Toronto Market Turning The Corner In August

08/26/22

In early 2020, at the beginning of the Covid-19 pandemic, mortgage rates were slashed to historically low levels. Real estate prices in the City of Toronto responded vigorously, resulting in an extreme sellers’ market over the past two years.

Efforts to combat the recession induced by the Covid-19 lockdowns and restrictions eventually caused high inflation. Interest rates were increased early this year to fight inflation, and this has led to falling prices over the past few months.

The price correction may be over, however. House prices in August are rising and condo prices have stabilized.

Thinking about buying or selling this fall? We’d be happy to help! Send us an email.

Houses (detached, semi-detached and attached homes)

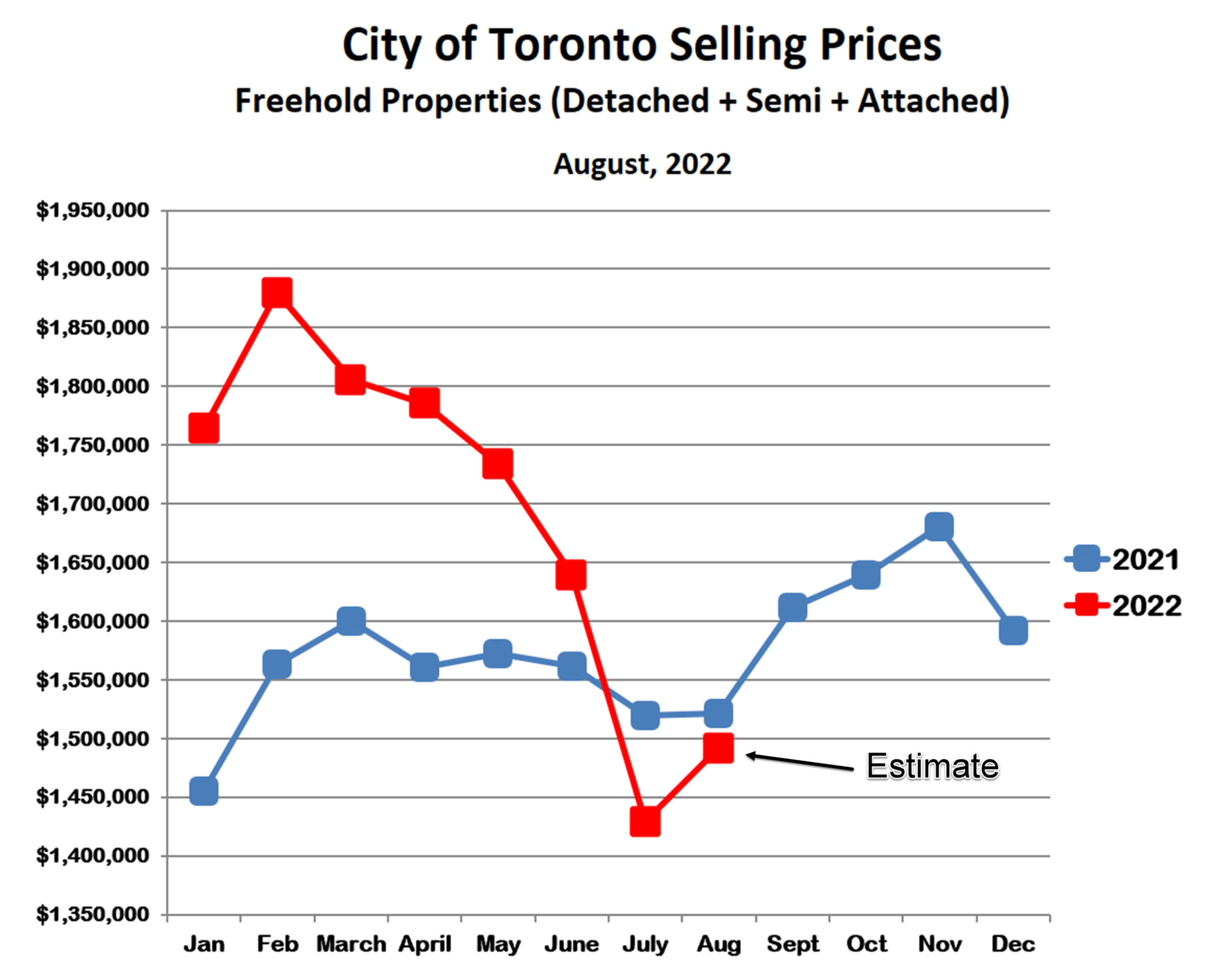

City of Toronto house prices hit an all-time high of just under $1,879,579 in February of this year, 53% higher than before the pandemic started. This was a very impressive bubble. The increase in mortgage interest rates burst the bubble, and house prices fell 24% over the next five months to a low of $1,428,950 in July. For perspective, this is still 16% above the pre-pandemic price level or more than 5%/year over the past three years. This is a very healthy increase indeed, though it was a very bumpy ride getting here.

So far in August, house prices are up almost 8% vs July and are only slightly lower than last July. This suggests that the worst of the correction is over. if true, this doesn’t mean that prices are likely to return to where they were in the spring. Rather, we will probably see a balanced market, with neither buyers nor sellers in control and stable to gently rising prices. After the last few months, this would be most welcome.

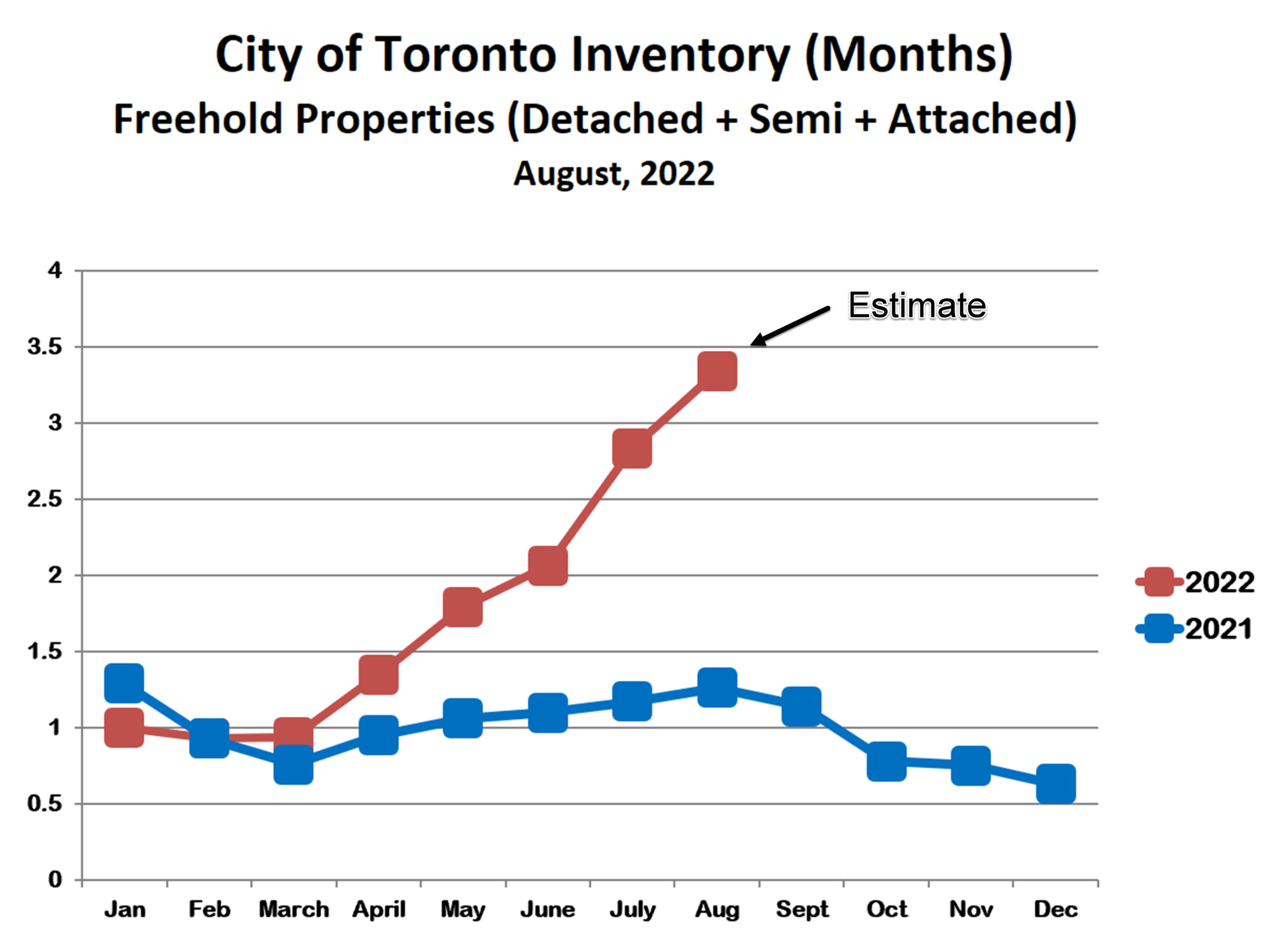

The inventory of houses for sale mirrors the trend in prices. Inventory is defined as the ratio of homes for sale to homes sold per month. For example, if the number of homes for sale is three times the number of homes sold, it means that it will take about three months to sell all the homes on the market if no more homes come up for sale. Over the past couple of years, inventory remained in a tight range close to one month’s supply. In other words, homes were selling as fast as they came on the market, and sometimes even faster. It was crazy.

Since interest rates started going up, however, inventory has increased steadily, and is now just over 3 months’ supply. We consider this to be a balanced market, with neither buyers nor sellers in control.

Condominium Apartments

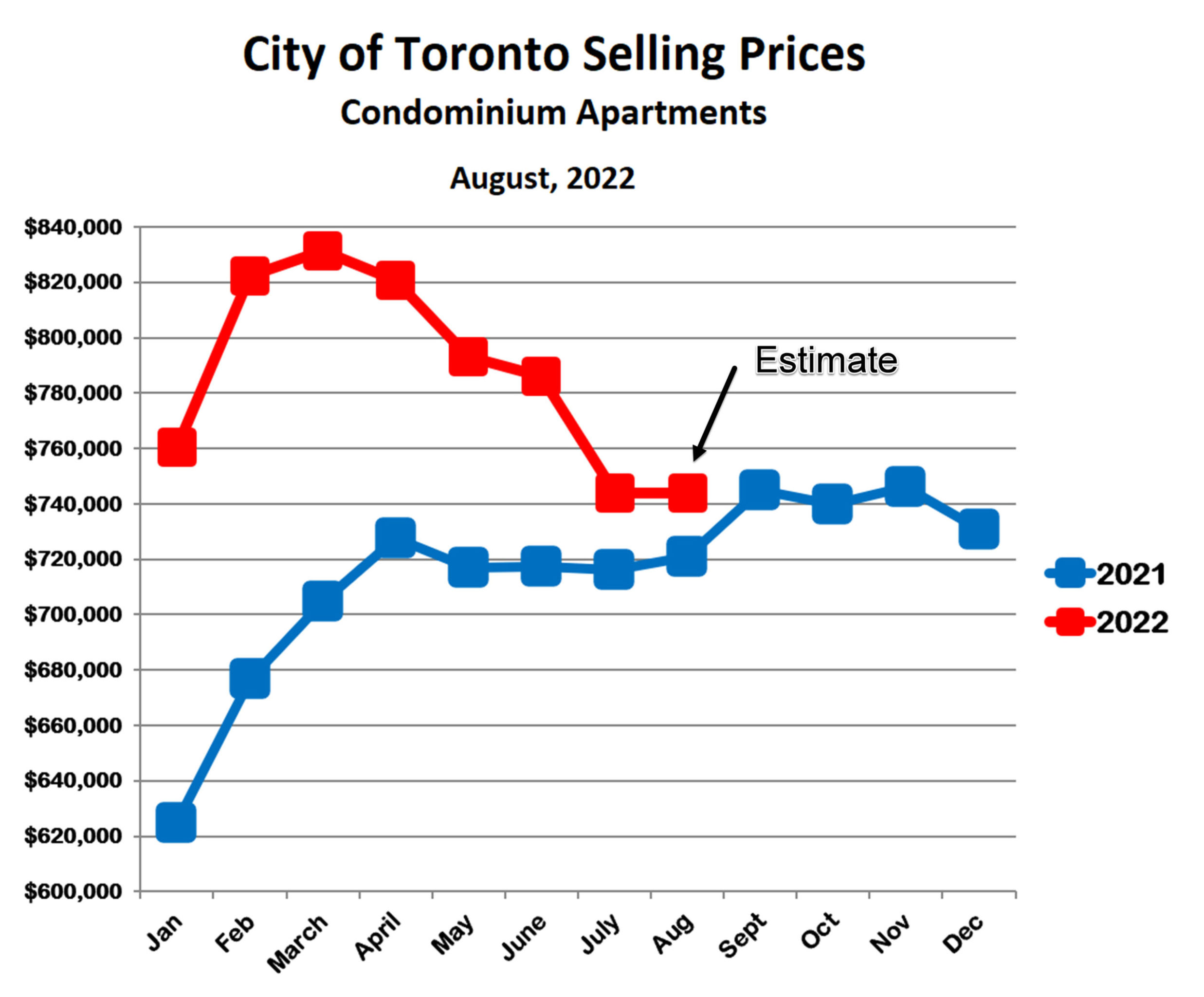

Prices for condos in the City of Toronto have followed a pattern similar to houses, though with considerably less volatility. Condo prices hit an all-time high of $822,090 this February, 30% higher than in 2019. Prices fell 9% between February and July, and the preliminary estimate for August is the same as July. This is 17% higher than 2019, almost exactly the same as for houses.

Condos were out of favour during the pandemic: being cooped up in a small space during the lockdowns wasn’t much fun, and only two people allowed in an elevator car often meant long waits to get to your apartment. This is perhaps one of the main reasons that condo prices were more subdued than houses.

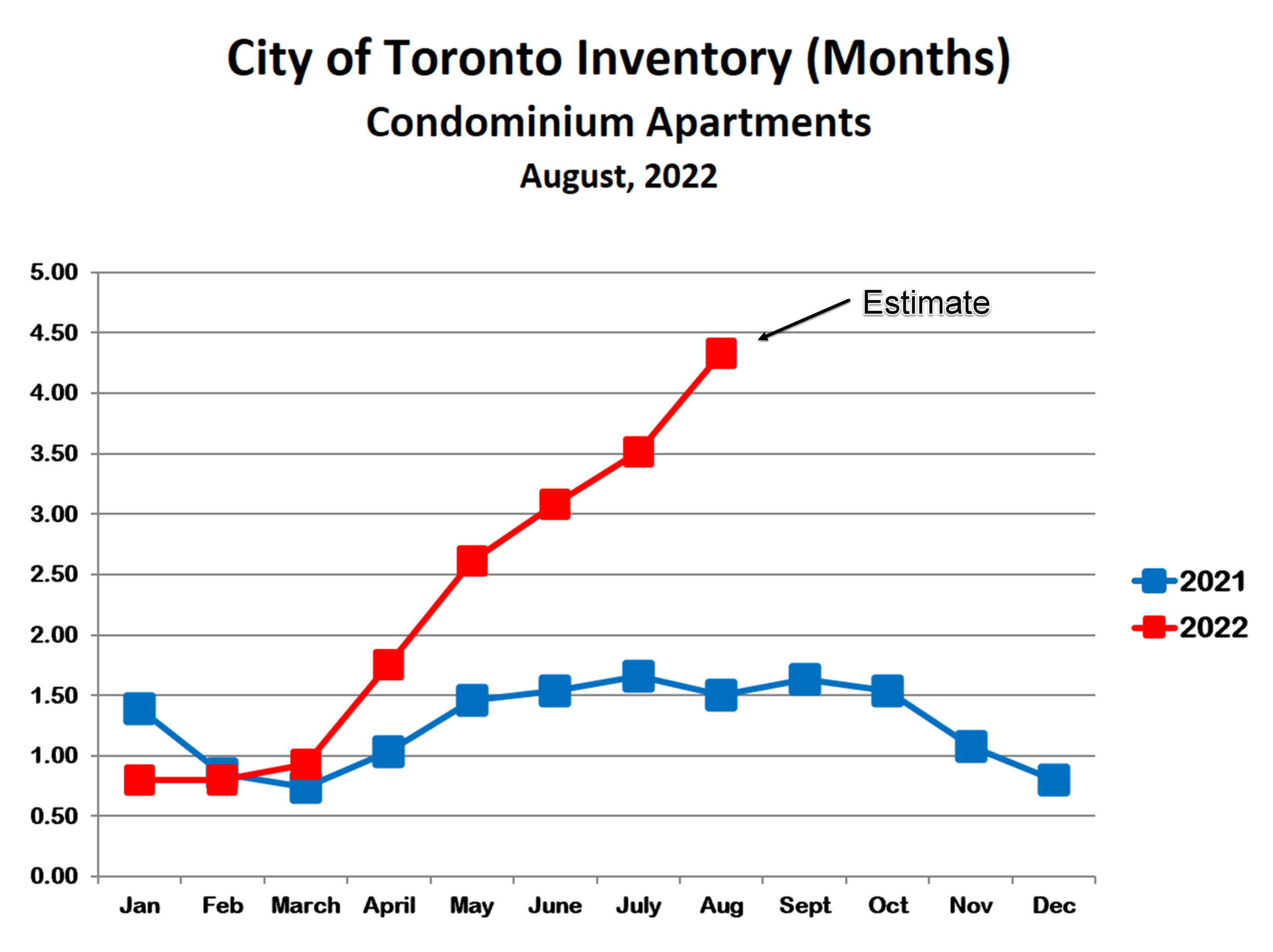

The inventory of condos for sale has also followed a pattern similar to houses. Throughout 2021 and into early 2022, inventory levels ranged from under 1 month to just over 1.5 months – extreme sellers’ market territory. Since this spring, when mortgage interest rates started moving up, inventory has increased steadily and is now just under 4.5 months – verging on a buyers’ market.

The bottom line is that we have seen the formation and collapse of a price bubble in the Toronto market over the past three years. It now seems as if the collapse phase is nearing completion if not already over. With any luck at all, we will have a much less volatile market, with steadier prices, over the next few months.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!