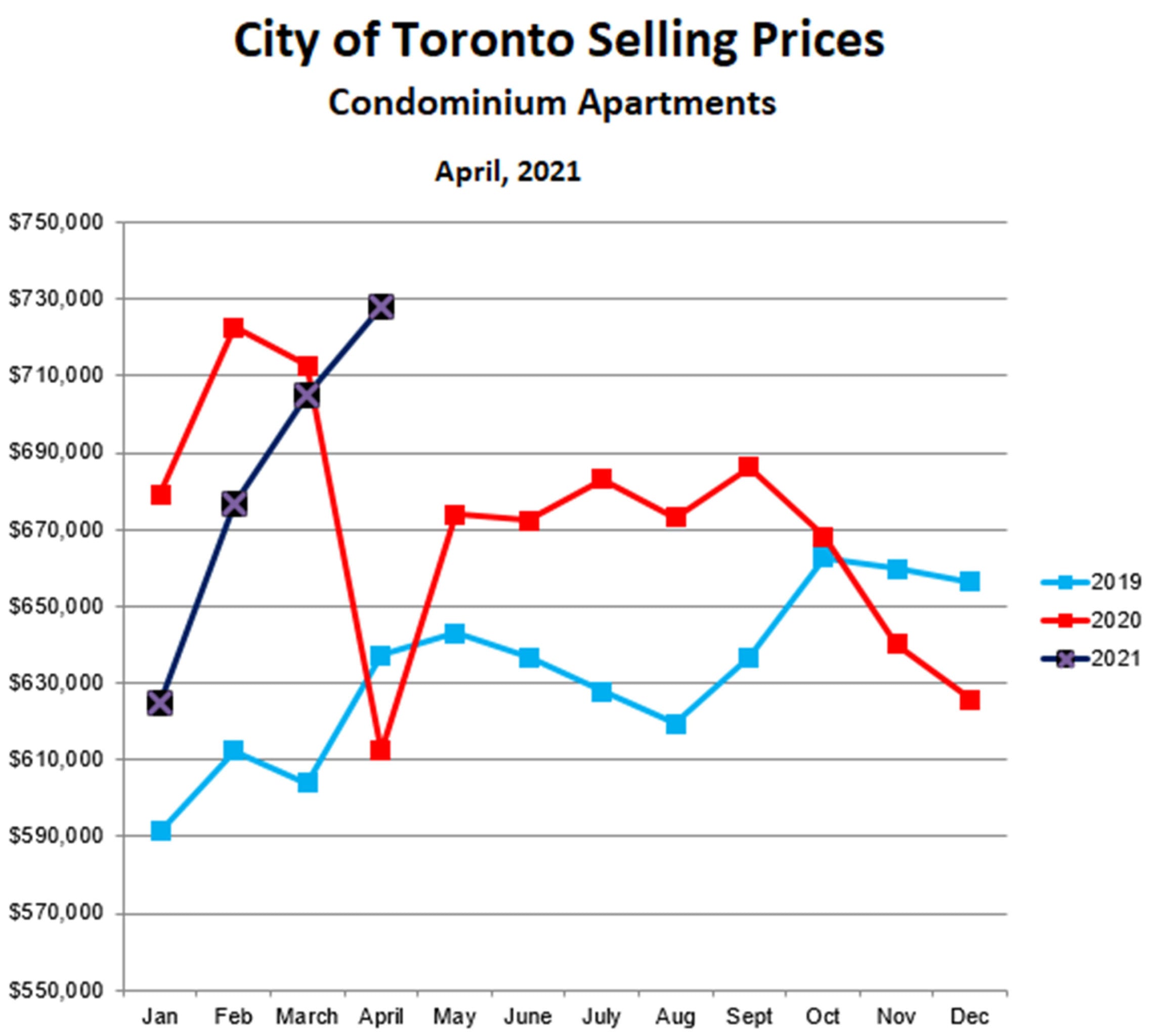

Let’s now turn to the condo market, which has followed a similar but more volatile path than houses during the Covid journey. Early last year, condo prices were increasing quickly, and reached an all-time high in February. Then came Covid, and prices fell steeply, recovered for a few months, and they fell steeply again as owners of investment condos dumped their units in the face of a declining rental market.

Then something changed. The tide of condo listings receded late in the year, and so inventory declined and prices stabilized. Inventory continued to fall early this year, and prices took off in February as inventory dipped to the one month level. While inventory increased slightly in April, it remained close to one month’s supply. Prices continued to surge higher and are now 16% higher than they were at the beginning of the year. As for houses, the low inventory level for condos will tend to be self-sustaining over the next few months. While we could see a brief consolidation period similar to houses, condo prices will probably keep rising.

Bottom line? The hot Toronto market will probably be with us for a while longer… unless something completely unexpected happens, of course.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!