The Dog Days Of Summer Are Upon Us

07/25/22

Toronto prices have been falling in June and July for three reasons:

- A summer slowdown is normal, as both buyers and sellers take time off from real estate to enjoy our relatively short warm season. We have seen this pattern virtually every year for decades;

- Pandemic-related restrictions have been eliminated or relaxed, and many folks are enjoying the freedom to get away for long-postponed vacations; and

- Interest rates are being sharply increased in an effort to fight inflation, and this is impacting affordability in a dramatic way.

Let’s have a look at how this is playing out.

Detached Homes

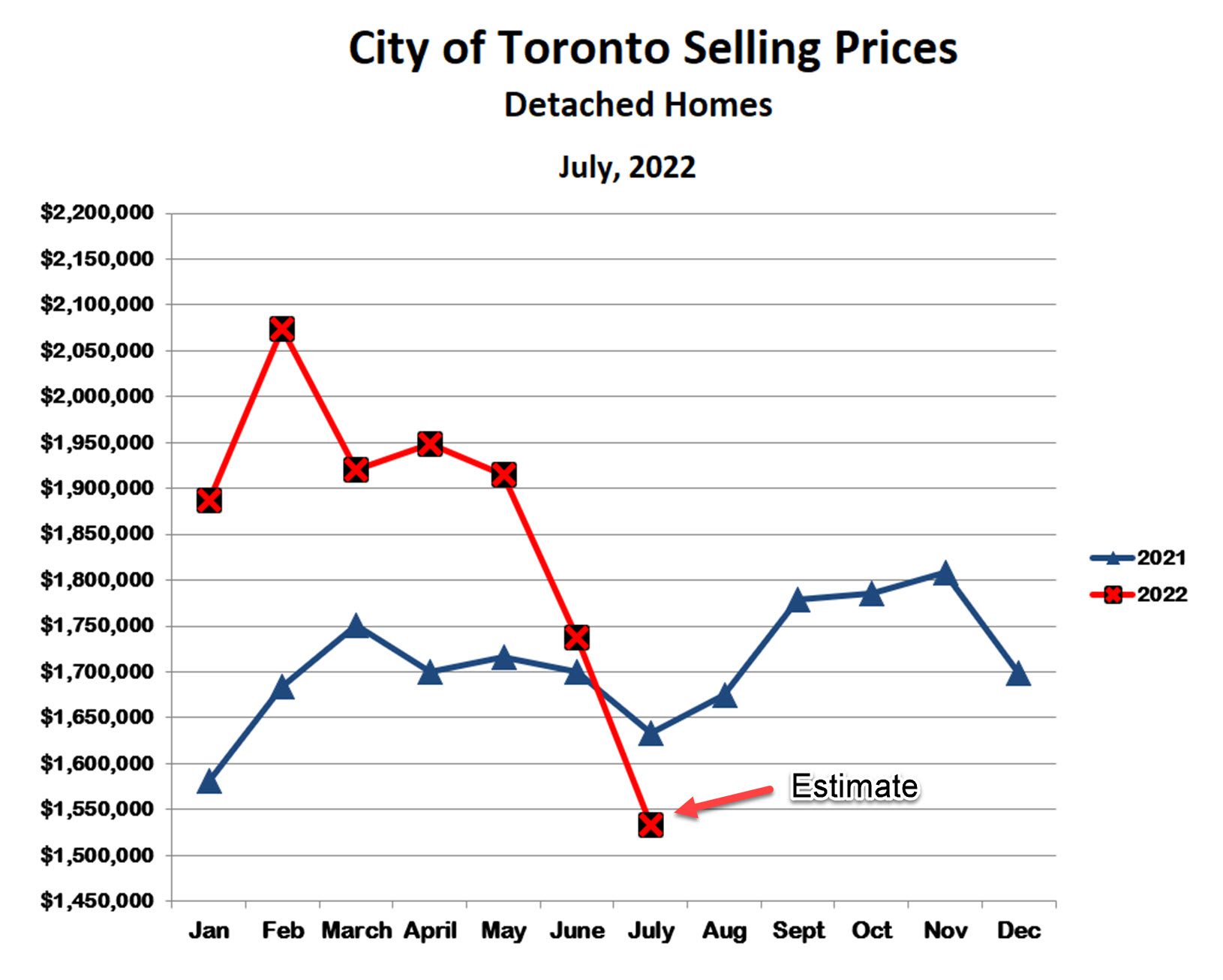

Based upon data from the Toronto Regional Real Estage Board, average prices for detached homes in the City of Toronto fell by 9% in June and are down a further 12% so far in July. In total, detached prices have fallen approximately 26% since the all-time high in February.

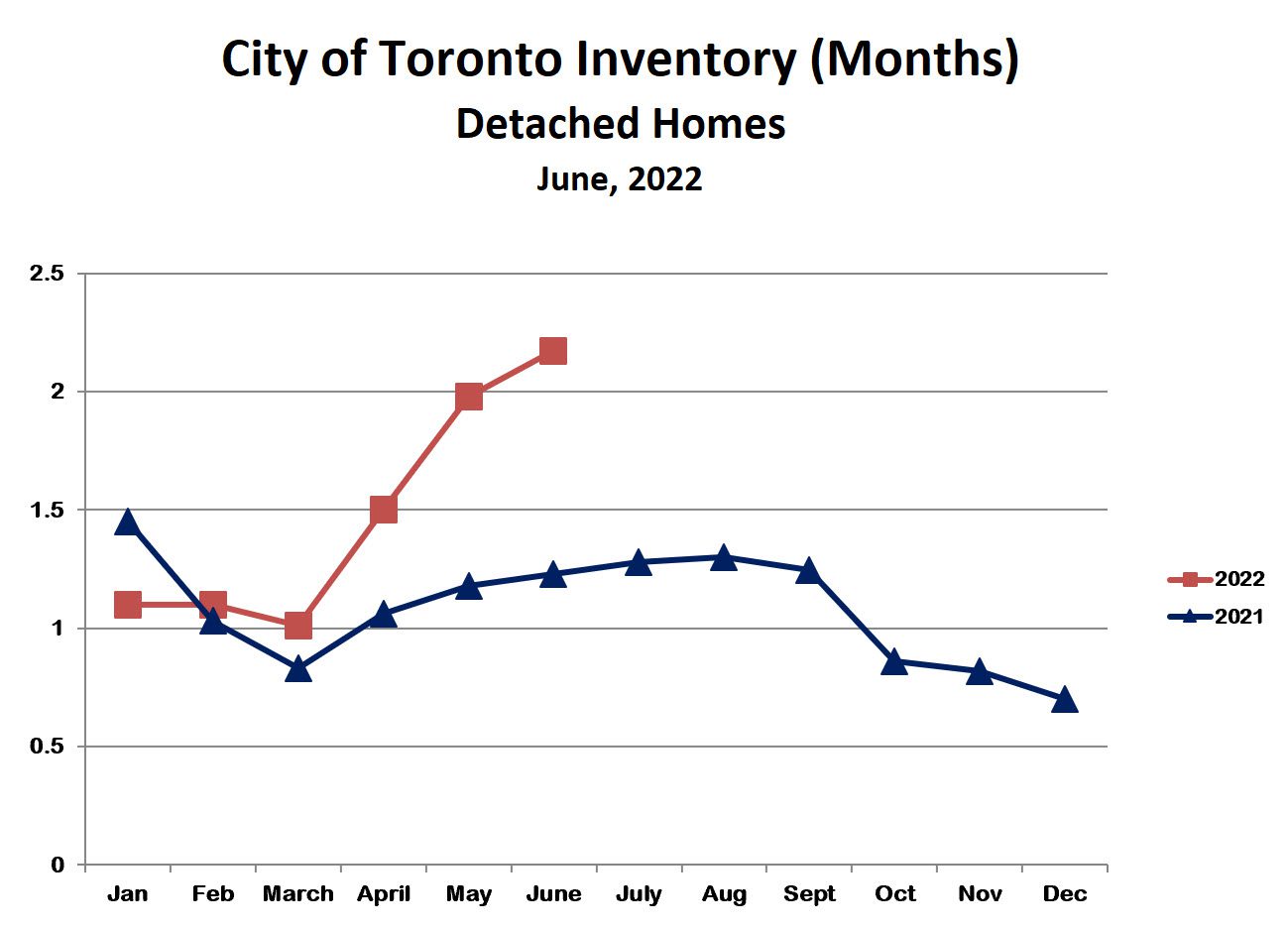

Not surprisingly, these changes come with a corresponding change in the supply of homes for sale. We define inventory (also known as months of supply) as the ratio of homes for sale to homes sold during a given month. For example, if there are twice as many homes for sale as there were homes sold last month, that means it would take two months to sell all the homes now for sale if no new homes came up for sale. Our rule of thumb is that 3 months’ supply represents a roughly balanced market, where neither sellers nor buyers are in control. As the chart below shows, we had very low inventory early this year (a strong sellers’ market), however, the inventory has risen steadily over the past three months and the market is now becoming more balanced.

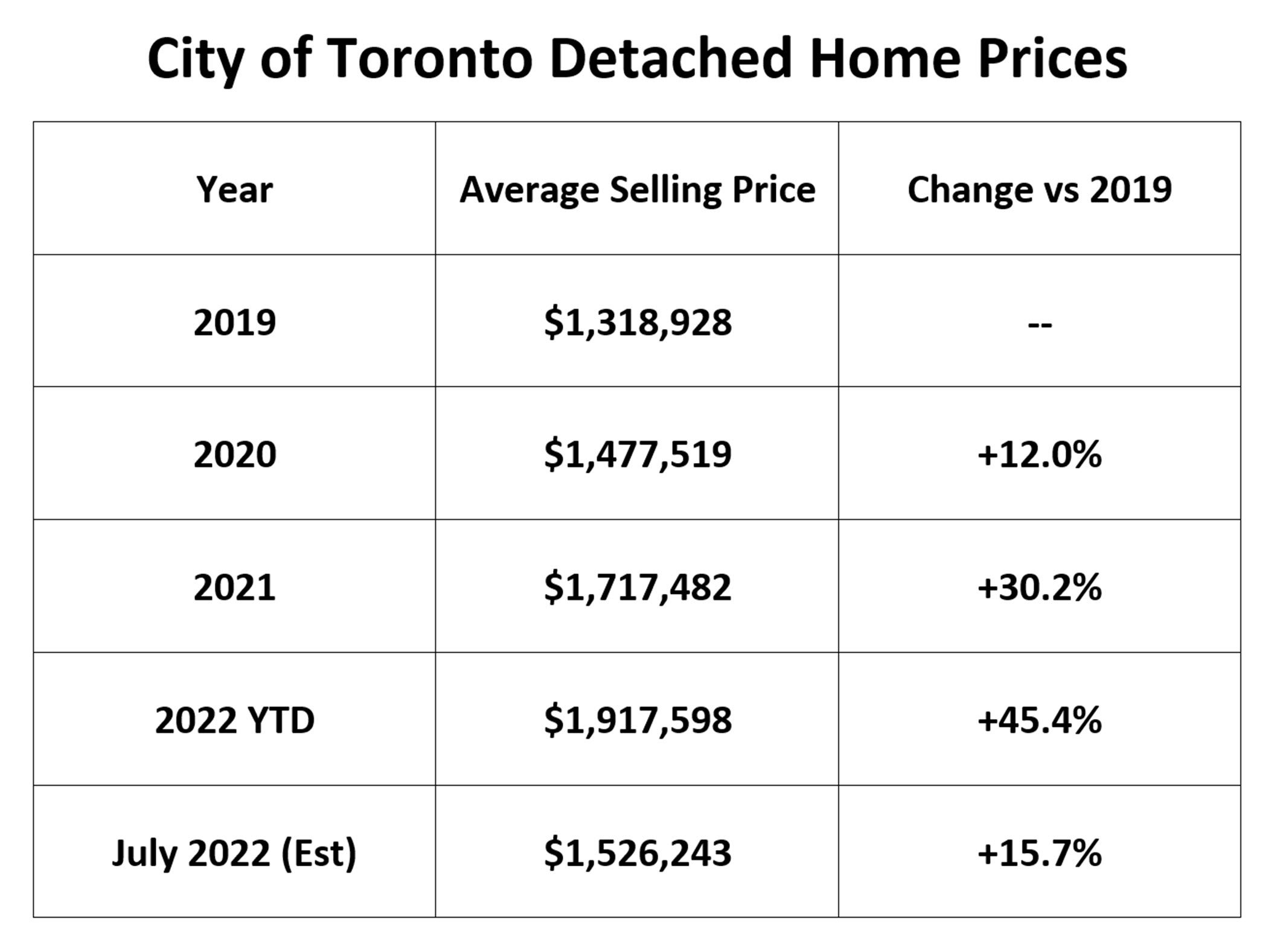

The decline in prices may seem extreme, however, a bit of history will help to put this into perspective. The chart below shows average detached prices over the past 3 years, tracking the changes over the course of the pandemic.

Between 2019 and 2022, detached prices rose by more than 45%! It seems crazy that this could happen during a pandemic, but it actually makes sense. First, the government caused a recession by imposing lockdowns and other covid restrictions. Then, the government and central bank tried to offset the effects of the recession by over-stimulating with free money and ultra-low interest rates. This led to frantic real estate buying and a ‘fear of missing out’ mentality that drove prices higher relentlessly.

Now, however, the over-stimulation has led to inflation, which the central bank is forced to fight with aggressive interest rate increases. This is taking a lot of the ‘bottled air’ out of the real estate market and bringing prices down to more realistic levels. Even with the latest price decrease, however, we are still more than 15% above 2019. This is about 5% increase per year, a very respectable number indeed.

Condominium Apartments

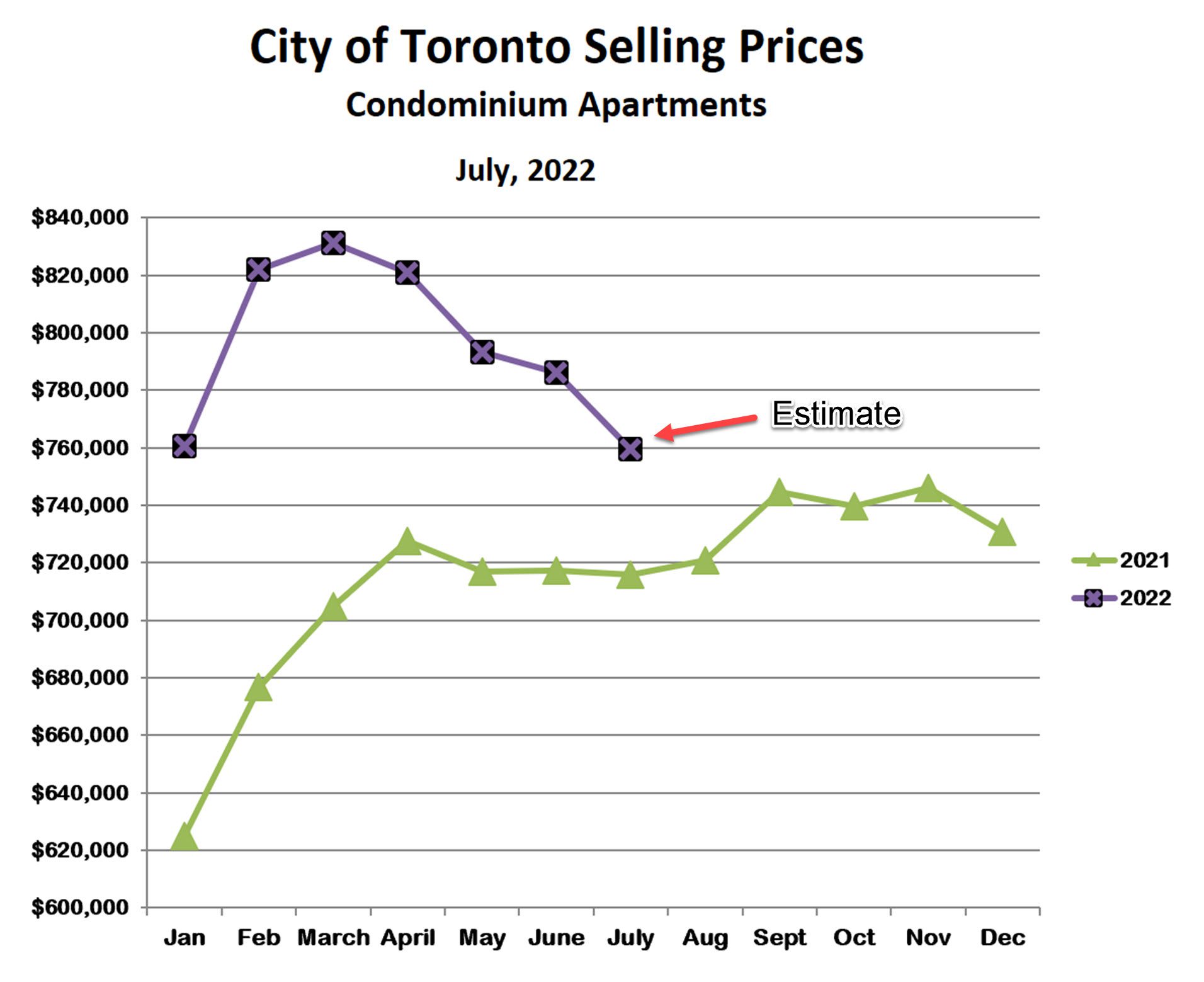

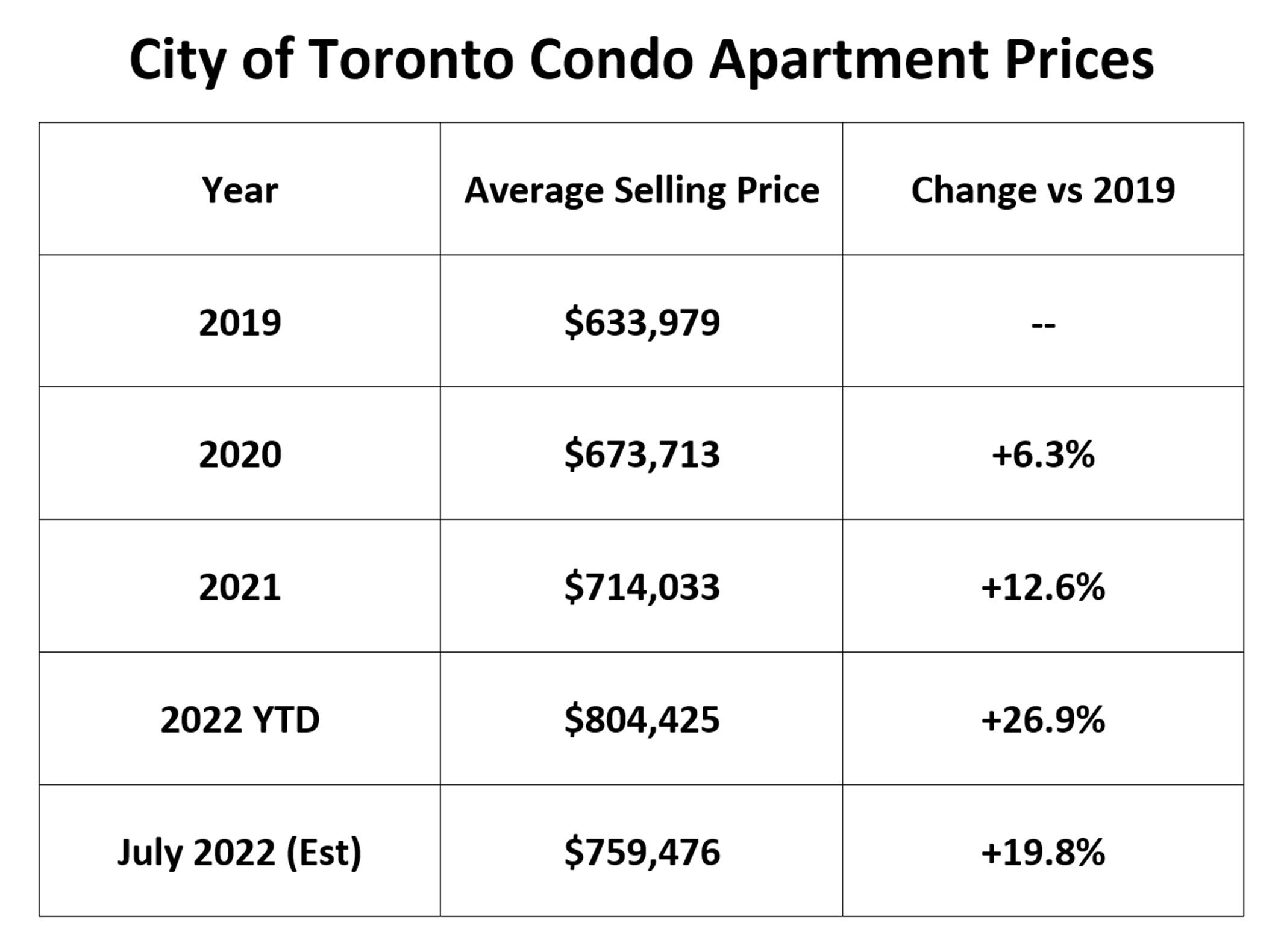

The story for condos is similar to houses, albeit less extreme. Prices have fallen for the past four months and are now about 9% below the March peak. Unlike houses, condo prices are still higher than last year, however.

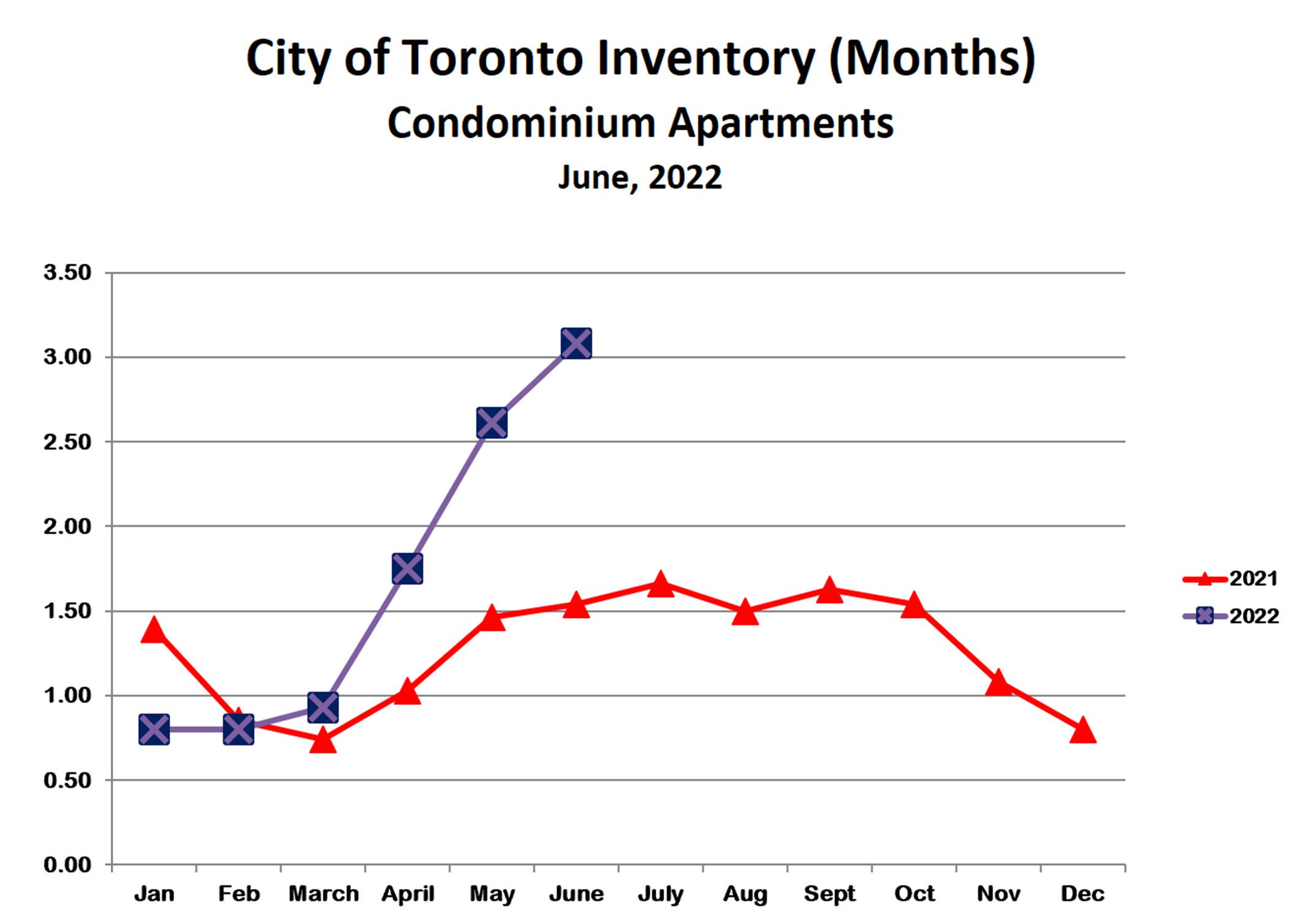

As for houses, the inventory of condos for sale has been increasing steadily and now stands at just over 3 months’ supply, representing a ‘balanced’ market, favouring neither sellers nor buyers.

The history of the condo market since the beginning of the pandemic also resembles houses. Prices as of this June were about 27% higher than in 2019, and are still almost 20% higher after the recent fall. This is a most respectable 6%-7% per year increase during the pandemic.

The bottom line is that the pandemic (or more accurately the responses to the pandemic) created a significant bubble in real estate prices. The bubble is now deflating due to rising interest rates made necessary by inflation, which was also caused by responses to the pandemic.

With a bit of luck, inflation will abate over the next few months, interest rates will decline (or at lease stop rising) and we will avoid a deep recession. If all of this comes to pass, we can hope for more stable, predictable prices and a more balanced market going forward.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!