Toronto Market Continues to Accelerate

02/08/20

It’s beginning to look a lot like 2017.

Three years ago we had an insane spring market, with house prices rocketing upward by 20% and then crashing back down to where they started. The entire process only took about five months from beginning to end. The bubble was driven primarily by extremely low inventory of homes for sale and ended because of Ontario government legislation aimed (very successfully) at cooling off the market.

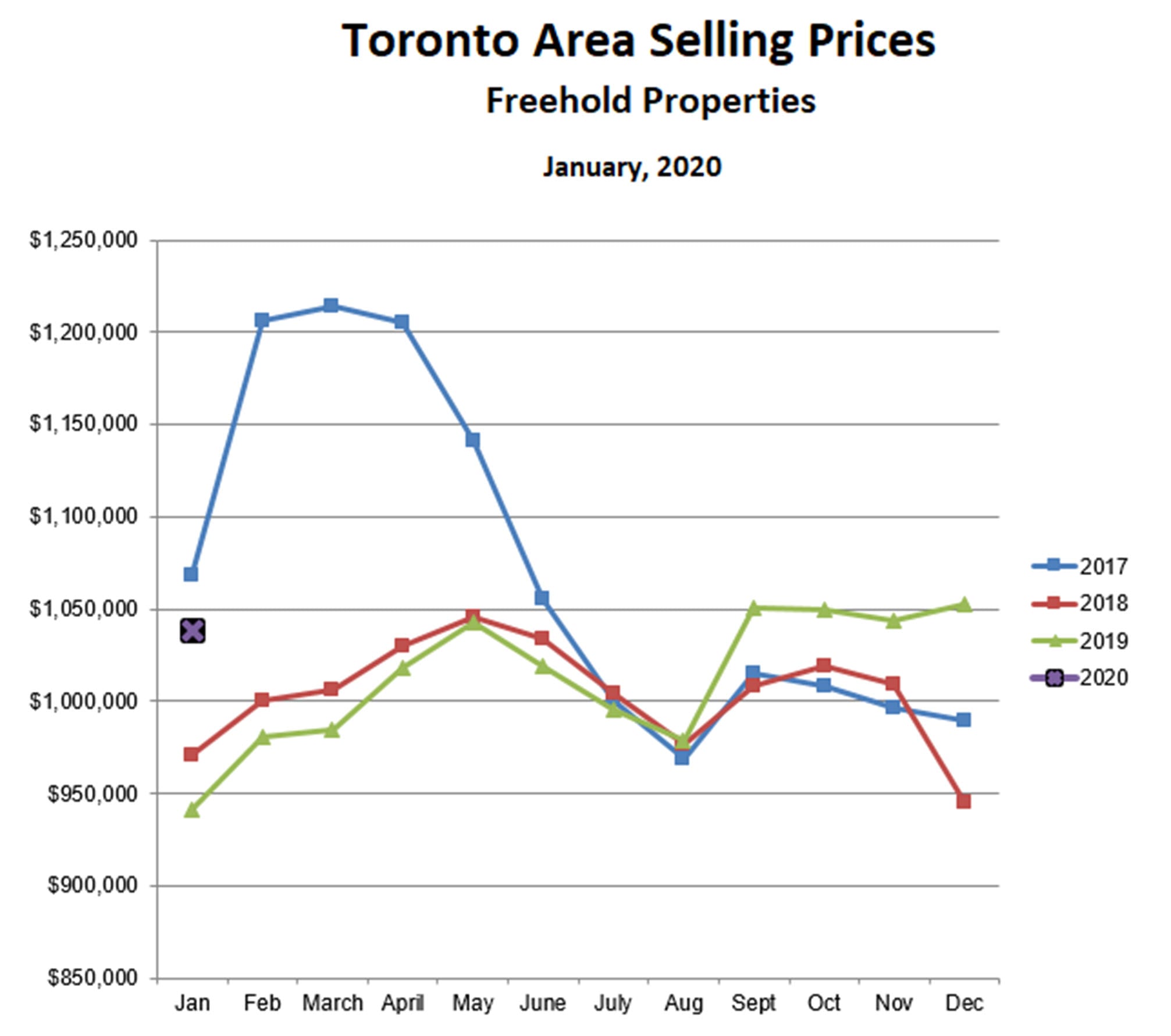

Following the collapse of the 2017 bubble, prices for freehold properties remained flat to slightly declining for the next two years. Then, last September, house prices increased sharply and continued to strengthen right through December, when normally the market sags a bit. The trend is continuing this year. Although January house prices are slightly below December, they are 10% higher than last January, and not far from the average price in January 2017.

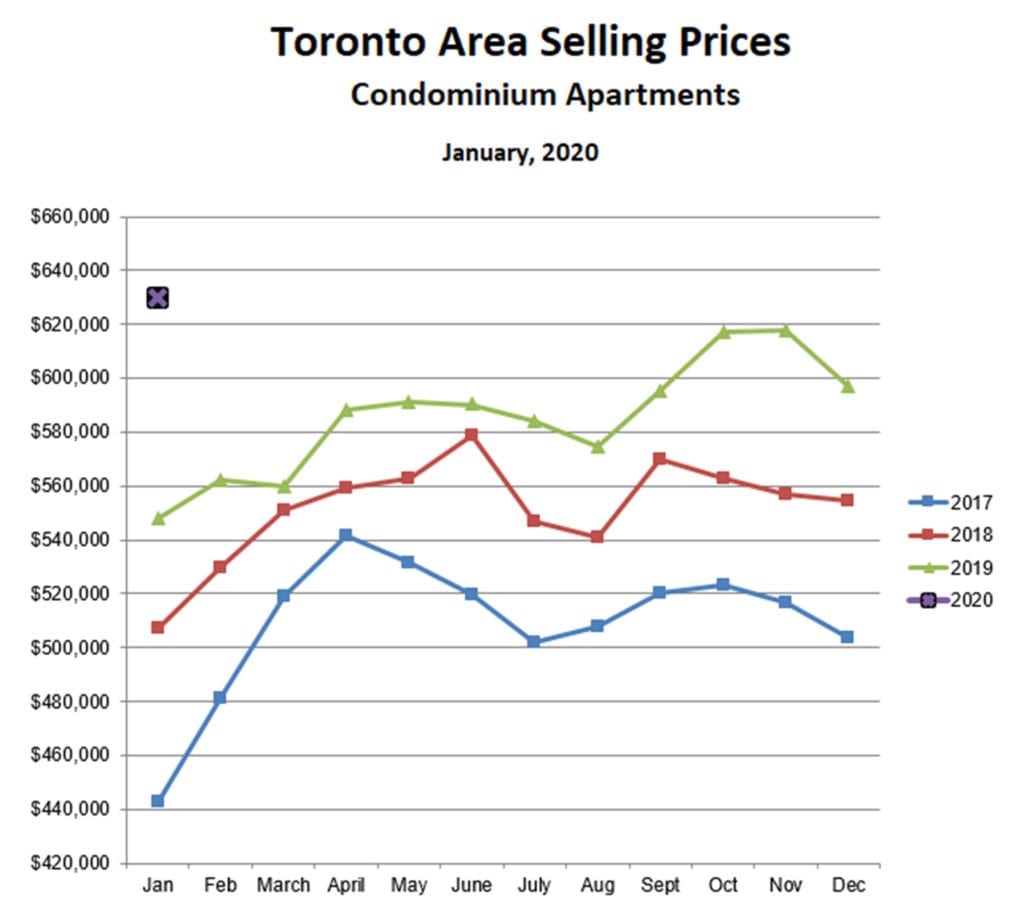

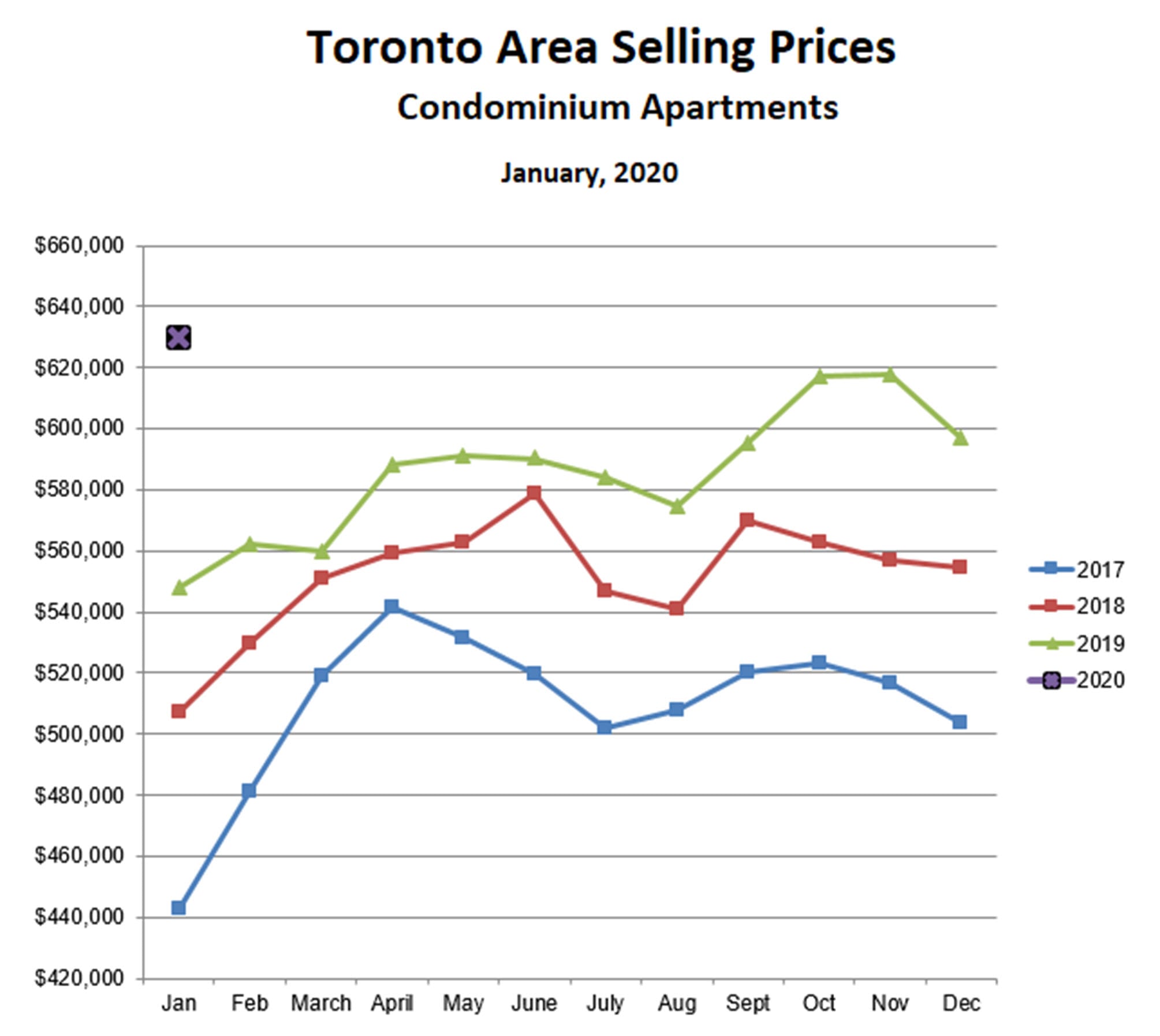

The market for condominium apartments in the GTA is even stronger than for houses. Back in 2017, condo prices also increased dramatically in the spring (by more than 20%) and also pulled back after April. However, condo prices did not collapse all the way back to where they started, and have continued to push higher ever since. Condo prices in January were 5% higher than December, 15% higher than last January, and 16% higher than the ‘bubble peak’ in April of 2017. While affordability (vs houses) is obviously one reason why the condo market is so strong, it is perhaps not the most important reason. The rental market in the GTA is extraordiarily tight and in fact could be described as a crisis situation. There simply aren’t enough rental units available to satisfy the steadily increasing demand. The primary source of new rental units is condominium apartments, and so condos have become very attractive to investors, to the point where they are starting to ‘crowd out’ end users. Also, many move-up buyers who bought condos a few years ago and now want a house are deciding to keep the condo for the rental income instead of putting it up for sale. The bottom line is that the demand for condos is growing faster than the supply.

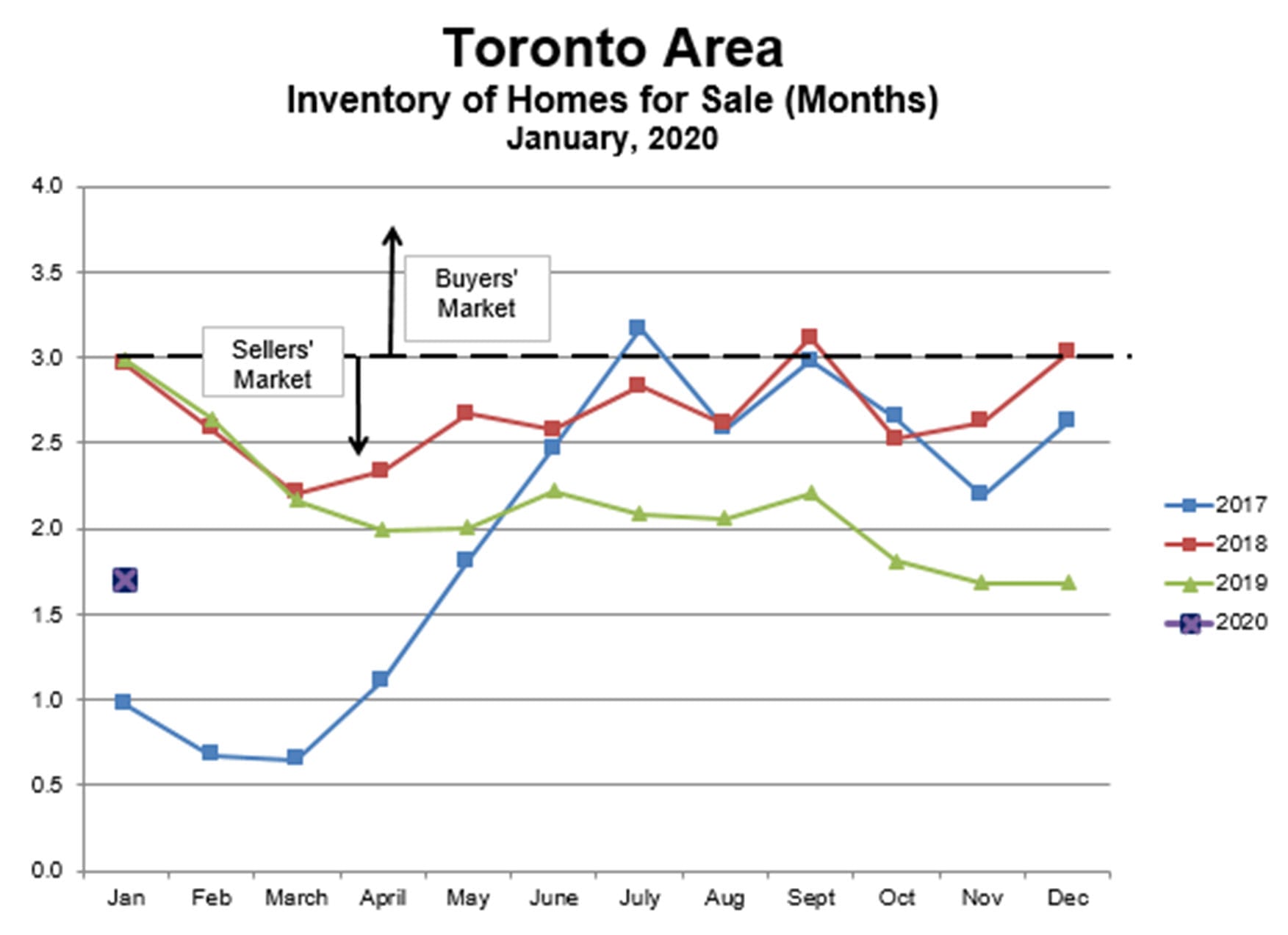

The increasing demand for both houses and condos relative to supply is reflected in the steadily declining inventory of homes for sale. For the past four months, overall inventory has been at less than 2 months’ supply, very deep in ‘sellers’ market’ territory, and lower than at any time since the 2017 bubble. While we still have a ways to go to match the extremely low (less than 1 month’s supply) levels seen in early 2017, we are definitely trending in that direction. We are getting close to the point where the increases in the market become self-reinforcing, if we aren’t already there. As inventory falls, it gets harder to find a house to buy and easier to sell the house you’ve got. So more and more move-up buyers decide to buy first before they put their house up for sale and, since a high proportion of homes for sale belong to move-up buyers, this means that the tighter the market gets, the more it tends to get even tighter.

Unless the government once again decides to intervene to cool off the market… and as long as the coronavirus outbreak soon comes under control… and as long as there are no dramatically negative financial, economic or geopolitical events, the spring market should continue to be very strong for at least the next 3-4 months.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!