Toronto Prices Still Rising — But More Slowly

05/27/24

Average prices in May are again higher than last month, but are lower than last May. We have likely reached the peak for the spring market.

Houses

House prices in May are about 1% higher than April and about 4% below last May. Spring prices typically top out in May and so we’ll probably see flat to lower prices over the next month as we head into the seasonally slower summer months.

Last year, prices fell rather steeply after May, mainly due to increases in mortgage interest rates when decreases were widely expected. The story is more positive this year. While the central bank has not yet reduced rates, the odds favour this happening over the next few months. If so, a strong fall rebound could be in the cards.

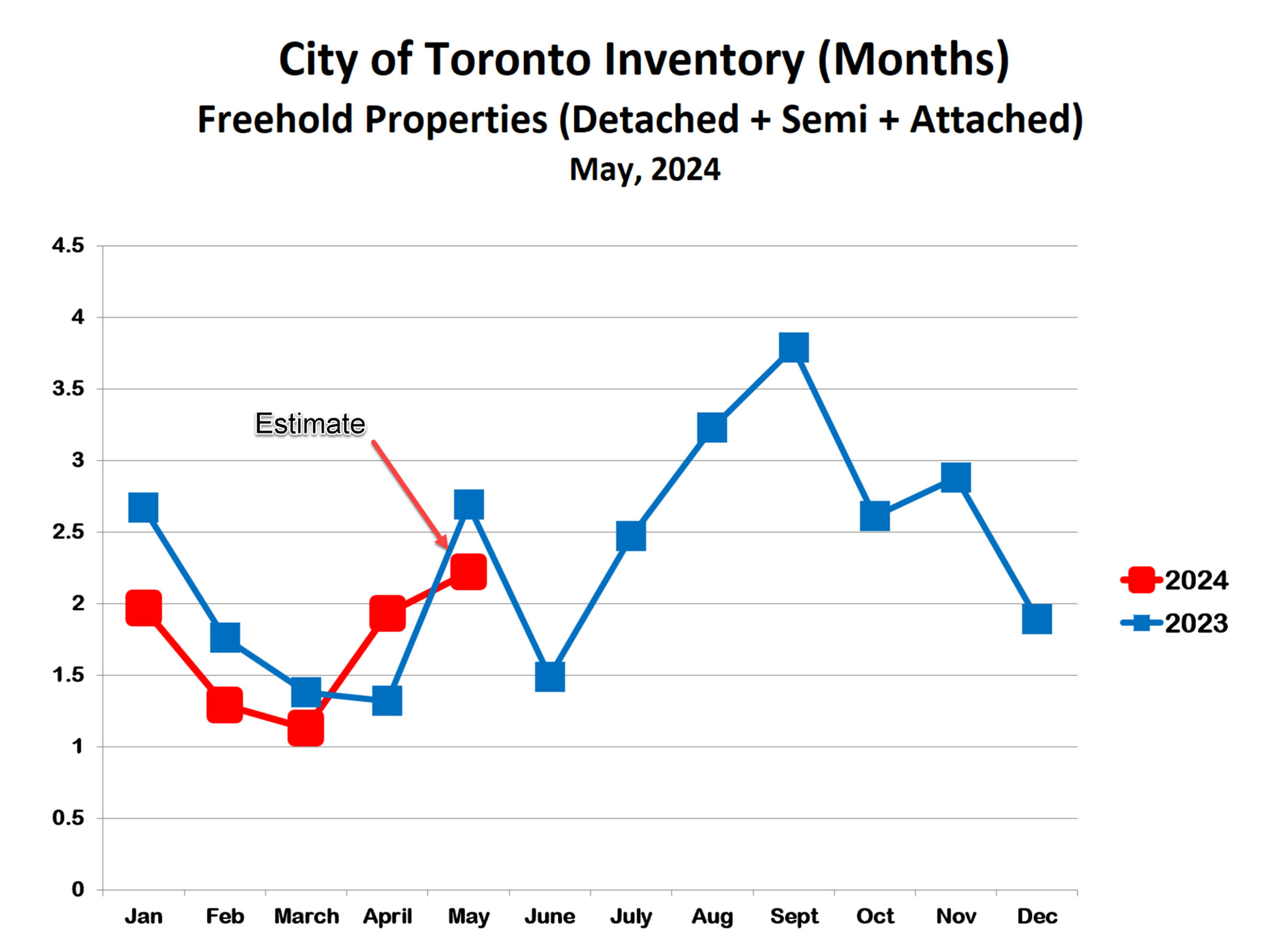

The inventory of houses for sale is somewhat higher in May, but below last May. This supports the thesis that we will see more of a leveling off of prices as we head into the summer rather than the steep drop that we saw last year.

Condo Apartments

Prices for condo apartments also seem to be leveling off as we come to the end of the spring market. As for houses, the price trend for condos over the past 5 months has closely matched last year. The prospects for lower interest rates sometime in the next few months should moderate any fall in prices over the summer. We might even see a fall rebound in condo prices, something that was completely absent last year.

Condo inventory remains elevated at just under 4 months’ supply. This is by no means a sellers’ market, but neither is it a buyers’ market. In combination with the projected interest rate cuts, this balance will hopefully buffer any fall in prices over the summer.

Bottom Line

Much depends on the outlook for interest rates. Last year there was much wishing & hoping early in the year, and this powered a strong spring market. When these hopes were cruelly dashed, prices fell steeply over the second half. This year, the spring market has been equally strong and, should the expected interest rate reductions (however modest) materialize, prices should be lest volatile during the second half of 2024.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!