Author: Dave Proulx

Spacious High Park Detached

02/08/20

Welcome to 280 Keele Street, a spacious three storey home in Toronto’s trendy Junction neighbourhood. This generous property would make a wonderful single-family home, and could also easily be turned into a three-unit residence.

Step into the grand foyer, which boasts beautiful, original wood trim and a massive front hall closet. French doors lead to the living area with a working fireplace and custom, original hardwood flooring in a unique pattern. A second set of French doors open to a large dining room with soaring ceilings. The main floor also features a conveniently located four-piece bathroom, an airy kitchen with a double sink and ample storage, and a bright sunroom that walks out to a deck and a large backyard, perfect for entertaining.

The expansive second level has four bedrooms, including a roomy master with a large closet and a triptych bay window. The second bedroom has a large closet as well. This level also features original hardwood flooring and trim throughout and another four-piece bathroom. The third level has two large, additional rooms with lots of closet space. The third level has rough-in plumbing for a potential kitchen, and it would be easy to convert the 2nd and 3rd floors into a very spacious two level apartment. The main floor could, in turn, serve as a separate one bedroom apartment.

The lower level is already designed as its own unit with a separate entrance. It features a kitchen, four-piece bathroom, living/dining area, bedroom, laundry, and ample storage.

A licensed parking pad at the front of the house makes it easy to park your vehicle, and this home is also steps from the TTC (41 Keele, 89 Weston, and 26 Dupont buses), a short ten-minute walk to Keele station, and is close to the Go and UP Transit’s Bloor Station and the West Toronto Railpath. 280 Keele is in a sought-after school district, falling in the catchment for Annette St. Jr. and Sr. Public, Humberside CI, and Western Tech. The vibrant Junction strip on Dundas is steps away, with its robust collection of restaurants, bars, and shopping.

With its terrific location, ample space, and adaptable layout, this spacious home is just waiting for you to move in!

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Mortgage Rates Are Falling, But This May Not Affect Prices

02/07/20

Largely because of the Novel Coronavirus and the resultant ‘flight to safety’ among investors, Government of Canada bond prices are being bid up, and this means that the corresponding interest rates are falling (bond prices and interest rates move in opposite directions). The major banks’ fixed mortgage rates are tied to these bond rates, and so they are falling too. However, these lower rates don’t automatically mean that homebuyers will be able to qualify for larger mortgages. Here’s why.

The federal government introduced new lending rules two years ago. These rules require that all mortgage lenders qualify based upon either the government of Canada’s ‘benchmark’ rate or the actual mortgage rate plus 2%, whichever is higher. This means that lower mortgage rates will not change lenders’ ability to qualify unless the government’s benchmark rate is also reduced.

Recently TD Canada Trust reduced it’s posted 5 year rate from 5.43% to 4.99%, in line with the reductions in it’s ‘actual’ fixed mortgage rates, and this could lead other major banks to follow suit. If all the major banks lower their posted rates, this could induce the government to reduce it’s benchmark rate by a similar amount. Then, and only then, will homebuyers be able to qualify for larger mortgage loans.

The GTA real estate market has been heating up steadily over the past few months without any change in the benchmark rate, and so it is quite possible that the government will decide to leave the benchmark rate where it is to avoid adding fuel to the fire and potentially causing or facilitating another 2017-like price bubble. It’s also possible that bond prices will retreat once the coronavirus crisis has passed, and the government may want to avoid “yo-yoing” their benchmark rate. For both of these reasons, I’m not expecting a quick reduction in the mortgage qualification rate. It’s even possible that the government rate could be increased if they feel this is needed to cool down the market.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Airbnb Bylaw Is Now In Effect in Toronto

01/15/20

Early in 2018, the City of Toronto approved the regulation of short-term rentals in Toronto. However, the resulting zoning bylaw amendments were immediately appealed to the Local Planning Appeal Tribunal (LPAT). Almost 2 years later, on November 18, 2019, the LPAT issued a ruling dismissing the appeal and upholding the bylaw amendments. The new bylaw is therefore now in effect, and the City of Toronto is moving forward with it’s implementation.

The bylaw defines short-term rentals as:

“all or part of a dwelling unit in the City of Toronto used to provide sleeping accommodations for any rental period that is less than 28 consecutive days in exchange for payment.”

This includes existing bed and breakfast’s but excludes hotels, motels, and accommodations where there is no payment (for example, staying with friends and family, and couch-surfing).

The key details are:

- Short-term rentals are permitted across the city in all housing types in residential and the residential component of mixed-use zones.

- People can host short-term rentals in their principal residence only – both homeowners and tenants can participate.

- People can rent up to three bedrooms in a unit for an unlimited number of nights per year (less than 28 consecutive days) or their entire home for a maximum of 180 nights per year.

- People who live in secondary suites and laneway suites can also participate, as long as the secondary suite/laneway suite is their principal residence.

Short-term rental companies will be required to be licensed with the City of Toronto. A short-term rental company is any company facilitating or brokering short-term rental reservations online and receiving payment for this service.

- Applicants will be required to pay a one-time licence application fee of $5,000 and an ongoing fee of $1.00 for every night booked through the company.

- Licensees will be required to ensure that all listings have valid registration numbers.

- Upon licensing, short-term rental companies will be required to provide a process for removal of listings that do not have valid registration numbers, and a procedure for dealing with problematic operators and responding to complaints.

- Short-term rental companies will be required to keep records of short-term rental activity and provide them to the City as requested.

Short-term rental operators (people renting their homes on a short-term basis) will be required to register with the City of Toronto.

- Operators will be required to pay registration fee of $50 per year and post their City-issued registration number in all advertisements.

- People renting their homes on a short-term basis will be required to pay a 4 per cent Municipal Accommodation Tax (MAT) on all rentals that are less than 28 consecutive days.

- Operators will need to provide the City with information, including:

- contact information and address

- details of the short-term rental

- name and telephone number of an emergency contact person who will be available 24 hours a day during rental periods.

- Government-issued identification is required to demonstrate that the short-term rental is the operator’s principal residence and that they are over the age of 18.

- Operators will also be required to keep records of short-term rental activity and provide to the City upon request.

The City is planning to implement the licensing and registration rules for short-term rentals in phases. This page will be updated as more details are available.

Phase 1: Complaint-based investigation – ongoing

As the licensing and registration system is being put in place, the City will respond to issues on a complaint basis. Residents can contact 311 to report issues related to short-term rentals, such as noise, waste and zoning infractions and the City will investigate accordingly.

Phase 2: Licensing and registration – Spring 2020

Licensing of short-term rental companies and registration of operators will begin in spring 2020. Current and prospective short-term rental operators will have three months to register. During this time, the City will educate the public on short-term rental rules, encourage operators to register their short-term rentals, and work with companies to ensure compliance with the licensing rules.

Phase 3: Enforcement and MAT – Summer 2020

All current short-term rental operators will need to be registered by the end of phase 2. The City will take enforcement actions against short-term rental operators that are not registered or are not following the rules. As of the end of phase 2, registered short-term rental operators will also be required to start paying the four per cent Municipal Accommodation Tax (MAT) on a quarterly basis.

Enforcement action will also be taken against companies that allow unregistered operators to list on their platform or contravene the bylaw. Anyone currently involved in Airbnb rentals or thinking about doing so would be wise to familiarize themselves with all the new rules.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Strong December Bodes Well For Toronto Homes In 2020

01/11/20

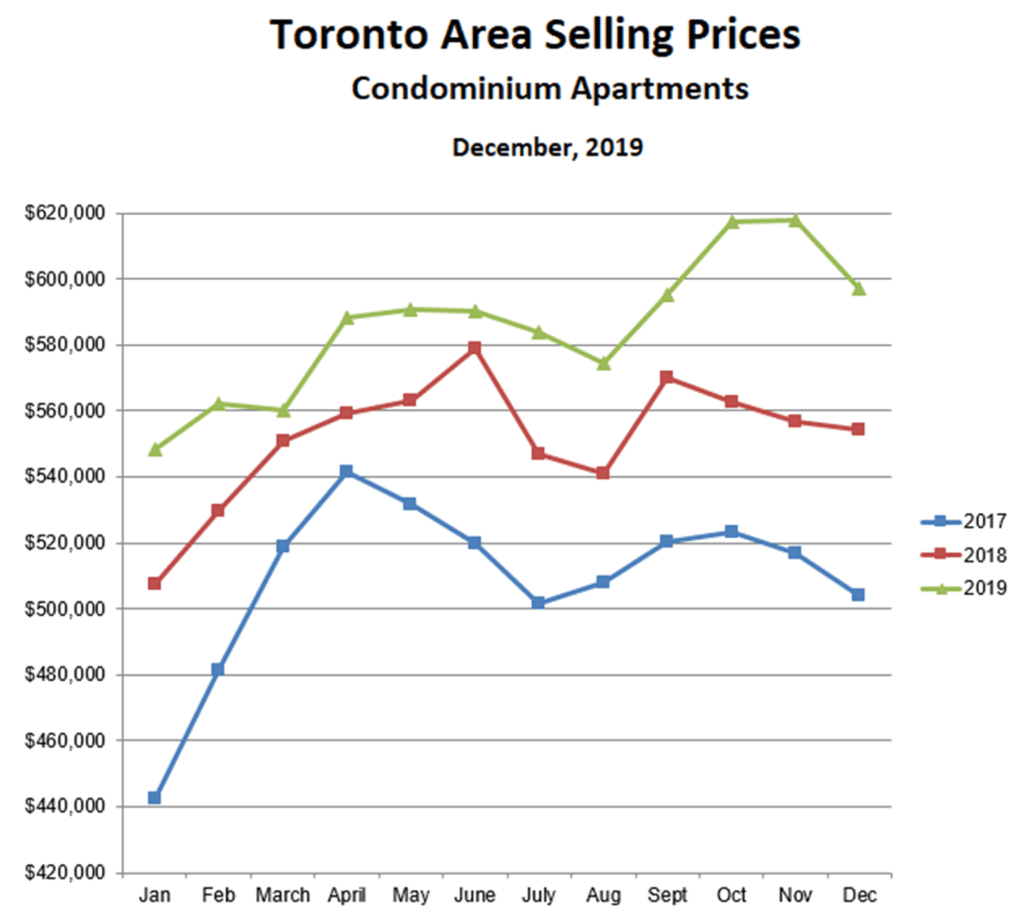

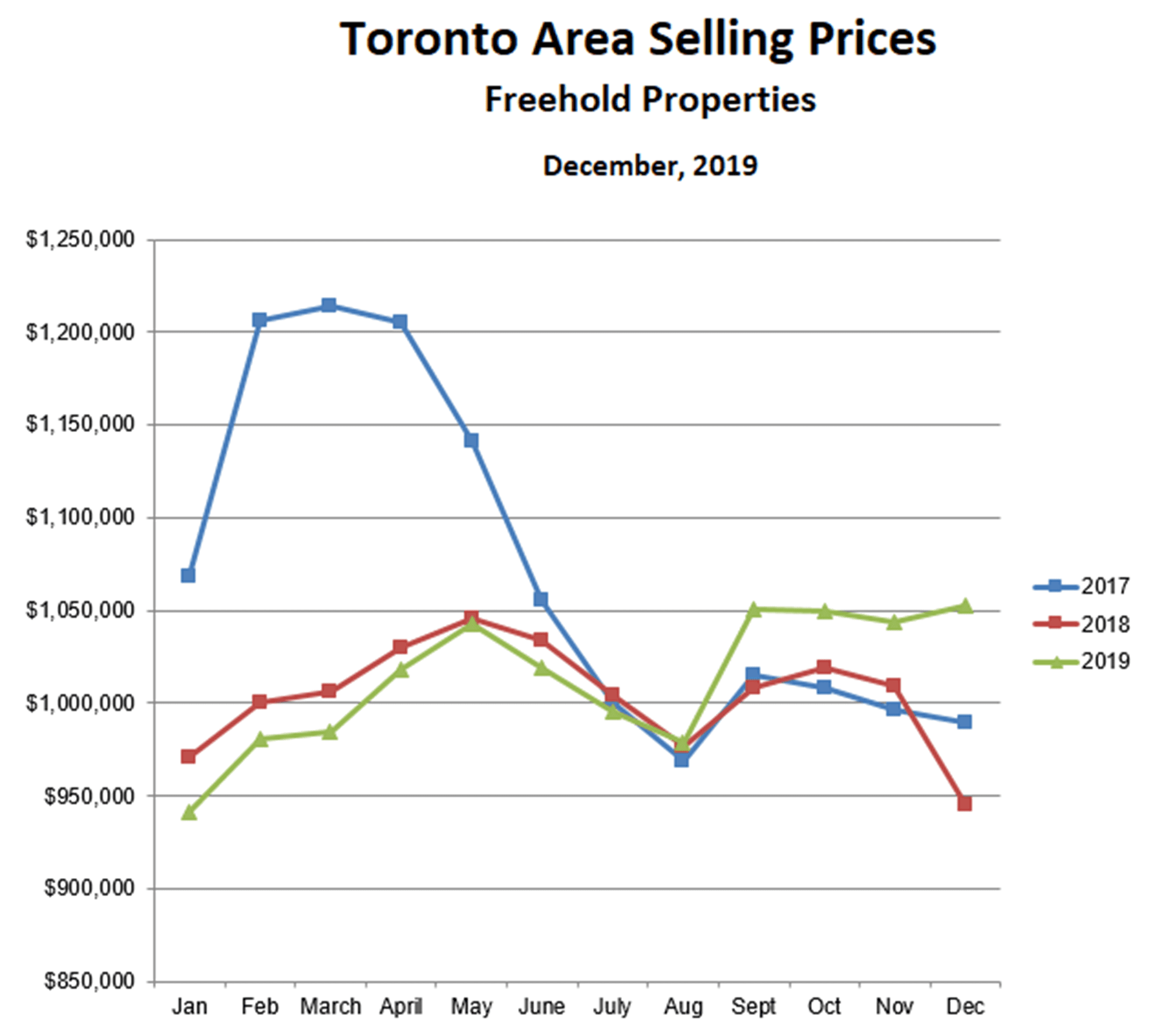

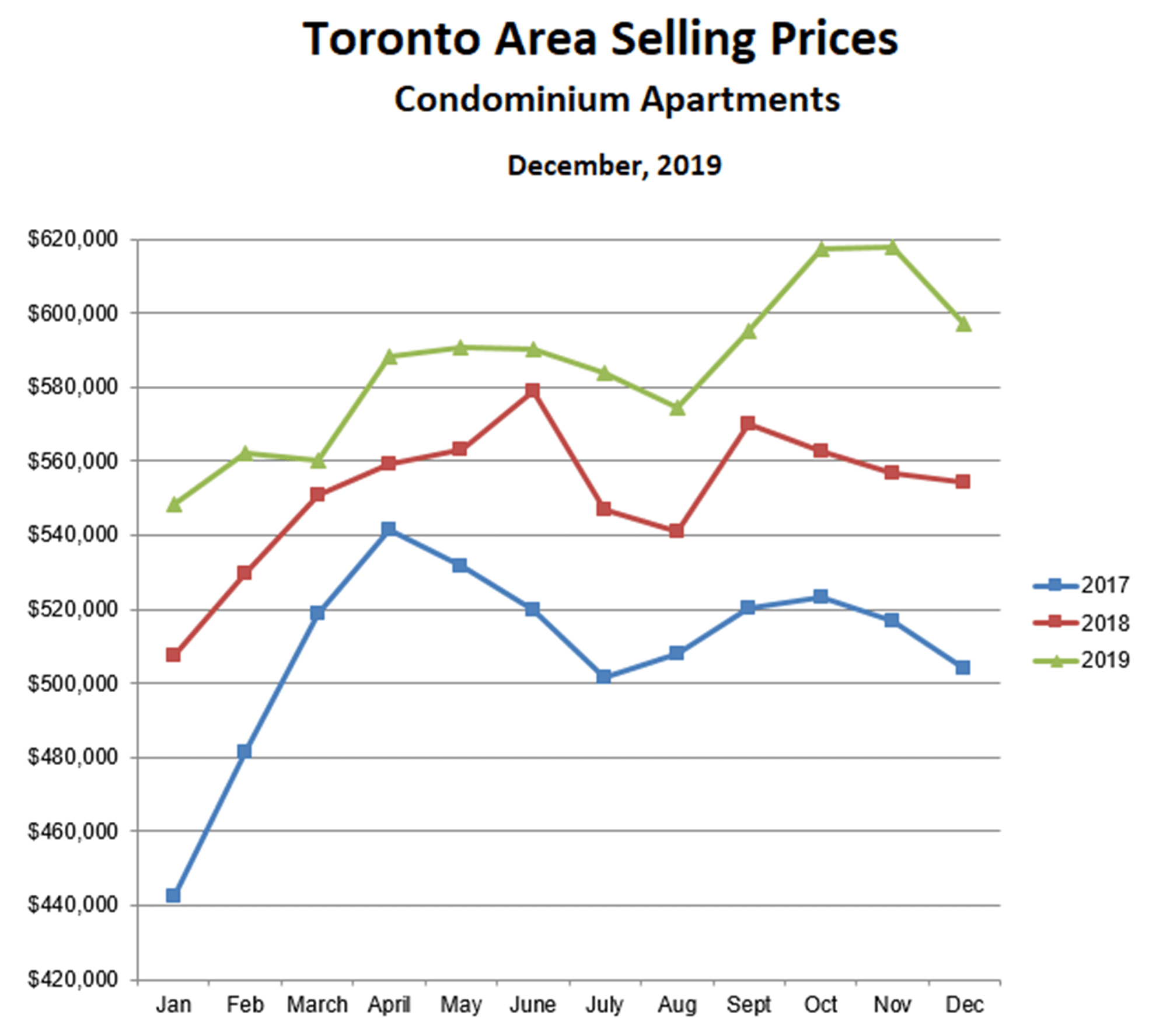

The breakout trend for Toronto area freehold properties continued in December. Prices were a stunning 11% higher than last December and sales were 25% higher. Even more surprising, prices in December were actually higher than in November, which almost never happens. Despite the relative weakness in the first 8 months of 2019, total year sales of freehold properties were up 20% over 2018, and total year prices were almost exactly the same, so the last 4 months made up for the first 8. The consistent strength over the past 4 months hints at a hot spring market in 2020. Expect both sales and prices to increase significantly, although probably not to the extent that we saw in the bubble three years ago.

Prices and sales for condo apartments also continued to be healthy in December though, for once, not as strong as freehold properties. December condo prices were up 8% over last December, and sales were up 6%, though prices were 10% lower than the all-time-high reached in the previous month. Total year condo sales were up 3% while prices were up 7%. For 2020, the expect more of the same for condos, with continued growth in sales and prices, though probably not accelerating like freehold properties.

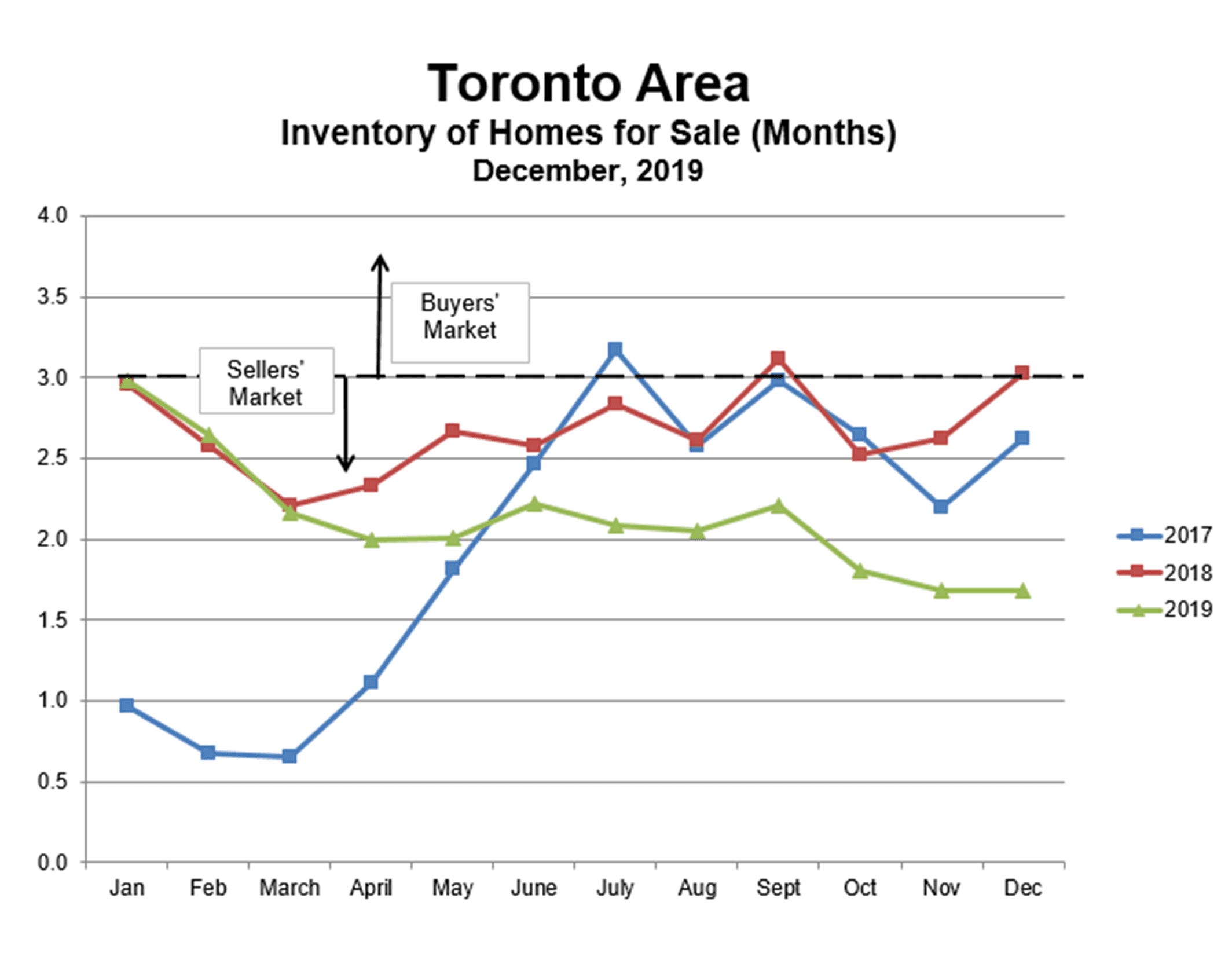

The main drivers of this strong market are continued low interest rates (with even lower rates likely to come) together with steadily declining inventory – there are steadily fewer homes for sale with steadily increasing buying pressure. Inventory has been less than 2 months’ supply for the past three months, very deep in ‘sellers’ market’ territory, though still nowhere close to the extreme that we saw in early 2017. Here also we can see the unusual strength in the market in December, as inventory almost always rises at the end of the year.

Hold on to your hats, it’s probably going to be wild ride over the next few months!

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!