Toronto Market Continues to Hold Steady Despite Rising Mortgage Rates

10/22/22

Prices in the City of Toronto have remained in a fairly tight range over the past four months after falling during the spring and summer. Rapidly rising mortgage interest rates pricked the price bubble that started building last summer and peaked this spring. Mortgage rates have continued to climb, with more to come, however, prices are so far resisting further declines. We shall see if this trend can be sustained as we get into the normally slower Christmas/New Years season.

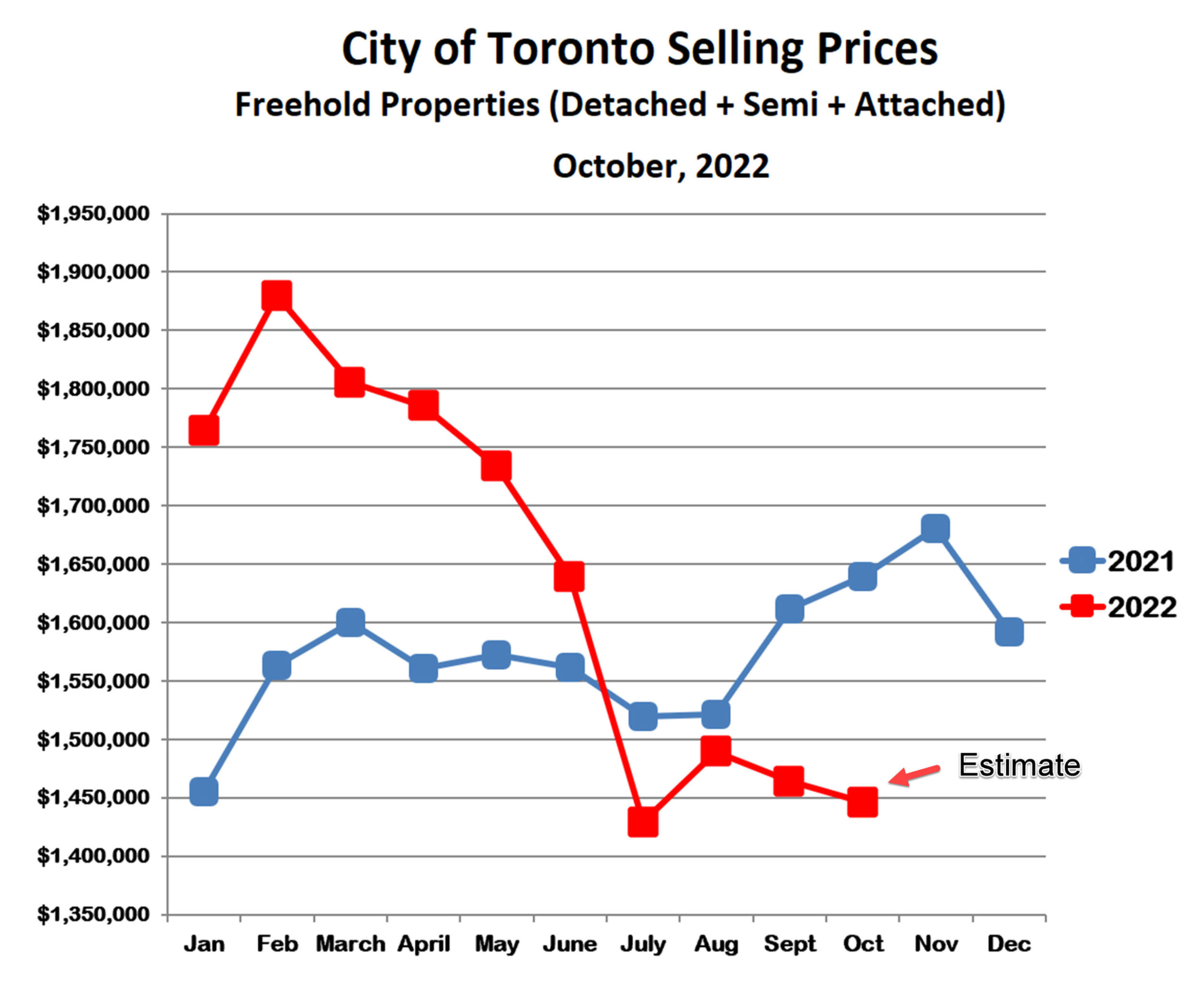

Freehold Home (Detached, semi-detached & attached)

Freehold prices have been on a real roller coaster ride over the past year. After a strong but fairly typical spring and summer in 2021, prices took off in the fall. This bubble continued to grow in early 2022 and then began to unwind in late spring under the weight of rising interest rates. Prices proceeded to fall by about 20%, and then leveled off after July. The estimate for October is a bit lower than September but still higher than July.

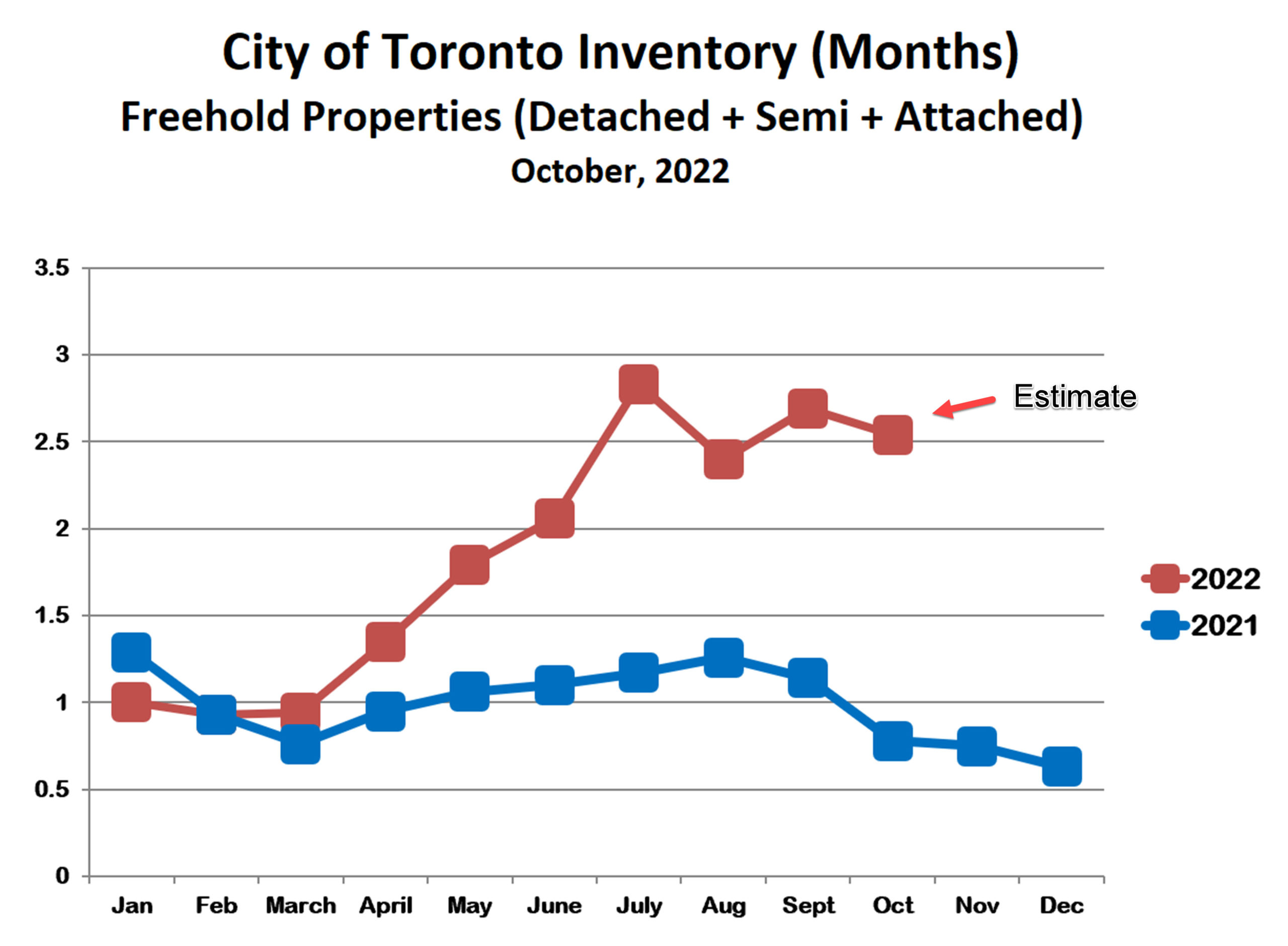

Inventory is defined as the ratio of properties for sale divided by properties sold in a given month. It’s an estimate of how long it would take to sell all the homes now on the market if no new listings came up for sale. Low inventory means that there is little selection available for buyers, and this increases the chances of competition among buyers. For example, inventory was under one month’s supply for seven months, beginning last October. This meant that properties were selling, in effect, faster than they came on the market. With the crazy low mortgage rates at the time, no wonder we had rampant bidding wars!

With increasing interest rates came buyer hesitancy and affordability issues. Prices began to fall and buying was no longer urgent. Homes were not selling on their offer dates, and inventory began to increase. By July, prices had fallen below 2021 levels, retracing all of the gains from the bubble, and buyers started to return. This has stabilized prices, though at a much lower level of activity than in the spring. For example, sales of freehold homes in the City of Toronto averaged 1,261/month from February through June, but only 725/month from July through September. This drop of more than 40% in sales is the main reason for the climb in inventory level. Projected October sales are about 800, modestly higher than the previous three months.

The gap between 2022 prices and 2021 prices is widening because of last year’s bubble. With all the volatility in the market, however, this isn’t a helpful comparison.

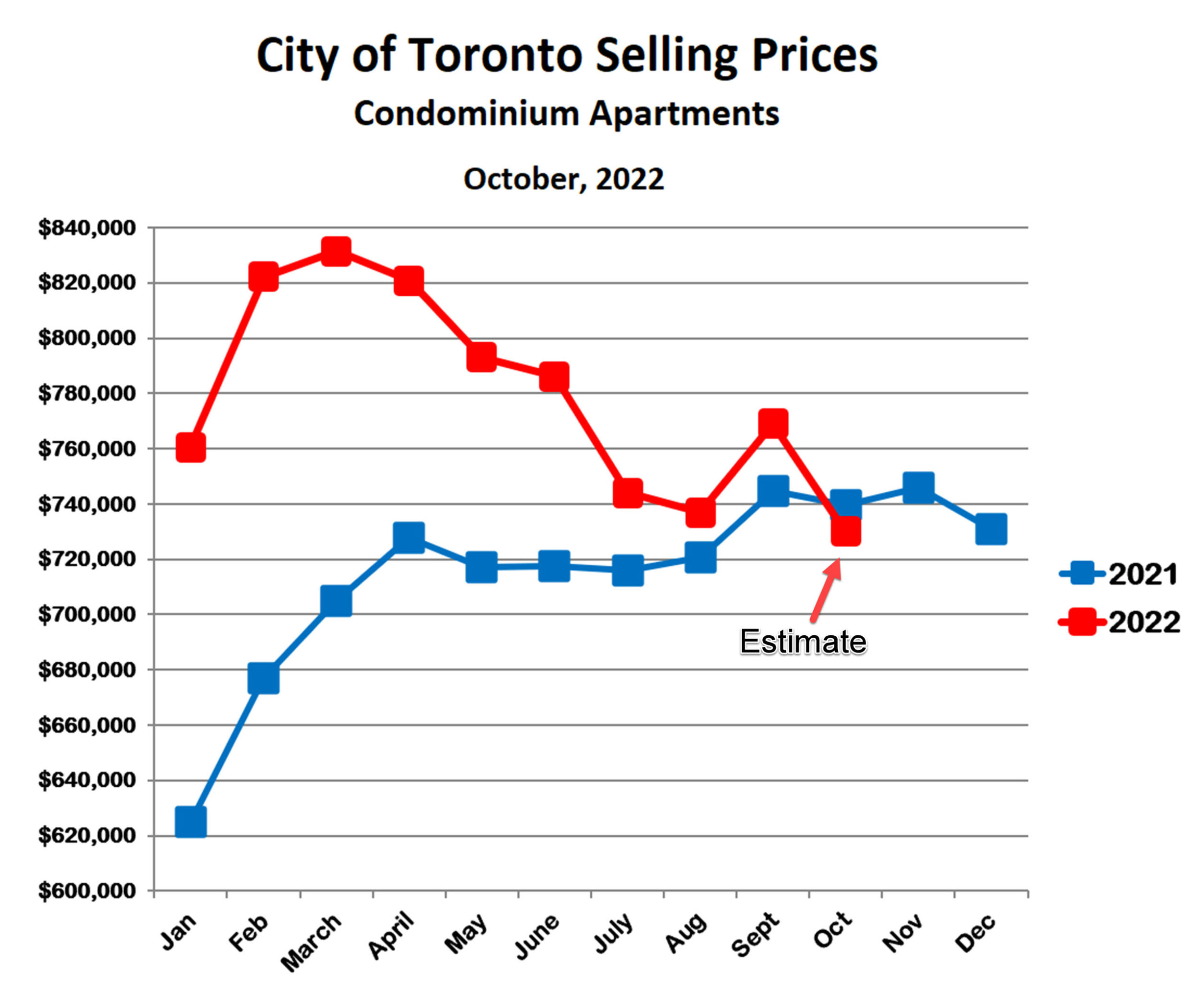

Condominium Apartments

The condo market has followed a somewhat different trajectory than freehold homes. After falling in the latter half of 2020, condo prices rebounded sharply in early 2021 and then remained steady for the rest of last year. Prices again increased strongly early in 2022, but then fell through the spring and summer more or less in tandem with houses. Also like houses, condo prices have been relatively steady since July.

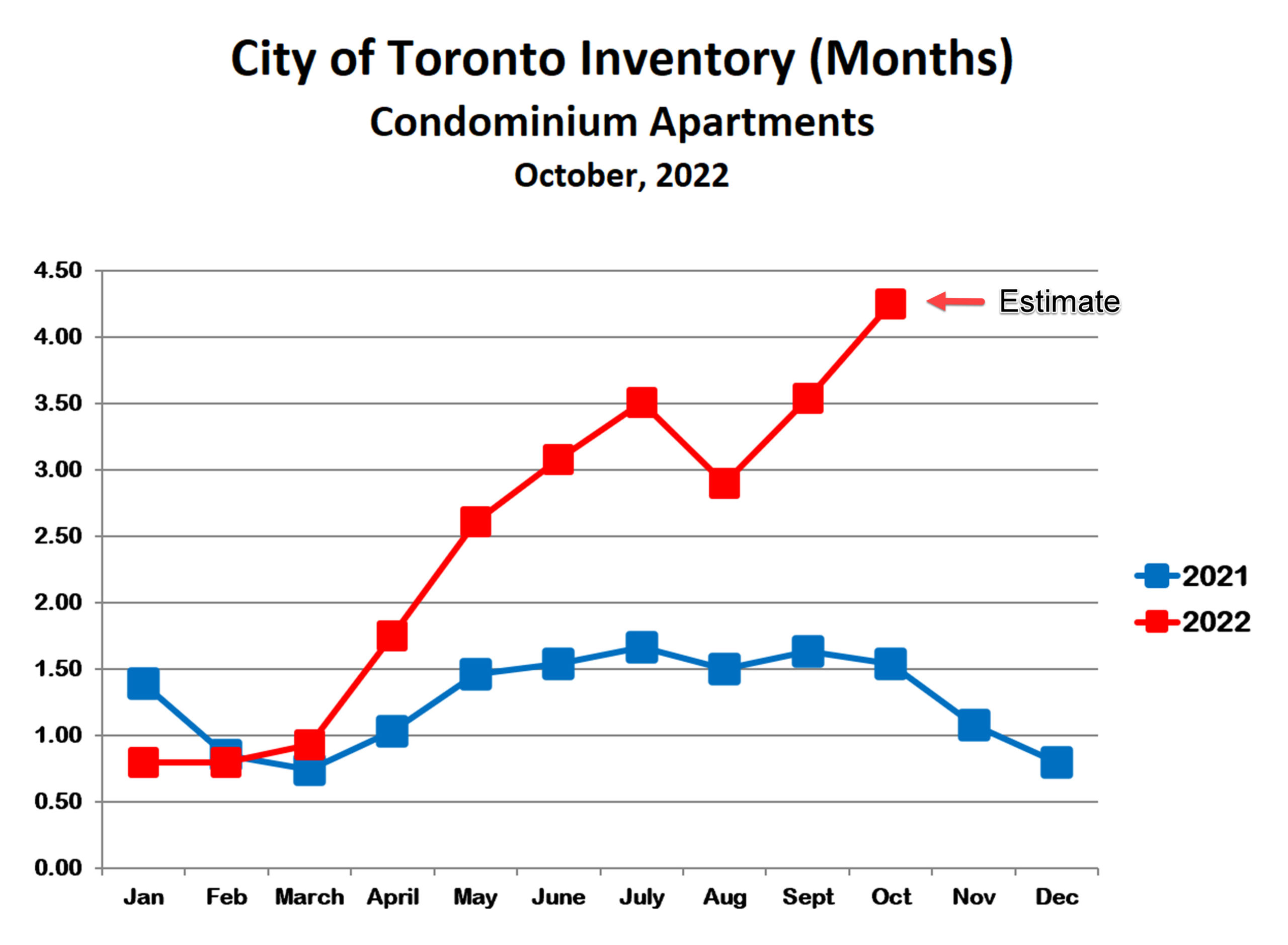

Condo inventory has increased significantly since the spring. The projection for October suggests that the condo market is approaching buyers’ market territory, and declining sales seems to be the main culprit. Condo sales averaged 1,575/month from February to June and fell to 955/month from July to September. This is a drop of 40%, almost exactly the same as houses. Unlike houses, however, the projection for October is approximately 751 sales which, if confirmed, would be drop of roughly another 20%. This might mean that the Christmas/New Years slowdown is starting early for condos.

Bottom line

The correction from the 2021/2022 bubble is over for now. However, we are approaching a normally slow time seasonally, and should expect prices to fall further over the next 3 months or so. Beyond that, there are far too many political and macroeconomic uncertainties to predict the direction of the market next spring.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!