Toronto Fall Market Heating Up

09/29/23

Looking for personalized real estate advice? We can help! Reach out at 416-769-6050 or email us at info@smithproulx.ca.

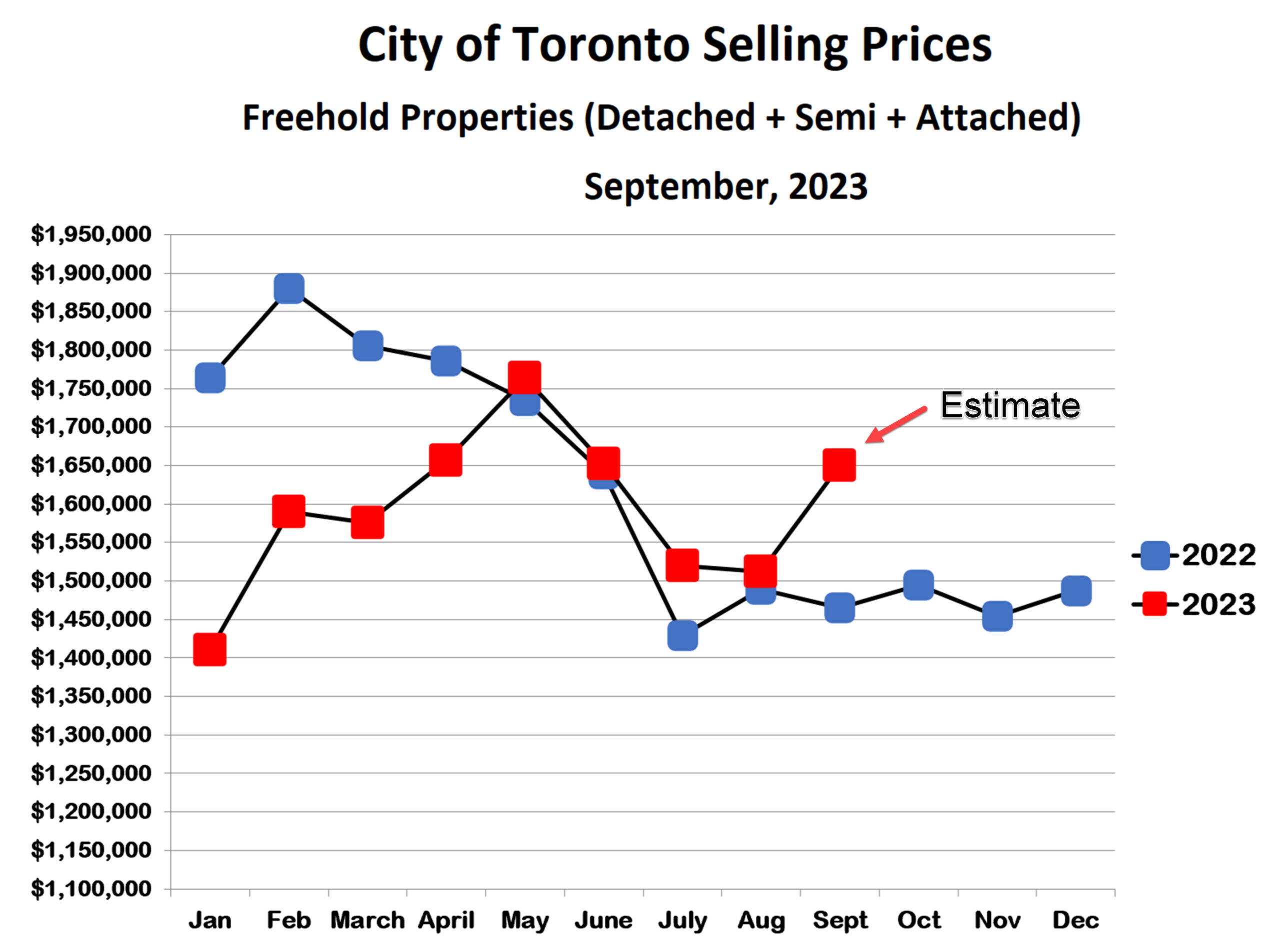

Houses (Detached, semi-detached and attached)

Following the seasonal script perfectly, house prices have rebounded sharply in September. Prices are up 9% from the August low and are back to where they were in June. We usually see continued momentum in October, so prices could be even higher next month. While the Bank of Canada did not hike interest rates this month, it seems likely that high mortgage rates will be with us until at least the middle of next year. So affordability limitations are not holding the Toronto market back. There are simply too many buyers chasing too few homes for sale, a reflection of our growing housing crisis.

Looking for home-buying advice? Start with these related blog posts.

- Should I Trust Real Estate Advice From Social Media?

- Why You Should Buy Instead of Renting

- Incentives & Tax Breaks First-Time Buyers Should Know About

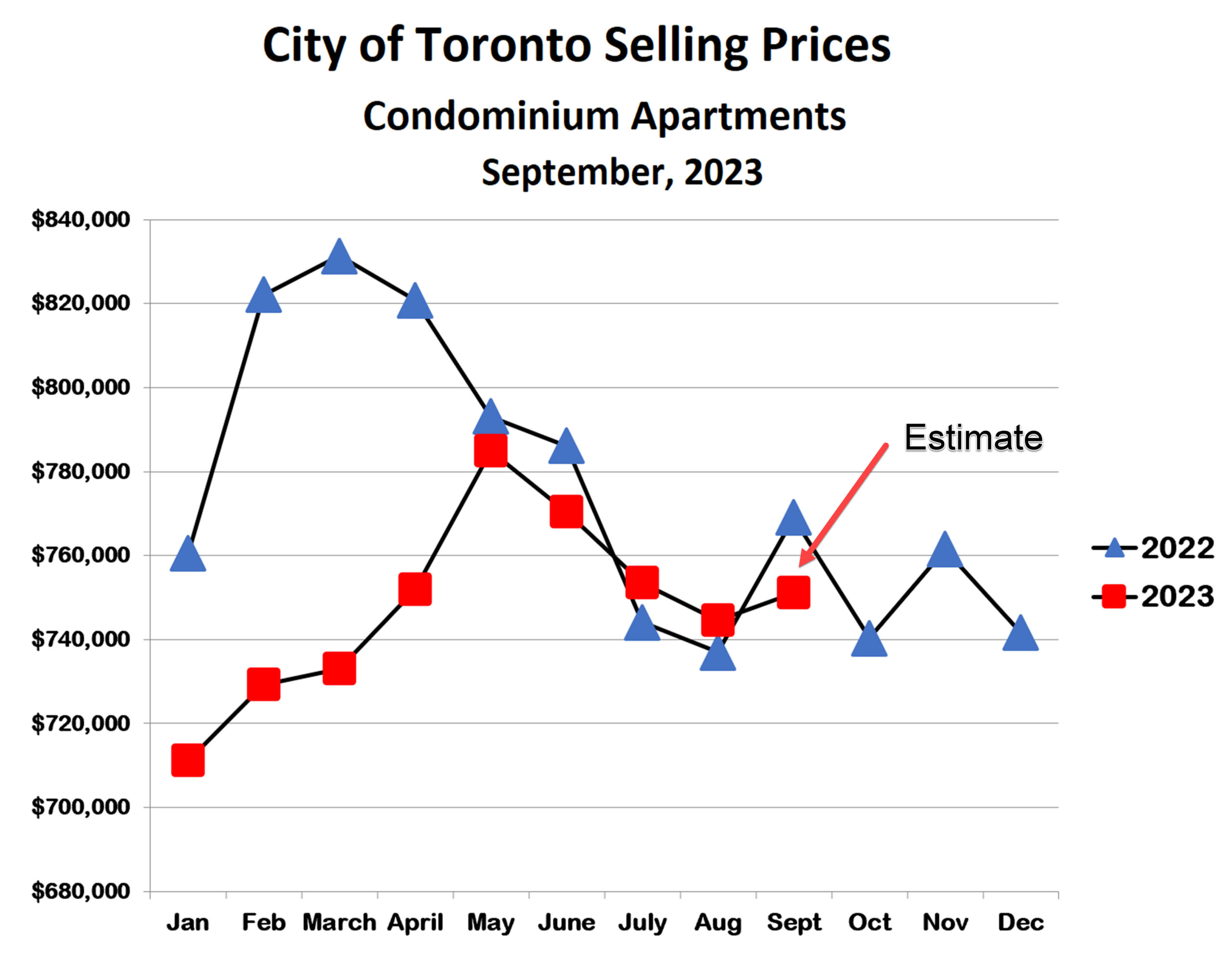

Condo Apartments

September prices for condos are up slightly versus August but are still below July. Counter-intuitively, the impact of higher interest rates has been even greater on condos than on houses. This is because many condos are income properties purchased by homeowners. As interest rates ramped up last year, these investors suddenly experienced considerable increases in mortgage payments on both their homes and their investment condos. Many of them decided to sell their condos, adding to the inventory of condos for sale. This may be why condo prices are not bouncing back this month to the same extent as house prices.

The Bottom Line

The outlook for the next 6-9 months is highly uncertain. The impact of higher interest rates is being felt more and more strongly by consumers, businesses and governments, and so the probability of a recession next year is increasing. Even if we can manage the mythical ‘soft landing’, a hot spring market in 2024 seems like a long-odds proposition.

It seems to me that the most likely scenario is a reasonably strong market until early to mid-November, followed by seasonal weakness over the Christmas season, and then a modest recovery in the spring that falls somewhat short of this year’s high. Many other scenarios are possible, of course… stay tuned.

Looking for personalized real estate advice? We can help! Reach out at 416-769-6050 or email us at info@smithproulx.ca.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!