Toronto House Prices Continue To Surge – And Condos Join The Party

03/07/21

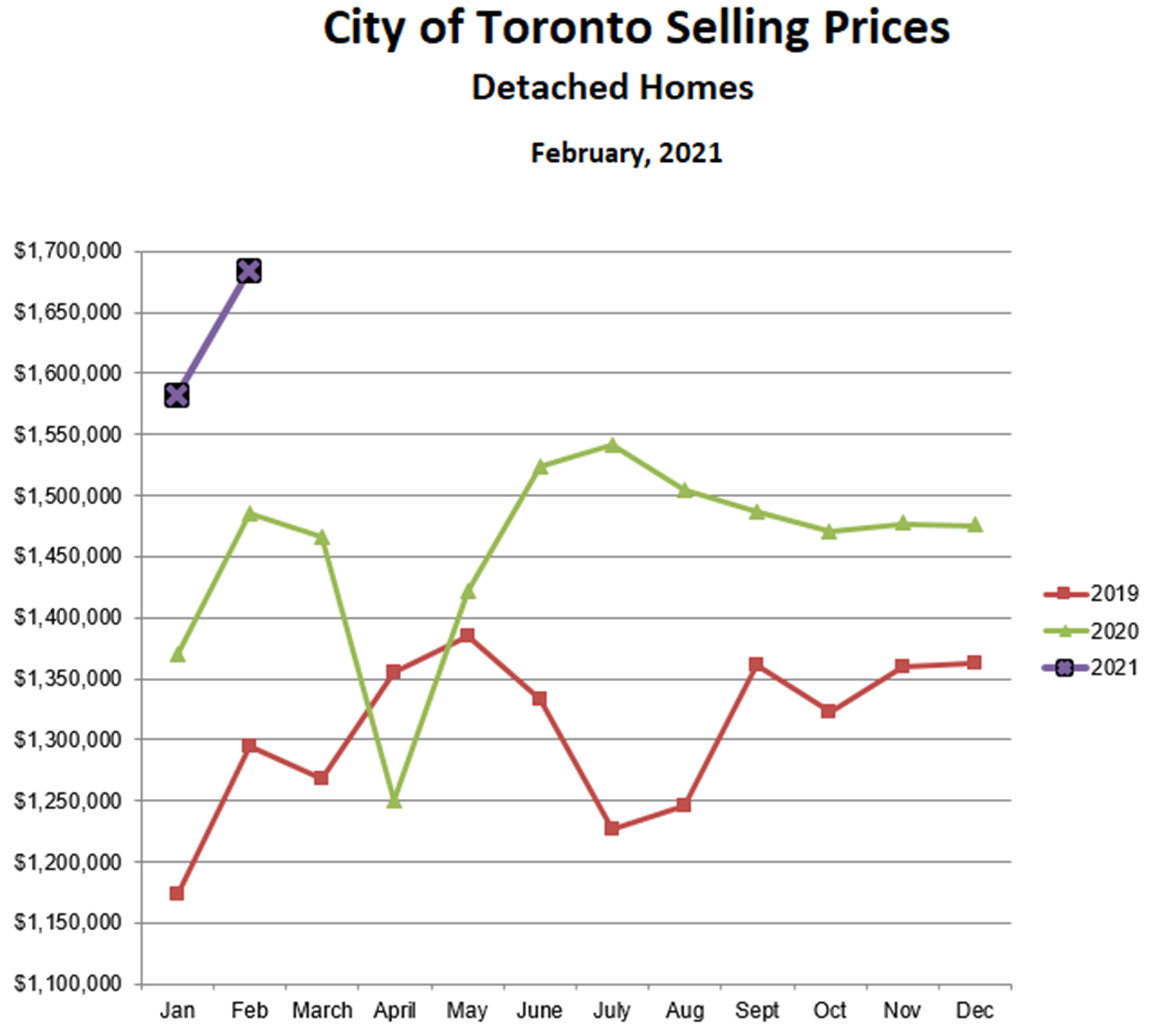

Prices for detached homes in Toronto jumped by 7% in February, for a total increase of 14% since December (!). Bidding wars are of course rampant, with selling prices routinely several hundred thousand dollars over asking. This rapid price escalation continues to be driven by very low inventory (less than one month’s supply) as well as extremely low mortgage interest rates. It would also seem that there is a psychological component at work – the fear of missing out (FOMO).

Interest rates have recently been creeping up because of inflation fears (which isn’t exactly surprising), and this could slow the market down a bit once buyers’ current guaranteed mortgage rates expire. Also, inventory could increase as more and more prospective sellers get wind of the hot market. It’s hard to miss in the media.

On the other hand, the government will be tweaking the mortgage ‘stress test’ rules in April to make it easier for buyers to pass. The stress test forces buyers to show that they could qualify for a mortgage if the interest rate were equal to the “Benchmark Qualification Rate”, which is higher than the actual rate they would have to pay. The idea is to make sure the buyer will be OK financially if mortgage rates should rise. This is fine in principle, however, the benchmark rate has remained very high as mortgage rates have fallen, making it more and more difficult for buyers to qualify. The change in April will allow the benchmark rate to float on a weekly basis, remaining 2% above actual market rates, and this will make it easier for buyers to pass the test.

The bottom line is that prices will likely continue to move higher over the next few months, although perhaps at a slowing rate.

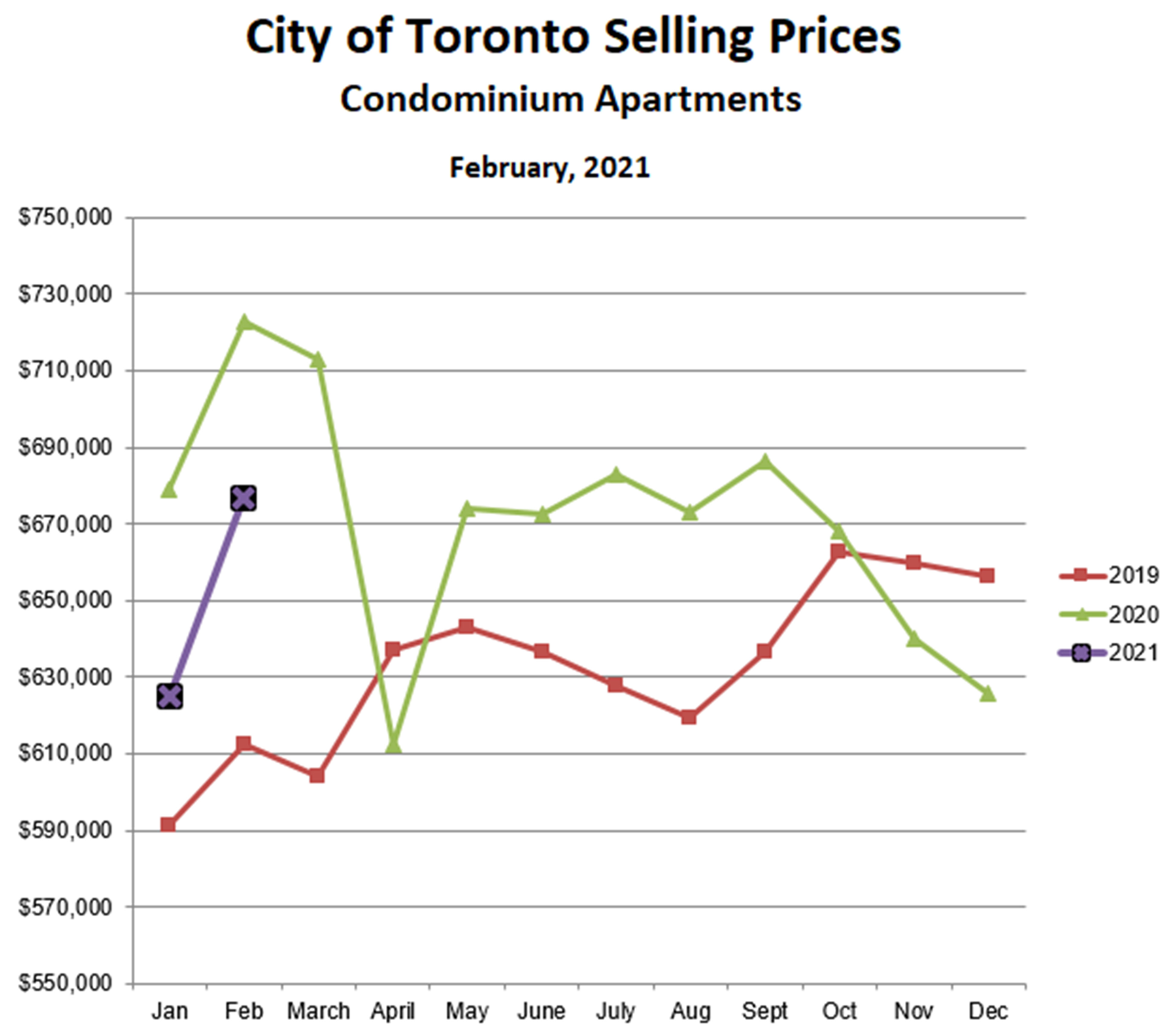

Condo apartment prices also surged higher in February, after languishing through 2020 and actually falling rather steeply in the fourth quarter. The weakness in late 2020 was due to a large spike in condo listings, tracing mainly to owners of rental condos dumping their units because of weakness in the rental market.

Condo prices leveled off in January and then increased by 8% in just the last month. As for houses, low inventory is also a big part of the story here, as there was less than one month’s supply of condos in February. Bidding wars have returned to condos after a long absence, though with less ferocity than houses. Clearly the 2020 glut of condo listings is behind us, and condo prices should continue to increase as rising house prices force many buyers to turn to condos as the only affordable alternative.

COVID has certainly created immense volatility in the Toronto real estate market. Last Spring, the CMHC confidently forecast that Toronto prices would drop 18% by the end of 2020. They have recently apologized for getting it so wrong, but this underlines just how capricious the market has become. According to an old Danish proverb (also attributed to Yogi Berra and Mark Twain, among others), ‘prediction is very difficult, especially about the future’. And so it is.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!