Waiting For The Fall Market

08/28/24

We remain in the dog days of summer, with low sales and high inventories. Optimism for a robust fall market abounds, as we have already had two bank rate cuts with more likely to come over the next few months. For houses, there is a basis for cautious optimism, but for condos… not so much.

Houses

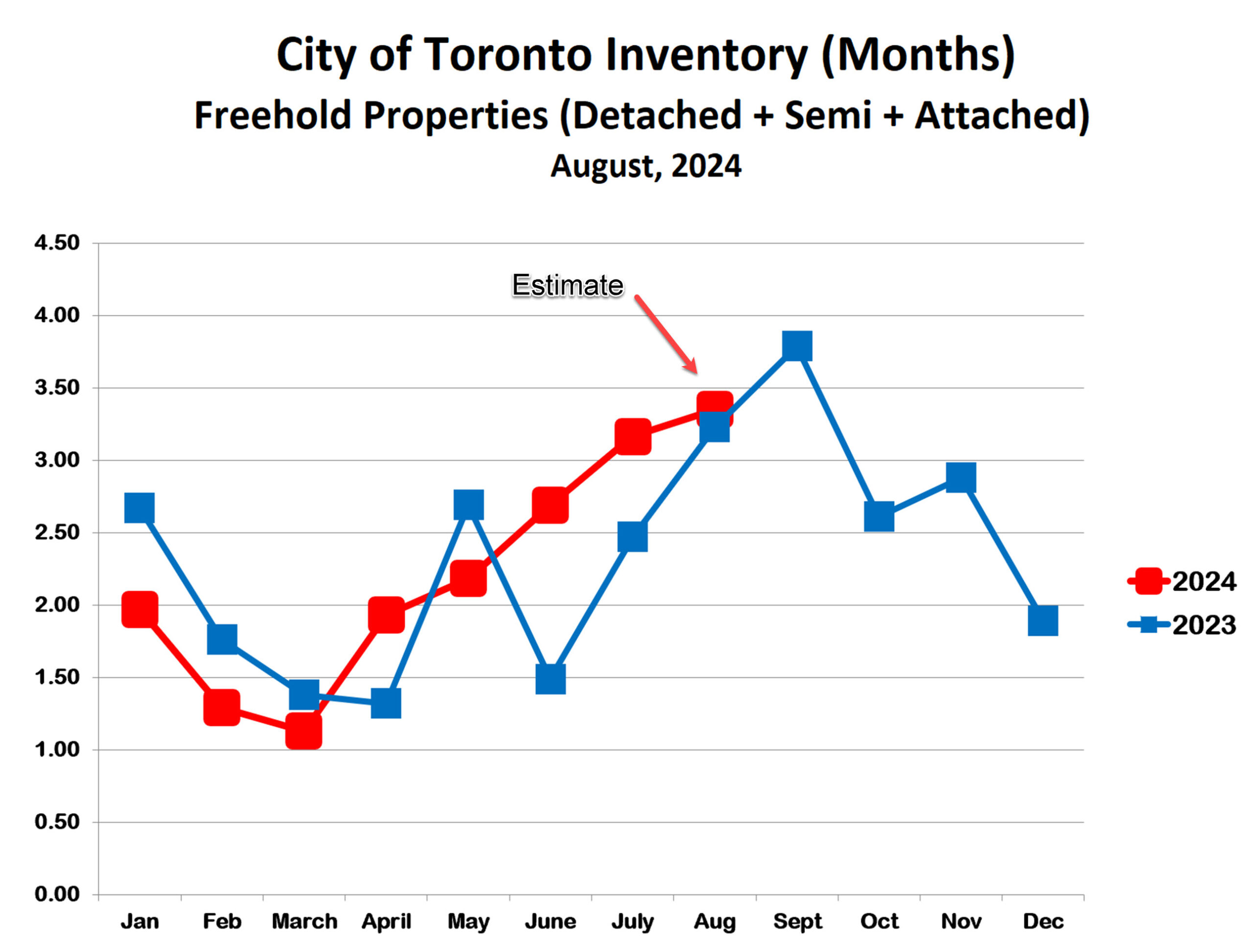

House prices continue to follow the 2023 script very closely. Unlike last year, prices have ticked up slightly in August where they fell a bit last year. This suggests that the interest rate cuts are finally starting to get some traction. This bodes well for the fall market (starting early September). While fall prices may well be higher than last year, however, it’s unlikely they will get as high as we experienced this spring.

The inventory of houses for sale continued to creep upward in August. This remains a ‘balanced’ market, favouring neither buyers nor sellers. The fact that both prices and inventory inched upward this month is another positive omen for the fall market.

Condo Apartments

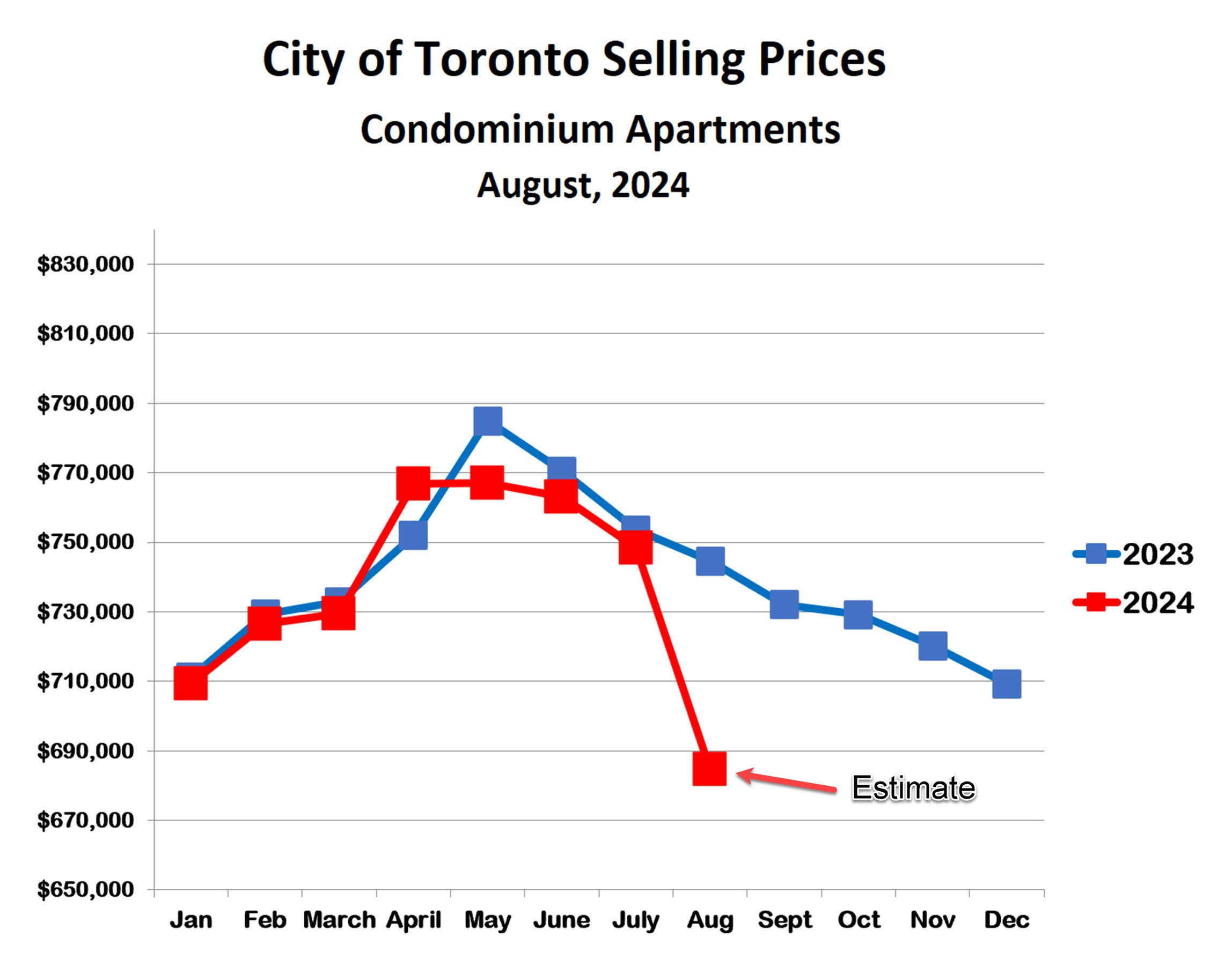

Condo prices fell very steeply in August, by more than 9% versus both last month and this time last year. This is huge. Average Toronto condo prices are now below $700,000 for the first time since early 2021. Clearly, interest rate cuts are not (yet) helping the condo market.

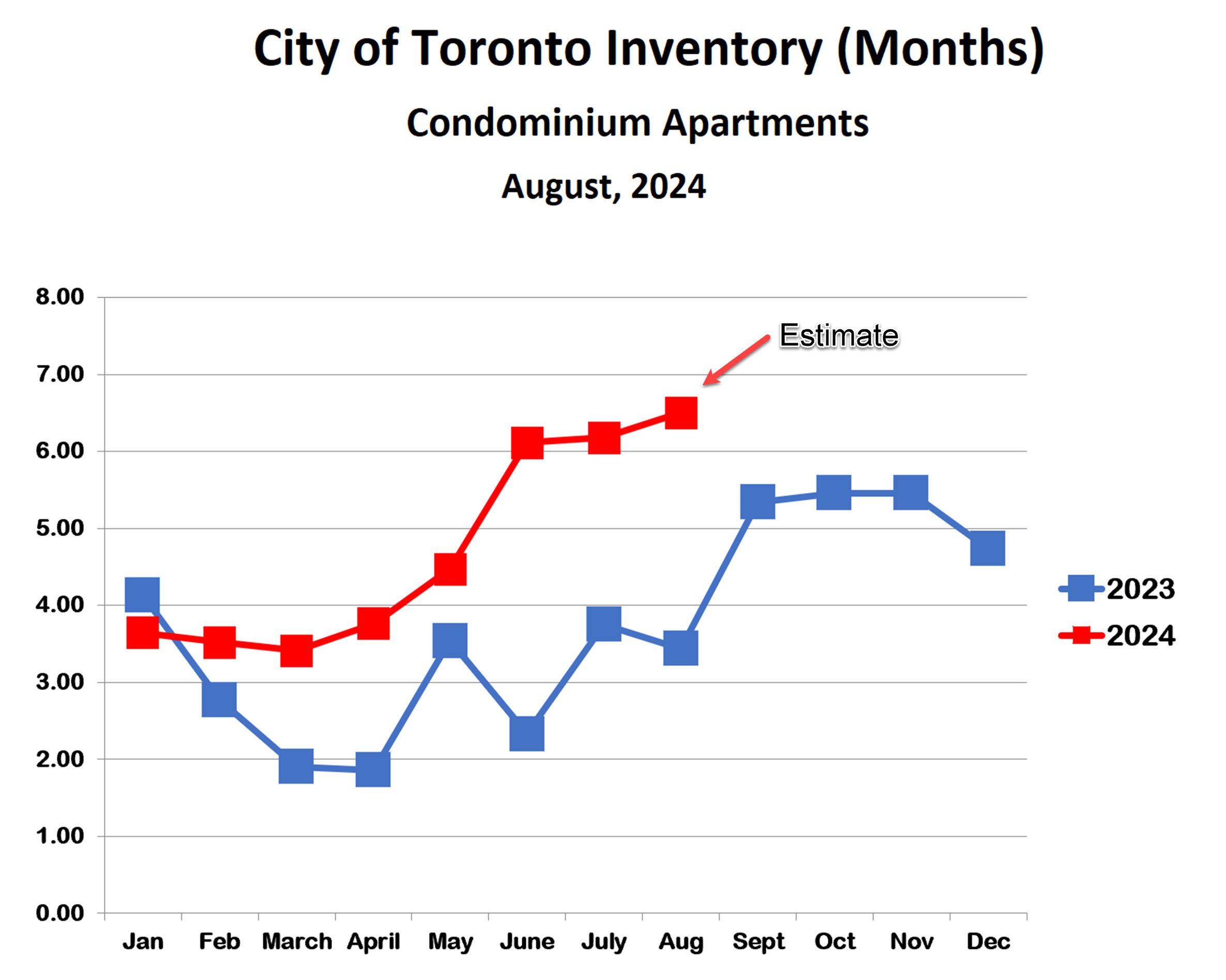

The continued very high inventory of condos for sale (over six months’ supply and still increasing) is the immediate cause of the weak condo market.

But, why is the inventory so high? Affordability is improving as interest rates come down, and there is still a shortage of housing, so why isn’t the demand for condos increasing? The most likely culprit is the fact that a very large proportion (about 50%) of Toronto condos are rented. The rise in interest rates since early 2022 has made rental condos an unattractive (and in many cases unaffordable) investment. Many investors, therefore, are dumping their rental condos. Compounding this further is the fact that the landlord tenant dispute resolution system in Toronto is badly broken. It takes many months to get a dispute heard by the tenant board. It’s understandable if buyers shy away from purchasing tenanted condos where they cannot be confident of vacant possession.

In light of all these issues, it seems unlikely that condo prices will recover until interest rates fall much more significantly.

Bottom Line

Interest rate cuts, both in place and forecast, are finally starting to gain some traction with house prices, and we can hope for a reasonably strong fall market for houses. Condos are another matter. The condo market may remain weak for many months to come.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!