The Toronto Summer Market Follows The Usual Script

07/27/24

Houses

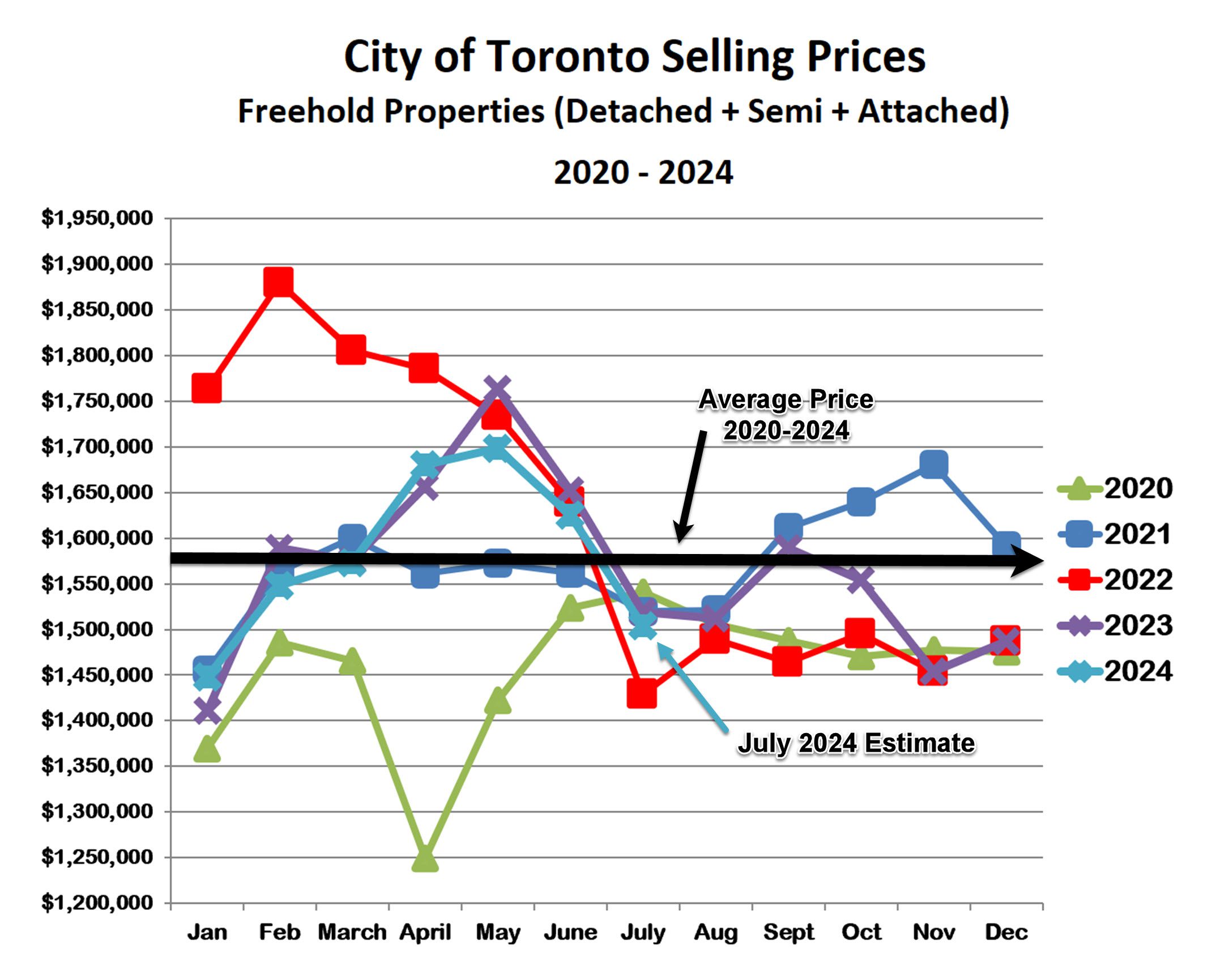

Just like the last two years, the summer market has arrived with slowing sales and falling prices. In 2022, prices fell by 24% between the spring top and July; in 2023 it was -14%; and this year it is -12%. These sorts of wild fluctuations have become normal since the beginning of Covid. On average, house prices are little changed since 2020, but there have been swings of +/- 20% above and below this average. It’s especially weird, in light of these wild oscillations, that prices this year have matched last year almost dollar for dollar every month.

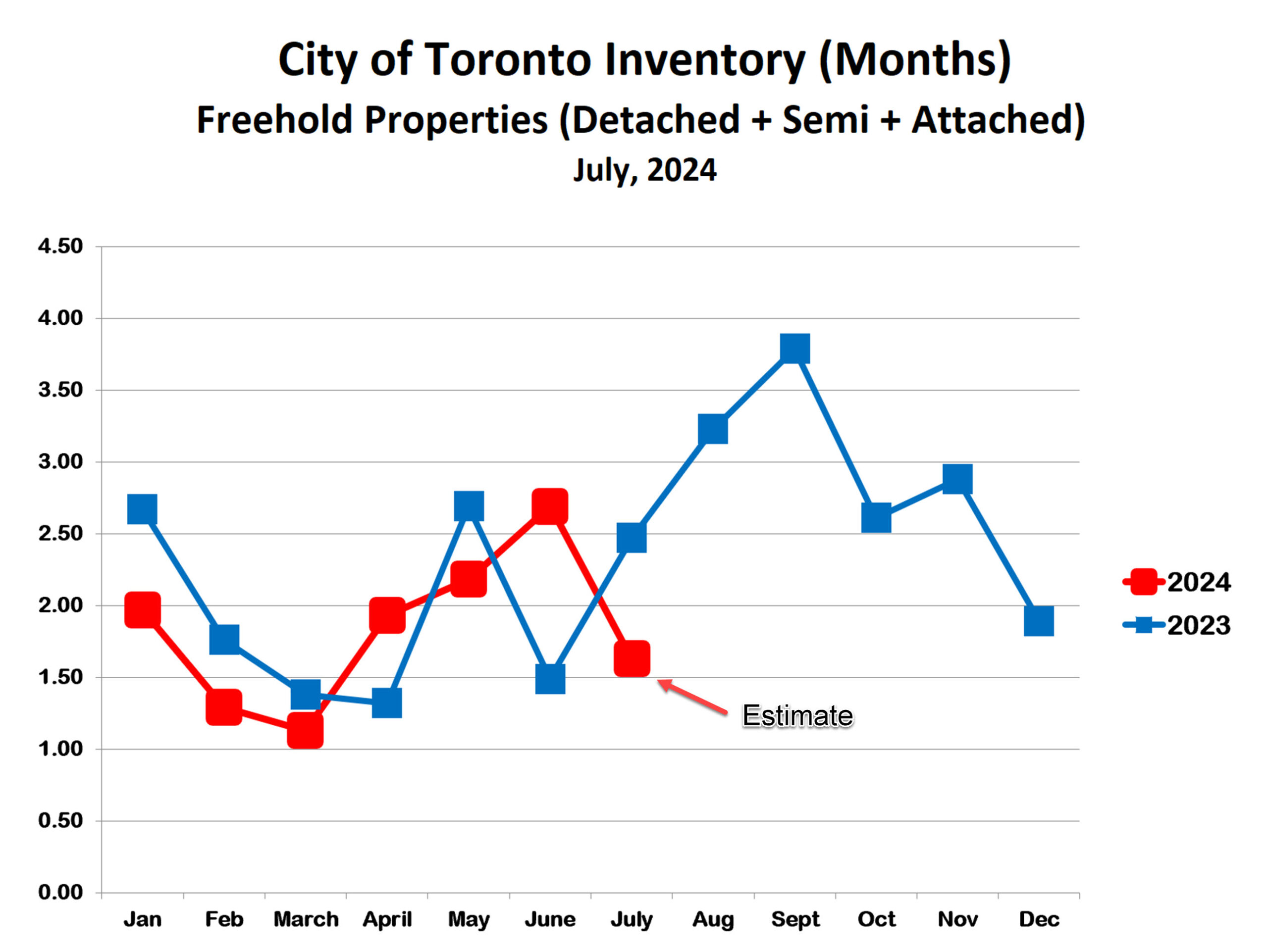

The inventory of homes for sale has remained surprisingly low. While sales have fallen by almost 30% over the past two months, active listings have fallen even more, and the inventory is now under 2 months’ supply. This would be a strong sellers’ market were it not for the anemic level of sales. It seems as if buyers have only slightly more interest in buying than sellers have in selling.

Condos

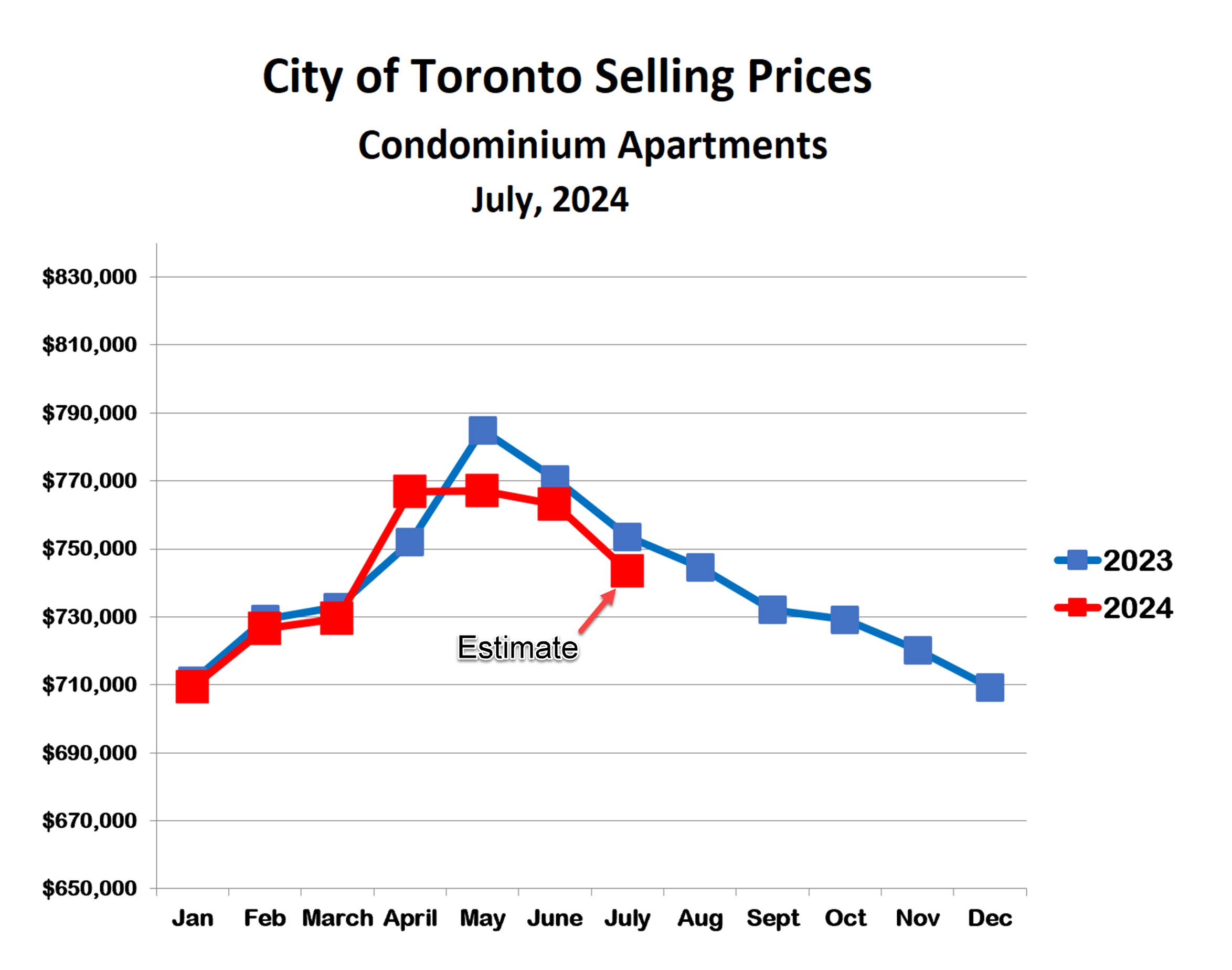

Similar to houses, condo prices are continuing to follow the 2023 trend. July prices are down about 3% from the spring peak and slightly below last July. The 0.25% drop in the bank rate in June has so far had no discernable effect on prices. Last year there was no ‘fall bounce’ in prices – they just kept dropping steadily until they returned at the end of the year to where they started in January.

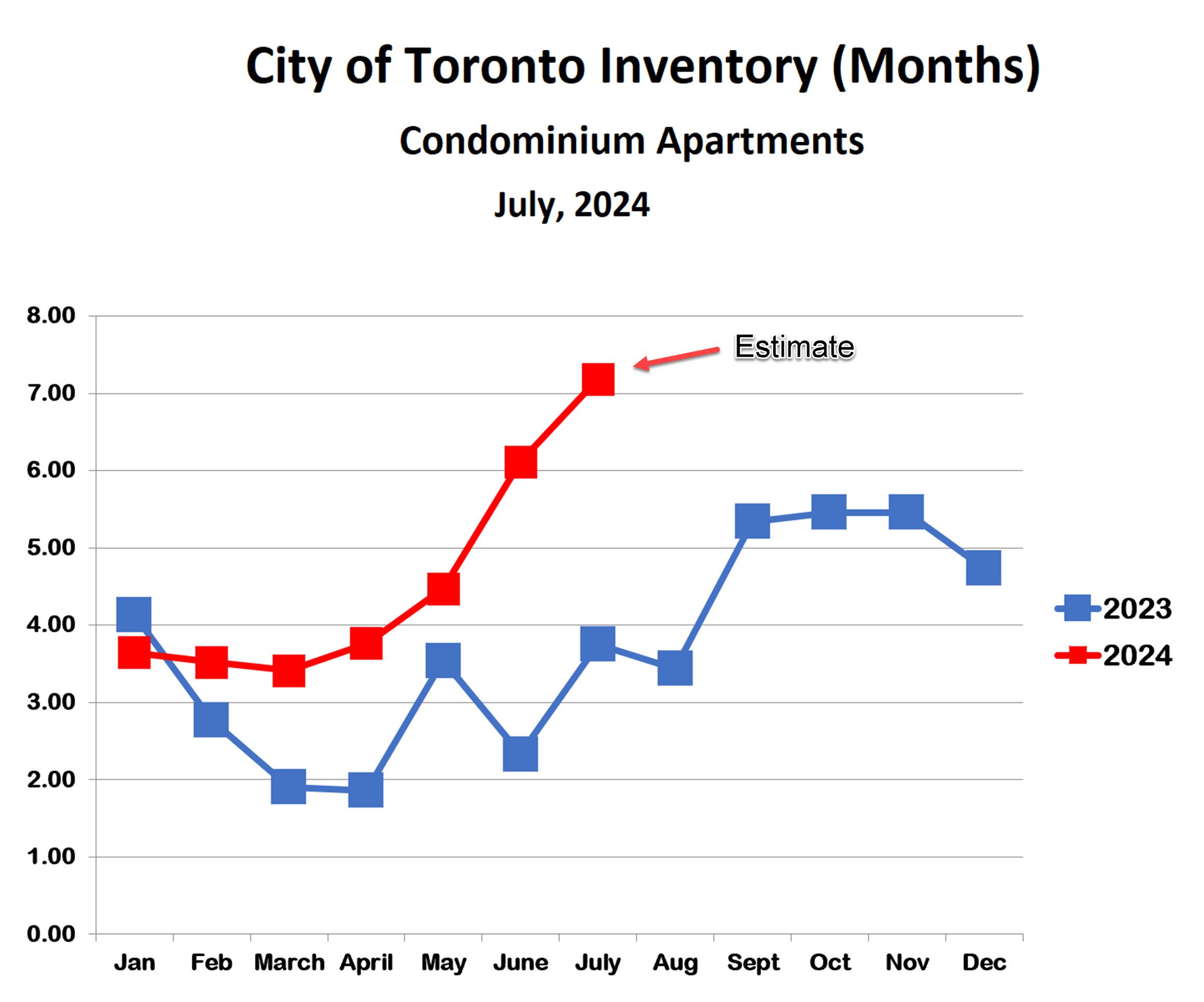

The inventory of condos for sale has risen steeply over the past two months. Early this year it was under 4 months’ supply; it was basically a balanced market. Now, however, we are above 7 months’ supply, deep in buyers’ market territory. This is due to a combination of falling sales and rising listings. The elevated inventory level will be a strong headwind against any bounce in condo prices this fall.

Bottom Line

We have now had two successive .25% reductions in the bank rate, and there’s a good chance of two more before the end of the year. Hopefully this will encourage more buyers to come off the sidelines and give us a healthy fall market. As interest rates fall, however, recession fears seem to be rising. Let’s hope the Bank of Canada hasn’t waited to long to bring interest rates down.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!