Toronto Area Prices and Sales Plunge in April

05/05/20

The COVID-19 restrictions that were imposed in late March have caused both sales and prices to fall steeply in April.

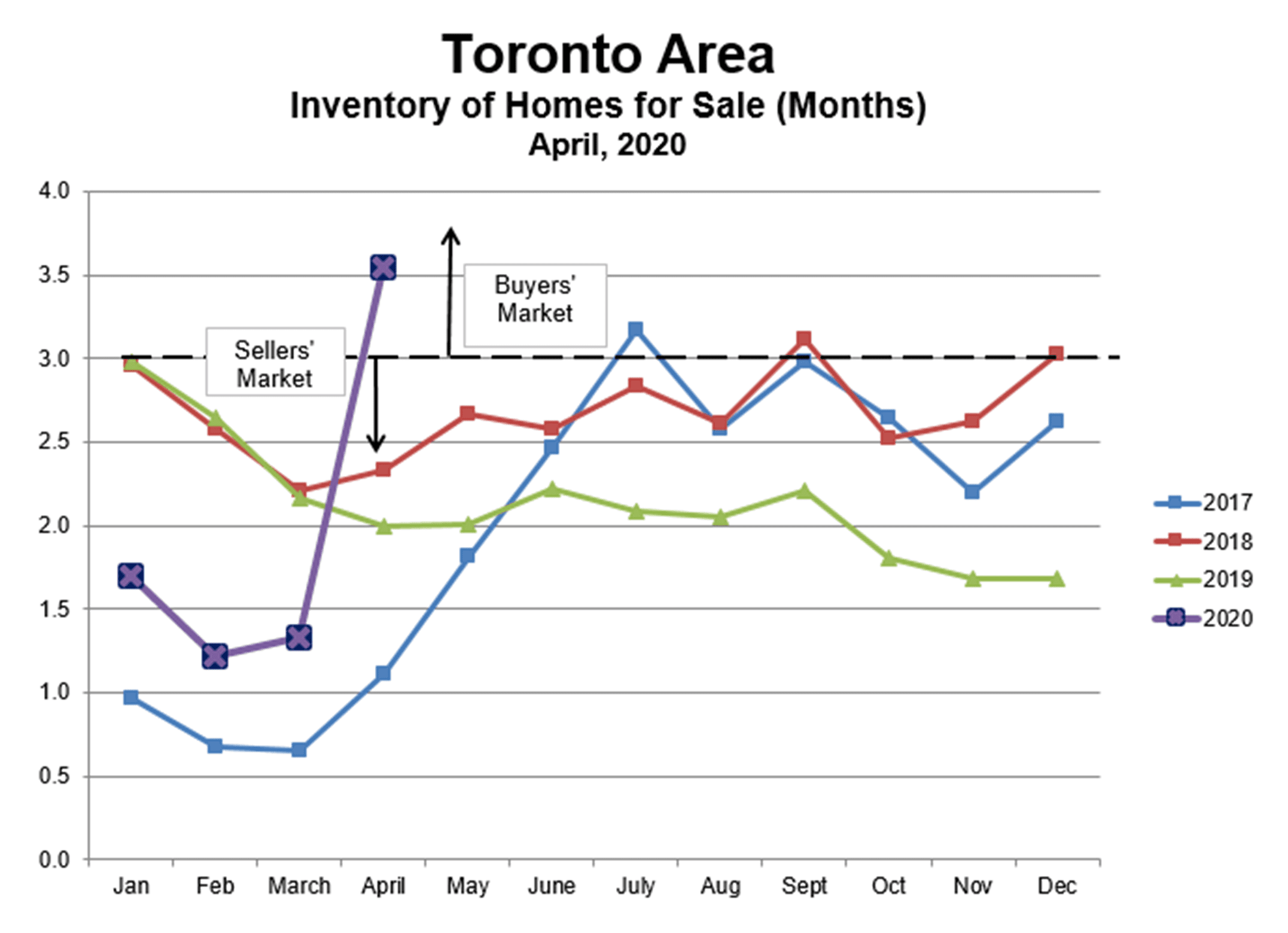

Sales for all property types fell by approximately 2/3 as compared with last April, while listings of properties for sale were about the same, so the inventory increased by almost a factor of three, from 1.3 months to 3.5 months. This places the GTA market firmly in buyers’ market territory.

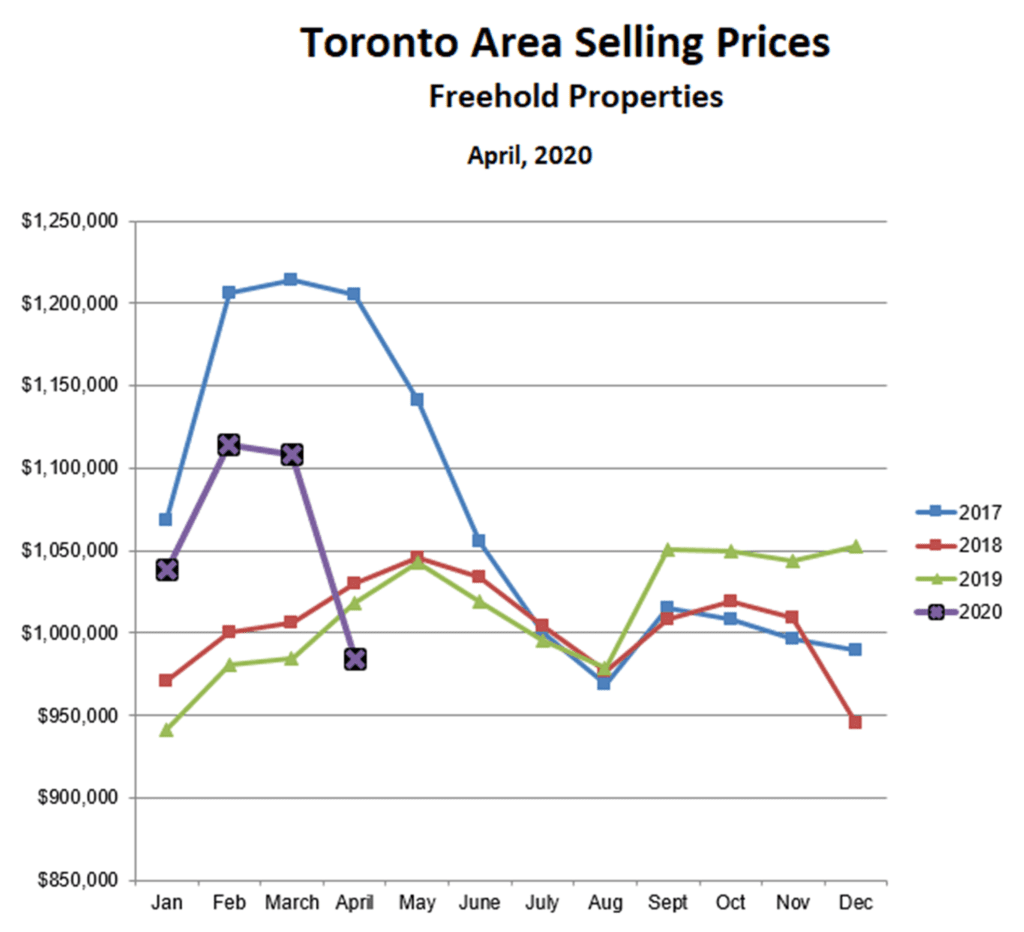

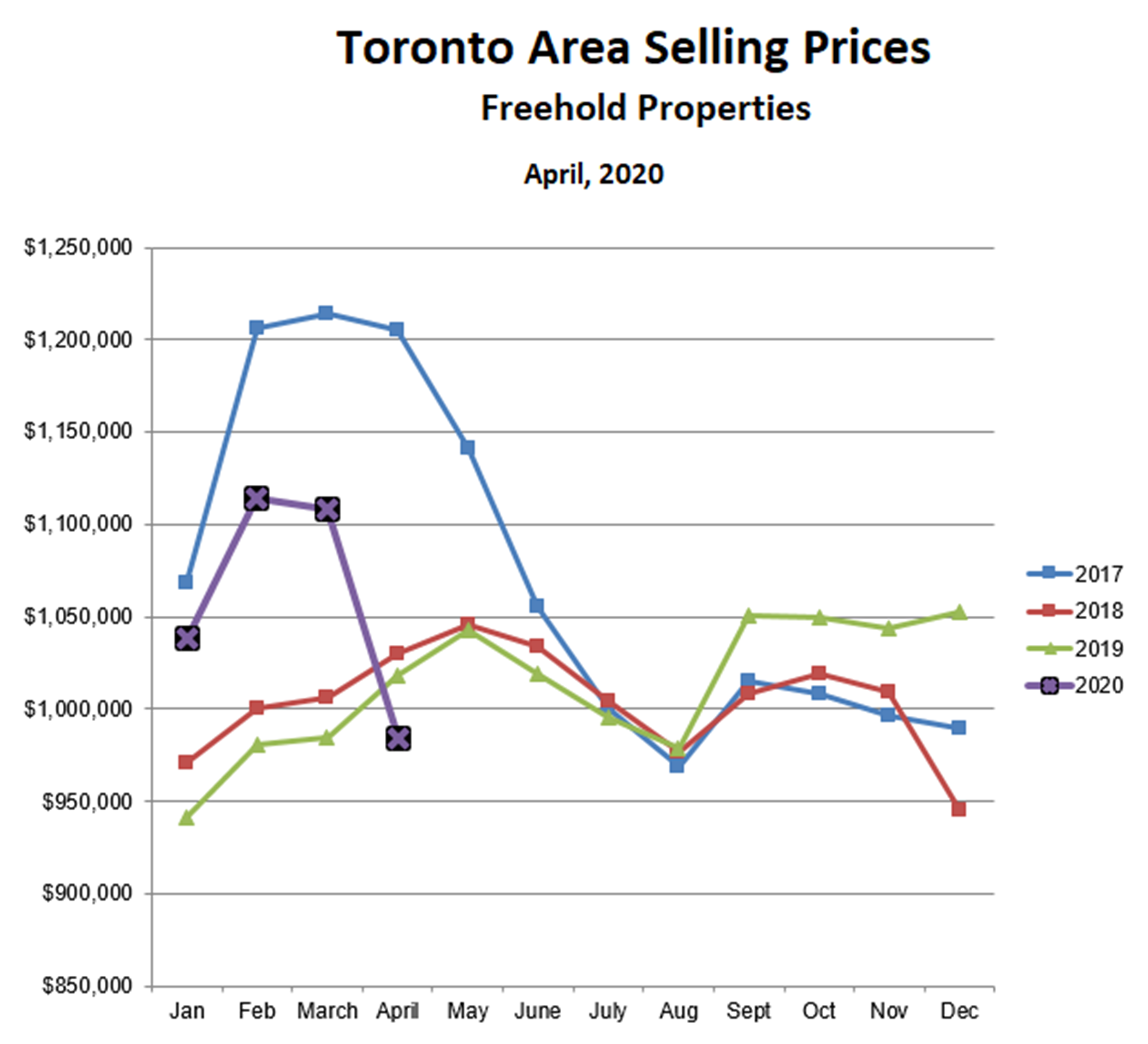

Prices for freehold (predominantly detached) properties fell steeply in April, by 11% as compared to March and by 3% as compared to last April. A bubble had been forming since late 2019, similar to what we saw in 2017, but that bubble burst prematurely when the COVID-19 restrictions were imposed in late March. Basically, prices have retreated to (or somewhat below) the plateau that was in place from late 2017 (after that bubble burst) until late 2019.

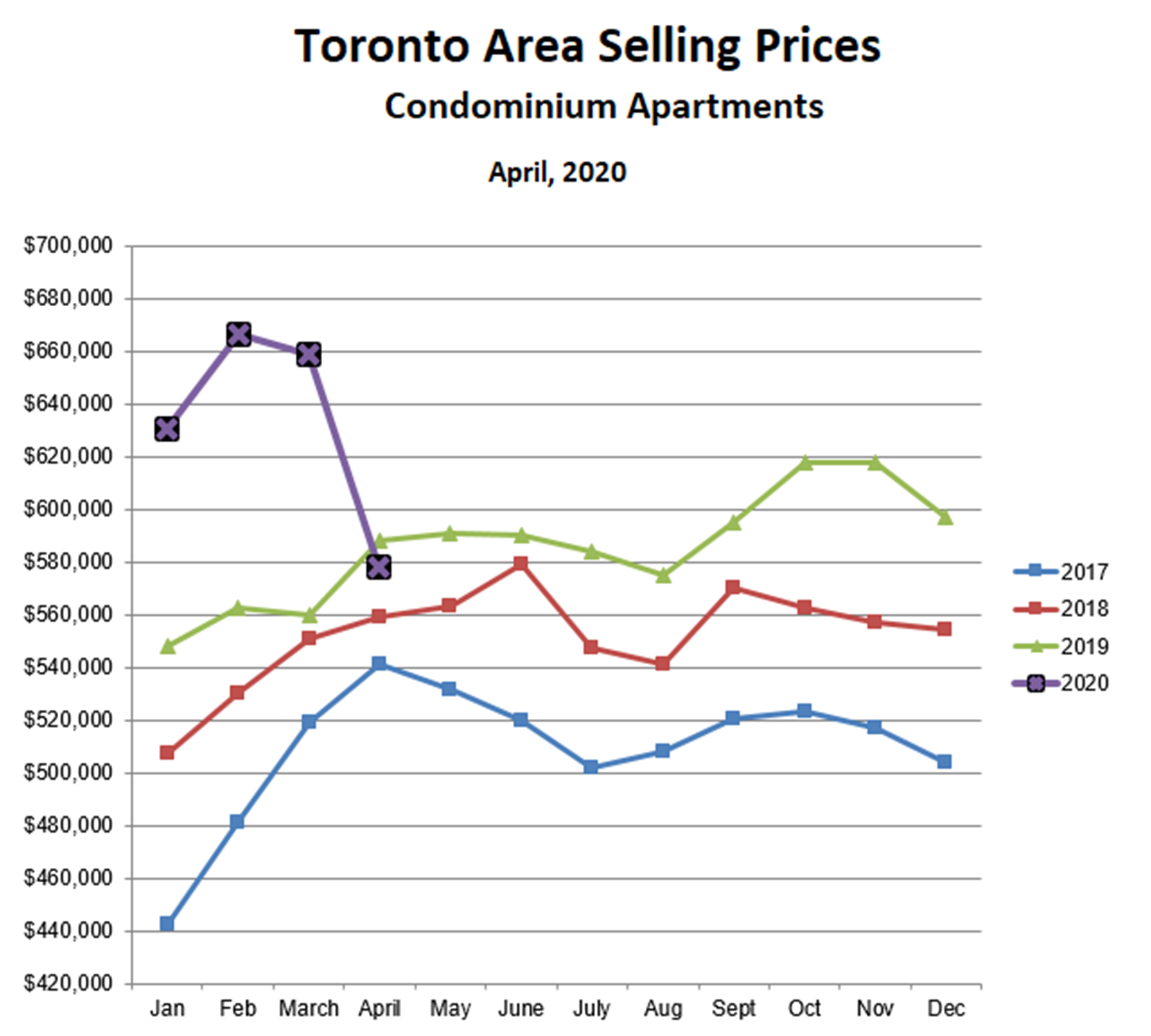

Prices for condominum apartments are following a similar trajectory. Condo prices fell by 12% from last month, and by 2% as compared with last April. As in the case of freehold properties, all the froth in the bubble that was forming late last year and early this year has left the market. Unlike 2017, when freehold prices collapsed but condo prices did not, this time condo prices have equally fallen victim to the COVID-19 restrictions.

Whether prices continue to fall as the lockdown continues will depend on the balance of sales to listings. So far, it appears that the number of sellers is falling faster than the number of buyers, which means that inventory will fall. For now, this suggests that prices should remain relatively stable, especially since mortgage interest rates are likely to remain very, very low.

But it’s much harder to predict the direction of the market once the lockdown ends. It all depends on how long the lockdown lasts, and the extent to which confidence in jobs, the economy and personal safety returns once it’s over. The optimistic scenario is that everything returns quickly to something resembling normal, which would lead to a resurgence in sales and prices. On the other hand, if large numbers of jobs are permanently lost, and COVID-19 fears & behaviours persist, we could see more homes for sale (e.g., due to financial difficulties, marriage breakups, etc) and more cautious buyers wanting to repair their balance sheets and increase their savings. This could lead to a deeper and more persistent buyers’ market with steadily declining prices.

We’ll just have to wait and see how this all plays out.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!