The Summer Slowdown Continues

07/20/23

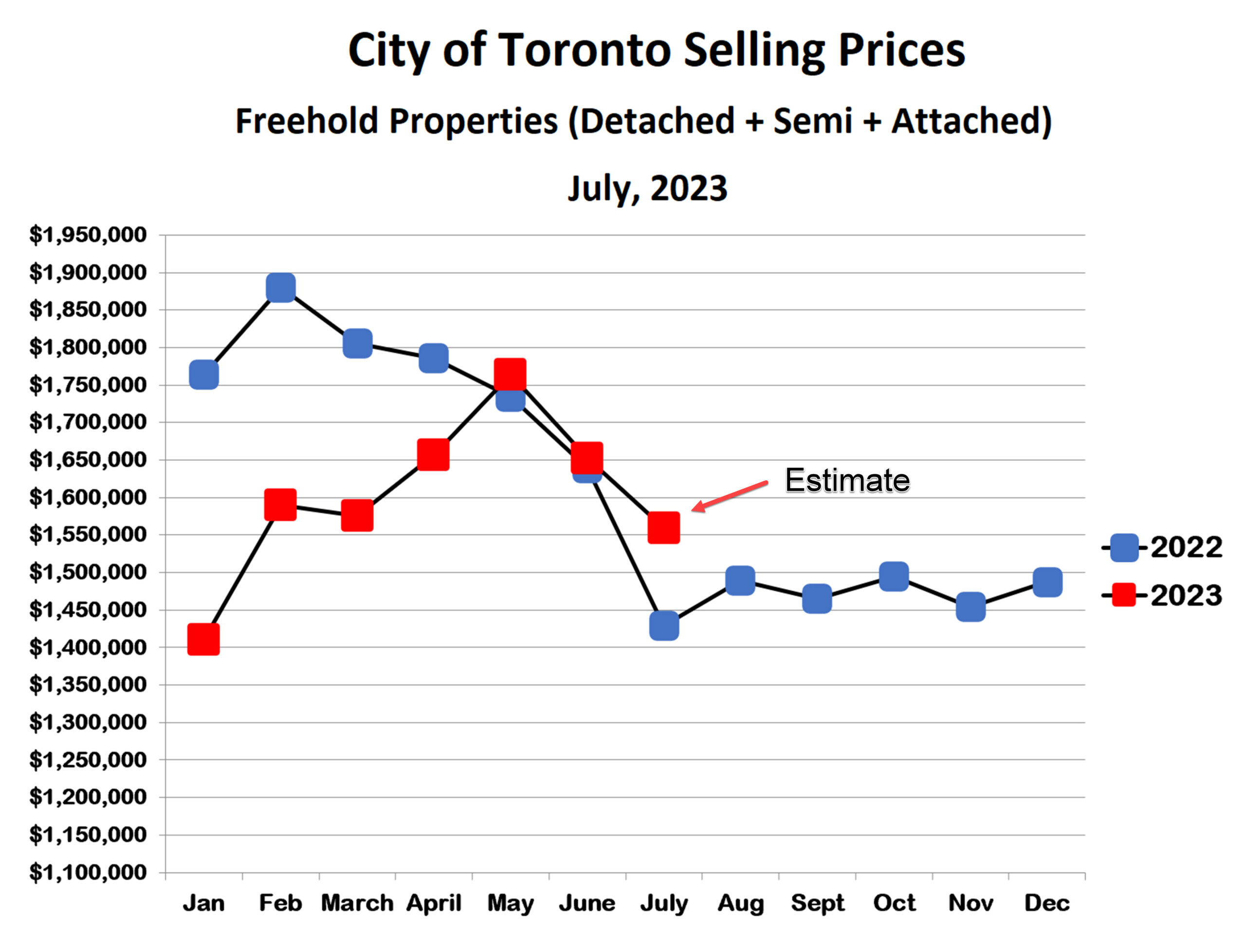

Houses (detached, Semi-detached and attached homes)

Prices for freehold houses in the City of Toronto continue to trend lower in July, although they remain higher than last year.

Last year the Bank of Canada began increasing interest rates in March, and ultimately raised the bank rate from 0.25% to 4.25% in a series of 8 hikes ending in January of this year. House prices started falling soon after the first rate increases, bottomed out in July, and were more or less unchanged for the next 6 months. Immediately after the final rate hike in January, prices started moving up again very strongly. Prices peaked in May, not far below the 2022 high, and then turned lower in June. It can’t be a coincidence that the Bank of Canada resumed their rate hikes at the same time, with 0.25% increases in both June and July.

Looking for home-buying advice? Start with these related blog posts.

- Why You Should Buy Instead of Renting

- Incentives & Tax Breaks First-Time Buyers Should Know About

- 3 Reasons Real Estate Transactions Fall Through and How to Avoid Them

It seems that there is a strong negative correlation between interest rate increases and house prices. Not surprising, perhaps, as mortgage interest rates obviously affect affordability very directly. What is intriguing, however, is that it appears to be changes in interest rates, not their actual level, that is weighing on prices. Early this year, once it was understood that there would be no further rate hikes, prices took off. It was as if buyers were always ready to jump in, but were waiting until they were confident that the correction was over. With the recent resumption of rate increases, perhaps buyers are once again hesitating.

If this theory is correct, always assuming that there will be no further interest rate changes this year (the current consensus), then we can hope for a strong fall market with prices once again increasing. The wild post-Covid market gyrations continue.

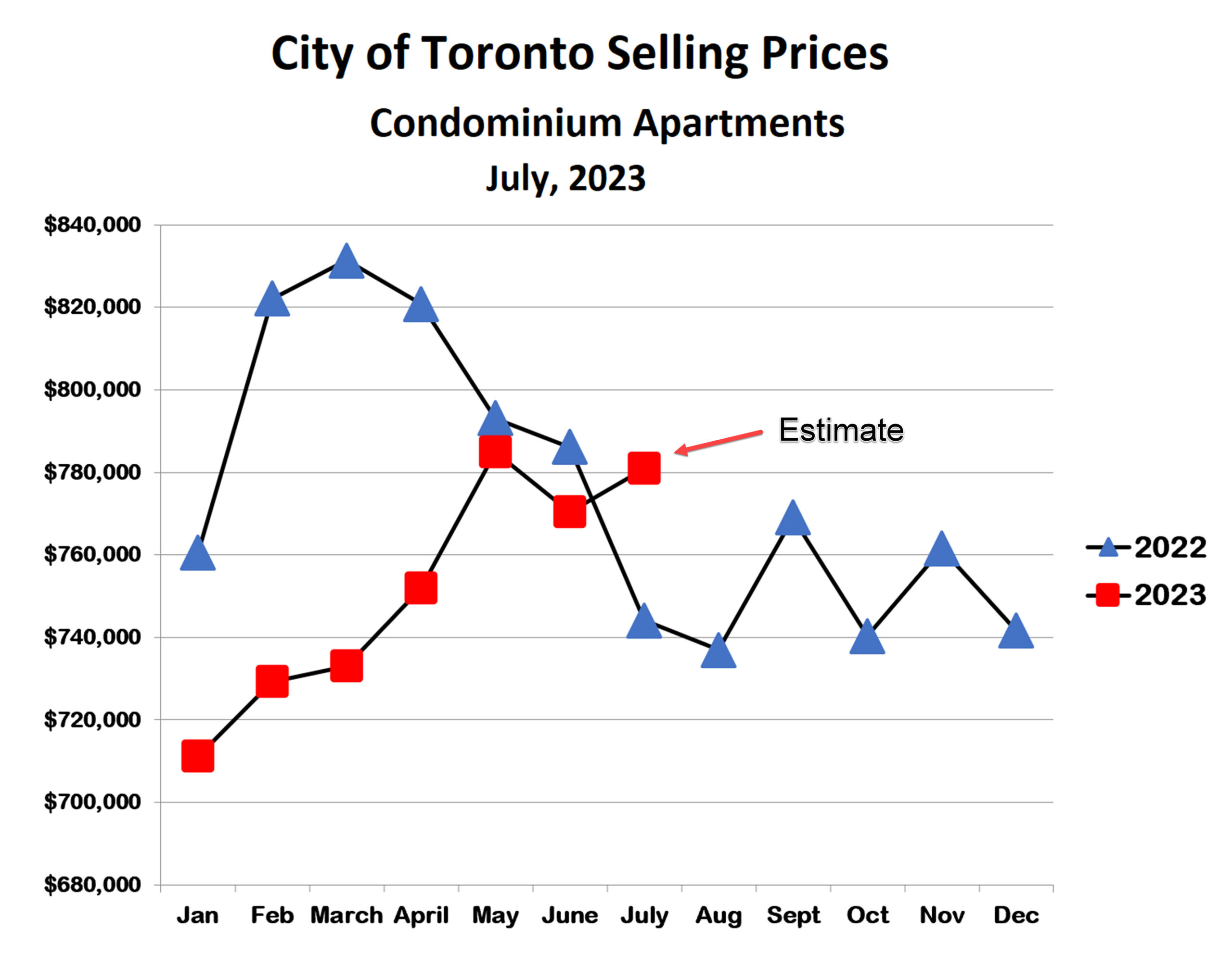

Condominium Apartments

As for houses, condo prices have fallen since interest rate hikes resumed in June, however, they are actually somewhat higher so far in July than they were in June.

Toronto condo prices have been more resilient than house prices in the face of rising interest rates. For example, the peak-to-trough correction in house prices last year (from February to July) was 24%, while the condo correction (from March to August) was less than half of that, about 11%. This further supports the idea that changes in interest rates are impacting prices more than the rates themselves. Otherwise we’d expect condo prices to be hit harder than house prices, since affordability is generally a bigger factor in the lower price ranges.

Bottom Line

We have a housing crisis in Canada, and especially in the GTA, with the growth in population greatly exceeding the growth in available housing. Resale and rental markets for houses and condos are tight, with generally low inventory in both. Upward price pressure on both markets is likely to continue in the medium to longer term, with short term fluctuations in the resale market due, in part, to buyers hoping to ‘time the market’. If we get a recession in the next year, this may also weigh on prices though, again, this is likely to be only a temporary blip in the longer term uptrend.

Looking to get into the market? We can help you reach your goals. Send us an email or call 416-769-6050 to get started.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!