Year: 2020

Toronto Market Bounces Back in May

06/03/20

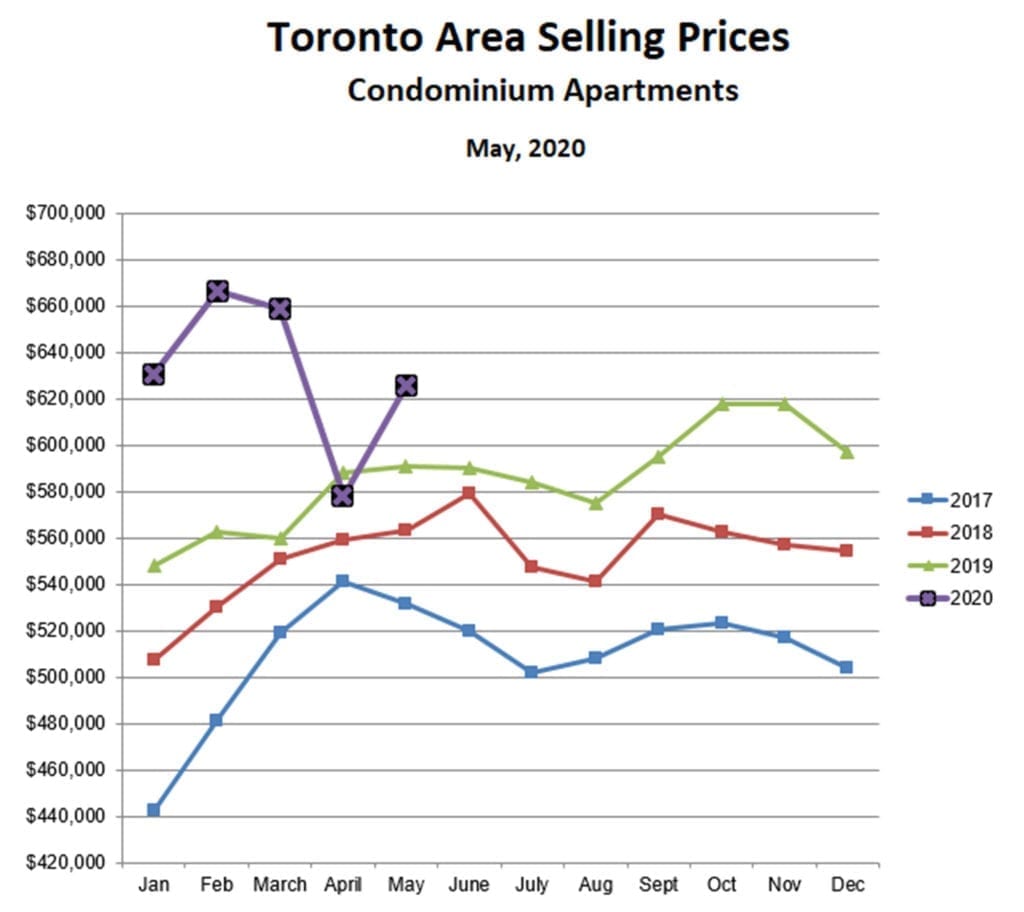

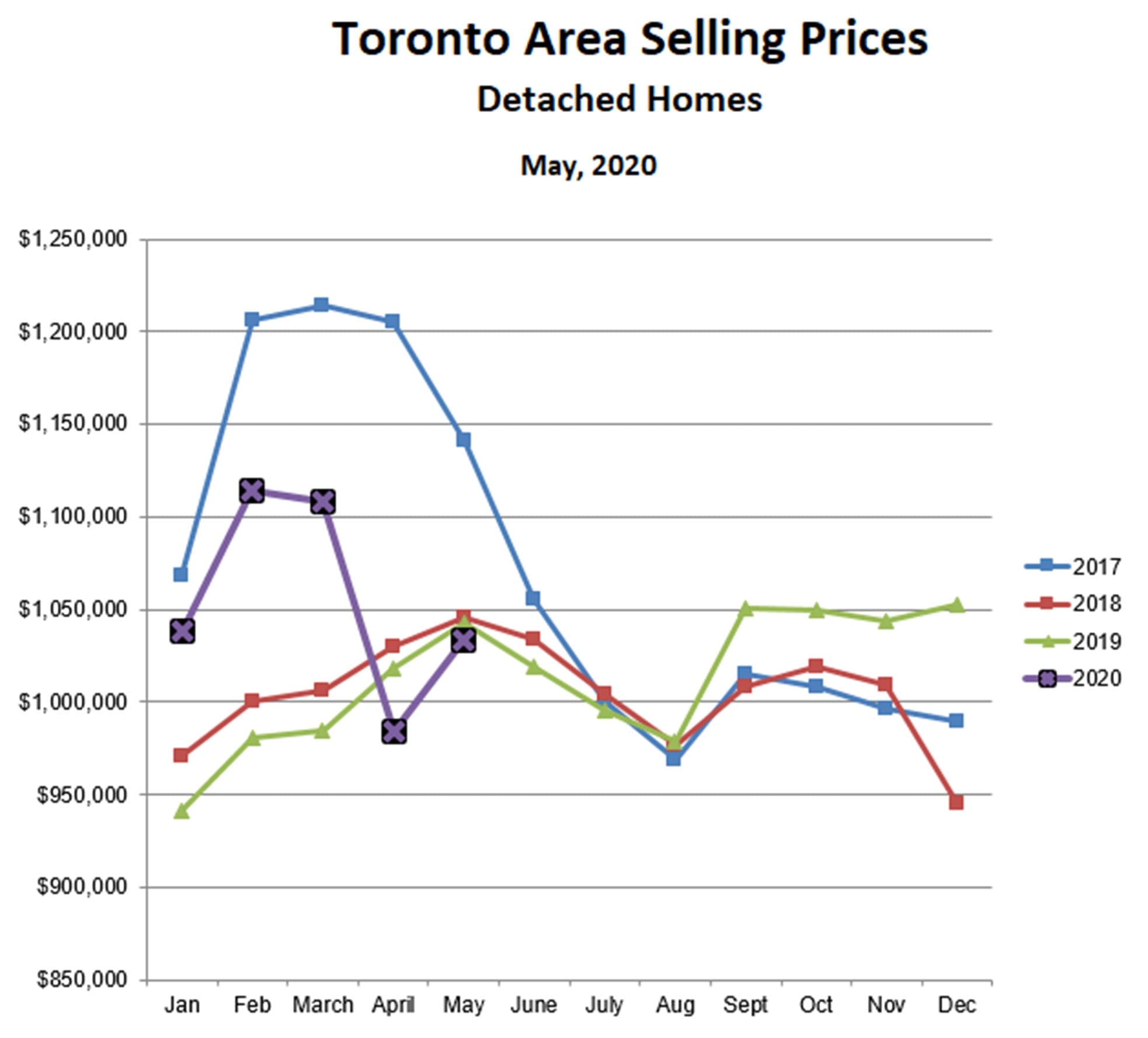

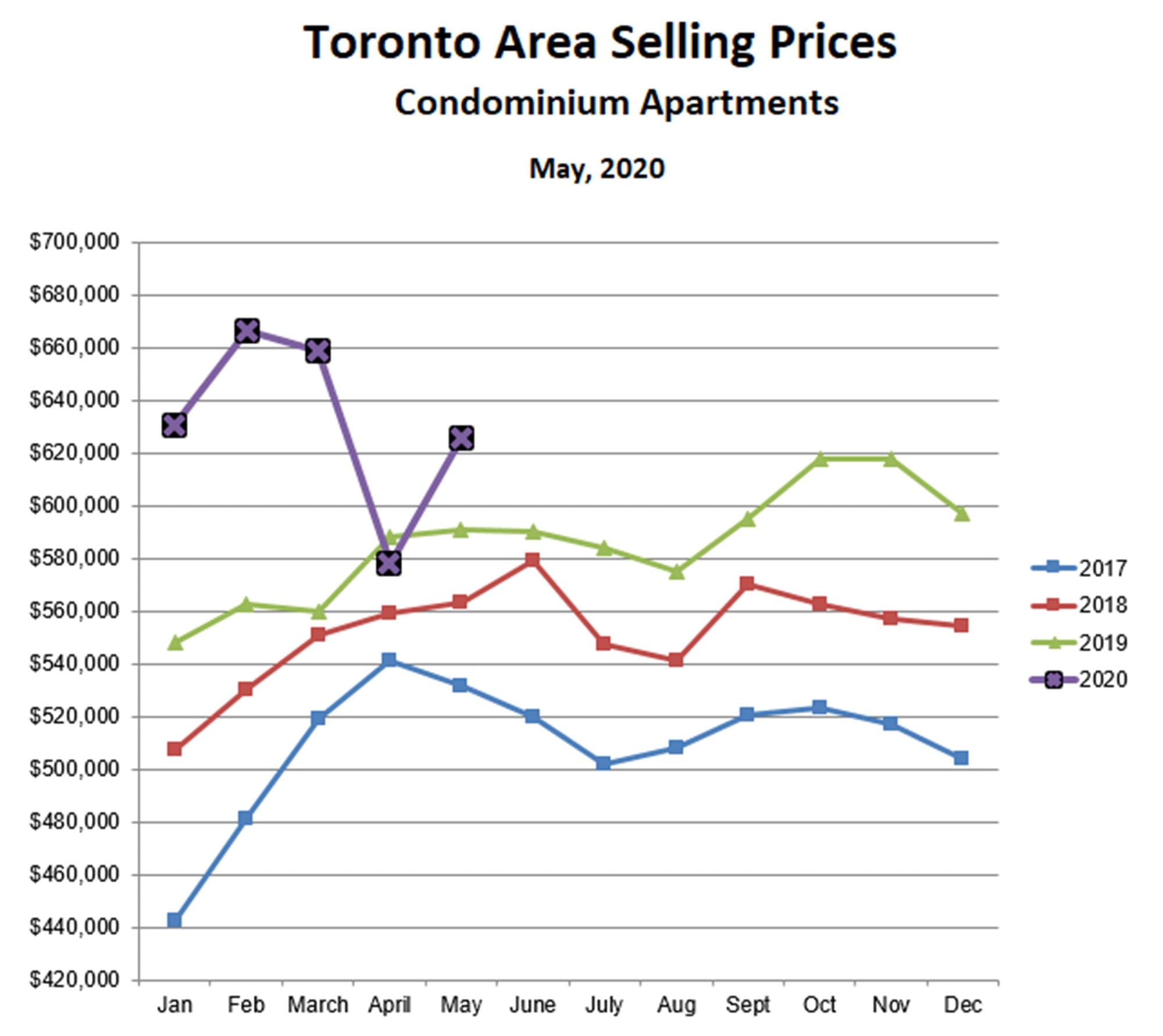

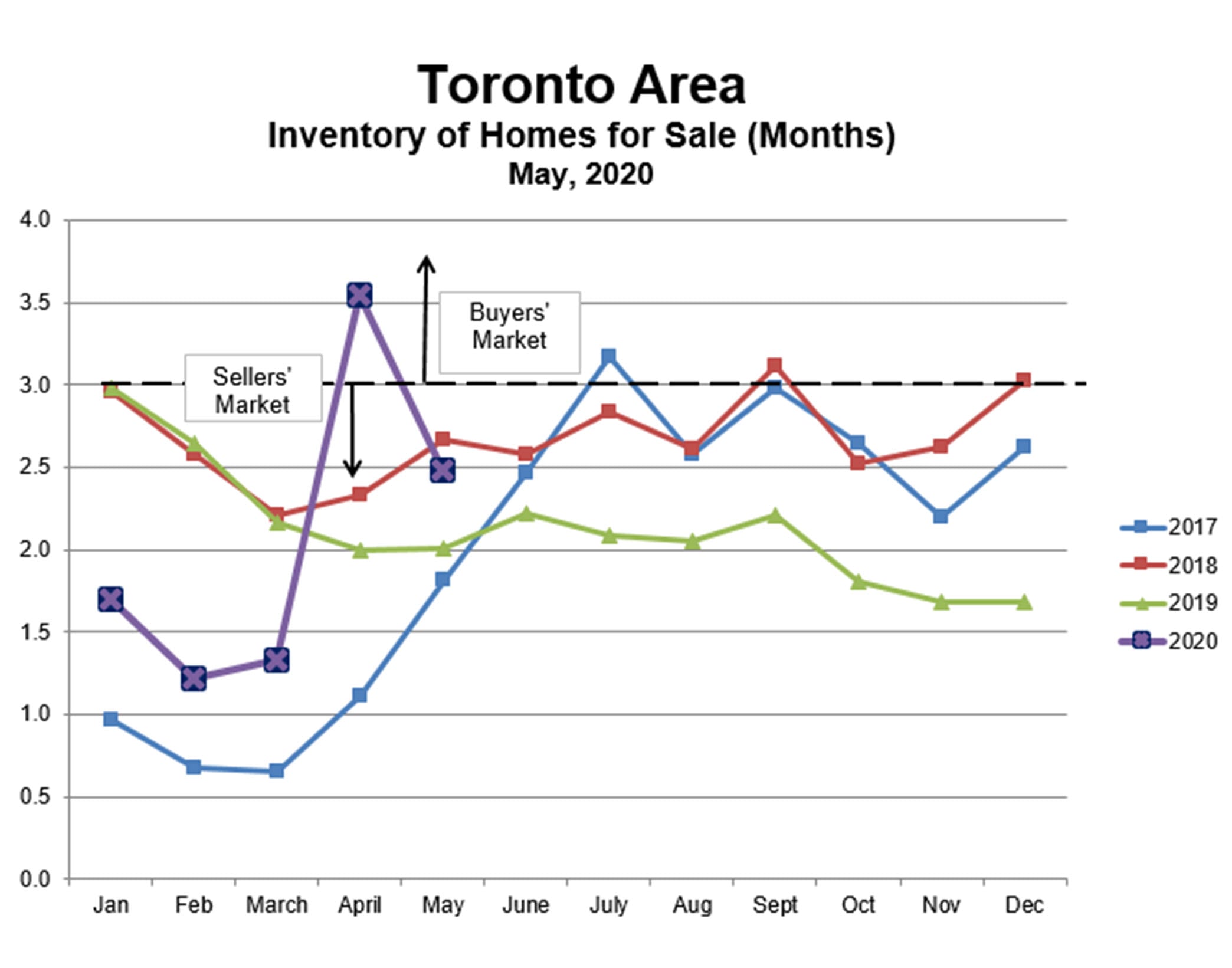

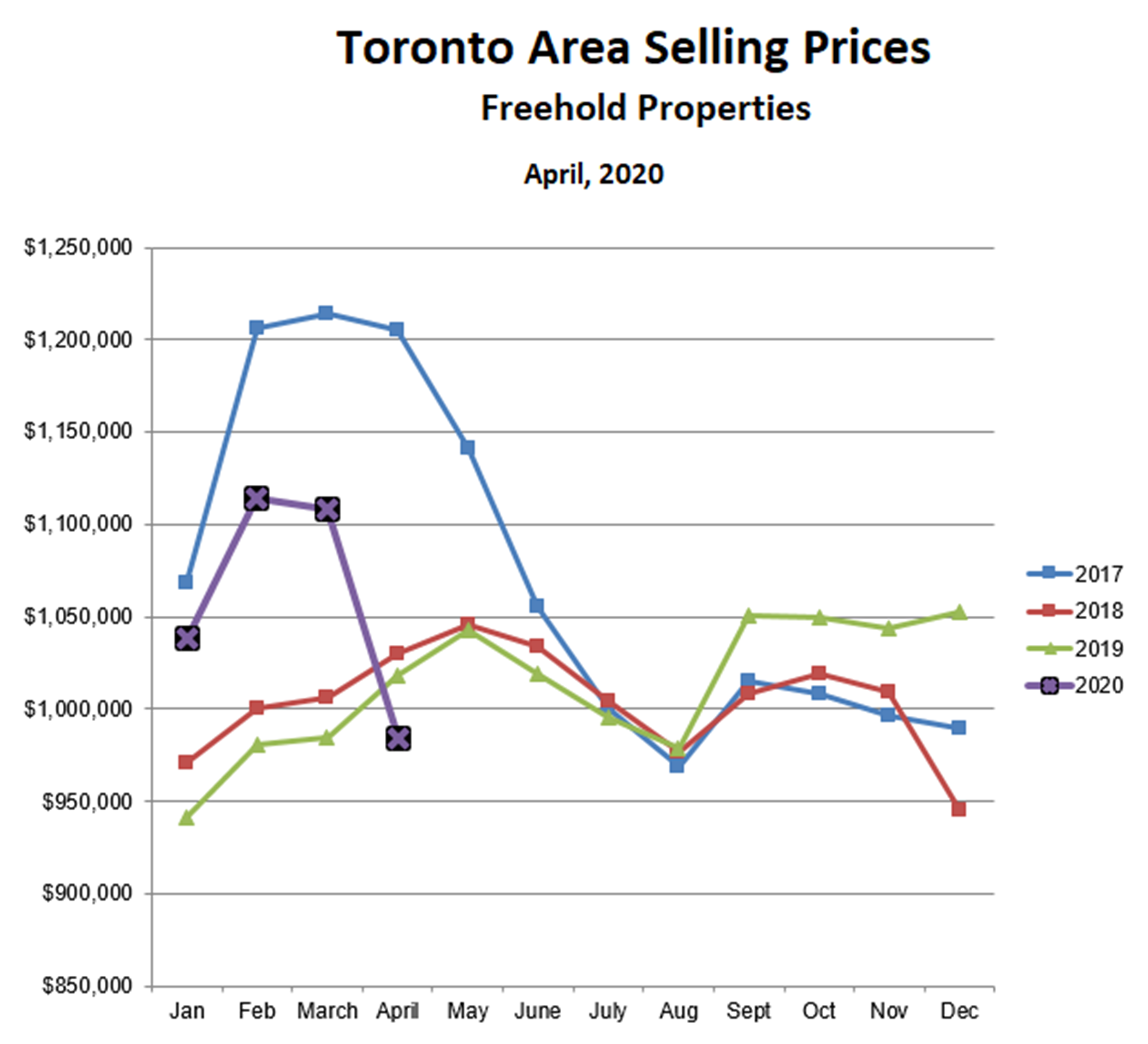

After being so rudely interrupted by the COVID-19 lockdown in late March, and suffering through a dismal April, the Toronto area real estate market has come roaring back May. Prices increased dramatically across all property types, the first time since 2016 (and briefly early this year) that freehold and condo properties have increased in lock-step.

Prices for detached homes, for example, increased by 5% as compared with last month, after falling by 11% in April, and are now almost exactly the same as they were last April (and, coincidentally, in April of 2018). The lockdowns quickly deflated this year’s nascent price bubble, but we are now back on solid ground with some upward momentum.

Prices for condominium apartments are following a similar trend. After falling 12% in April, condo prices increased by 8% in May, and are now higher than at any point last year.

Sales also rebounded sharply in May, up more than 50% as compared with last month, but still only about 50% of last April, reminding us of just how steep the drop in market activity was in April. Active listings also increased in April, but only by about 8%, and so the inventory of homes for sale (active listing/sales) declined from 3.5 months to 2.5 months, putting us back into a moderate sellers’ market similar to this time last year. Clearly buyers are returning to the market more quickly than sellers, and we are seeing this in the re-emergence of bidding wars in certain areas.

The Toronto real estate market has shown amazing resilience in the face of the COVID-19 lockdowns, and we can look forward to continued improvement in the market over the next few months as the economy re-opens.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Falling Rents May Impact House Prices

05/28/20

A recent report from Capital Economics highlights falling rents in Canadian cities, especially Toronto and Vancouver, and points out that this could have a significant knock-on effect on Canadian house prices.

The report identifies several reasons why rents are falling:

- The surge in unemployment due to COVID-19 lockdowns has hit low-wage earners the hardest, and they are typically renters. Large numbers of these people can no longer qualify for rentals and, even if they can, they may want to stay wherever they are until the situation is less uncertain.

- Because of COVID-19, Tenants in rental properties who are planning to move out are generally unwilling to allow viewings of their unit by prospective new tenants. This means that the landlord may have to wait until the existing tenant moves out to start the rental process and, in turn, this may increase the landlord’s motivation to get the unit rented quickly, even if it means a reduction in rent.

- Much rental demand comes from new immigrants, and COVID-19 has caused immigration to drop from about 30,000 per month to almost zero.

- The temporary ban on short term Airbnb has shifted many of these properties to the longer term rental market, increasing inventory.

- As university teaching moves online, this will likely reduce the demand for rentals by university students.

Since Toronto and Vancouver receive most of the new arrivals to Canada and also have the highest share of short term rentals, these two cities could see the largest fall in rents. For instance, Capital Economics projects that, in Toronto, the vacancy rate could jump from 1.5% to 4.5% by July, and even further in the fall depending on what happens with universities. Their calculations suggest that this could translate to a huge 15% drop in rents. As the economy ‘reopens’, and especially if travel restrictions are quickly loosened, the impact on rentals could be mitigated, but Capital Economics expects that the best case scenario will be a 5%-10% decline in rents.

With rents declining, many owners of rental properties may decide to sell, adding to the supply of properties for sale and exacerbating the decline in resale prices that is already underway.

These projections are, of course, highly uncertain, and depend critically on how quickly, and to what extent, our economy returns to something resembling ‘normal’ in the coming months.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Book Your Free Birthday Panda Visit!

05/25/20

Social distancing rules have pretty much eliminated the traditional birthday party celebration for kids — but if you live in the High Park, Bloor West, Junction, Swansea or Roncesvalles area, you can book a free visit from the Birthday Panda to bring some joy to your child’s special day!

Click here to view a clip from Global News on the Birthday Panda.

Just call or email Renee to book your Birthday Panda walk-by, greeting & dance:

Call: 416-826-4787 email: renee@smithproulx.ca

Birthday Panda has made 60 visits during the month of May, with more booked in June!

(Social distancing rules apply during the visit, of course.)

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

No Nosedive Ahead for Canadian Real Estate Prices: RE/MAX

05/15/20

Canadian real estate kicked off 2020 with a bang, but there are conflicting opinions as to how we’ll finish out the year. Canada’s federal housing agency has warned that average house prices could fall by up to 18 per cent over the next 12 months – a dismal prediction that’s being challenged by RE/MAX based on market activity from coast to coast.

Basic economics has taught us that supply and demand dictates housing prices, and according to what RE/MAX brokers are reporting at ground level, housing inventory is down in many markets, demand is still high, and multiple offers are a common scenario. Assuming that demand continues its current course, Canadian real estate prices will likely remain relatively stable or experience a single-digit price correction at worst this year – which is a far cry from CMHC’s dire decline of up to -18 per cent.

“CMHC doesn’t seem to understand the sheer number of sellers that would have to accept this kind of price reduction, in order for average housing prices to plummet to this degree in such a short time span,” says Christopher Alexander, Executive Vice President and Regional Director, RE/MAX of Ontario Atlantic Canada. “Sellers simply won’t accept that kind of discount on their listings. A statement of this nature is panic-inducing and irresponsible.”

Is Canadian Real Estate In Trouble?

Late last year, RE/MAX expected Canadian real estate prices to rise by 3.7 per cent in 2020. A few short months later, COVID-19 threw everyone for a loop. Recently, Canada Mortgage and Housing Corp. (CMHC) predicted that average home prices could decline anywhere between nine and 18 per cent in the coming year, due to the economic impacts of COVID-19. In addition, CMHC warns that mortgage deferrals could rise from 12 to 20 per cent by September, with up to one-fifth of all mortgages ending up in arrears, if the Canadian economy does not recover sufficiently.

“The resulting combination of higher mortgage debt, declining house prices and increased unemployment is cause for concern for Canada’s longer-term financial stability,” CMHC CEO Evan Siddall told the House of Commons Standing Committee on Finance earlier this week.

However, the Big Banks, economists and many Realtors aren’t aligned with CMHC’s expectation.

What the Big Banks are Saying About Canadian Real Estate

According to a recent article published by The Globe And Mail, CIBC said Canadian real estate prices could fall between five and 10 per cent this year compared to 2019. Similarly, RBC forecasts a decline of seven per cent, while BMO expects a five-per-cent decline.

“[Mr. Siddall] said that all these things will happen if the economy ‘does not recover sufficiently.’ That’s a very broad statement,” CIBC deputy chief economist Benjamin Tal told The Globe And Mail. “Without looking at the assumption behind that statement regarding GDP growth, unemployment rate and so on, it is very difficult to assess the likelihood of such a prediction. Is it a worst-case scenario, or the base case? I think he was highlighting a worst-case scenario,” he said.

A single-digit decrease in house prices can be classified as a correction, and is a far cry from CMHC’s trough of -18 per cent.

RE/MAX Brokers Report Low Housing Inventory, Multiple Offer Scenarios

RE/MAX brokers in some of the biggest Canadian real estate markets say a dramatic price drop is unlikely under current conditions, barring any major unforeseen circumstances – and as we’ve all come to learn recently, anything is possible. But assuming current market conditions remain stable, the current inventory of homes for sale continues to fall short of demand – even amidst this pandemic, social distancing measures and the economic fallout.

“The recovery of the real estate market will be market and region specific,” says Elton Ash, Regional Executive Vice President, RE/MAX of Western Canada. “We are seeing a strong return to real estate inquiries, with our Realtors becoming very busy again.”

Here’s what RE/MAX brokers are reporting on Canadian real estate in some of our biggest cities and key housing markets.

ATLANTIC CANADA

Newfoundland real estate has been a consistent “down market” since 2014, thanks to weakening oil prices and a shaky local economy. COVID-19 dealt another blow, but even so, the economy was already slow in the region. Interestingly, RE/MAX reports a spike in multiple offers in the region recently.

Multiple offers have been virtually non-existent in Newfoundland since the peak in market activity in 2014. Since the pandemic, there have been a dozen. There has even a home for sale that received four offers, when previously even one offer may have been uncommon.

Housing prices in Newfoundland remain consistent right now, and the market is better positioned than originally anticipated. The pulse is good, and this is unlikely to change in the near future.

Halifax real estate was riding high before the pandemic, with a lot of good foundational activity happening across the region. Simply put, the Halifax real estate market was hot, with low housing inventory common across the marketplace. Specific to the Halifax housing market, multiple-offer scenarios continue to be common, with brokers and agents reporting sequential multiple offer scenarios on their last three, four, five deals. That’s certainly the making of stable house prices, or even increasing slightly.

About one-third of Halifax listings in recent weeks have sold over asking price, which bodes well for house prices in the near future. Showings are up, and new listings that are coming online are up slightly as well. There’s consumer confidence, but buying activity is heavily dependent on how people have been affected financially. If current trends continue, an 18-per-cent drop in home prices is highly unlikely.

ONTARIO

Ottawa real estate has experienced an increase in home prices and a decrease in days on market – both good indicators that the housing market is stable, at least for the time being. The current seller’s market is characterized by low housing supply and high demand, which continues to drive up prices. In fact, within the last two weeks, Ottawa’s list-to-sales-price ratio has a median of 100 per cent. Most properties are still holding offers, with multiple-offer scenarios a common occurrence and homes selling for over asking price.

Within the last two weeks, compared to the previous two weeks, RE/MAX has experienced an influx of inquiries regarding properties for sale, with questions about the process of buying/selling homes. Consumers in the region want to be informed again about the housing market.

Toronto real estate is experiencing a proportionate decline in new listings and buyers, leading RE/MAX to conclude that prices should remain stable. Toronto homes are currently selling for asking price, or slightly above or below that price point, but the region has not experienced any decline in price and if current conditions continue, there’s nothing to indicate that prices will fall between nine and 18 per cent, as CMHC has predicted.

Toronto continues to experience multiple-offer scenarios, with RE/MAX reporting a consistent two or three offers on every listing. These conditions were prevalent prior to the lockdown on March 13, and continue to be the case, even with social distancing measures in place and the economic fallout. Toronto’s housing supply shortage continues, and demand remains high, as evidenced by the many multiple offers RE/MAX is seeing across the board.

The pandemic has negatively impacted listings, because many homeowners who were planning to sell are now opting to hold on to their listings, unwilling to host traditional open houses at this time. When government financial aid runs out and the six-month mortgage deferral period expires, people may then start listing their homes if they can’t afford to keep them. However, right now this is not the case. If a flood of listings does occur in Toronto this fall, it will be a short cycle.

London real estate experienced a large downturn in the number of sales in April and May compared to April/May 2019, but the region has also seen a large decrease in the number of listings compared to last year, which is causing multiple-offer scenarios.

The London housing market is holding strong, homes for sale are being scooped up and prices remain relatively stable. Within the past 14 days, RE/MAX reports 180 firm sales, 83 of which went for over asking, and 20 sold at full price. In April 2020 the average sale price in London was up slightly by a couple of thousand dollars compared to April 2019, however May’s month-to-date average price in London is about $29,000 higher compared to all of May 2019.

WESTERN CANADA

Edmonton real estate continues to experience a significant hit to its local economy due to oil prices, and the biggest factor going forward will be employment, or lack thereof. The impacts of COVID-19 may result in a double-digit unemployment rate, which is expected to impact housing demand.

When it comes to selling prices, RE/MAX reported some lowball offers at $40,000, $60,000 and $80,000 below asking, however none of those deals went through. Since then, those properties have gone pending close to the asking price.

Moving forward, RE/MAX expects an average five-per-cent price decrease in Edmonton throughout the rest of the year. Edmonton saw prices fall two to three per cent in 2019, based on buyer demand. Edmonton has more millennials than baby boomers, which makes it a unique marketplace. Buyers wants new homes, which means many dated homes in older neighbourhoods aren’t moving, while infill and new construction in those neighbourhoods are in high demand. Furthermore, RE/MAX is reporting an influx in downsizers who are using COVID-19 as the catalyst to sell the big house and move into a condo or smaller home.

Multiple offers are common in Edmonton’s housing market, with houses selling for $20,000 to $30,000 over asking price. This is due to buyers shifting and adjusting needs. This could present a good opportunity for investors and house flippers to tackle some of those older, larger homes.

Lenders tightening up their lending policies is a concern for the Canadian real estate economy, and how they assess and react to buyers’ employment status will affect the buyer pool. This will dictate the market in the next year post COVID-19.

Calgary real estate is experiencing a double-edged sword, due to COVID-19 and the oil industry, and the greater concern is oil. It is still too early to accurately predict where prices will trend in the coming year. Housing supply has come down, which has kept prices relatively steady. RE/MAX reports some multiple offers on properties that are priced appropriately in the right neighbourhoods. Meanwhile, some properties have seen large price drops, but it’s unclear if that is related directly to the pandemic or if it is related to the overall economy.

Some regions in Calgary are experiencing drops, but others are doing well. A five-per-cent price correction is a more likely scenario. Some price adjustments are happening already, but an 18-per-cent price drop across the board isn’t realistic. But if by chance it did happen, prices would bounce back again. Higher-priced properties will be most affected, while properties at lower price points are expected to remain fairly stable.

Vancouver real estate is fluctuating from week to week, not just on seller side but also on agent side as well. People are re-emerging, with RE/MAX reporting lots of new inventory and many multiple offers, not just on $500,000 condos but those priced in the $2-3 million range as well. and. Perception is that now with easing of restrictions, people are more confident that things are moving in the right direction.

It’s possible to have high unemployment, yet a very strong real estate market. Unemployment appears to be having a greater impact on lower earners, and with the region’s high real estate prices, homebuyers are typically those in the higher income bracket.

Vancouver Realtors who were initially fearful are back in business, and an 18-per-cent decline in Vancouver housing values – or anything close to that – is highly unlikely. A five-per-cent price correction is more likely.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

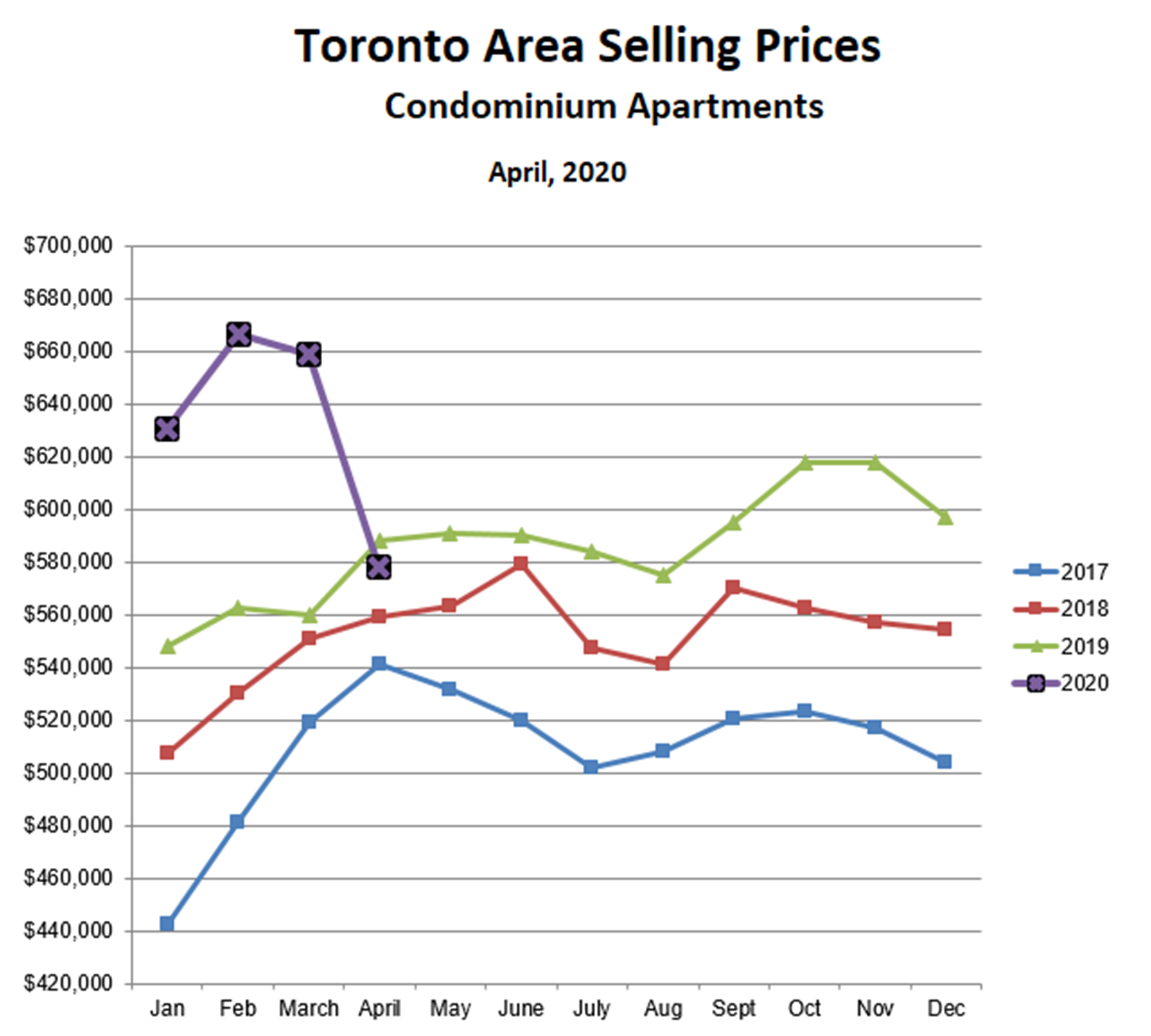

Toronto Area Prices and Sales Plunge in April

05/05/20

The COVID-19 restrictions that were imposed in late March have caused both sales and prices to fall steeply in April.

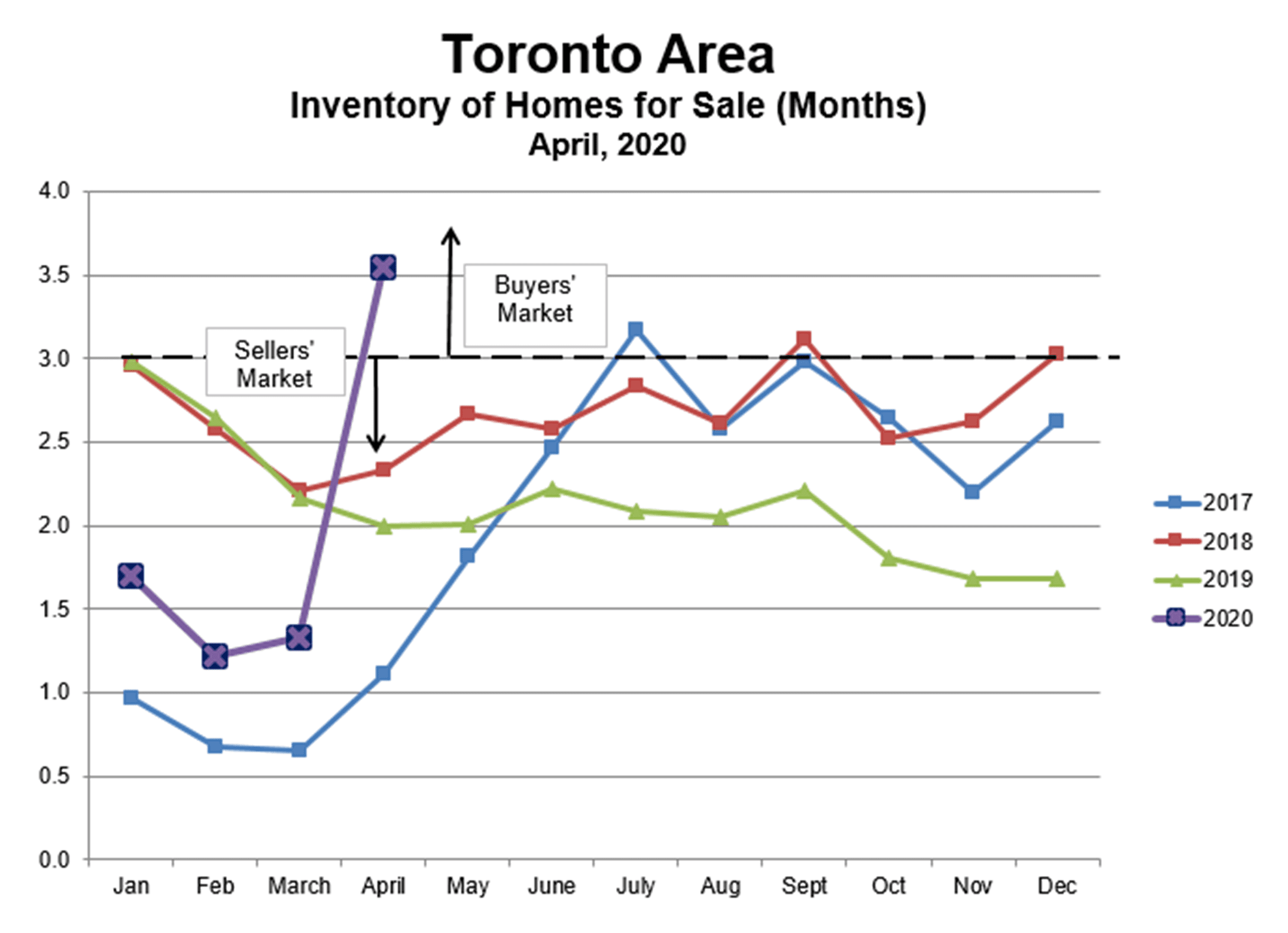

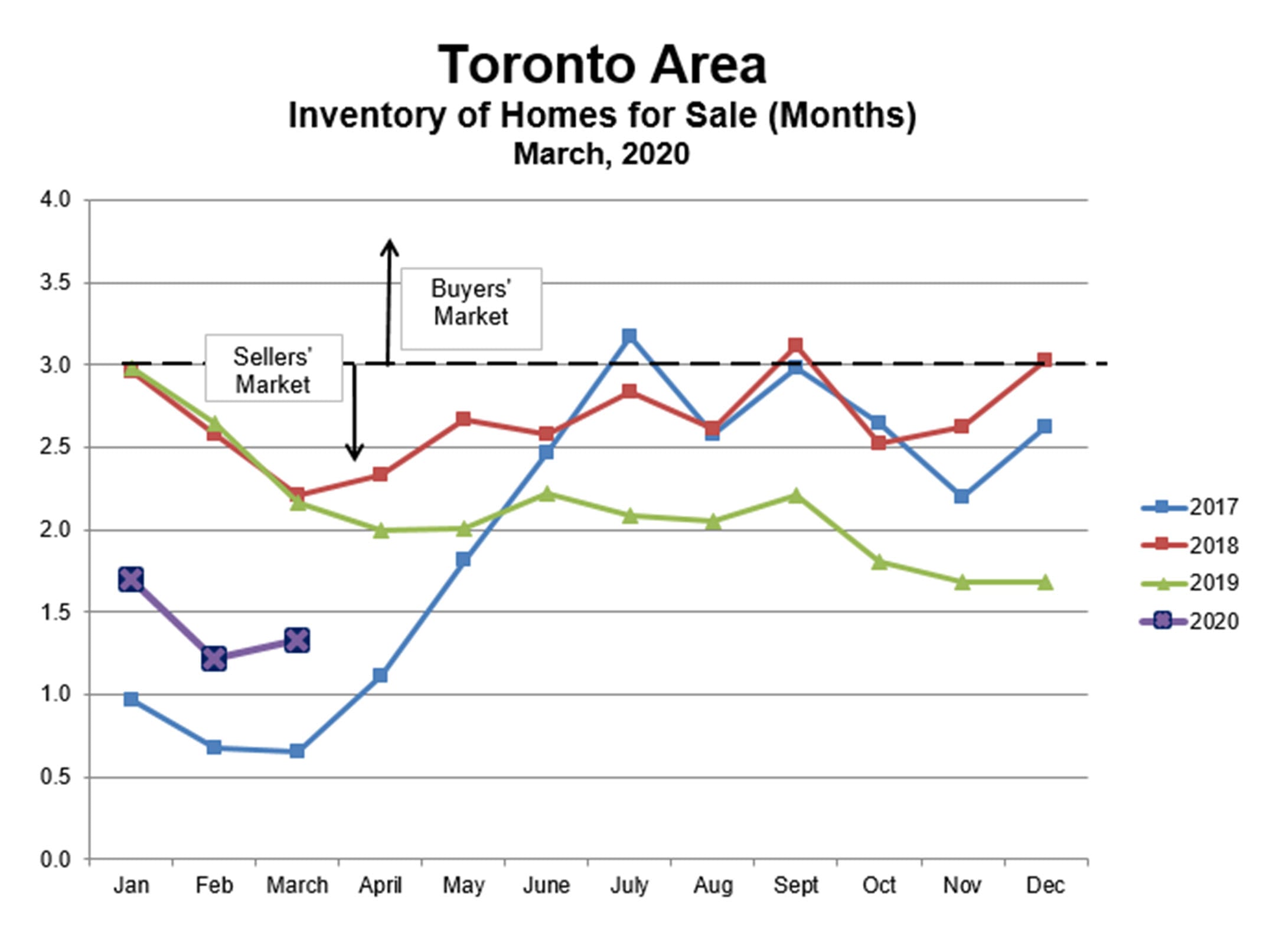

Sales for all property types fell by approximately 2/3 as compared with last April, while listings of properties for sale were about the same, so the inventory increased by almost a factor of three, from 1.3 months to 3.5 months. This places the GTA market firmly in buyers’ market territory.

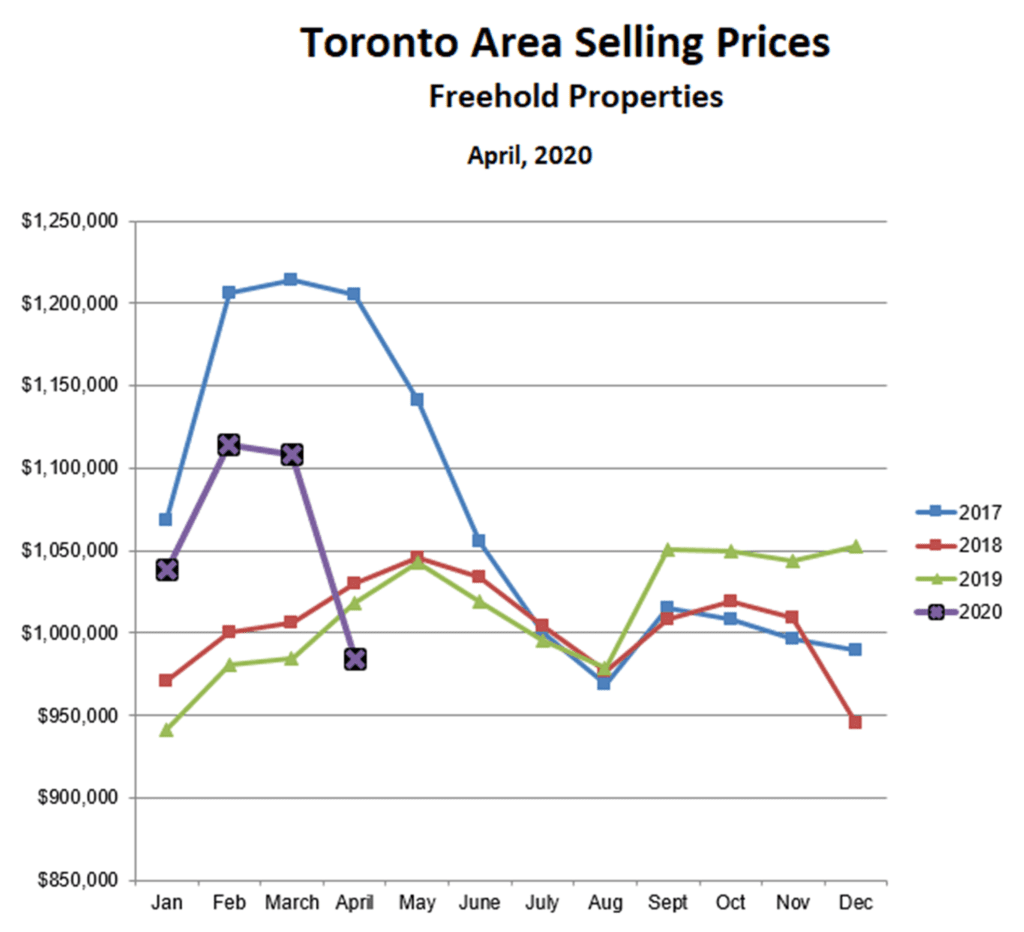

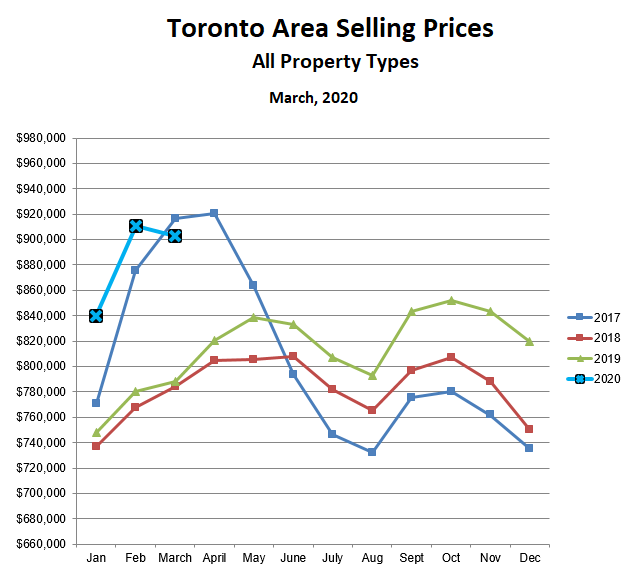

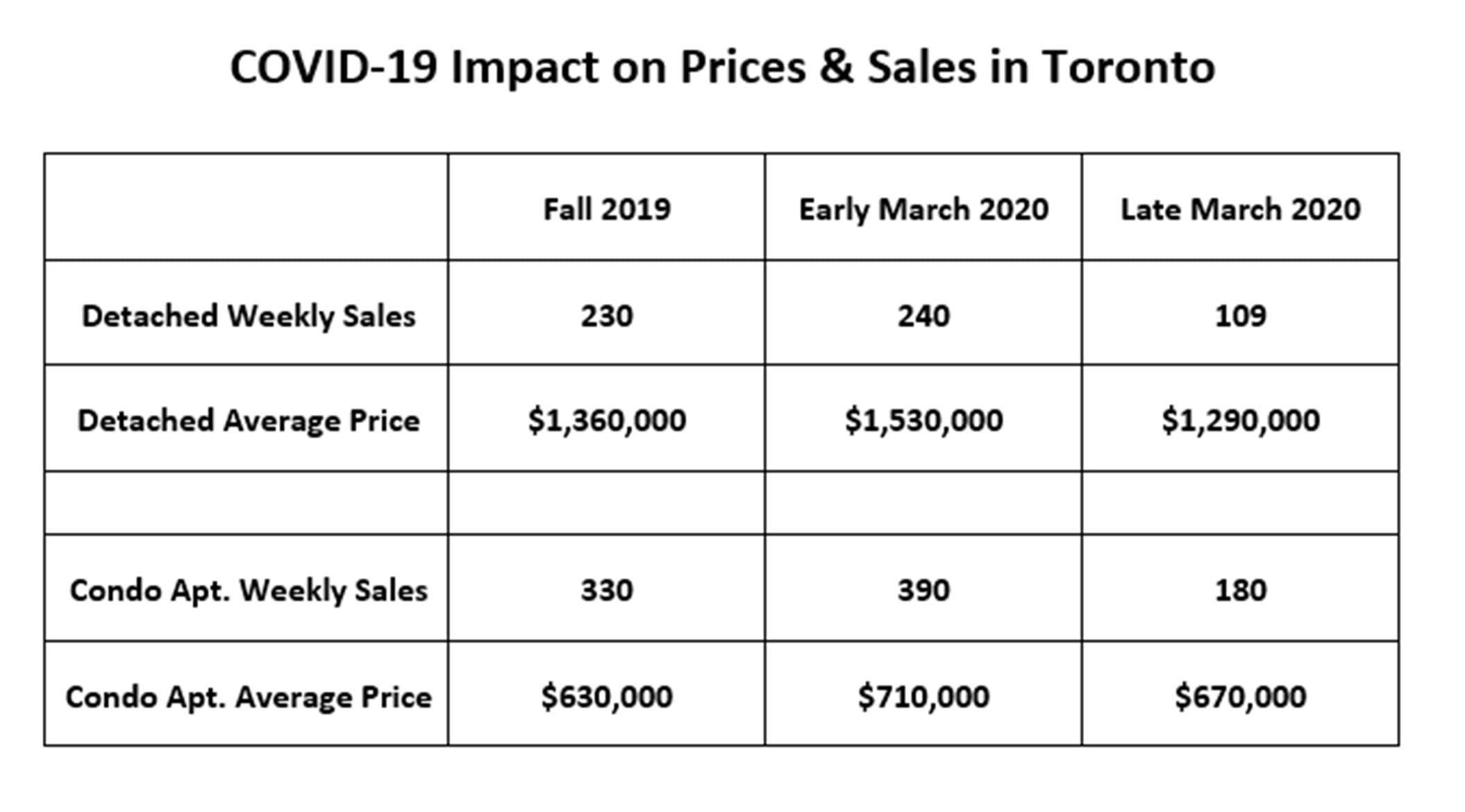

Prices for freehold (predominantly detached) properties fell steeply in April, by 11% as compared to March and by 3% as compared to last April. A bubble had been forming since late 2019, similar to what we saw in 2017, but that bubble burst prematurely when the COVID-19 restrictions were imposed in late March. Basically, prices have retreated to (or somewhat below) the plateau that was in place from late 2017 (after that bubble burst) until late 2019.

Prices for condominum apartments are following a similar trajectory. Condo prices fell by 12% from last month, and by 2% as compared with last April. As in the case of freehold properties, all the froth in the bubble that was forming late last year and early this year has left the market. Unlike 2017, when freehold prices collapsed but condo prices did not, this time condo prices have equally fallen victim to the COVID-19 restrictions.

Whether prices continue to fall as the lockdown continues will depend on the balance of sales to listings. So far, it appears that the number of sellers is falling faster than the number of buyers, which means that inventory will fall. For now, this suggests that prices should remain relatively stable, especially since mortgage interest rates are likely to remain very, very low.

But it’s much harder to predict the direction of the market once the lockdown ends. It all depends on how long the lockdown lasts, and the extent to which confidence in jobs, the economy and personal safety returns once it’s over. The optimistic scenario is that everything returns quickly to something resembling normal, which would lead to a resurgence in sales and prices. On the other hand, if large numbers of jobs are permanently lost, and COVID-19 fears & behaviours persist, we could see more homes for sale (e.g., due to financial difficulties, marriage breakups, etc) and more cautious buyers wanting to repair their balance sheets and increase their savings. This could lead to a deeper and more persistent buyers’ market with steadily declining prices.

We’ll just have to wait and see how this all plays out.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Coronavirus Infects Toronto Rental Market

05/03/20

We have only limited data so far, but already it is clear that the number of MLS rental transactions in the GTA has plummeted by about 50% since the COVID-19 restrictions were imposed just over a month ago. There were approximately 2,500 MLS rental transactions per month in January, February and March, but only about 1,300 such transactions in April.

So far, rental prices have held up remarkably well. The average MLS rental price for freehold properties (e.g., houses, apartments in houses, and apartment buildings) was virtually unchanged in April as compared with January-March, while the average price for condo apartment rentals was down about 4%.

With many tenants at least temporarily out of work, and many others in fear of losing their jobs, it’s not surprising that the demand for rentals has dropped; and, together with the temporary banning of Airbnb rentals, this has significantly increased the inventory of available rental properties.

All of this points toward a continued decline in rental prices together with a continued increase in rental vacancies as the lockdowns drag on. On the surface this might seem to be good news for tenants in a market that has been exceptionally tight and, indeed, in a crisis due to very limited availability of rental accommodation and ever-increasing prices. For many tenants (those who still have steady employment) this will, of course, be good news. However, everybody needs to live somewhere, and so perhaps we will have an even bigger crisis of a somewhat different kind.

The decline in the rental market may also affect the resale market, particularly for condo apartments. Investors may conclude that it’s better to sell their condos than to leave them vacant for extended periods and/or accept significantly lower rents. While it’s far too soon to project how this will play out, it could exacerbate an already fragile resale market and contribute to a self-reinforcing downward spiral in condo apartment sales and prices.

Let’s hope the lockdowns end soon!

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Coronavirus Threatens Survival of Toronto Small Businesses

04/25/20

The Broadview-Danforth Business Improvement Association (on behalf of dozens of Toronto BIAs) recently surveyed 561 small business tenants and 137 landlords across the city as to how the Coronavirus lockdown has affected them. A majority of the respondents (61%) said that they would not survive over the next 3 months without rent relief, and 76% said that they would have to close down for good within 5 months.

Another recent survey, conducted by Restaurants Canada, concluded that, if conditions don’t improve within three months, 50% of independent restaurants won’t survive, and most multi-unit foodservice businesses will have to permanently close at least one of their locations. Most of these businesses are extremely concerned about the amount of additional debt they will have accumulated when the crisis is past, even if they do manage to survive.

Restaurants Canada received a total of 914 completed surveys from foodservice operators across Canada, representing 11,856 locations (as many respondents belong to multi-unit businesses). Canada’s commercial foodservice industry is made up of 97,500 establishments, including full-service restaurants, quick-service restaurants, caterers and drinking places. A very large number of jobs are involved, so say the least.

While the federal government has announced the ‘Canada Emergency Commercial Rent Assistance’ program, which will provide loans to small businesses to provide some rent relief, there are concerns that loans will only delay the problem until later.

These snapshots show how serious the impact of the business closures has been, and how much worse it will get as the lock-down drags on. It’s simply not possible to switch off the economy and expect everything to go back to ‘normal’ quickly once the switch is turned back on. Government money will cushion the blow to some extent, but government spending will not substitute for lost economic activity, nor will it replace lost jobs and businesses.

Obviously, the real estate market has also felt the effects of the virus. Since the lock-down started, sales of homes and condos have been cut by more than two thirds and, while prices have held up remarkably well, the knock-on effects on the economy of the reduced activity (fewer renovations, appliance & furniture sales, etc) will be more and more significant as time goes on. Plus, many people will emerge from the crisis with more debt than ever: this could make buyers reluctant to purchase until they have repaired their balance sheets; and some people may need to sell. And another potential impact: the stresses of forcible confinement could lead to a surge in marriage break-ups leading to family homes being put up for sale. Rather than a strong ‘bounce-back’ later this year, we might instead have a sustained buyers’ market (more sellers than buyers) and falling prices for the first time in more than 20 years. Good news, perhaps, for millennials who have had a tough time affording a home for many years, but still, the longer the lock-down continues, the larger the negative impact on both the real estate market and the economy as a whole.

As we learn more about the extent of the damage being done to the economy, we are also learning more about the coronavirus itself. For example, while there is still much that is not known about the virus, there is evidence from many sources that the virus is much less lethal than was indicated by early information. We also know that the virus is much more lethal among the elderly and those with other health problems, while young, healthy people often have only mild symptoms or none at all. SARS CoV-2 is a very nasty virus to be sure, but we need to maintain some perspective and to dial back the fear and hysteria rather than continuing to feed it.

It is certainly sensible that we continue to encourage social distancing; to discourage people from congregating in large groups; and in particular to focus on protecting the elderly and immunocompromised among us. However, we also need to re-open the economy and get people back to work as soon as we can safely do so. The virus will probably be with us for a long time (it’s unlikely there will be an effective vaccine any time soon, if ever), and most people will follow the rules well enough to ‘keep the curve flattened’ and prevent overloading our health care system while the virus continues to spread slowly through the population. After all, the goal from the beginning was to slow the spread of the virus, not to eliminate the risk of being infected. As stated in the federal government’s guidance publication, Public health measures: Canadian Pandemic Influenza Preparedness: Planning Guidance for the Health Sector:

“When planning public health measures, decision-makers must weigh not just the costs of implementation but also any secondary impacts. Social and economic impacts on individuals, families, communities and businesses due to, for example, closing schools or cancellation of public events, should be considered with any intervention and weighed against its potential benefit. Individual behavioural measures, such as practicing hand hygiene, respiratory etiquette and self-isolation when ill, are promoted during seasonal influenza and should be encouraged in any pandemic scenario. Other measures, such as school closures and border restrictions, are complex, costly to sustain and likely to have unintended societal and economic consequences.”

This document didn’t anticipate the unprecedented actions that have closed down significant portions of the economy but, of course, the same principle of weighing costs versus benefits must apply. A lot of economic damage has already been done and, even if the economy were to be opened up today, it would be quite some time before businesses would return to something resembling normal. Many jobs may have been permanently lost. It is critical that the authorities constantly seek to strike the right balance between minimizing the impact of the virus on public health versus on our economic well-being. Both are vitally important.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Canadian Government Supporting Mortgage Market

04/15/20

Soon after the COVID-19 lock-downs began last month, signs started to appear that the mortgage market was headed for a credit freeze, where mortgage lenders would be unable or unwilling to keep lending to homebuyers. A credit freeze would likely crash the real estate market – if mortgage lending isn’t possible, home sales would collapse and prices would fall off a cliff.

However, the government is aware that the housing market is critically important to the Canadian economy – in effect, it’s ‘too big to fail’ – and so they took aggressive action very quickly to head off the problem.

Canada Mortgage and Housing Corporation (CMHC, the government owned mortgage insurer) will be buying $150 billion worth of mortgages from mortgage lenders. Similar to Quantitative Easing, CMHC will buy ‘packaged’ mortgage loans (basically mortgage backed securities) from banks, providing the banks with cash to keep making mortgage loans as well as providing a cushion against losses due to individuals and business not making payments or even defaulting. CMHC did the same thing during the 2008 financial crisis, but this time is committing more than twice as much money, amounting to about 10% of the total Canadian mortgage debt. The Bank of Canada will be also be buying up mortgage debt at the rate of $2 billion per month for as long as they feel it’s necessary.

That the government is liable for mortgage defaults is nothing new – CMHC has been insuring banks against mortgage defaults for a long time. What’s different is that we now have an actual state-owned mortgage lender.

Full marks to the government for taking these steps – and so far it seems to be working.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Canadian Consumer Confidence Falls

04/10/20

The Conference Board of Canada’s Index of Consumer Confidence fell by 32 points in March, the largest monthly decline ever. Canadians are clearly anxious about the coronavirus, and are mostly staying home both because the government is encouraging them to do so and also because they are afraid of venturing outside more than absolutely necessary.

Consumers are concerned about future job prospects and that their financial situation will get worse. Accordingly, many feel that this is a bad time to make a major purchase.

Click here to see the Conference Board report.

Truth is, the government response to the coronavirus will have a significant and lasting impact on jobs and on the economy. This would be bad enough, but the negative consumer psychology could make it worse. Many people will have their finances significantly impaired by the lock-down and will be in no position to buy real estate or make other major purchases. Many others, however, may still be in good financial shape but simply be afraid to buy anything out of concern that the virus might return, the economy might continue to get worse, and/or they might still lose their job.

The combination of a weak economy and a fearful, timid consumer could set up a downward spiral, where the worse things get, the more people will tend to hunker down, buy less and save their money which, of course, will make things even worse.

We definitely need to work more on ’emphasizing the positive’ about how the virus is coming under control, how people are getting back to work, how businesses are up and running. We need as much good news as possible about how everything is getting better, and less bad news about how many more people got sick or died today and how dangerous the virus is.

It’s time for the media and government officials to step up to the plate and start instilling hope instead of fear.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

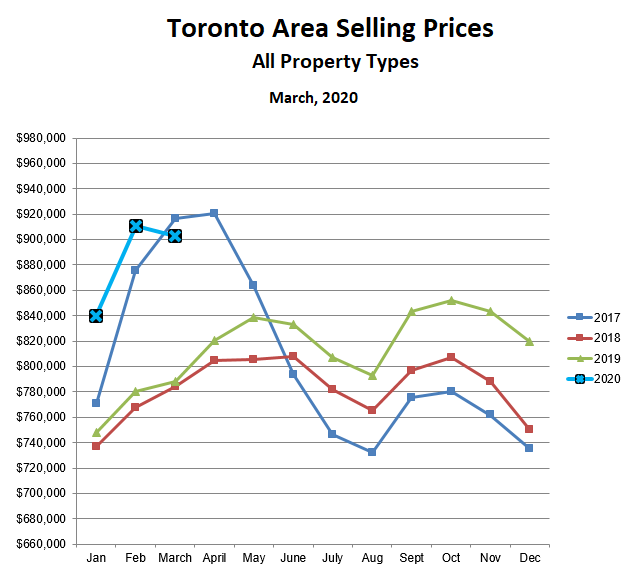

COVID-19 Thins Out Toronto Market

04/08/20

Oh what a difference a month has made.

Overall, results for the month of March were very good, though not quite as strong as February. Total sales were up by 10% and, while active listings were up by 20%, the overall inventory of homes for sale was only slightly higher than in February and still comfortably in ‘sellers’ market’ territory.

Prices fell slightly for all property types, but remained well above 2019 levels.

However, the overall results mask what happened to the market in late March when the government of Ontario called a halt to all non-essential businesses and strongly encouraged everyone to stay at home and observe social distancing. Because of these restrictions, real estate activity has fallen steeply, with less than half as many homes being sold per week at the end of March as compared with the beginning of the month.

Prices have also declined since the COVID-19 restrictions came into effect. As shown in the chart above, for example, prices for detached homes in metro Toronto were 12% higher than last fall in early March. However, COVID-19 has taken all of the air out of that emerging bubble, and, as of the last week of March, prices were about 5% below last fall.

For condominium apartments in metro Toronto, sales and prices also fell in late March, however, condo prices are still well above last fall.

The market has thinned out dramatically, with both sellers and buyers moving to the sidelines in large numbers until the COVID-19 crisis has passed. Prices have held up remarkably well under the circumstances, mostly because the inventory of homes for sale remains low. There are fewer buyers and fewer sellers, but still more of the former than of the latter.

How this situation will play out over the next few months is very hard to predict. One school of thought says that, once the “all clear” has sounded on COVID-19 restrictions, both buyers and sellers will return to the market with a vengeance, and both sales and prices will move upward vigorously.

On the other hand, the economy may not be in great shape by the time the virus crisis is past. This could cause buyers to be more cautious at a time when sellers who have delayed their plans decide to rush into the market. That would be a recipe for increasing inventory and a shift toward a buyers’ market as well as falling prices.

Interesting times indeed.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Selling Homes Safely In The Age Of COVID-19

04/05/20

Many people still need or want to buy or sell a home, even in the midst of the coronavirus pandemic. For example, some bought homes some time ago, and need to sell their present home; others have sold their homes and need to buy a new one.

We have instituted 5 key measures to ensure that buying and selling real estate can be done safely at this time:

- The property must be vacant – either no-one is living in the home, or the owners have moved out while their house is on the market.

- Maximize virtual access – we are providing floor plans, video tours, 3D virtual tours, plenty of photos, and detailed descriptions of the homes we have for sale. This allows buyers to decide if the home is for them and whether they want to arrange a visit. In this way, in-person visits to the home are minimized.

- We make it easy to view the home safely. Each morning, we turn on all the lights and make sure all the inside doors are open, so that the home can be viewed without touching anything. Then, at the end of the day, all the lights are turned off and the door knobs, key and lockbox are wiped down to make everything as sanitary as possible.

- Visitors are screened before they can enter the home. Both at the time the viewing is booked, and again at the front door, we ask that both the agent and the buyers confirm that they have not traveled in the past 21 days; that they do not have any cold or flu symptoms and have not been around anyone who does; that they use hand sanitizer (which we provide) before viewing the home; and that they touch as little as possible while in the home.

- Minimize the number of people in the home at once. For example, the buyer can view the home without their agent, and then they can change places so the agent can see it. That way, social distancing can be maintained.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Trinity Bellwoods

04/02/20

Welcome to 159 Wolseley Street, a deceptively spacious (25 ft wide) 4 bedroom row home in the sought after Trinity Bellwoods neighbourhood just a one minute walk from the Queen Streetcar and the shops, restaurants & cafes of trendy Queen West. Stroll to Trinity Bellwoods Park and enjoy the Community Centre, playground, tennis courts and soccer, football & softball fields. It’s a walkers’ & riders’ paradise: 97 Walk Score & 100 Transit Score!

The main floor features a bright open plan living/dining room with extra-large windows overlooking the sunny south facing garden. Walk out from the updated eat-in kitchen to your private back yard oasis.

The main floor also has two large bonus rooms at the front that can be used as bedrooms, offices, or for extra storage!

Upstairs there are three generous bedrooms plus a spa-like bathroom and a convenient 2nd floor laundry.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!