Toronto Area House Prices On Rocket Fuel

02/15/21

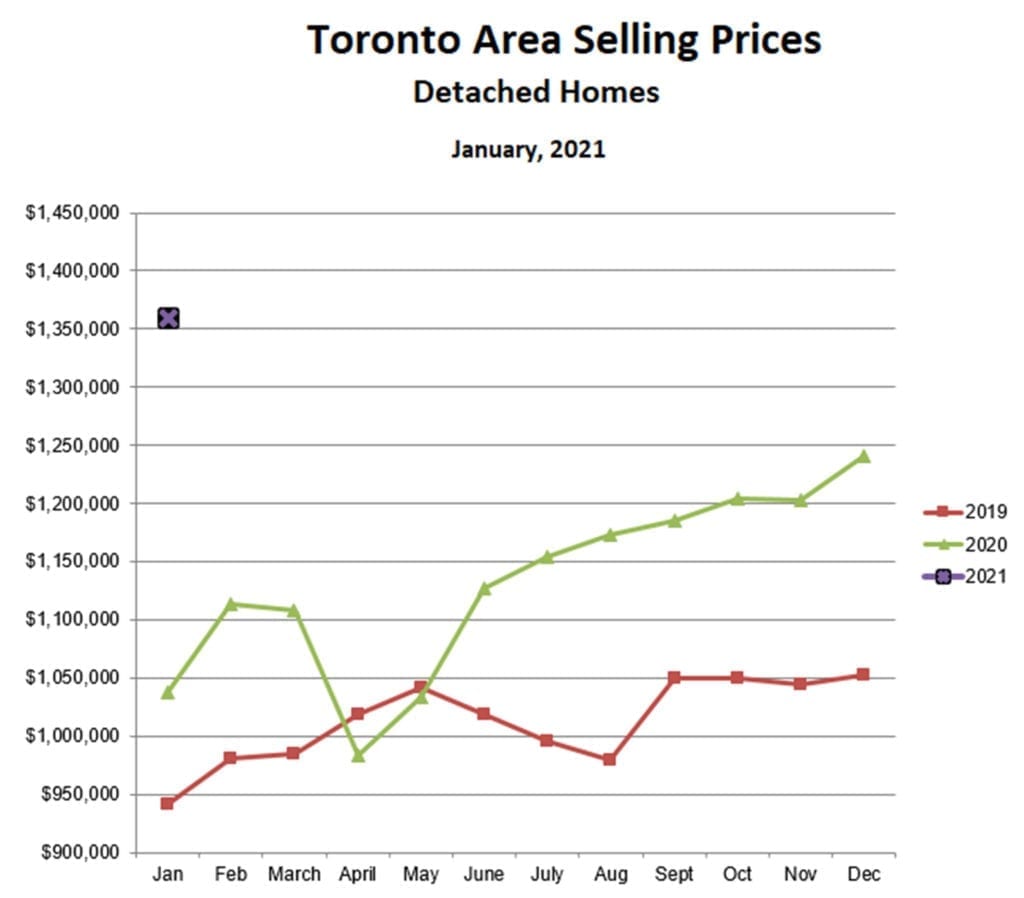

House prices in the Toronto area have been on a tear since the temporary dip last April caused by the initial Covid lockdown. Over the next 8 months, from May through December, prices for detached homes increased by 26%, but then the market shifted into an even higher gear and prices went parabolic.

In the month of January alone, detached prices in the GTA increased by 10% to $1,359,915, blasting past the all-time record high of $1,214,422 reached in March, 2017. Preliminary data suggest that prices will increase by another 6% or so in February, not quite as much as January but still huge.

Year-over-year, prices have increased by a whopping 37% since last January.

Prices in the areas surrounding Metro Toronto to the west, north and east are actually going up faster than the city proper: the average increase in Halton (west), York (north) and Durham was 11% for January vs December, as compared with “only” a 7% increase in the City of Toronto. This is, of course, because of the Covid-driven diaspora of families seeking larger houses at lower prices and able (or required) to work from home. This difference in the rate of price escalation may shrink as outside-Toronto prices catch up with prices in the city – in fact, York and Halton are already there.

What is driving prices up so quickly? Two things:

- Interest rates are unbelievably low, with five year fixed mortgages available at under 1.5%, and it’s unlikely rates will increase over the next couple of years. If anything they may drift even lower.

- The inventory of houses for sale is approximately 1 month’s supply, meaning that homes are selling as fast as new listings come on the market. The only time that inventory has been lower was in the spring of 2017, just before the bubble burst. the low inventory is due, in part, to higher-than-normal market activity in December and January. Usually these are slow months because of seasonal celebrations, but because of Covid this didn’t happen and homebuying continued apace.

As more and more new listings come on the market over the next few months, inventory levels should increase and the rate of price increases should slow, however, we should expect a strong sellers’ market to continue for most if not all of 2021.

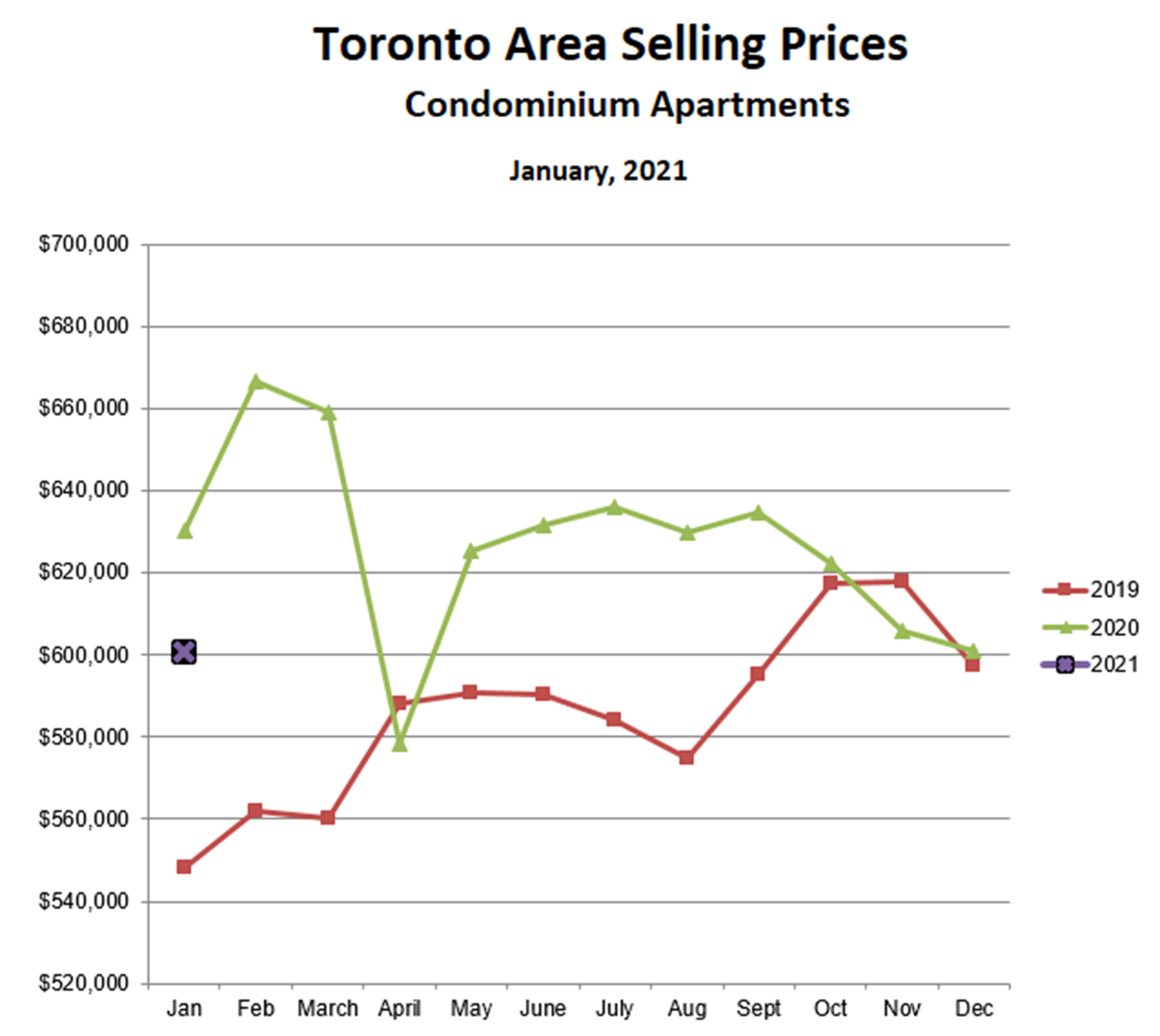

The Toronto area condo market continues to be a completely different story. Condo prices were extremely volatile throughout 2020, increasing quickly in the first quarter; then falling steeply in April following the Covid lockdown; then bouncing back and remaining stable from May until September; then falling again in the fourth quarter. Prices in January 2021 were almost exactly the same as in the previous month, suggesting that the market has stabilized once again and may bounce back, if weakly, through the rest of this year. It’s encouraging that sales of condos were higher in January than in December, and close to double the sales in January 2020. What has been ailing the condo market isn’t lack of demand, it’s Covid-related factors such as the collapse of the rental market.

So far it seems that the market in 2012 will be much stronger than in 2020, and much less of a roller coaster ride.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!