Toronto Prices Hold Steady Despite Falling Sales

12/24/22

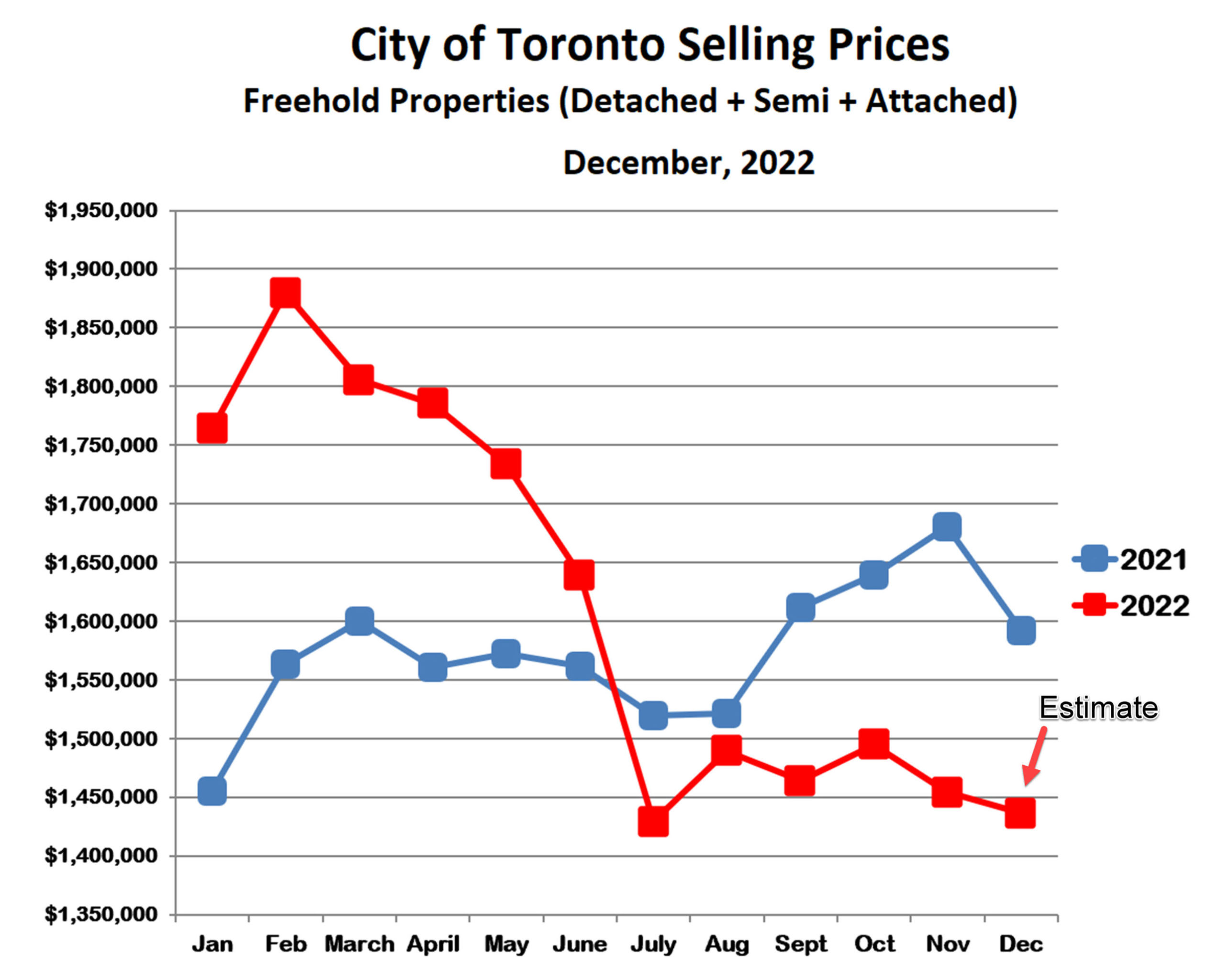

Average selling prices in the City of Toronto continue to hold steady through December. As everyone knows, prices fell steeply between May and July once the 2021/2022 ‘bubble’ popped. Once the correction was over, prices had returned to (roughly) where the bubble started in the fall of 2021, and they have remained there ever since.

Houses (Detached/Semi-Detached/Attached Homes)

From an average price of just over $1,800,000 between January and April, freehold prices fell by 20% between April and July. Since then, prices have stayed in a narrow range between $1,430,000 and $1,490,000.

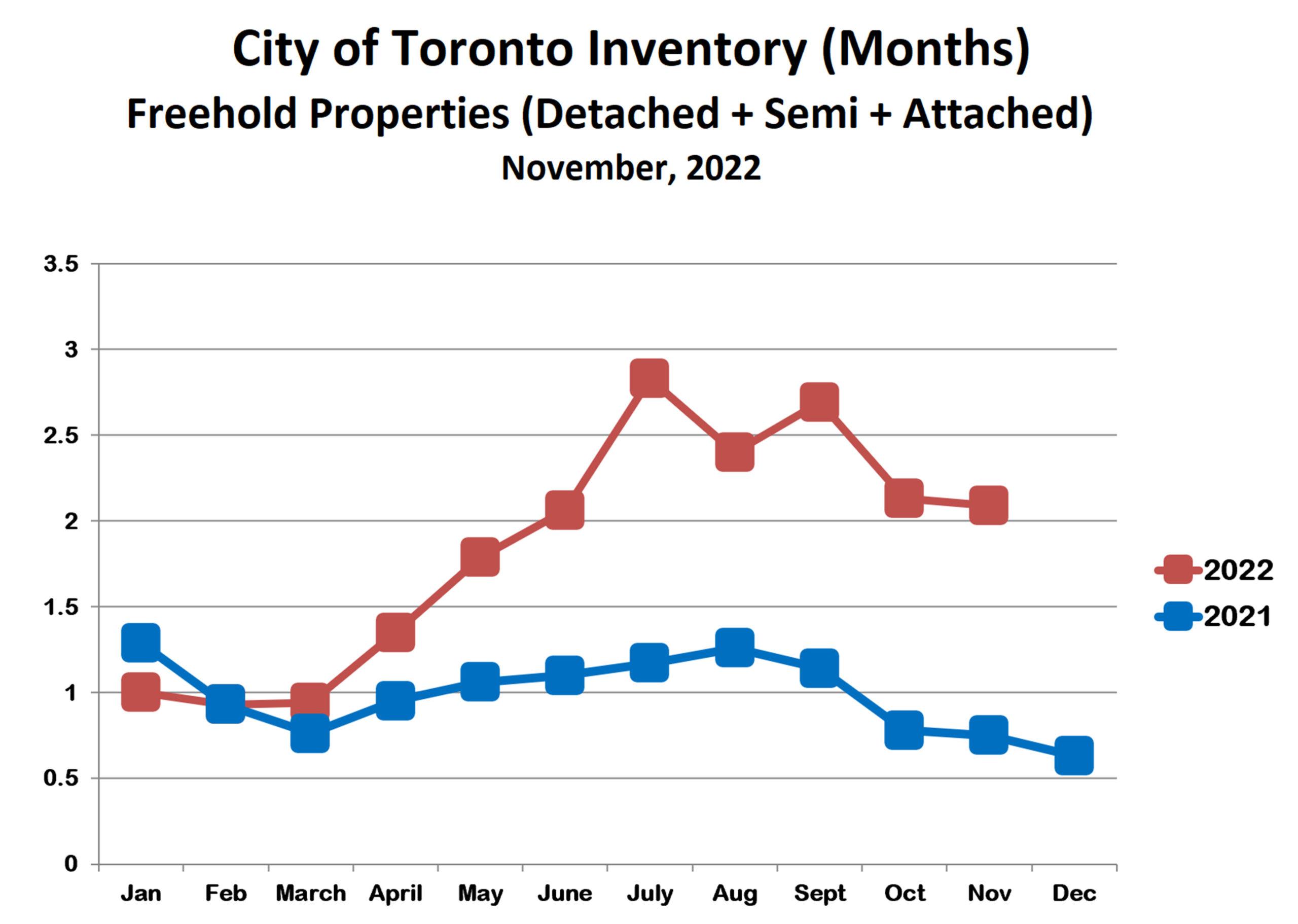

The relative stability of freehold prices over the second half of the year came despite falling sales, particularly in December. Total freehold sales were 862 units in October, 778 in November, and only 330 as of the third week of December. In part this is because the number of active listings has also fallen, so that inventory has stayed relatively low (as shown in the chart below). More importantly, perhaps, this is because buyers have become increasingly selective at the same time as sellers have become increasingly stubborn. Many buyers feel that prices are not going to rise any time soon and in fact may fall further in 2023. Many sellers, however, are holding out for a return to the higher prices they missed out on just a few months ago. Accordingly, homes with even minor flaws tend to get passed over, and this creates resistance to falling prices.

By the way, year-over-year comparisons are dramatic but not very useful. Of course, prices and sales today are very significantly lower than last year. However, last year we were in a rapidly expanding bubble, and now the bubble has collapsed. It’s not even apples to oranges, more like apples to camels.

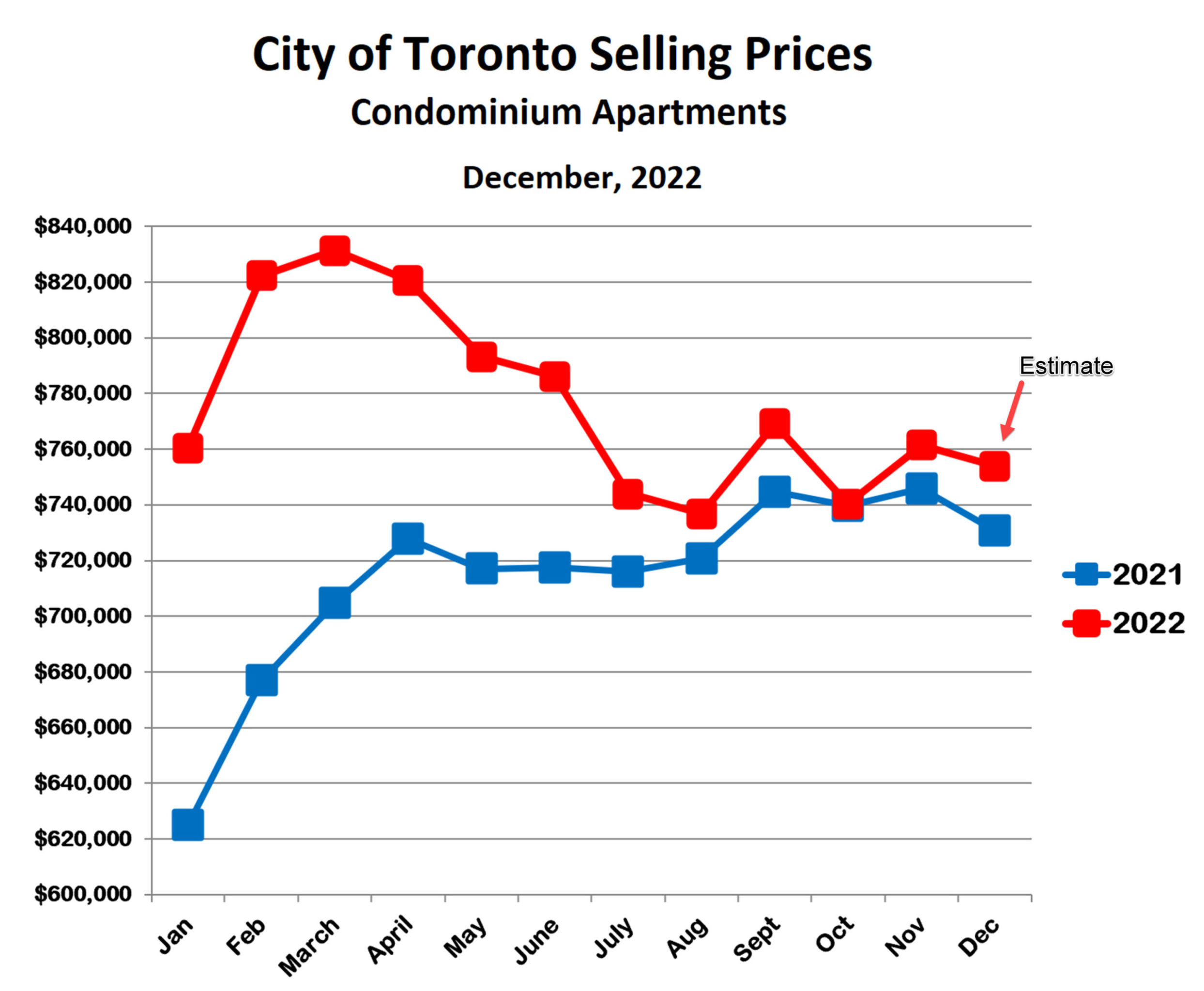

Condo Apartments

Just like houses, condo prices in Toronto fell sharply between April and July and have held steady since then. Unlike houses, though, condo prices have held up much better. The drop from the February-April peak to the July-December bottom was less than 10%, and at no time did 2022 condo prices fall below 2021 levels. There are two main reasons for this. First, condos are simply less expensive than houses and more affordable as interest rates ratchet upward. Second, and more important, condos are a huge part of the rental housing stock, and rental demand is increasing. So, end-user demand for condos is being bolstered by investor demand.

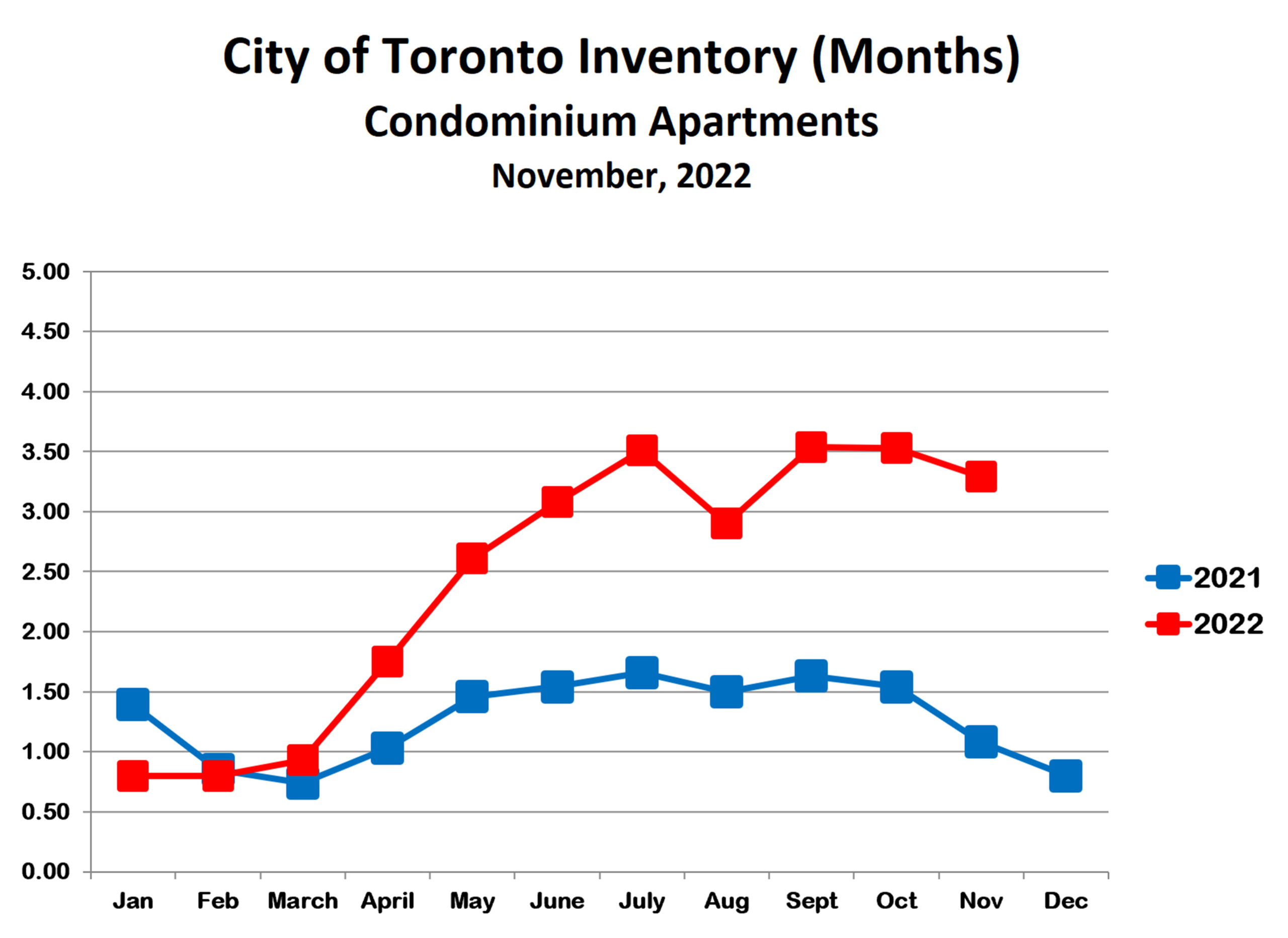

As the chart below shows, the inventory of condos for sale is significantly higher than last year and approaching buyers’ market territory. Condo sales were steady in October and November, at 888 and 899 units, respectively. However, only 475 units were sold as of December 23, so inventory in December could rise even further. The resiliency of condo prices in the face of increasing inventory is quite impressive.

Bottom Line

It’s been quite a roller coaster ride for the Toronto real estate market over the past two years and, indeed, since the beginning of the pandemic. It would seem that the world that we knew for the past 40 years or so, with low inflation, falling interest rates and loose monetary policy, has come to an end and will not return any time soon. Exactly what this means for the real estate market has yet to clarify. However, if there’s one thing that seems certain it’s that uncertainty will be a dominant theme for some time to come.

Will prices rise next year or will they fall? The answer, tongue firmly in cheek, is ‘yes’.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!