Houses Outperforming Condos In Toronto Fall Market

10/27/23

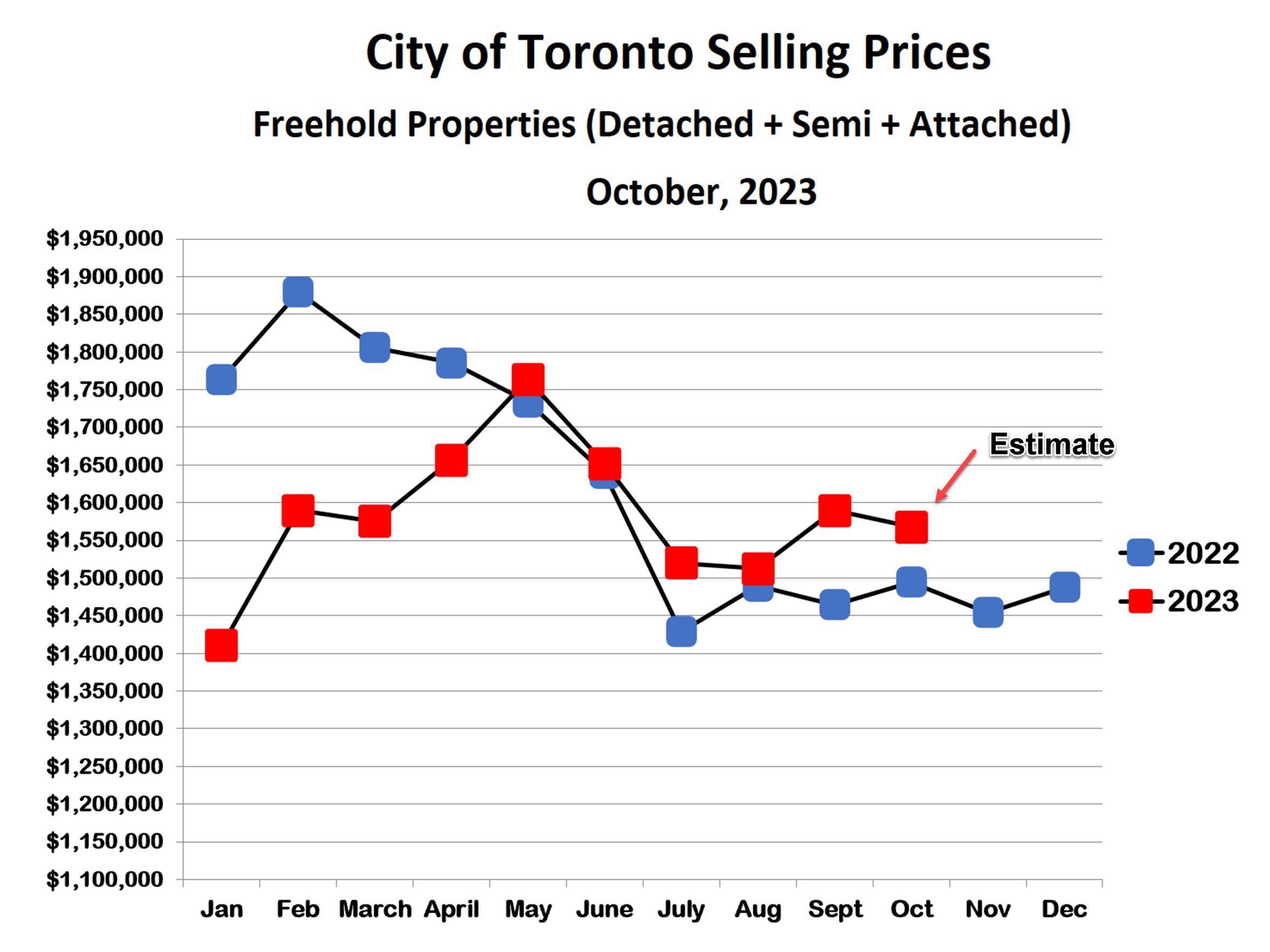

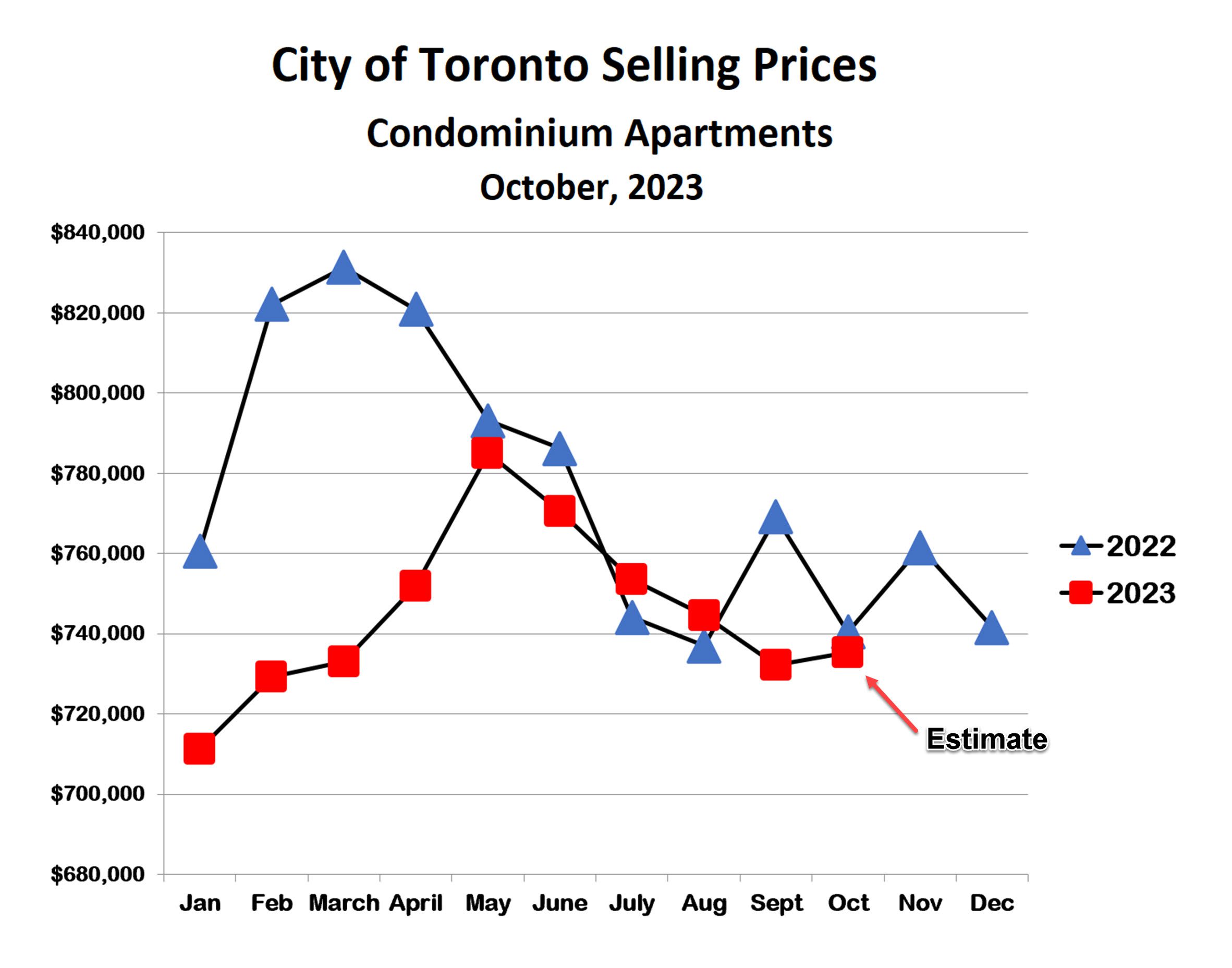

We are almost two months into the fall market, and the trend is clear. House prices are up modestly from the summer months, while condo prices have continued to trend downward.

Houses

Through the summer months, the Toronto market was slow and house prices fell 14% from the peak in May. Many prospective sellers have waited, hoping for higher prices in the fall. For a brief, exciting moment, it looked as if that might happen. By mid-September, house prices were up 9% versus the summer, and it seemed as if a hot fall market was underway. Alas, it was not to be, as a surge in listings starting in late September nudged house prices back down.

Even so, fall prices are up 4% versus the summer and up 7% versus last fall. This shows that the house market is comparatively healthy and steady. However, it’s not as strong as sellers had hoped. The burning question now is whether we will see a hot spring market next year, similar to the past 3 years. Many sellers are banking on it. However, the unrelenting bad news we have been receiving lately makes this a very uncertain call.

Condos

Condo prices also fell during the summer, and the downward trend continued in September. October prices have improved slightly, suggesting that condo prices may have stopped falling, but they remain lower than in the summer.

Inventory Levels

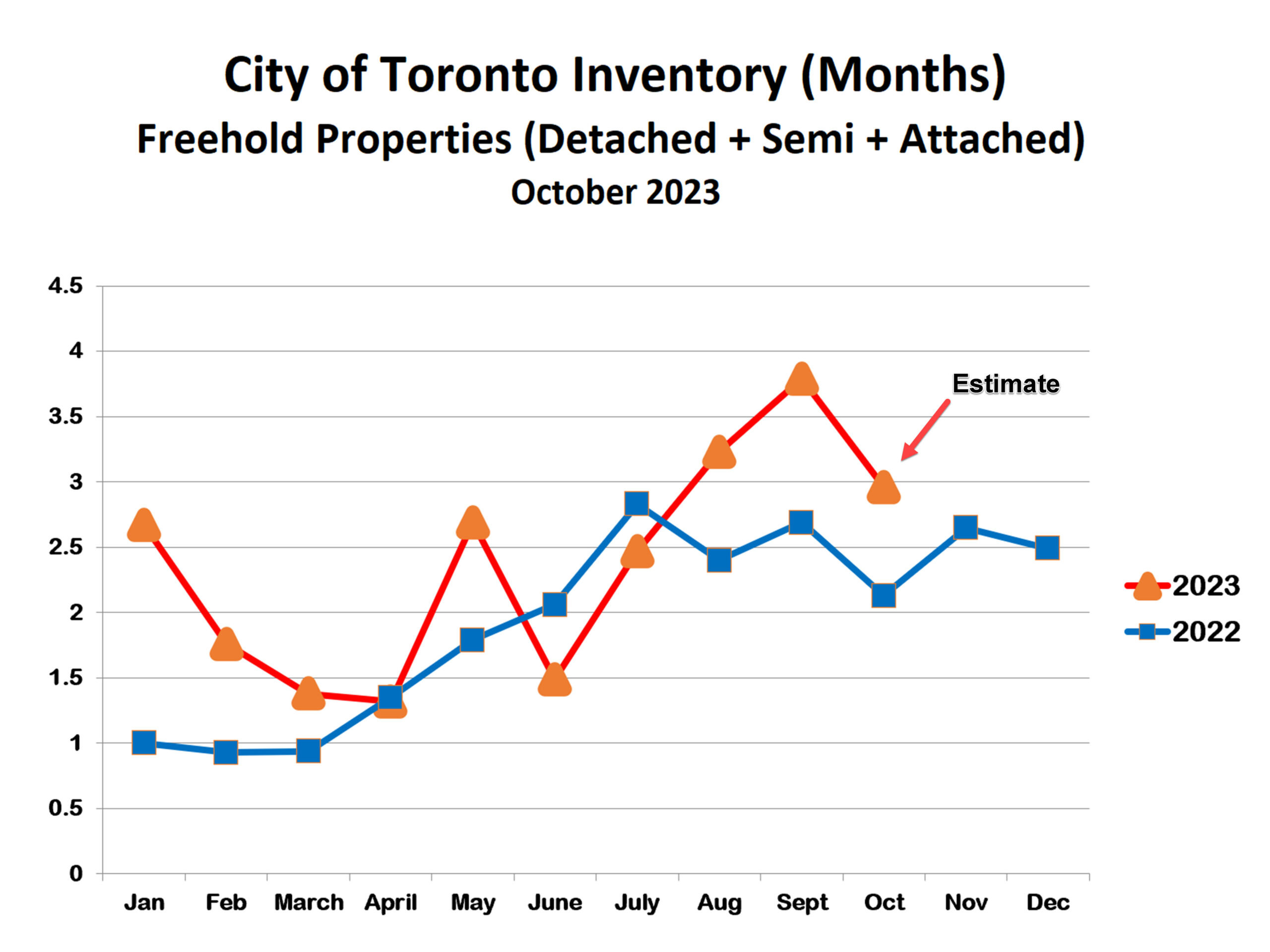

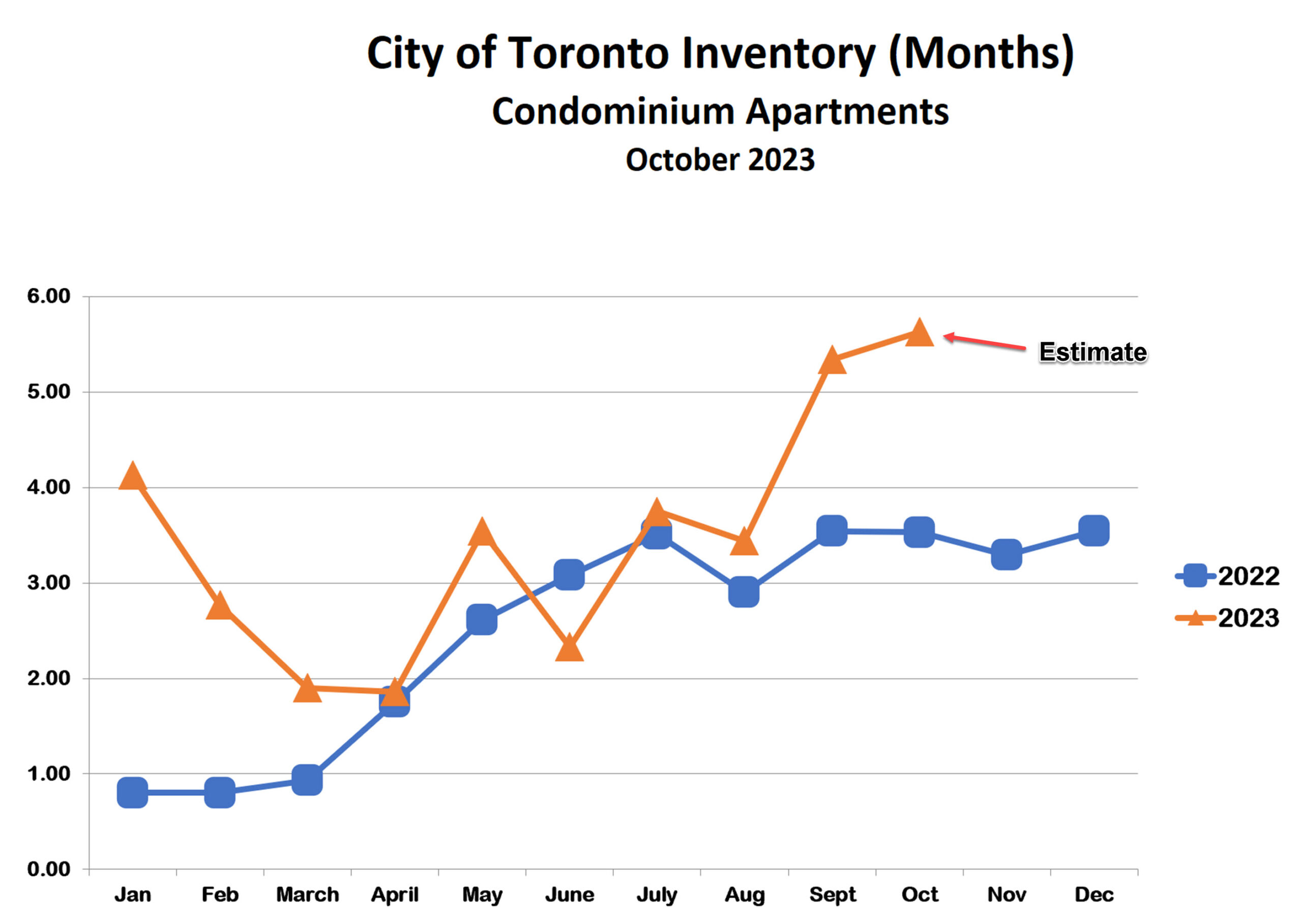

We describe inventory in terms of ‘months’ supply’. This indicates how long it would take to sell all of the properties now on the market at the current rate of sales, assuming no other homes are listed. We estimate inventory by dividing the number of properties for sale by the number of properties sold in the most recent month. As a rule of thumb, we reckon that 3-4 months’ inventory is a balanced market where neither buyers nor sellers are in control, while 5 months or more is a buyers’ market.

House inventory increased steadily over the summer months, and by September houses had moved into balanced market territory after having been mostly in a sellers’ market for the past several years. In October, however, house inventory has pulled back to just under 3 months. This suggests that house prices should remain steady in the short term.

The condo market is different. A large inventory spike in September has put condos into buyers’ market territory and this trend has continued in October. This is consistent with the falling condo prices and suggests that the weak market may persist.

Ironically, one of the chief causes of the higher inventory levels is that investors are listing their income properties. One might think that, with the rental market being so hot, income properties would be very attractive. While this is certainly true, higher mortgage payments have put financial strains on many investors carrying mortgages on income properties as well as their personal residences. Of course, when push comes to shove, it’s the income property and not the home that has to go. This is especially true of condos, since a large proportion of the condo market is for rental purposes, and many people bought rental condos over the past few years when interest rates were ultra-low. Condos are a preferred starter property for many beginner investors, as they are low cost and easy to manage.

Bottom Line

The Toronto market has weakened since the spring, and it’s apparent that the lower summer prices were not just a seasonal trend. The house market has withstood this trend better than the condo market, and house prices more likely to remain steady over the short term than condo prices.

As for next year, we may or may not see a bounce in prices in the spring. If we do, houses are likely to benefit to a greater extent than condos.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!