Toronto Fall Market Picking Up Steam

10/30/24

Houses

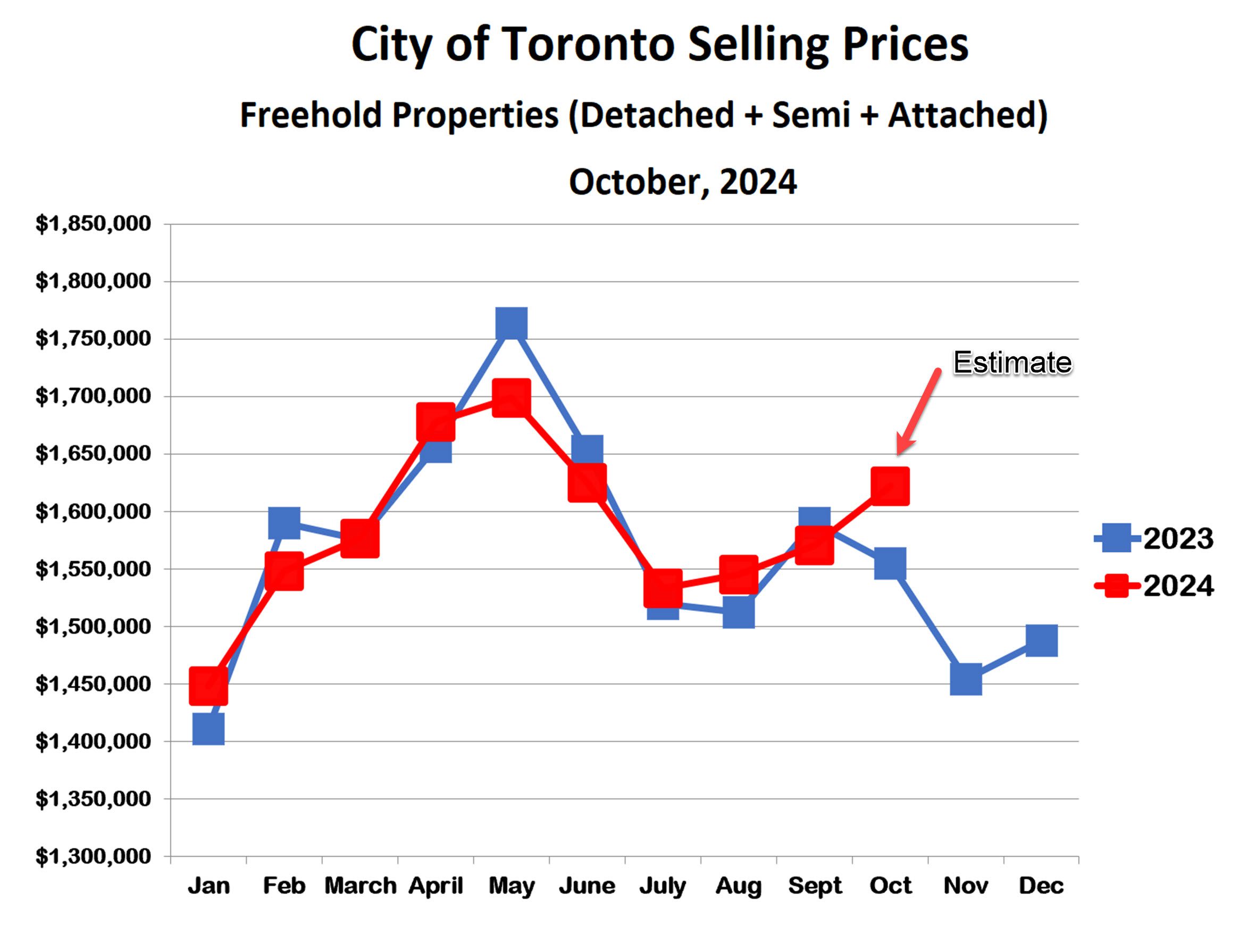

Average house prices increased in Toronto for the third month in a row, and are now back to where they were in June. The 2024 trend line, which has, until now, followed the 2023 trend very closely, has convincingly broken to the upside.

Sales of houses also increased substantially in October, to roughly the same level as in May, this year’s peak month. This corresponds to a big reduction in inventory to under 3 months’ supply, which is back in sellers’ market territory.

Clearly the multiple cuts to the Bank of Canada interest rate are gaining significant traction. Buyers who have been waiting on the sidelines are returning to the market.

Condo Apartments

Prices also improved dramatically for condos. So far, this has only brought condo prices back to where they were last October. Still. this is a welcome improvement after the dismal results in August and September.

Condo sales are also higher in October, similar to houses. Even better, sales are higher than the same month last year for the first time since February. The inventory of condos for sale also fell, though it’s still a bit over 5 months supply. It’s still a buyers’ market for condos.

It would seem that the Bank of Canada interest rate cuts are also bringing condo buyers back to the market. The condo market was hit harder than houses by higher interest rates because of the high proportion of rental units that suddenly became unprofitable and/or unaffordable. It’s very possible that the rebound in condo prices and sales could be even stronger than houses as investors return to the market (and stop selling).

Bottom Line

The Toronto real estate market is showing increasing strength as falling interest rates gain traction with buyers. This trend will likely continue through November and possibly well into December. Following the usual Christmas/New Years slowdown, the spring market could start as early as late January, and the peak price next Spring might even challenge the all-time high that we saw in February of 2022.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!