Author: Dave Proulx

Understanding Mortgage Approvals

08/18/20

Buyers are sometimes confused about the differences among Mortgage Pre-Qualification, Mortgage Pre-Approval and final Mortgage Approval. These differences are important and need to be understood properly if you are buying a house or condo.

Mortgage Pre-Qualification – This is the first step when you are getting started on your homebuying journey. It’s a very simple process, where you give your mortgage lender some basic financial information such as income, debt and assets. The lender will then give you a rough idea as to what you can afford as well as what mortgage options are available to you. This can be done very quickly over the phone or online. While this is a good starting point, it is far from complete. The lender will not look into your credit rating and will not verify the information that you provide.

Mortgage Pre-Approval – This involves a much more thorough evaluation of your financial situation. Your lender will verify your income, savings, assets and credit rating and then determine what home value you can afford based on the down payment that you plan to make. You may want to get pre-approved by more than one lender to compare the rates they offer, but be aware that if your credit report is accessed more than three times in a six month period, this could lower your credit rating. Ideally you should seek a pre-approval from only your top three lenders. A pre-approval will give you a very solid indication as to what you can afford and, in addition, the lender will usually ‘lock in’ a specific mortgage interest rate for up to 120 days. This will ensure that your interest rate will not be higher than the quoted rate as long as you purchase within the locked-in period, and will not prevent you from taking advantage of a lower rate.

Mortgage Approval – This is the final step in obtaining approval from a lender for a mortgage on the actual home that you are buying. It’s very important to understand that this approval depends on the lender’s evaluation of the house as well as on your ability to make the mortgage payments. This evaluation, called an appraisal, can only be done after you have signed an agreement to buy the home, and this can cause problems if the appraisal is lower than your price.

For example, if you enter into an agreement to buy a home for, say, $700,000, but the lender’s appraiser says the home is only worth $675,000, then your mortgage financing will be based on the lower number. If your down payment is large enough, this may not be a problem. Let’s say, however, that you planned to make the minimum allowable down payment on the $700,000 purchase, which would be $45,000, or 6.4%. On the appraised value of $675,000, the minimum down payment would be $32,500, or 4.8%. This is $12,500 than your planned down payment, but this would still leave you $12,500 short of making up the $25,000 difference between the $700,000 price and the $675,000 appraised value. If you cannot borrow or beg this additional amount, you will not be able to finance the purchase no matter how much you can afford in monthly payments.

Financing Conditions and Bidding Wars – The problem caused by a home being appraised at less than the purchase price can be easily solved by including a condition on financing approval in the offer to purchase. If the offer is accepted, you will have a defined period of time (usually a week) during which the lender can appraise the property and give full mortgage approval. If the appraisal is low, and it’s not possible to approve the financing, then the financing condition is not satisfied, the agreement is terminated, and the deposit is returned to you. Not great for the seller, but you are protected. Unfortunately, the market is highly competitive right now and multiple offers (AKA bidding wars) are very common. In a multiple offer situation, the seller will typically want to see an offer without any conditions, and in fact it is difficult to ‘win’ a bidding war with a conditional offer. While this is very understandable from the seller’s point-of-view, it creates a dilemma for the buyer. In order to have the winning bid, the buyer will typically have to make an unconditional offer and, even worse, the offer will almost always have to be higher than the asking price.

Facing a bidding war situation, it’s very important for the buyer to have a frank discussion with the lender as to the risks involved in making an unconditional and over-asking offer. Also, the buyer’s realtor can help by making a careful evaluation of the ‘fair market value’ of the property. The bottom line is that the buyer needs to have a backup source of funds (e.g., the Bank of Mom & Dad) in case the worst happens.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

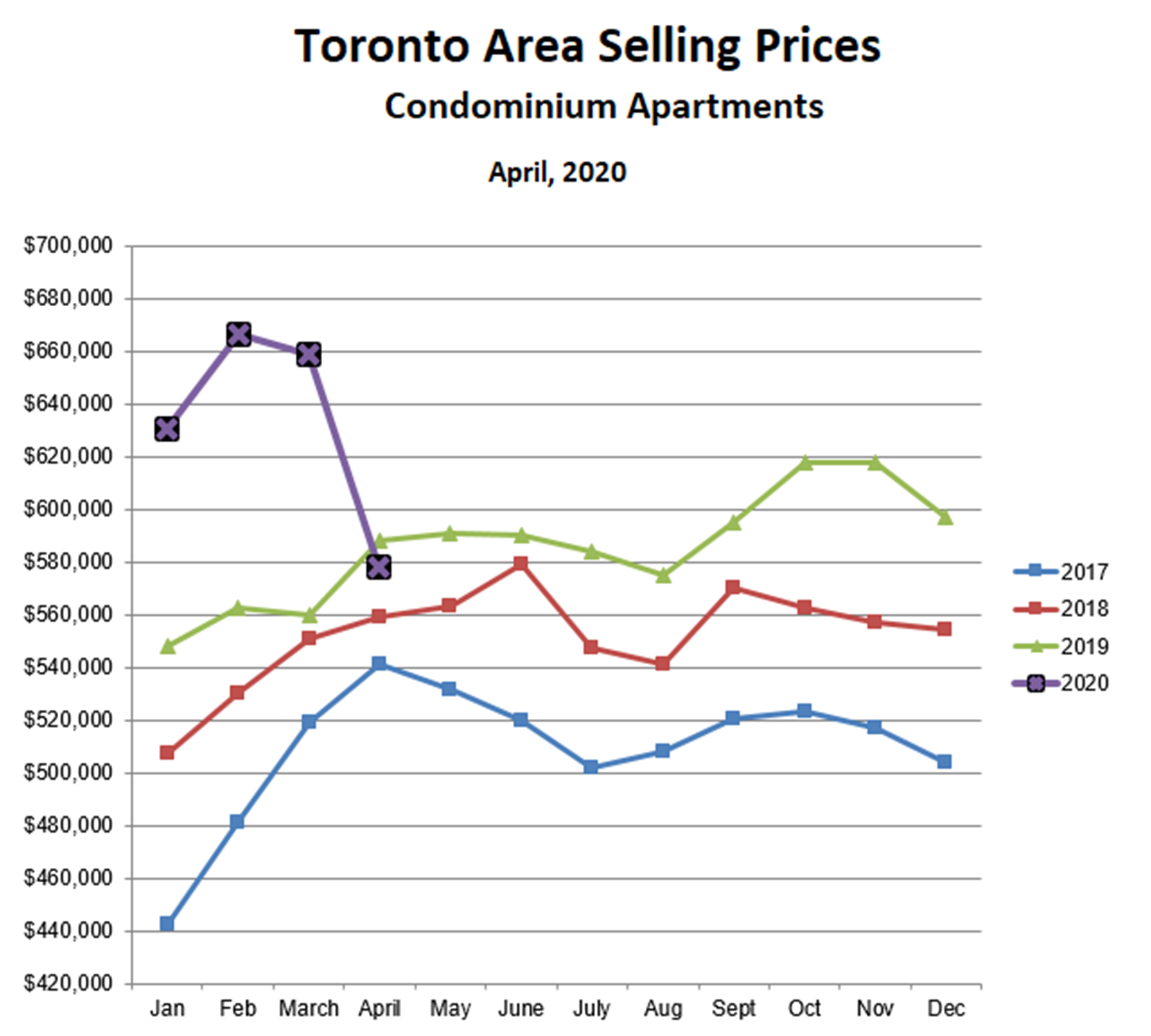

Toronto Prices Surge Higher

08/09/20

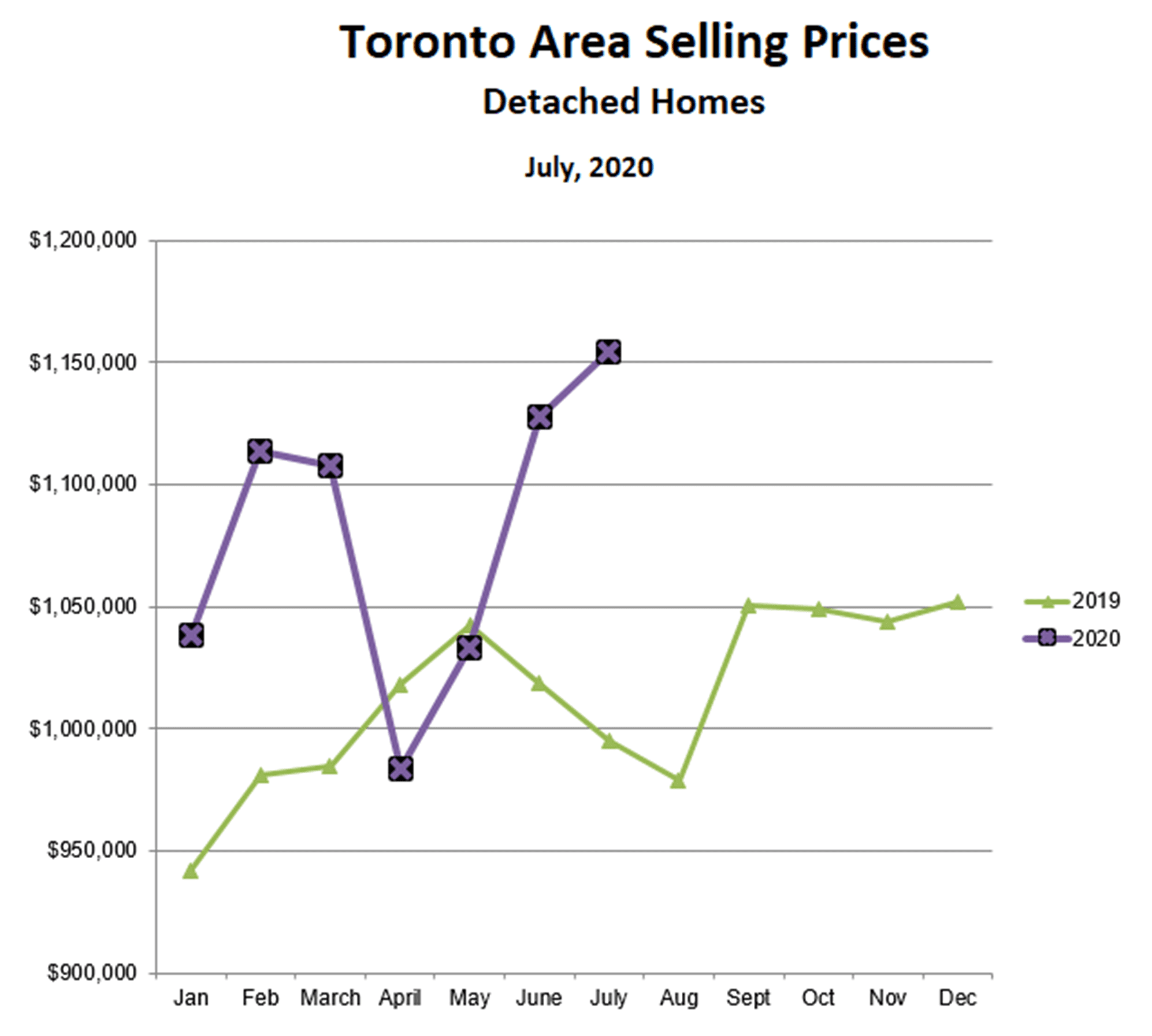

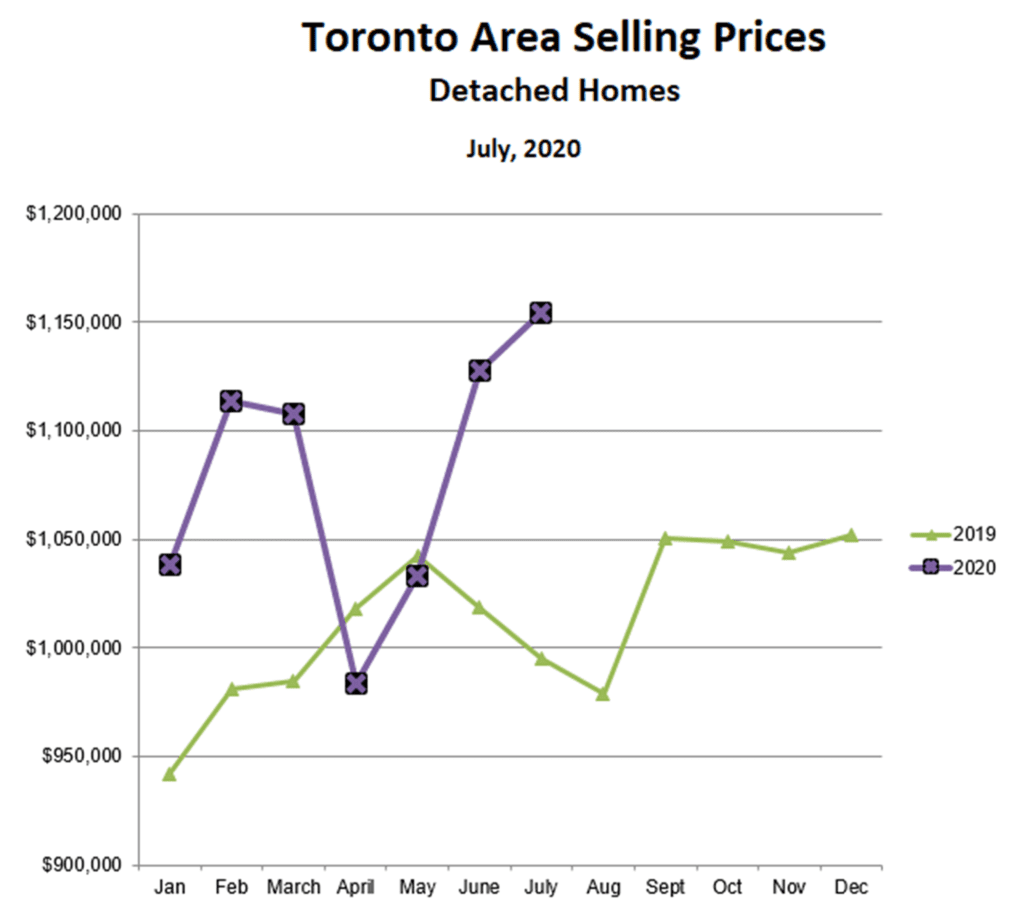

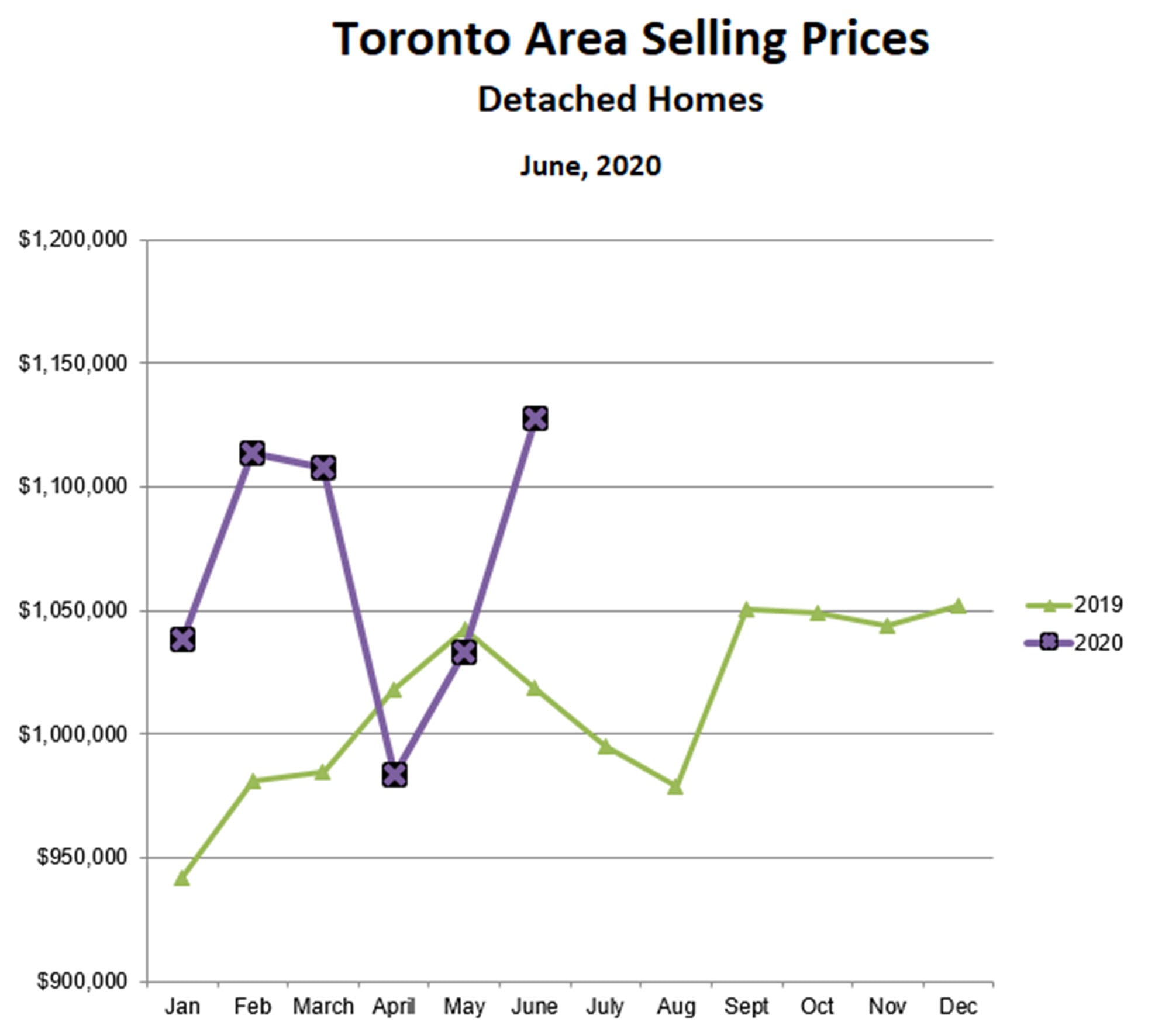

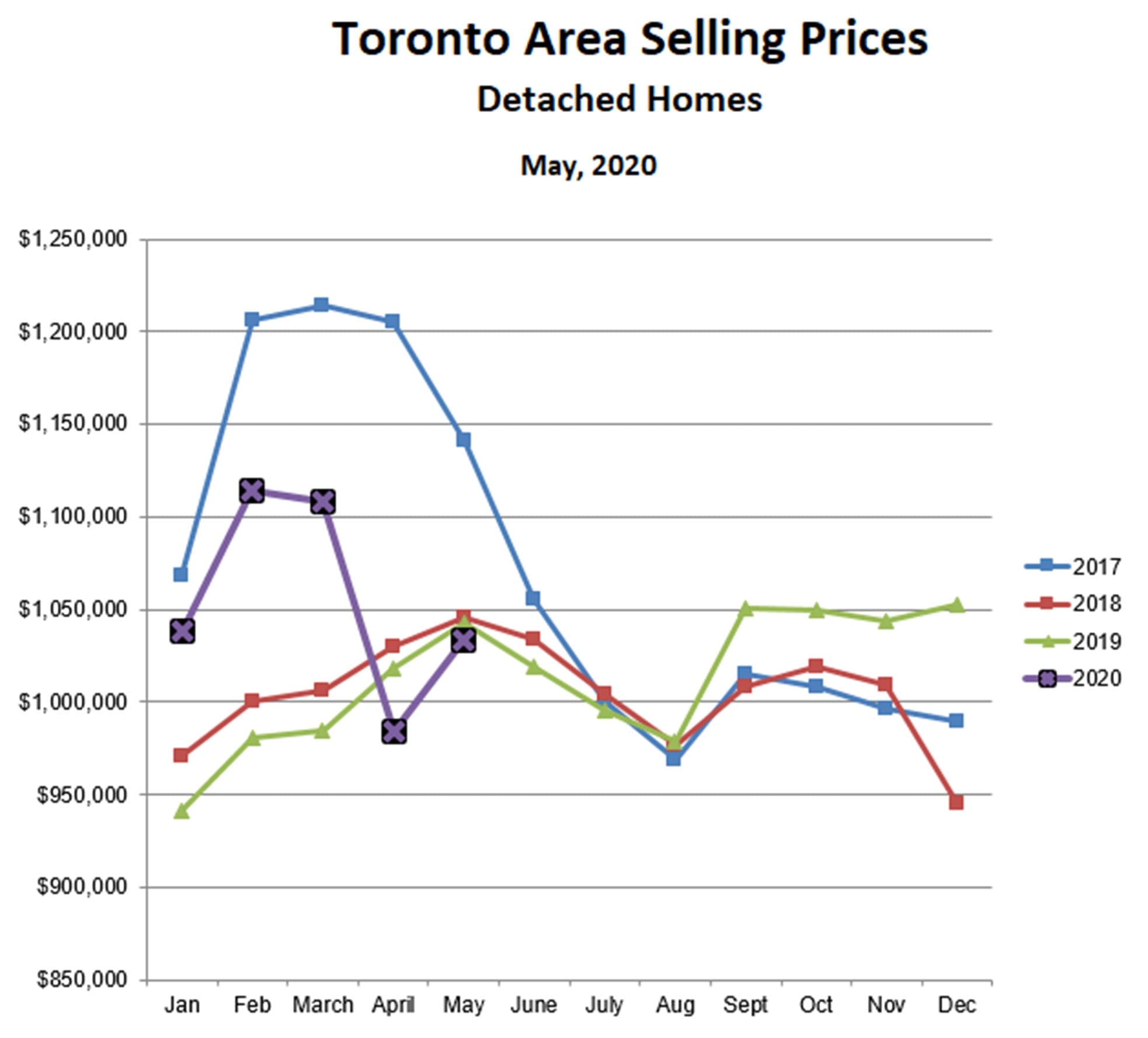

Detached home prices averaged just over $1.15 million in July, and are closing in on the all-time high of just over $1.2 million reached during the 2017 bubble. For the first time in many years, we have not seen the typical summer slowdown, as buyers continue to take advantage of once-in-a-lifetime low mortgage interest rates.

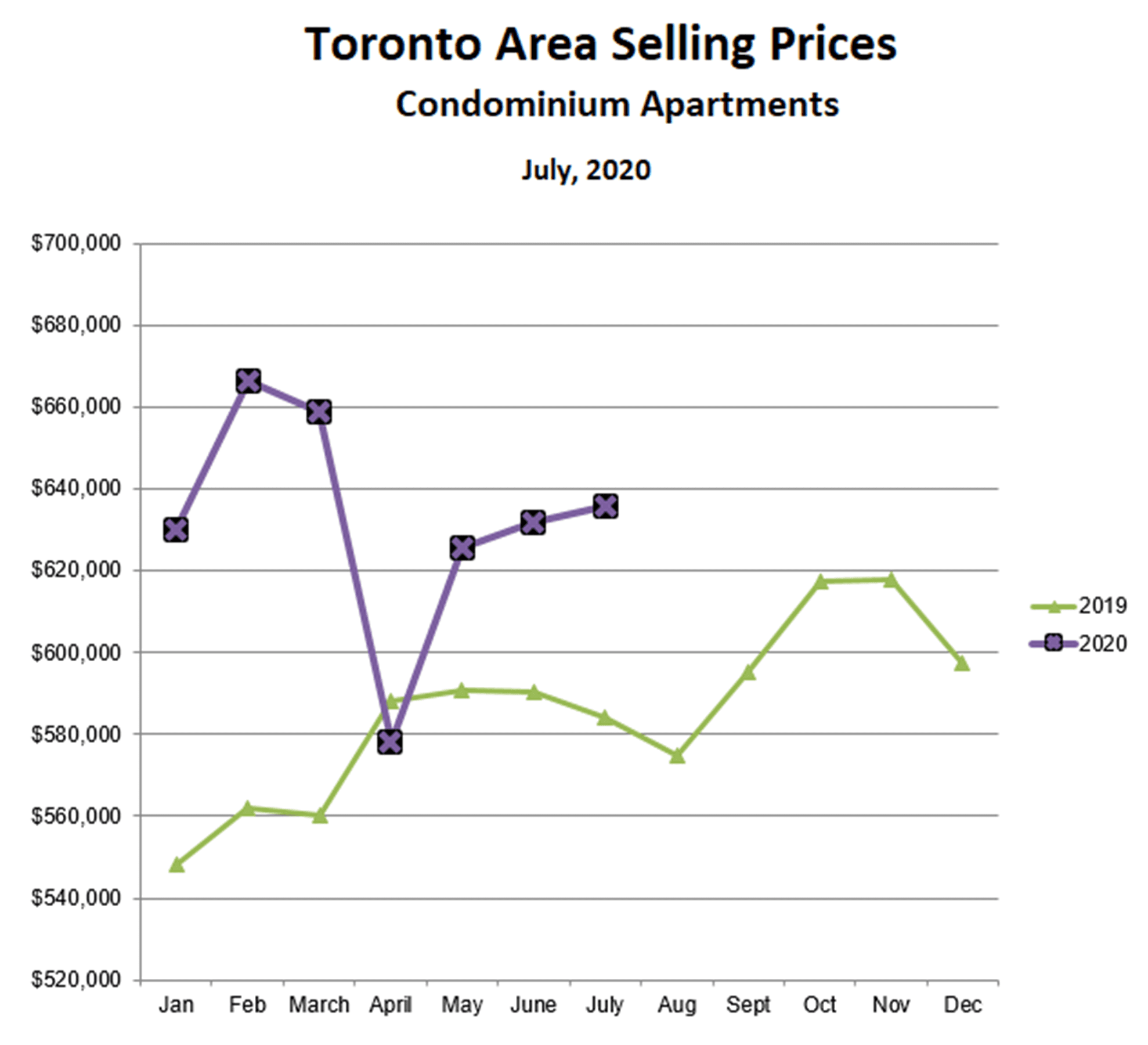

Condo prices were also higher in July. The pandemic is moderating the demand for condos, however, because:

- The need for home office space is increasing, making houses much more attractive;

- High rise towers and elevators feel confining and are not very conducive to social distancing;

- The rental market is weak because immigration has been cut off and because many airbnb units have been added to the inventory of rental properties. This is reducing investor demand for condos.

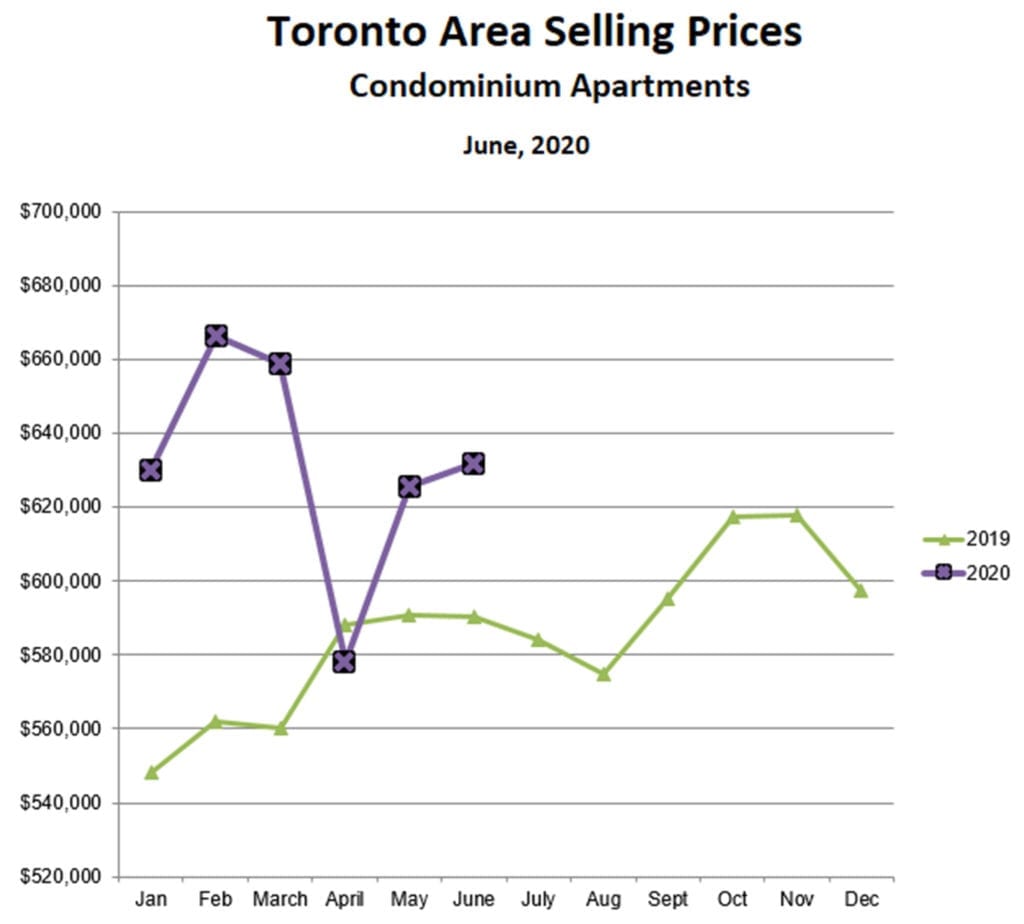

While condo prices continue to increase, therefore, they remain about 5% below the all-time high reached earlier this year.

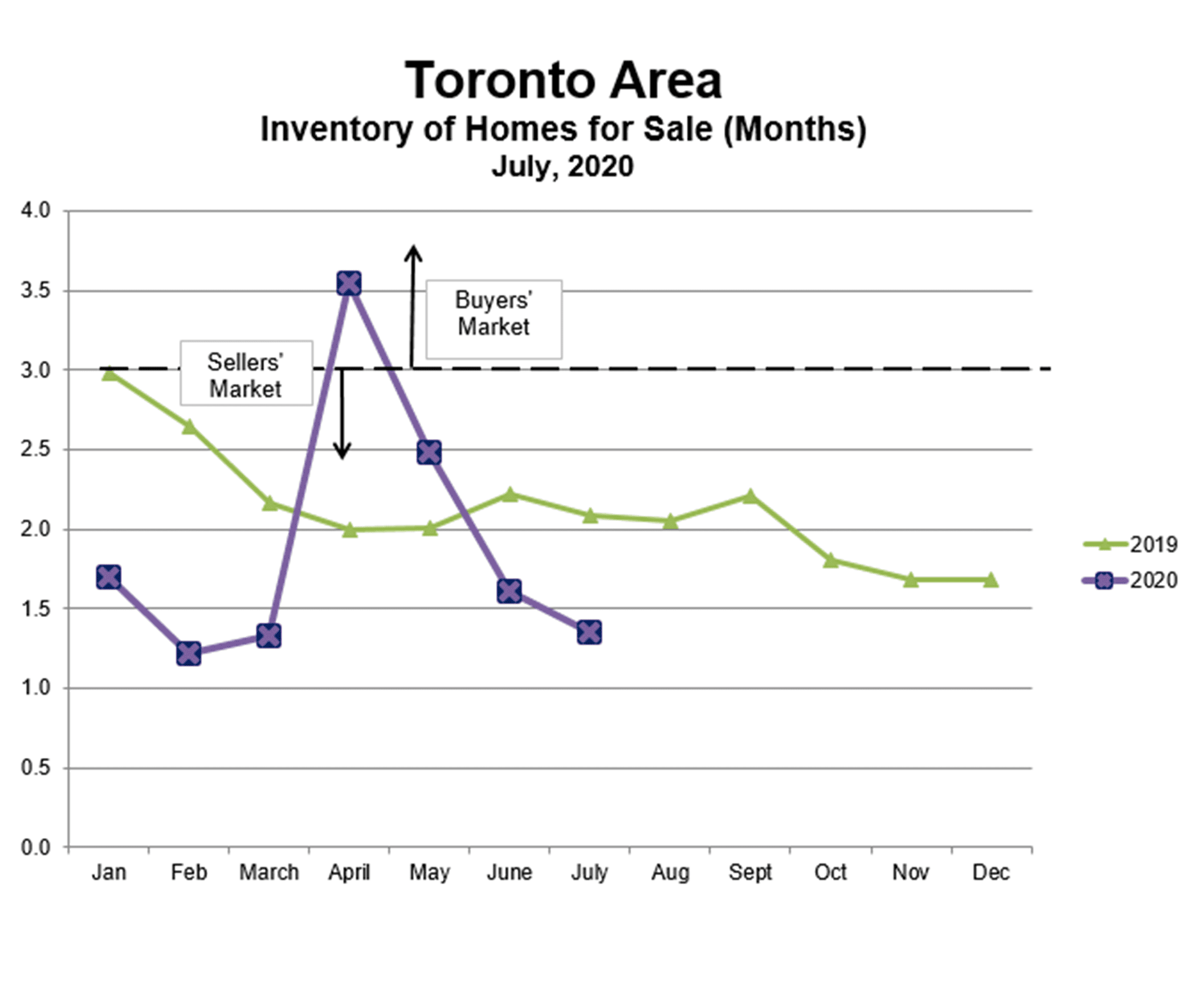

A huge imbalance between buyers and sellers continues to power the market. Sales of all property types increased by 27% between June and July, from 8,701 to 11,081. Active listings of properties for sale also increased, but by only 7%, from 14,001 to 15,018. Basically, homes are getting sold much more quickly than new listings are coming on the market, and the result is rapidly decreasing inventory, now at about 1.4 months’ supply and falling. With more and more buyers chasing fewer and fewer homes, bidding wars and bully offers have returned with a vengeance, driving prices higher.

This trend appears to be the result of eager buyers (because of low interest rates) combined with somewhat reluctant sellers (because of COVID fears). The pandemic is likely to be with us for the foreseeable future, and government CERB payments will continue for at least another two months, so the uber-hot market will likely persist until the fall. Beyond that, my crystal ball gets very hazy…

This trend appears to be the result of eager buyers (because of low interest rates) combined with somewhat reluctant sellers (because of COVID fears). The pandemic is likely to be with us for the foreseeable future, and government CERB payments will continue for at least another two months, so the uber-hot market will likely persist until the fall. Beyond that, my crystal ball gets very hazy…

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

New Listing in The Kingsway

07/12/20

Welcome to The Kingsway, one of the most prestigious condominium residences in Toronto’s west end.

This luxurious 1153 sq ft one bedroom + den suite has two full baths, and the den is a separate room that can also serve as a second bedroom. The eat-in chef’s kitchen has sleek cabinetry & granite counters, and the airy, open-concept living/dining area walks out to a large balcony. The extra-large master suite boasts two walk-in closets and a lavish, five-piece marble ensuite bath.

First-class amenities include a well-equipped party room opening to a large terrace and beautifully landscaped gardens, exercise room, indoor pool and spa, guest suite, media room, 24-hour concierge, and ample visitors’ parking.

This exclusive building is perfectly located a short walk from the subway station, historic Old Mill, and the beautiful trails and green spaces of the Humber Valley. It’s also close to Kingsway & Bloor West Village shops, restaurants and cafes.

Well-appointed, elegant, and ideally located, this bright, spacious unit is just waiting for you to move in.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

New Listing in Bloor West Village

07/12/20

Presenting 178 Brookside Avenue, a tastefully renovated Bloor West Village home with gorgeous front landscaping and a spectacular back yard oasis. It’s a comfortable and enjoyable living space that’s also perfect for entertaining with family & friends!

This home is close to two popular shopping districts, Bloor West West Village and The Junction. It is also in the catchment area for the highly rated Humbercrest PS with its well-regarded French Immersion program; close to TTC and Humber Valley parkland; and just steps from Loblaws Humber Market.

Notable recent upgrades include: quartz kitchen counters; all new appliances; 5-person hot tub; top quality Velux skylights in the family room addition; new hardwood flooring on the main floor and upper level; a renovated basement with new drywall, pot lighting & vinyl plank flooring; durable composite decking & stairs on the covered front porch; and wiring for an electric vehicle hookup.

Excellent mechanics include: upgraded electrical (200 amp service, no knob & tube); upgraded water supply (3/4” copper); backwater valve and new drains inside & outside; new exterior doors; upgraded windows; and new blown-in attic insulation. An above average home inspection report is available on request.

Exceptional parking includes both a licensed front pad as well as a laneway & garage that qualifies for a laneway house up to approximately 1500 sq ft. Design your own laneway suite for extra income, family/guest accommodation or home based business!

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Toronto Market Continues To Heat Up

07/12/20

In the past, the typical pattern was for the real estate market to slow down as the July 1 holiday approached, with both buyers and sellers making plans to enjoy our relatively short summer season. Not this year — COVID-19 has thrown a large monkey wrench into the normal seasonal pattern.

After the sharp lockdown-induced slowdown in April, the market bounced back strongly in May, and that rebound continued apace in June. For example prices for detached homes increased by 9% versus last month and 11% versus last June. Detached price are now higher than they were at the beginning of the year, pre-COVID.

Condo prices also increased, though not as dramatically as houses, up 1% versus May and up 7% versus last June. Clearly the momentum has shifted away from condos and toward houses, although the condo market remains very strong.

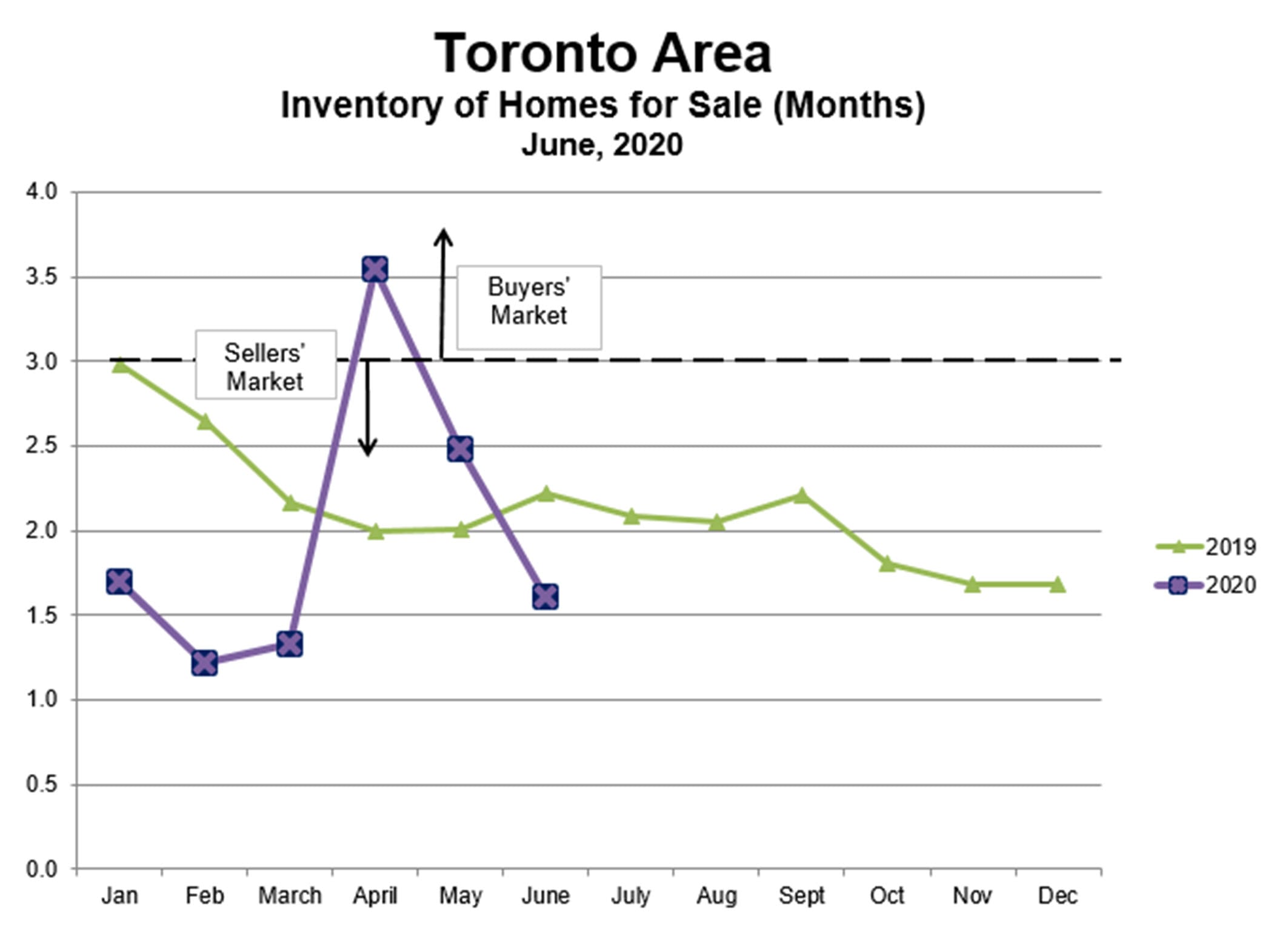

The strength in the market traces mainly to the declining inventory of homes for sale. After increasing rapidly in April due to the COVID-19 lockdowns, inventory has fallen equally rapidly over the past two months, and is now back in deep sellers’ market territory, similar to early this year, pre-COVID. The reason for the quick drop in inventory is that buyers are returning to the market in force (mainly due to astonishingly low interest rates), while sellers have been more reluctant, perhaps wary of having strangers viewing their homes. Homes are therefore selling faster than new listings are coming on the market… and so inventory is falling.

Will the market continue to be hot throughout the summer? Certainly there are no signs yet of any slowdown.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Ontario Government Encouraging Co-Ownership Of Homes

06/23/20

If you’re tired of renting but can’t quite scrape together a down payment for a home of your own; or if you are retiring and would like to keep your living costs as low as possible; you may need to get creative. One option is to purchase a home with friends or relatives, entering into something called ‘Co-ownership’.

Late last year, the Ford government released a consumer guide aimed at encouraging buyers to consider co-ownership as a way to make home ownership more affordable as well as to alleviate the housing supply crisis. The government defines co-ownership as follows:

“Co-ownership housing is a shared living arrangement where two or more people own and live in a home together. Co-owners may share living spaces like kitchens and living rooms, or the home may be divided into separate units. Responsibilities for care and upkeep of the home are usually shared, as well as some amenities and services.”

While there are obvious financial advantages to co-ownership, the arrangements can be complicated and need to be sorted through carefully. For example, there are multiple options for sharing ownership, including:

- Shared ownership as a group of individuals, either as joint tenants or tenants-in-common. In the former case, if one owner dies, the other owners automatically inherit the deceased’s share of the property; in the latter, the deceased’s share becomes part of their estate. The ownership shares may be equal, or may be different, for example depending on how much each owner contributes to the purchase. Also, a process for decision making and dispute resolution needs to be worked out, for example, what happens if one owner wants to sell and the others don’t? How to manage maintenance and improvement costs also needs to be clearly defined. It is essential to work out all of these issues before the property is purchased, otherwise, there could be a lot of unnecessary conflict and hard feelings down the road. The result is a contract called a ‘co-ownership agreement’. A well-crafted co-ownership agreement can also be a great aid to getting financing approved.

- Set up a co-op corporation, where each owner has a defined share of ownership of the property, and these shares can be bought and sold. Co-ops have a long history and, while this approach is more complicated legally, there are lots of models for how to set one up properly, and it greatly simplifies the question of how one owner can sell without selling the entire property. The disadvantage, as with all co-ops, is that the owners are not listed on title, and this can make financing for a new owner more difficult.

- If the property has clearly defined units, as well as common areas, then a condominium corporation is a possibility. While setting up a condominium corporation is more complicated (and more expensive) than setting up a co-op, this approach has the advantage that each owner has registered title to his/her own unit and can therefore sell more easily. Like co-ops, condos are a well established form of property ownership.

With all of these options and complications, it’s obviously important to enlist legal help to advise as to the advantages and disadvantages of the different forms of ownership, as well as to prepare the necessary documents, such as the co-ownership agreement. Some careful forethought, sound decision making, and clear documentation can make co-ownership a great option for many prospective buyers.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Toronto Market Bounces Back in May

06/03/20

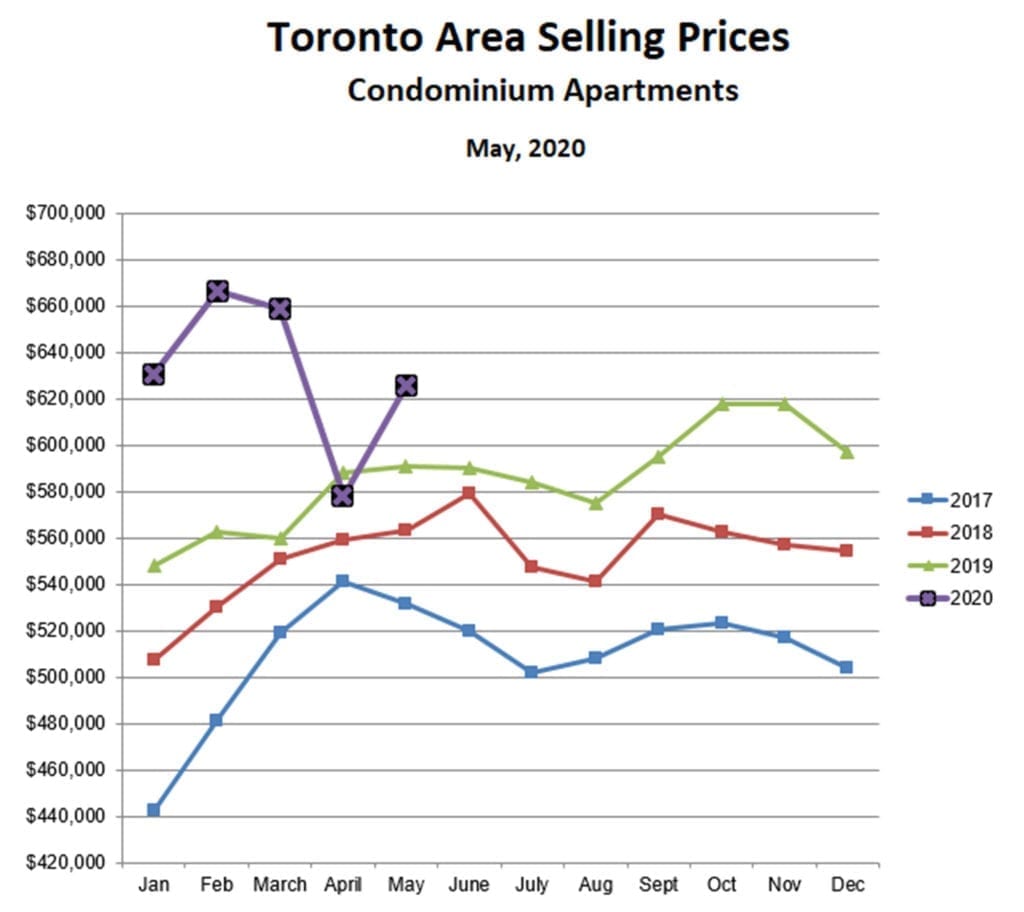

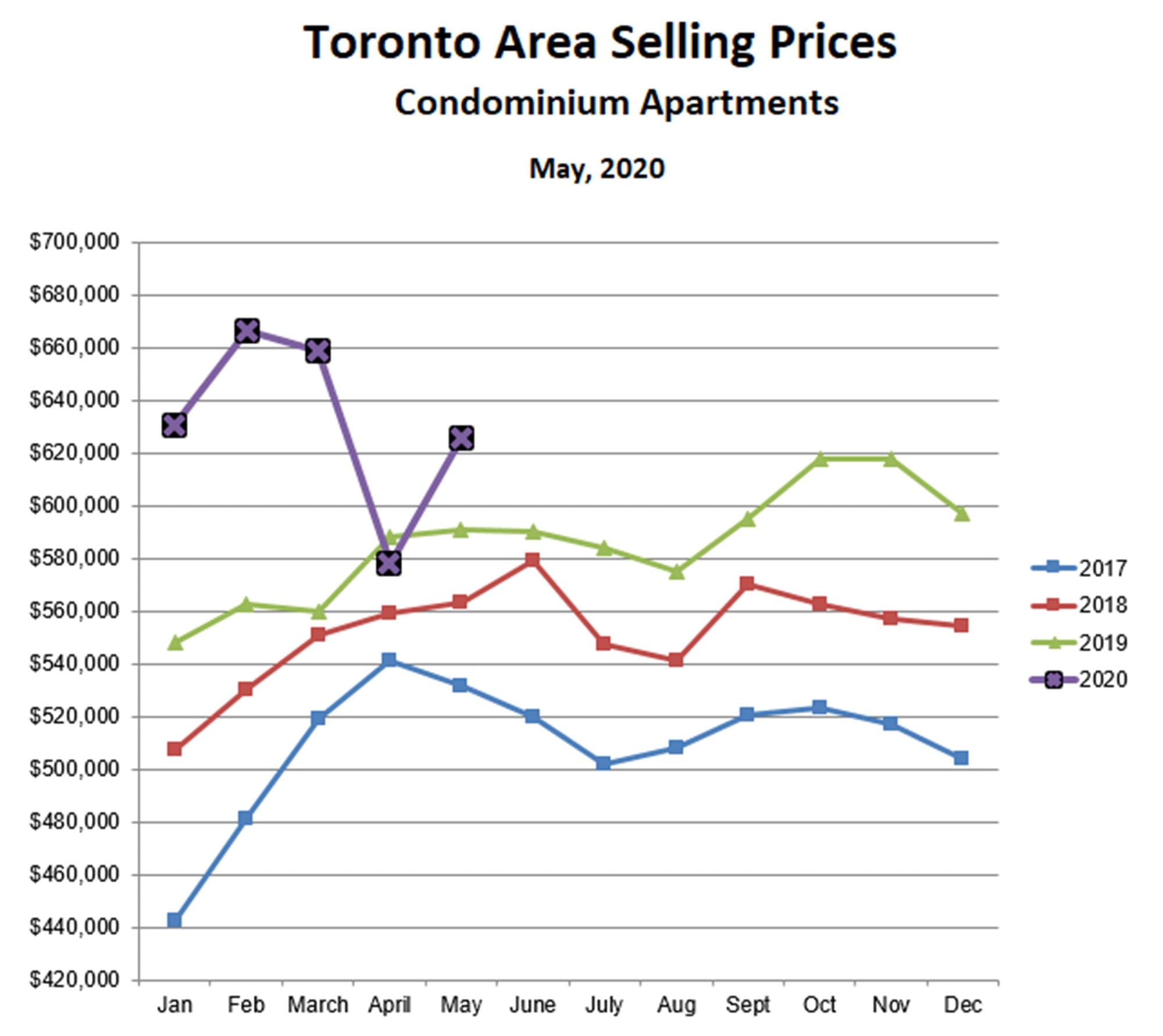

After being so rudely interrupted by the COVID-19 lockdown in late March, and suffering through a dismal April, the Toronto area real estate market has come roaring back May. Prices increased dramatically across all property types, the first time since 2016 (and briefly early this year) that freehold and condo properties have increased in lock-step.

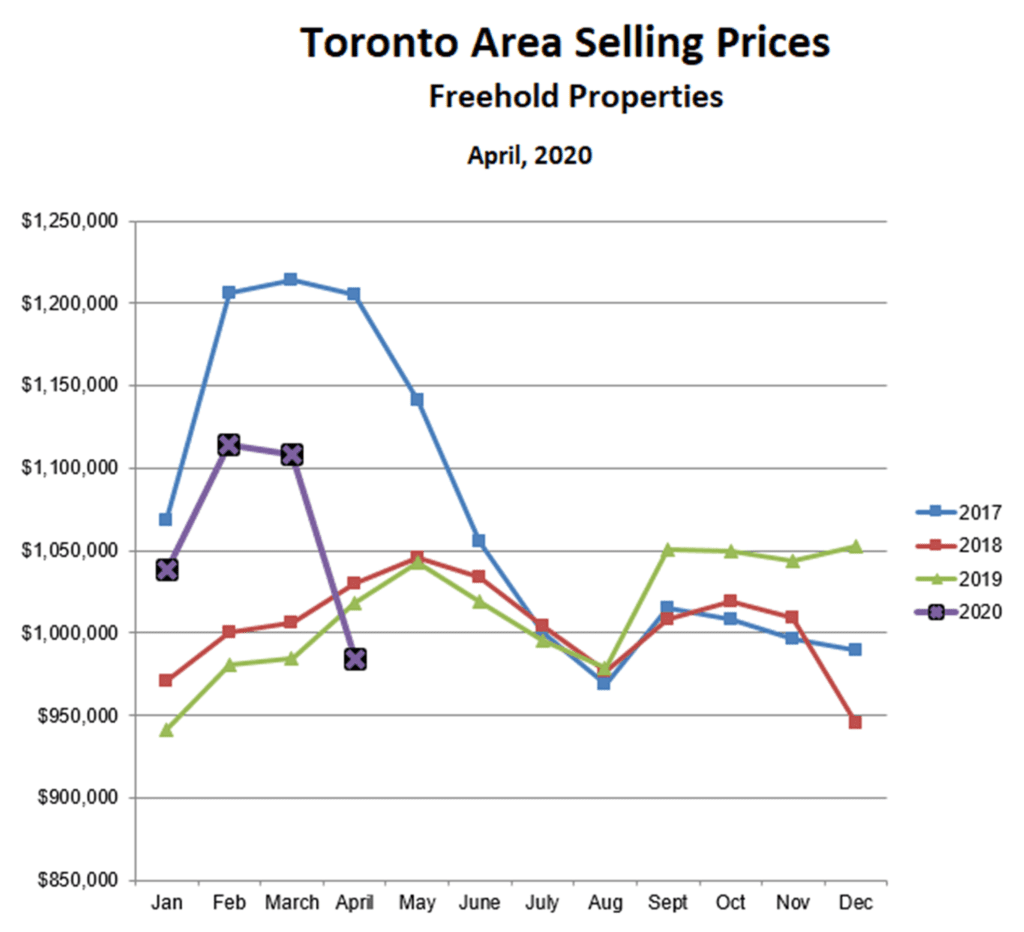

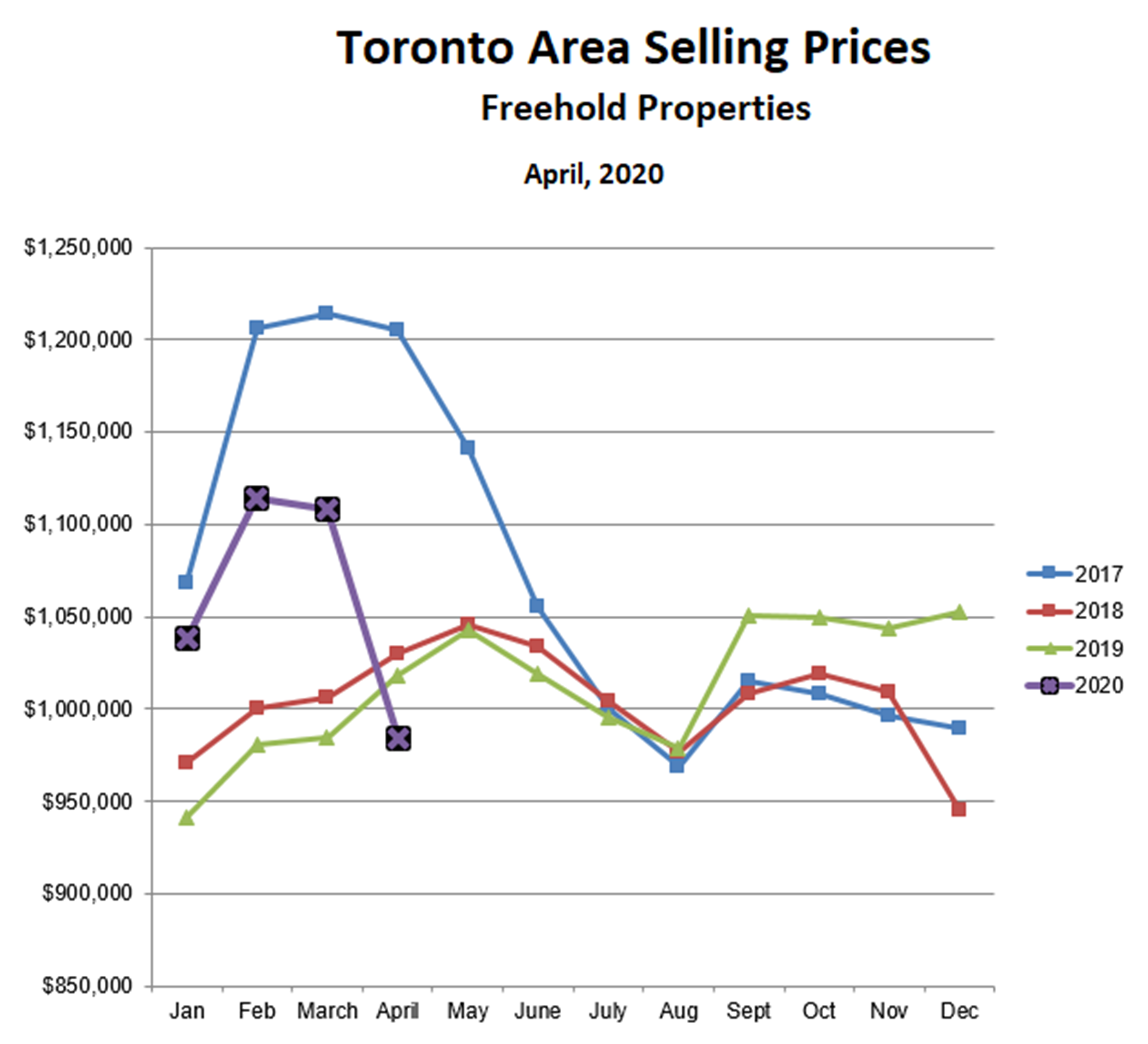

Prices for detached homes, for example, increased by 5% as compared with last month, after falling by 11% in April, and are now almost exactly the same as they were last April (and, coincidentally, in April of 2018). The lockdowns quickly deflated this year’s nascent price bubble, but we are now back on solid ground with some upward momentum.

Prices for condominium apartments are following a similar trend. After falling 12% in April, condo prices increased by 8% in May, and are now higher than at any point last year.

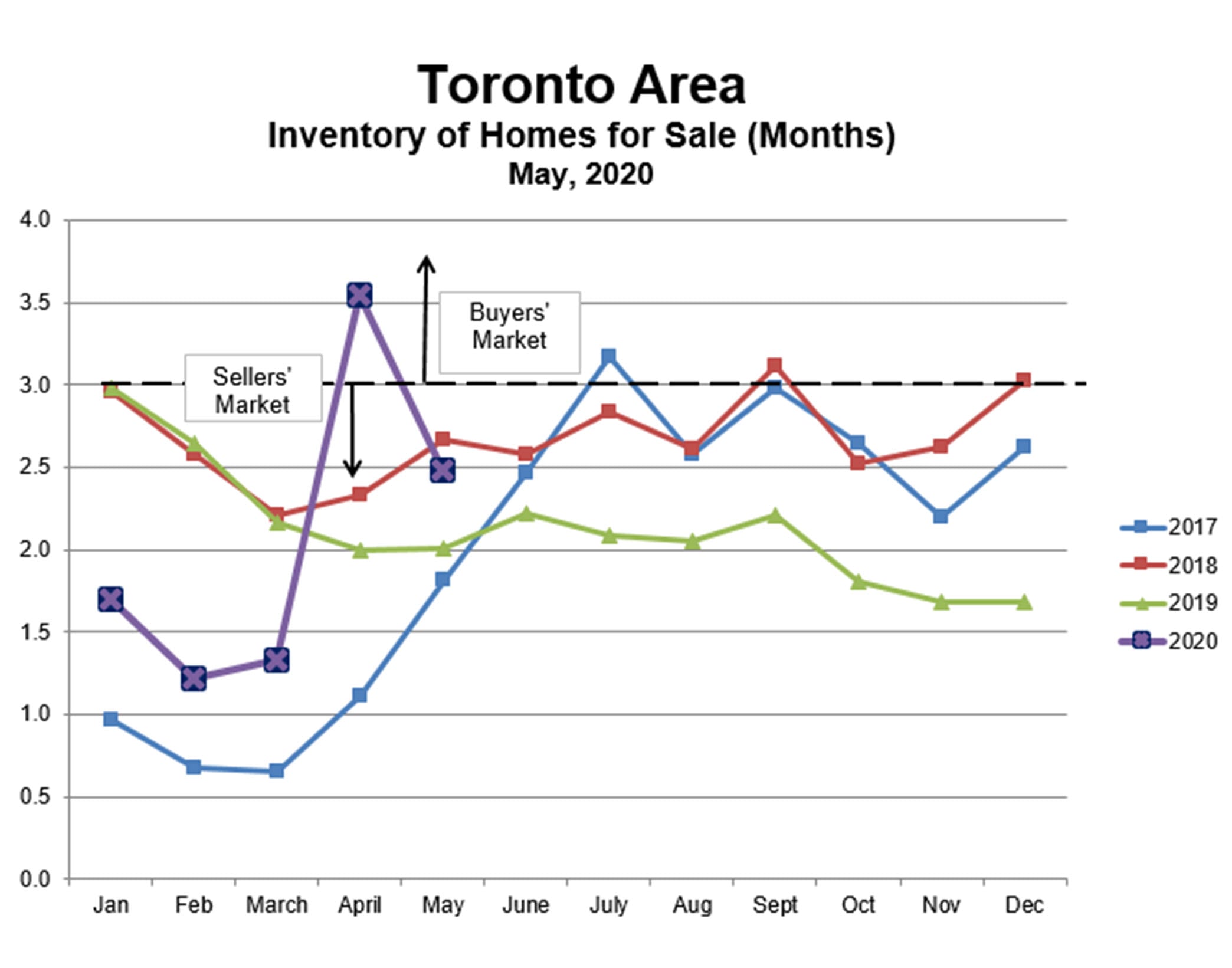

Sales also rebounded sharply in May, up more than 50% as compared with last month, but still only about 50% of last April, reminding us of just how steep the drop in market activity was in April. Active listings also increased in April, but only by about 8%, and so the inventory of homes for sale (active listing/sales) declined from 3.5 months to 2.5 months, putting us back into a moderate sellers’ market similar to this time last year. Clearly buyers are returning to the market more quickly than sellers, and we are seeing this in the re-emergence of bidding wars in certain areas.

The Toronto real estate market has shown amazing resilience in the face of the COVID-19 lockdowns, and we can look forward to continued improvement in the market over the next few months as the economy re-opens.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Falling Rents May Impact House Prices

05/28/20

A recent report from Capital Economics highlights falling rents in Canadian cities, especially Toronto and Vancouver, and points out that this could have a significant knock-on effect on Canadian house prices.

The report identifies several reasons why rents are falling:

- The surge in unemployment due to COVID-19 lockdowns has hit low-wage earners the hardest, and they are typically renters. Large numbers of these people can no longer qualify for rentals and, even if they can, they may want to stay wherever they are until the situation is less uncertain.

- Because of COVID-19, Tenants in rental properties who are planning to move out are generally unwilling to allow viewings of their unit by prospective new tenants. This means that the landlord may have to wait until the existing tenant moves out to start the rental process and, in turn, this may increase the landlord’s motivation to get the unit rented quickly, even if it means a reduction in rent.

- Much rental demand comes from new immigrants, and COVID-19 has caused immigration to drop from about 30,000 per month to almost zero.

- The temporary ban on short term Airbnb has shifted many of these properties to the longer term rental market, increasing inventory.

- As university teaching moves online, this will likely reduce the demand for rentals by university students.

Since Toronto and Vancouver receive most of the new arrivals to Canada and also have the highest share of short term rentals, these two cities could see the largest fall in rents. For instance, Capital Economics projects that, in Toronto, the vacancy rate could jump from 1.5% to 4.5% by July, and even further in the fall depending on what happens with universities. Their calculations suggest that this could translate to a huge 15% drop in rents. As the economy ‘reopens’, and especially if travel restrictions are quickly loosened, the impact on rentals could be mitigated, but Capital Economics expects that the best case scenario will be a 5%-10% decline in rents.

With rents declining, many owners of rental properties may decide to sell, adding to the supply of properties for sale and exacerbating the decline in resale prices that is already underway.

These projections are, of course, highly uncertain, and depend critically on how quickly, and to what extent, our economy returns to something resembling ‘normal’ in the coming months.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Book Your Free Birthday Panda Visit!

05/25/20

Social distancing rules have pretty much eliminated the traditional birthday party celebration for kids — but if you live in the High Park, Bloor West, Junction, Swansea or Roncesvalles area, you can book a free visit from the Birthday Panda to bring some joy to your child’s special day!

Click here to view a clip from Global News on the Birthday Panda.

Just call or email Renee to book your Birthday Panda walk-by, greeting & dance:

Call: 416-826-4787 email: renee@smithproulx.ca

Birthday Panda has made 60 visits during the month of May, with more booked in June!

(Social distancing rules apply during the visit, of course.)

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

No Nosedive Ahead for Canadian Real Estate Prices: RE/MAX

05/15/20

Canadian real estate kicked off 2020 with a bang, but there are conflicting opinions as to how we’ll finish out the year. Canada’s federal housing agency has warned that average house prices could fall by up to 18 per cent over the next 12 months – a dismal prediction that’s being challenged by RE/MAX based on market activity from coast to coast.

Basic economics has taught us that supply and demand dictates housing prices, and according to what RE/MAX brokers are reporting at ground level, housing inventory is down in many markets, demand is still high, and multiple offers are a common scenario. Assuming that demand continues its current course, Canadian real estate prices will likely remain relatively stable or experience a single-digit price correction at worst this year – which is a far cry from CMHC’s dire decline of up to -18 per cent.

“CMHC doesn’t seem to understand the sheer number of sellers that would have to accept this kind of price reduction, in order for average housing prices to plummet to this degree in such a short time span,” says Christopher Alexander, Executive Vice President and Regional Director, RE/MAX of Ontario Atlantic Canada. “Sellers simply won’t accept that kind of discount on their listings. A statement of this nature is panic-inducing and irresponsible.”

Is Canadian Real Estate In Trouble?

Late last year, RE/MAX expected Canadian real estate prices to rise by 3.7 per cent in 2020. A few short months later, COVID-19 threw everyone for a loop. Recently, Canada Mortgage and Housing Corp. (CMHC) predicted that average home prices could decline anywhere between nine and 18 per cent in the coming year, due to the economic impacts of COVID-19. In addition, CMHC warns that mortgage deferrals could rise from 12 to 20 per cent by September, with up to one-fifth of all mortgages ending up in arrears, if the Canadian economy does not recover sufficiently.

“The resulting combination of higher mortgage debt, declining house prices and increased unemployment is cause for concern for Canada’s longer-term financial stability,” CMHC CEO Evan Siddall told the House of Commons Standing Committee on Finance earlier this week.

However, the Big Banks, economists and many Realtors aren’t aligned with CMHC’s expectation.

What the Big Banks are Saying About Canadian Real Estate

According to a recent article published by The Globe And Mail, CIBC said Canadian real estate prices could fall between five and 10 per cent this year compared to 2019. Similarly, RBC forecasts a decline of seven per cent, while BMO expects a five-per-cent decline.

“[Mr. Siddall] said that all these things will happen if the economy ‘does not recover sufficiently.’ That’s a very broad statement,” CIBC deputy chief economist Benjamin Tal told The Globe And Mail. “Without looking at the assumption behind that statement regarding GDP growth, unemployment rate and so on, it is very difficult to assess the likelihood of such a prediction. Is it a worst-case scenario, or the base case? I think he was highlighting a worst-case scenario,” he said.

A single-digit decrease in house prices can be classified as a correction, and is a far cry from CMHC’s trough of -18 per cent.

RE/MAX Brokers Report Low Housing Inventory, Multiple Offer Scenarios

RE/MAX brokers in some of the biggest Canadian real estate markets say a dramatic price drop is unlikely under current conditions, barring any major unforeseen circumstances – and as we’ve all come to learn recently, anything is possible. But assuming current market conditions remain stable, the current inventory of homes for sale continues to fall short of demand – even amidst this pandemic, social distancing measures and the economic fallout.

“The recovery of the real estate market will be market and region specific,” says Elton Ash, Regional Executive Vice President, RE/MAX of Western Canada. “We are seeing a strong return to real estate inquiries, with our Realtors becoming very busy again.”

Here’s what RE/MAX brokers are reporting on Canadian real estate in some of our biggest cities and key housing markets.

ATLANTIC CANADA

Newfoundland real estate has been a consistent “down market” since 2014, thanks to weakening oil prices and a shaky local economy. COVID-19 dealt another blow, but even so, the economy was already slow in the region. Interestingly, RE/MAX reports a spike in multiple offers in the region recently.

Multiple offers have been virtually non-existent in Newfoundland since the peak in market activity in 2014. Since the pandemic, there have been a dozen. There has even a home for sale that received four offers, when previously even one offer may have been uncommon.

Housing prices in Newfoundland remain consistent right now, and the market is better positioned than originally anticipated. The pulse is good, and this is unlikely to change in the near future.

Halifax real estate was riding high before the pandemic, with a lot of good foundational activity happening across the region. Simply put, the Halifax real estate market was hot, with low housing inventory common across the marketplace. Specific to the Halifax housing market, multiple-offer scenarios continue to be common, with brokers and agents reporting sequential multiple offer scenarios on their last three, four, five deals. That’s certainly the making of stable house prices, or even increasing slightly.

About one-third of Halifax listings in recent weeks have sold over asking price, which bodes well for house prices in the near future. Showings are up, and new listings that are coming online are up slightly as well. There’s consumer confidence, but buying activity is heavily dependent on how people have been affected financially. If current trends continue, an 18-per-cent drop in home prices is highly unlikely.

ONTARIO

Ottawa real estate has experienced an increase in home prices and a decrease in days on market – both good indicators that the housing market is stable, at least for the time being. The current seller’s market is characterized by low housing supply and high demand, which continues to drive up prices. In fact, within the last two weeks, Ottawa’s list-to-sales-price ratio has a median of 100 per cent. Most properties are still holding offers, with multiple-offer scenarios a common occurrence and homes selling for over asking price.

Within the last two weeks, compared to the previous two weeks, RE/MAX has experienced an influx of inquiries regarding properties for sale, with questions about the process of buying/selling homes. Consumers in the region want to be informed again about the housing market.

Toronto real estate is experiencing a proportionate decline in new listings and buyers, leading RE/MAX to conclude that prices should remain stable. Toronto homes are currently selling for asking price, or slightly above or below that price point, but the region has not experienced any decline in price and if current conditions continue, there’s nothing to indicate that prices will fall between nine and 18 per cent, as CMHC has predicted.

Toronto continues to experience multiple-offer scenarios, with RE/MAX reporting a consistent two or three offers on every listing. These conditions were prevalent prior to the lockdown on March 13, and continue to be the case, even with social distancing measures in place and the economic fallout. Toronto’s housing supply shortage continues, and demand remains high, as evidenced by the many multiple offers RE/MAX is seeing across the board.

The pandemic has negatively impacted listings, because many homeowners who were planning to sell are now opting to hold on to their listings, unwilling to host traditional open houses at this time. When government financial aid runs out and the six-month mortgage deferral period expires, people may then start listing their homes if they can’t afford to keep them. However, right now this is not the case. If a flood of listings does occur in Toronto this fall, it will be a short cycle.

London real estate experienced a large downturn in the number of sales in April and May compared to April/May 2019, but the region has also seen a large decrease in the number of listings compared to last year, which is causing multiple-offer scenarios.

The London housing market is holding strong, homes for sale are being scooped up and prices remain relatively stable. Within the past 14 days, RE/MAX reports 180 firm sales, 83 of which went for over asking, and 20 sold at full price. In April 2020 the average sale price in London was up slightly by a couple of thousand dollars compared to April 2019, however May’s month-to-date average price in London is about $29,000 higher compared to all of May 2019.

WESTERN CANADA

Edmonton real estate continues to experience a significant hit to its local economy due to oil prices, and the biggest factor going forward will be employment, or lack thereof. The impacts of COVID-19 may result in a double-digit unemployment rate, which is expected to impact housing demand.

When it comes to selling prices, RE/MAX reported some lowball offers at $40,000, $60,000 and $80,000 below asking, however none of those deals went through. Since then, those properties have gone pending close to the asking price.

Moving forward, RE/MAX expects an average five-per-cent price decrease in Edmonton throughout the rest of the year. Edmonton saw prices fall two to three per cent in 2019, based on buyer demand. Edmonton has more millennials than baby boomers, which makes it a unique marketplace. Buyers wants new homes, which means many dated homes in older neighbourhoods aren’t moving, while infill and new construction in those neighbourhoods are in high demand. Furthermore, RE/MAX is reporting an influx in downsizers who are using COVID-19 as the catalyst to sell the big house and move into a condo or smaller home.

Multiple offers are common in Edmonton’s housing market, with houses selling for $20,000 to $30,000 over asking price. This is due to buyers shifting and adjusting needs. This could present a good opportunity for investors and house flippers to tackle some of those older, larger homes.

Lenders tightening up their lending policies is a concern for the Canadian real estate economy, and how they assess and react to buyers’ employment status will affect the buyer pool. This will dictate the market in the next year post COVID-19.

Calgary real estate is experiencing a double-edged sword, due to COVID-19 and the oil industry, and the greater concern is oil. It is still too early to accurately predict where prices will trend in the coming year. Housing supply has come down, which has kept prices relatively steady. RE/MAX reports some multiple offers on properties that are priced appropriately in the right neighbourhoods. Meanwhile, some properties have seen large price drops, but it’s unclear if that is related directly to the pandemic or if it is related to the overall economy.

Some regions in Calgary are experiencing drops, but others are doing well. A five-per-cent price correction is a more likely scenario. Some price adjustments are happening already, but an 18-per-cent price drop across the board isn’t realistic. But if by chance it did happen, prices would bounce back again. Higher-priced properties will be most affected, while properties at lower price points are expected to remain fairly stable.

Vancouver real estate is fluctuating from week to week, not just on seller side but also on agent side as well. People are re-emerging, with RE/MAX reporting lots of new inventory and many multiple offers, not just on $500,000 condos but those priced in the $2-3 million range as well. and. Perception is that now with easing of restrictions, people are more confident that things are moving in the right direction.

It’s possible to have high unemployment, yet a very strong real estate market. Unemployment appears to be having a greater impact on lower earners, and with the region’s high real estate prices, homebuyers are typically those in the higher income bracket.

Vancouver Realtors who were initially fearful are back in business, and an 18-per-cent decline in Vancouver housing values – or anything close to that – is highly unlikely. A five-per-cent price correction is more likely.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Toronto Area Prices and Sales Plunge in April

05/05/20

The COVID-19 restrictions that were imposed in late March have caused both sales and prices to fall steeply in April.

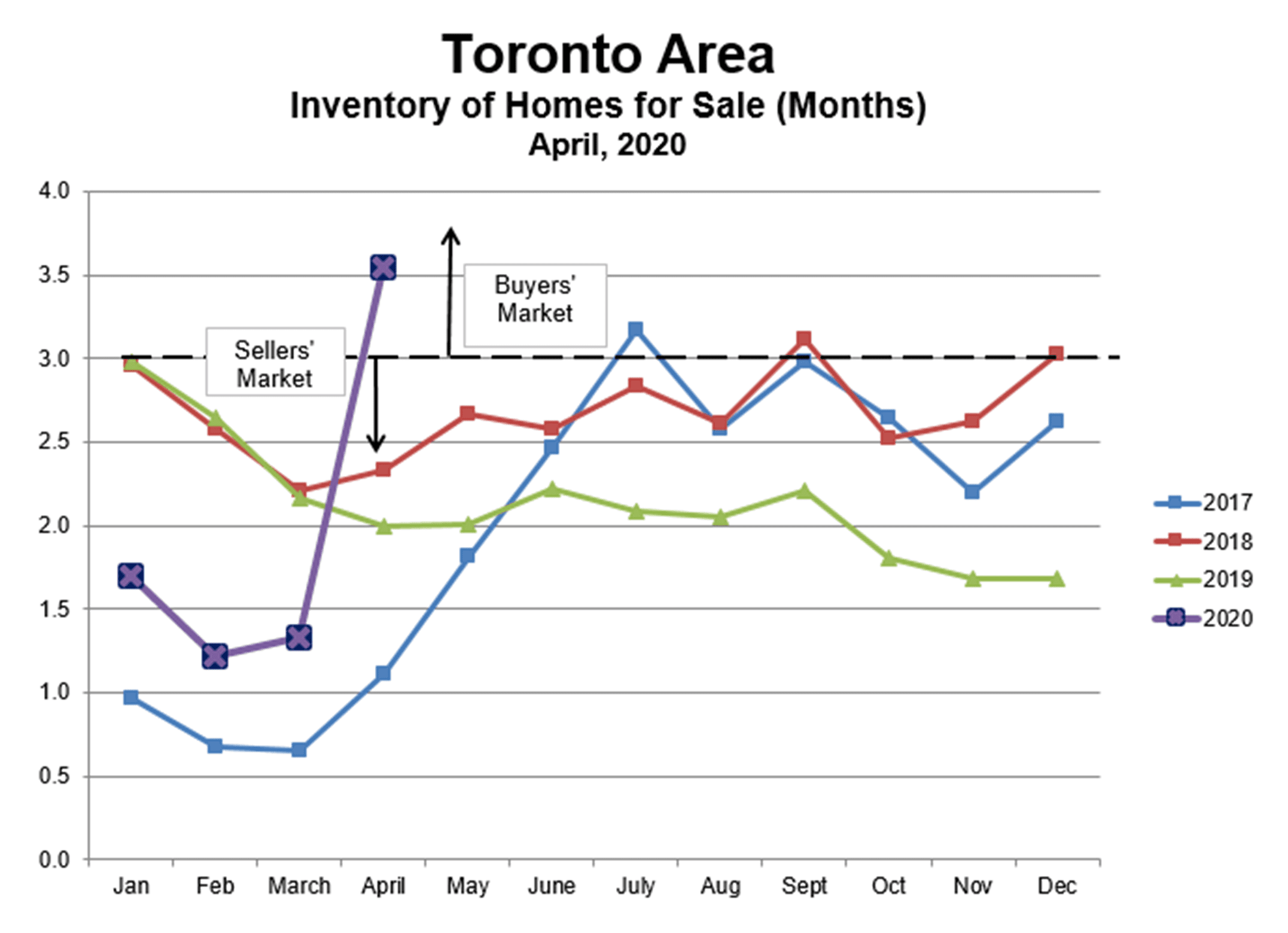

Sales for all property types fell by approximately 2/3 as compared with last April, while listings of properties for sale were about the same, so the inventory increased by almost a factor of three, from 1.3 months to 3.5 months. This places the GTA market firmly in buyers’ market territory.

Prices for freehold (predominantly detached) properties fell steeply in April, by 11% as compared to March and by 3% as compared to last April. A bubble had been forming since late 2019, similar to what we saw in 2017, but that bubble burst prematurely when the COVID-19 restrictions were imposed in late March. Basically, prices have retreated to (or somewhat below) the plateau that was in place from late 2017 (after that bubble burst) until late 2019.

Prices for condominum apartments are following a similar trajectory. Condo prices fell by 12% from last month, and by 2% as compared with last April. As in the case of freehold properties, all the froth in the bubble that was forming late last year and early this year has left the market. Unlike 2017, when freehold prices collapsed but condo prices did not, this time condo prices have equally fallen victim to the COVID-19 restrictions.

Whether prices continue to fall as the lockdown continues will depend on the balance of sales to listings. So far, it appears that the number of sellers is falling faster than the number of buyers, which means that inventory will fall. For now, this suggests that prices should remain relatively stable, especially since mortgage interest rates are likely to remain very, very low.

But it’s much harder to predict the direction of the market once the lockdown ends. It all depends on how long the lockdown lasts, and the extent to which confidence in jobs, the economy and personal safety returns once it’s over. The optimistic scenario is that everything returns quickly to something resembling normal, which would lead to a resurgence in sales and prices. On the other hand, if large numbers of jobs are permanently lost, and COVID-19 fears & behaviours persist, we could see more homes for sale (e.g., due to financial difficulties, marriage breakups, etc) and more cautious buyers wanting to repair their balance sheets and increase their savings. This could lead to a deeper and more persistent buyers’ market with steadily declining prices.

We’ll just have to wait and see how this all plays out.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Coronavirus Infects Toronto Rental Market

05/03/20

We have only limited data so far, but already it is clear that the number of MLS rental transactions in the GTA has plummeted by about 50% since the COVID-19 restrictions were imposed just over a month ago. There were approximately 2,500 MLS rental transactions per month in January, February and March, but only about 1,300 such transactions in April.

So far, rental prices have held up remarkably well. The average MLS rental price for freehold properties (e.g., houses, apartments in houses, and apartment buildings) was virtually unchanged in April as compared with January-March, while the average price for condo apartment rentals was down about 4%.

With many tenants at least temporarily out of work, and many others in fear of losing their jobs, it’s not surprising that the demand for rentals has dropped; and, together with the temporary banning of Airbnb rentals, this has significantly increased the inventory of available rental properties.

All of this points toward a continued decline in rental prices together with a continued increase in rental vacancies as the lockdowns drag on. On the surface this might seem to be good news for tenants in a market that has been exceptionally tight and, indeed, in a crisis due to very limited availability of rental accommodation and ever-increasing prices. For many tenants (those who still have steady employment) this will, of course, be good news. However, everybody needs to live somewhere, and so perhaps we will have an even bigger crisis of a somewhat different kind.

The decline in the rental market may also affect the resale market, particularly for condo apartments. Investors may conclude that it’s better to sell their condos than to leave them vacant for extended periods and/or accept significantly lower rents. While it’s far too soon to project how this will play out, it could exacerbate an already fragile resale market and contribute to a self-reinforcing downward spiral in condo apartment sales and prices.

Let’s hope the lockdowns end soon!

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!