Toronto Market Showing Early Signs of Life

02/03/24

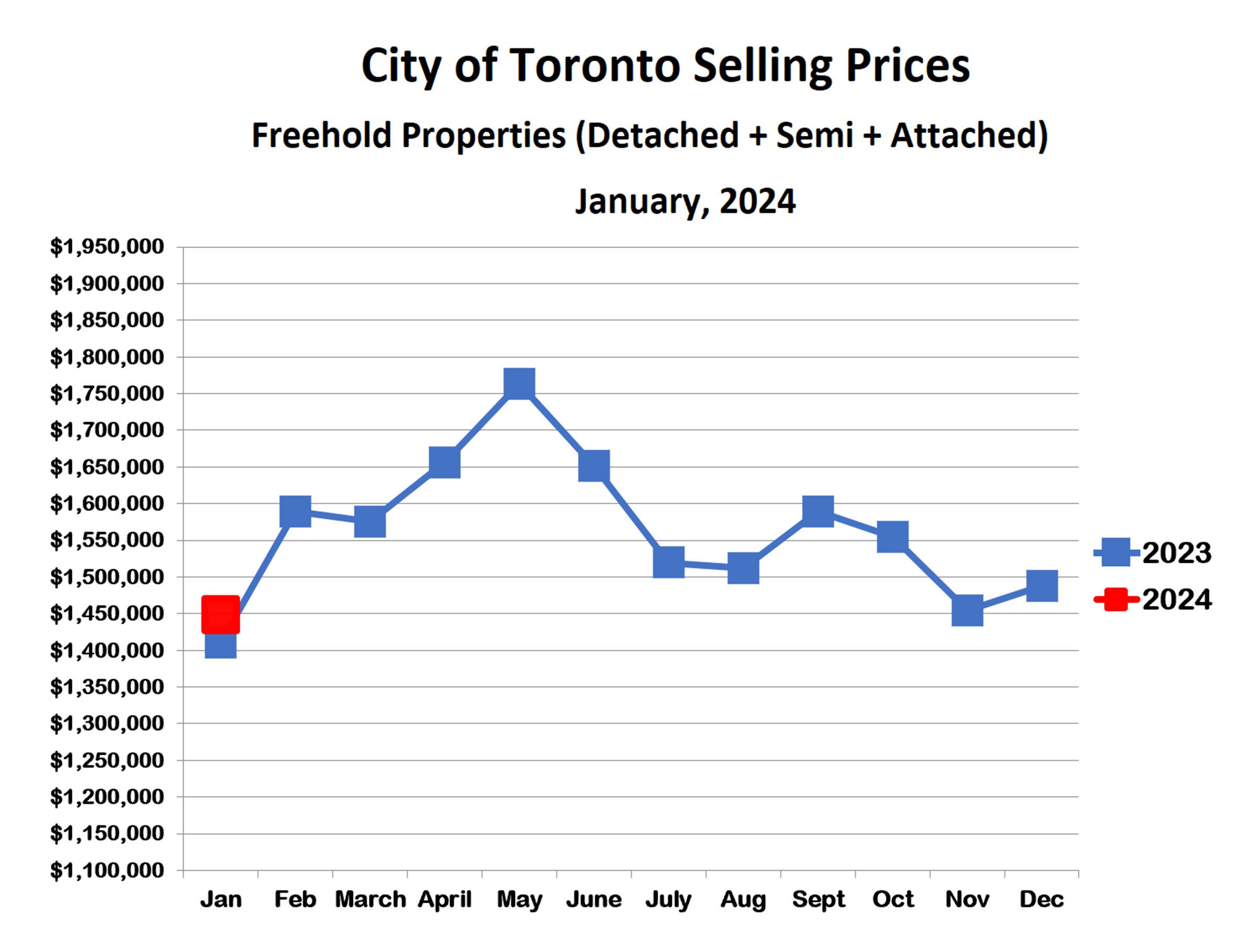

Houses

January house prices are slightly down from December and roughly the same as they were last January. Digging a bit deeper, however, we find that prices in the second half of January were about 10% higher than in the first half. Bidding wars are returning with a vengeance and, while we are not (yet) seeing crazy high prices, there have been double-digit multiple offers on many properties. There have also been many sales of properties that languished on the market last fall. Clearly, buyers are returning to the market, even though they remain somewhat cautious on price.

After being ‘faked out’ last spring by the central banks (which led to a dismal second half of the year), buyers now seem convinced that we are finally done with interest rate hikes. Buyers seem to be sensing that prices have bottomed and will rise in anticipation of falling rates. If so, we could see prices surge upward over the next few months. Further, assuming that interest rates actually do start falling in the second half, we could also have a very strong fall market.

One caveat: there is the possibility that the economy could spoil the real estate party. Fourth quarter GDP results will be published at the end of February. Third quarter GDP was negative, and another negative print would mean that we will be (technically) in a recession. One can imagine the headlines. If this happens, fear of job loss might cool buyers’ interest and soften prices.

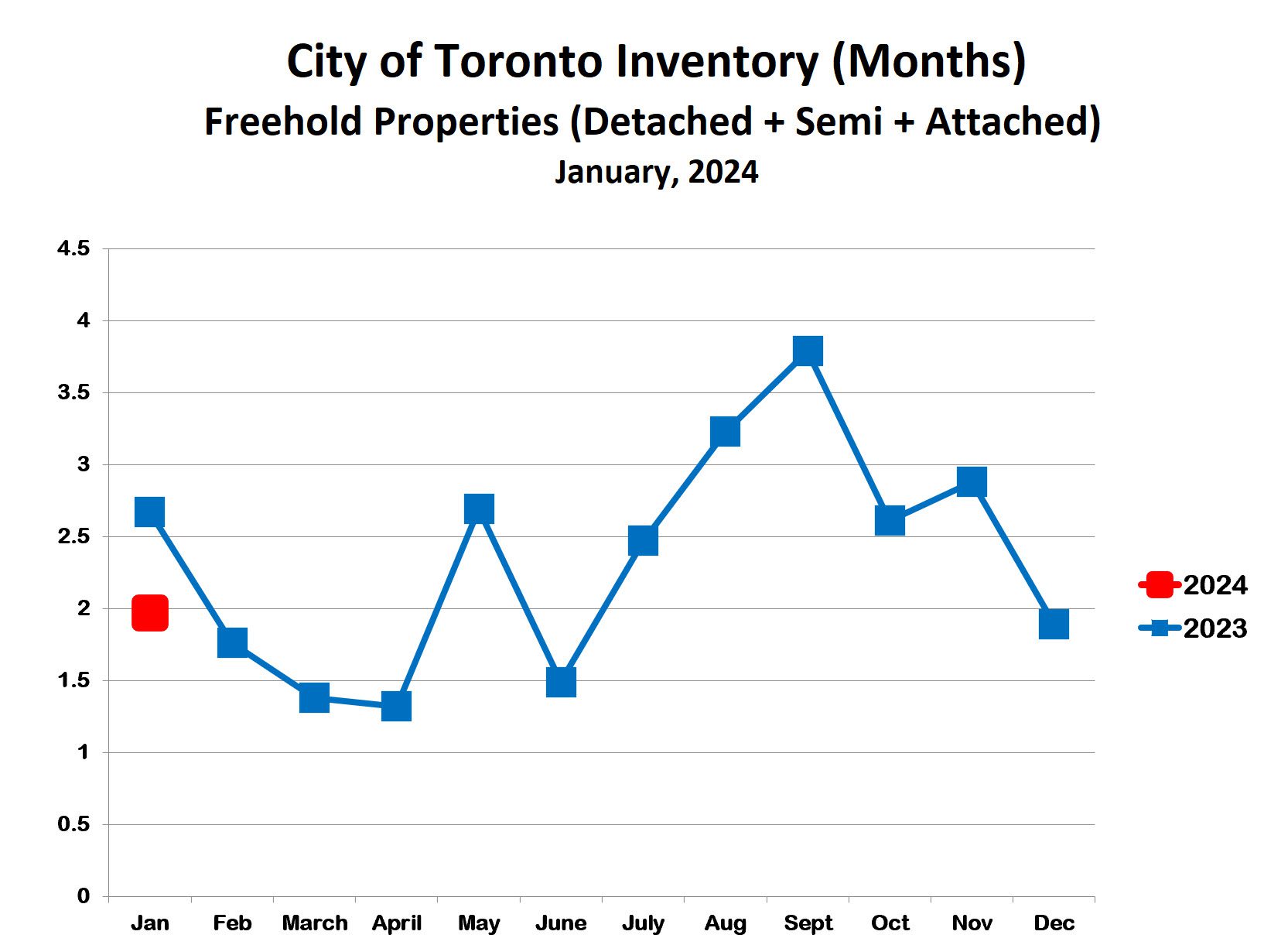

The inventory of homes was about the same as in December and lower than last January. This is the typical pattern in a strong spring market.

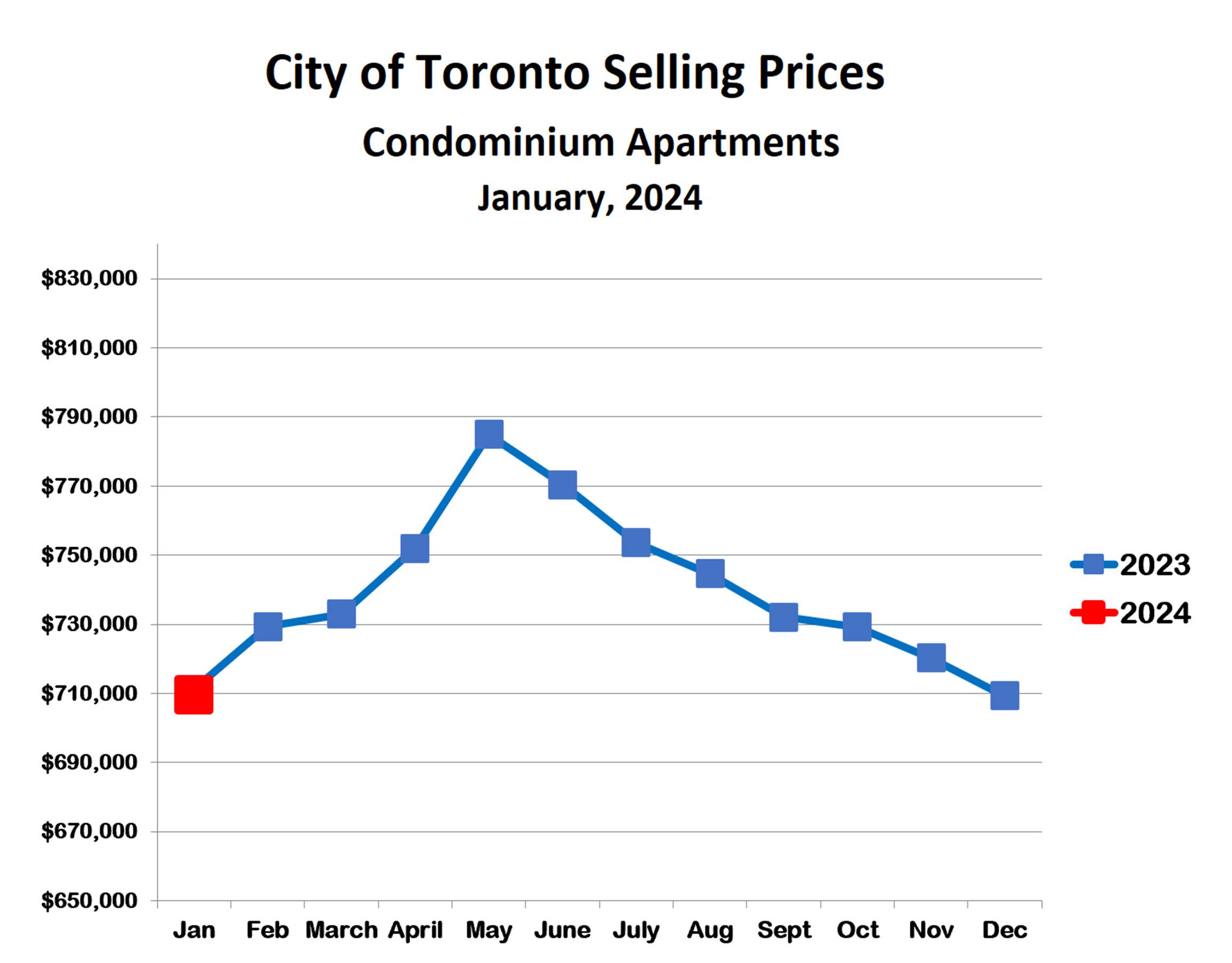

Condo Apartments

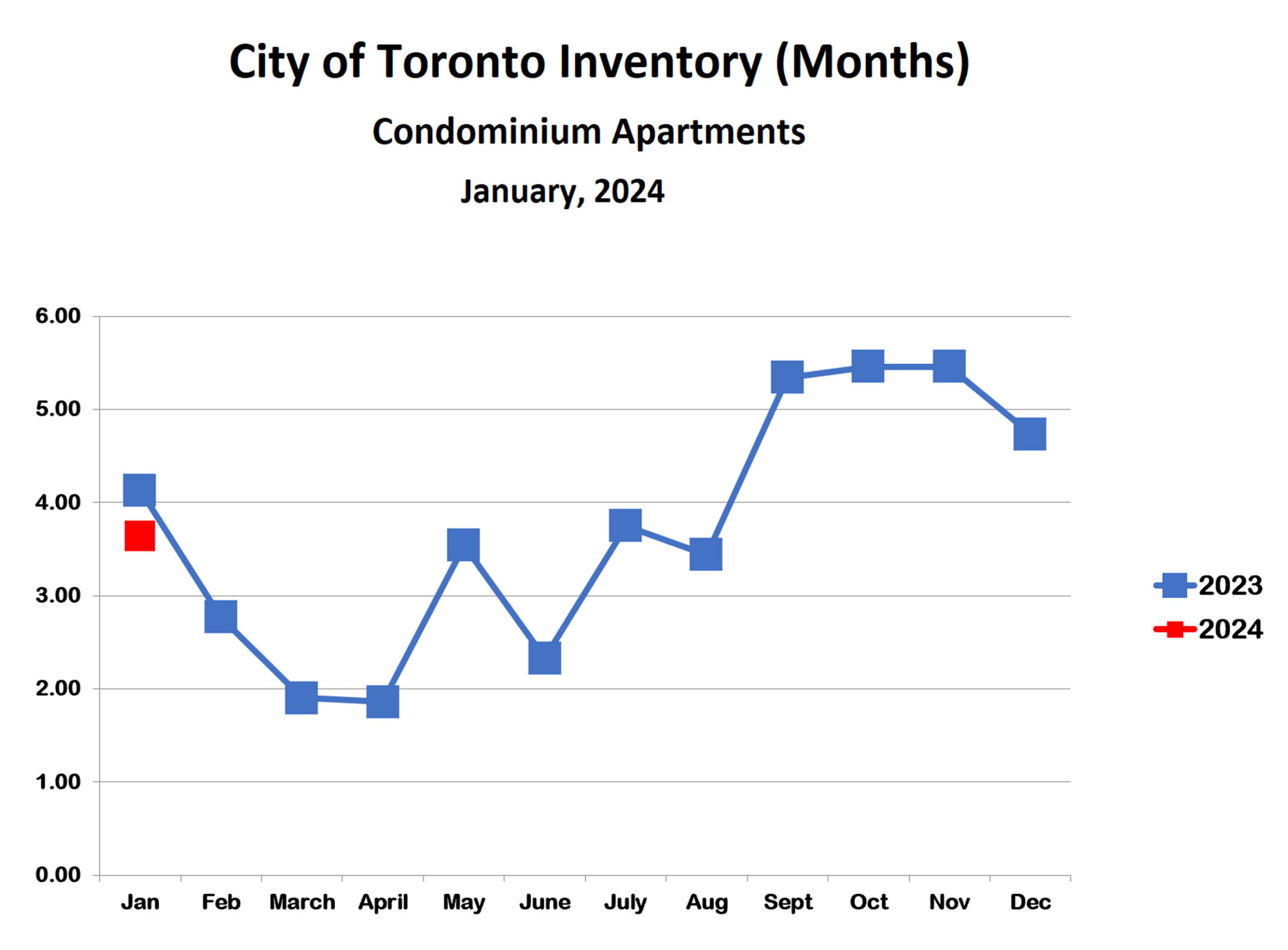

The condo market also sagged in the second half of last year, even more so than the house market. After peaking in May, condo prices fell for seven months in a row and ended pretty much where they started the year. The main reason for the relative weakness of condos versus houses is the large proportion of condos that are income properties. For decades, there has been very limited construction of rental apartment buildings. Condo apartments have filled the gap between demand and supply, to the point where roughly half of all condo apartments in Toronto are rented.

Many condo investors have seen (or will soon see) their mortgage payments rise steeply. This has made the investment much less attractive, even as rents have continued to rise. For some that are carrying a mortgage on their home as well as on one or two rental condos, the financial burden is becoming onerous or even unaffordable. Not surprisingly, many are deciding to dump their investment condos. This has led to a steep rise in condo inventory to over 5 months’ supply, well into buyers’ market territory.

This ‘pig in a python’ should work its way through the market over the next few months, especially with the anticipation of lower interest rates. We are already seeing condo inventory falling. The condo market will probably continue to lag behind the housing market this spring but could see a healthy bounce back in the second half.

Some Perspective On The Toronto Market

A Ten Year Price Overview

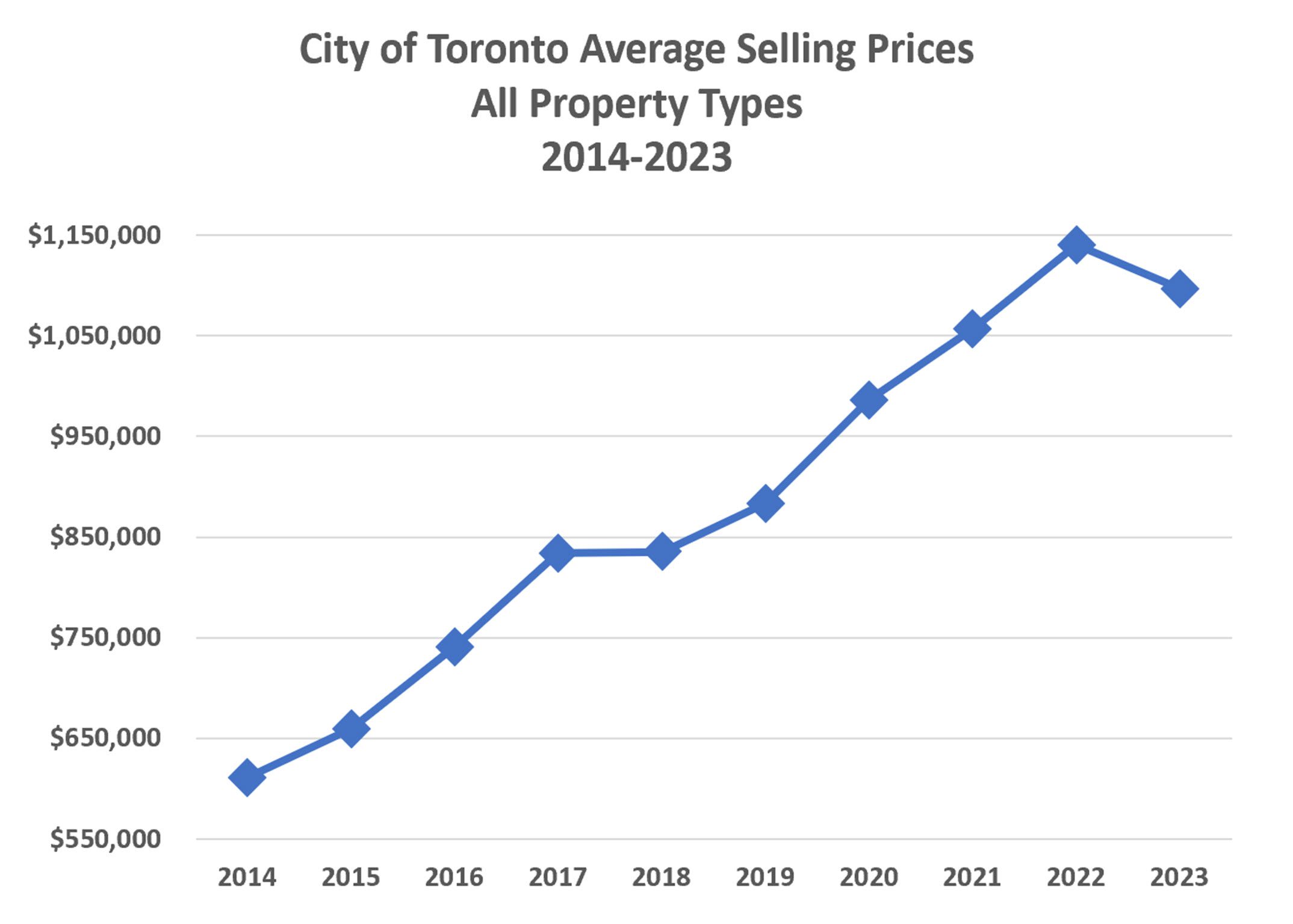

For those who believe that the Toronto market has suffered from the one-two punch of Covid and higher interest rates, I offer the chart below. This chart shows average selling prices for all property types (freehold as well as condos) since 2014. Especially surprising, at least to me, was that prices increased by 12% during 2020! This was the year of the lockdown when there was extreme doom and gloom about almost everything!

Since the beginning of Covid in 2020, prices have risen by 24%, despite the fact that prices fell last year for the first time in a decade. There has been tremendous volatility over those four years, however, the highs overpowered the lows by a wide margin.

Interestingly, the increase in prices from 2014 until 2020 was also 24%, so Covid and higher interest rates had essentially no overall positive or negative impact on prices. The imbalance between the number of people needing a place to live, and the housing available to accommodate them, seems to be overpowering all other factors.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!