Toronto Market Picking Up Steam In February

02/28/24

Prices and sales are increasing in February for all property types in the City of Toronto. Overall, the market is closely following the 2023 script, where we saw steady improvement each month until spring. Last year, the market faded significantly in the second half as hopes for lower interest rates were dashed. This year, lower rate hopes once again abound, and perhaps this time our wishes will come true. If so, we could see a market that stays strong all year long.

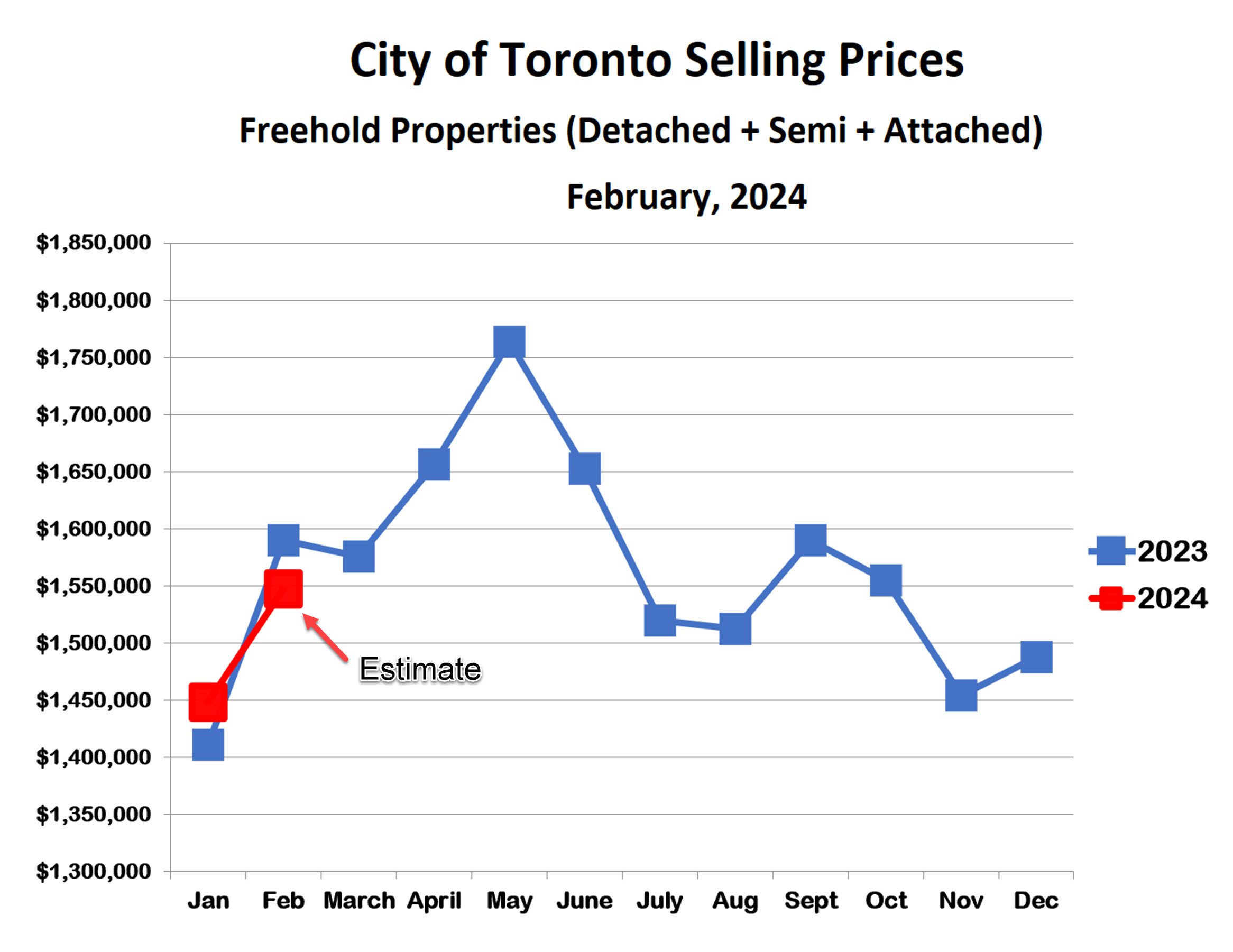

Houses

House prices are up about 6% since last month, and only slightly lower than last February. The trend line is closely similar to last year, suggesting that prices will continue to increase over the next 3 months. Barring, of course, any sudden changes economically, financially, or geopolitically (fingers crossed!).

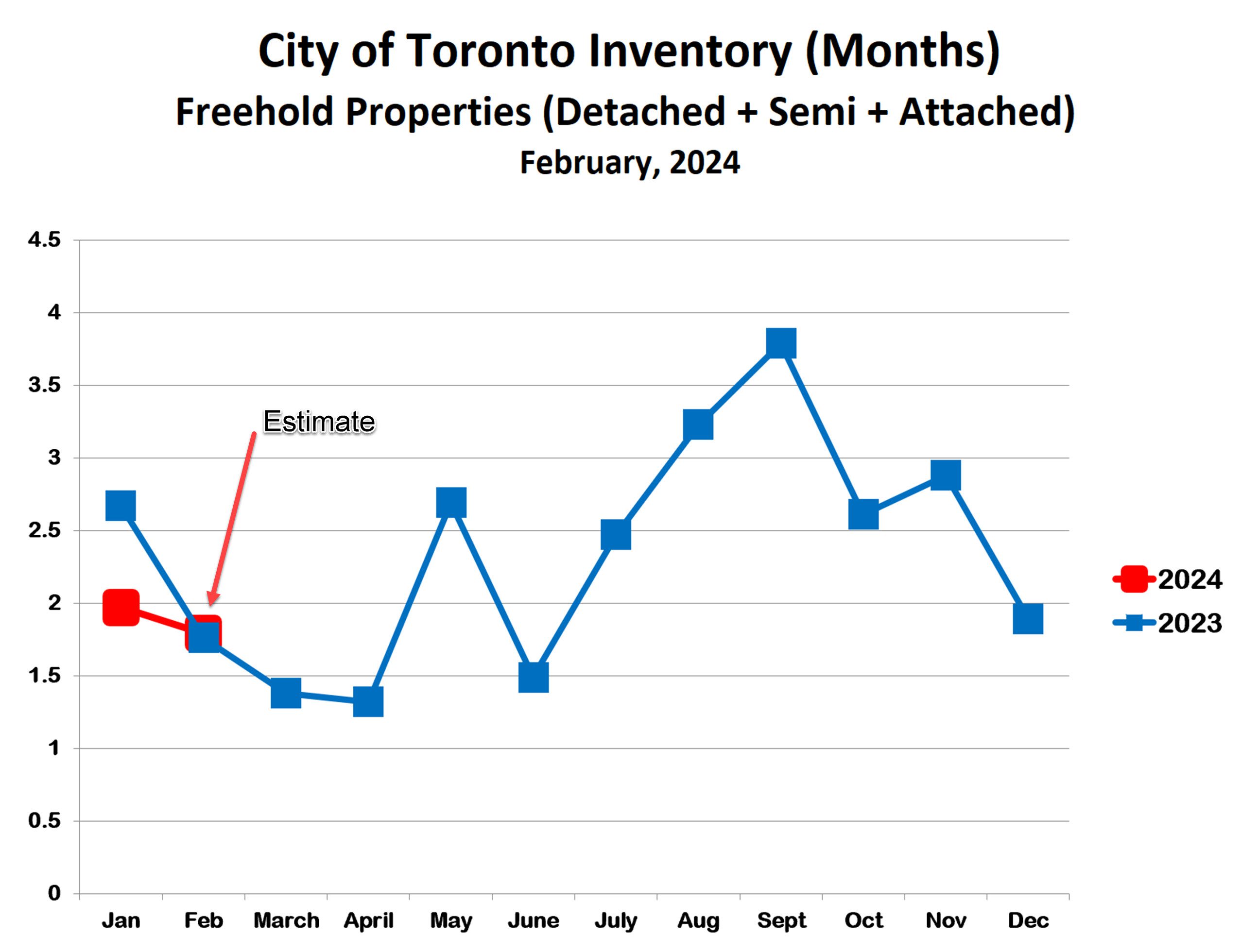

Sales and listings for houses are both more than 50% higher than in January, and the inventory level fell slightly to just under 2 months’ supply. This is solidly in sellers’ market territory, and will likely remain so for the next 3 months or so.

Condo Apartments

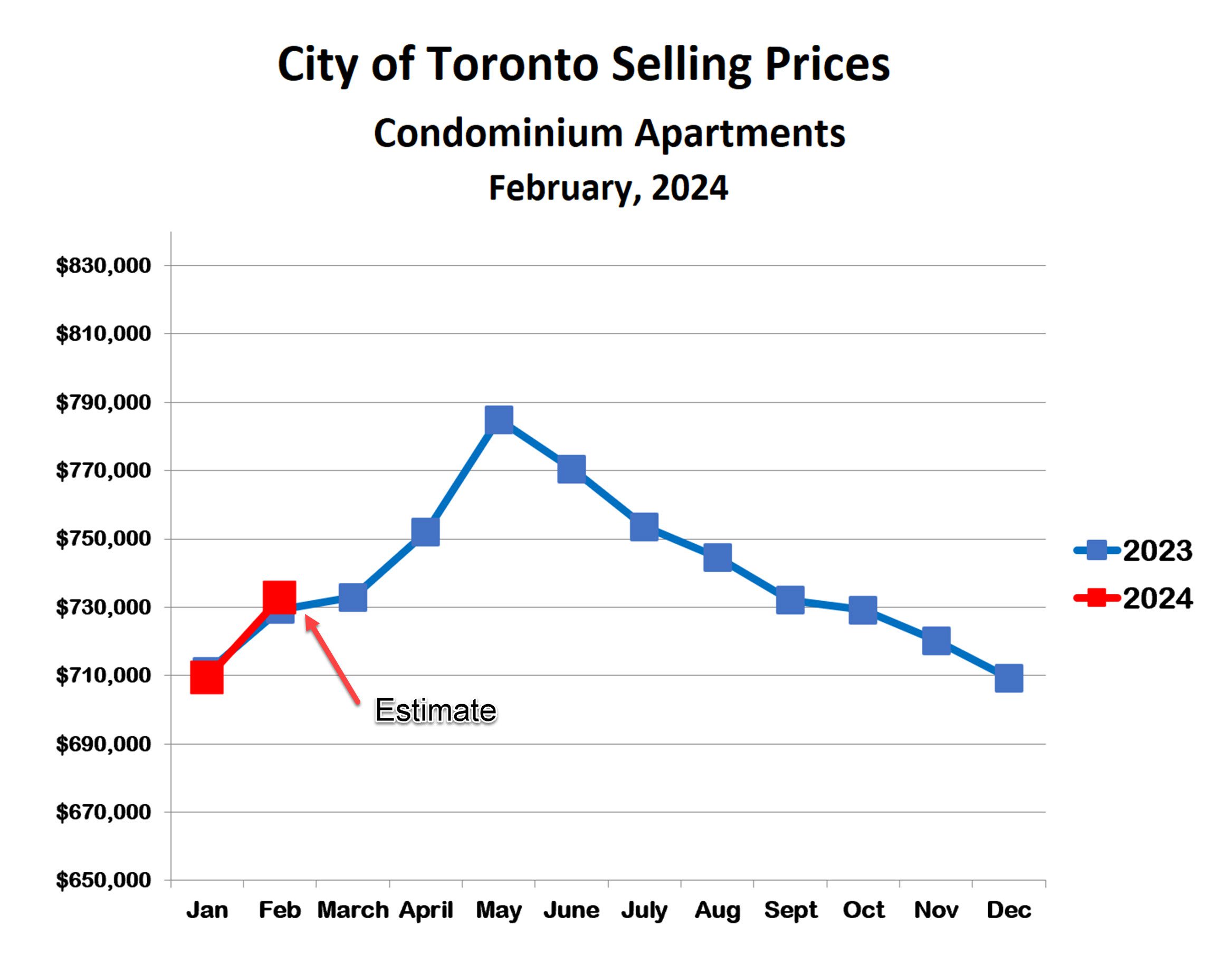

After seven consecutive months of falling prices, the Toronto condo market is turning around. Prices are up by about 3% over January, and the trend line is exactly matching last year. Similar to houses, we can expect prices to continue upward for the next three months, as long as present conditions continue.

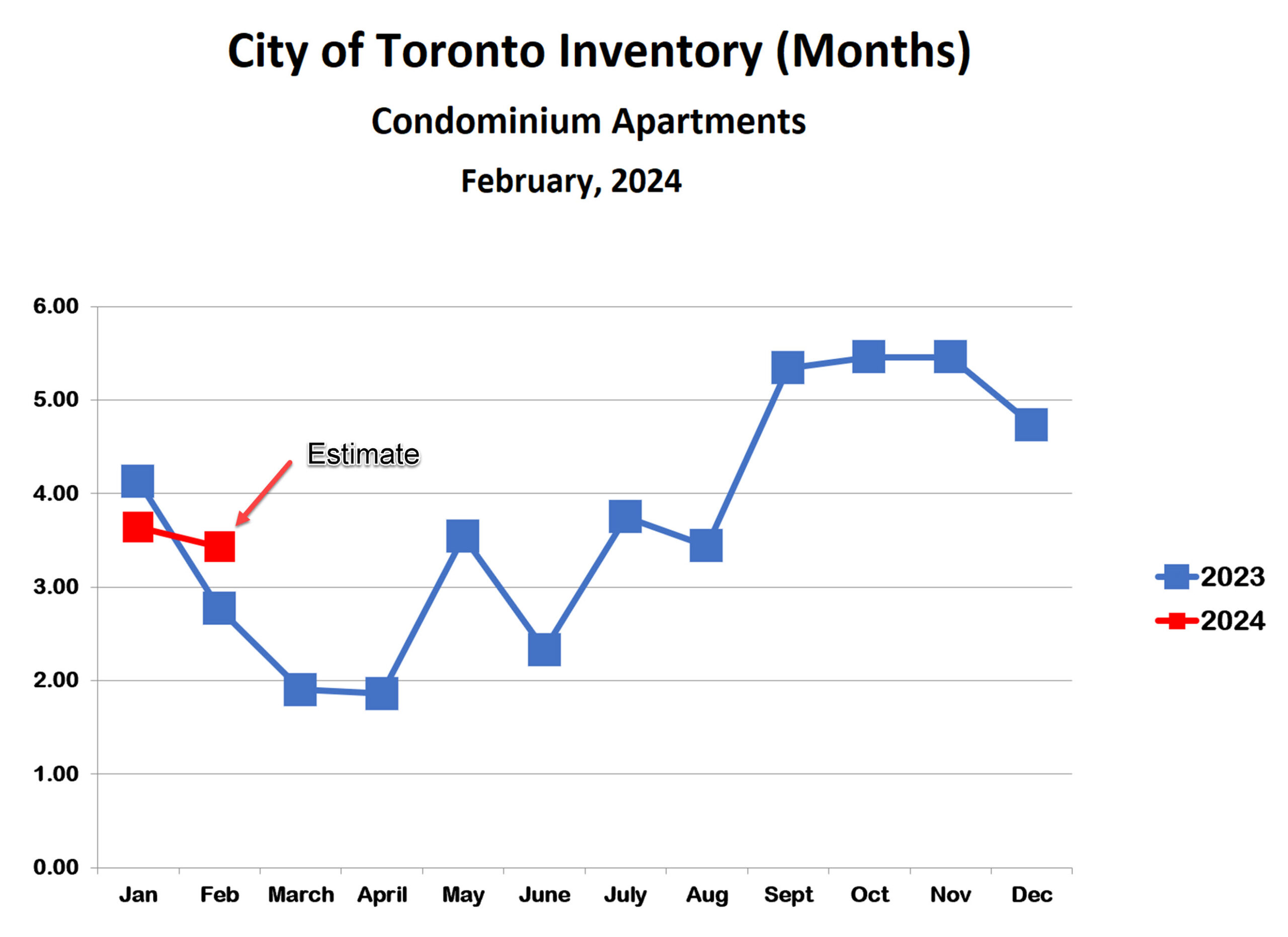

The inventory of condos for sale is falling after spiking up to over 5 months’ supply last September, gradually morphing from a buyers’ market to something more balanced. As financially burdened condo investors continue to sell, and as hope for lower mortgage rates grows, inventory should continue to fall.

Bottom Line

Just like last year, the Toronto market is showing early strength for all property types. This is based, once again, on hopes for falling interest rates sometime later this year. If this should come to pass, we could have a healthy market right through until Christmas. If the hoped-for reductions turn out to be another head-fake, however, we may have yet another weak second half. Interesting times.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!