Toronto Prices Surge Higher

08/09/20

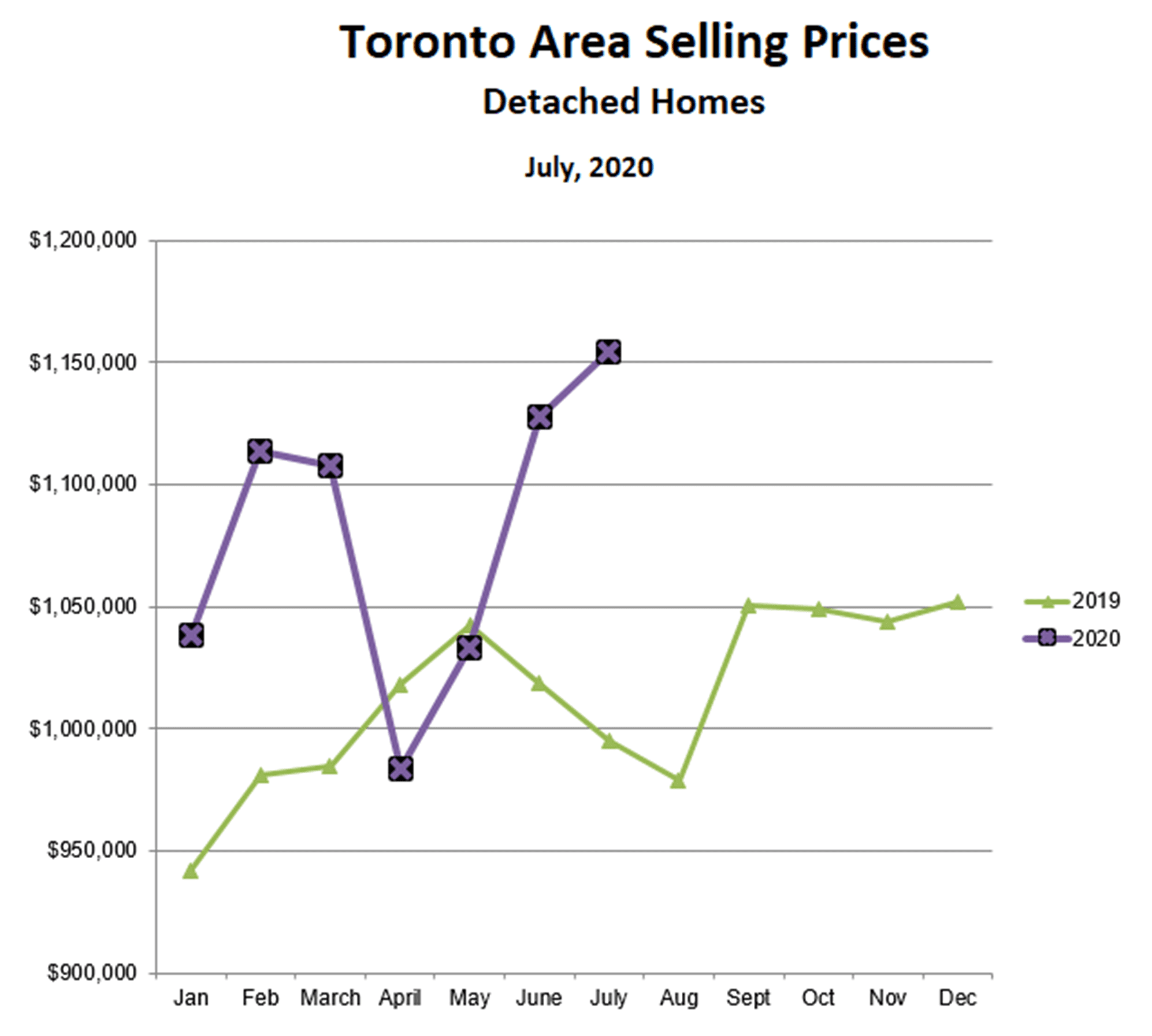

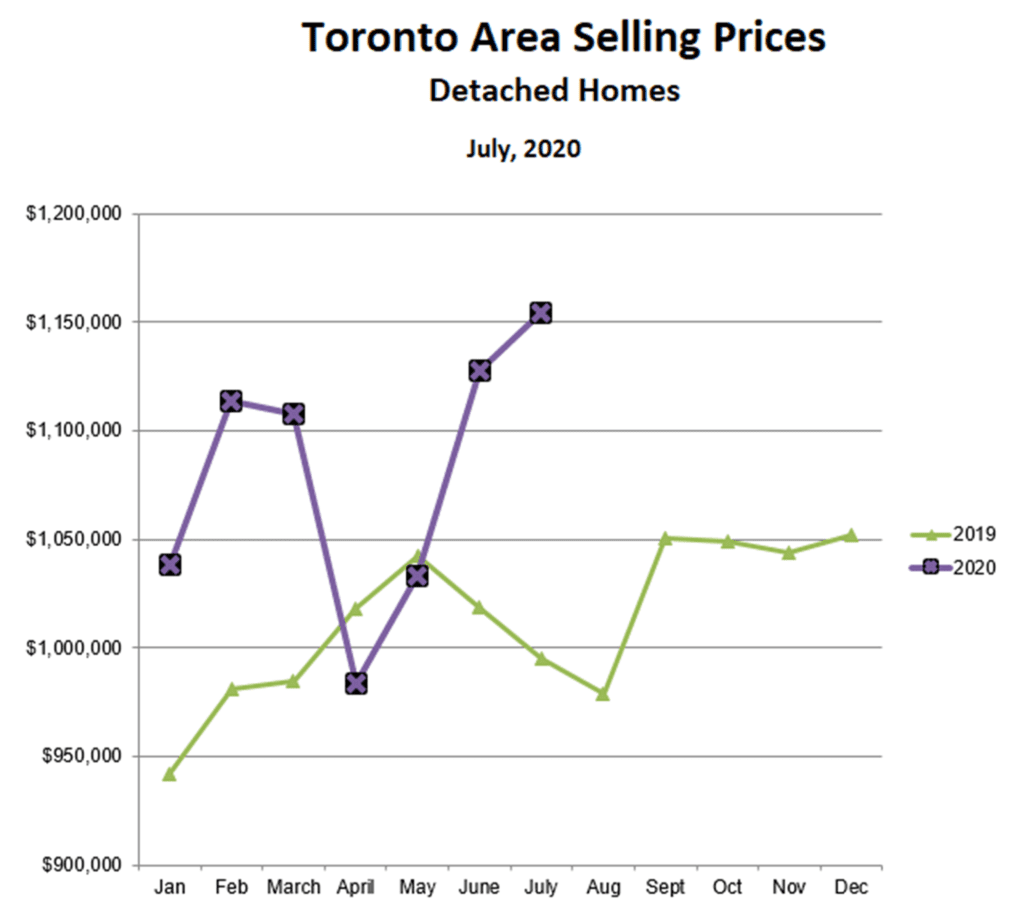

Detached home prices averaged just over $1.15 million in July, and are closing in on the all-time high of just over $1.2 million reached during the 2017 bubble. For the first time in many years, we have not seen the typical summer slowdown, as buyers continue to take advantage of once-in-a-lifetime low mortgage interest rates.

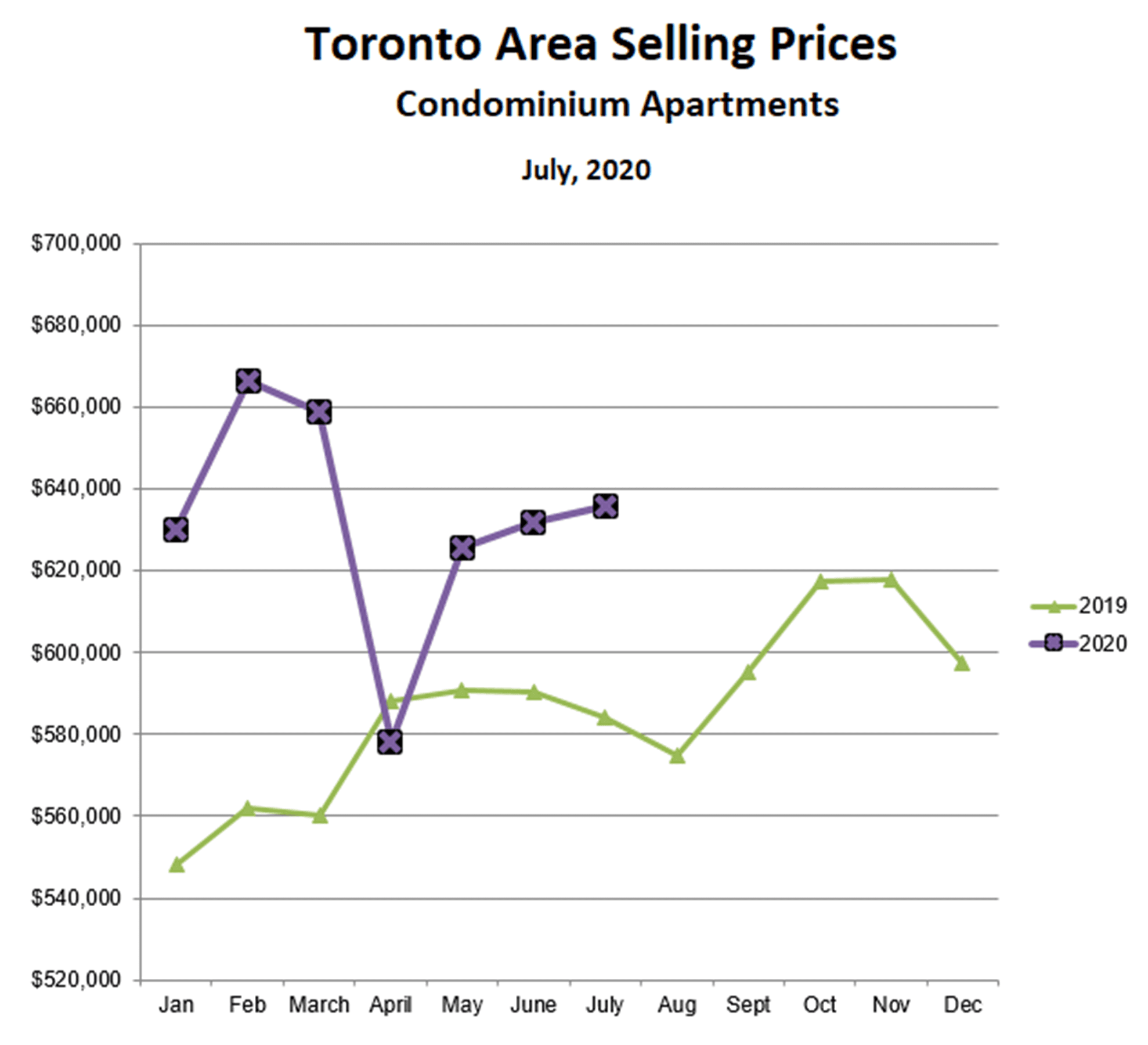

Condo prices were also higher in July. The pandemic is moderating the demand for condos, however, because:

- The need for home office space is increasing, making houses much more attractive;

- High rise towers and elevators feel confining and are not very conducive to social distancing;

- The rental market is weak because immigration has been cut off and because many airbnb units have been added to the inventory of rental properties. This is reducing investor demand for condos.

While condo prices continue to increase, therefore, they remain about 5% below the all-time high reached earlier this year.

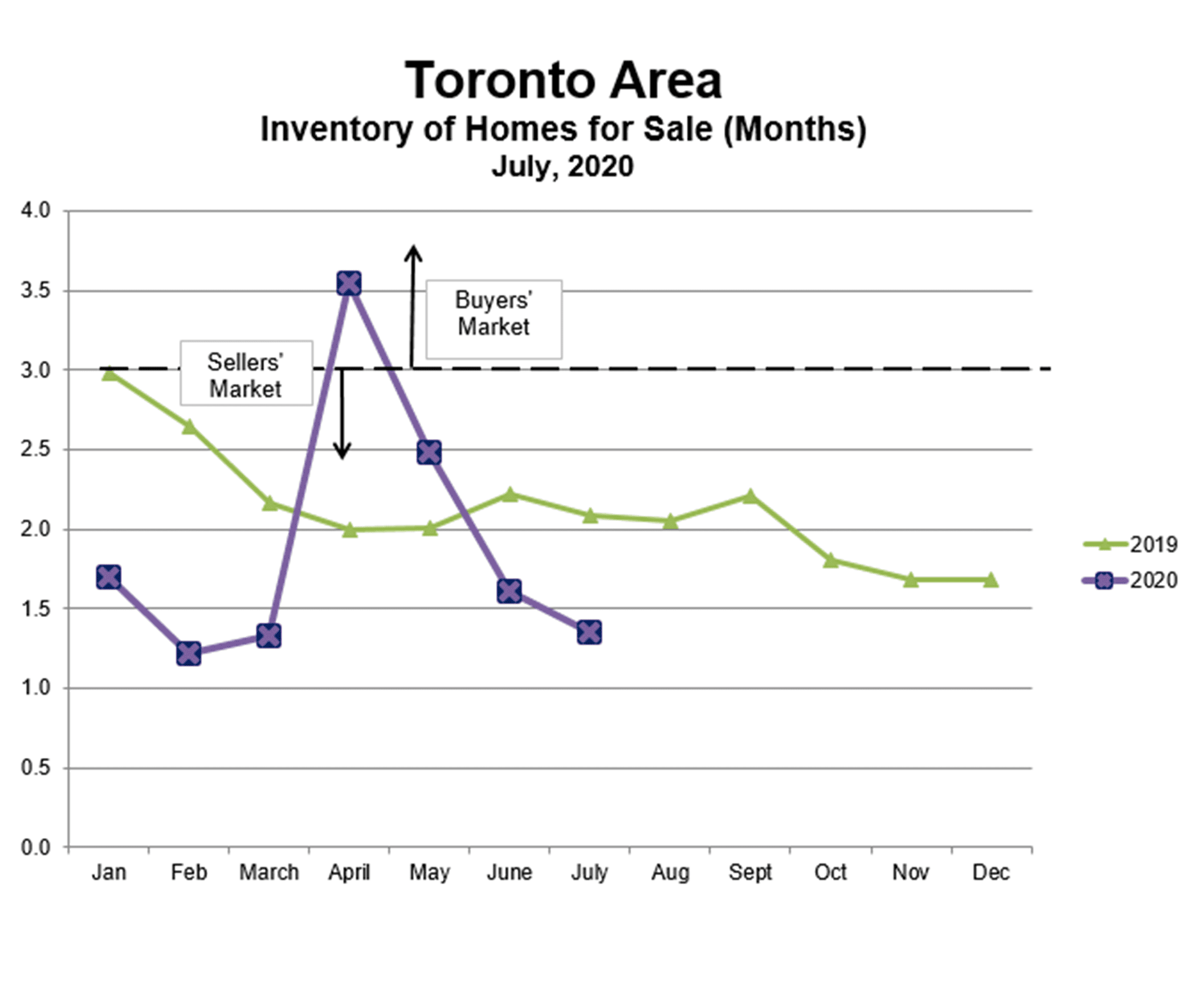

A huge imbalance between buyers and sellers continues to power the market. Sales of all property types increased by 27% between June and July, from 8,701 to 11,081. Active listings of properties for sale also increased, but by only 7%, from 14,001 to 15,018. Basically, homes are getting sold much more quickly than new listings are coming on the market, and the result is rapidly decreasing inventory, now at about 1.4 months’ supply and falling. With more and more buyers chasing fewer and fewer homes, bidding wars and bully offers have returned with a vengeance, driving prices higher.

This trend appears to be the result of eager buyers (because of low interest rates) combined with somewhat reluctant sellers (because of COVID fears). The pandemic is likely to be with us for the foreseeable future, and government CERB payments will continue for at least another two months, so the uber-hot market will likely persist until the fall. Beyond that, my crystal ball gets very hazy…

This trend appears to be the result of eager buyers (because of low interest rates) combined with somewhat reluctant sellers (because of COVID fears). The pandemic is likely to be with us for the foreseeable future, and government CERB payments will continue for at least another two months, so the uber-hot market will likely persist until the fall. Beyond that, my crystal ball gets very hazy…

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!