Toronto Market Beginning to Slow

05/17/22

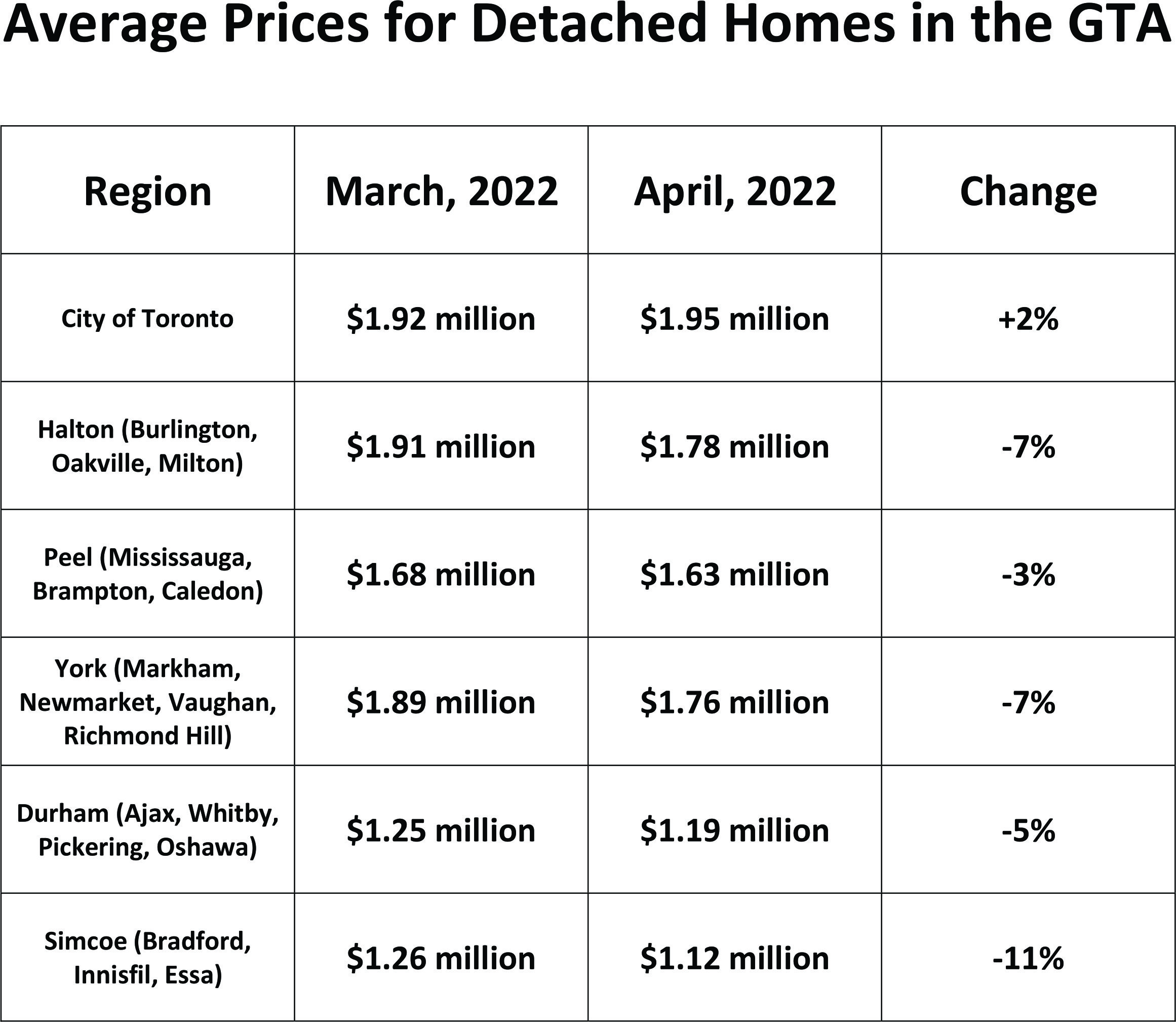

There was much noise in the media a couple of weeks ago, following the release of data on home prices and sales in April. A Globe and Mail headline was typical: “Toronto home sales plunge 27% in April, home prices dip”. Let’s put this into context, however. The “Toronto” in this headline is actually the Greater Toronto Area, which includes the suburbs to the east (Pickering, Ajax, etc), north (Markham, Vaughan, etc) and west (Oakville, Mississauga, etc). As the chart below shows, the City of Toronto had dramatically different results as compared with the suburbs: prices outside the city all went down in April vs March, whereas prices in the city actually went up.

As the pandemic ebbs, many who have been working from home are now being called upon to spend more time in the office. In combination with rapidly increasing gas prices, this makes it much less attractive to commute. This is especially true in light of the extreme escalation in prices in the suburbs as compared with the city over the past couple of years. So, we shouldn’t be surprised to see prices hold up much better in the city as the market begins to slow.

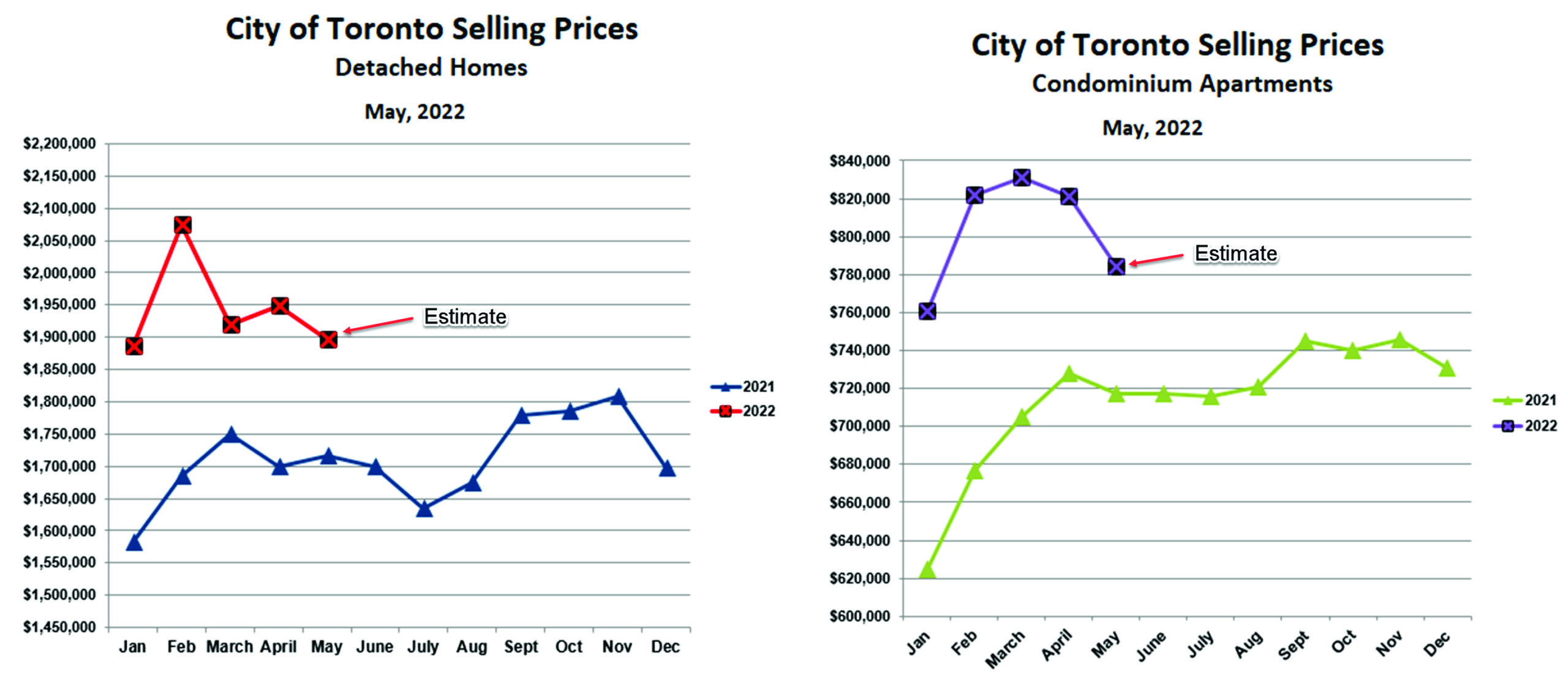

Even in the city, however, the signs of slowing are beginning to appear. While prices were steady between March and April, sales fell by about 25% — less than in the suburbs, but still substantial. And estimated prices for the first half of May are lower for both detached homes and condo apartments, as the chart below shows.

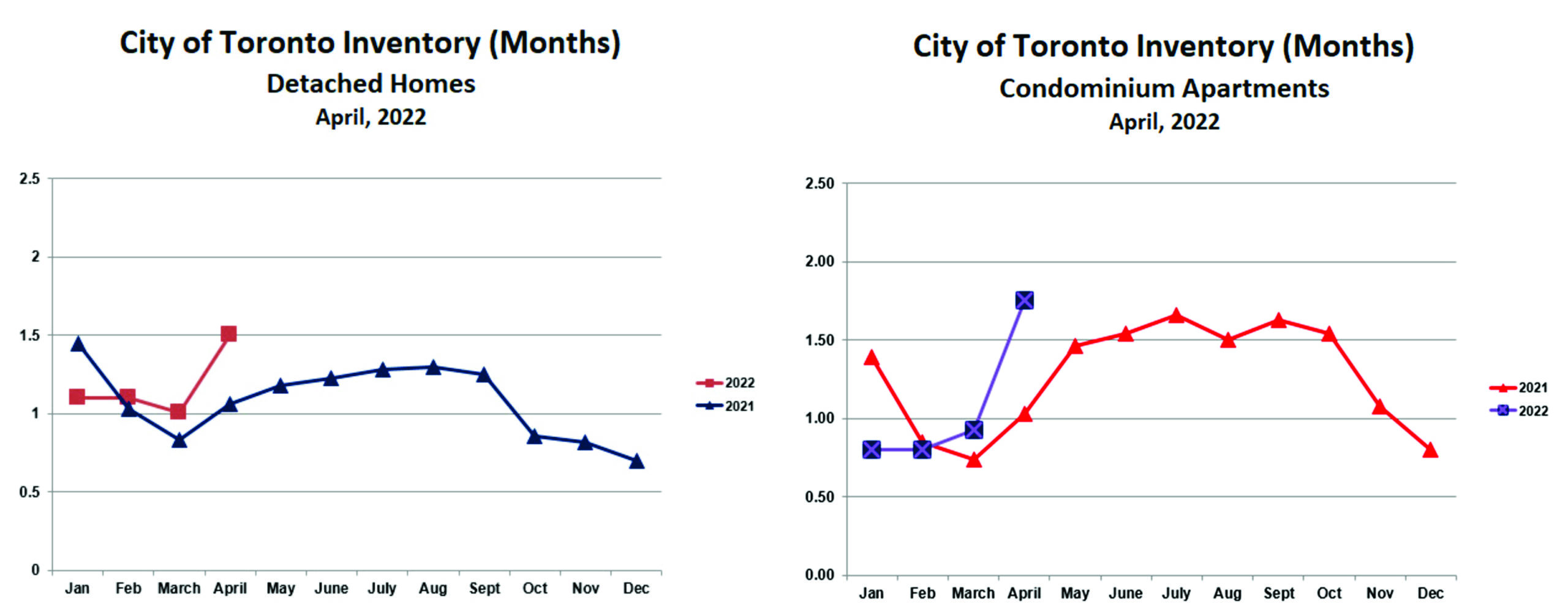

Inventory levels also increased from March to April, though both condos and detached homes are still comfortably in sellers’ market territory, each below 2 months’ supply. We’d consider the market to be balanced (favouring neither buyers nor sellers) when inventory is about 3 months.

Overall, just to keep things in perspective, we are shifting from an “insane sellers’ market” to a “strong sellers’ market”. We saw a somewhat similar pattern last spring and summer, which was followed by another insane sellers’ market in the fall. This year, however, with interest rates rising and inflation (so far) unabated, it seems unlikely that the fall market will be as strong as in 2021.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!