Toronto Market Starts Off Slow

02/08/26

Houses

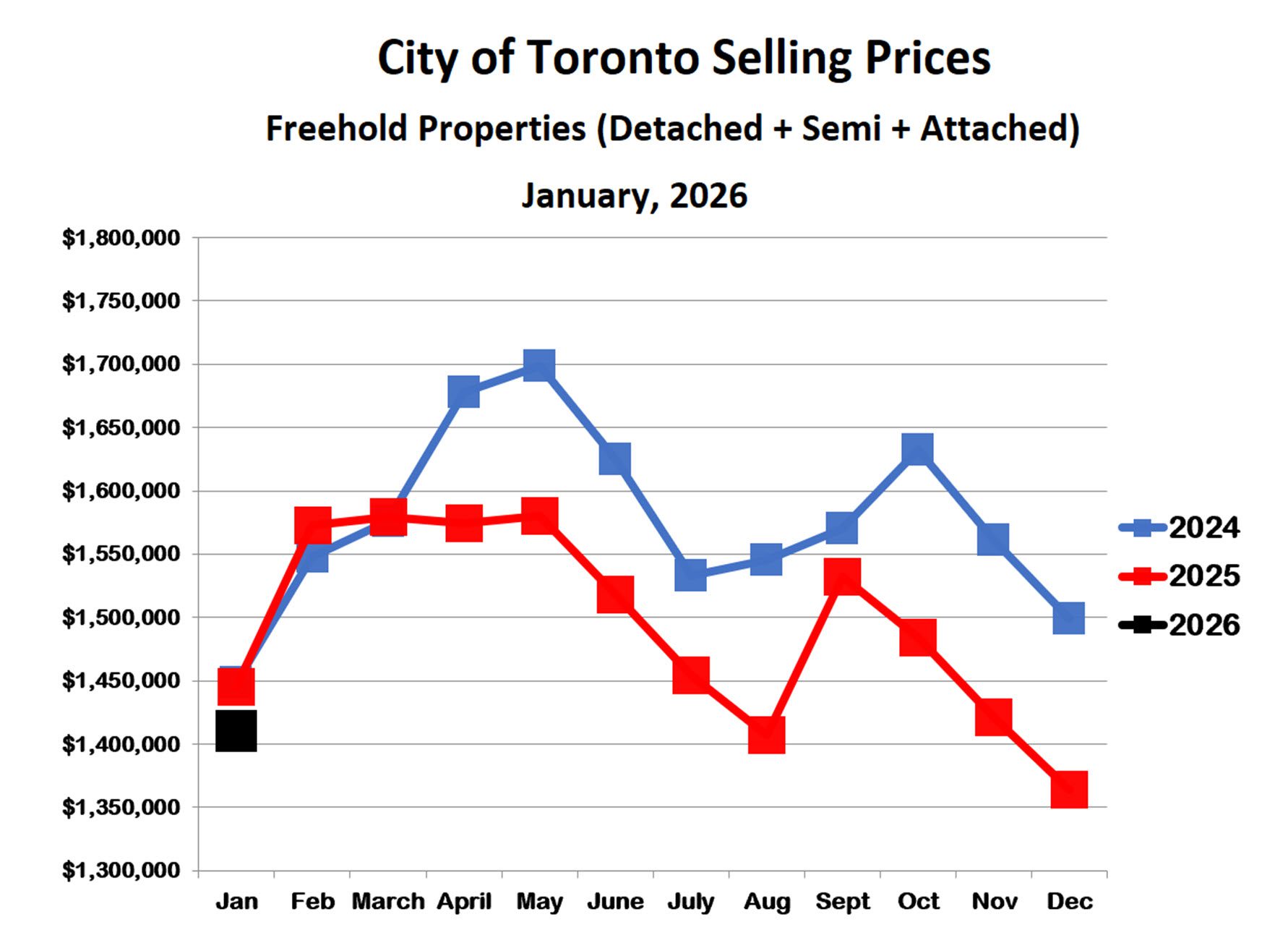

The Toronto market for houses experienced a notable slowdown over the final three months of 2025, so it’s not surprising that January activity was somewhat muted. The encouraging news is that January prices were only slightly lower than last year and notably higher than in December, suggesting positive momentum heading into February.

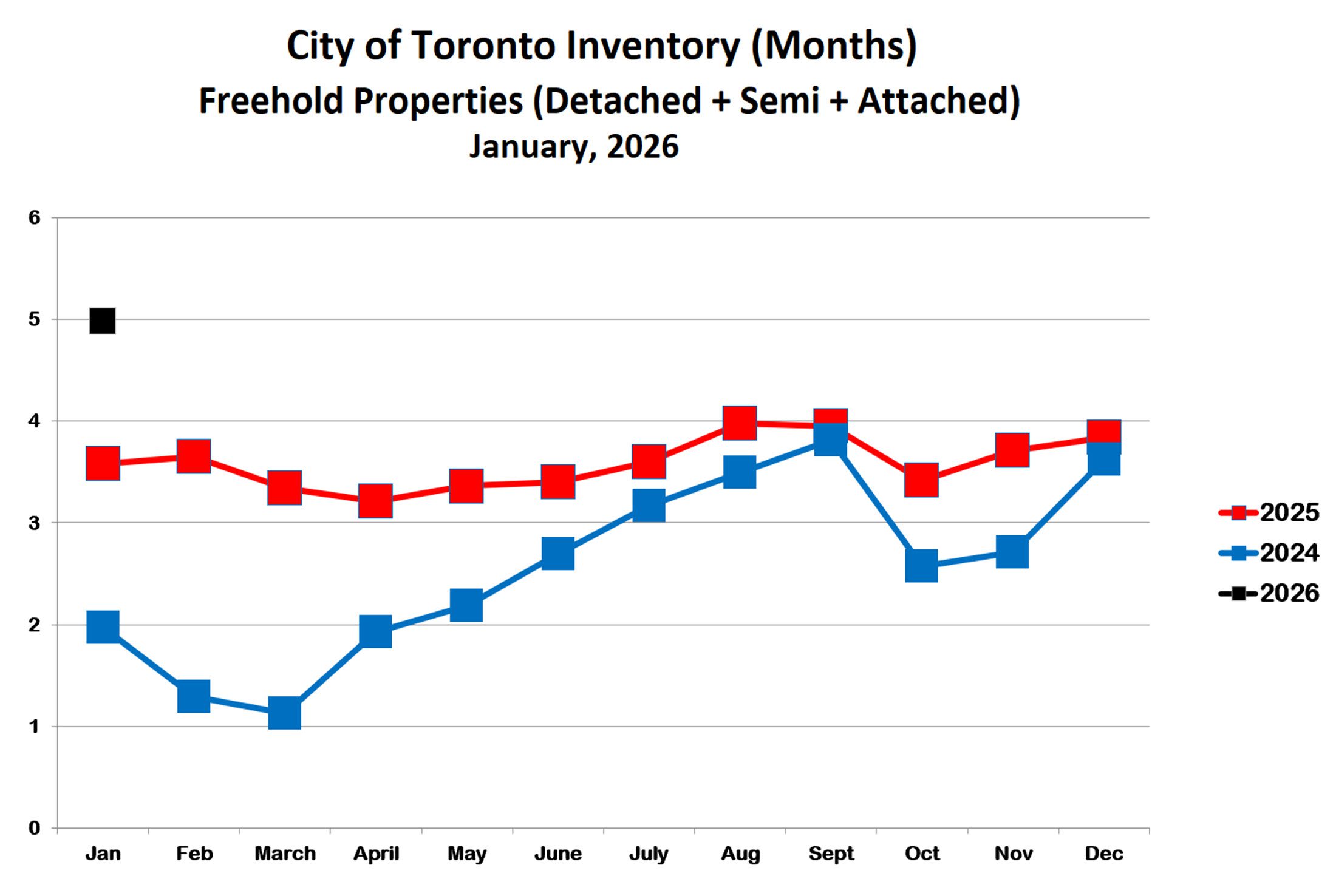

The inventory of houses for sale rose to 5 months’ supply in January. This is the highest inventory level that we have seen since before Covid, and indicates that the market has shifted into buyer-friendly territory. This reflects the low level of sales in January, which were at their weakest in more than 6 years, as many buyers remain on the sidelines amid ongoing uncertainty.

Recent headlines have focused on weakness in GTA house prices in January, but it’s important to distinguish between the broader GTA and the City of Toronto. While GTA house prices were down 7% year over year in January, prices within the City of Toronto declined by only 2%. This highlights that, although the Toronto market is softer than last year, it remains considerably stronger than the GTA overall.

Much of this difference can be traced back to pandemic-driven migration patterns. During COVID, the rise of work-from-home encouraged many Toronto residents—particularly condo owners—to relocate to 905 communities, driving a surge in suburban house prices. As work-from-home policies are increasingly rolled back, this trend is reversing. The relative appeal of the 905 has diminished, and demand for city living is strengthening. As a result, we are seeing a reversion to the mean, with 905 prices declining more sharply compared to those in the City of Toronto.

Condo Apartments

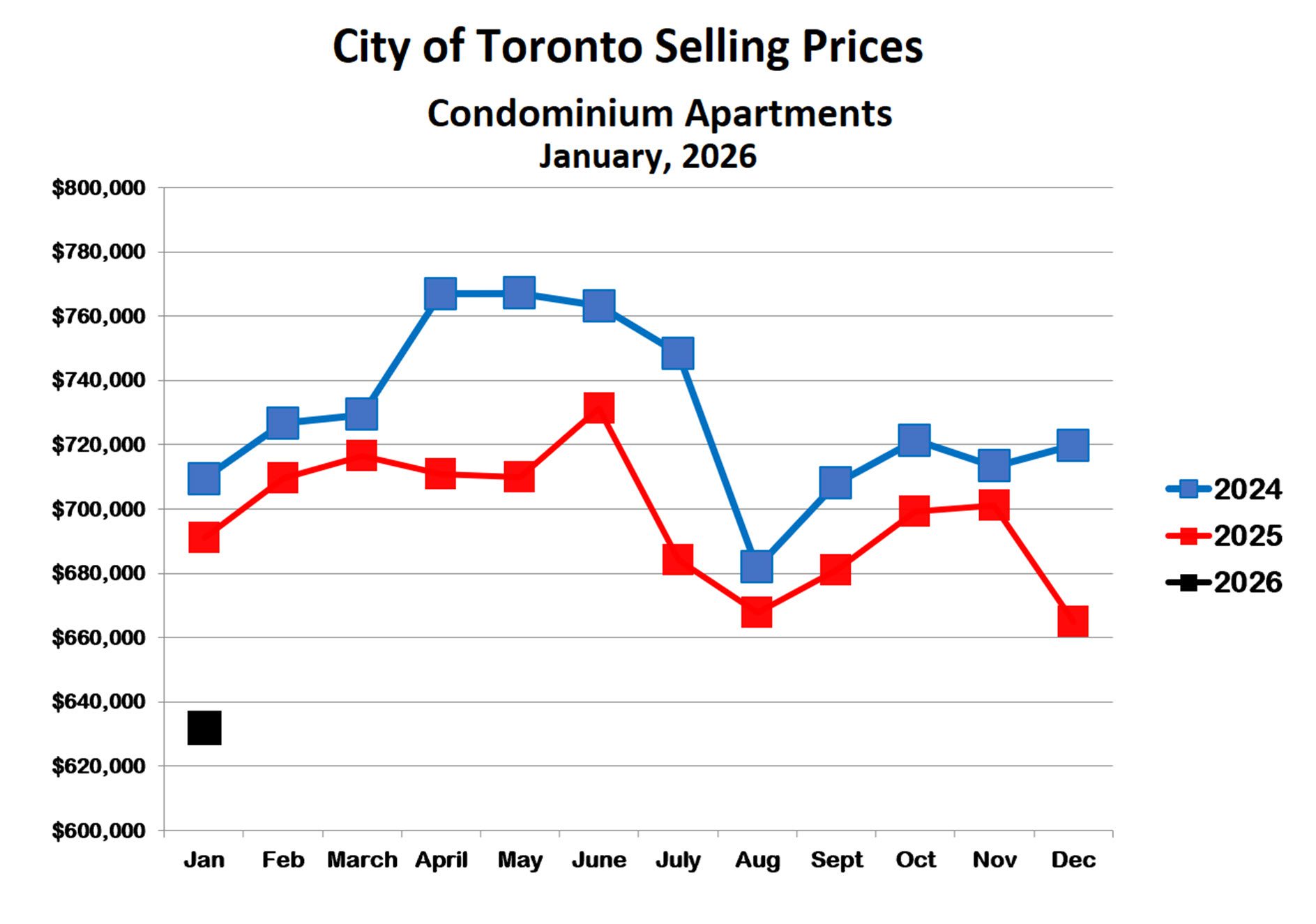

The Toronto condo market remains weak in January. Prices are 9% below last January and 5% below December. Condo prices are still falling.

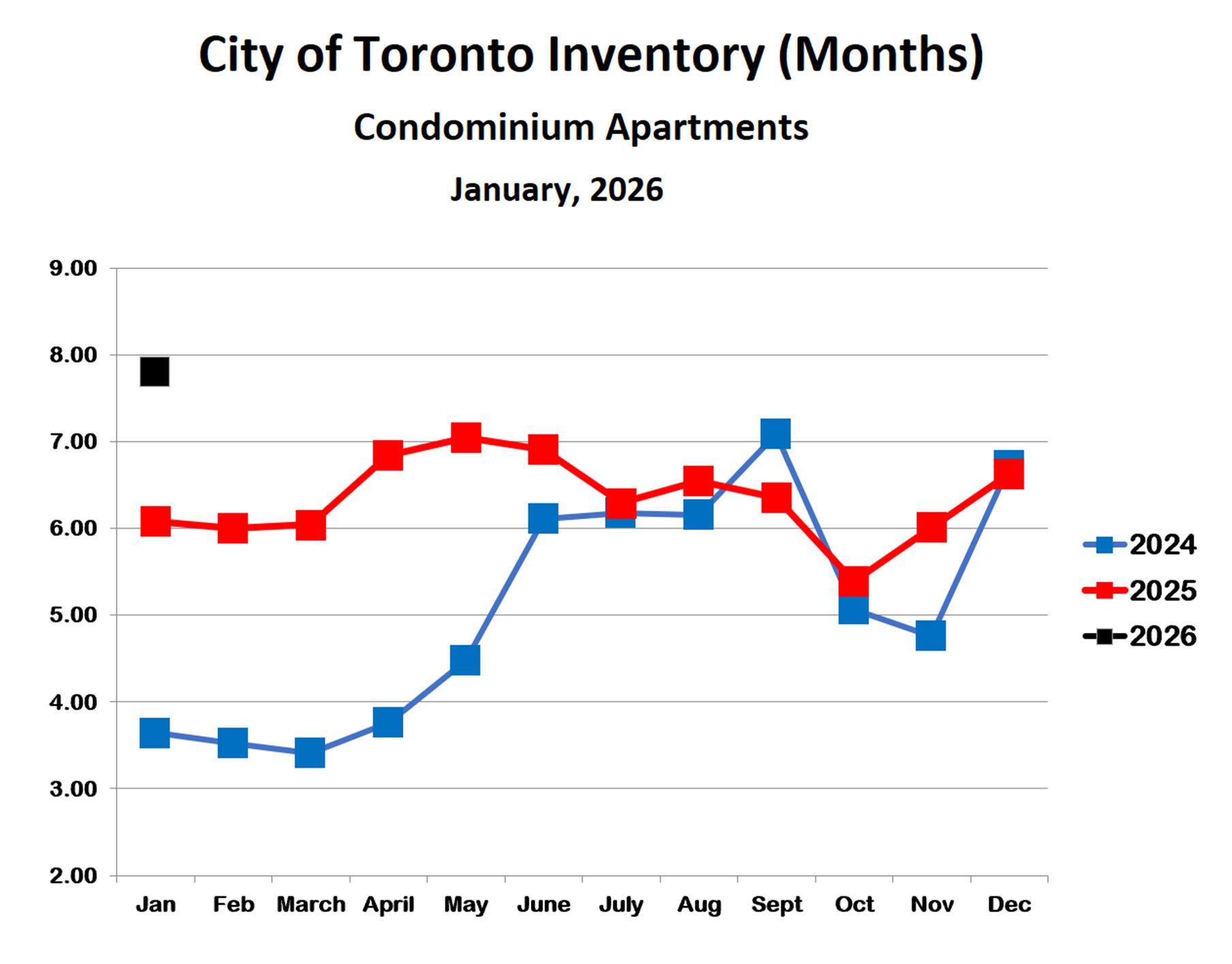

The inventory of condos for sale increased by 17% as compared with last January, to almost 8 months’ supply. This is very deep in buyers’ market territory, and reflects very low sales. Interestingly, the GTA condo market as a whole is quite similar to Toronto: prices fell by 10% versus last year, and inventory was also close to 8 months’ supply.

Bottom Line

The Toronto market is off to a slow start for both houses and condos. For houses, the outlook for February is positive, as January prices were only slightly lower than last year despite higher inventory levels. The outlook for condos is less positive, as prices fell steeply while inventory increased substantially.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!