Author: Dave Proulx

Toronto Market Builds Energy For Spring

01/26/23

It’s normal for the real estate market to start off very slowly in early January, and this year is no different. Sales and prices were well below last month in the first two weeks of the year, but both are accelerating as we get closer to February. This augurs well for a healthy spring market notwithstanding all the doom and gloom that’s in the air.

Freehold (detached, semi-detached and attached homes)

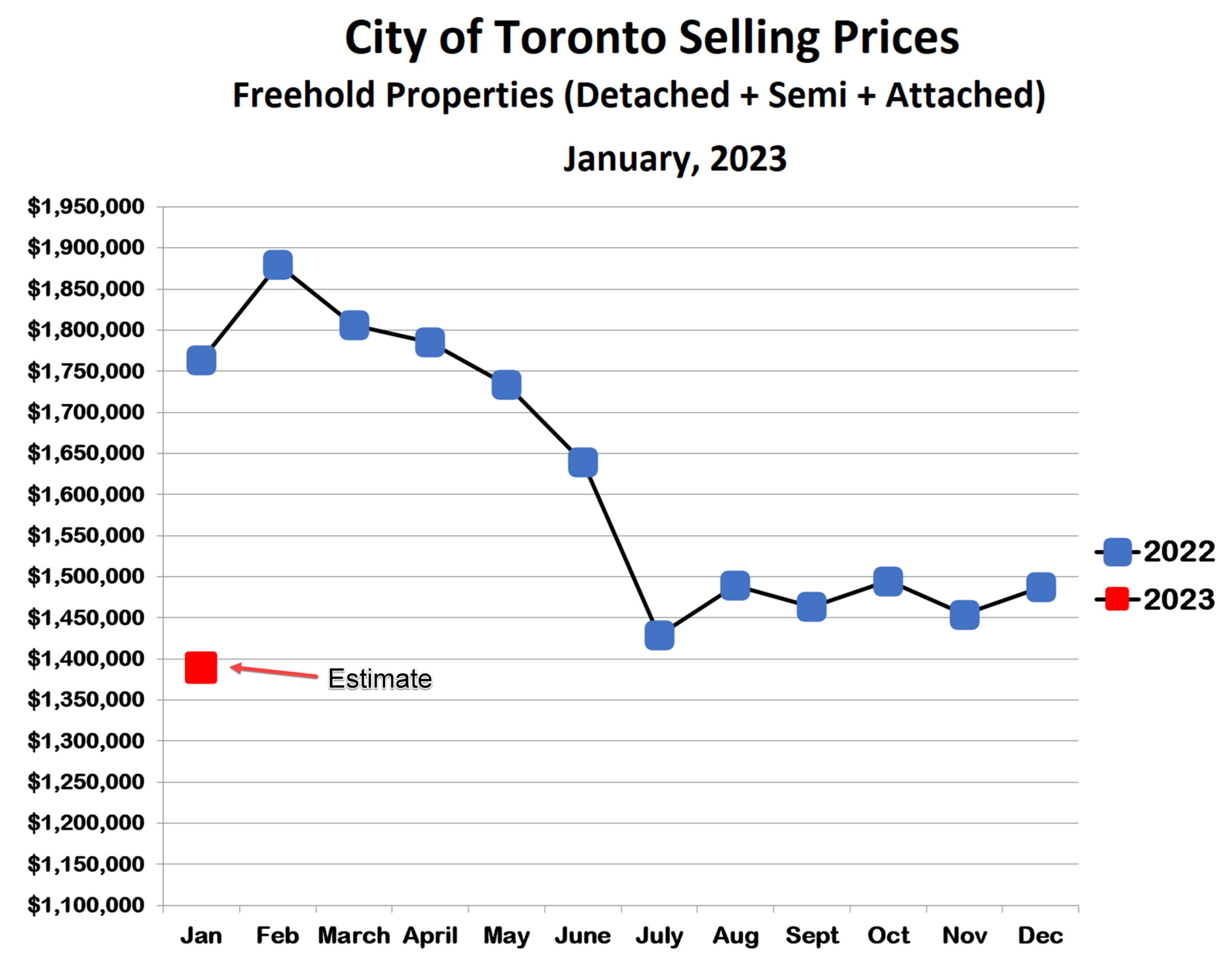

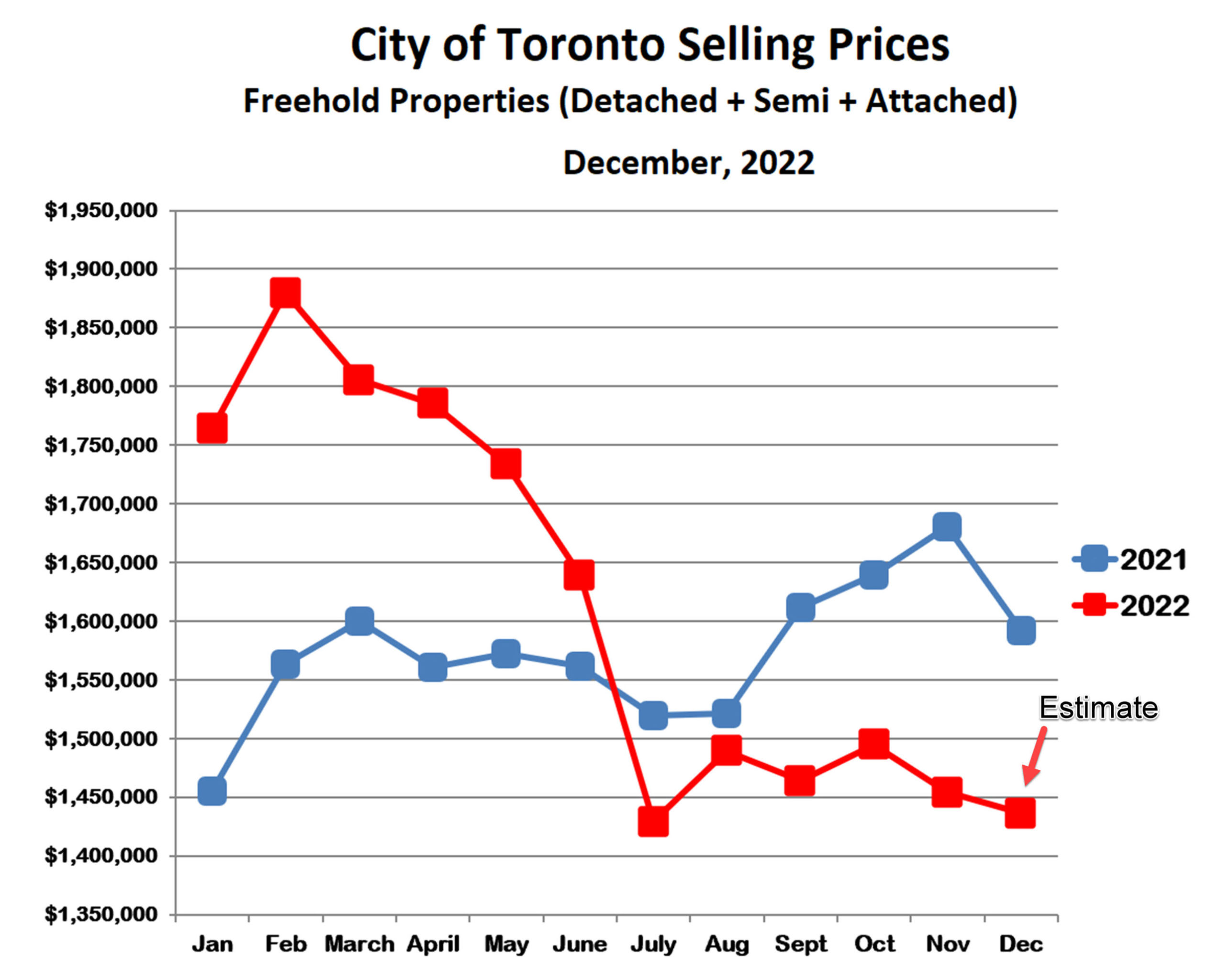

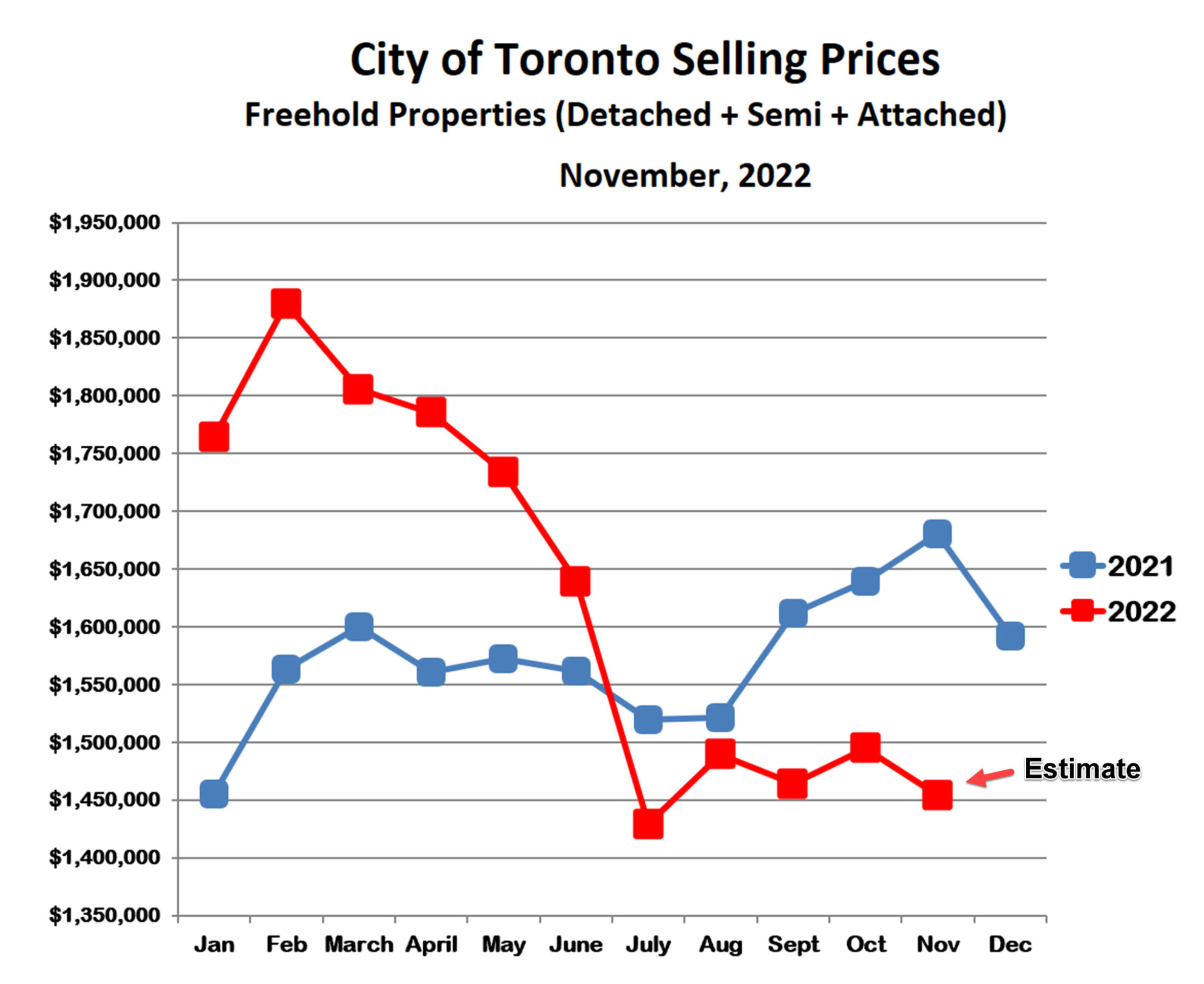

As of late January, prices for freehold properties were slightly below the $1.4-$1.5 million range that we saw throughout the second half of 2022. However, prices are increasing steadily, from an average of $1,336,278 in the first two weeks, to an average of $1,437,396,396 since then. So prices are already back to 2022 levels and likely to rise further in February.

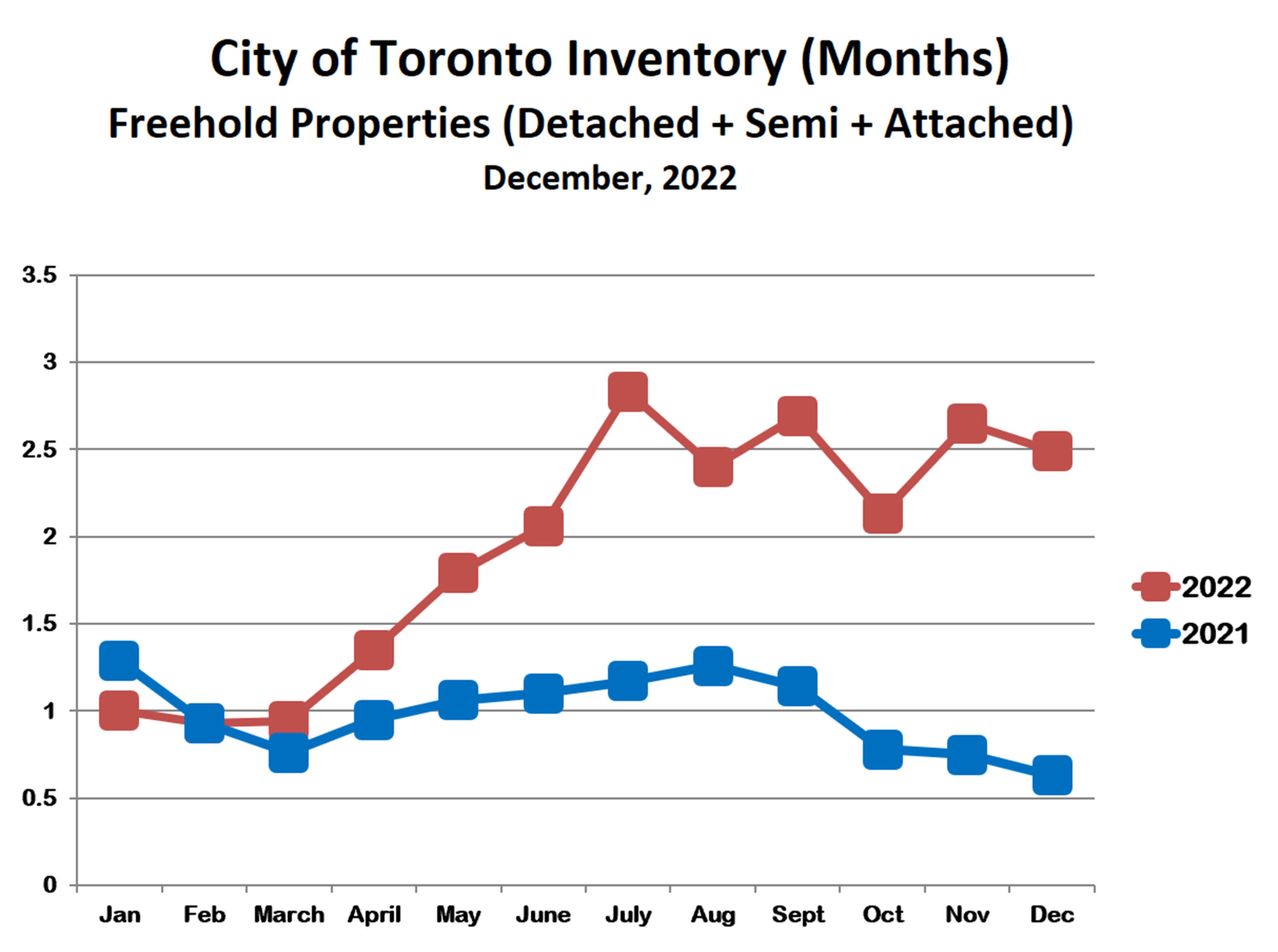

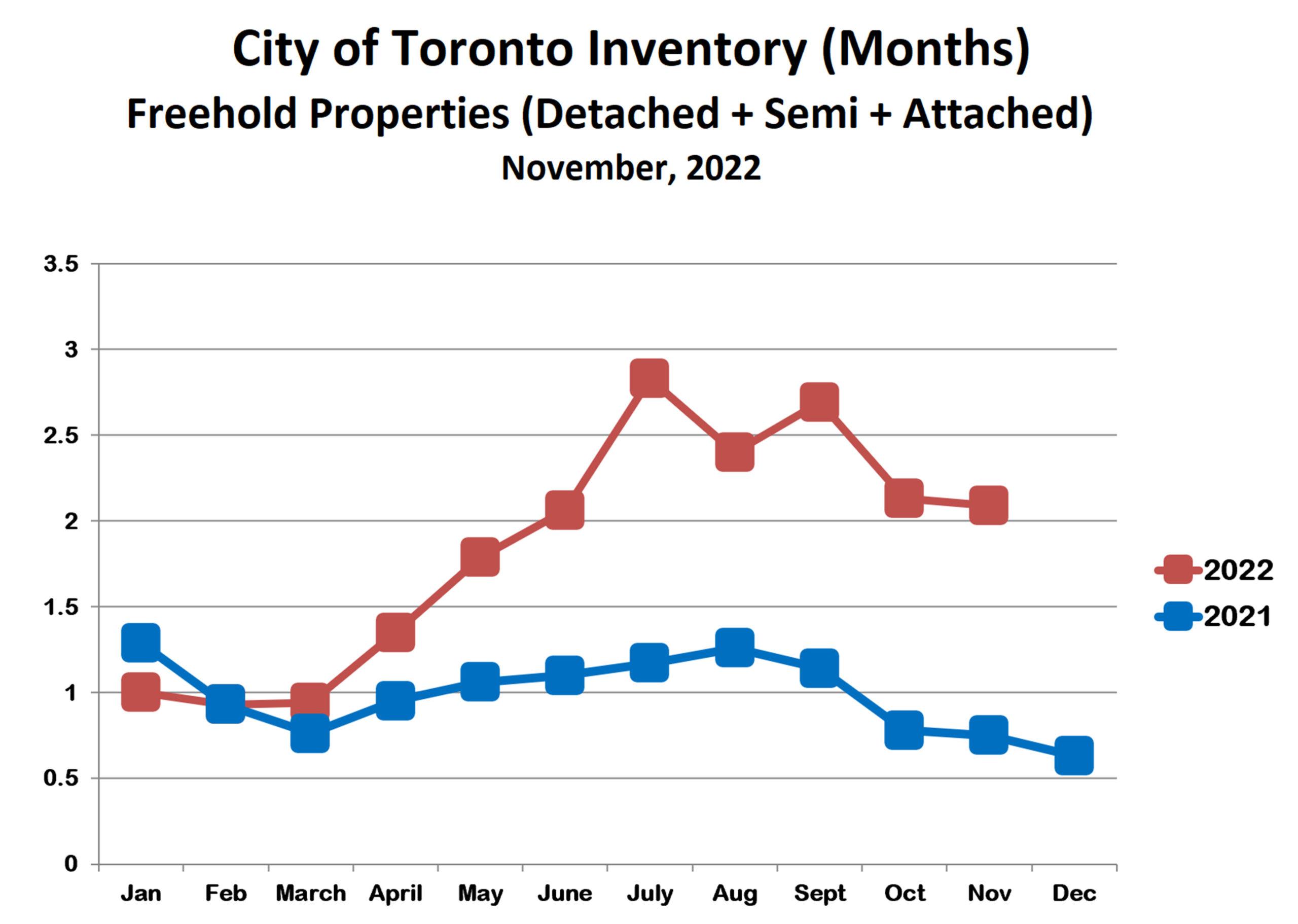

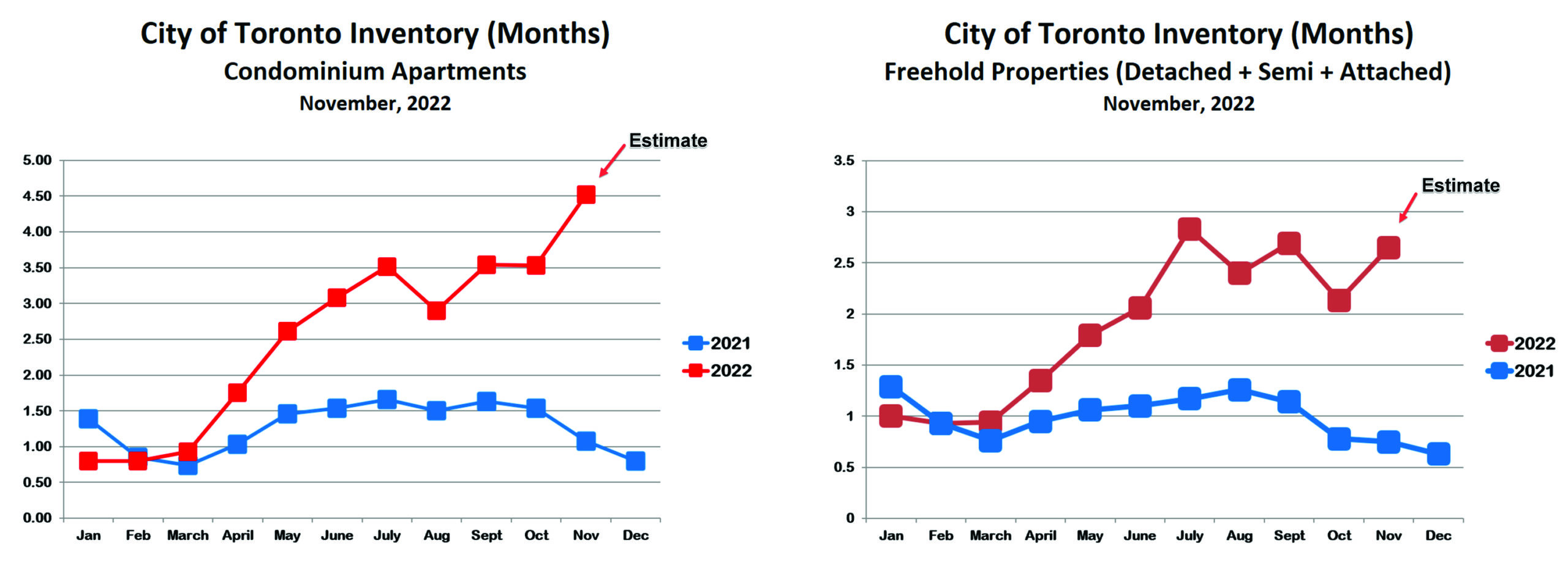

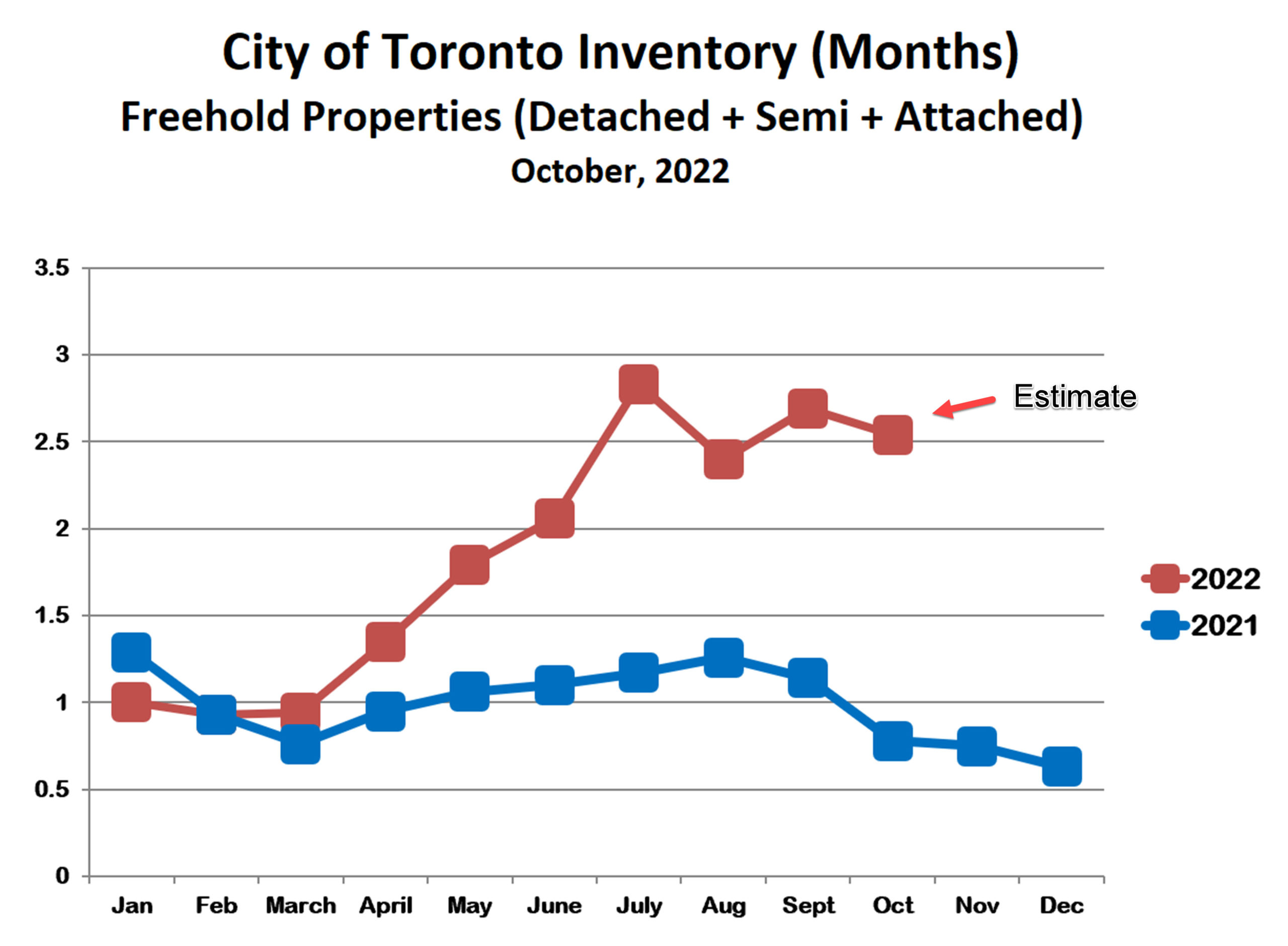

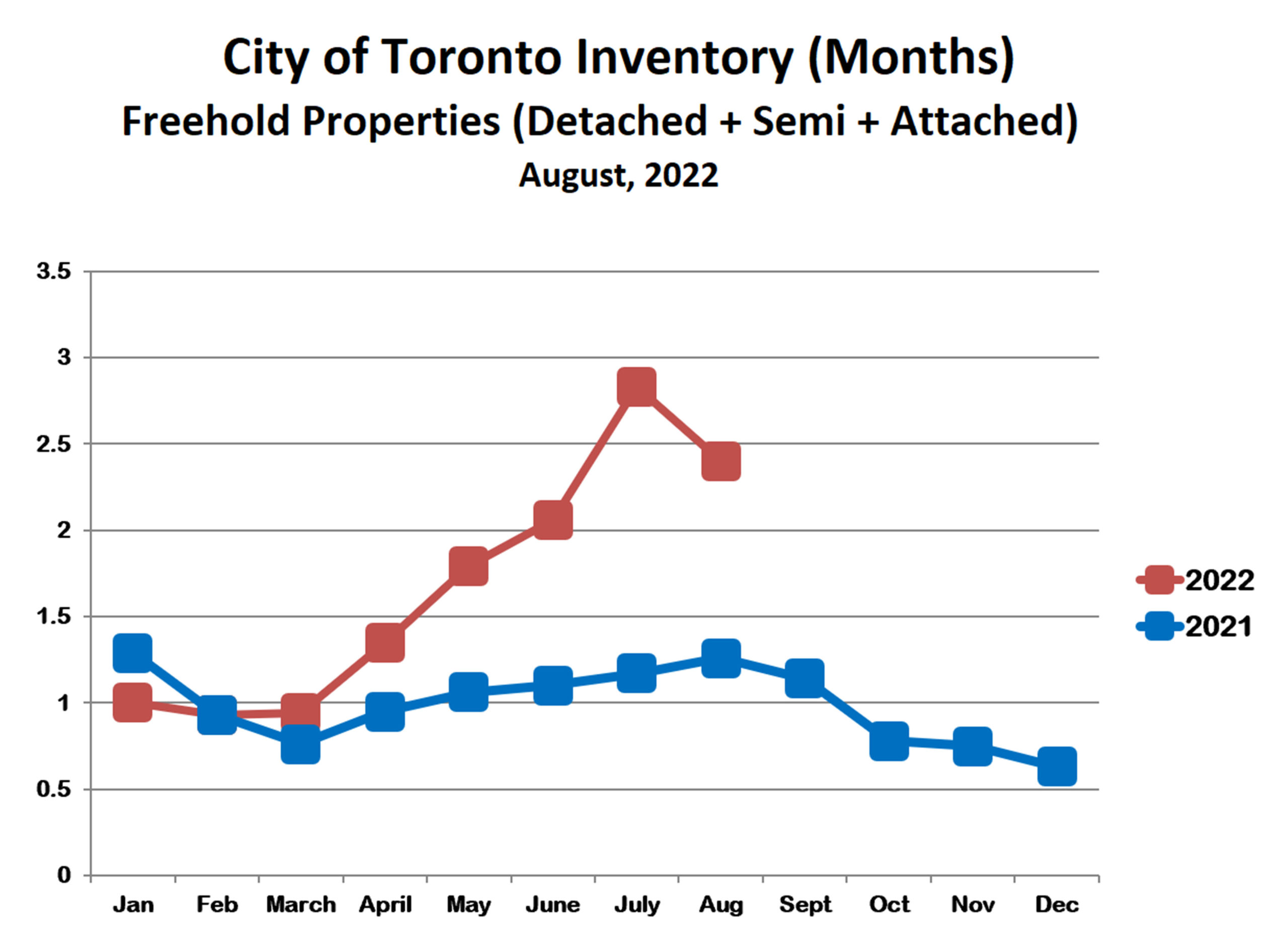

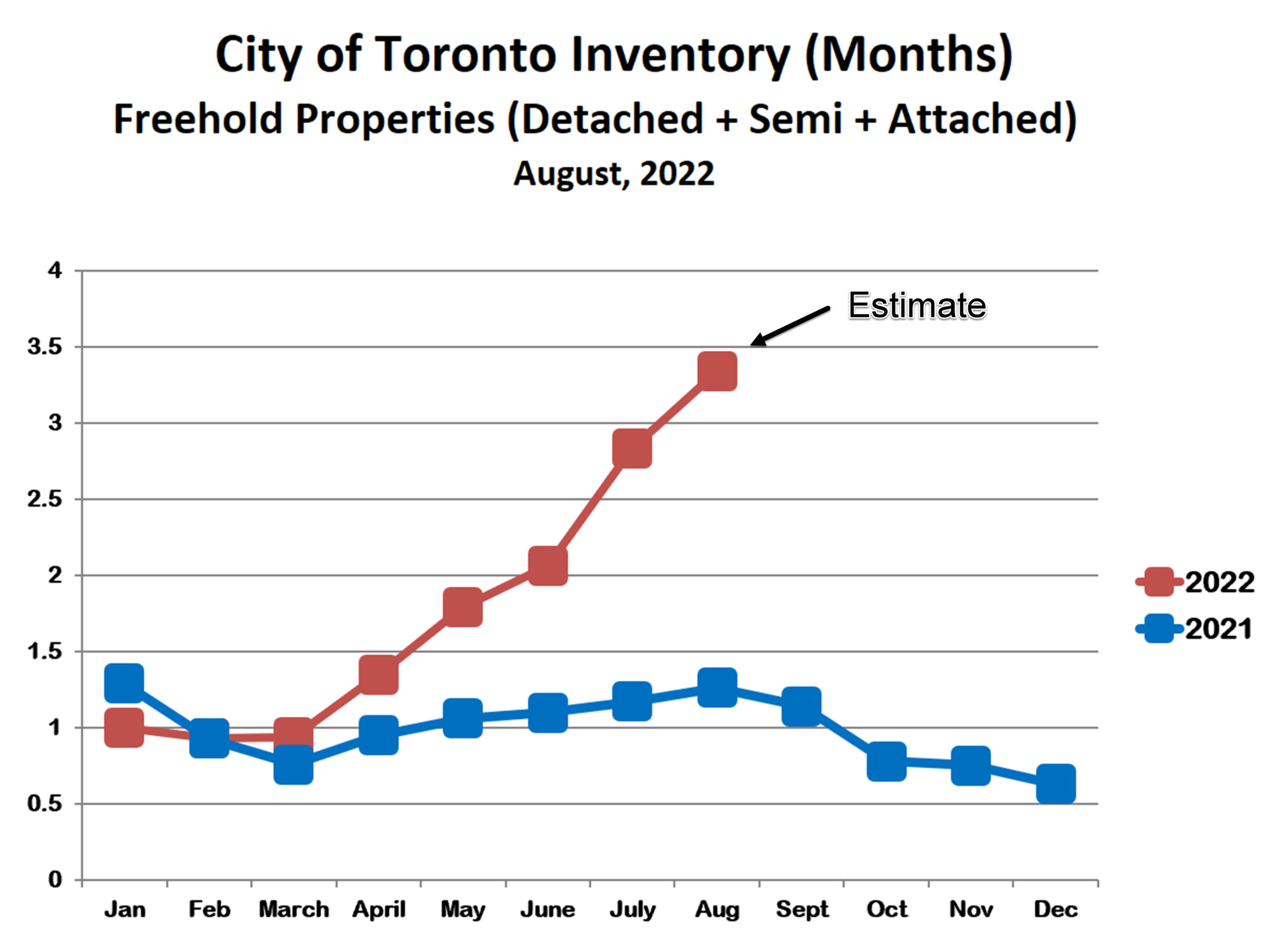

The inventory of freehold properties for sale rose in the second half of 2022 and remained steady between 2 and 3 months’ supply over the past 7 months. This was further evidence that the correction from the 2021/2022 bubble was complete and the market had stabilized. So far in 2023, sales have declined significantly while active listing fell only slightly. This means that January inventory will likely clock in much higher than last year. The fact that prices are remaining relatively steady is another encouraging sign for the spring market.

Condominium Apartments

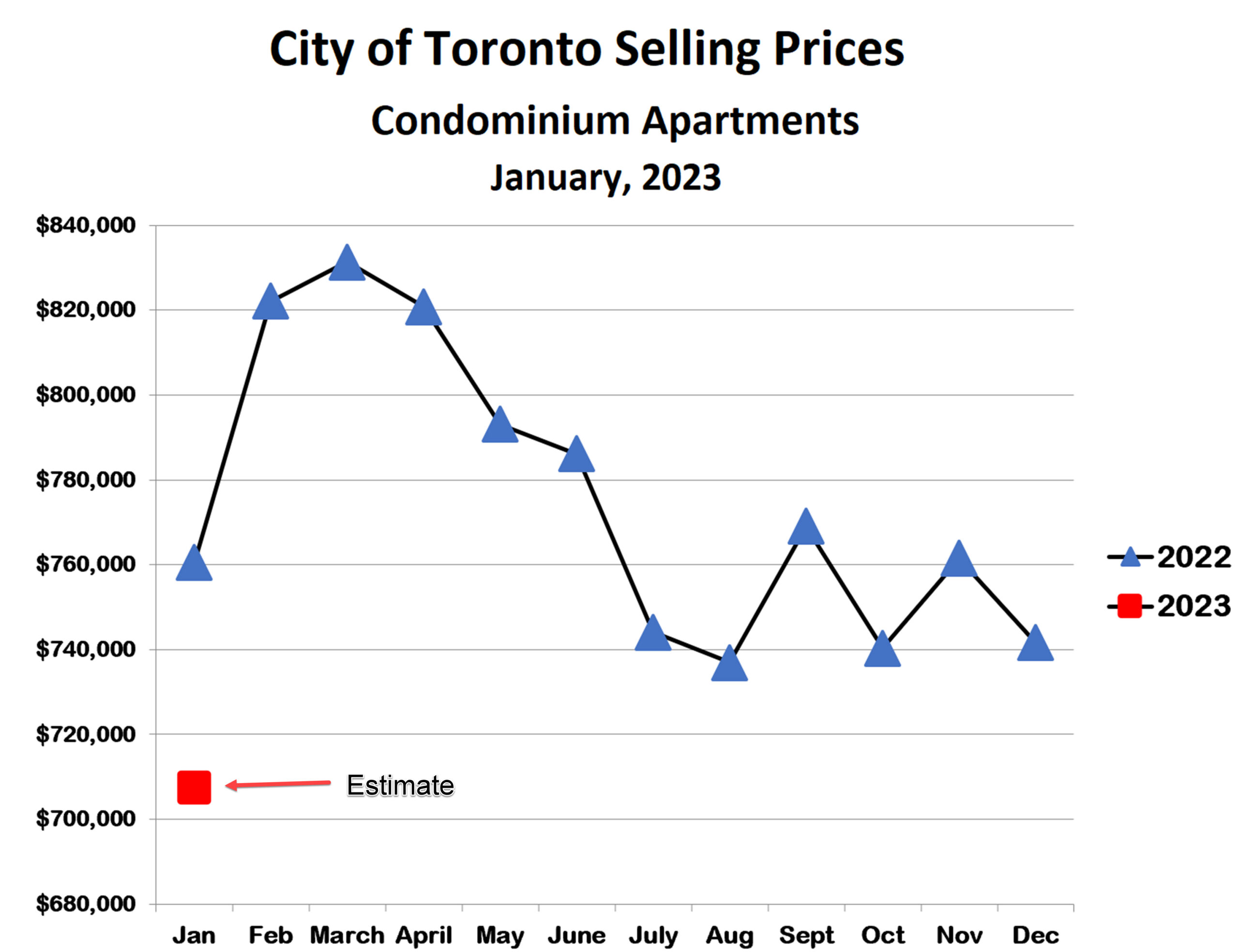

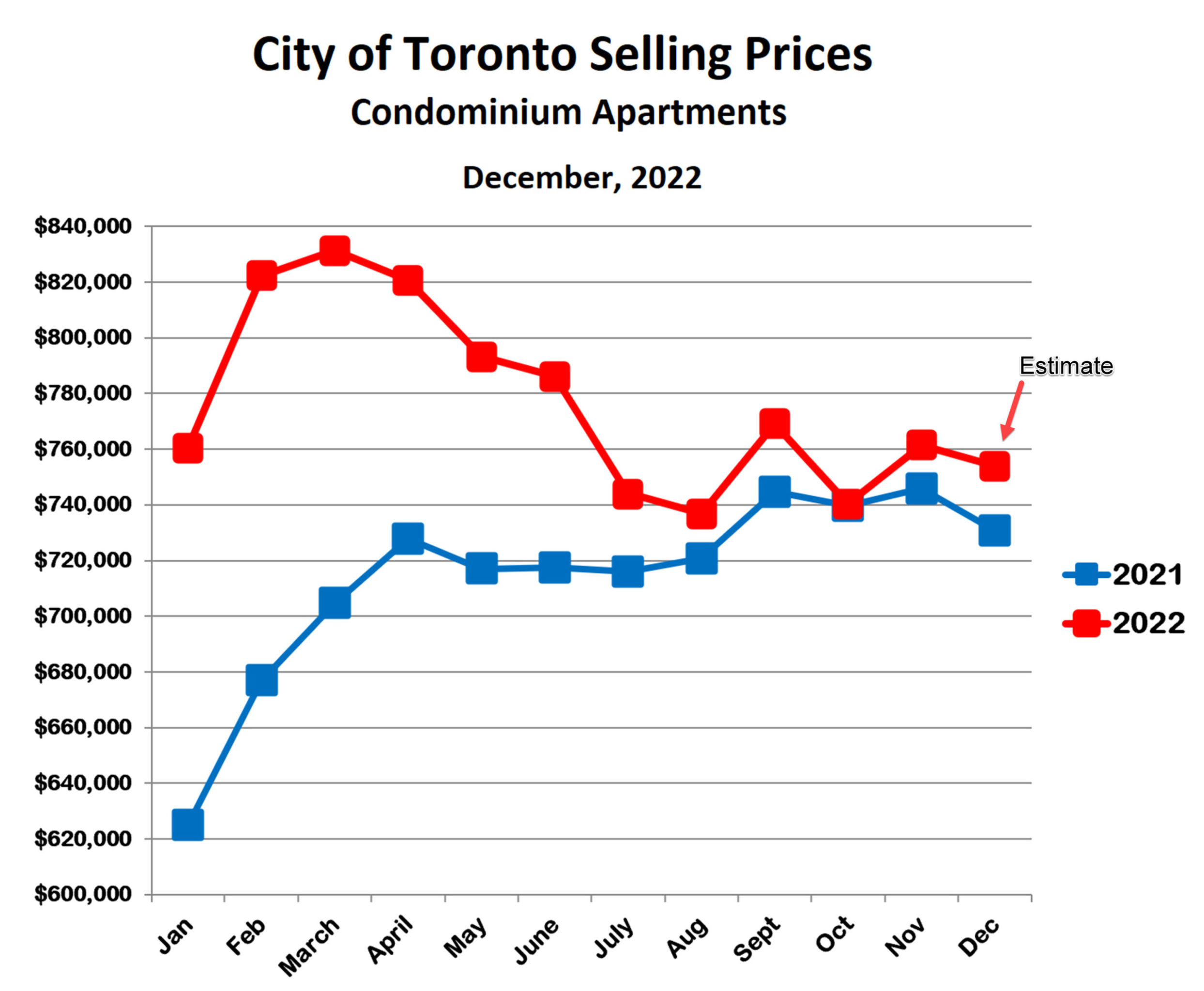

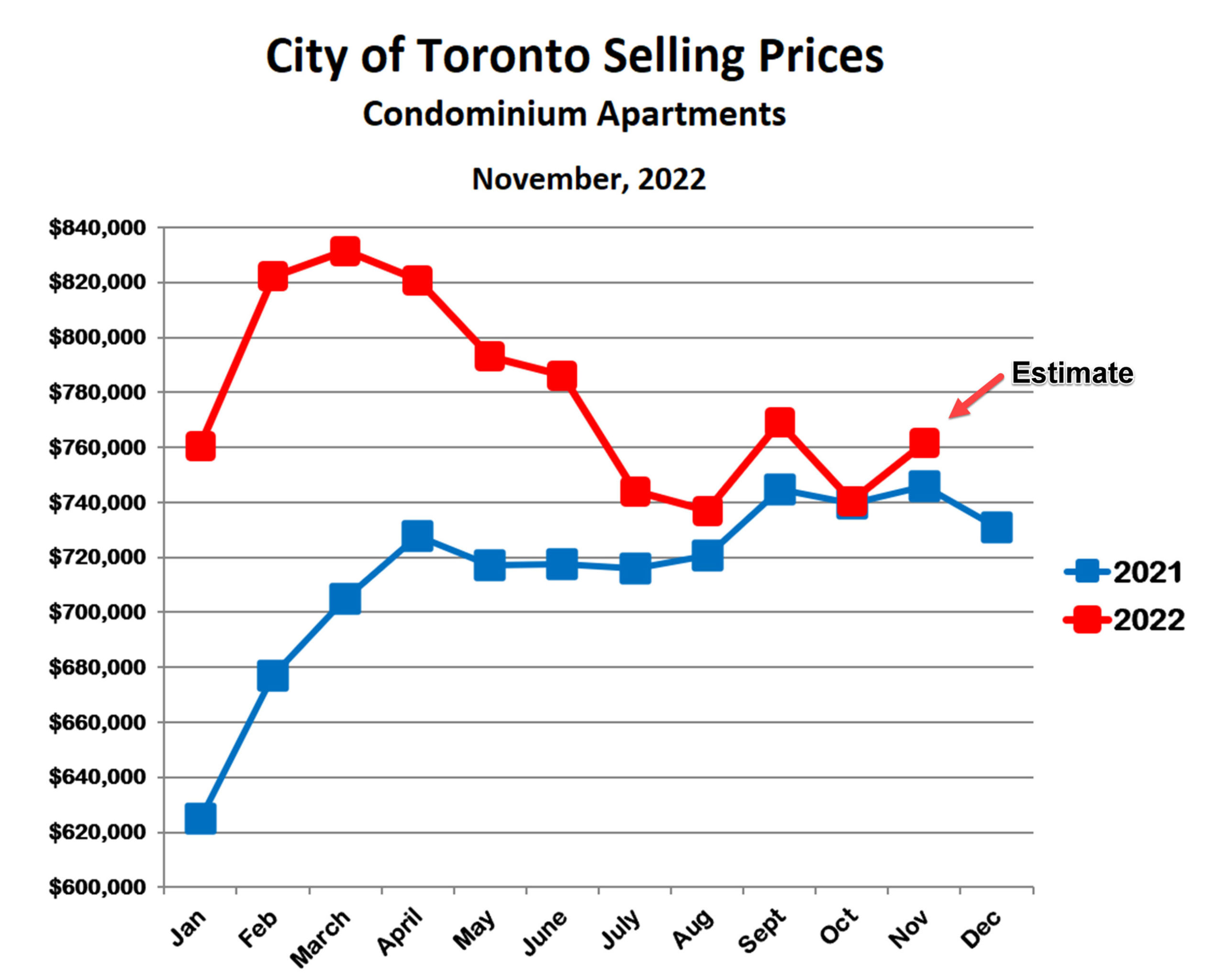

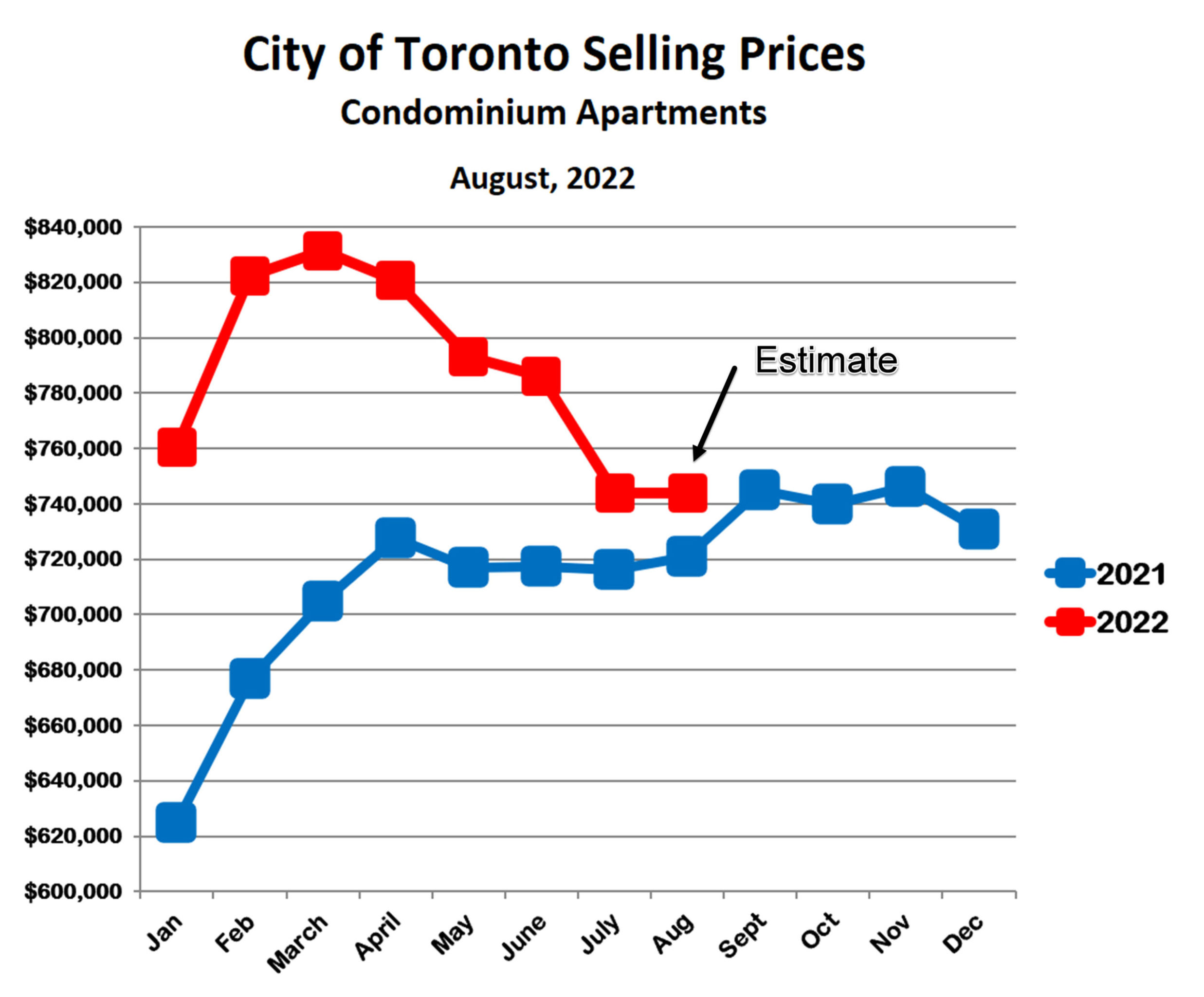

Condo prices in the City of Toronto remained in a narrow range throughout the last 6 months of 2023, much like freehold properties. Prices in January were quite low in the first two weeks (average $691,630), and have increased since then to $725,731. While this is still lower than last year, it does point toward further improvement next month, with prices likely reaching or exceeding last fall.

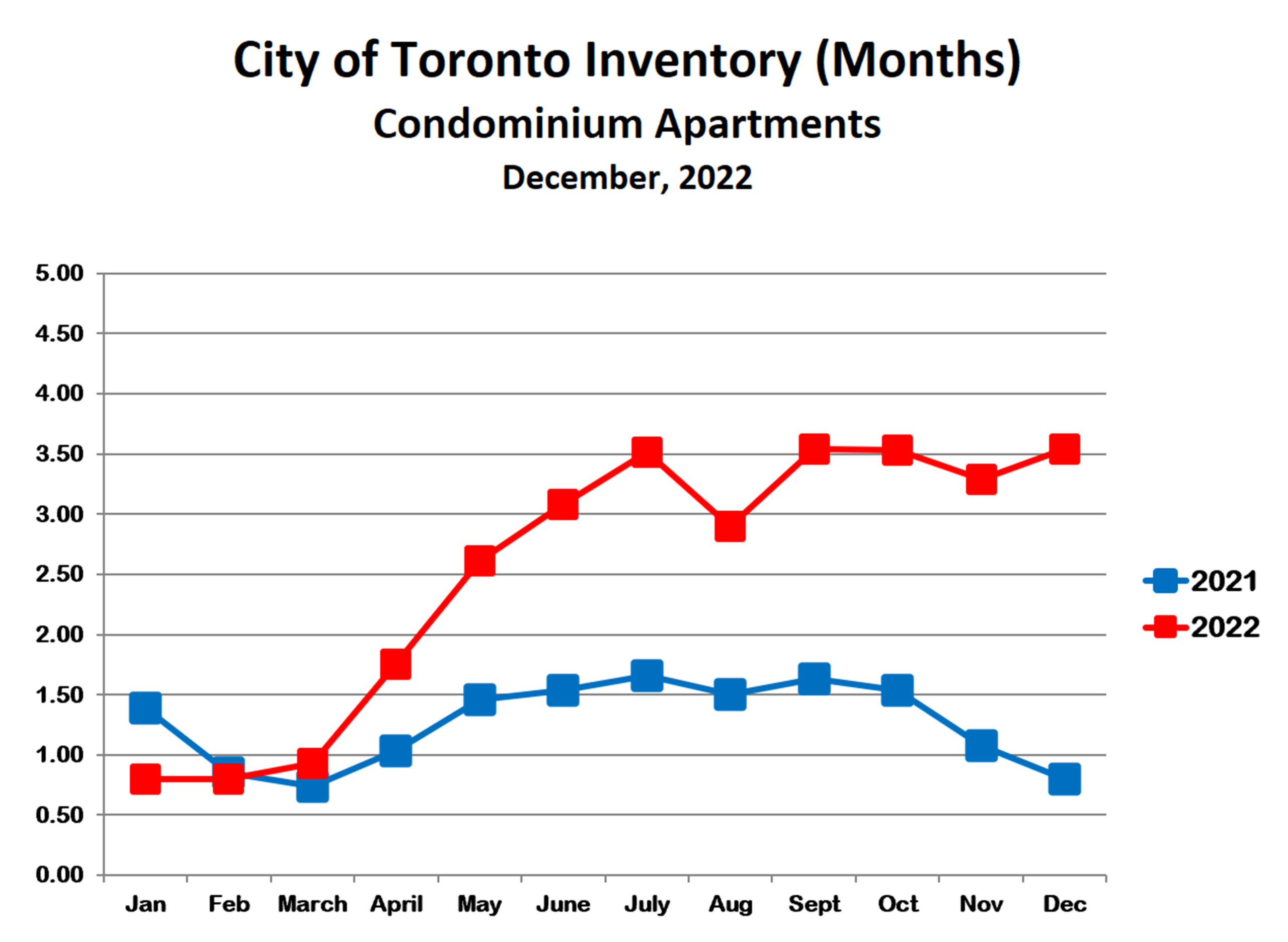

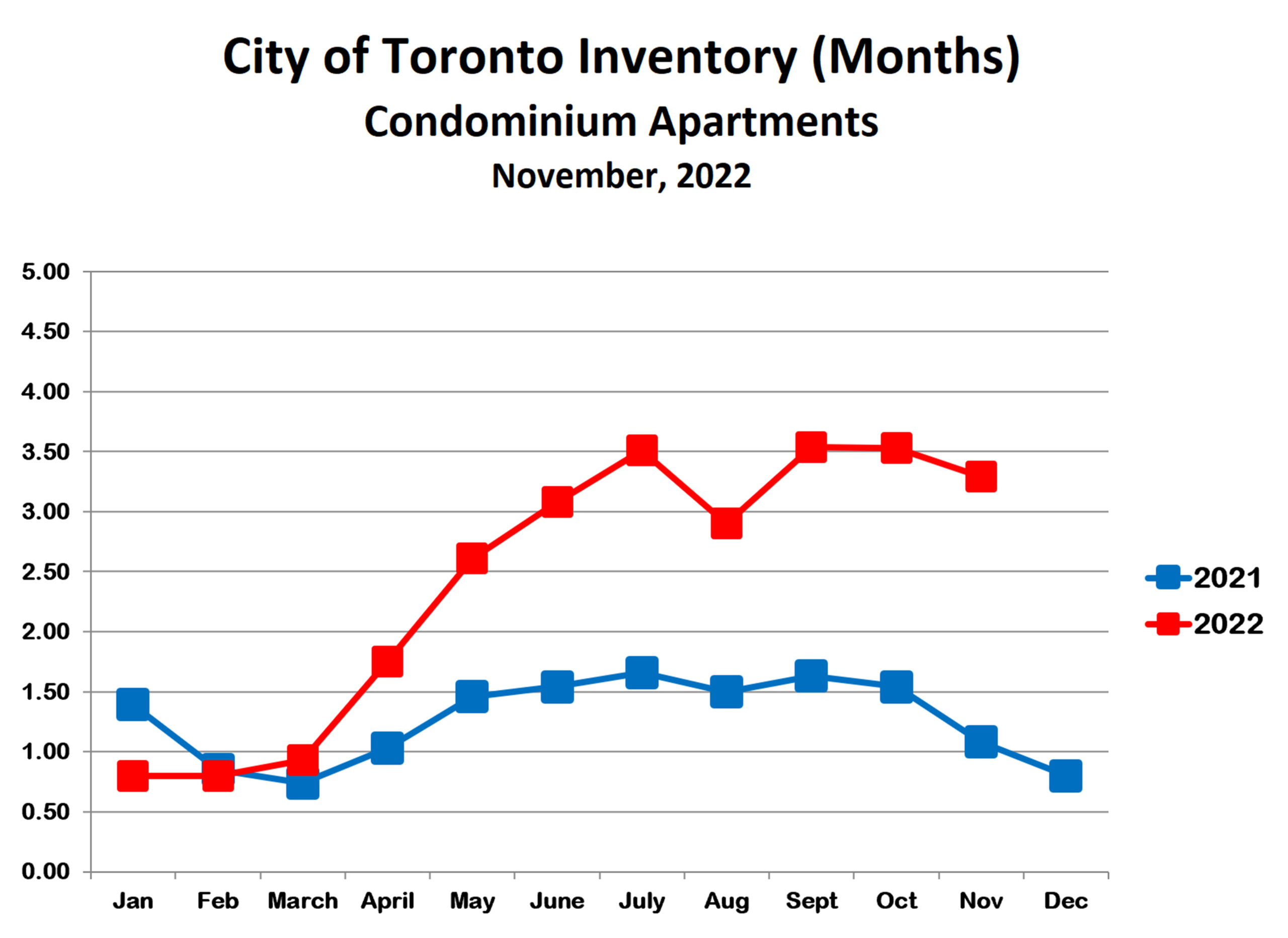

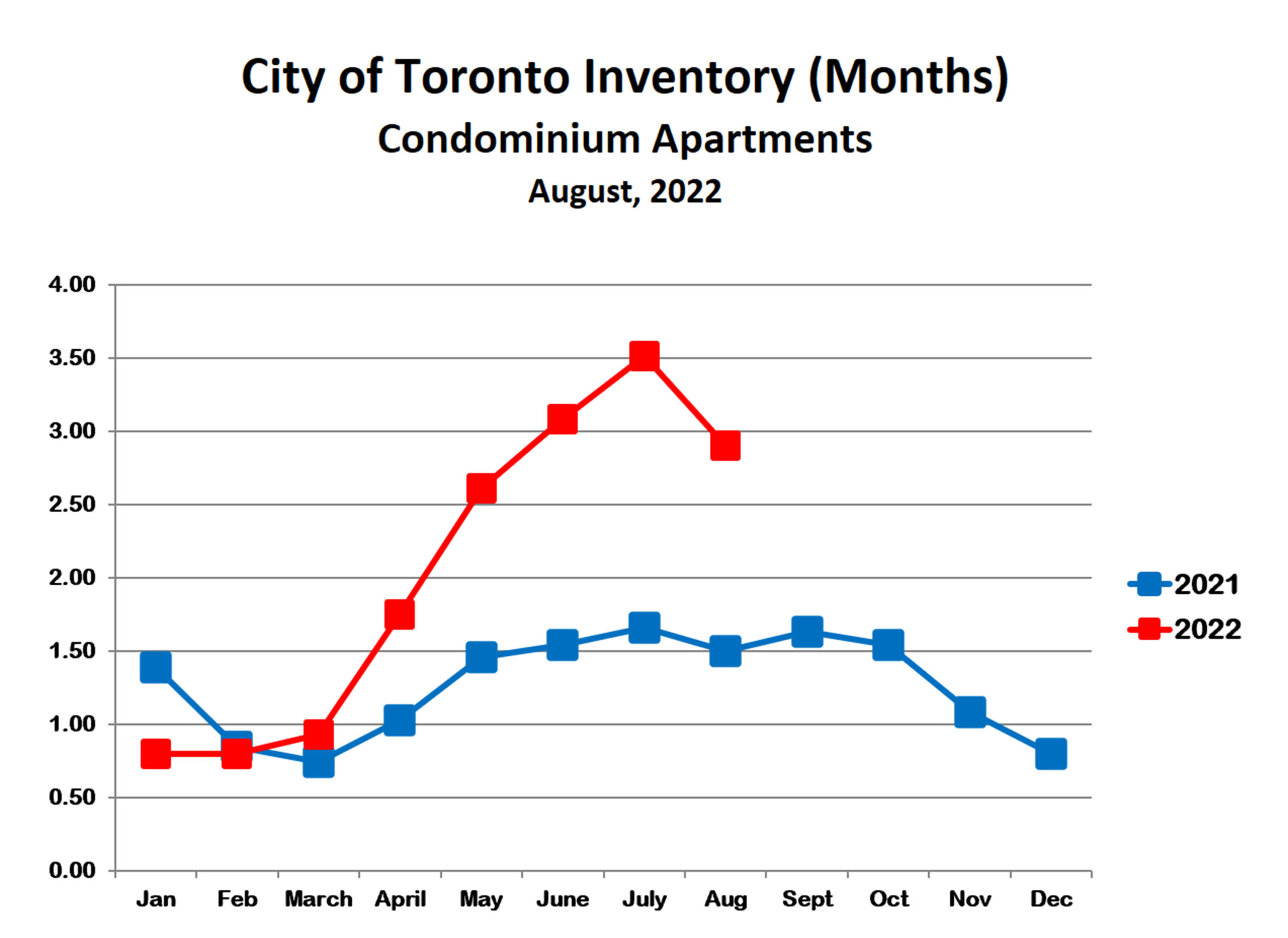

Condo sales have been very slow so far this month. Active listings, however, are actually higher than in December. The January inventory of condos for sale will therefore print significantly higher than the 3.0-3.5 months’ supply that we saw over the last 7 months. Once again, given the rising prices, this is a positive sign for the spring market.

The Bank of Canada recently announced another 0.5% bump in the bank rate, hopefully the final hike in this cycle of interest rate increases. While this will obviously not help the real estate market, it’s unlikely that it will lead to a further decline in prices. Most likely we will see a healthy, balanced spring market this year, with prices rising modestly above last year. What happens later in the year will depend whether the economy falls into a recession in the second half, as well as how deep and long the recession will be if it does arrive. Let’s hope our central bank gets it right and is able to tame inflation without sinking the economy!

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Toronto Prices Hold Steady Despite Falling Sales

12/24/22

Average selling prices in the City of Toronto continue to hold steady through December. As everyone knows, prices fell steeply between May and July once the 2021/2022 ‘bubble’ popped. Once the correction was over, prices had returned to (roughly) where the bubble started in the fall of 2021, and they have remained there ever since.

Houses (Detached/Semi-Detached/Attached Homes)

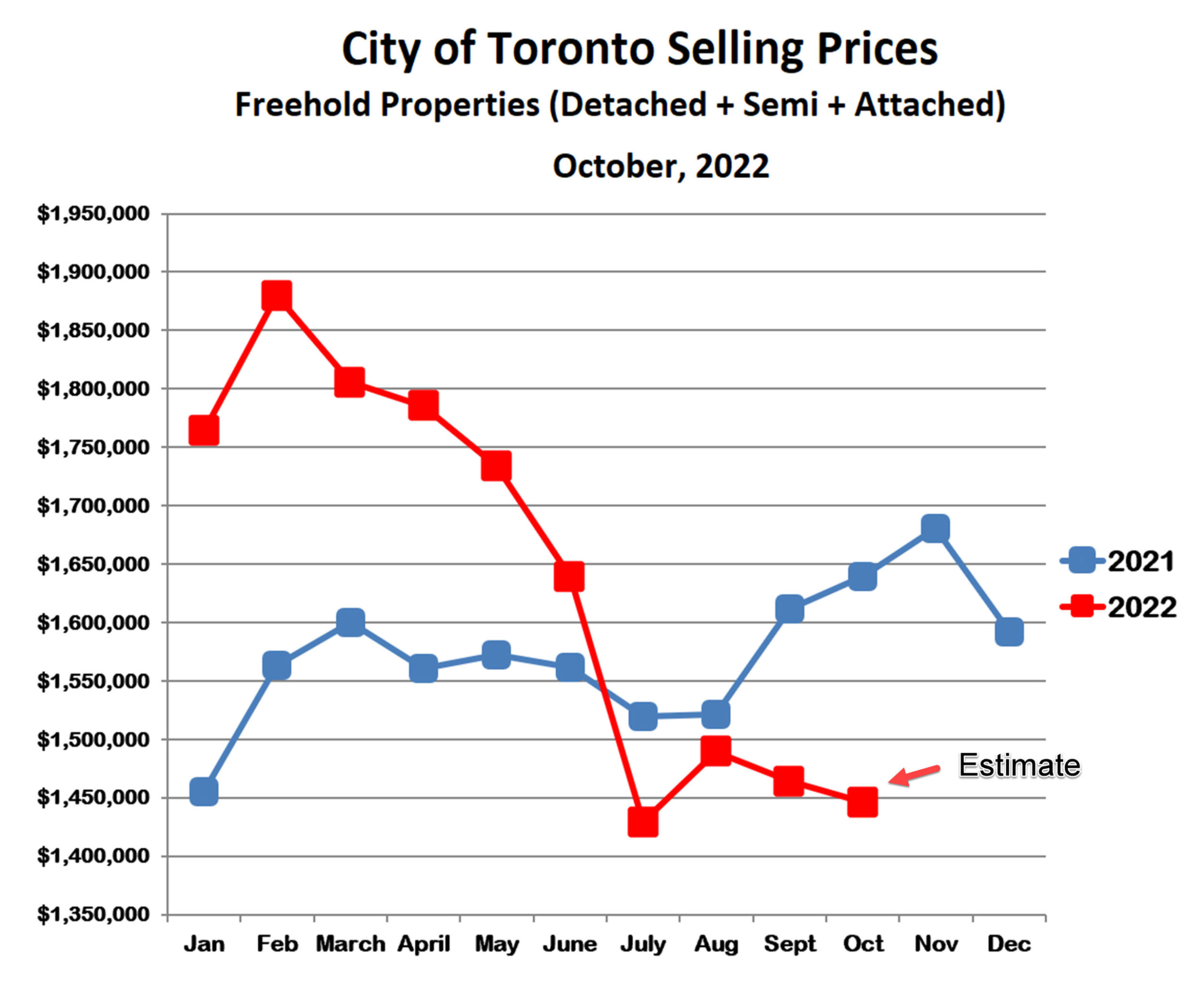

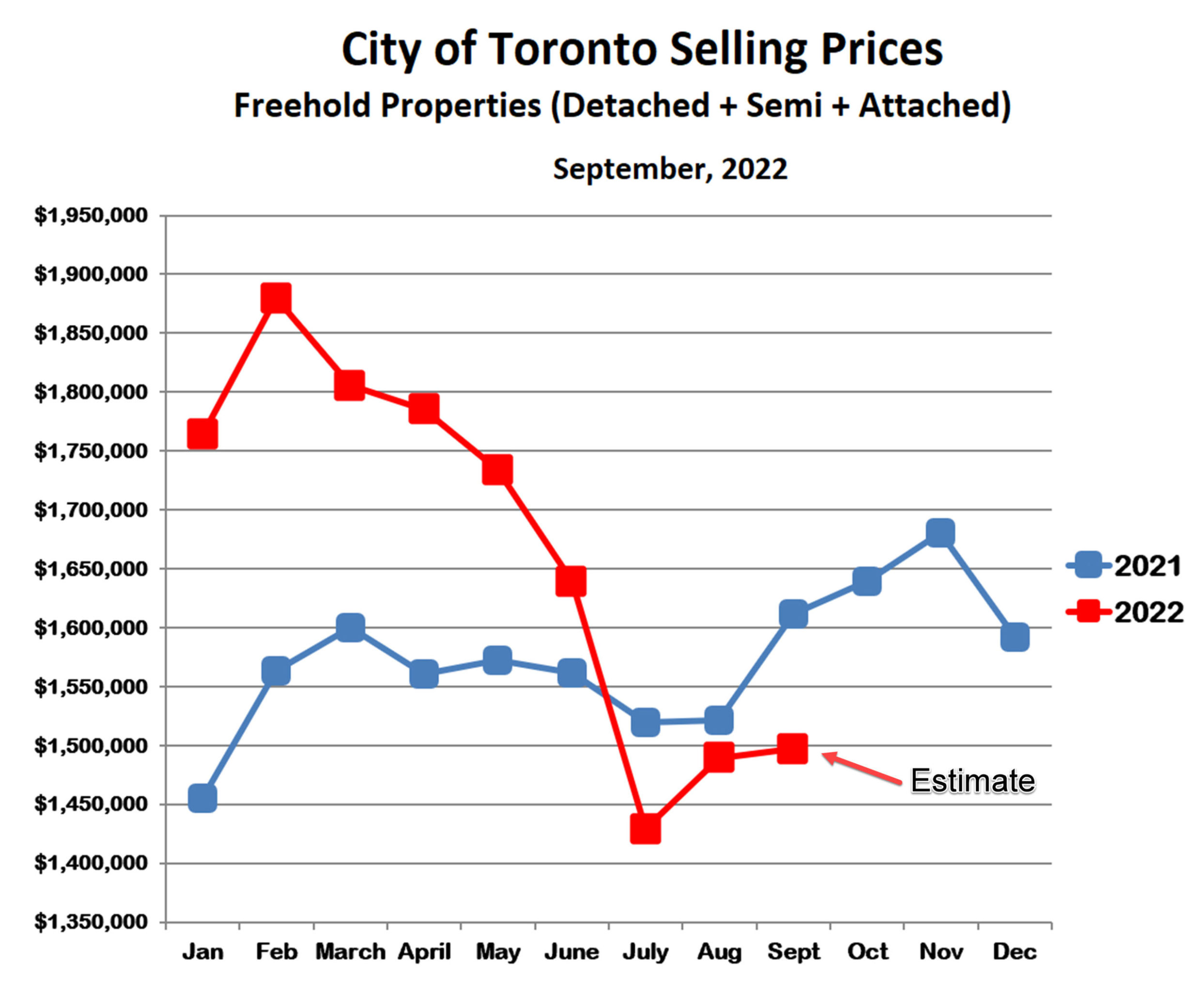

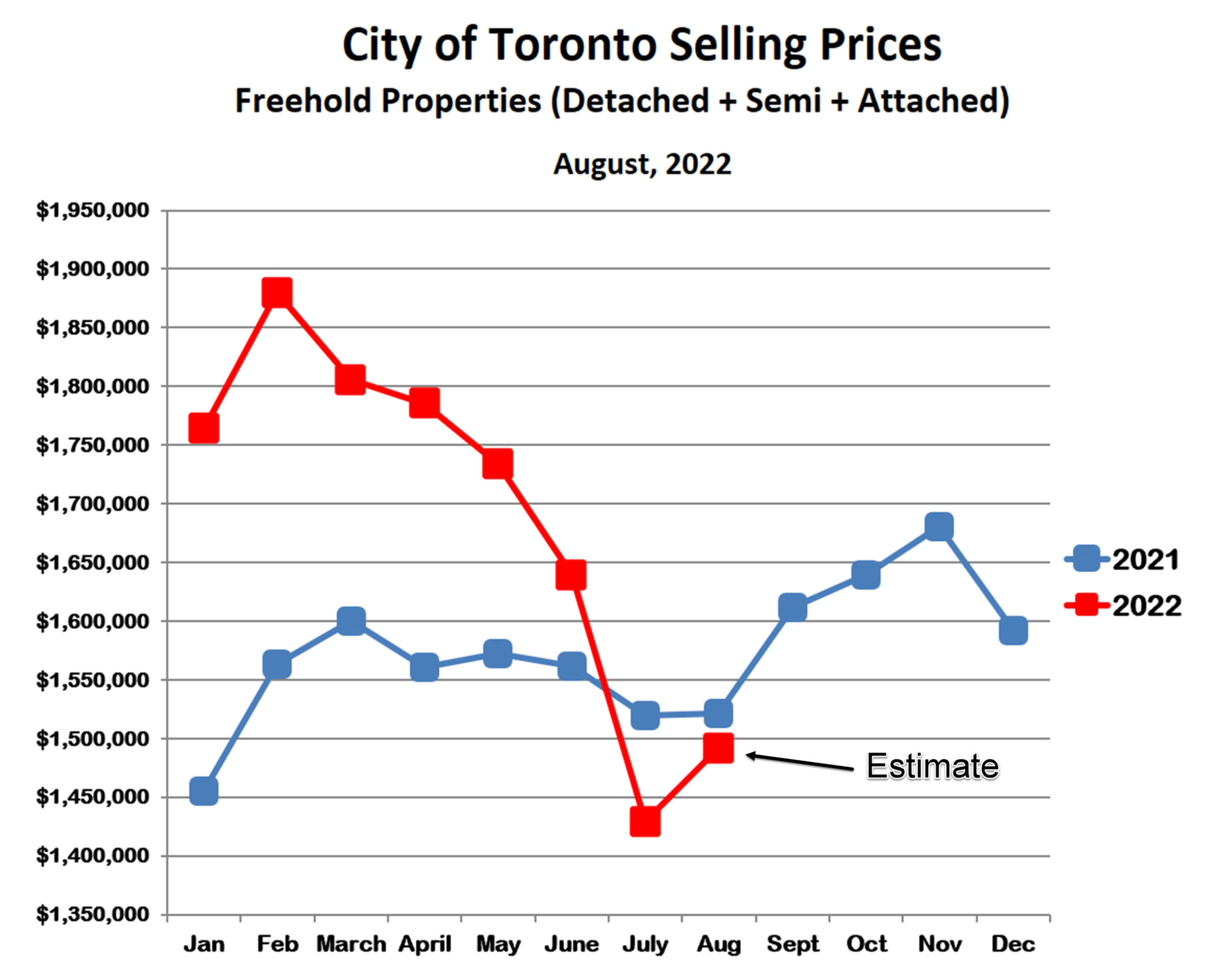

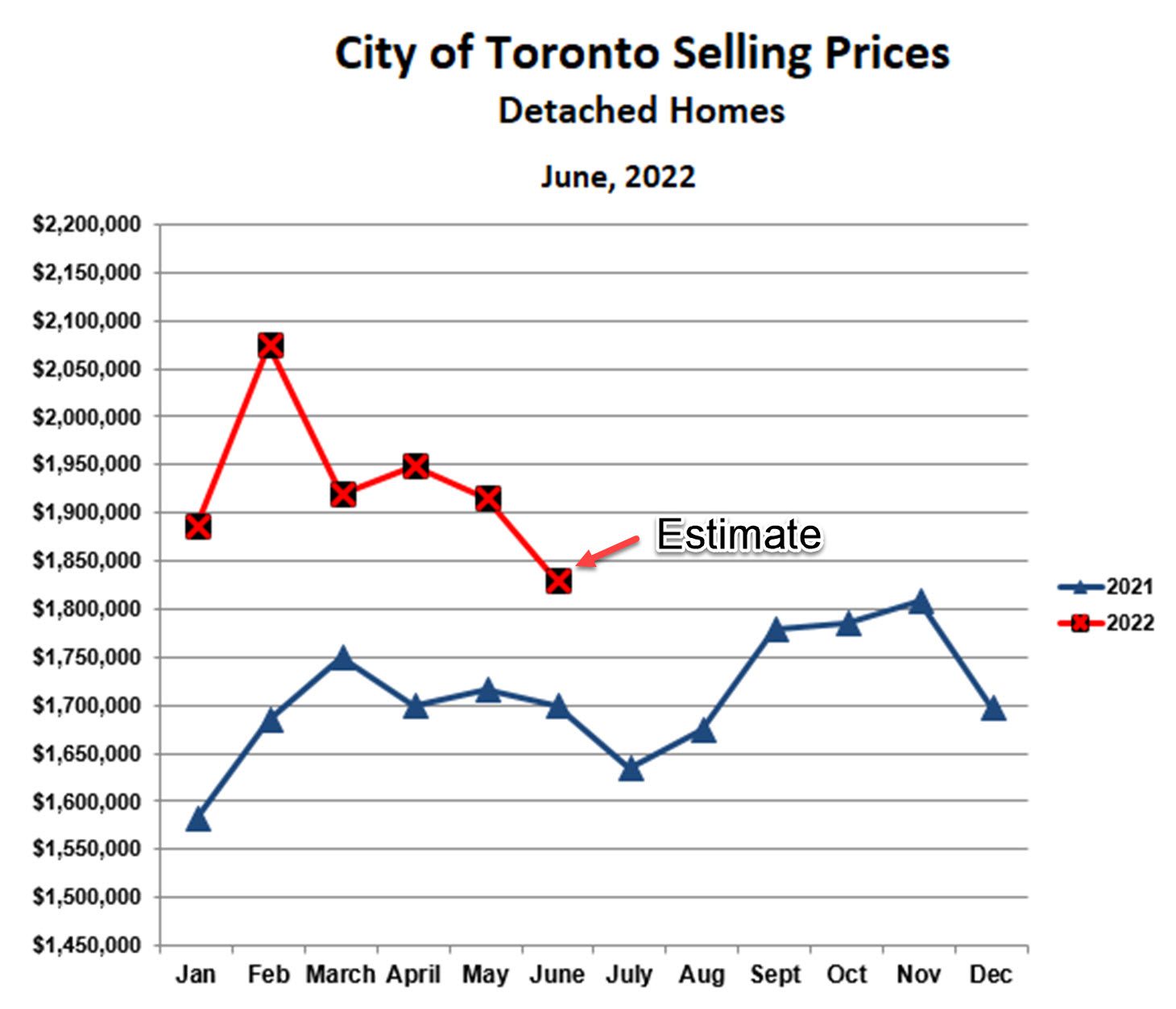

From an average price of just over $1,800,000 between January and April, freehold prices fell by 20% between April and July. Since then, prices have stayed in a narrow range between $1,430,000 and $1,490,000.

The relative stability of freehold prices over the second half of the year came despite falling sales, particularly in December. Total freehold sales were 862 units in October, 778 in November, and only 330 as of the third week of December. In part this is because the number of active listings has also fallen, so that inventory has stayed relatively low (as shown in the chart below). More importantly, perhaps, this is because buyers have become increasingly selective at the same time as sellers have become increasingly stubborn. Many buyers feel that prices are not going to rise any time soon and in fact may fall further in 2023. Many sellers, however, are holding out for a return to the higher prices they missed out on just a few months ago. Accordingly, homes with even minor flaws tend to get passed over, and this creates resistance to falling prices.

By the way, year-over-year comparisons are dramatic but not very useful. Of course, prices and sales today are very significantly lower than last year. However, last year we were in a rapidly expanding bubble, and now the bubble has collapsed. It’s not even apples to oranges, more like apples to camels.

Condo Apartments

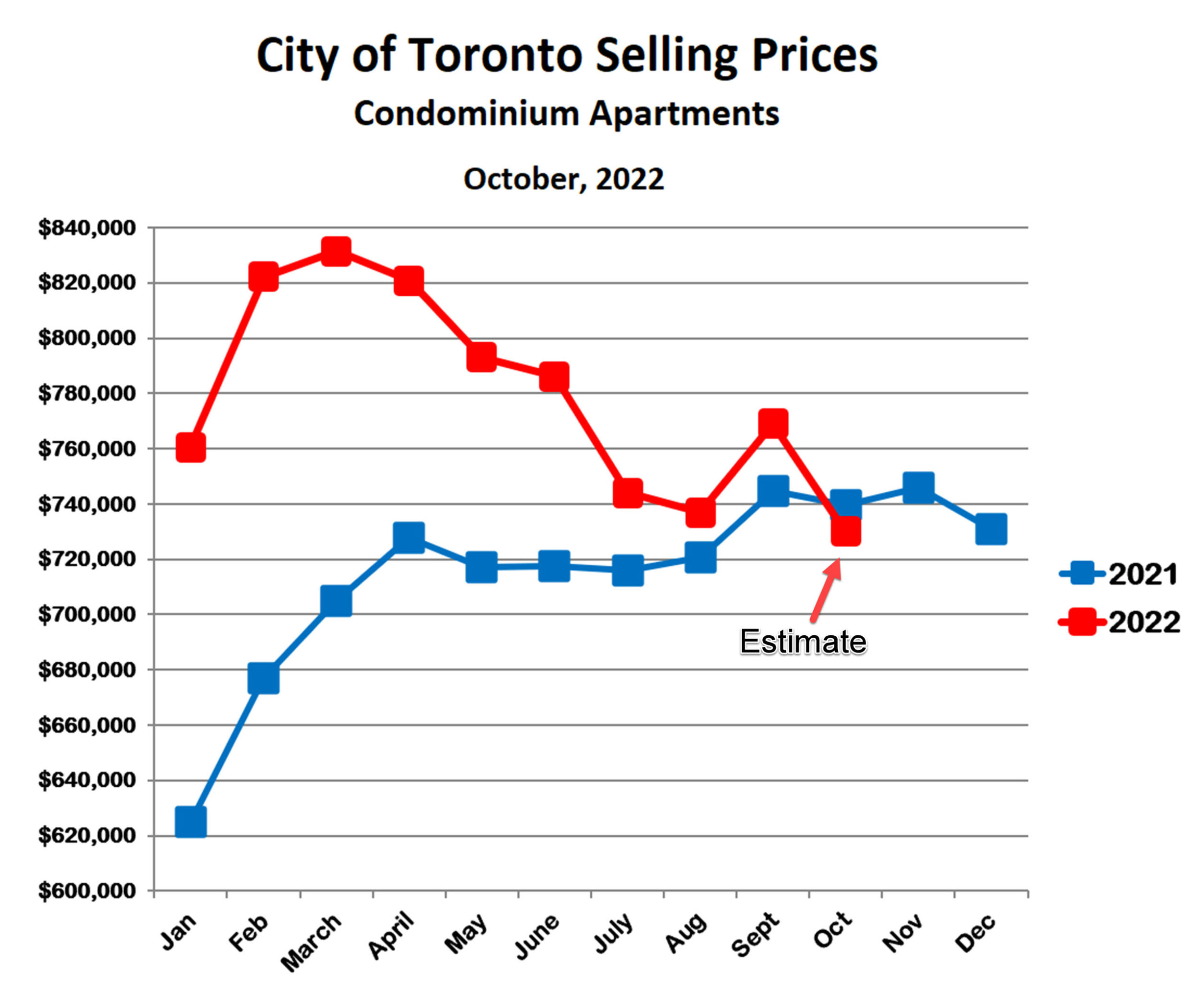

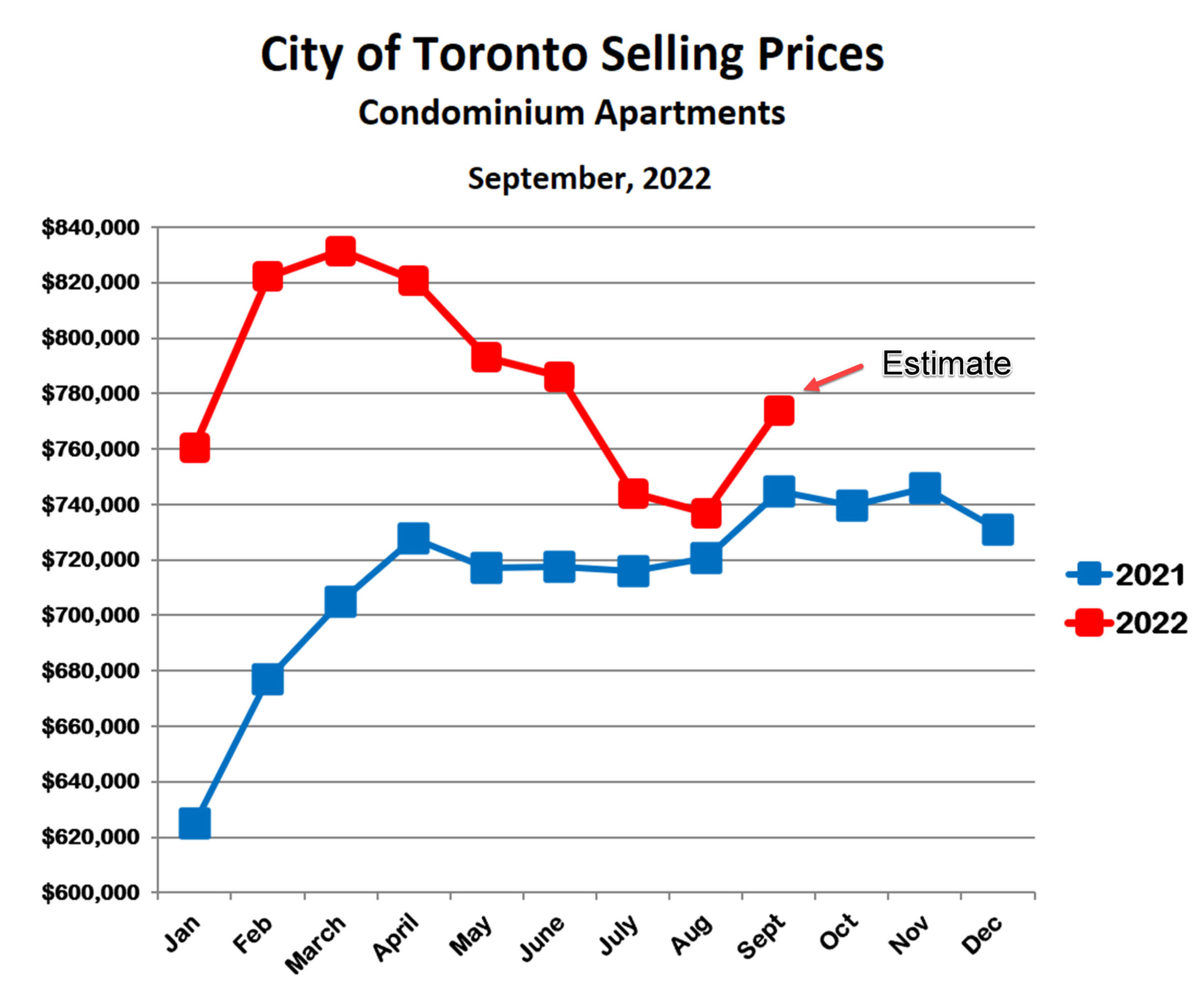

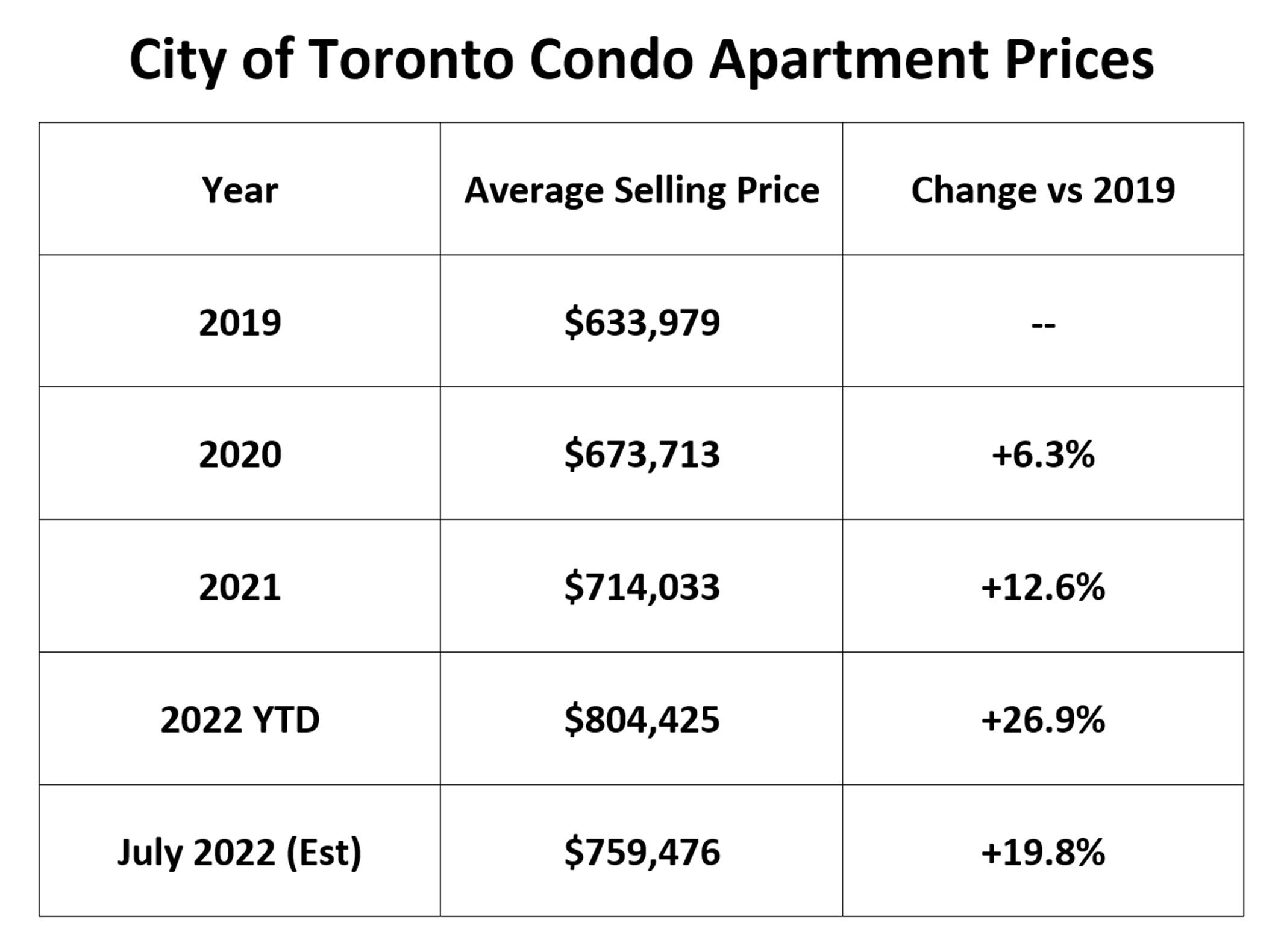

Just like houses, condo prices in Toronto fell sharply between April and July and have held steady since then. Unlike houses, though, condo prices have held up much better. The drop from the February-April peak to the July-December bottom was less than 10%, and at no time did 2022 condo prices fall below 2021 levels. There are two main reasons for this. First, condos are simply less expensive than houses and more affordable as interest rates ratchet upward. Second, and more important, condos are a huge part of the rental housing stock, and rental demand is increasing. So, end-user demand for condos is being bolstered by investor demand.

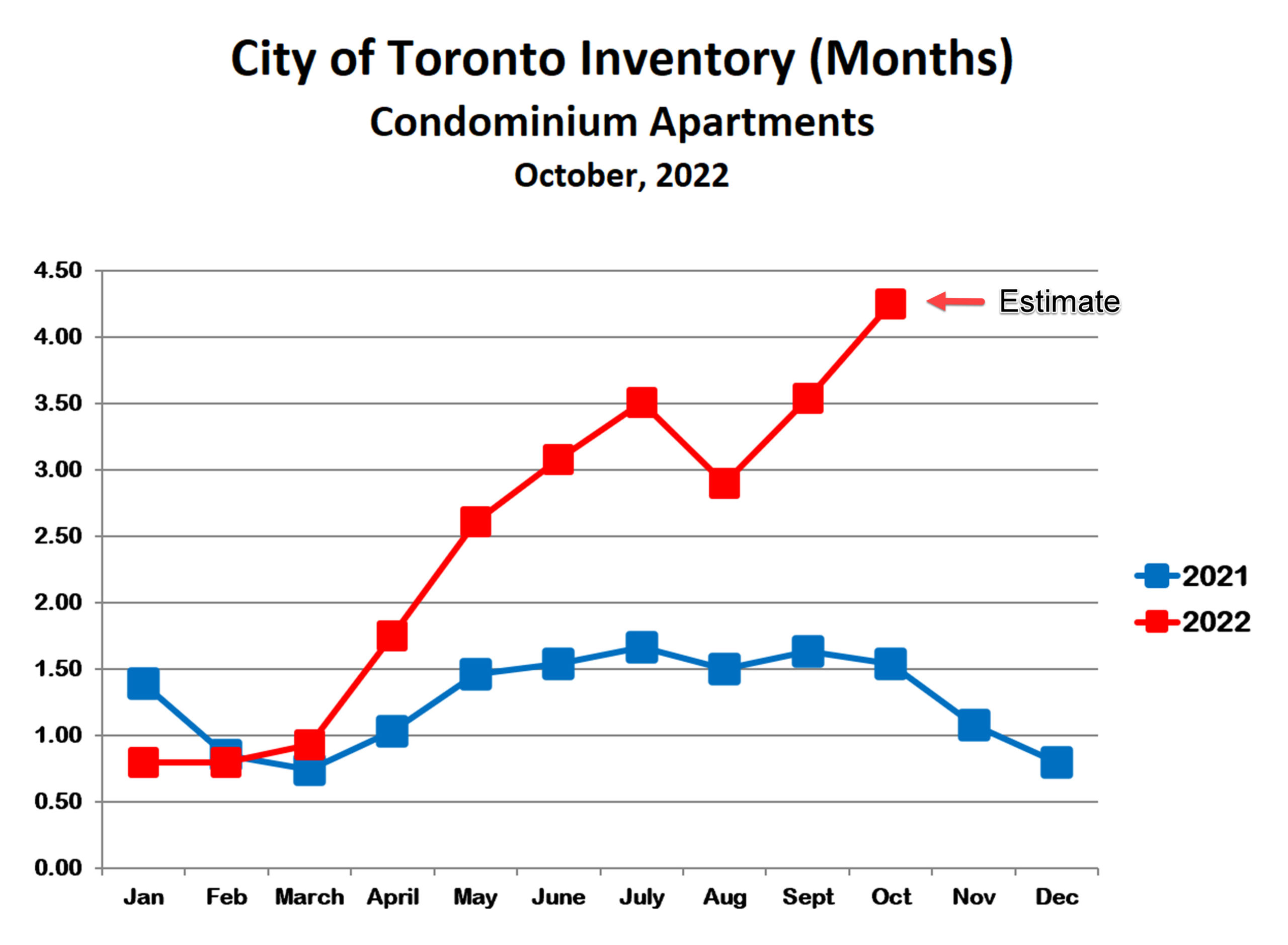

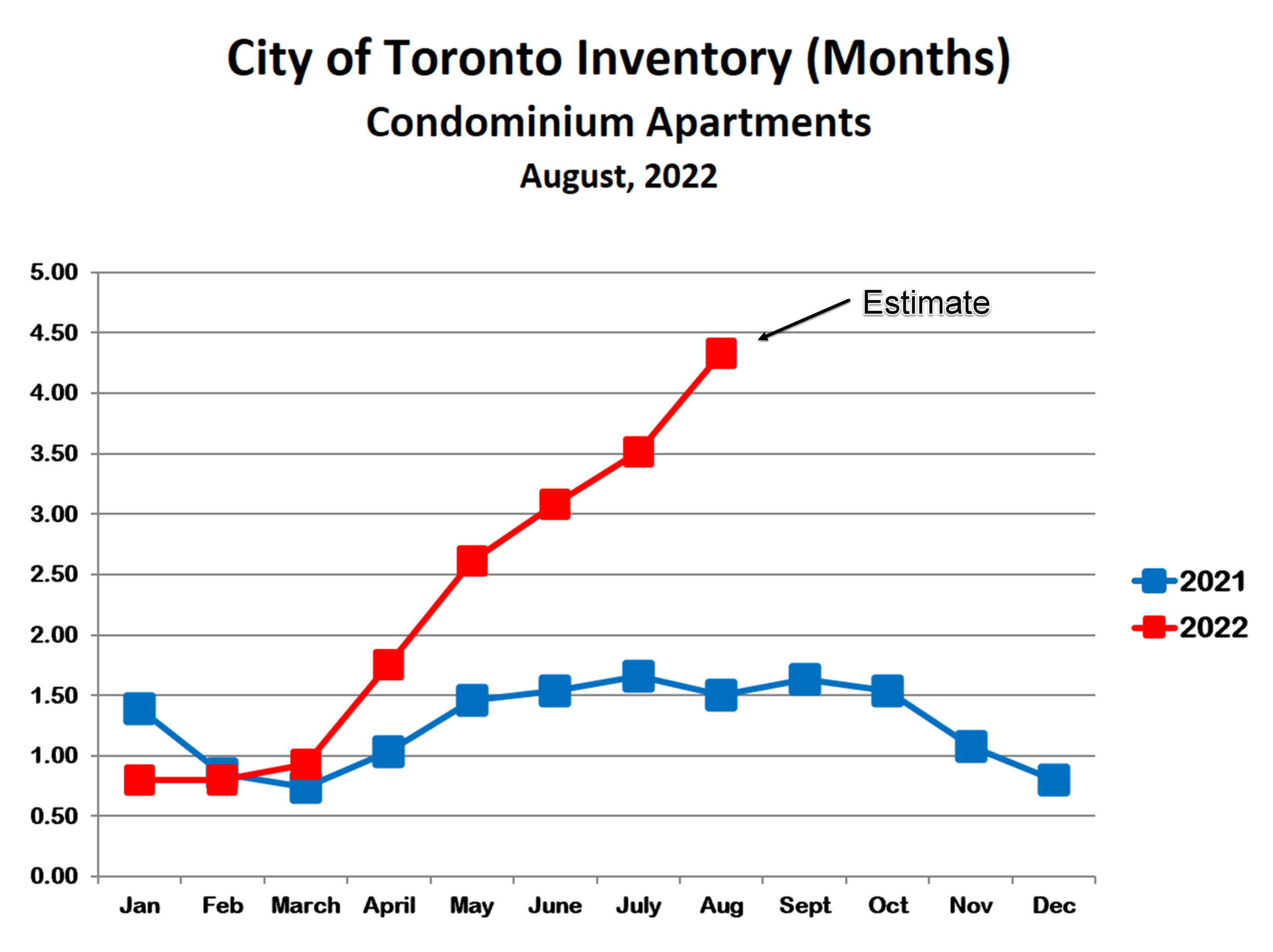

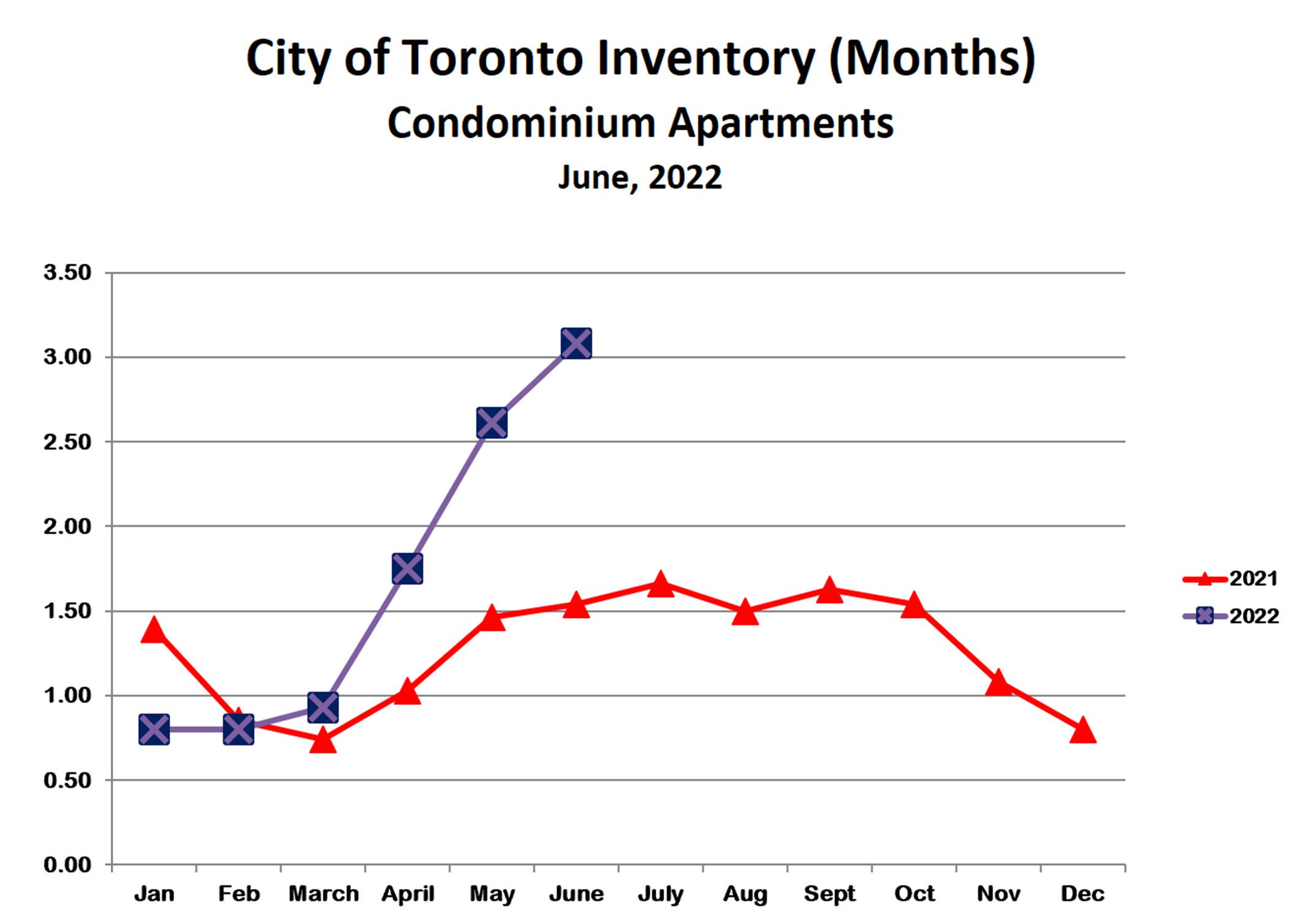

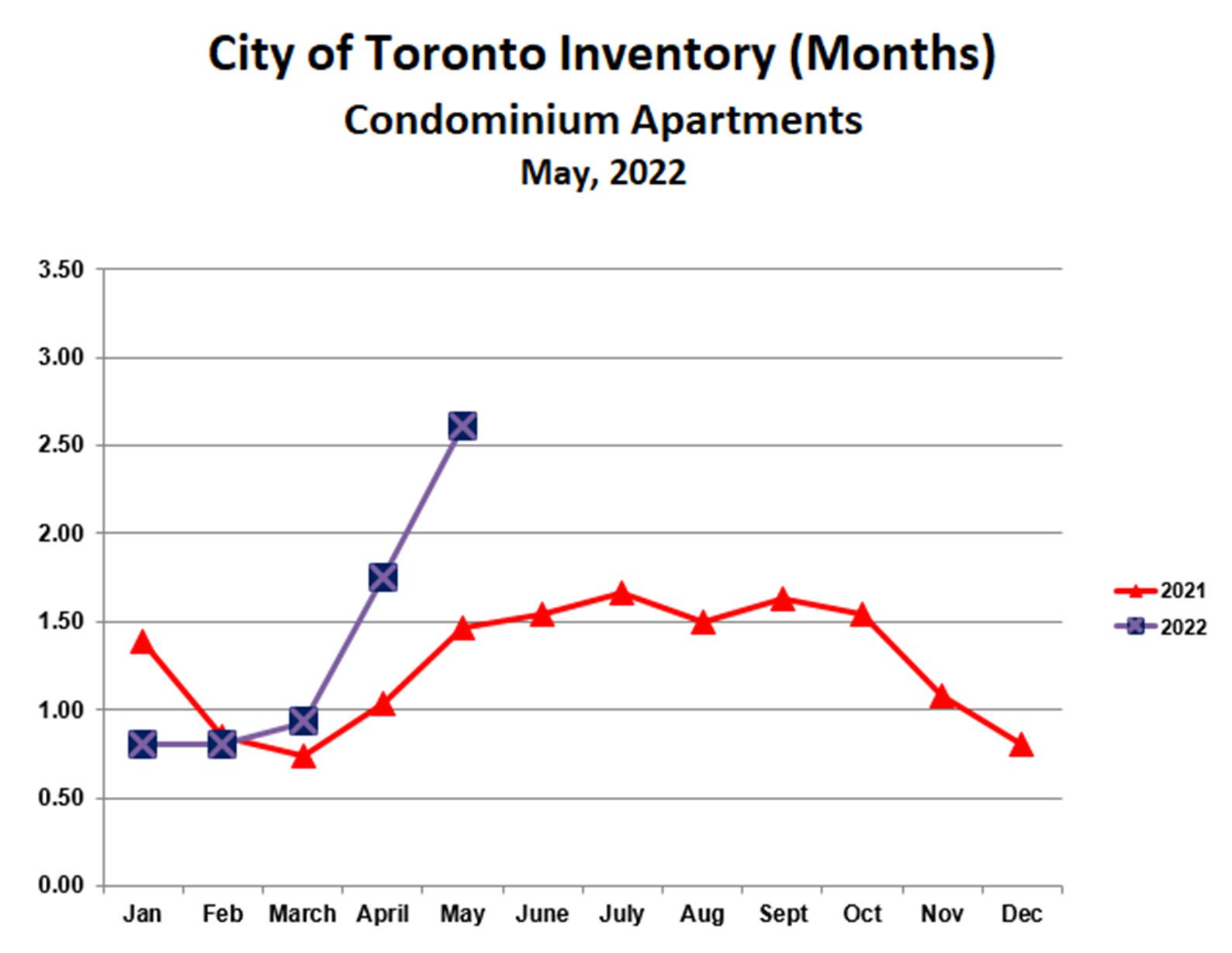

As the chart below shows, the inventory of condos for sale is significantly higher than last year and approaching buyers’ market territory. Condo sales were steady in October and November, at 888 and 899 units, respectively. However, only 475 units were sold as of December 23, so inventory in December could rise even further. The resiliency of condo prices in the face of increasing inventory is quite impressive.

Bottom Line

It’s been quite a roller coaster ride for the Toronto real estate market over the past two years and, indeed, since the beginning of the pandemic. It would seem that the world that we knew for the past 40 years or so, with low inflation, falling interest rates and loose monetary policy, has come to an end and will not return any time soon. Exactly what this means for the real estate market has yet to clarify. However, if there’s one thing that seems certain it’s that uncertainty will be a dominant theme for some time to come.

Will prices rise next year or will they fall? The answer, tongue firmly in cheek, is ‘yes’.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

What You Need to Know About Selling a Tenanted Property in Ontario

12/19/22

Whether you’re looking to sell your current home with a secondary suite in the basement or you have a dedicated income property such as a condo, selling with tenants does have its fair share of complexities.

From navigating tenant rights to listing, preparing, and showing a home that someone lives in, it’s a fairly involved process. But with good planning, communication, and the help of an expert, you can ensure a property sale that’s both smooth and profitable.

If you’re looking to sell a tenanted property in Toronto, or elsewhere in Ontario – here’s what you need to know.

Looking to become a savvy investor in Toronto’s real estate market? Stay up-to-date on local market activity by signing up for our monthly newsletter! Click here to subscribe.

Expert Support Goes a Long Way

Like any home sale, the best place to start when selling with tenants is working with an experienced real estate agent. However, it’s important to keep in mind that selling a tenanted property is a unique process, both logistically and from a legal standpoint. Luckily, there are real estate professionals who specialize in working with investors.

Not only can a real estate agent with investment property expertise guide you through your regulatory obligations as a landlord, but they’ll also help you get the best possible price for your property.

There Will Be Red Tape

As a landlord, navigating the various bylaws and regulations that come with having tenants is likely nothing new to you. That being said, things become a little more complicated when it comes time to sell your property.

First things first, as a property owner in Ontario you have the legal right to sell your property whenever you wish to do so and for any reason. However, during the process of selling your tenants will have certain rights too.

Tenant protections aren’t one-size-fits-all, and some tenants will have different rights than others. Navigating the red tape can get complicated so working with a real estate who has niche expertise in tenanted properties is the best way to avoid landing yourself in hot water.

Selling your home or investment property in West Toronto? Explore some of these resources from our blog to learn how you can maximize your return.

- The Power of Staging a Home to Sell

- Smith Proulx’s 9 Steps of Selling

- How to Sell Your Toronto Home in a Balanced Market

Start Planning Early

When it comes to selling a tenanted property, it’s best to start planning as early as possible. This is especially true if any of your tenants have been living on the property for a short period of time.

Under the Ontario Residential Tenancies Act (RTA), if any of your tenants are within the first 12 months of their lease, it must be honoured regardless of your sale. While you can still legally sell your property during this time frame, a buyer will not be able to evict the tenant until their lease is up.

Interested in learning more about how the Smith Proulx Team sells properties in West Toronto? Click here to discover our selling advantage.

Coordinating Showings

When the time comes to have interested buyers tour the property, you’ll need to keep your tenants in the loop. Under the RTA, you must provide tenants with a minimum of 24 hours’ notice before entering their suite or unit. In addition to advanced notice, you’re only allowed to schedule showings between the hours of 8 AM and 8 PM. Once again, working with an experienced agent is the easiest way to take the stress out of this process.

Key Dates & Deadlines

As a landlord in Ontario, you technically have no legal obligation to tell your tenants about the sale of your property until the deal is done. That being said, it’s always best to open up the lines of communication early, especially since they may need to find new living arrangements. Plus, you’ll likely need to work closely with your tenants during the process of scheduling showings so a little compassion can go a long way.

What About Evictions?

As you may expect, evictions are one of the most challenging parts of selling a property with tenants. Depending on the buyer’s plans for the property, you as the acting landlord may be tasked with overseeing the eviction process. This mainly comes down to whether or not the buyer intends to live in the property or continue renting it out.

If the buyer intends to move into the property on the possession date and your tenants are beyond the initial year of their lease, you are required to oversee their eviction with a minimum of 60 days’ notice.

Need help selling your West Toronto property? As experienced real estate agents we can make the process smooth, easy, and successful. Send us an email or call 416-769-6050.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Stable Fall Market Continues in Toronto

11/22/22

Prices in the City of Toronto continue to hold steady through mid-November. Sales, however, are slowing as we approach the holiday season. After a couple of years of ‘Covid-stolen’ Christmases, it would not be surprising to see many buyers and sellers take a break from real estate to get festive.

Prices

Average freehold prices in Toronto have stayed in a narrow range from $1.4-$1.5 million since the ‘bubble correction’ ended in July. While prices are presently about 14% below last November, this is misleading since the bubble was expanding strongly at that time. A better comparison might be last summer, when prices were about 5% higher than today. So, freehold prices are lower than last year but not that much lower.

Condo prices in Toronto have also remained within a fairly tight range since July, and are now slightly higher than last year. The condo market has been much less volatile than the freehold market, with a peak-to-trough bubble correction of about 11%. This compares with a correction of about 27%. This is partly because condos are lower priced and therefore ‘buffered’ from the impact of higher interest rates. It’s also because condos are a popular investment vehicle, and the rental market is very strong.

Sales and Inventory

Sales of both freehold and condo properties are tracking about 20% below October as of mid-November. Active listings for both property types are roughly unchanged, and so inventory levels are increasing. The inventory estimates for November shown in the charts below assume that sales will continue at the present pace until the end of the month, and that active listings will remain unchanged.

For condos, this means that inventory will be well over 4 months’ supply at the end of November, well into buyers’ market territory. For freehold properties, inventory will remain under 3 months’ supply, still a sellers’ market. This suggests that we might see some divergence between the condo and freehold markets over the holiday season.

Bottom Line

The Toronto real estate market has remained steady, for all property types, throughout the fall season. We will probably see a more or less normal seasonal slowdown over the next couple of months. The spring market is inscrutable at this time. One could make cogent arguments for prices moving either upward or downward next year…

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

3 Reasons Real Estate Transactions Fall Through (and How to Avoid Them)

11/11/22

In Toronto, real estate transactions are far from an overnight process. Whether you’re buying or selling a home, after navigating the many variables of the market, finally reaching the negotiations stage can feel like you’ve reached the finish line. However, it’s not time to celebrate just yet.

As the city transitions into a balanced market, contingencies have become a more prominent factor in the offer process. Contingencies help both buyers and sellers protect themselves from potential pitfalls, but they can also cause the transaction to fall through – leading to stress and disappointment.

As West Toronto real estate experts, we’ve closed countless transactions over the years and know the process inside and out. This post will analyze common contingencies, how they can cause a transaction to fall through, and what you can do to avoid a delayed or terminated sale.

Thinking about buying or selling soon? Stay up-to-date on local market activity by signing up for our monthly newsletter! Click here to subscribe.

Something is Uncovered During the Home Inspection

Today, home inspections are a fairly common part of real estate transactions. In most cases, the buyer includes a home inspection as a contingency in their offer. After an offer is accepted, there’s a 3-5 day period for the buyer to have the home inspected.

During this process, a professional inspector will analyze the property from top to bottom, evaluating key elements such as the structural integrity of the home, HVAC and electrical systems, plumbing, the roof, and more. If the inspector discovers a significant issue that will be expensive for the buyer to repair, they may choose to walk away.

Reducing Risk

Ensuring there are no unpleasant surprises during the home inspection process is mostly up to the seller. In West Toronto, many homes are close to or more than a century old. If you’ve lived in your property for many years and are looking to sell, it may be worth obtaining a pre-market inspection. This proactive step can uncover any hidden issues with your home before buyers see it, reducing the chance of a jeopardized sale down the road.

In need of helpful tips for selling your home in West Toronto? Explore some of these resources from our blog.

- Selling After a Divorce: What You Need to Know

- The Power of Staging a Home to Sell

- How to Sell Your Toronto Home in a Balanced Market

Delays With the Buyer’s Home Sale

Unless you’re entering the market for the first time, there’s a good chance that selling your current home will factor into buying your next one. Buying and selling a home simultaneously is easier said than done, and in order to reduce the risk of getting stuck with two mortgages at the same time, some buyers will elect to include a home sale contingency in their offer.

This means that the transaction is conditional on the buyer’s current home selling within a set timeframe. If their existing property doesn’t sell, the buyer is able to walk away from the agreement.

Reducing Risk

As the sale of the buyer’s home relies on a number of variables, delays or setbacks with this type of contingency can be somewhat common depending on the market. That said, there are a few things both buyers and sellers can do to avoid finding themselves in stressful circumstances.

For buyers, the best way to optimize your odds of a fast and profitable home sale is by working with the right selling agent. An experienced agent with local expertise can help you prepare, price, and market your home to maximize your chances of market success.

For sellers, the best way to protect yourself from this hazard is by being as selective as possible in which offers you consider. Of course, in certain market conditions, it may be worthwhile to accept an offer with this type of contingency. However, you should always trust your gut, and if necessary, include an escape clause in the agreement.

Thinking about entering the housing market for the first time? Check out these blog posts to make the most of your first home purchase in Toronto.

- How Buying a Condo is Different From Buying a House

- How to Maximize Your First Home Without Going Over Budget

- Everything You Need to Know About Canadian Interest Rate Hikes

Financing Setbacks

Another common contingency in Toronto real estate transactions pertains to mortgages. In short, this contingency makes the home sale conditional on the buyer being able to secure adequate financing for the home. If the buyer is unable to obtain mortgage approval from their lender within the established timeframe (often a week) then the agreement is terminated.

Reducing Risk

As a buyer, one of the best steps you can take to prepare for your home-buying journey is obtaining a mortgage pre-approval. Not only can getting pre-approved help you establish an appropriate budget for your home purchase, but it can also help you avoid future disappointment by ensuring you don’t place an offer on a property you can’t afford. To assist you in this process, a well-connected real estate agent can refer you to a trusted local mortgage broker.

Looking for a compassionate West Toronto team who can assist you in accomplishing your real estate goals? We’re here for you. Send us an email or call 416-769-6050.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Toronto Market Continues to Hold Steady Despite Rising Mortgage Rates

10/22/22

Prices in the City of Toronto have remained in a fairly tight range over the past four months after falling during the spring and summer. Rapidly rising mortgage interest rates pricked the price bubble that started building last summer and peaked this spring. Mortgage rates have continued to climb, with more to come, however, prices are so far resisting further declines. We shall see if this trend can be sustained as we get into the normally slower Christmas/New Years season.

Freehold Home (Detached, semi-detached & attached)

Freehold prices have been on a real roller coaster ride over the past year. After a strong but fairly typical spring and summer in 2021, prices took off in the fall. This bubble continued to grow in early 2022 and then began to unwind in late spring under the weight of rising interest rates. Prices proceeded to fall by about 20%, and then leveled off after July. The estimate for October is a bit lower than September but still higher than July.

Inventory is defined as the ratio of properties for sale divided by properties sold in a given month. It’s an estimate of how long it would take to sell all the homes now on the market if no new listings came up for sale. Low inventory means that there is little selection available for buyers, and this increases the chances of competition among buyers. For example, inventory was under one month’s supply for seven months, beginning last October. This meant that properties were selling, in effect, faster than they came on the market. With the crazy low mortgage rates at the time, no wonder we had rampant bidding wars!

With increasing interest rates came buyer hesitancy and affordability issues. Prices began to fall and buying was no longer urgent. Homes were not selling on their offer dates, and inventory began to increase. By July, prices had fallen below 2021 levels, retracing all of the gains from the bubble, and buyers started to return. This has stabilized prices, though at a much lower level of activity than in the spring. For example, sales of freehold homes in the City of Toronto averaged 1,261/month from February through June, but only 725/month from July through September. This drop of more than 40% in sales is the main reason for the climb in inventory level. Projected October sales are about 800, modestly higher than the previous three months.

The gap between 2022 prices and 2021 prices is widening because of last year’s bubble. With all the volatility in the market, however, this isn’t a helpful comparison.

Condominium Apartments

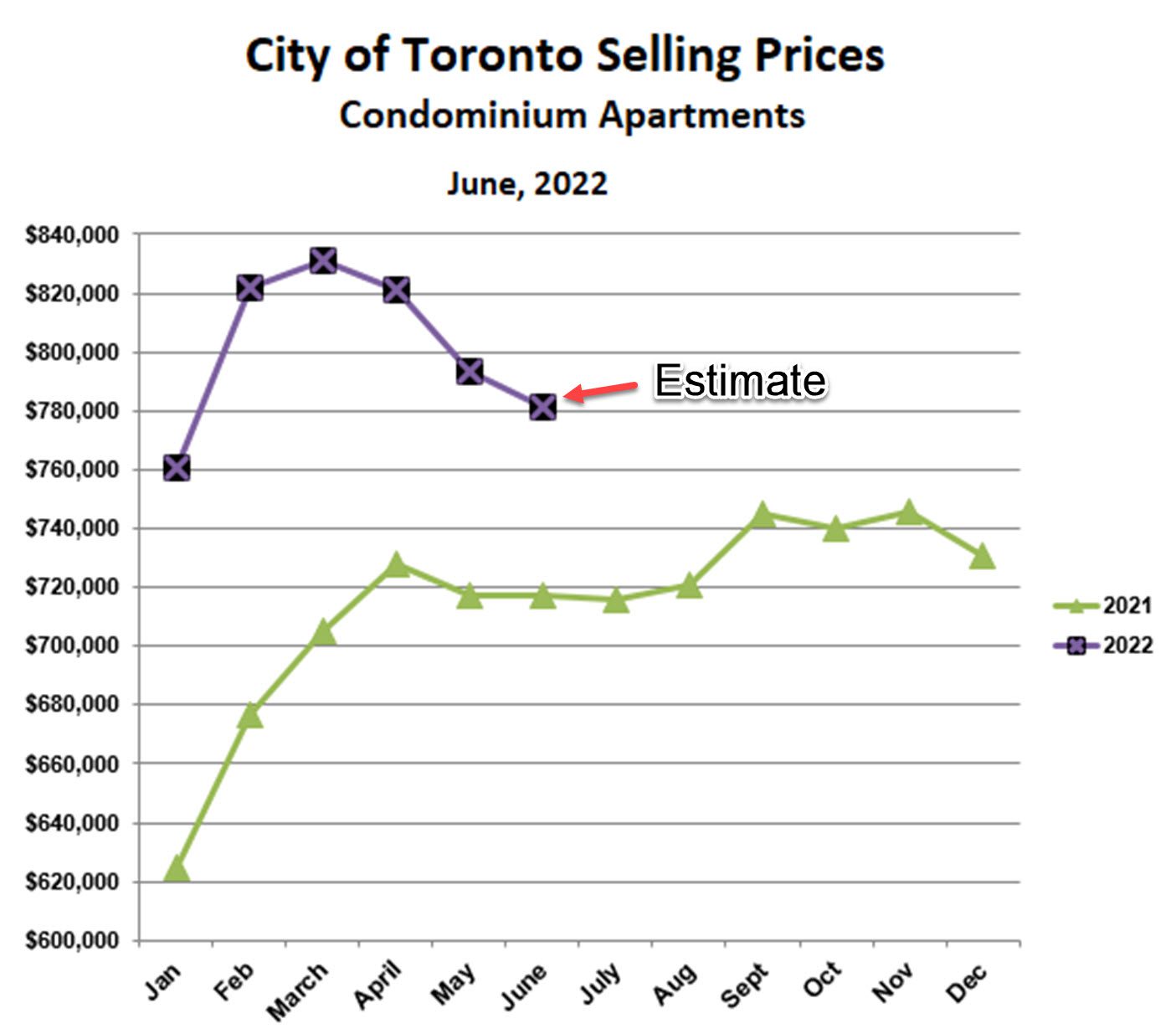

The condo market has followed a somewhat different trajectory than freehold homes. After falling in the latter half of 2020, condo prices rebounded sharply in early 2021 and then remained steady for the rest of last year. Prices again increased strongly early in 2022, but then fell through the spring and summer more or less in tandem with houses. Also like houses, condo prices have been relatively steady since July.

Condo inventory has increased significantly since the spring. The projection for October suggests that the condo market is approaching buyers’ market territory, and declining sales seems to be the main culprit. Condo sales averaged 1,575/month from February to June and fell to 955/month from July to September. This is a drop of 40%, almost exactly the same as houses. Unlike houses, however, the projection for October is approximately 751 sales which, if confirmed, would be drop of roughly another 20%. This might mean that the Christmas/New Years slowdown is starting early for condos.

Bottom line

The correction from the 2021/2022 bubble is over for now. However, we are approaching a normally slow time seasonally, and should expect prices to fall further over the next 3 months or so. Beyond that, there are far too many political and macroeconomic uncertainties to predict the direction of the market next spring.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Toronto Prices Holding Steady In September

09/24/22

Prices for both houses and condos hit bottom in July and are now trending upward. Inventory is following the opposite pattern, moving down slightly in August after increasing steadily since the spring.

Freehold Houses

The estimated average price for houses in the City of Toronto is $1,497,000 as of September 23, slightly higher than both August and July. This is further evidence that the correction is over, at least for now. It’s interesting that the current average price is very close to last August, which is when prices began to go hyperbolic. We have witnessed a classic bubble inflation and collapse, returning almost exactly to its starting point after slightly over-correcting.

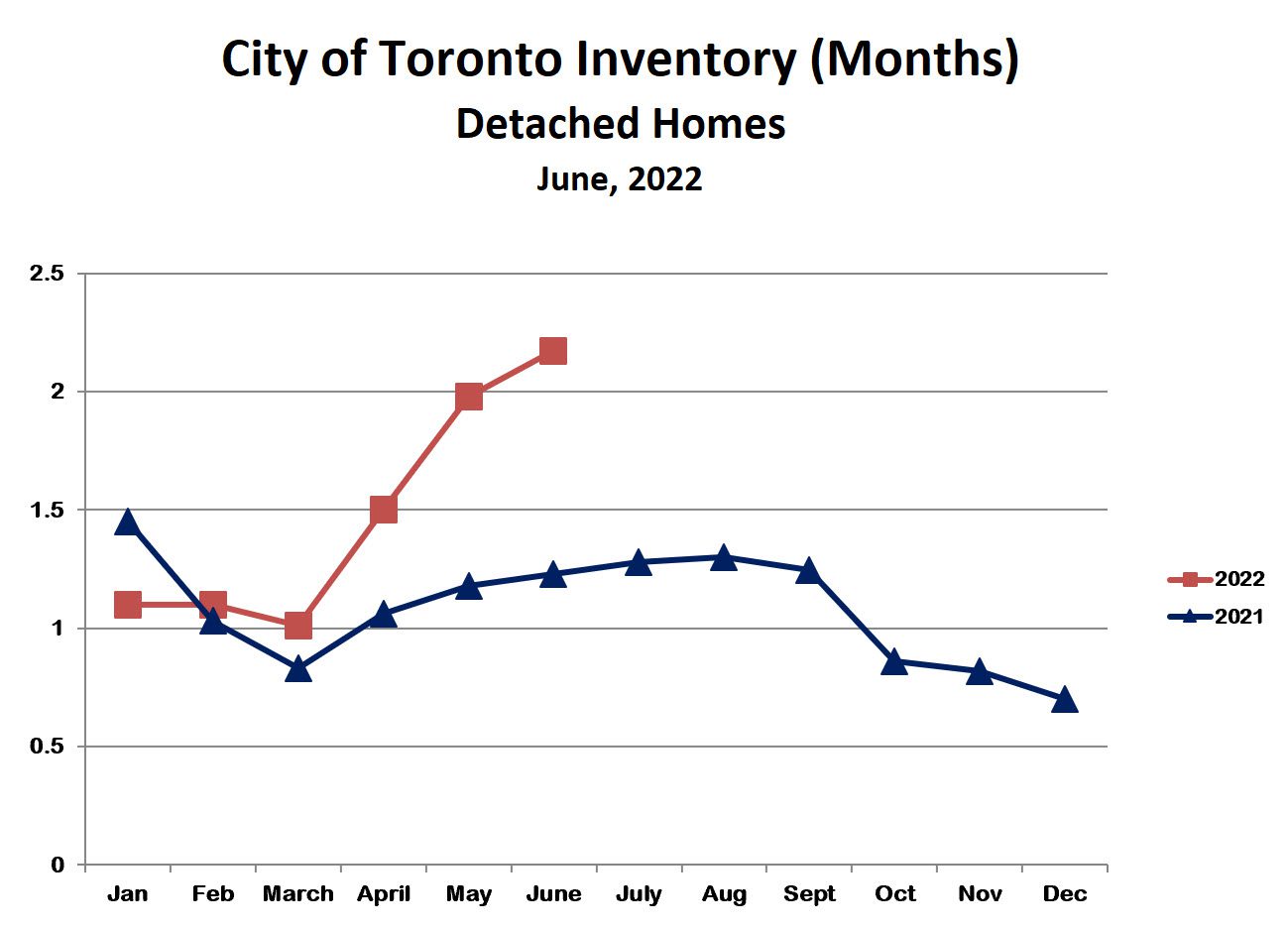

The inventory trend for houses is supporting this narrative. From March through July, the inventory of houses for sale increased from just under one month’s supply (extreme sellers’ market) to just under 3 months’ supply (balanced market) as prices fell. In August, inventory fell back to just under 2.5 months as prices finally turned upward. The reduction in inventory in August is due to a combination of higher sales and fewer active listings.

Condominium Apartments

Condo prices have been more resilient than house prices since early this year. Like houses, condo prices fell for several months during the spring and summer, but are rebounding in September. The estimated average price for City of Toronto condos is $773,939, 5% higher than August and 4% ahead of last September. In part the reason for the relative strength of the condo market is that a large proportion of the condos in Toronto are rental units — and the rental market is hot.

The inventory trend for condos, as for houses, is consistent with the price trend. Condo inventory increased from a low of under 1 month’s supply early this year, to 3 1/2 months in July, and fell to just under 3 months in August. Based on the September price trend, inventory should be even lower by the end of this month.

The bottom line is that the Toronto real estate market has entered a period of relative stability after a very volatile year. Based on normal seasonal trends, prices for both houses and condos should remain steady to slightly increasing over the next month or so, and then fall somewhat over the normally slower Christmas/New Years period, starting roughly early November.

Next spring is a different story. We are likely headed into a recession within the next few months (if we aren’t already in one), and this isn’t likely to be good for the real estate market. There is no certainty at all about next year, of course. However, my sense is that the downside risk is higher than the upside potential. Interesting times to be sure.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Toronto Market Turning The Corner In August

08/26/22

In early 2020, at the beginning of the Covid-19 pandemic, mortgage rates were slashed to historically low levels. Real estate prices in the City of Toronto responded vigorously, resulting in an extreme sellers’ market over the past two years.

Efforts to combat the recession induced by the Covid-19 lockdowns and restrictions eventually caused high inflation. Interest rates were increased early this year to fight inflation, and this has led to falling prices over the past few months.

The price correction may be over, however. House prices in August are rising and condo prices have stabilized.

Thinking about buying or selling this fall? We’d be happy to help! Send us an email.

Houses (detached, semi-detached and attached homes)

City of Toronto house prices hit an all-time high of just under $1,879,579 in February of this year, 53% higher than before the pandemic started. This was a very impressive bubble. The increase in mortgage interest rates burst the bubble, and house prices fell 24% over the next five months to a low of $1,428,950 in July. For perspective, this is still 16% above the pre-pandemic price level or more than 5%/year over the past three years. This is a very healthy increase indeed, though it was a very bumpy ride getting here.

So far in August, house prices are up almost 8% vs July and are only slightly lower than last July. This suggests that the worst of the correction is over. if true, this doesn’t mean that prices are likely to return to where they were in the spring. Rather, we will probably see a balanced market, with neither buyers nor sellers in control and stable to gently rising prices. After the last few months, this would be most welcome.

The inventory of houses for sale mirrors the trend in prices. Inventory is defined as the ratio of homes for sale to homes sold per month. For example, if the number of homes for sale is three times the number of homes sold, it means that it will take about three months to sell all the homes on the market if no more homes come up for sale. Over the past couple of years, inventory remained in a tight range close to one month’s supply. In other words, homes were selling as fast as they came on the market, and sometimes even faster. It was crazy.

Since interest rates started going up, however, inventory has increased steadily, and is now just over 3 months’ supply. We consider this to be a balanced market, with neither buyers nor sellers in control.

Condominium Apartments

Prices for condos in the City of Toronto have followed a pattern similar to houses, though with considerably less volatility. Condo prices hit an all-time high of $822,090 this February, 30% higher than in 2019. Prices fell 9% between February and July, and the preliminary estimate for August is the same as July. This is 17% higher than 2019, almost exactly the same as for houses.

Condos were out of favour during the pandemic: being cooped up in a small space during the lockdowns wasn’t much fun, and only two people allowed in an elevator car often meant long waits to get to your apartment. This is perhaps one of the main reasons that condo prices were more subdued than houses.

The inventory of condos for sale has also followed a pattern similar to houses. Throughout 2021 and into early 2022, inventory levels ranged from under 1 month to just over 1.5 months – extreme sellers’ market territory. Since this spring, when mortgage interest rates started moving up, inventory has increased steadily and is now just under 4.5 months – verging on a buyers’ market.

The bottom line is that we have seen the formation and collapse of a price bubble in the Toronto market over the past three years. It now seems as if the collapse phase is nearing completion if not already over. With any luck at all, we will have a much less volatile market, with steadier prices, over the next few months.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

How to Sell Your Toronto Home in a Balanced Market

08/24/22

Today, rising interest rates (and a few other economic factors) are steadily cooling down the city’s once hyper-competitive seller’s market. With fewer active home buyers, a growing surplus of inventory is letting some air out of the Toronto real estate bubble.

In balanced market conditions, sellers looking to get the best possible return on their home sale will need to be strategic. As long-time Toronto real estate agents, we’ve got a few tips for capturing the attention of potential buyers and helping you make the most of your home sale.

Want to know more about how rising interest rates are impacting real estate in West Toronto? Explore our blog post on the topic here.

Start With a Great Agent

In Toronto, home sellers have a lot of real estate agents to choose from. That said, no two agents are the same and who you choose to work with will greatly impact your home sale. From pre-listing preparations to marketing and closing the deal, agents take on a wide range of responsibilities during the sales process. You’ll want to do some research to find the right agent for you.

Not to mention – Toronto hasn’t seen balanced market conditions like today since the 1990s. This means that some newer local agents haven’t yet experienced selling in this type of real estate environment. As a seller, working with an agent who has first-hand experience in a similar real estate landscape can offer you a leg-up over other listings.

Transformative Upgrades

In a balanced market, buyers have the opportunity to be more selective in finding their ideal home. Strategic property upgrades and renovations can be a smart way to stand out from other homes on the market and increase your property value at the same time.

While some improvement projects can nicely increase your home’s market value, they may not always be necessary given market conditions. Before undertaking any significant renovations, talk to your real estate agent. As experts on home valuation and local real estate trends, they can help you determine which upgrades will help you get the best return when your home enters the market.

Looking to maximize your home’s selling price in today’s market? Explore these helpful resources from our blog.

- Will New Government Initiatives Really Make Housing More Affordable?

- The Power of Staging a Home to Sell

- Transforming Your Home: Before & After

Thoughtful Staging

In a balanced market, staging is essential. With fewer buyers looking for homes, it’s imperative that your home stands out from others on the market. In addition to catching the eyes of potential buyers, industry data shows that staged homes sell faster and for higher prices. Some agents may offer in-house staging services, or they can connect you with a third-party professional.

Don’t forget – these days, most buyers will first discover your home online. Therefore, you’ll want your home to look great both digitally and in person. A complete approach to staging should ensure your home shines wherever buyers see it.

Staging begins with a deep clean and decluttering. Then, larger furniture optimizations and carefully selected decorative elements create a cohesive and inviting aesthetic to maximize buyer appeal.

Looking to unlock more home selling insights? Sign up for our newsletter and get up-to-date information about West Toronto real estate sent directly to your inbox here.

High-Exposure Marketing

With fewer active buyers in today’s market, sellers should utilize a variety of both digital and traditional marketing techniques to maximize their reach. Once again, this is an important step to discuss when selecting a real estate agent to work with.

While each agent will have their own approach, here is a brief overview of our team’s expansive marketing philosophies.

First and foremost, a great presentation requires high-quality photos that make your home look its best wherever buyers see it. After capturing beautiful photos of your property, our multi-faceted presentation techniques such as immersive 3D tours, detailed video walk-throughs, personalized listing websites and magazine-style booklets allow potential buyers to picture themselves in your home before even stepping inside.

Next, our data-driven, targeted approach to digital marketing ensures your home reaches an expansive buyer audience. In this stage, we utilize a variety of online marketing strategies including organic and paid social media placements, display network advertising, digital newsletter promotion, and amplified presentation on an array of home search platforms.

Strategic Pricing

Like marketing, strategic pricing aims to maximize interest by presenting your home in a way that compels buyers. Pricing strategies can vary based on market conditions, however, a tactical listing price should be based on market data, local buyer activity, and property features. It’s hard to overstate the importance of a thoughtful, deliberate approach to pricing. Be sure to ask your agent about their pricing process.

Our Approach to Selling

As multi-decade veterans of Toronto real estate, we’ve seen it all. Our goal is to surpass client expectations by providing top-tier selling strategies and service that goes above and beyond. Beginning with a one-on-one conversation to understand your selling goals, we create a custom, results-oriented selling plan to ensure your success.

From pre-listing preparations to dynamic staging and full-scale modernized marketing techniques, we take a proactive approach to maximizing buyer interest. Next, our negotiation and business expertise allow us to land the best possible price for your home – keeping you connected, confident and informed all the way through.

We believe that every seller deserves an agent who will put them first. Whatever you need, we’re ready to help!

Want to learn more about our selling advantage? Explore these posts from our site.

Ready to sell your home? It’s time to find out if we’re the right fit – Book a Seller’s Consultation.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

The Dog Days Of Summer Are Upon Us

07/25/22

Toronto prices have been falling in June and July for three reasons:

- A summer slowdown is normal, as both buyers and sellers take time off from real estate to enjoy our relatively short warm season. We have seen this pattern virtually every year for decades;

- Pandemic-related restrictions have been eliminated or relaxed, and many folks are enjoying the freedom to get away for long-postponed vacations; and

- Interest rates are being sharply increased in an effort to fight inflation, and this is impacting affordability in a dramatic way.

Let’s have a look at how this is playing out.

Detached Homes

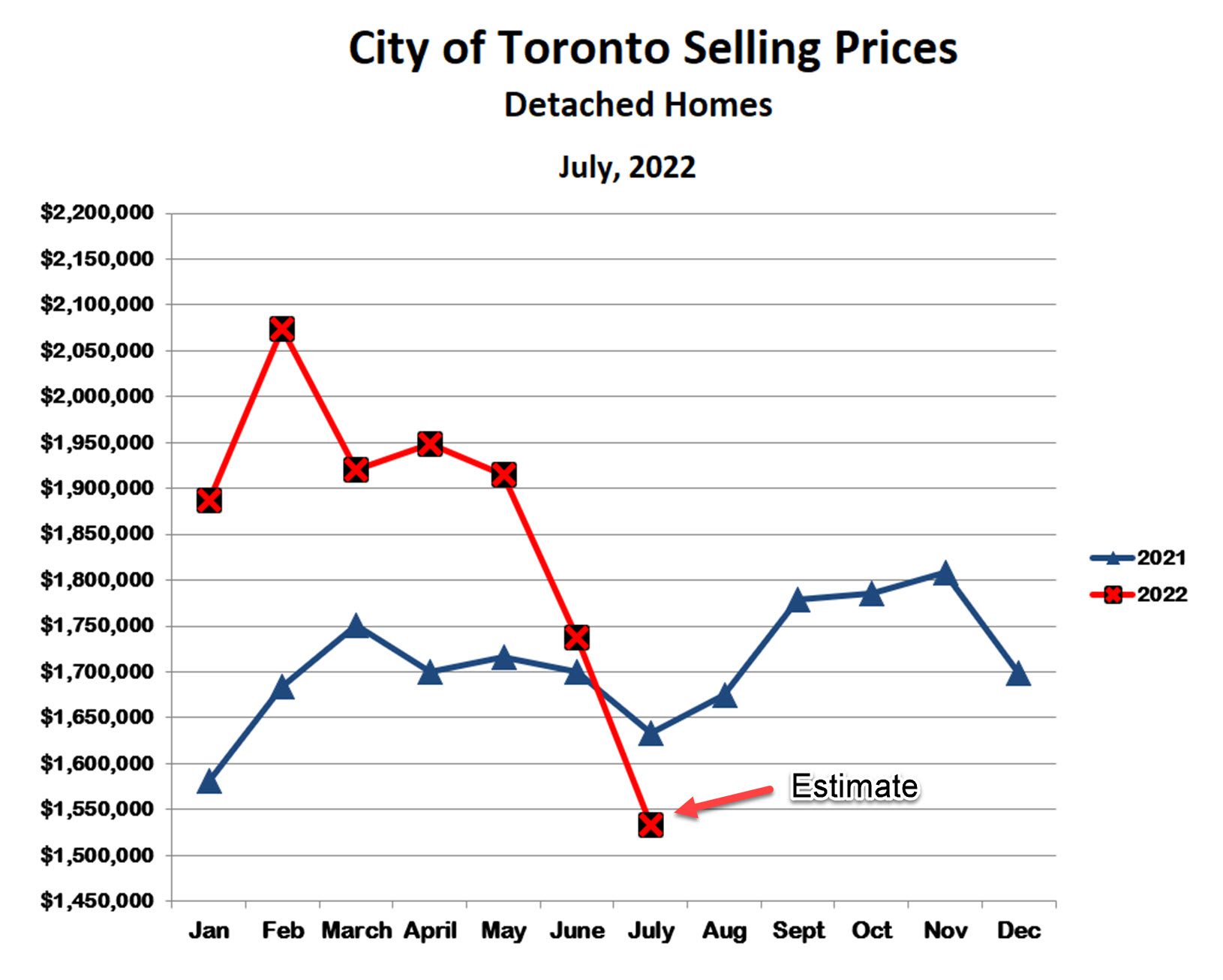

Based upon data from the Toronto Regional Real Estage Board, average prices for detached homes in the City of Toronto fell by 9% in June and are down a further 12% so far in July. In total, detached prices have fallen approximately 26% since the all-time high in February.

Not surprisingly, these changes come with a corresponding change in the supply of homes for sale. We define inventory (also known as months of supply) as the ratio of homes for sale to homes sold during a given month. For example, if there are twice as many homes for sale as there were homes sold last month, that means it would take two months to sell all the homes now for sale if no new homes came up for sale. Our rule of thumb is that 3 months’ supply represents a roughly balanced market, where neither sellers nor buyers are in control. As the chart below shows, we had very low inventory early this year (a strong sellers’ market), however, the inventory has risen steadily over the past three months and the market is now becoming more balanced.

The decline in prices may seem extreme, however, a bit of history will help to put this into perspective. The chart below shows average detached prices over the past 3 years, tracking the changes over the course of the pandemic.

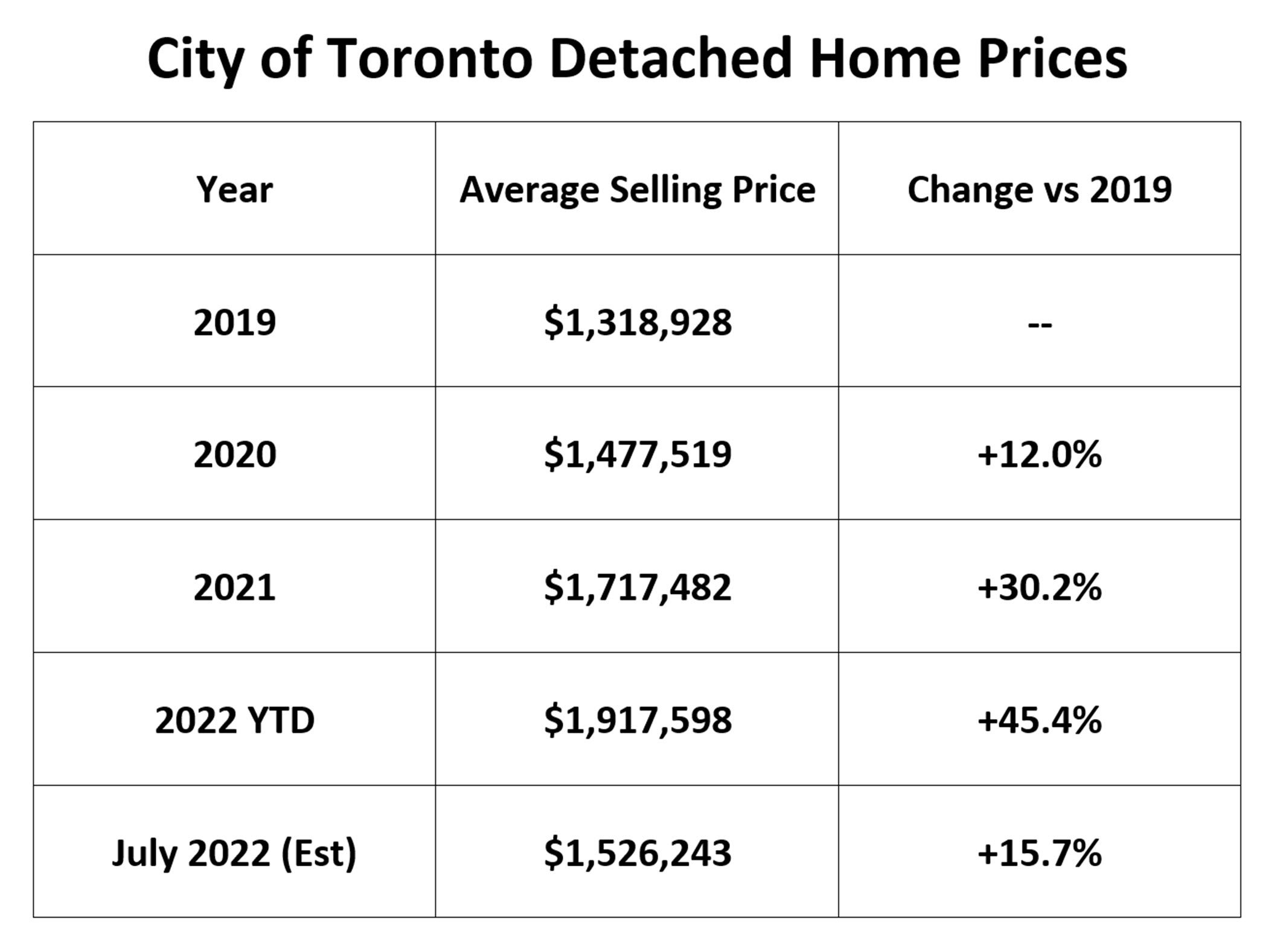

Between 2019 and 2022, detached prices rose by more than 45%! It seems crazy that this could happen during a pandemic, but it actually makes sense. First, the government caused a recession by imposing lockdowns and other covid restrictions. Then, the government and central bank tried to offset the effects of the recession by over-stimulating with free money and ultra-low interest rates. This led to frantic real estate buying and a ‘fear of missing out’ mentality that drove prices higher relentlessly.

Now, however, the over-stimulation has led to inflation, which the central bank is forced to fight with aggressive interest rate increases. This is taking a lot of the ‘bottled air’ out of the real estate market and bringing prices down to more realistic levels. Even with the latest price decrease, however, we are still more than 15% above 2019. This is about 5% increase per year, a very respectable number indeed.

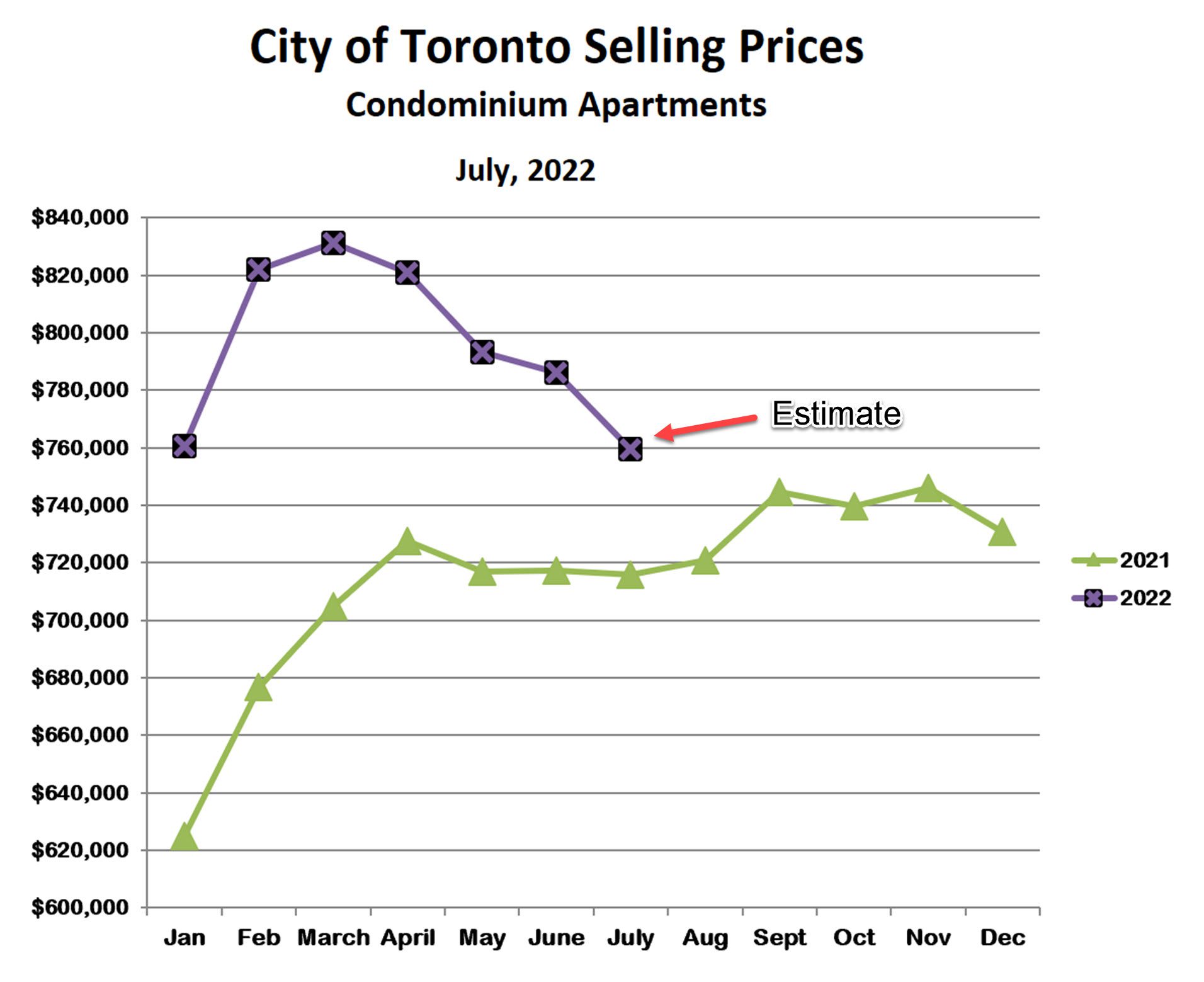

Condominium Apartments

The story for condos is similar to houses, albeit less extreme. Prices have fallen for the past four months and are now about 9% below the March peak. Unlike houses, condo prices are still higher than last year, however.

As for houses, the inventory of condos for sale has been increasing steadily and now stands at just over 3 months’ supply, representing a ‘balanced’ market, favouring neither sellers nor buyers.

The history of the condo market since the beginning of the pandemic also resembles houses. Prices as of this June were about 27% higher than in 2019, and are still almost 20% higher after the recent fall. This is a most respectable 6%-7% per year increase during the pandemic.

The bottom line is that the pandemic (or more accurately the responses to the pandemic) created a significant bubble in real estate prices. The bubble is now deflating due to rising interest rates made necessary by inflation, which was also caused by responses to the pandemic.

With a bit of luck, inflation will abate over the next few months, interest rates will decline (or at lease stop rising) and we will avoid a deep recession. If all of this comes to pass, we can hope for more stable, predictable prices and a more balanced market going forward.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Toronto Real Estate Market Continues to Soften

06/16/22

Detached Homes

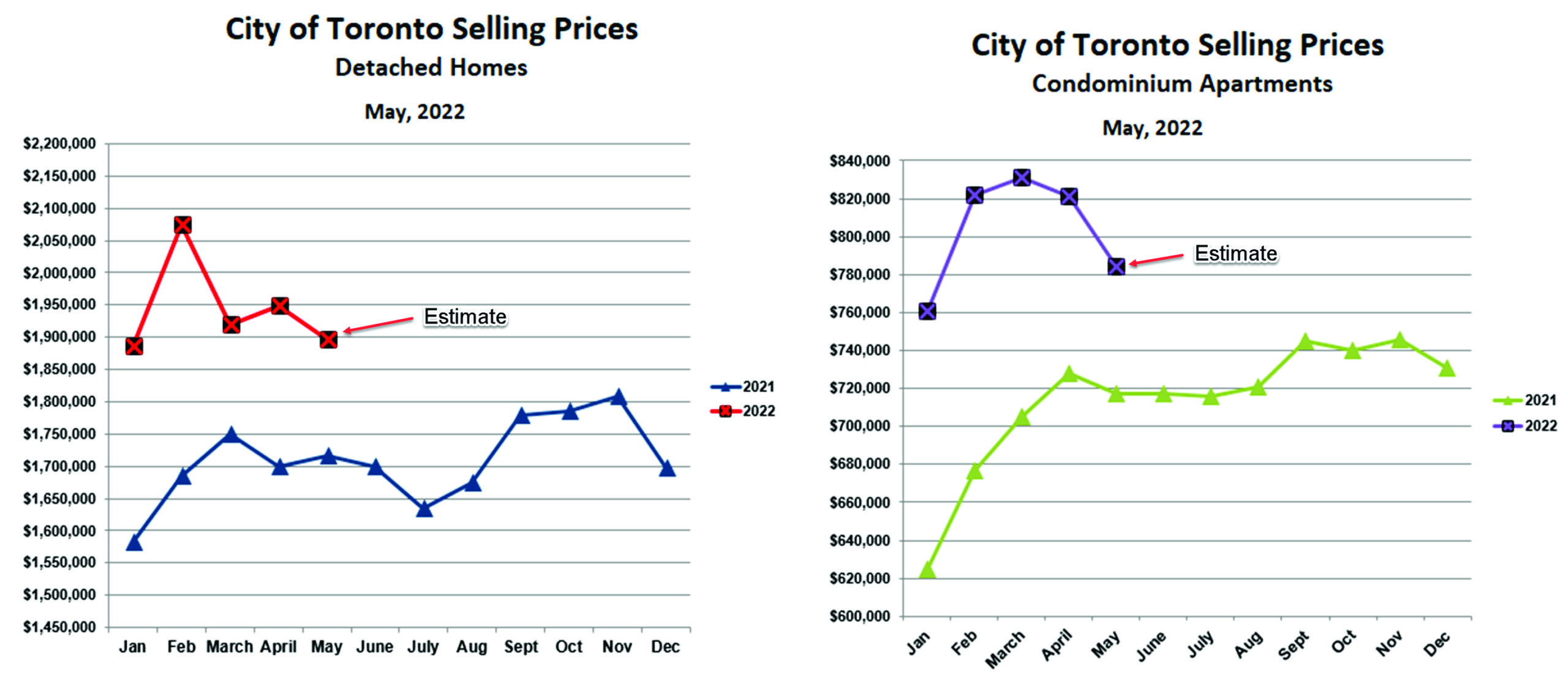

Prices for detached homes in the City of Toronto are trending lower in June than in the first five months of this year. After peaking in February at an average of close to $2.1 million, prices remained steady at just over $1.9 million in March, April in May. June prices are just over $1.8 million, still almost 8% higher than last June, and above the 2021 peak reached last November. And 2021 was a very strong year.

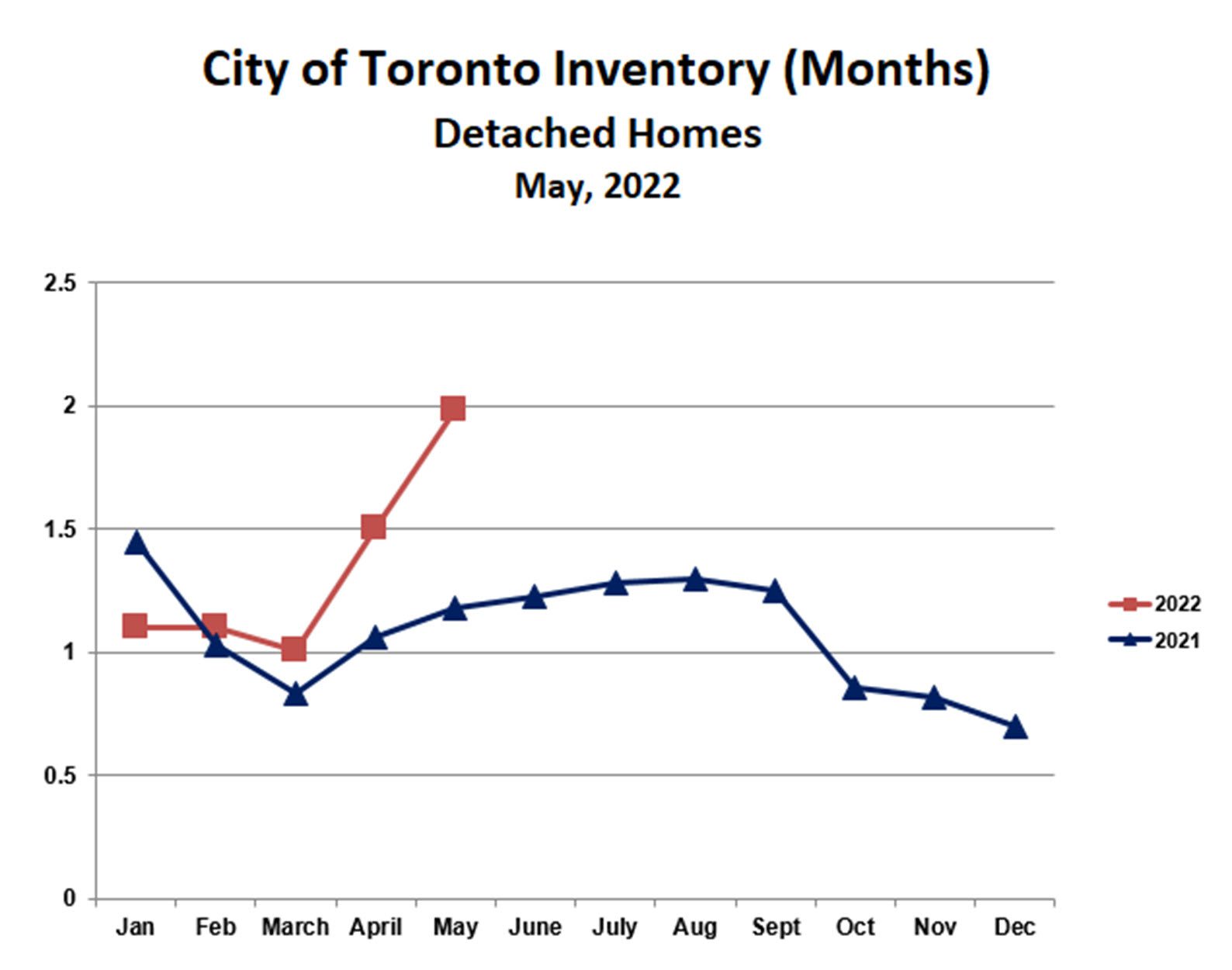

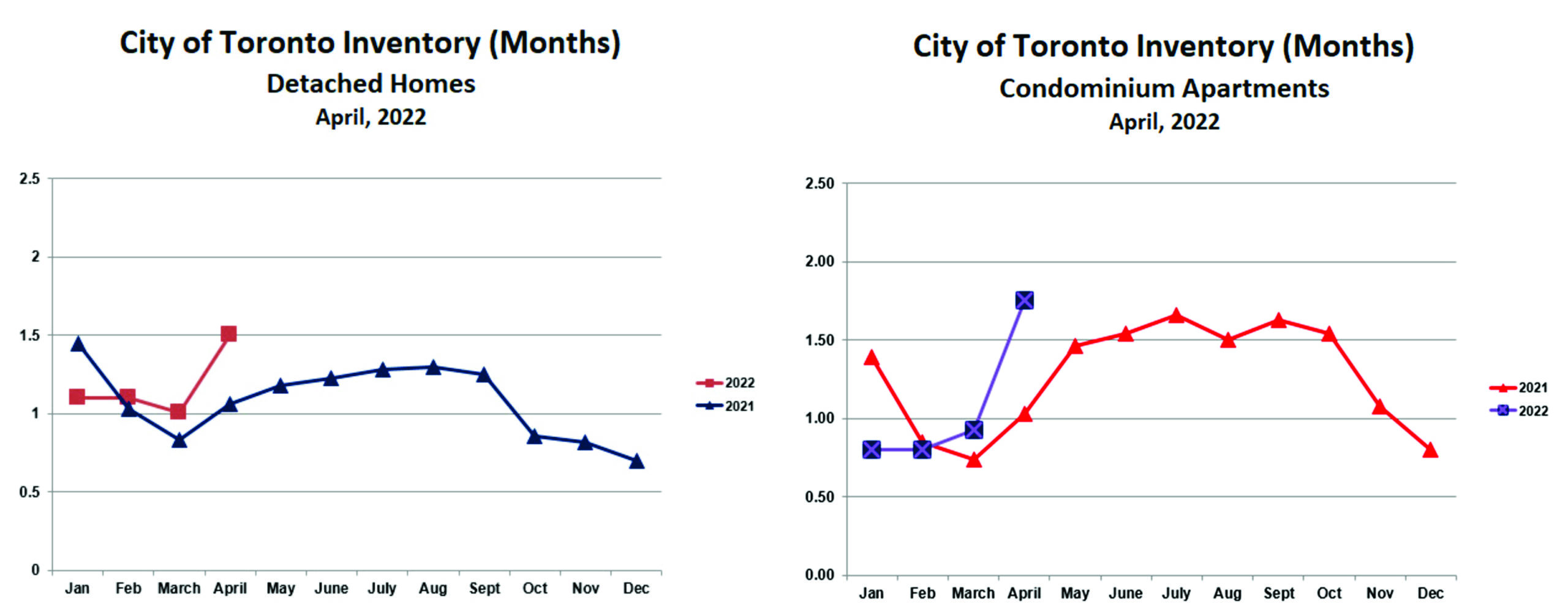

The softening of detached prices is due to declining sales and increasing listings. The driving forces behind this are increasing interest rates and declining affordability. The chart below shows the inventory of homes for sale. This is simply the ratio of active listings to monthly sales, that is, how long would it take to sell all homes presently for sale if no more listings came up for sale. As you can see, inventory increased sharply in April and May, and is now at about 2 months’ supply. Our rule of thumb is that 3 months’ supply represents a balanced market, with neither buyers nor sellers in control. We are still in a sellers’ market, however, we may slip into a buyers’ market over the summer if the trend continues. Not surprisingly, bidding wars are becoming few and far between. Asking prices are more often being set close to market value.

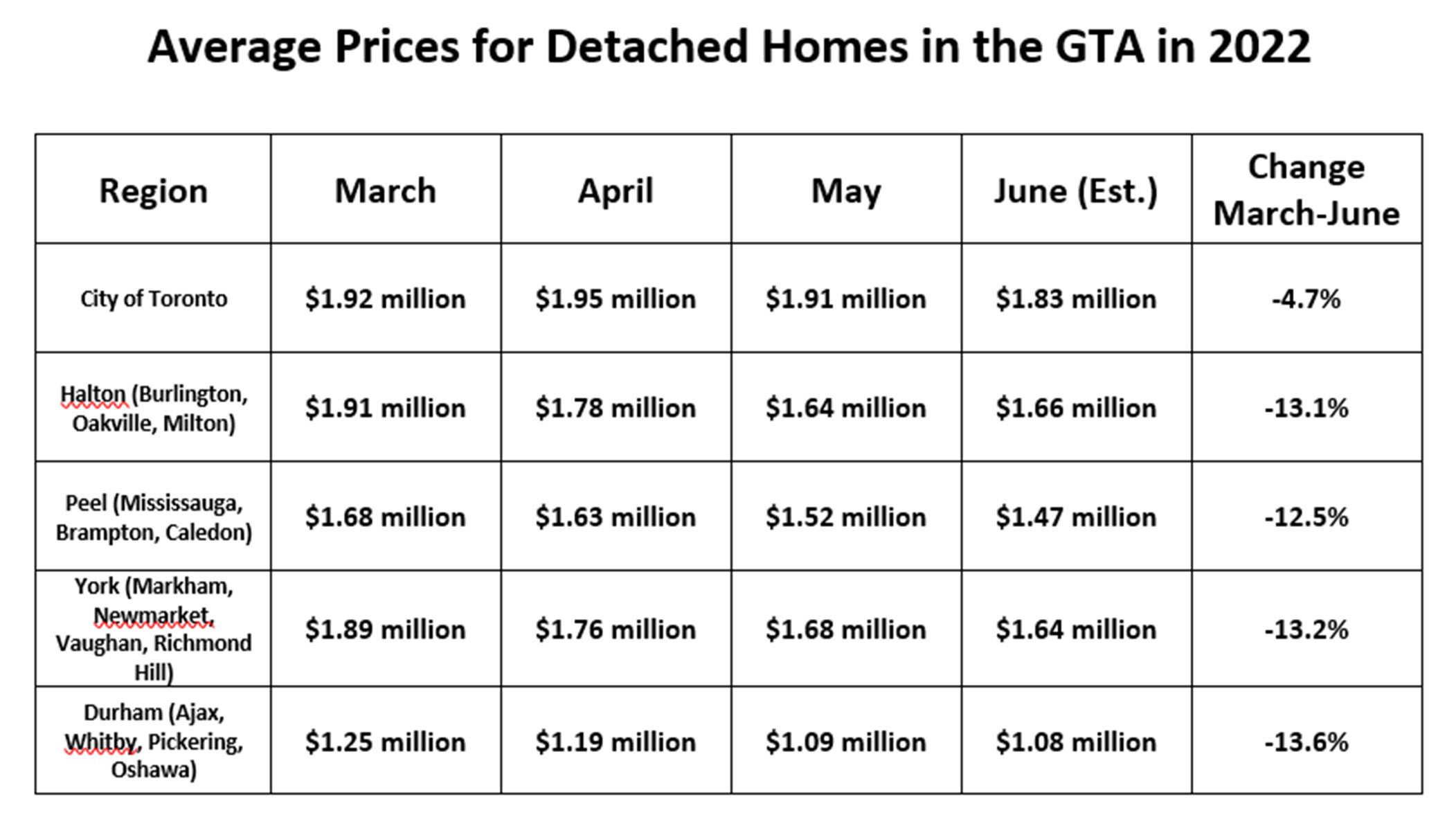

The market for detached homes in the City of Toronto remains stronger than in the rest of the GTA. As the chart below shows, prices in the surrounding areas have fallen by about 13%, while prices in the city fell by only 5%. This suggests that the Covid-induced exodus to the suburbs is somewhat reversing. Long commutes to the office are not very attractive now that gas prices have doubled.

Condominium Apartments

Condos are following a similar trend. Prices peaked in March, and began falling in May, again due to increasing interest rates and declining affordability. As for detached homes, prices remain well above last year.

Similar to detached homes, the inventory of condos for sale increased sharply in April and May due to declining sales and increasing listings. At just over 2.5 months, the inventory is approaching buyers’ market territory. Unsurprisingly, bidding wars for condos are also disappearing rapidly.

The summer season generally tends to be ‘thin’, as both buyers and sellers take a break to enjoy the warm weather. This could be especially true this year as we are finally free from (most) Covid restrictions. Whether we see a typical rebound in prices in the fall will depend almost entirely on what happens with inflation and interest rates over the next 2-3 months. Stay tuned.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Toronto Market Beginning to Slow

05/17/22

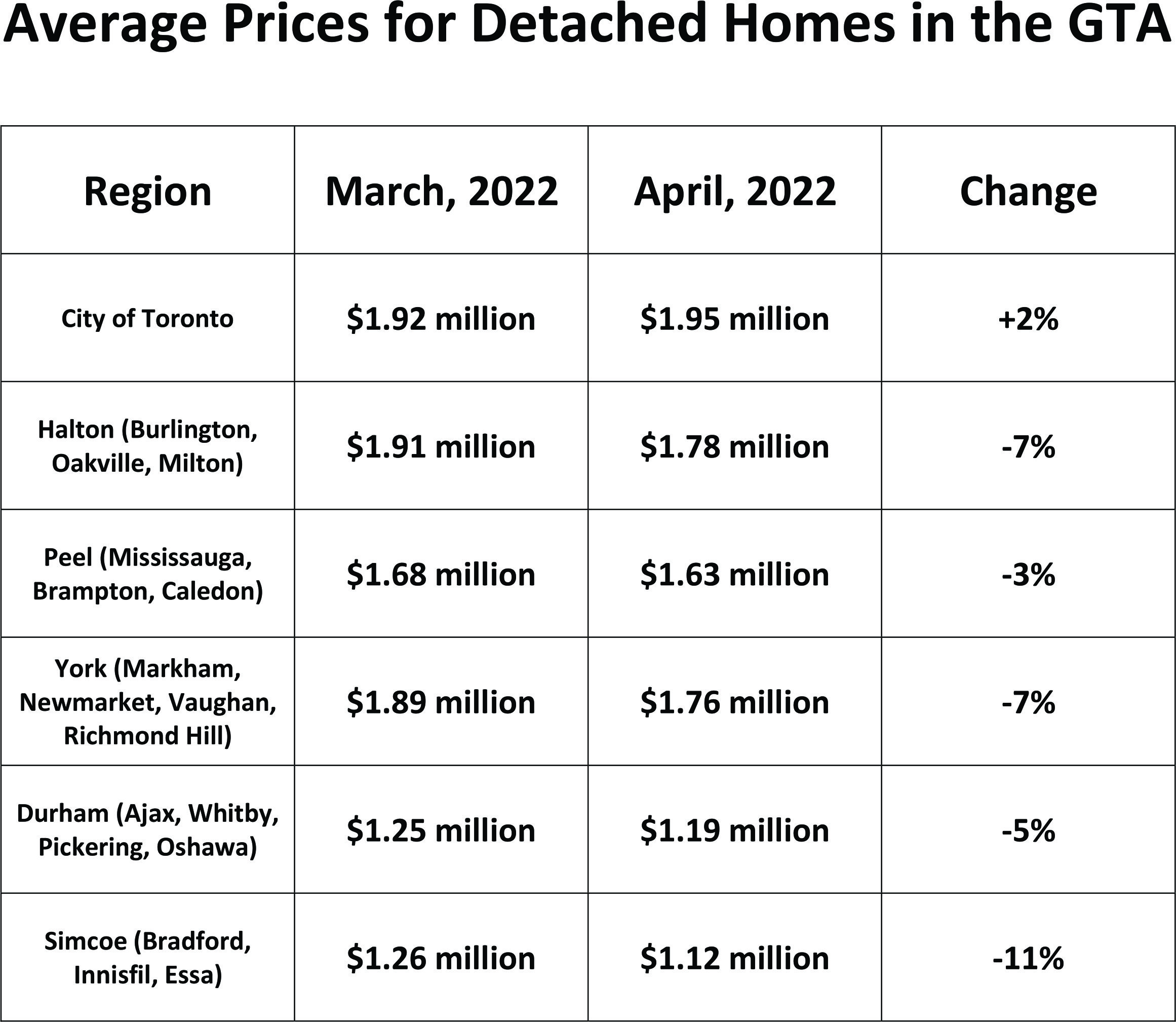

There was much noise in the media a couple of weeks ago, following the release of data on home prices and sales in April. A Globe and Mail headline was typical: “Toronto home sales plunge 27% in April, home prices dip”. Let’s put this into context, however. The “Toronto” in this headline is actually the Greater Toronto Area, which includes the suburbs to the east (Pickering, Ajax, etc), north (Markham, Vaughan, etc) and west (Oakville, Mississauga, etc). As the chart below shows, the City of Toronto had dramatically different results as compared with the suburbs: prices outside the city all went down in April vs March, whereas prices in the city actually went up.

As the pandemic ebbs, many who have been working from home are now being called upon to spend more time in the office. In combination with rapidly increasing gas prices, this makes it much less attractive to commute. This is especially true in light of the extreme escalation in prices in the suburbs as compared with the city over the past couple of years. So, we shouldn’t be surprised to see prices hold up much better in the city as the market begins to slow.

Even in the city, however, the signs of slowing are beginning to appear. While prices were steady between March and April, sales fell by about 25% — less than in the suburbs, but still substantial. And estimated prices for the first half of May are lower for both detached homes and condo apartments, as the chart below shows.

Inventory levels also increased from March to April, though both condos and detached homes are still comfortably in sellers’ market territory, each below 2 months’ supply. We’d consider the market to be balanced (favouring neither buyers nor sellers) when inventory is about 3 months.

Overall, just to keep things in perspective, we are shifting from an “insane sellers’ market” to a “strong sellers’ market”. We saw a somewhat similar pattern last spring and summer, which was followed by another insane sellers’ market in the fall. This year, however, with interest rates rising and inflation (so far) unabated, it seems unlikely that the fall market will be as strong as in 2021.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!