Will Toronto Prices Bounce Back in the Spring?

12/26/23

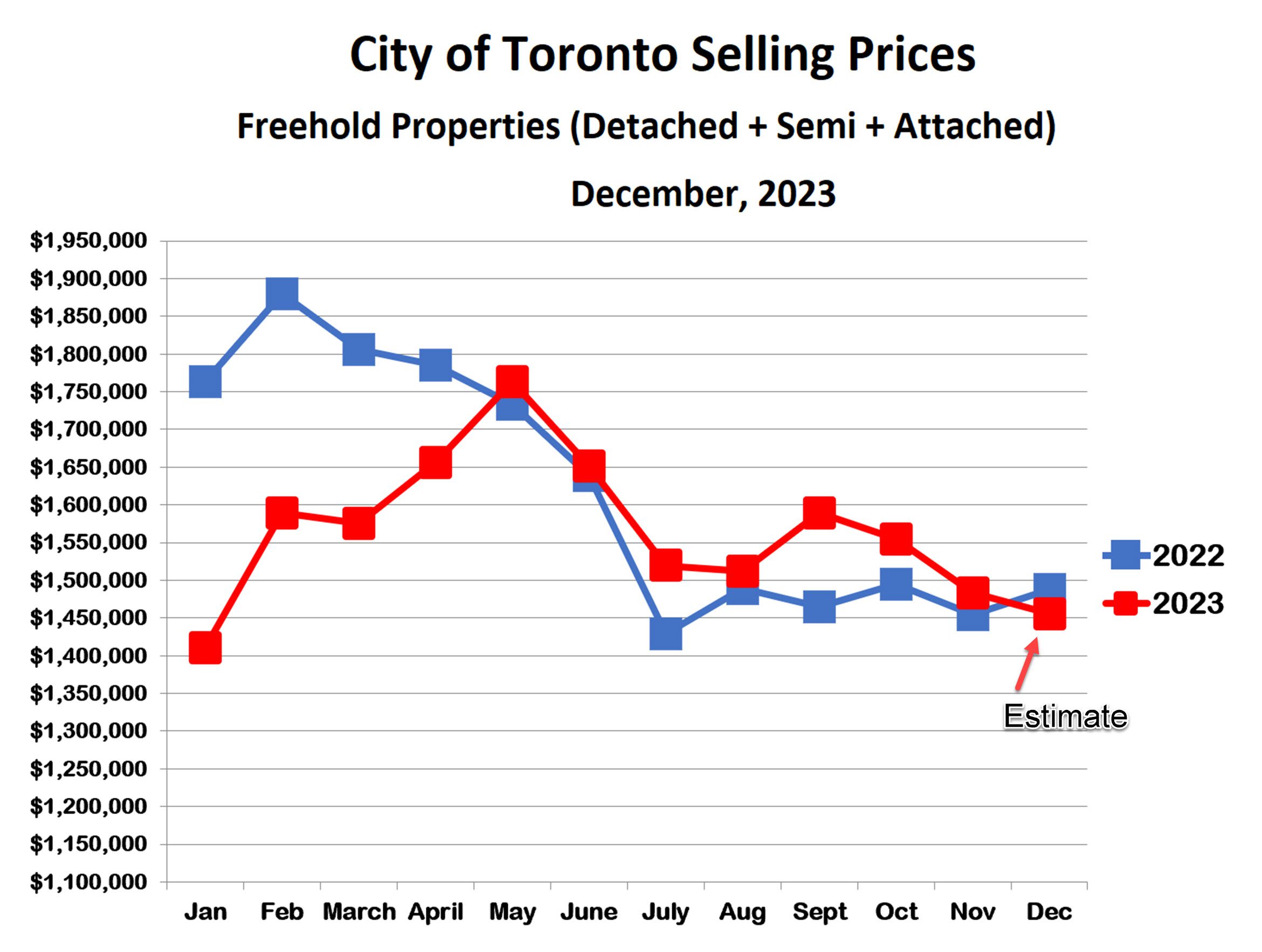

Houses

House prices fell by about 14% this summer, and many sellers expected that prices would improve in the fall, as per the normal seasonal pattern. While prices did increase in mid-September, the bounce was short-lived, as the market was soon flooded with new listings.

By late September, prices were once again falling, and have continued to do so each month since then. As of late December, house prices are about the same as they were throughout last fall.

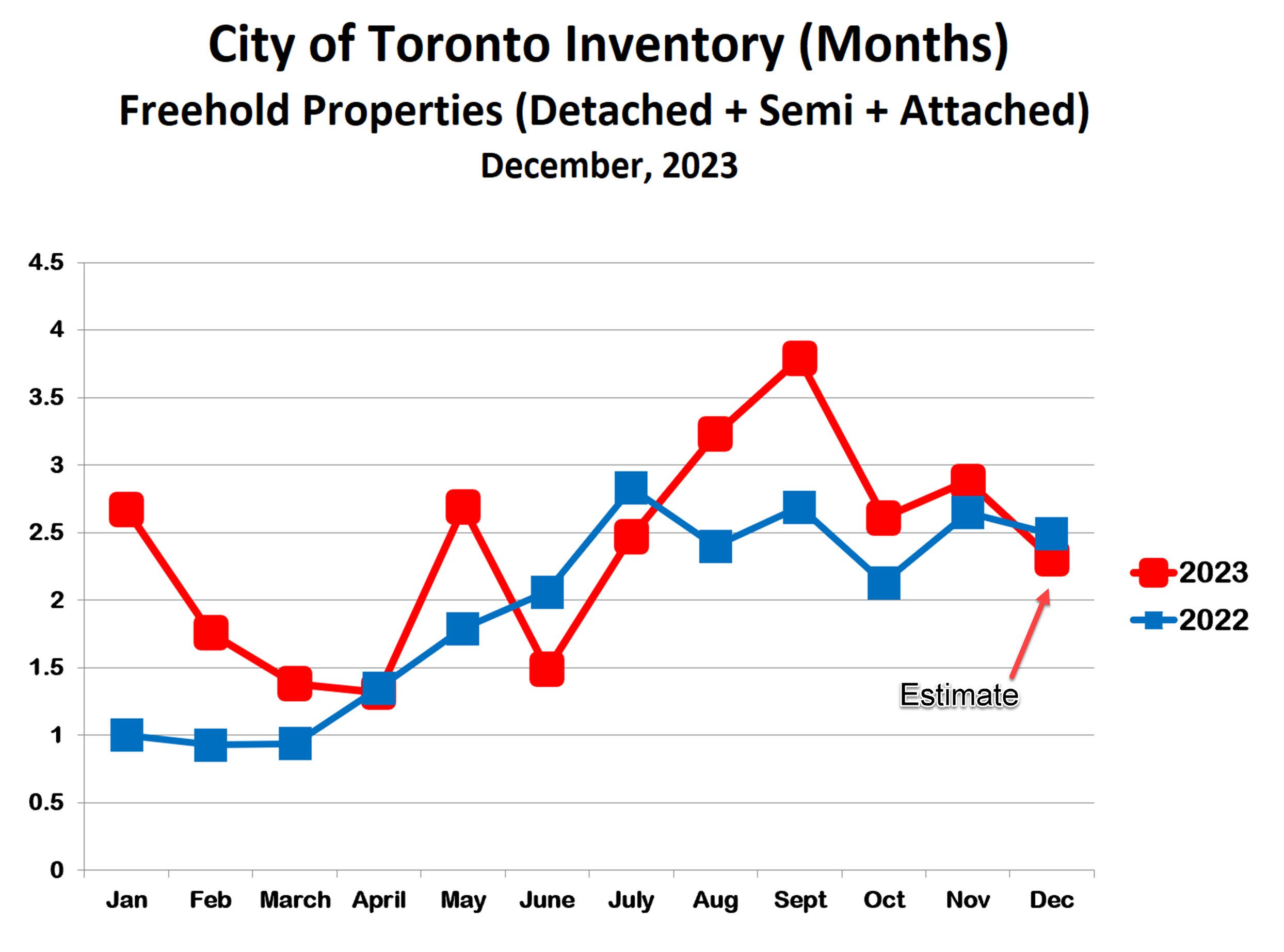

The inventory of houses for sale actually fell slightly in December, reflecting steady sales with declining houses for sale. This is a positive sign for the spring market, since houses remain in a moderate sellers’ market.

The central banks in both Canada and the USA have suggested that they are done with interest rate increases and, in fact, that rates will come down in 2024. Equity markets have responded with a huge rally, and this may lead buyers to expect higher house prices next year. This, combined with the usual seasonal pattern, suggests that we will likely see a nice bounce in house prices next spring.

Buyer sentiment could be the key to the strength of the spring market. Now that the signs are pointing toward lower interest rates next year, buyers who have been hesitating may decide to jump in early to get ahead of rising prices.

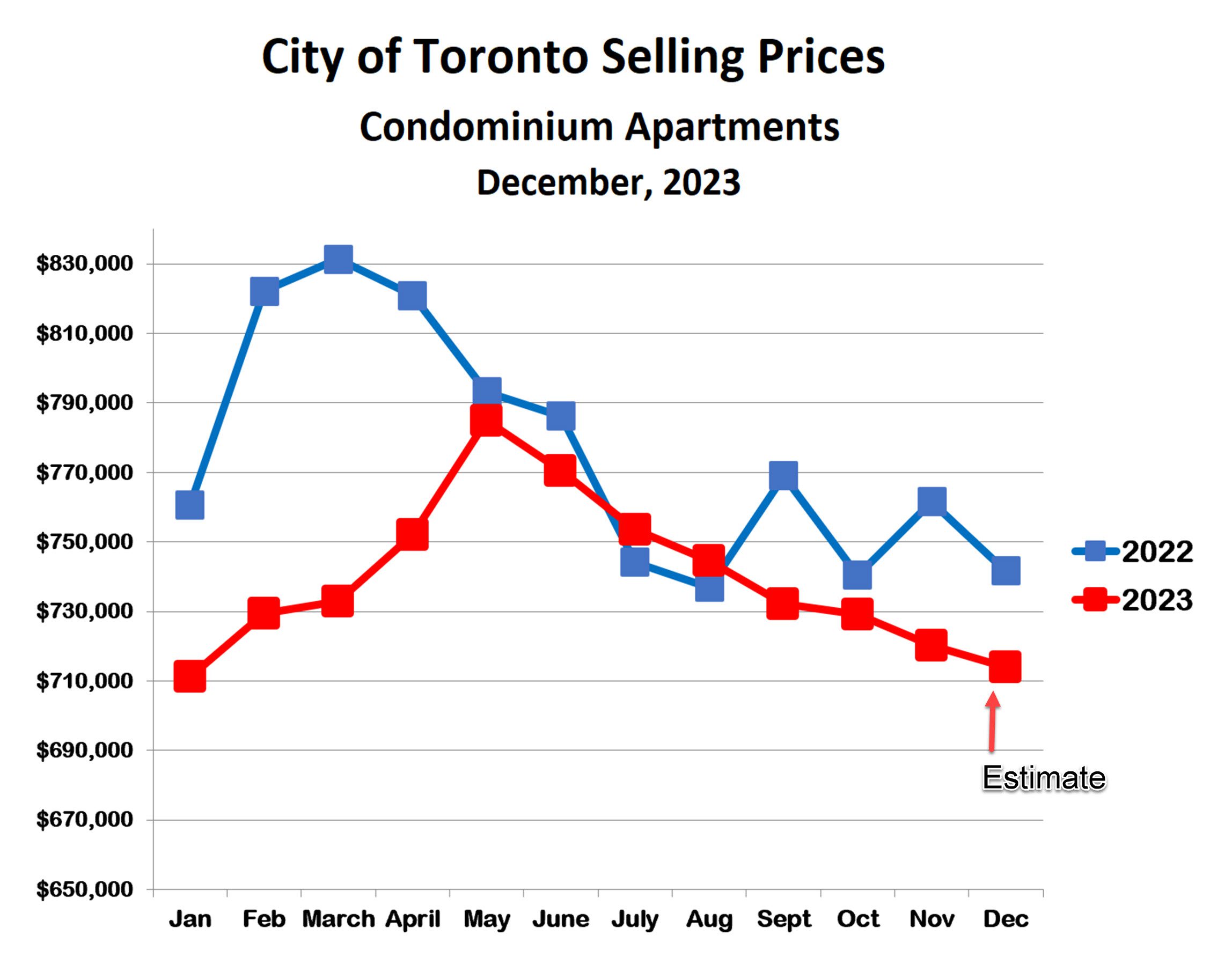

Condos

The condo market followed the same trend as houses through the spring and summer. Unlike houses, however, condos did not see even a hint of a fall recovery. Price have fallen for seven months in a row, and are now 4% below last December.

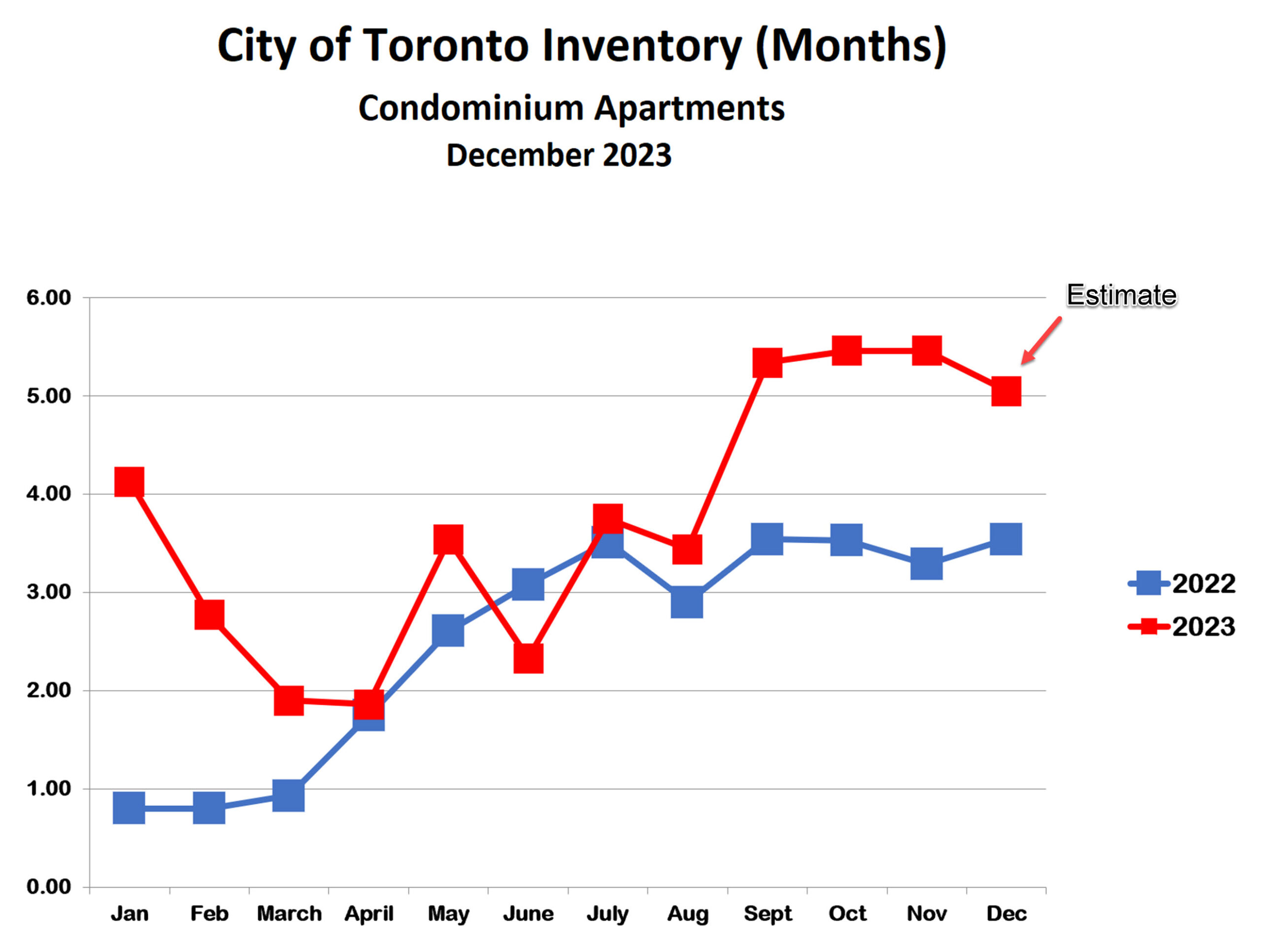

A large factor in this decline has been a sharp increase in inventory levels since August. With more than 5 months’ supply, condos are in a buyers’ market. Much of the increase in inventory traces to investors who have been financially strained by huge increases in mortgage payments on both their personal residences as well as on the condos they bought as income properties.

With the prospect of lower interest rates next year, as well as the continued strength of the rental income market, condo prices seem likely to recover next year, although perhaps a bit more slowly than house prices.

Bottom Line

Prices for both houses and condos recovered early this year, after a dismal second half in 2022. This was mostly due to hopes for an end to rising interest rates, to be followed soon by falling rates. The central banks did little to encourage these hopes, however, with a ‘higher for longer’ narrative that suggested that high interest rates could be with us for quite a while. While the market during the second half of this year was stronger than in 2022, but many buyers have remained on the sidelines.

The central banks are now giving us much more hope for lower interest rates next year. This will likely lead to a strong spring market in 2024, with houses outperforming condos to some extent.

There remains some risk of recession next year. Third quarter GDP was negative, and the fourth quarter GDP print will be announced at the end of February. If it is again negative, we will (technically) be in a recession, and this could dampen buyers’ enthusiasm if they fear losing their jobs. Worst case, we could have a healthy early spring market followed by weakness during the summer and fall, like an echo of 2022 and 2023.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!