Toronto Market Super Hot in February, Moderating in March

03/20/22

The month of February was insane, a ‘perfect storm’ combining very low interest rates and low numbers of homes for sale with large numbers of eager buyers wanting to buy something, anything, before prices rose even further. The month of March has so far been a different story, however. Let’s look at the numbers.

Freehold Properties

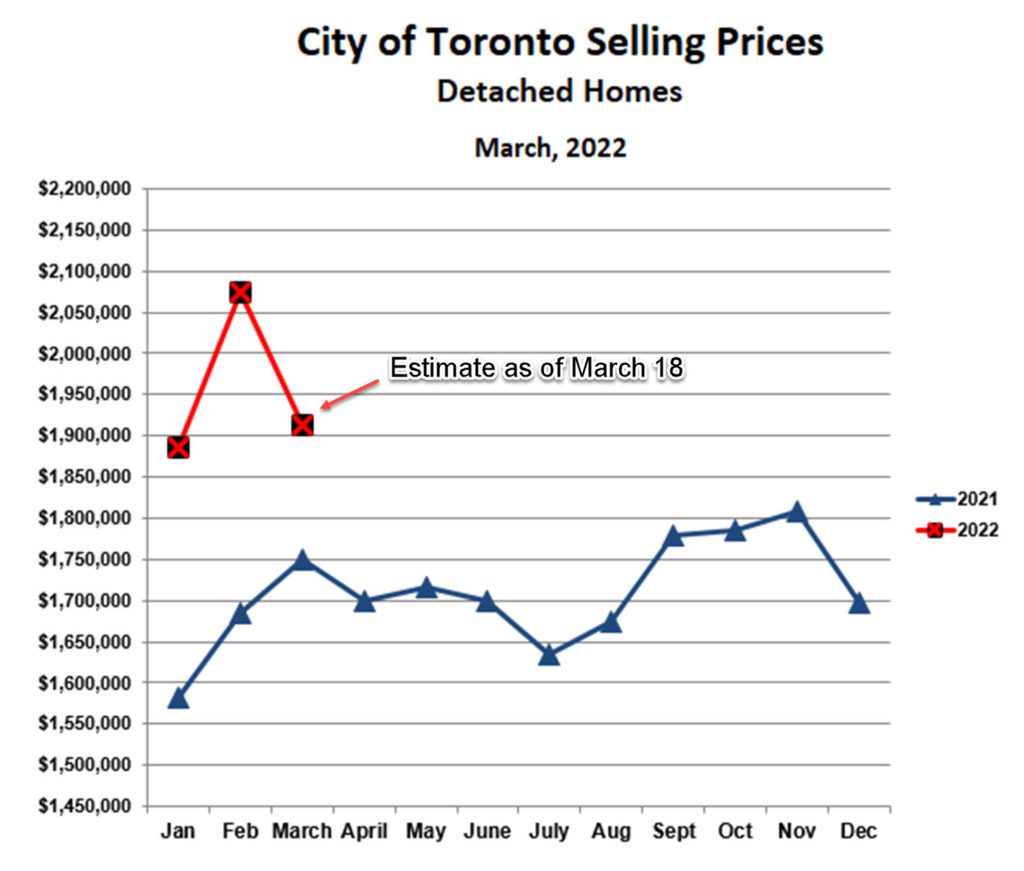

The average price for detached homes in February was $2,073,989, cracking the $2 million mark for the first time. This was 23% higher than February, 2021, which itself wasn’t too shabby. Bidding wars were rampant, and selling prices more than $500,000 over asking were common. (Though, it must be said that properties were often being priced more than $500,000 under value.) Crazy times.

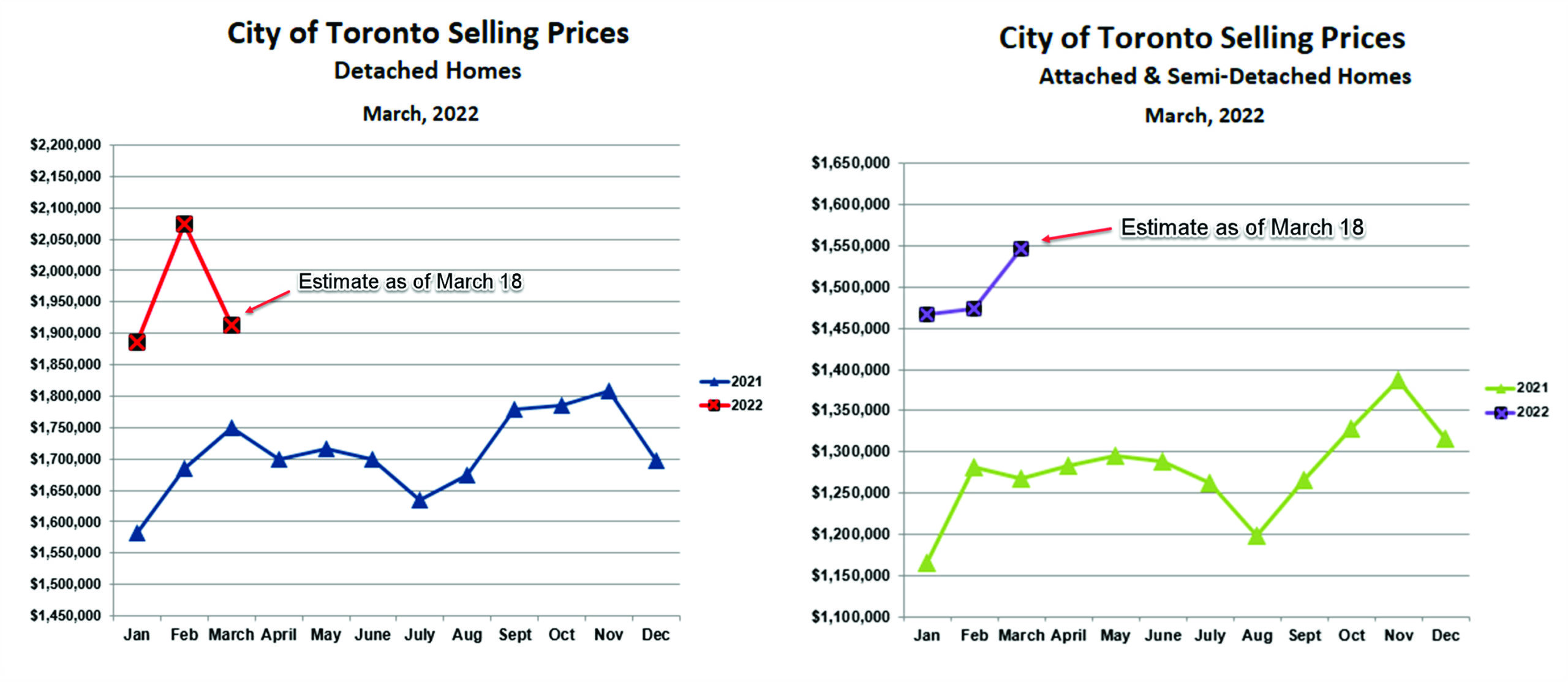

Based on estimated average prices as of March 18, however, the market seems to be changing. While bidding wars are still the norm, the average selling price for detached homes has fallen by about 8%. Curiously, the same is not true of semi-detached and attached homes, where the average price in March is so far about 5% higher than in February. So what is going on here?

Overall, these data suggest that we are seeing some moderation; perhaps we have passed ‘peak insanity’ and can look forward to a more steady market over the next few months. Remember that the pattern was similar last year: rising prices and jaw-dropping bidding wars early in the year, and then flat to slowly falling prices until the fall. We are hitting the peak about a month earlier this year, and there are good reasons for this:

- Both the Bank of Canada and the Federal Reserve have raised interest rates for the first time in years;

- Inflation has risen to levels not seen in decades, stoking fears that interest rates will accelerate upward;

- The Ukraine conflict has introduced a lot of uncertainty, and buyers tend to hesitate in uncertain times; and

- Affordability is being strained, especially at higher price points.

None of this means that the market is going to correct strongly, at least not in the short term. More likely we will see a continued strong sellers’ market through the rest of the spring, just a bit more balanced than it’s been for the past few months. This will be good news for buyers suffering from bidding war fatigue.

Condominium Apartments

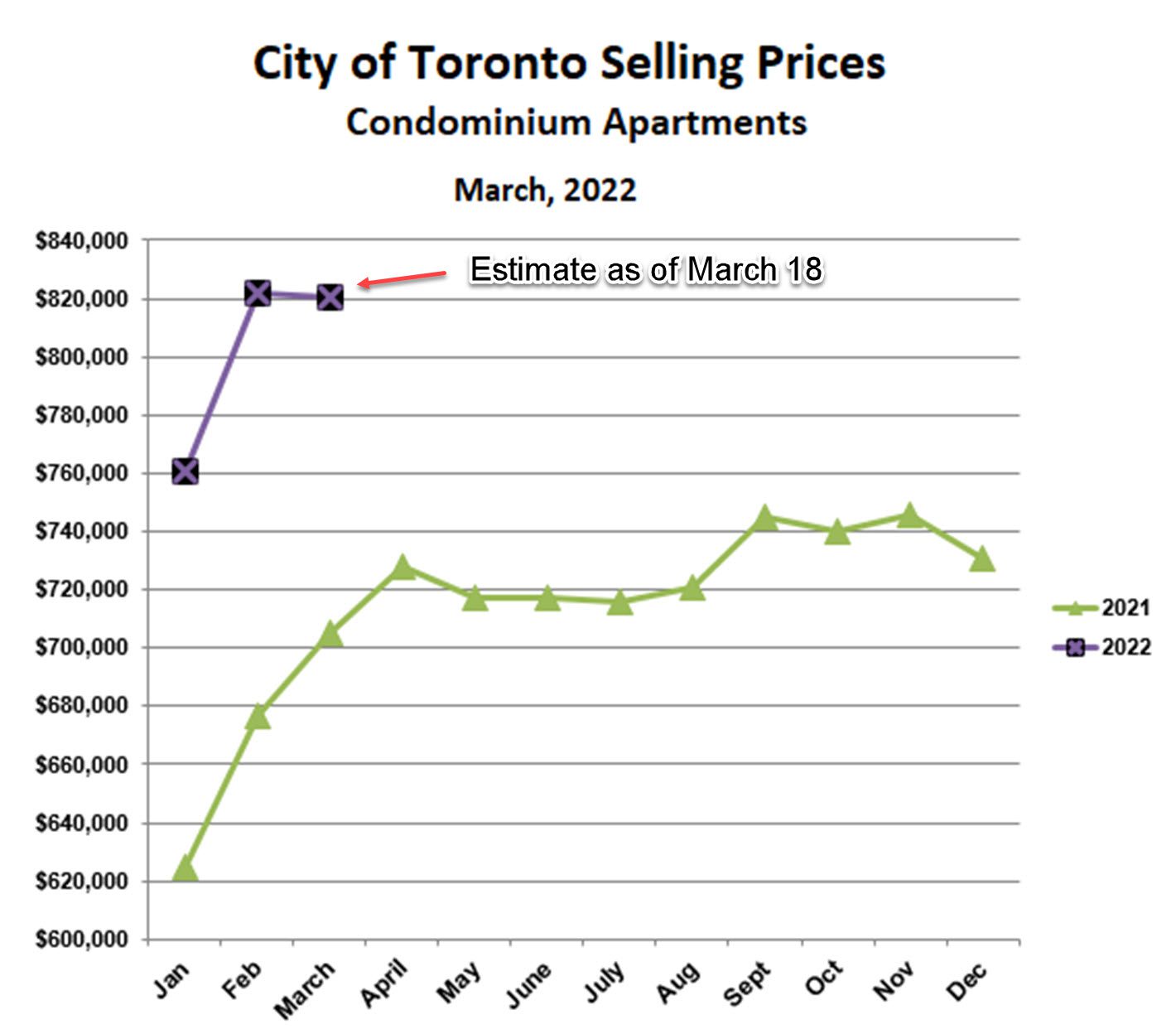

Prices for condo apartments in the City of Toronto increased to an average of $822,090 in February, up 8% over January and 21% over last February. This was very similar to freehold properties and also represented another all-time high. Also like freehold properties, prices are not, so far, increasing further in March. As of the middle of the month, condo prices are virtually flat as against February, again suggesting that the early year craziness in the Toronto market is subsiding. The pattern of an early upward thrust in prices, followed by a more even, steady market over the rest of the spring, seems to be in store for condos as well.

Inventory

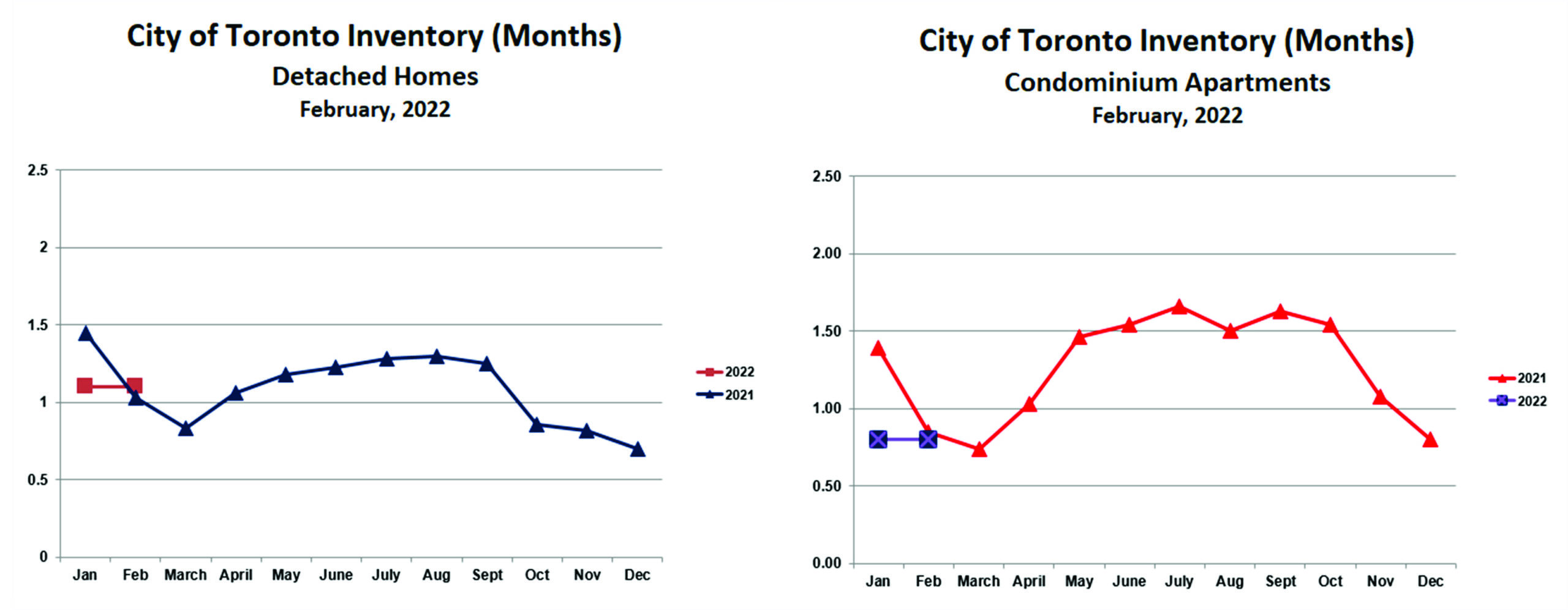

Inventory (months of supply of homes for sale) was very low for both freehold and condo properties in February. This isn’t at all surprising given how strong the market has been. It’s basic supply and demand. We will have inventory numbers for March after the end of the month, and, given the mid-month price trends, a rise in inventory should be expected. Last year inventories rose after the January-March craziness subsided. This year it looks as if everything has been moved up by one month. If so, we can look forward to a strong, but not feverish, market for the next 2-3 months or so.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!