Toronto Real Estate Market Continues to Soften

06/16/22

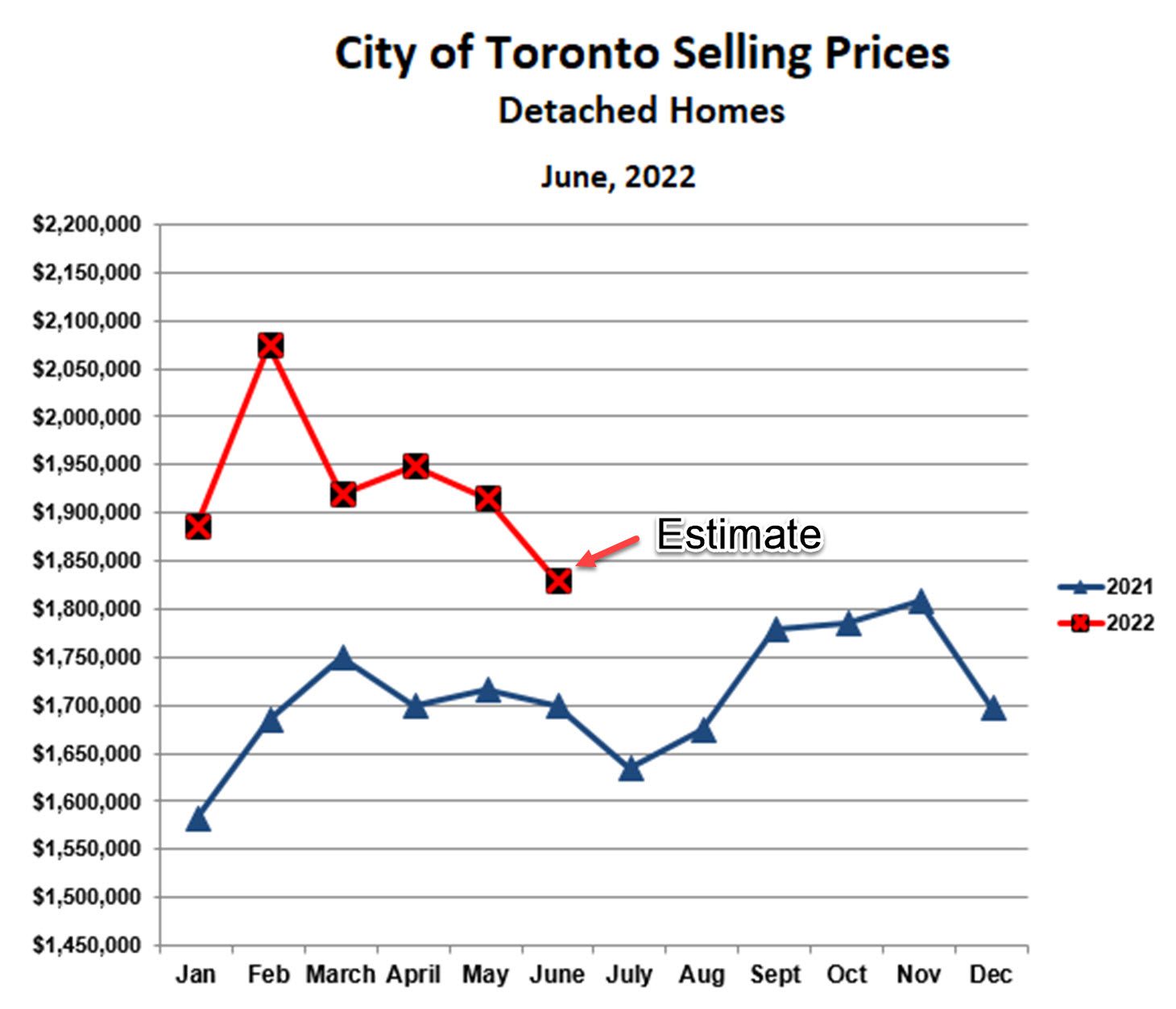

Detached Homes

Prices for detached homes in the City of Toronto are trending lower in June than in the first five months of this year. After peaking in February at an average of close to $2.1 million, prices remained steady at just over $1.9 million in March, April in May. June prices are just over $1.8 million, still almost 8% higher than last June, and above the 2021 peak reached last November. And 2021 was a very strong year.

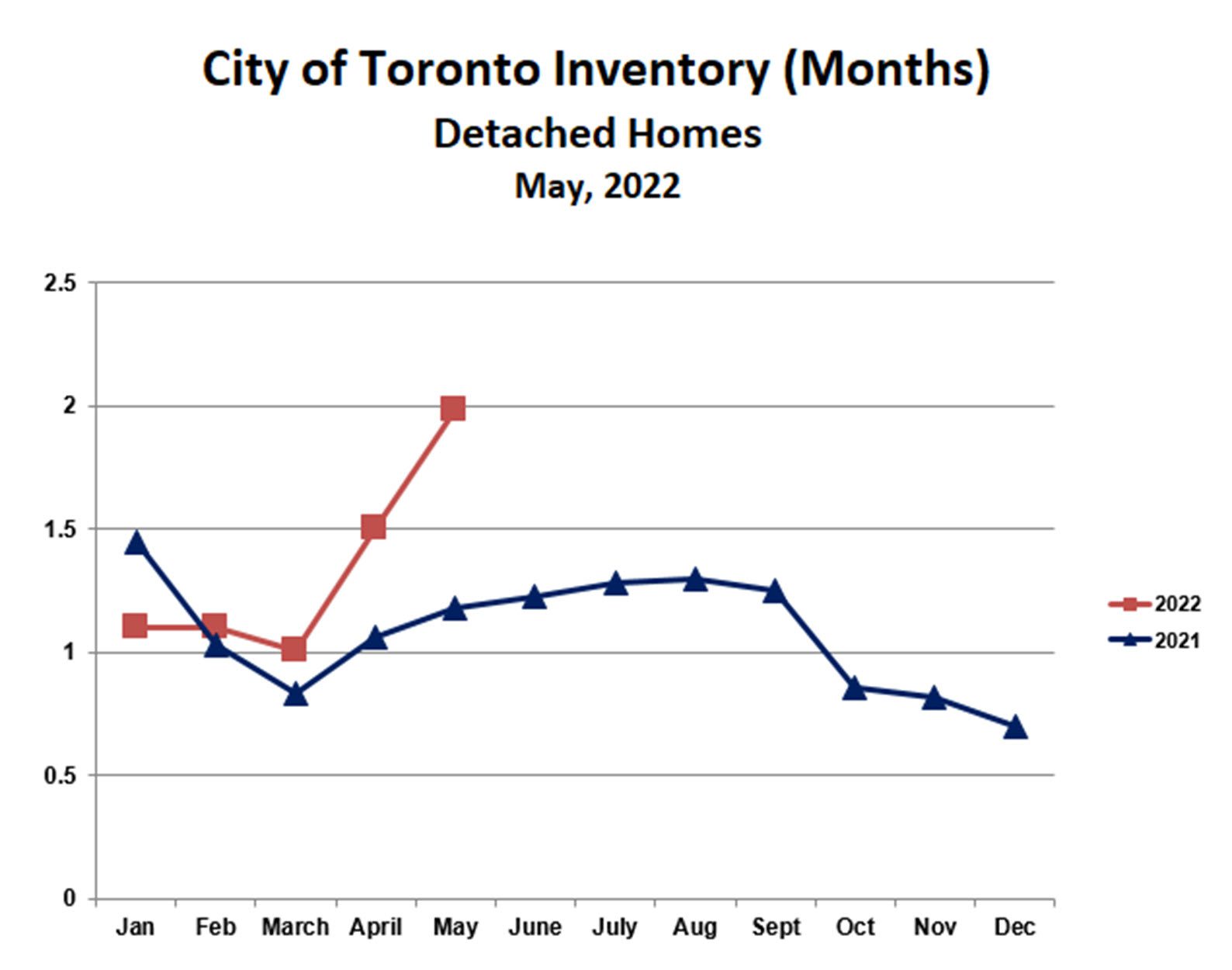

The softening of detached prices is due to declining sales and increasing listings. The driving forces behind this are increasing interest rates and declining affordability. The chart below shows the inventory of homes for sale. This is simply the ratio of active listings to monthly sales, that is, how long would it take to sell all homes presently for sale if no more listings came up for sale. As you can see, inventory increased sharply in April and May, and is now at about 2 months’ supply. Our rule of thumb is that 3 months’ supply represents a balanced market, with neither buyers nor sellers in control. We are still in a sellers’ market, however, we may slip into a buyers’ market over the summer if the trend continues. Not surprisingly, bidding wars are becoming few and far between. Asking prices are more often being set close to market value.

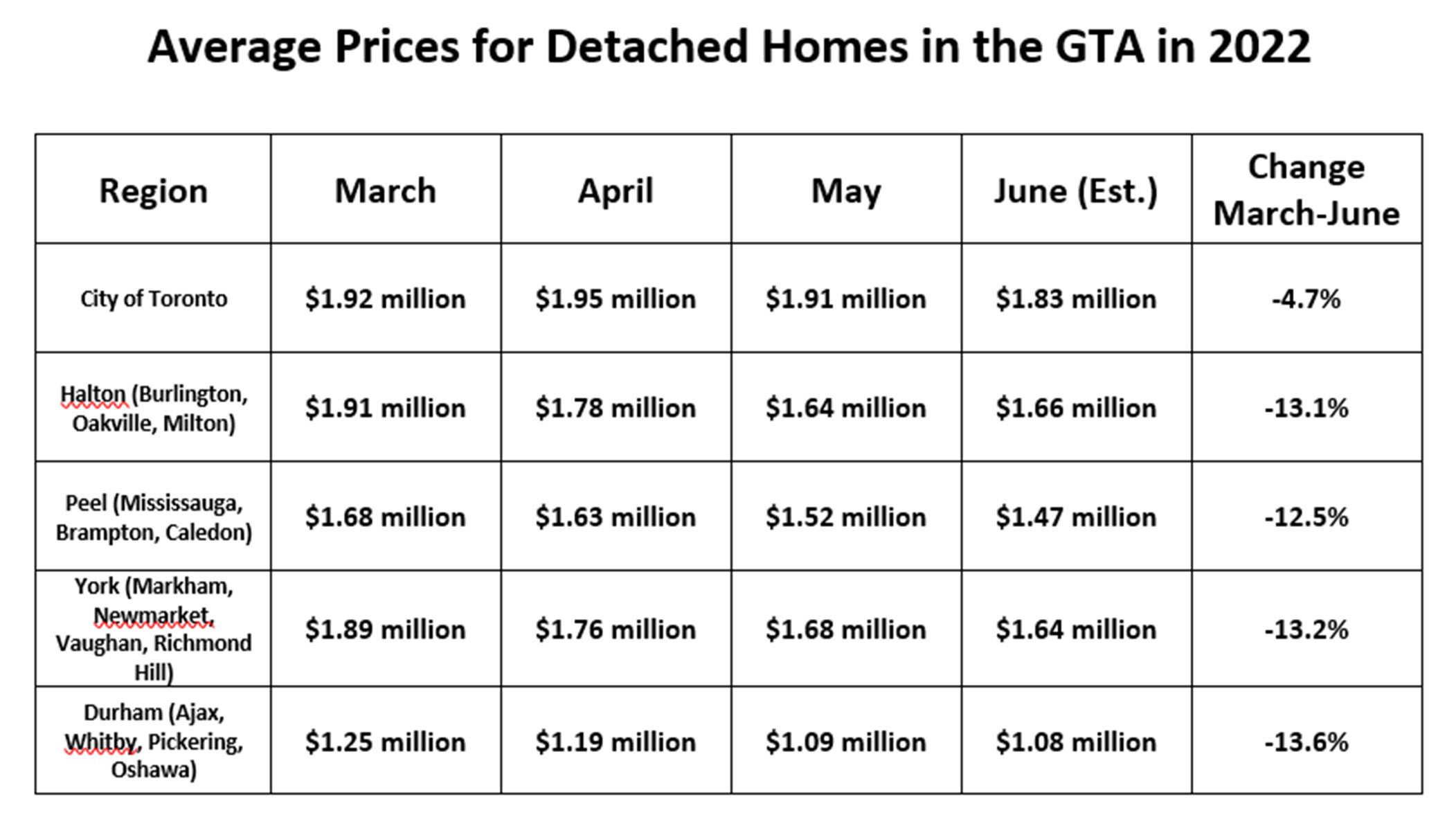

The market for detached homes in the City of Toronto remains stronger than in the rest of the GTA. As the chart below shows, prices in the surrounding areas have fallen by about 13%, while prices in the city fell by only 5%. This suggests that the Covid-induced exodus to the suburbs is somewhat reversing. Long commutes to the office are not very attractive now that gas prices have doubled.

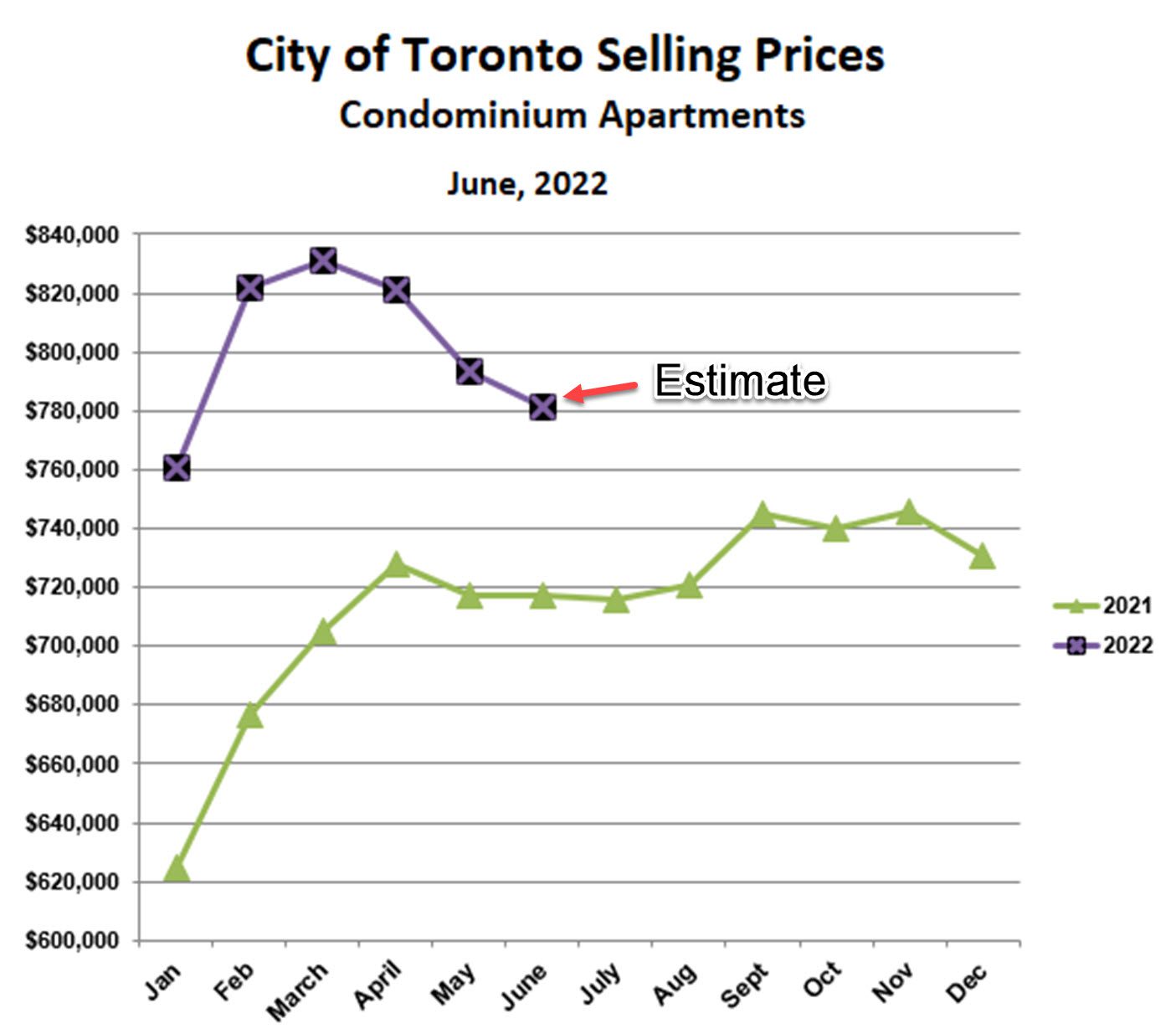

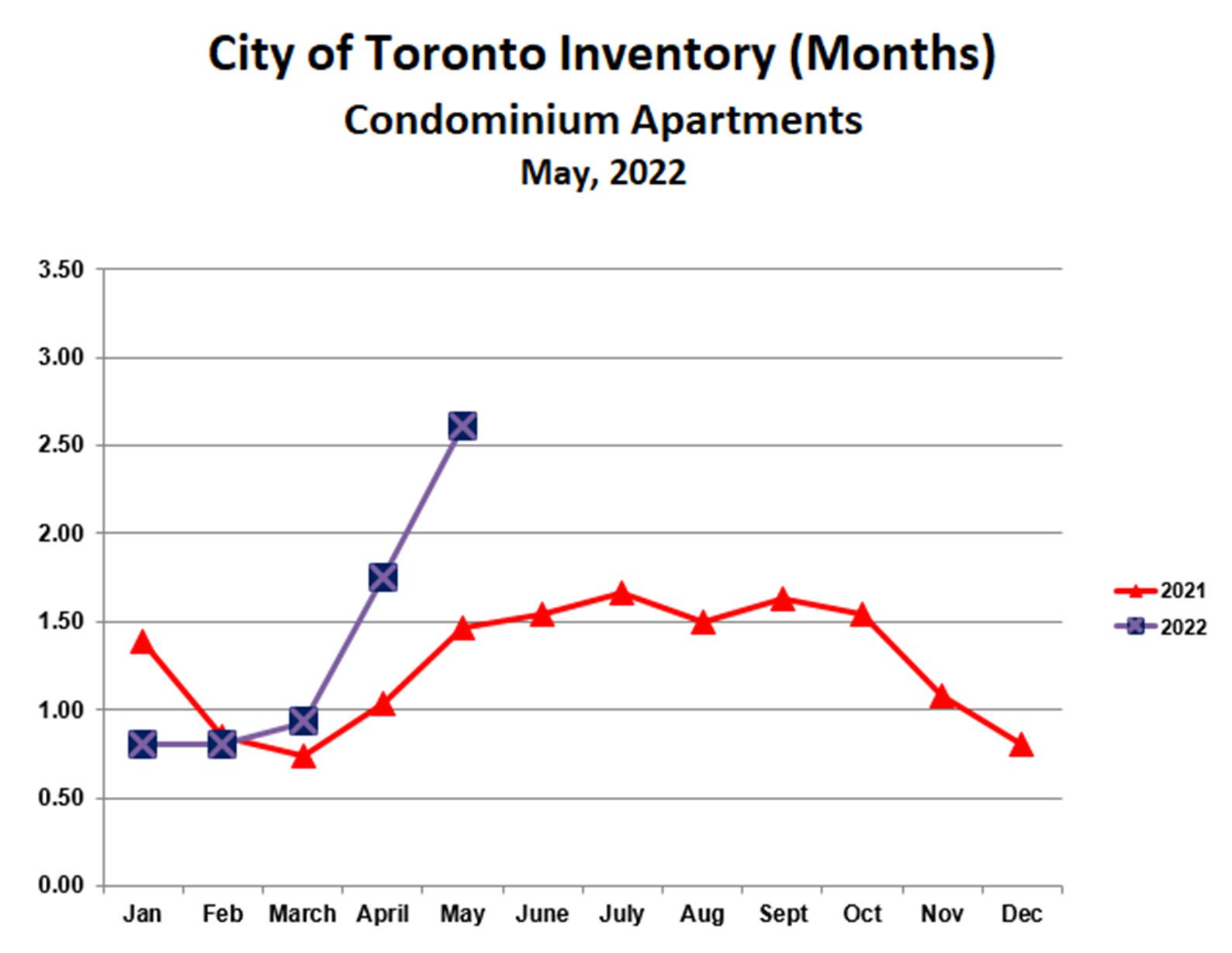

Condominium Apartments

Condos are following a similar trend. Prices peaked in March, and began falling in May, again due to increasing interest rates and declining affordability. As for detached homes, prices remain well above last year.

Similar to detached homes, the inventory of condos for sale increased sharply in April and May due to declining sales and increasing listings. At just over 2.5 months, the inventory is approaching buyers’ market territory. Unsurprisingly, bidding wars for condos are also disappearing rapidly.

The summer season generally tends to be ‘thin’, as both buyers and sellers take a break to enjoy the warm weather. This could be especially true this year as we are finally free from (most) Covid restrictions. Whether we see a typical rebound in prices in the fall will depend almost entirely on what happens with inflation and interest rates over the next 2-3 months. Stay tuned.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!