Toronto Prices Keep Rising

04/28/24

Houses

Prices in April are up about 5% over last month and are once again almost identical to the same month last year. Prices have risen by about 15% since January and, if we continue to match last year’s trend, they will be up another 7% or so next month. This sort of wild volatility has been going on for the last 5 years, since the lockdowns began, and shows no signs of changing any time soon.

That said, we can make some tentative predictions about the short term direction of the Toronto market. Prices are likely to level off and begin to fall over the next couple of months for two reasons:

- The summer months almost always bring a slower market and falling prices because so many buyers and sellers put their real estate plans on temporary hold in order to better enjoy our limited summer weather; and

- The rising prices this spring were driven in large part by hopes for falling interest rates. Inflation has become stubbornly persistent, and this is pushing expectations for interest rate reductions further and further in the future. This will probably curb buyers’ enthusiasm, much as it did last year.

It seems unlikely that prices will fall as far and as steeply as they did in the second half of last year, as the interest rate outlook is better than in 2023. Also, buyers are beginning to realize that rates are not going back to where they were pre-2022 any time soon, if ever. After all, 5% mortgages were the norm 10 years ago and may become so again.

Sales of houses have increased this month, but listings have increased more, so inventory is rising. We are still deep in sellers’ market territory at under 2 months’ supply, however, higher inventory is often a harbinger of a slowing market. So this is another hint that we are nearing the end of this hot spring market.

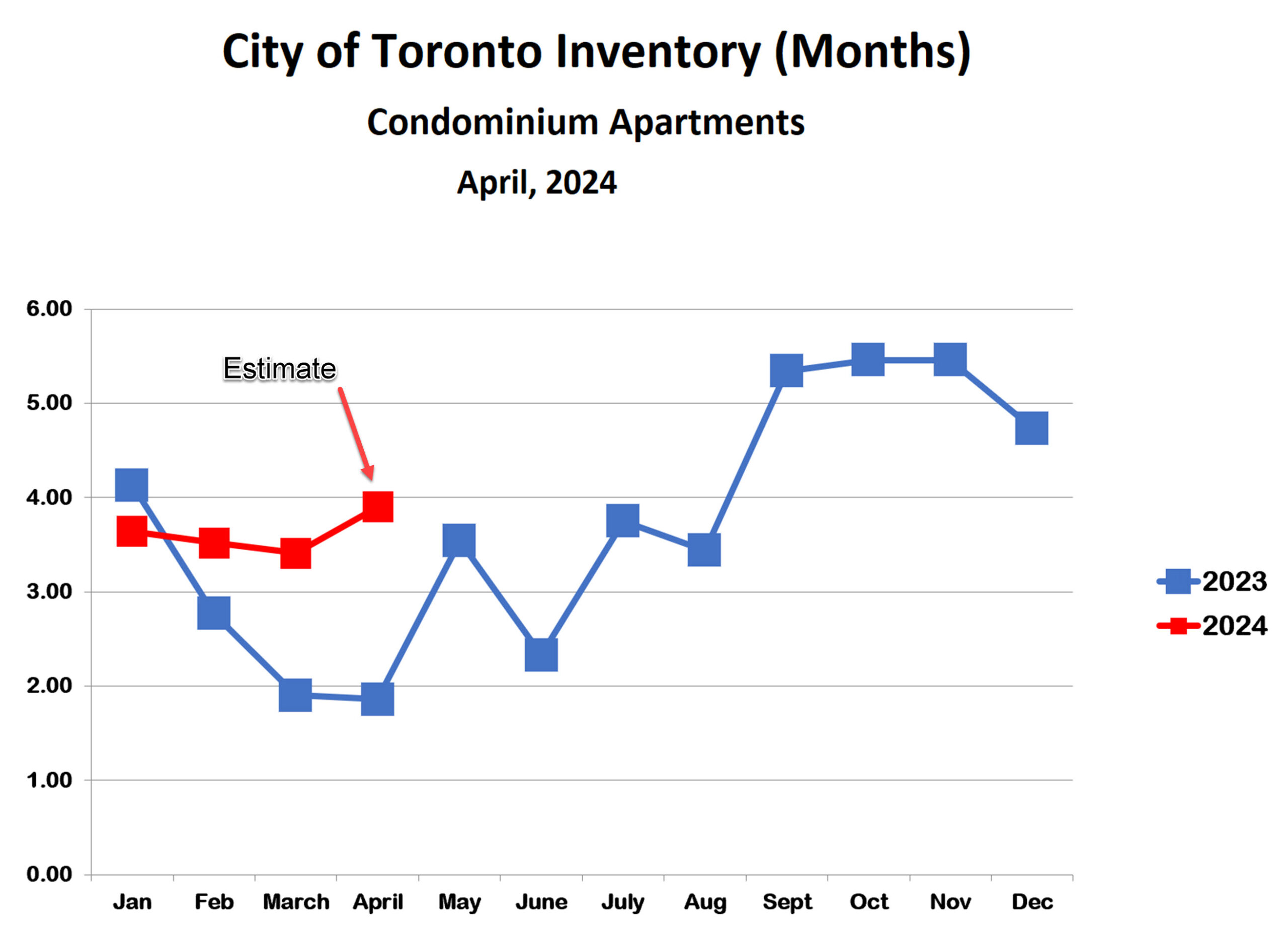

Condo Apartments

Condo prices are also continuing to rise. April prices are about 5% higher than March, and are up about 8% since January. The short term direction of the condo market will likely mirror that of houses, with prices leveling off and then declining over the next few months. As for houses, we should expect the decline will be milder this year than in 2023.

As for houses, the inventory of condos for sale is rising modestly after falling for the past three months. The condo market was already balanced between buyers and sellers and so, once again, a cooling trend is probably not far away.

Bottom Line

This year has so far been eerily similar to last year, with price levels almost exactly matching 2023. The outlook for interest rates is more positive than last year, and so any softening in the second half will hopefully be less extreme than in 2023. The market remains extremely volatile, however. To paraphrase Yogi Berra, prediction is very difficult, especially about the future.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!