Toronto Market Springs Back To Life

02/24/23

After a very quiet seven months, the Toronto market has become reinvigorated in February. After the bubble burst late last spring, prices bottomed out in July and remained essentially flat through January. This month, however, prices are rising and bidding wars are back.

Freehold Houses (detached, semi-detached and attached)

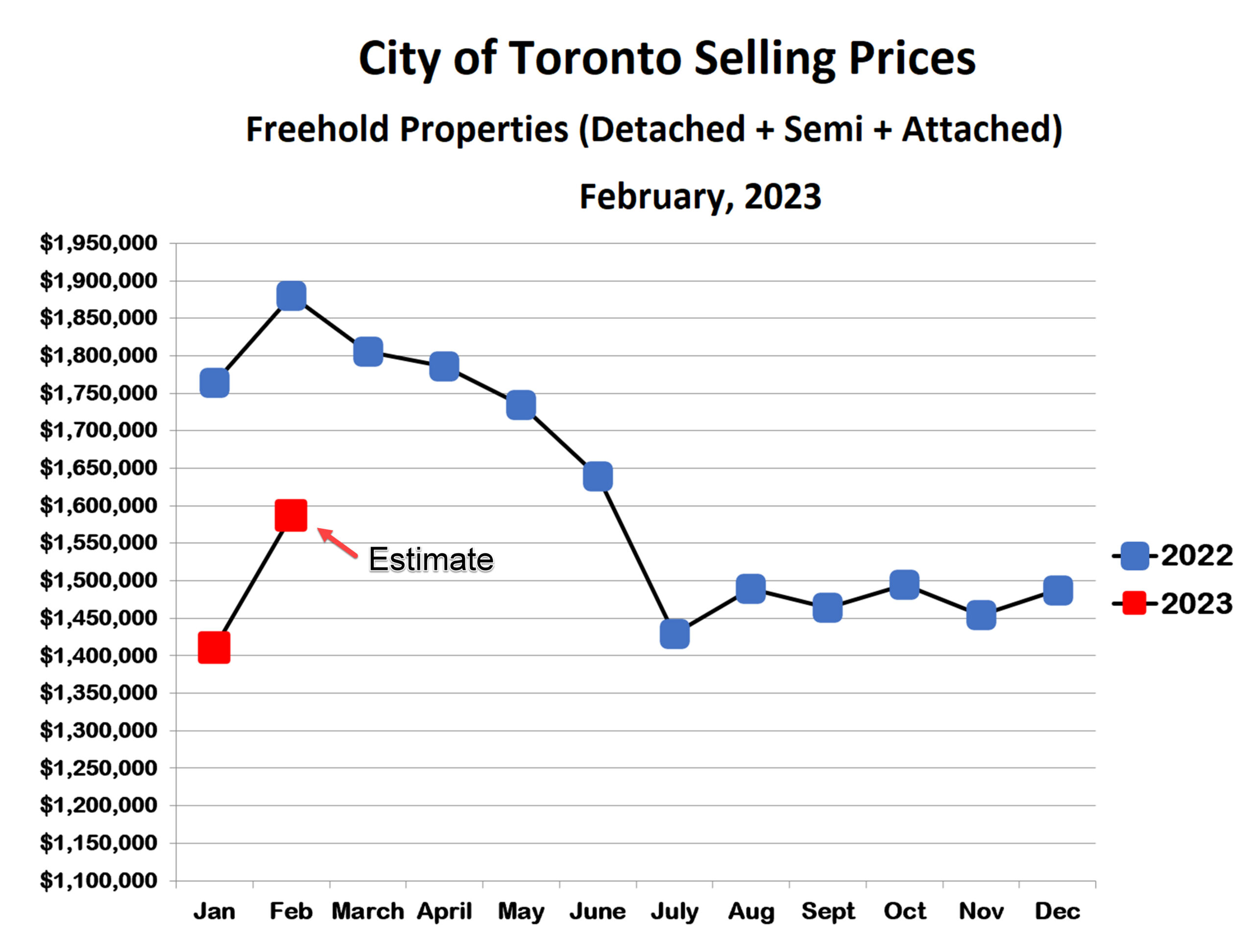

After falling from a peak of almost $1.9 million last February, average freehold prices in Toronto fluctuated between $1.4 million and $1.5 million from July through January. This month, however, prices have broken above that narrow range. So far, average prices in February are up about 7% and will likely go a bit higher by the end of the month. Bidding wars are back, with selling prices often several hundred thousand dollars over asking. Even so, the prices are not crazy high like they were last year, it’s just that asking prices are being set very far below value. Clearly there is a ton of pent-up demand for houses. Buyers were somewhat hesitant over the past few months, concerned that prices might fall further. Now, however, they seem to feel that the correction is truly over.

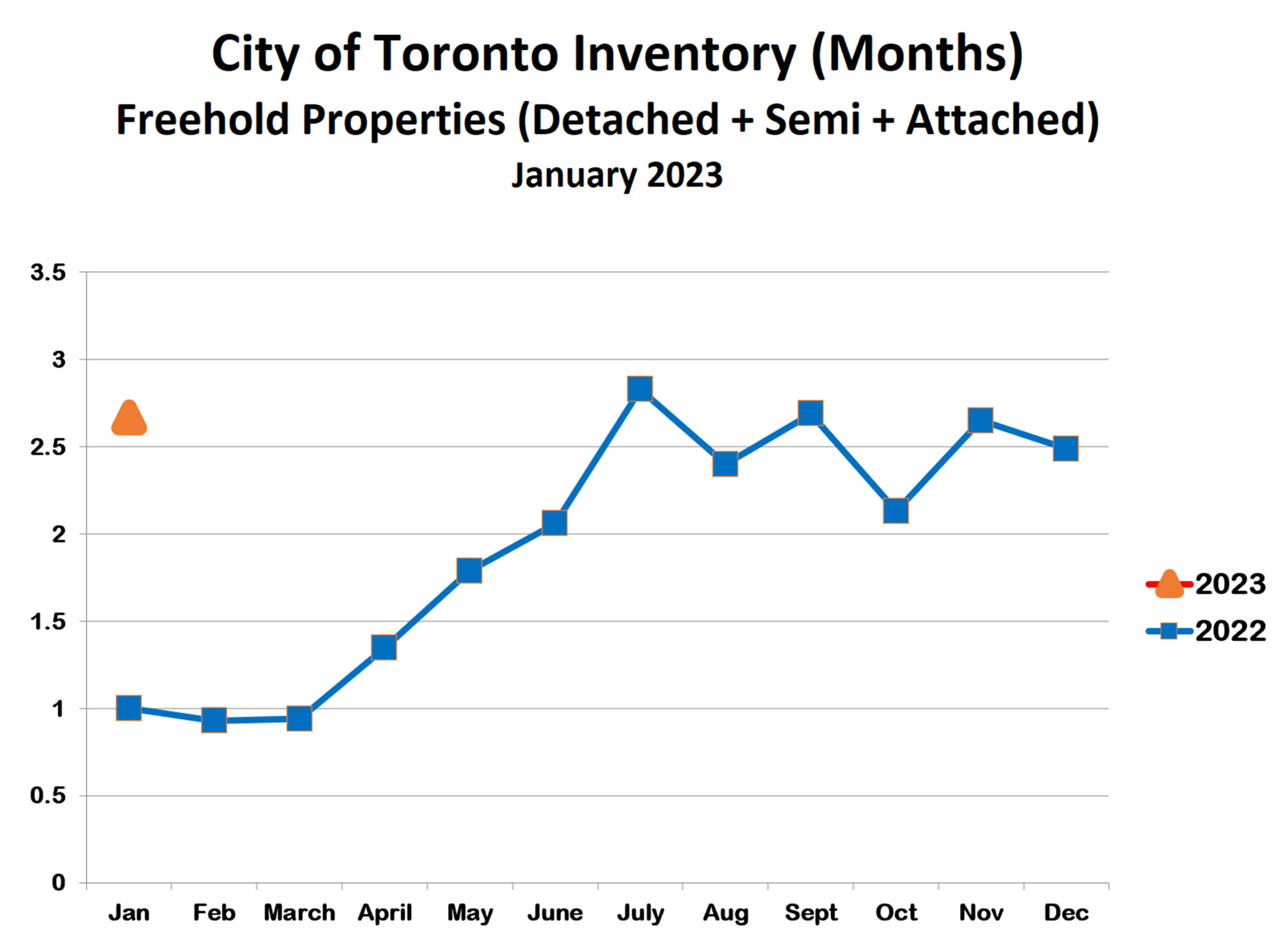

The inventory of freehold houses for sale mirrored selling prices over the past year. From about 1 month of supply early last year, inventory rose as the bubble broke, reaching almost 3 months’ supply in July. From July through January, inventory fluctuated between 2 and 3 months’s supply, reflecting a balanced market. Inventory is almost certainly falling in February given the strong uptick in prices.

Condominium Apartments

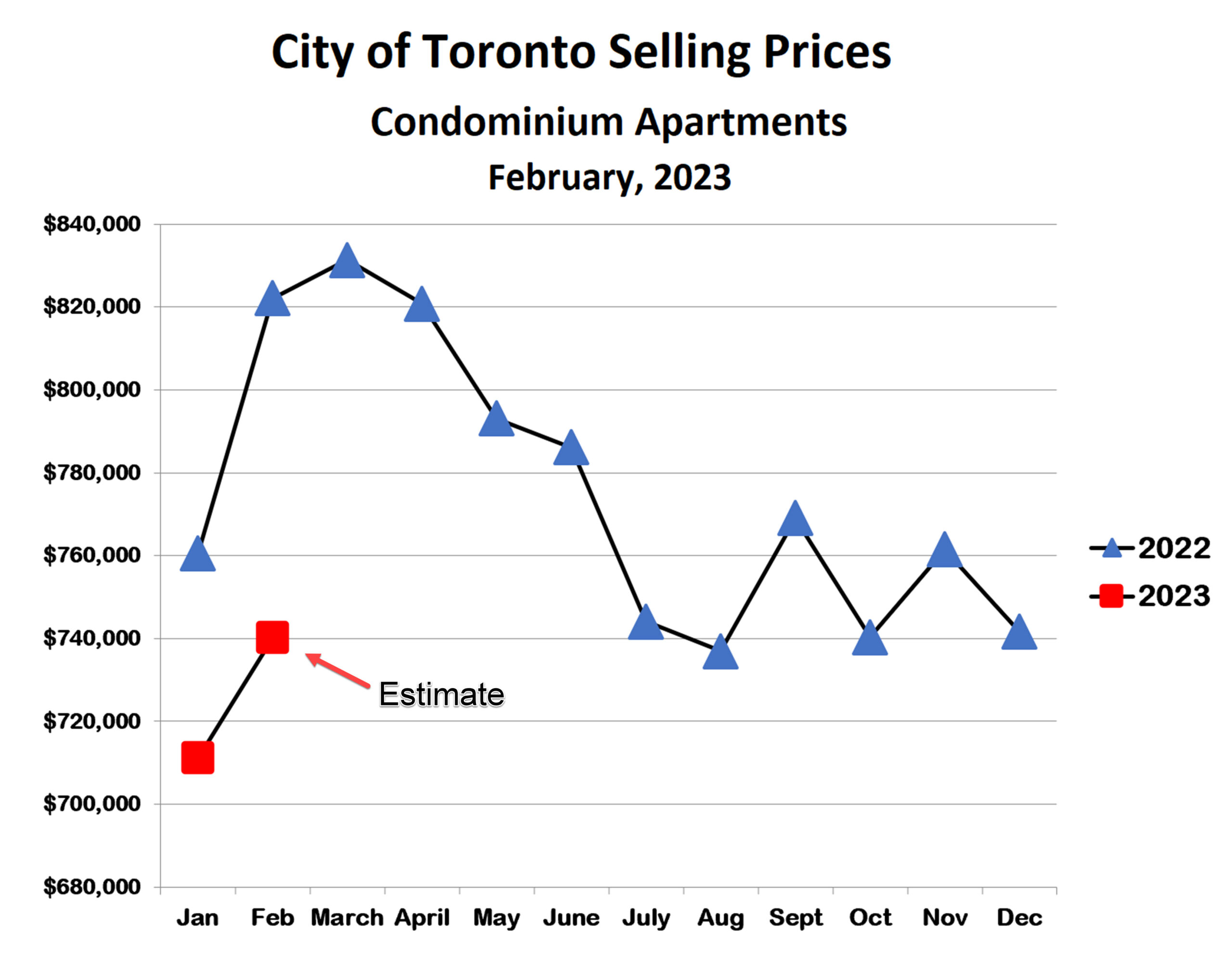

Average condo prices in Toronto also fell last spring, from a high of about $830,000 in March to a low of just under $740,000 in August. After bouncing around in the $740,000-$770,000 range from August through December, prices then fell to about $710,000 in January. February prices have bounced back strongly, however, and are now back inside the July-December range.

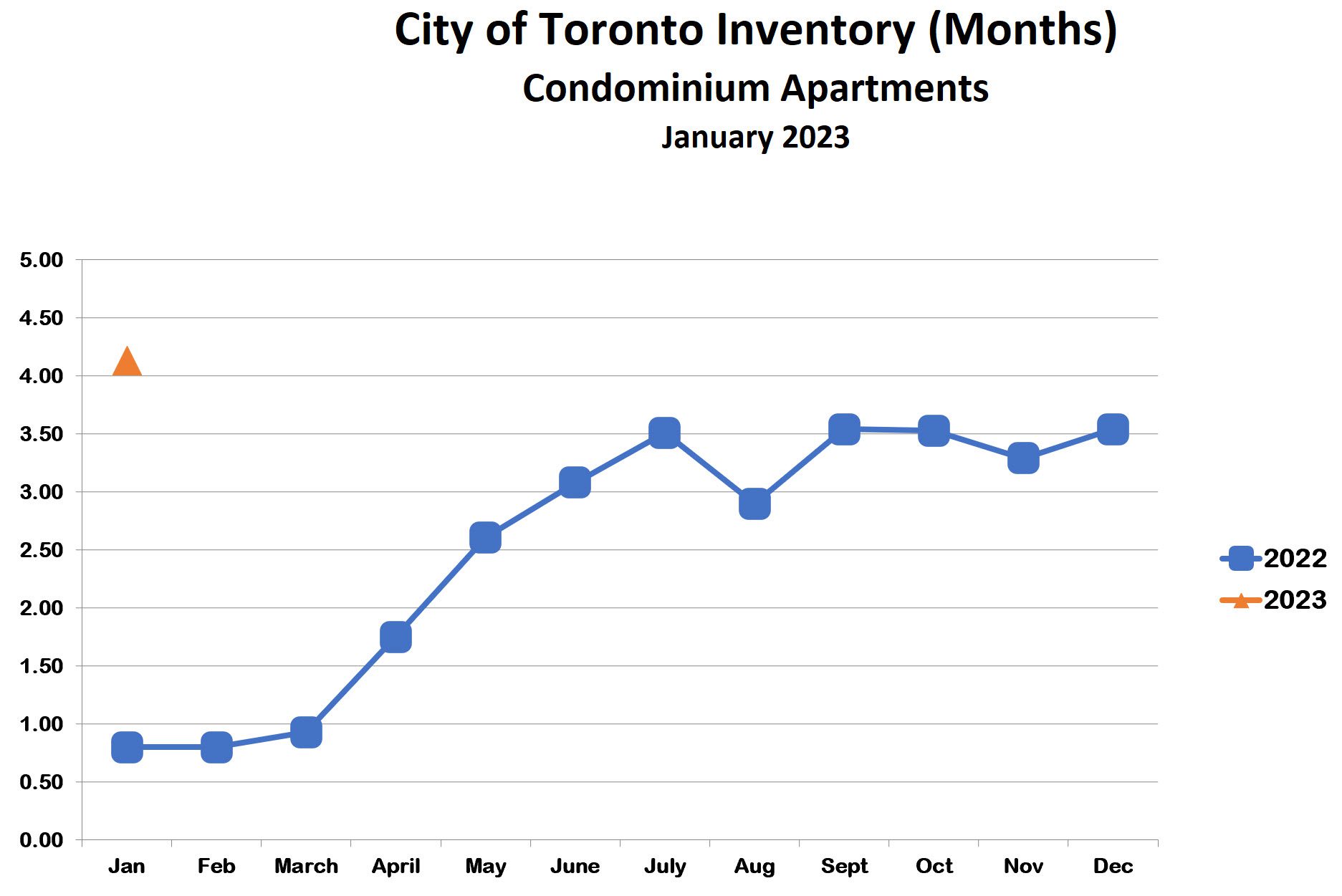

Condo inventory levels increased from under one month early last year to over 3 months as the bubble collapsed. Inventory remained in the 3.0-3.5 month range from July through December, somewhat higher than freehold but still a balanced market. In January, inventory increased to more than 4 months, which is buyers’ market territory. No doubt inventory is falling in February as prices rise.

I can think of two possible reasons for the relative weakness of the condo as compared with houses. First, higher interest rates are likely having a larger impact on buyers in the lower price ranges. Many of these are first time buyers struggling to save a down payment and to meet the tougher-than-ever mortgage stress test rules. Second, many condos are rental properties purchased by homeowners investing in a second property. Rising interest rates are putting a lot of financial pressure on many of them and, if push comes to shove, they will sell the rental condo before they will sell their home. This could be contributing to the higher inventory of condos for sale.

Bottom line: the Toronto real estate market is strong right now, and the momentum should continue through the spring. The forecast for later this year is more uncertain. The lagging effects of higher interest rates on the economy may be more strongly felt in the second half, and it’s unclear how this will impact the real estate market.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!