Quiet Fall Market Continues In Toronto

11/27/23

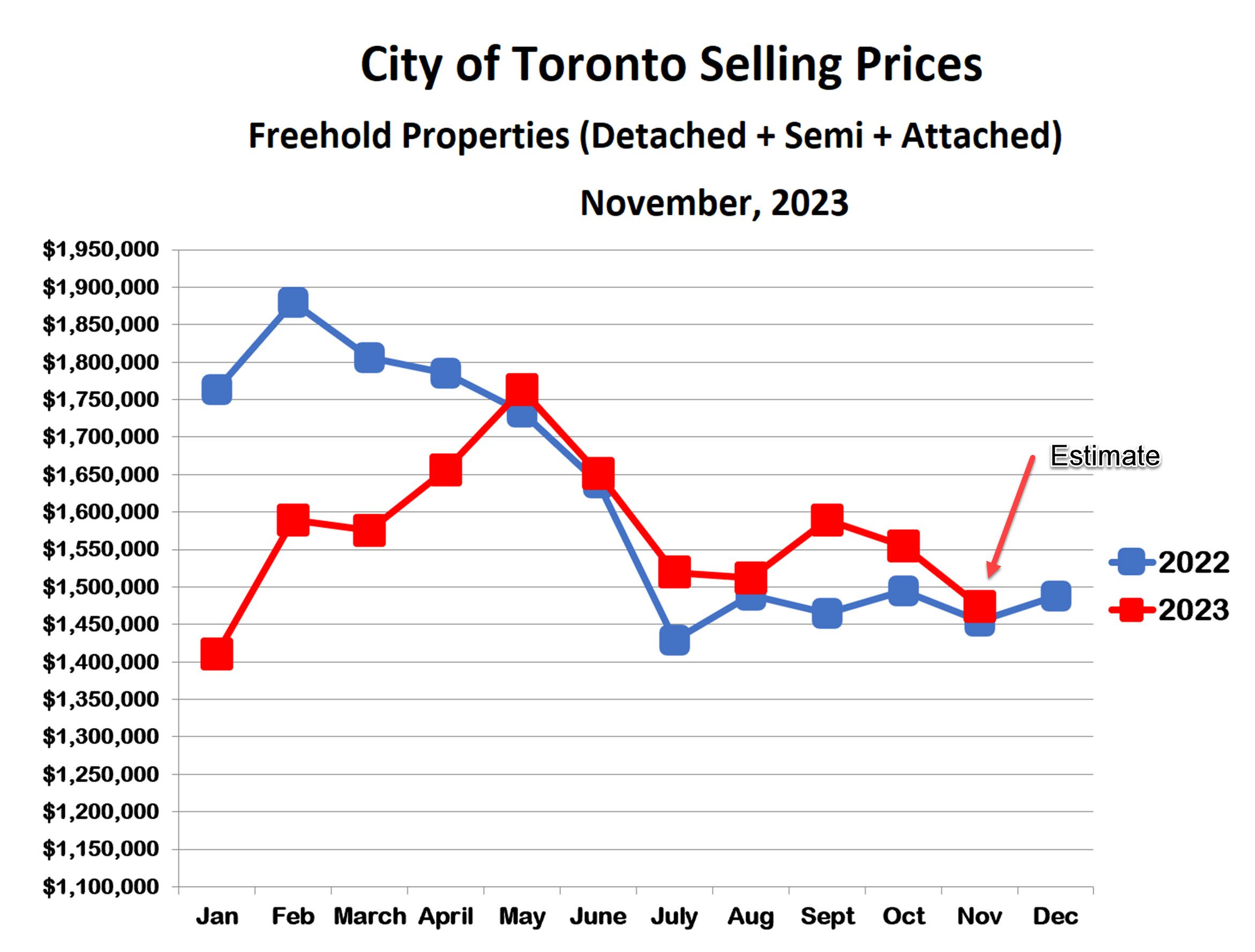

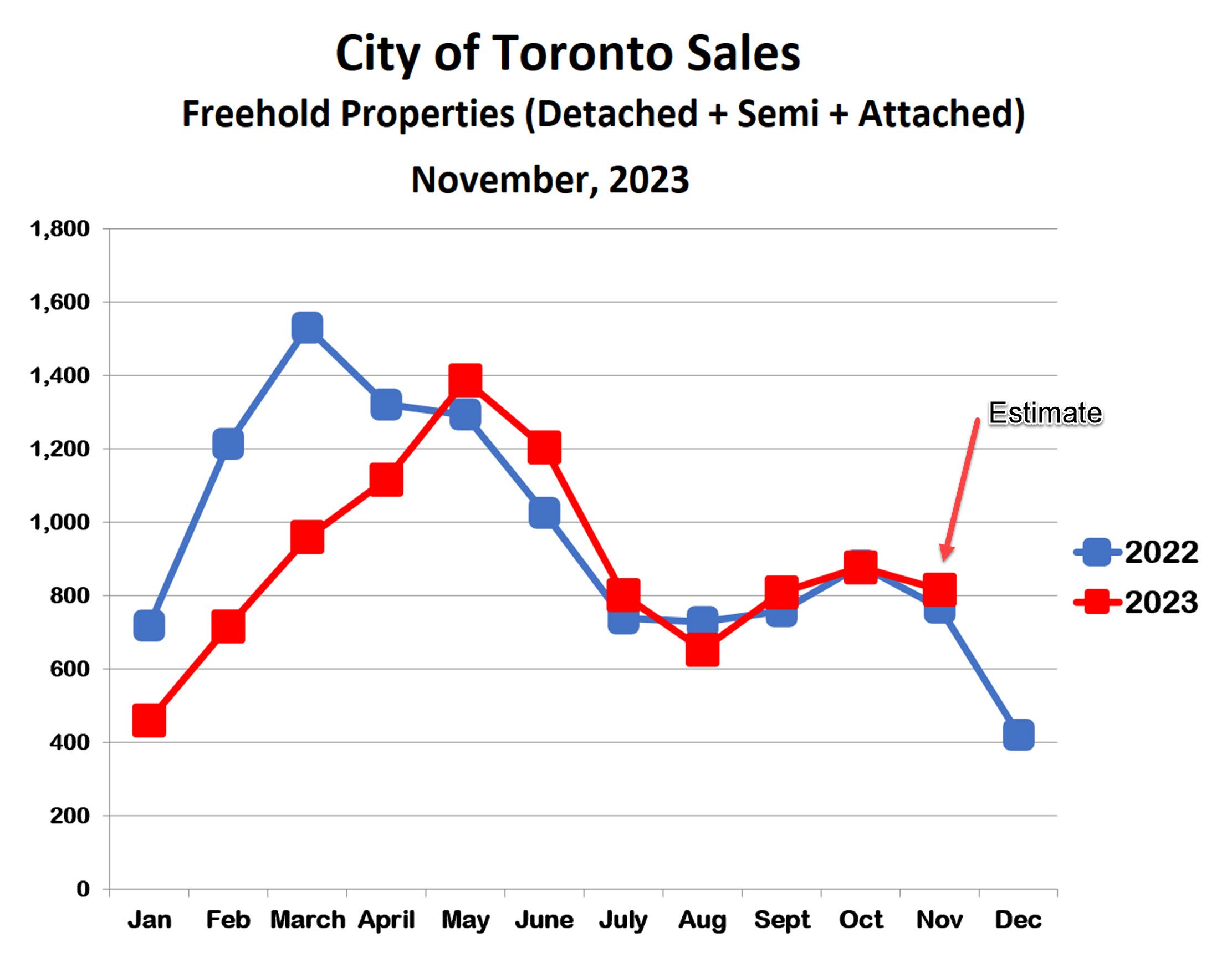

Houses

Prices for freehold properties are falling again in November and are now just above last November. We seem to be completing a correction back to the 2022 trend line after the brief upward ‘blip’ in early September. If this trend holds, December prices will likely be about the same as November.

Sales of freehold properties are following a pattern that is very similar to prices. As with prices, sales got off to a slower start this year as compared with 2022. After ‘catching up’ with 2022 in May, however, sales in 2023 have matched 2022 very closely. This included a steep drop during the summer followed by a leveling off in the fall.

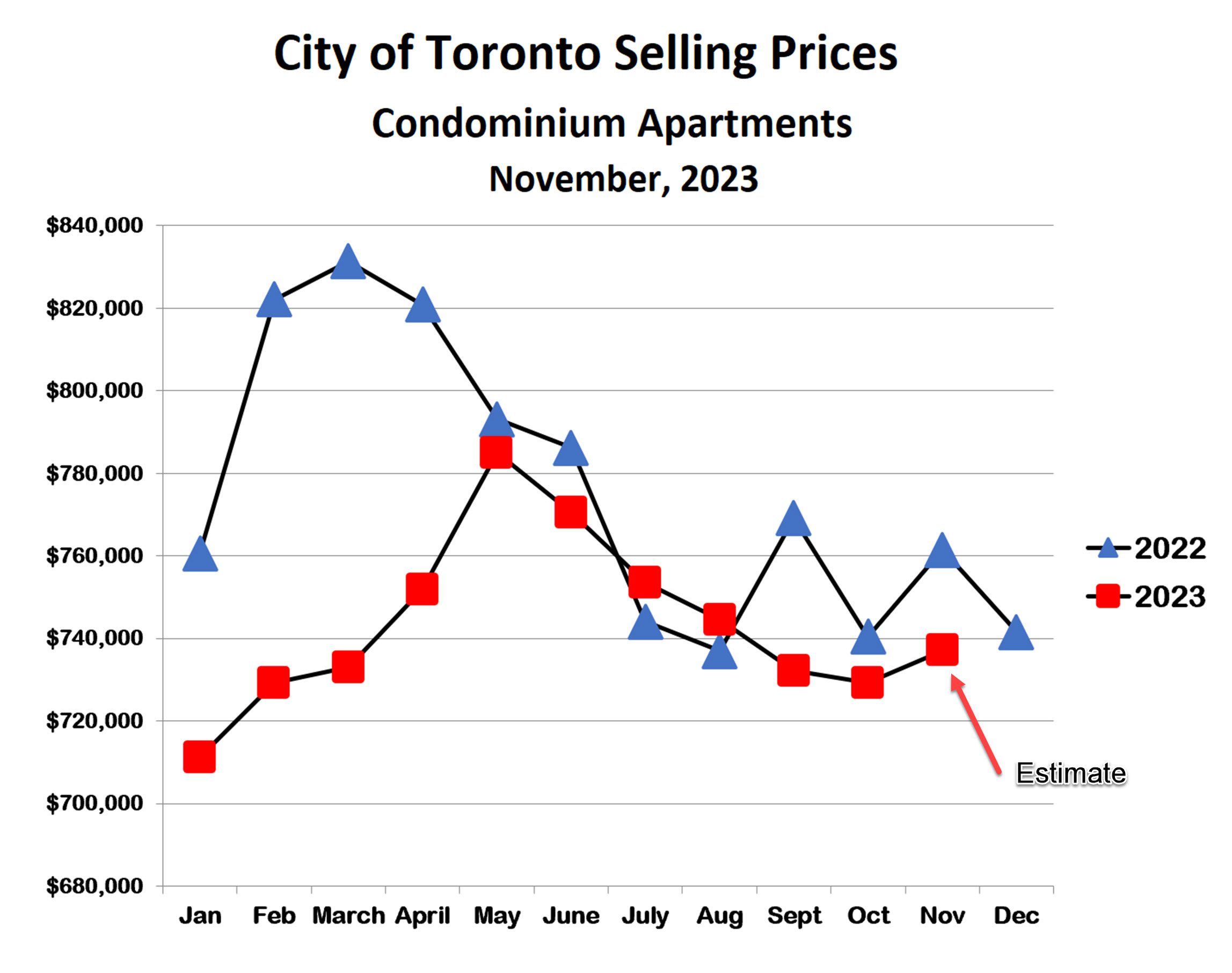

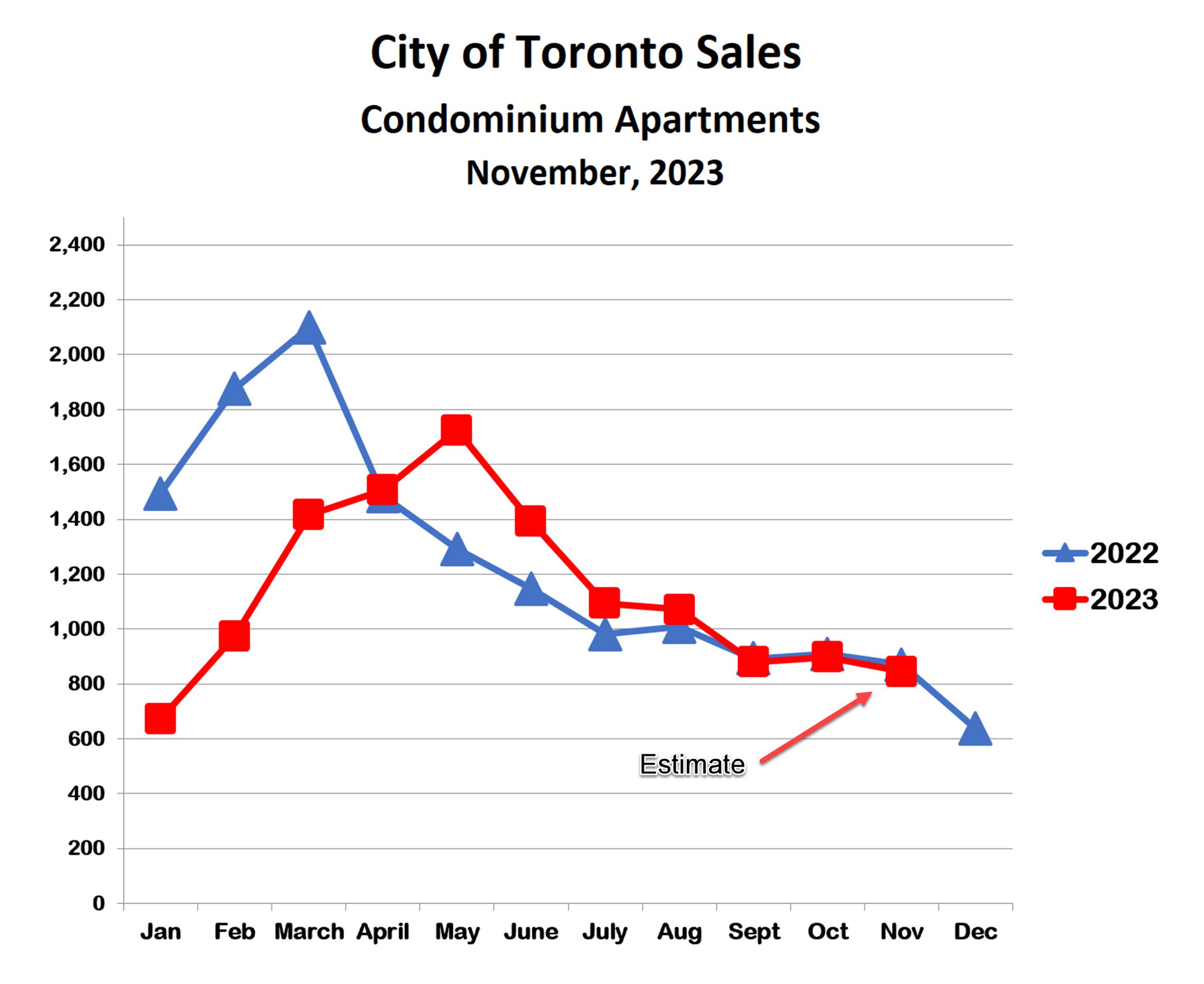

Condo Apartments

Like houses, condo prices got off to a slower start this spring as compared with last year, but have closely followed 2022 since May. Condo prices have been leveling off over the past three months, and have actually fallen a bit below last year. This is likely due at least in part to the impact of high interest rates on owners of investment condos. Many homeowners bought condos for extra income when interest rates were very low. Now, they are feeling the pain of multiple mortgage payments that have increased dramatically, and many are deciding to dump their condos.

Sales of condos have, as for houses, followed a pattern similar to prices. Since the summer, monthly condo sales have been almost exactly the same as last year. If past is prologue, we should expect condo sales to fall in December while prices remain more or less steady.

Where Do We Go From Here?

Price and sales trends for both houses and condos this year were eerily similar to last year. In 2022, an overheated market in the early months succumbed to rising interest rates, and both prices and sales fell steeply until they bottomed out in the fall. This year, prices and sales both recovered in the spring based on the widely accepted narrative, namely, that inflation was coming under control and interest rates would soon be falling. This turned out to be a massive head fake, of course, as inflation has proved stubborn and interest rates have continued to rise, if only slightly. The market reacted as it did in 2022, and both prices and sales fell in precisely the same way as they did last year.

So, what will happen next year? In my view, several conflicting factors will come into play:

- Supply and demand. As we all know, we have a housing crisis in Canada and especially in the GTA. There are many more people than there are places for them to live, so there is enormous pressure on rental prices and huge pent-up demand to buy houses. While high interest rates have limited affordability, there are still lots of buyers with the wherewithal to buy homes. What is causing them to hesitate is uncertainty about the economy as well as whether prices will go even lower. On balance, the excess demand will put a floor under house prices and will cause them to rise as uncertainties wane.

- The seasonal trend. ‘Everyone knows’ that prices always go up in the spring and this powerful element of buyer psychology may cause prices to pop in the spring (at least briefly) despite all the bad news.

- The economy. GDP was down slightly in the 2nd quarter, and, if it’s down again in the 3rd quarter, we will be (technically) in a recession. This will add another layer of uncertainty – potential buyers who fear for their jobs are less likely to buy.

- Interest rates. It’s unlikely that interest rates will fall before the middle of next year. However, if they should go up again, even by a small amount, this will put a damper on the spring market. This isn’t about the impact on affordability, it’s about the belief that higher rates will lead to lower prices, which can become a self-fulfilling prophesy.

- Inflation. We all hope that the inflation rate will continue to fall. However, if inflation should increase, for example because of a geopolitically-induced spike in oil prices, this will further fuel uncertainty and put downward pressure on prices.

I think it’s highly unlikely that prices will fall over the next few months. I suspect that factors 1 and 2 will lead to a least a modest (if short-lived) increase in prices in the spring. The best case would be good news about the economy, interest rates and inflation, which could lead to a very hot market indeed. Interesting times and vuncertain predictions

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!