Vacant Property Tax Is Coming To Toronto

08/09/21

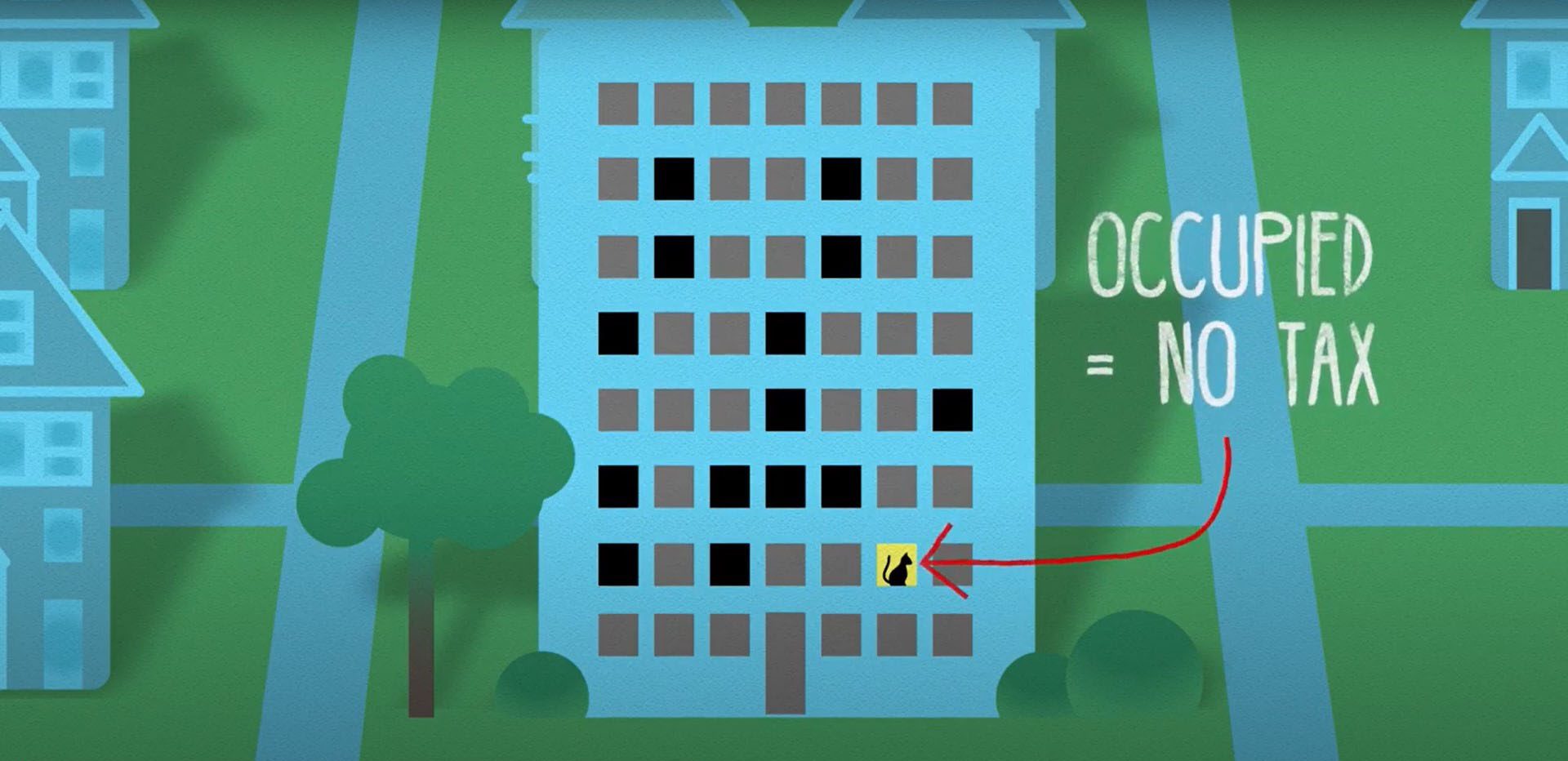

The City of Toronto plans to implement a vacant home tax effective January 1, 2022. Here’s how it will work:

- 2022 will be the ‘reference year’ for determining the vacancy status of the property.

- Starting in 2023, property owners will have to declare the vacancy status of their properties during the previous year.

- If the property was vacant in 2022, a tax of 1% of the assessed value will be assessed. For example, if the assessed value is $1,000,000, the tax will be $10,000. This tax rate is 64% higher than the property tax, which is 0.611% in 2021 for single-family homes!

There will be exemptions from the tax. For example, properties being renovated, properties owned by ‘snowbirds’, and properties where the homeowner passes away or is in medical care will not be considered vacant. The tax will be payable on properties that are unoccupied for more than six months or for which an exemption applies. A bylaw to be implemented later this year will spell out the details.

Vancouver Vacant Property Tax

Vancouver implemented a similar tax in 2017. The vacant property tax rate in Vancouver is currently 1.5% and will be increased to 3% in 2022 (payable in 2023 on properties vacant in 2022). So the Toronto tax is a bargain!

Federal Vacant Property Tax

The federal government is also implementing a 1% vacant property tax, effective January 1, 2022. This tax will apply to non-resident owners only. Non-residents thinking about purchasing a property in Toronto will potentially be subject to both a 15% tax on purchase as well as a 2%/year tax if they don’t rent the property for at least 6 months each year.

Ontario Vacant Property Tax?

Even our provincial government wants a vacant property tax. If this happens will it be in addition to the Toronto tax? Talk about piling on!

What Will The Vacant Property Tax(es) Accomplish?

The stated intention is to encourage owners to make vacant properties available for rent or for sale. This would improve the supply of both rental and resale properties.

The limited supply of resale homes has been one factor feeding the rapid increase in prices this year. Increased supply should slow the rate of price appreciation.

The limited supply of rental housing was a serious issue pre-Covid. While this hasn’t been the case for the past 16 months, the tight rental market will probably return once Covid is behind us.

Let us not forget the law of unintended consequences, however. This law states that intervention in complex systems can result in unexpected and often undesirable outcomes. For example, the implementation of the foreign buyers’ tax in early 2017 (part of the 16-point Ontario Fair Housing Plan), caused a very rapid 20% crash in house prices. Four years later, prices have finally returned to 2017 levels. Obviously, the framers of the plan did not desire or anticipate such a violent reaction. Why did it happen? The most credible theory is that buyers and sellers expected that the legislation would cause prices to fall. Buyers, therefore, held off on purchasing while sellers rushed in to sell before prices fell. This caused an overnight shift from an extreme sellers’ market with insane bidding wars to an extreme buyers’ market with too many listings. The market went into freefall.

Fast forward to 2021 and the impending vacant property tax(es). What could go wrong?

First of all, let’s consider that there may be good reasons why an owner would not want to rent out their vacant property. After all, why not enjoy the extra income? For owners like these, the vacant tax might lead the owner to sell rather than rent. Second, investors may well anticipate that the tax will reduce the value of income properties (not an unreasonable assumption). This could encourage them to cash in rather than continue to rent.

The vacant tax might therefore cause a large price correction (a la 2017) while tightening the supply of rental properties. I submit that the government doesn’t expect or desire either of these outcomes.

Time will tell how this will actually play out.

Toronto vacant tax coming in 2022. Owners will pay 1% in 2023 on properties that were vacant in 2022.

Toronto will implement a 1% vacant home tax in 2022. The tax will be paid in 2023 on homes that were vacant in 2022.