Toronto Market Runs Hot In January

02/06/22

Prices in the City of Toronto jumped to new all-time highs in January as the real estate market continued to heat up.

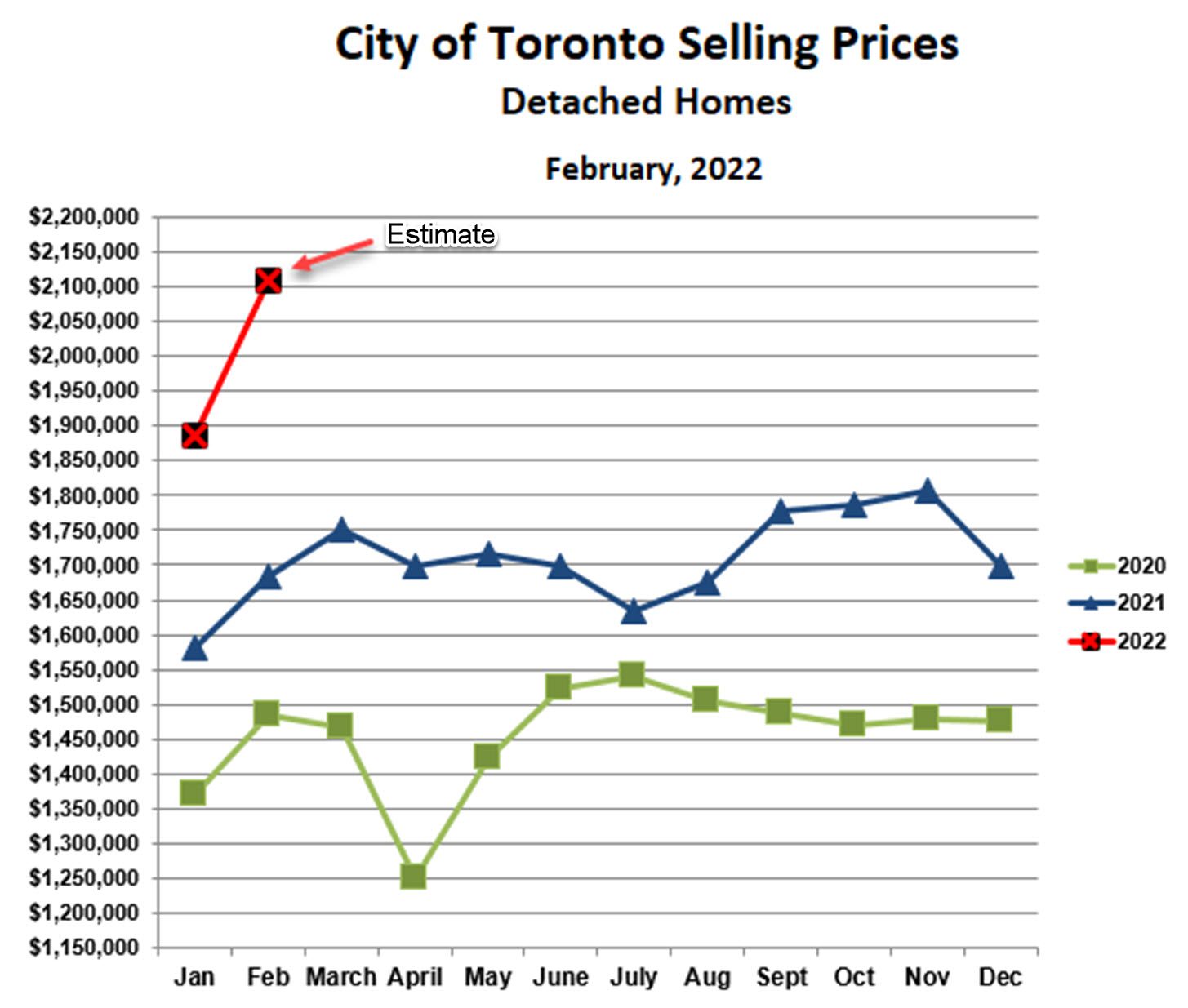

Detached Homes

The average price for detached homes in the City of Toronto was $1,886,413 in January, up 11% vs December, up 19% vs last January, and yet another all-time high. This pattern was echoed in all of the GTA regions surrounding Metro Toronto, with month-over-month increases ranging from 6% in York region to 12% in Durham region. As reported last month, the pandemic has driven average prices for detached homes above $1 million in all parts of the GTA.

For the first week of February, prices for detached homes are even higher, just over $2.1 million. So the momentum is continuing unabated, at least for now.

We saw a similar increase in the City of Toronto from December to January last year. The ‘spring fever’ in 2021 lasted about three months and then cooled off somewhat from April through August before igniting again in the fall.

An even more extreme example came 5 years ago, when prices took off in February through April of 2017, and then fell 20% over the following 4 months. As we recall vividly, this resulted in chaos. Many buyers who bought in the spring were unable to close because the value of the home had fallen and their lenders were only willing to finance the purchase based upon the new value. The sudden drop in prices in 2017 was, in large part, a result of government intervention. Startled by the rapid increase in home prices, the Ontario Government introduced, among other things, a 15% foreign buyer tax intended to curb speculation. They definitely succeeded in cooling the market. Be careful what you wish for.

The cooling of the market in the spring of 2021 was more organic, a natural rebalancing. Perhaps we will see something similar this year. Let’s hope the government doesn’t intervene this time.

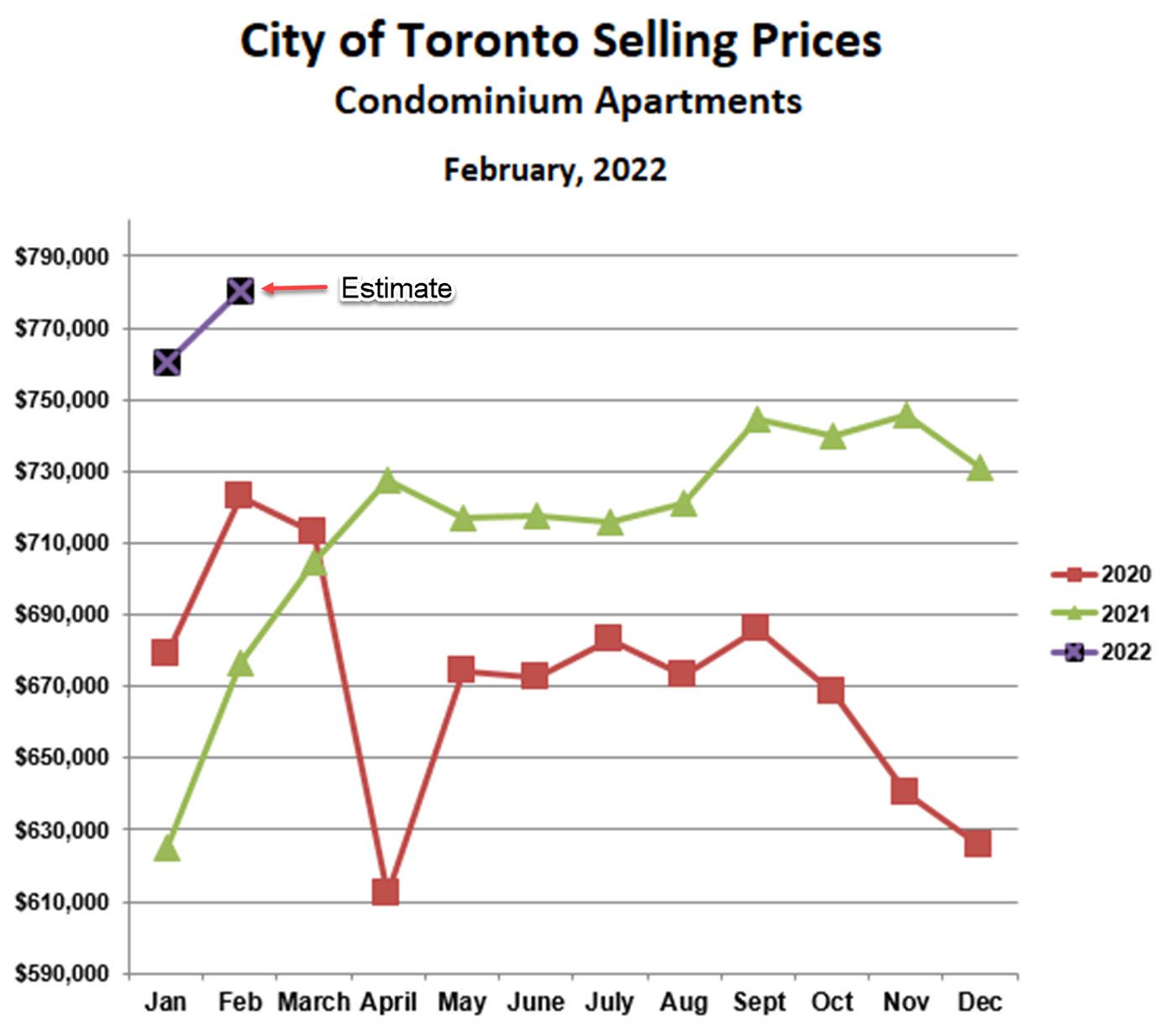

Condominium Apartments

As for detached homes, condo prices increased over the past month, and in the process set another all-time high. The average price for condo apartments in the City of Toronto in January was $760,643, 4% higher than December and 18% above last January. And the trend is continuing in early February, as for detached homes.

The seasonal pattern for condos last year was also similar to detached homes. Prices increased relentlessly until April, softened until late summer, then spiked again in the fall to new highs. This year’s early frenzy suggests we could see the same sort of pattern this year.

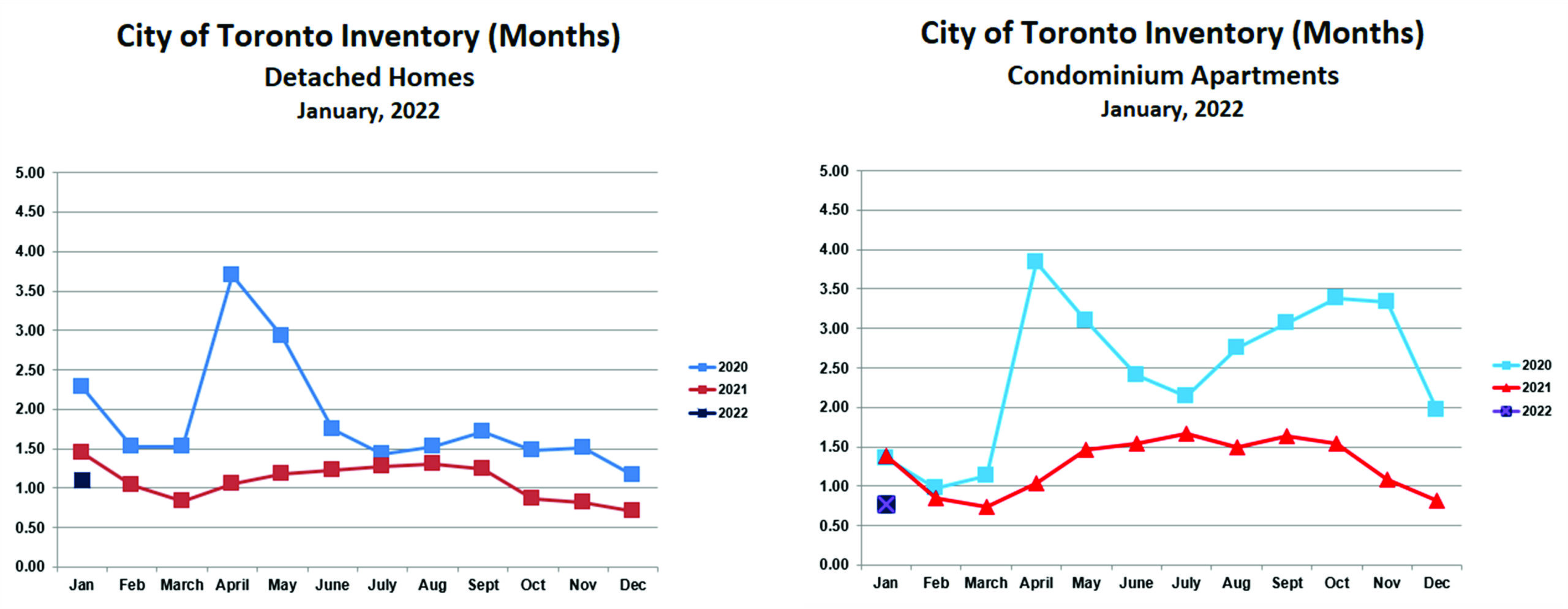

The Supply of Homes for Sale

One of the key factors driving the ups and downs in the market is the supply of homes for sale, also called inventory. We define inventory as the ratio of homes for sale to homes sold. For example, if 100 homes were sold last month, and there are 100 homes presently for sale, then it will take about one month for all of those homes to sell if no other homes come on the market. So the inventory is one month’s supply.

Inventory is both a cause and a result of the oscillations in the market. Basic supply and demand says that if inventory is low, buyers will compete for the limited supply. This will push prices upward, all else being equal.

The result part is a bit more subtle. When inventory is low, it is hard to buy and easy to sell. This encourages many move-up buyers to buy first before putting their homes up for sale. The majority of people selling are also buying, most of their homes won’t come on the market until they buy. This leads to a self-reinforcing pattern of ever-tightening inventory, leading to ever-higher prices.

The pattern breaks for at least three reasons. First, successful early buyers put their homes up for sale; second, many homeowners who have been thinking about selling see the rising prices and decide to accelerate their plans; and, third, buyer fatigue sets in after losing bidding wars over and over again, and the buyer pool shrinks. All three of these factors cause increased inventory and less price pressure.

The charts below show inventory for detached homes and condos in the City of Toronto over the past two years. For perspective, we consider 3 months’ supply to represent a balanced market, where neither buyers nor sellers have the upper hand.

Detached homes have been in a sellers’ market (under two months’ supply) for most of the past 24 months. The exception was in the spring of 2020, when the first lockdowns were imposed and it seemed the world was coming to an end. Late last year, inventory dipped below one month meaning, in effect, that homes were selling faster than they were coming on the market.

January inventory has improved to just over one month, though it’s too early to call this a trend.

Condos were much more volatile, spending much of 2020 in buyers’ market territory. Condo owners took advantage of work-from-homes to sell their condos and buy homes outside the city.

The condo market gained momentum in 2021, and inventory has dropped below one month for the past two months in a row.

Looking Ahead

As both prices and interest rates rise, many buyers will give up, either because of affordability or simply because they are discouraged. Others will shift (reluctantly) to condos.

Combined with the seasonal pattern discussed above, this suggests that the frenzy in the freehold (detached, semi-detached and attached) market will subside over the next 2-3 months. Prices will likely moderate and possibly decline somewhat. Barring government intervention, a ‘crash’ is very unlikely.

Condos will probably continue to be hot through the next few months. They will benefit from the “affordability shift” away from freehold properties.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!