Still A Seller’s Market In Toronto

07/09/21

The Toronto market continued to moderate in June. However, inventory remains very low and sellers are still firmly in control.

Detached Homes

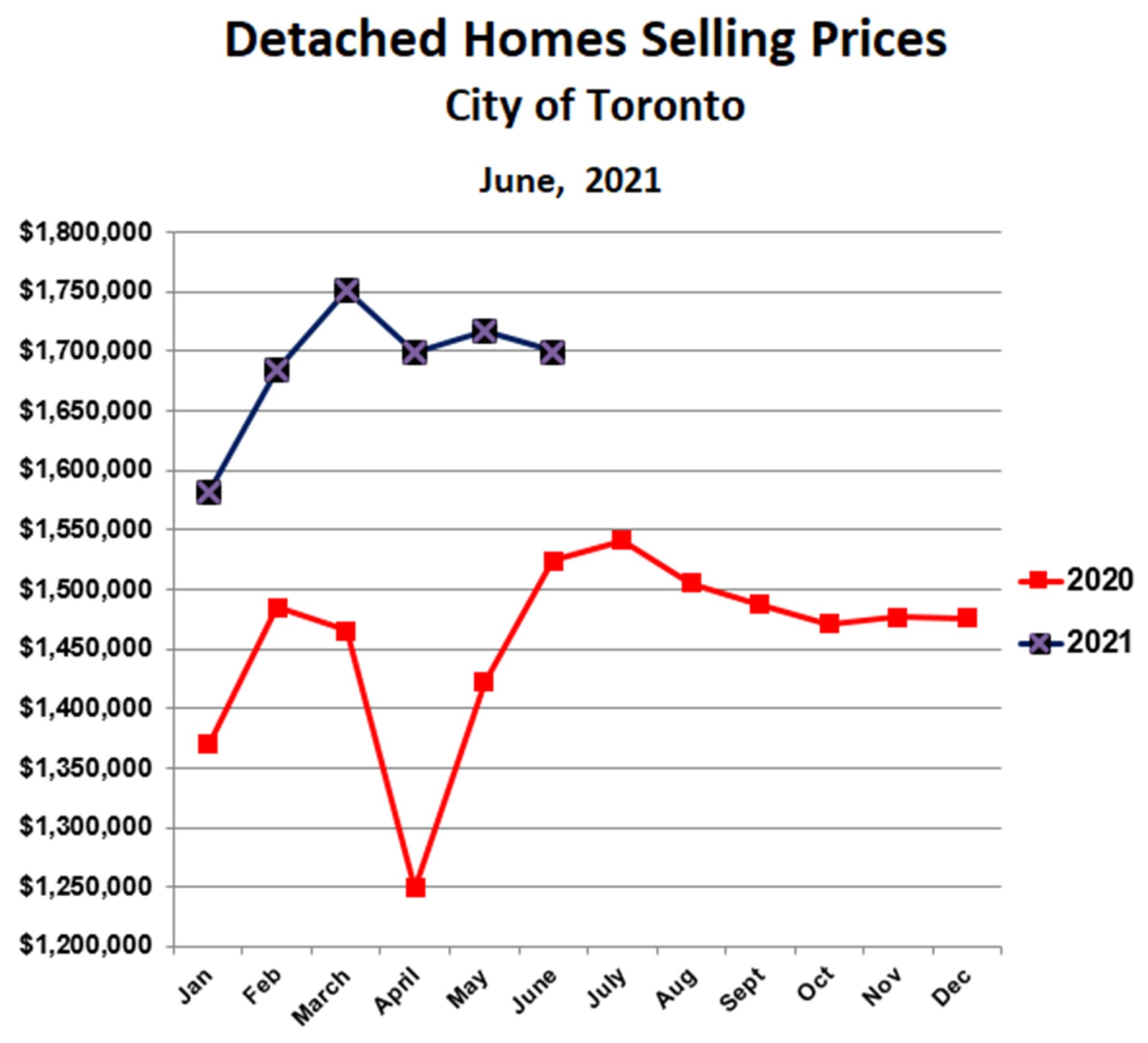

The average price for detached homes in the City of Toronto slipped by a slim 1%, from $1,716,272 in May to $1,699,881 in June. Detached prices have been in a narrow range, from $1.68 million to $1.75 million, for the past four months. Furthermore, prices remain far above last year.

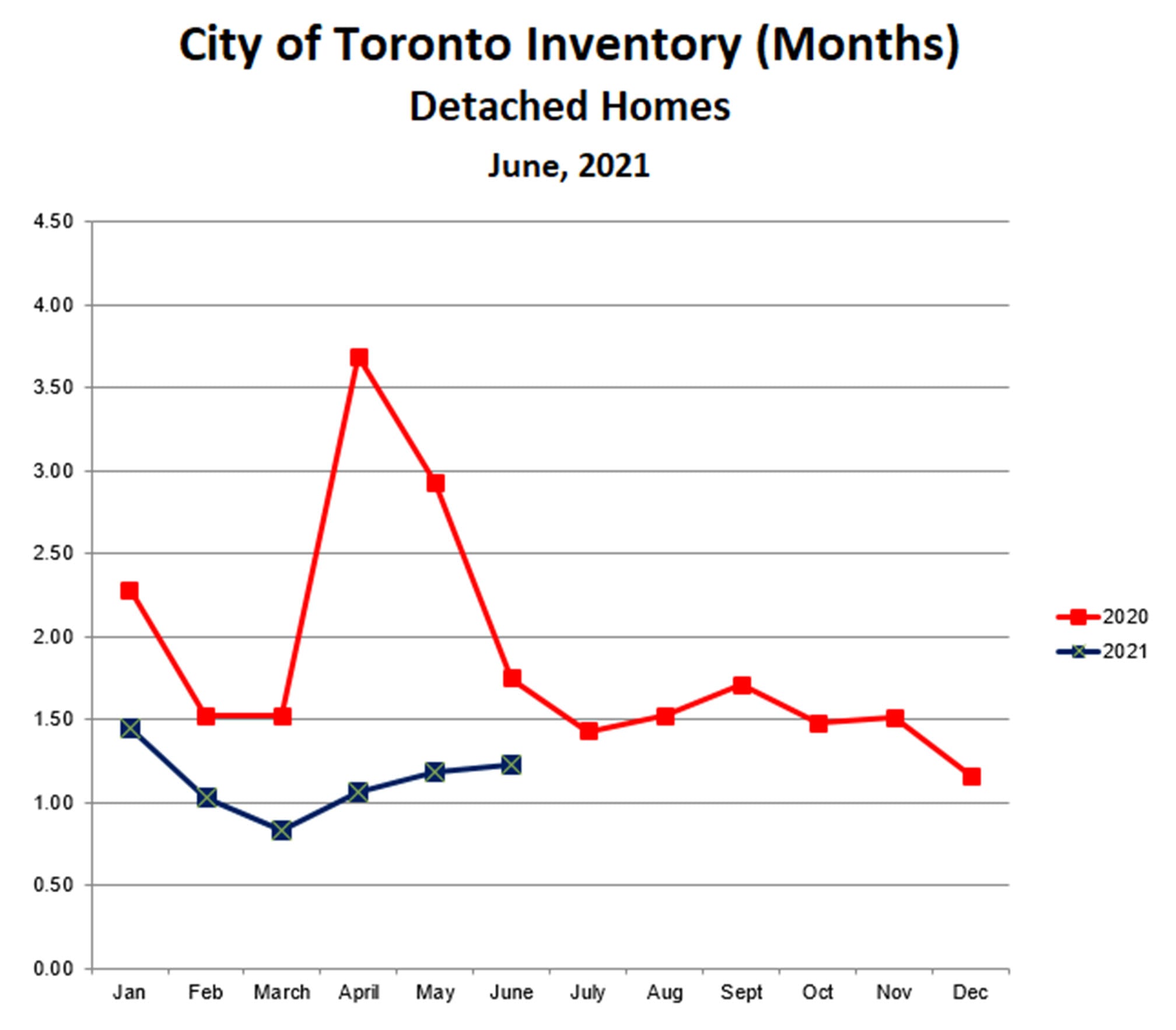

It appears that home prices may have peaked in March. Nevertheless, prices are unlikely to fall significantly any time soon. On the contrary, while the inventory of homes for sale crept up slightly in June, it is still extremely low at just over one month’s supply. This is very deep in seller’s market territory.

Condo Apartments

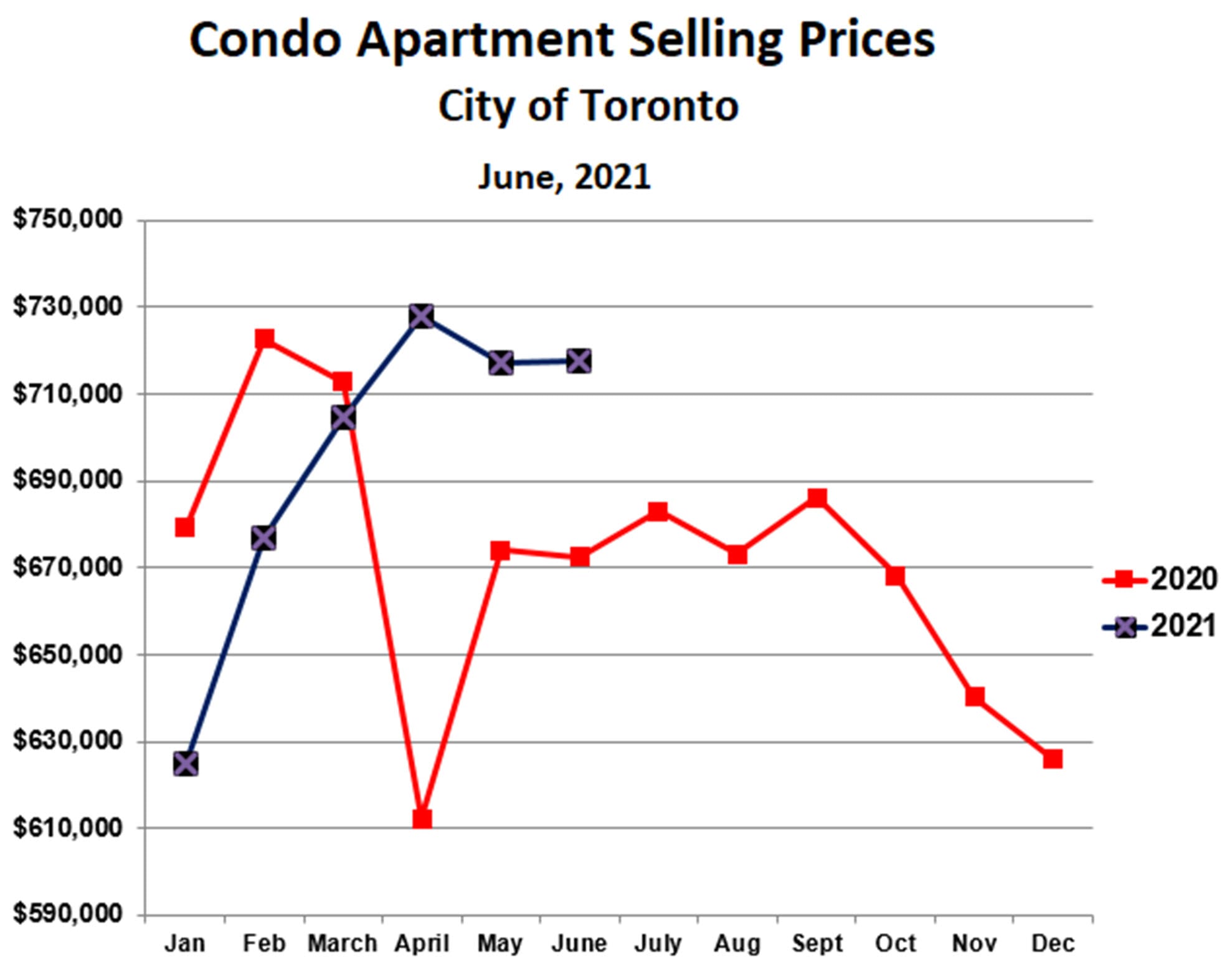

Condo apartments are following a similar pattern. Prices played catch-up for the first four months of this year, following a steep decline in Q4 2020. However, prices peaked in April and have been relatively flat since then. Prices for condo apartments in the City of Toronto were almost exactly the same in June ($717,476) as they were in May ($716,976).

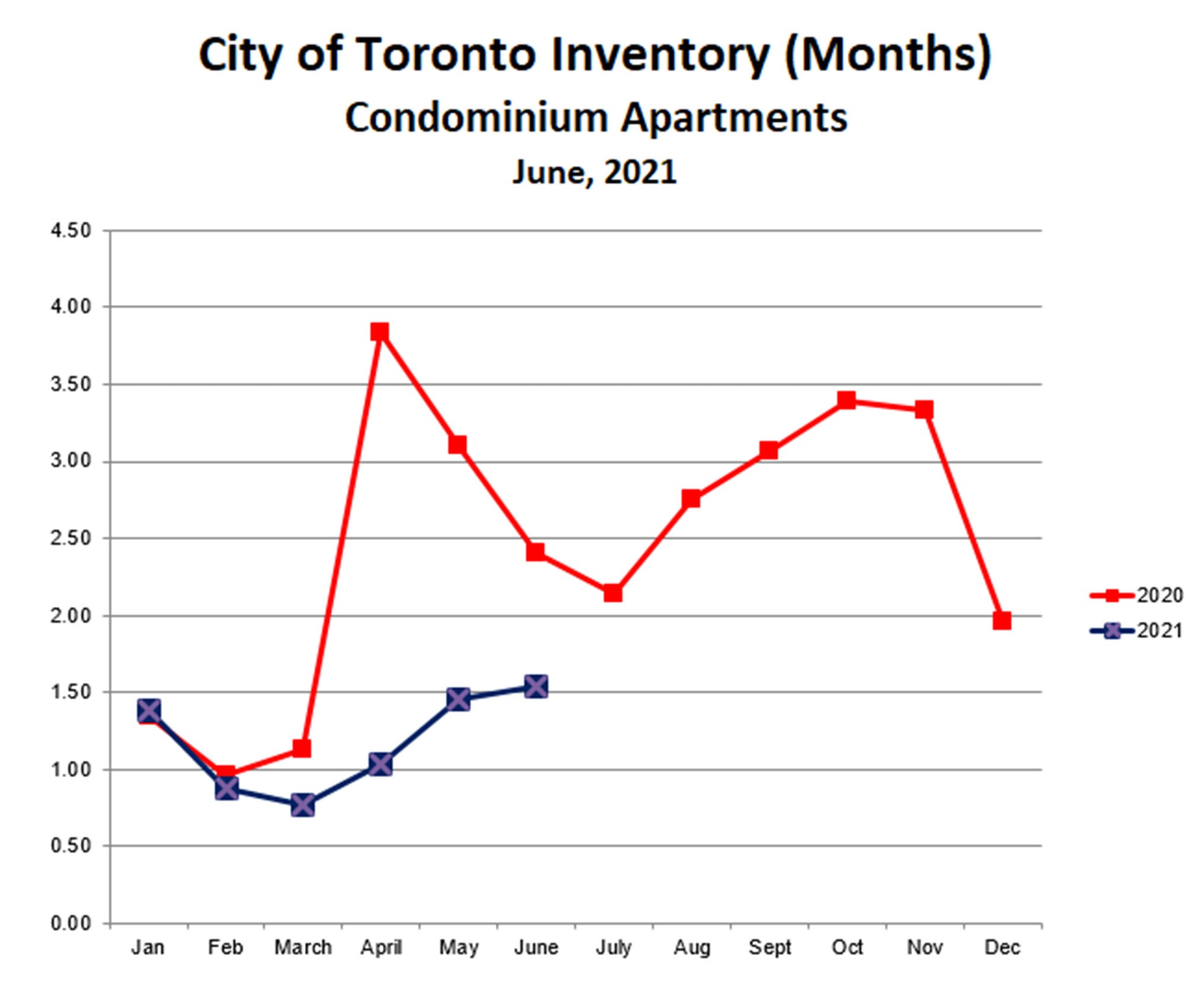

The inventory of condos for sale remains very low at about 1.5 months’ supply. This is slightly higher than for detached homes, but still deep in seller’s market territory. As for detached homes, condo prices aren’t likely to fall any time soon.

Prognosis

Historically, summer has always been a slower time, as many buyers and sellers take time off from real estate to enjoy our relatively short warm weather season. This summer could be even more so, as Covid restrictions are being lifted and freedom is being restored. Even so, prices won’t necessarily fall. The important thing is the balance between buyers and sellers: if both flee the city in similar numbers, the market will be ‘thinner’ but not weaker.

What is already changing, though, is the prevalence and virulence of bidding wars. We experienced what can only be described as a crazy buying frenzy early this year. Now, the frenzy has passed, and we have ‘only’ a solid sellers’ market. Back in March, virtually every home that came on the market sold in a week or less, and bully offers were rampant. Most received many offers and the selling price was often several hundred thousand dollars above the asking price. This was a game that both buyers and sellers understood well, as the asking price was known to be far below the ‘nominal’ of the home. The eventual selling price was often higher than this nominal value (causing prices to ratchet upward), but not that much higher.

Now, however, the game is changing. Buyers are no longer lining up to submit multiple bids for every new listing. Instead, more and more homes are failing to sell on their ‘offer dates’. Sellers must then adjust their asking prices upward to more closely reflect the ‘true’ value of their home. Most of these home eventually sell for close to this value, however, it’s an awkward process. Buyers, of course, are taking notice. They are becoming more reluctant to bid aggressively on each new listing that comes along.

Sellers need to accept that we’re not in March any more and to adjust their expectations accordingly. Pricing strategies must be re-assessed. In many cases sellers should adopt the more ‘conventional’ approach of pricing at value without an offer date (gasp!). Prices won’t necessarily fall, the market will simply be more calm and orderly. In my view this will be a welcome change.

Looking beyond the summer, volume and prices may surge again in the fall. As the government continues to ease Covid restrictions, the borders could be re-opened to immigration. This will increase the demand for both resale and rental properties. With no significant increase in supply in sight, another frenzied resale market may emerge. An increase in immigration could also enable a recovery in the beaten-down rental market. All depending on the virus and the political reactions to it, of course.

Still A Sellers' Market In Toronto

The Toronto market continued to moderate in June. However, inventory remains very low and sellers are still firmly in control.