Year: 2020

Old Mill

03/31/20

Welcome to 18 Bridgeview Road, a lovely 3+1 bedroom family home on a quiet street in the highly desirable Old Mill neighbourhood. While this home is in need of some cosmetic updates, it is roomy and bright and has beautiful original wood features.

The spacious foyer showcases the original wood wainscoting and leads to the open-concept living/dining area. The living room features a wood-burning fireplace, leaded-glass bay windows, and crown molding. French doors open to the dining room, which has built-in cabinets and an entrance from the kitchen for easy entertaining. The dining area opens to a sunny family room with lots of windows and an exit to the backyard. The backyard itself is large and incredibly private, perfect for children’s playdates, entertaining, or just relaxing in this secluded green space. The bright kitchen has lots of storage, including a pantry.

The second level features a uniquely designed master suite with a 2-in-1 tandem room, ensuite bath, walkout to a private balcony, and a walk-in closet. A skylight provides lots of natural light to the second bedroom, which has built-in shelving in addition to the closet space, and the spacious third bedroom has a double closet. This level also has a four-piece bathroom and a very large linen closet for additional storage.

18 Bridgeview Road is right in the heart of Old Mill, a scenic and historic Toronto neighbourhood. It’s steps from Etienne Brule Park, as well as the Humber River and its surrounding walking trails and parkland. Bloor West Village, with its shops and restaurants, is a short walk away, as are the Jane and Old Mill subway stations.

With its striking original features and wonderful, quiet location, this home is just waiting for the right family to make it their own.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

2017 Redux Continues in Toronto

03/08/20

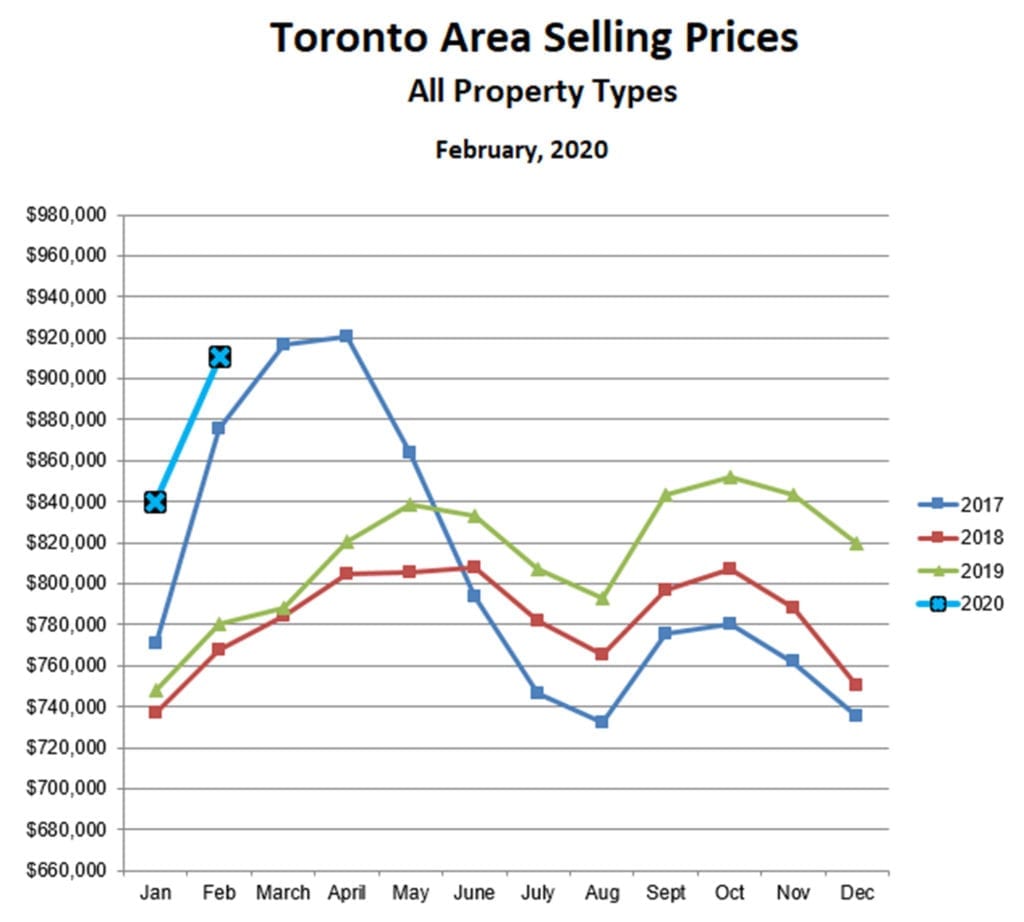

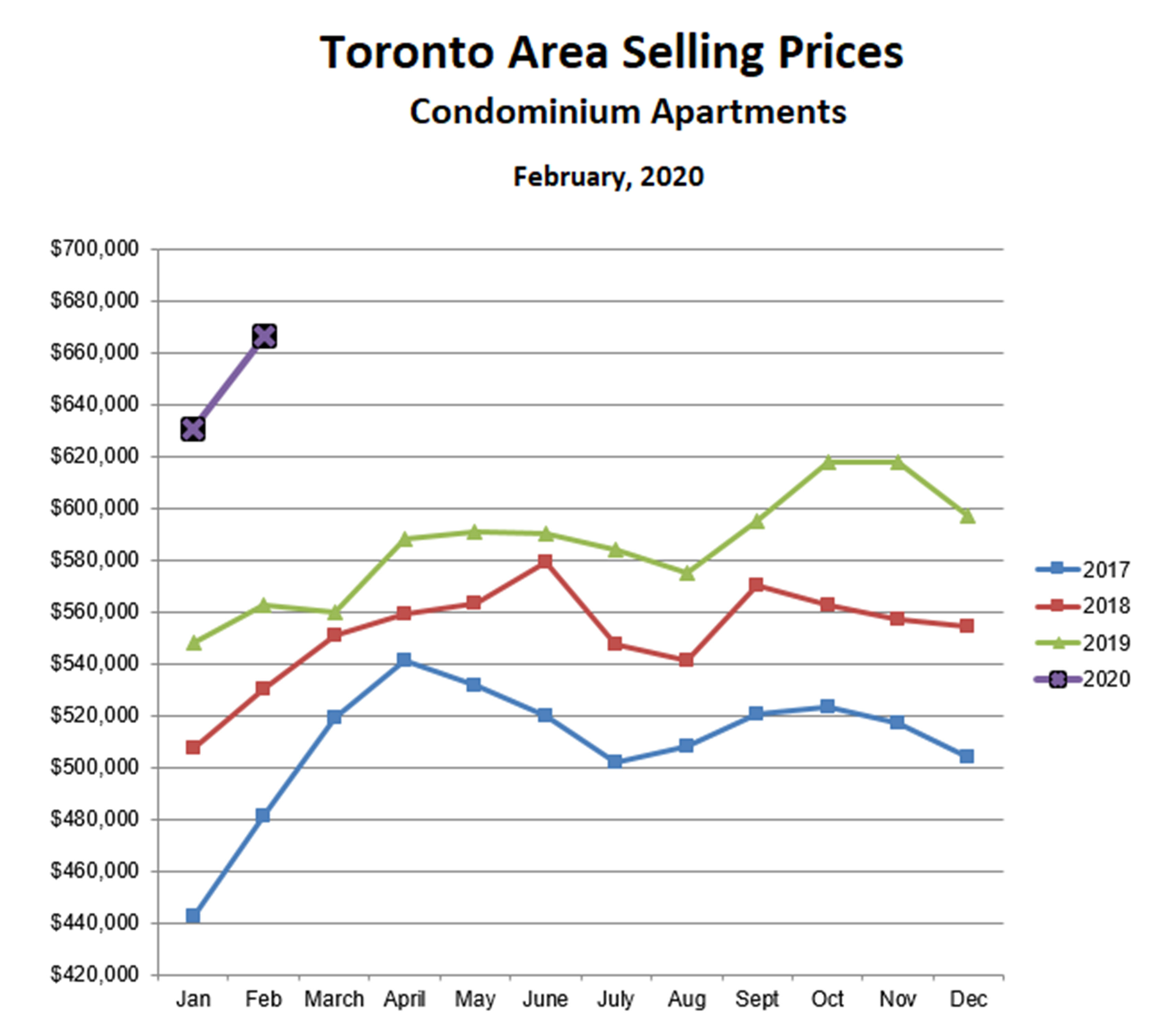

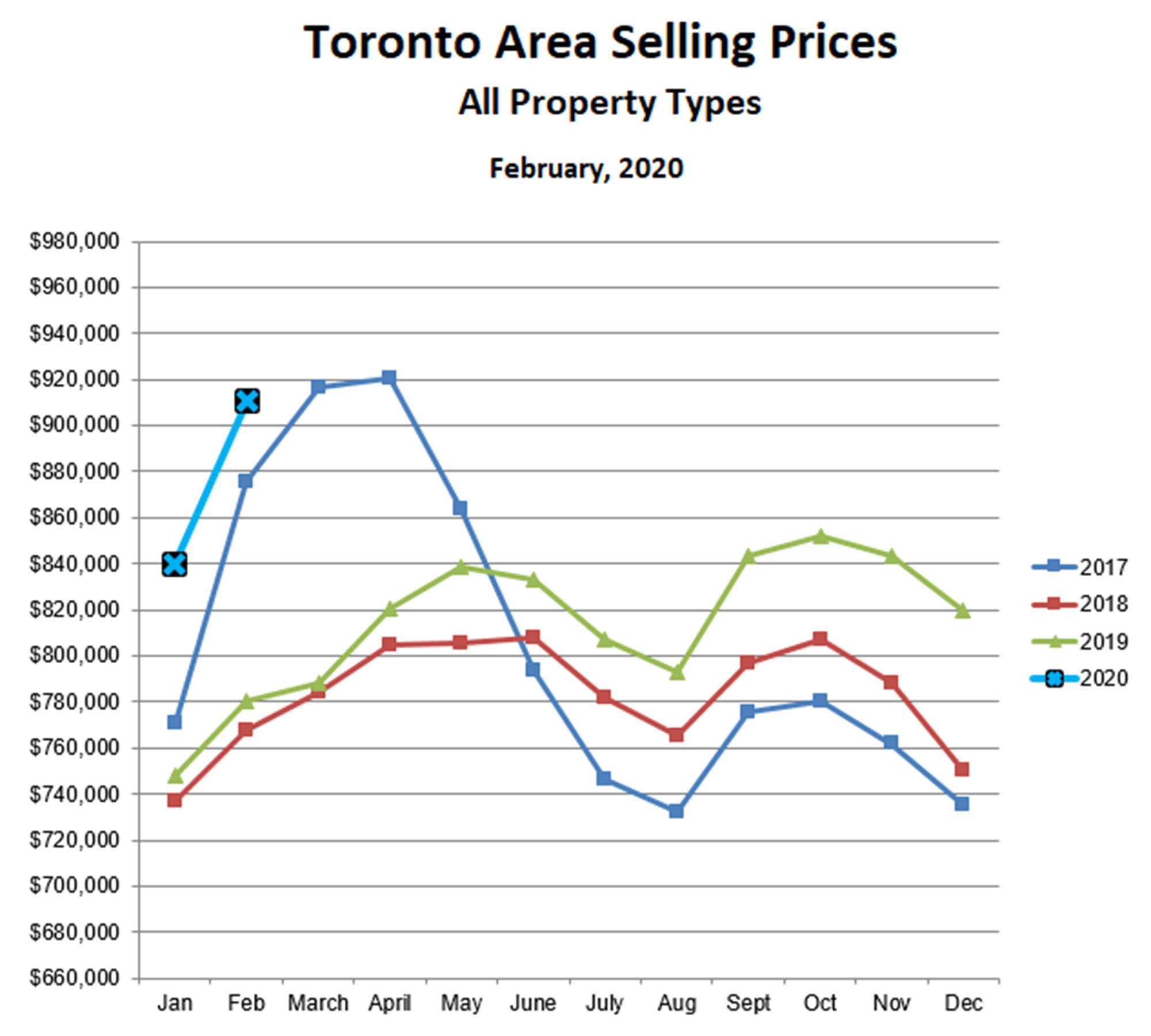

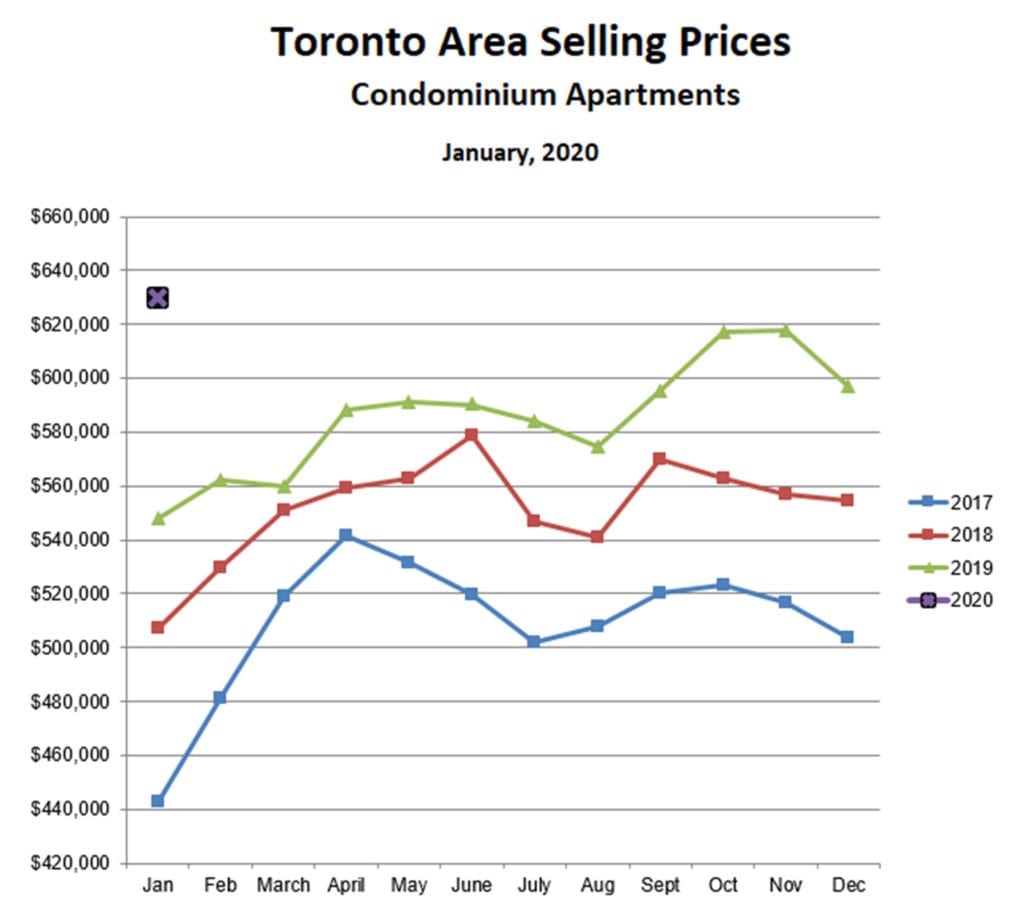

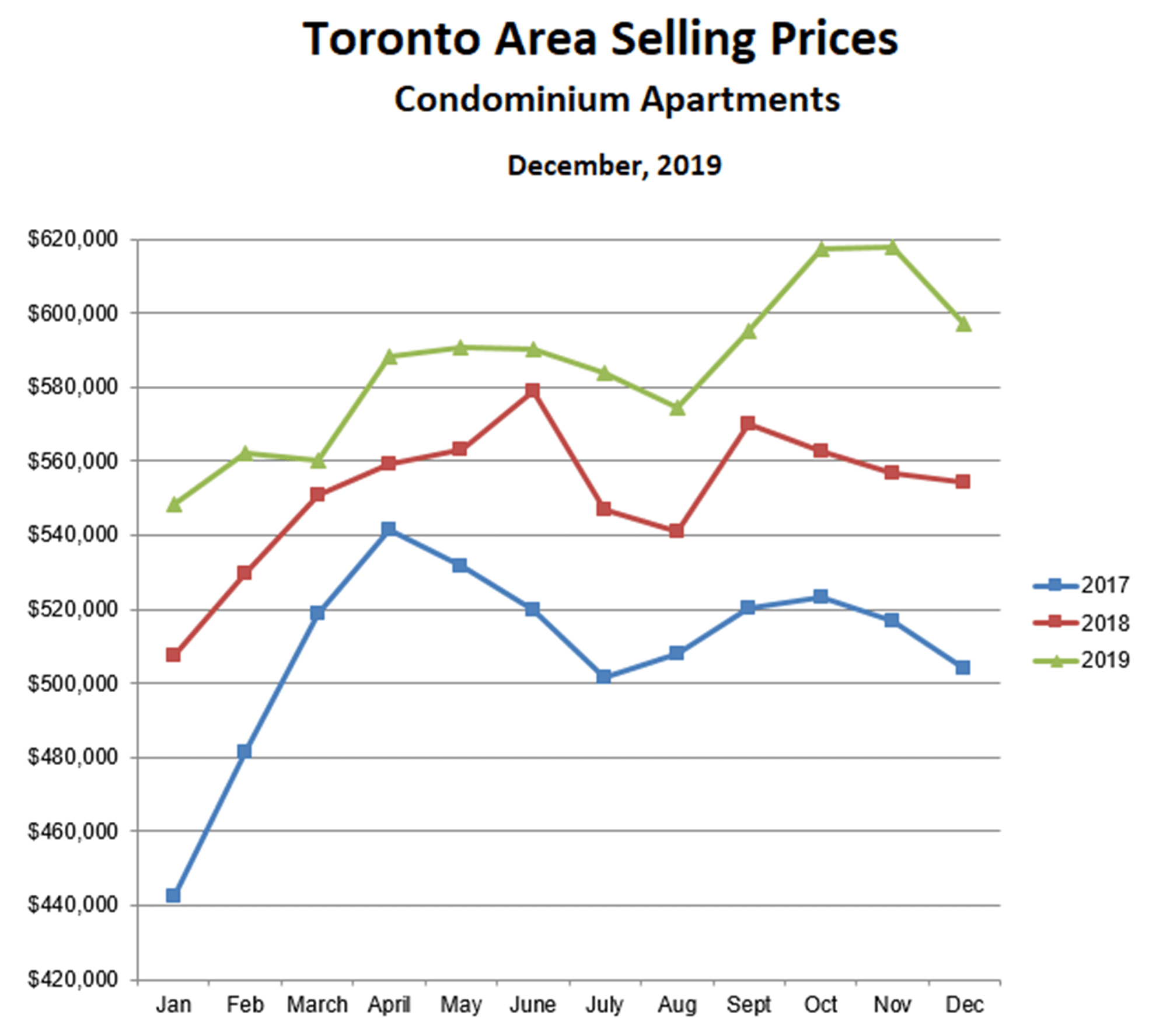

Prices for both condominium and freehold properties continued upward in February, following the trail blazed in early 2017. The market for condominium apartments, in particular, is on fire, with prices 22% higher than last February and 8% higher than the most recent all-time high reached last November.

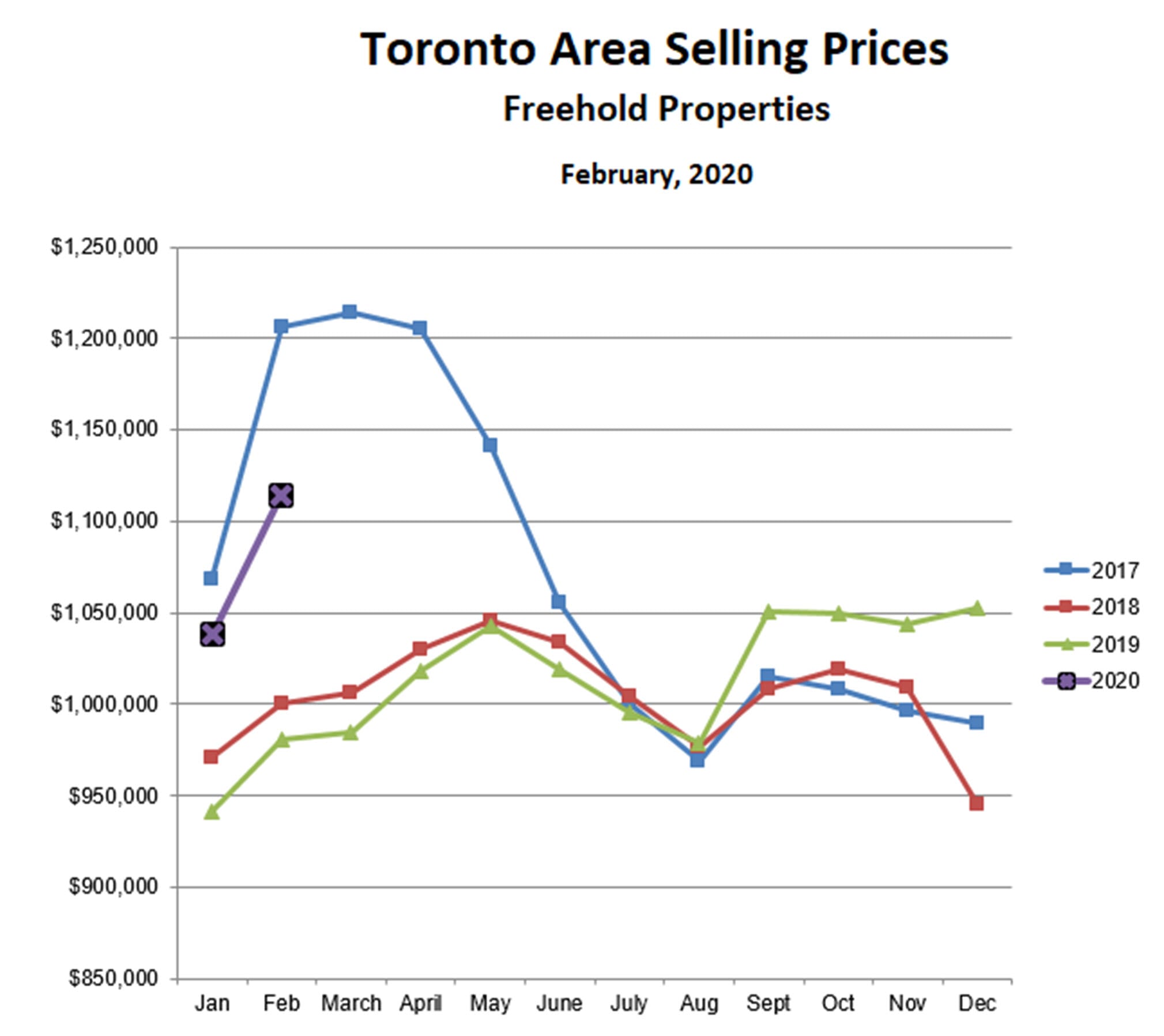

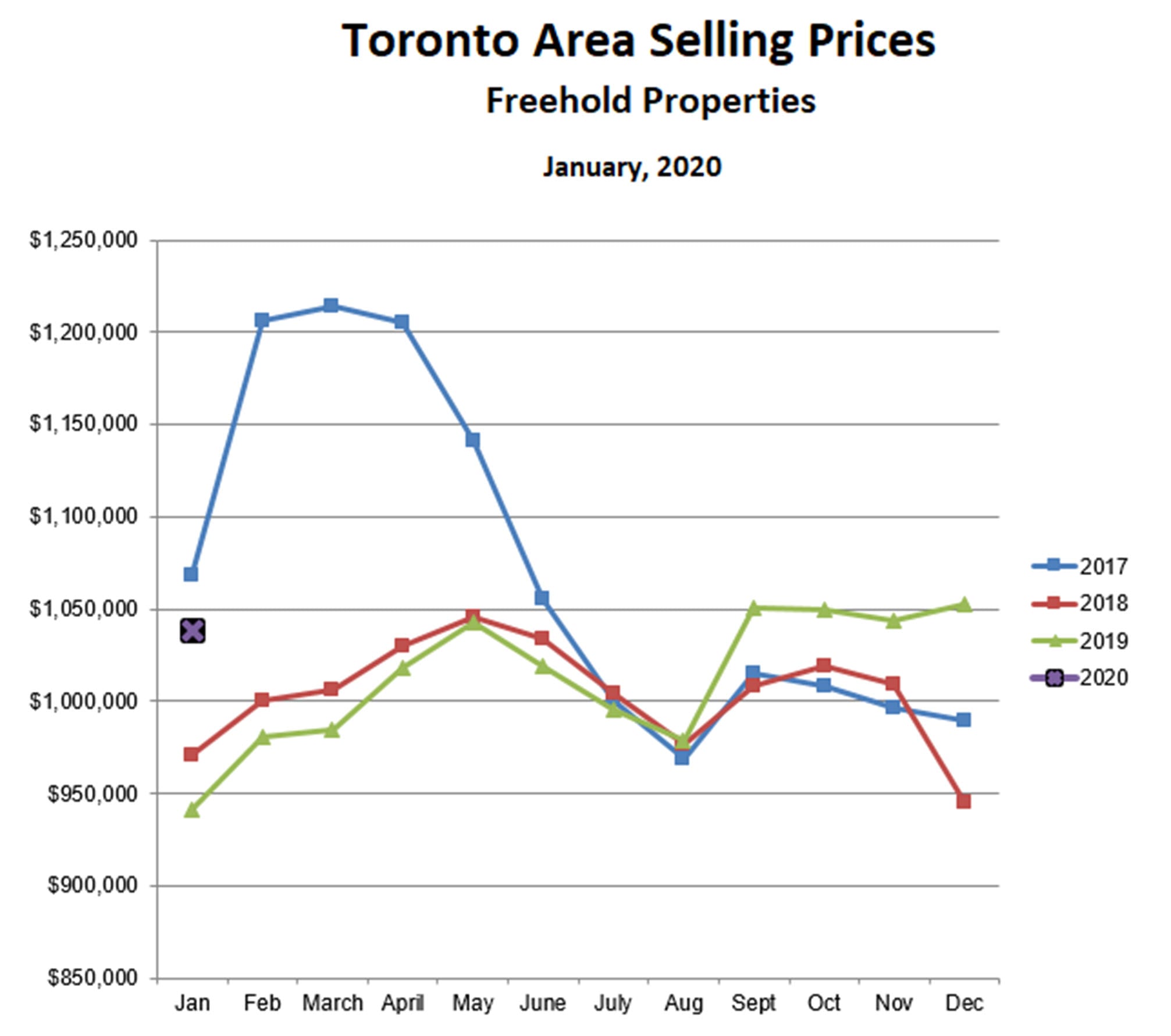

Prices for freehold properties (mostly detached homes) also moved higher in February, to 14% above last year and within 10% of the ‘bubble peak’ reached in March of 2017.

While condominium and freehold prices have followed very different pathways over the past three years since the 2017 bubble collapsed, the 2020 chart for all property types is eerily similar to 2017. Average prices in February for all properties combined were actually 4% higher than in 2017!

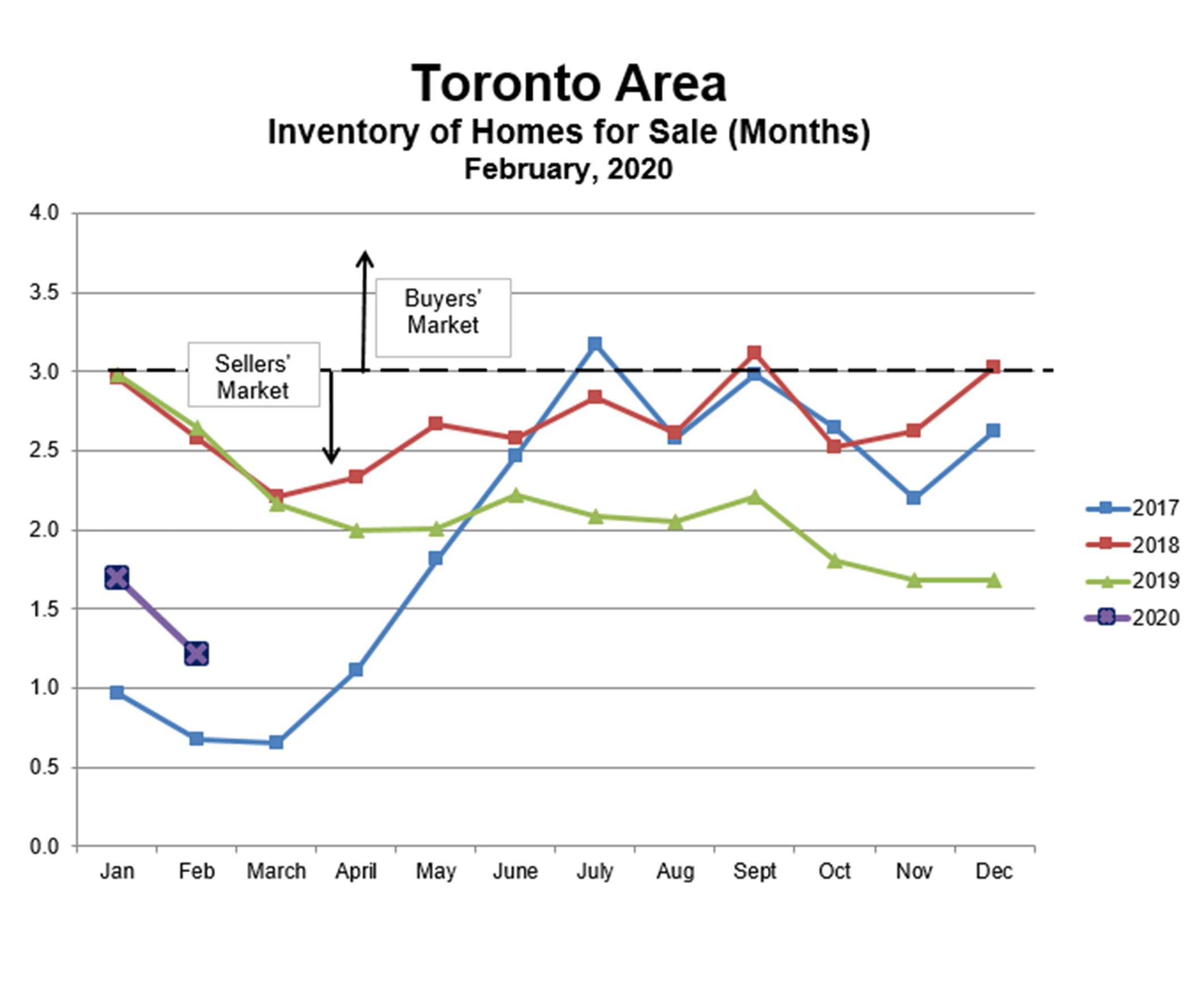

Just like in 2017, the strength of the market corresponds to low and falling inventory of homes for sale. As we have discussed previously, at some point the falling inventory/rising price pattern becomes self-reinforcing and self-accelerating, and we have probably reached that point already.

It seems clear that another 2017-like bubble is forming right before our eyes, and the recent mortgage interest rate reductions will probably add kerosene to the flames. The pin that burst the bubble in 2017 was called the “Ontario Fair Housing Plan”, a 16 point piece of government legislation that included a 15% foreign buyers’ tax. Maybe this year’s pin will be called COVID-19?

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Just Sold – Renovated Roncy Gem

03/04/20

Welcome to 62 Lynd Avenue, a renovated family home with 2 car laneway parking in a prime Roncesvalles location.

An inviting covered front porch draws you in to the contemporary open plan main floor, which has recently refinished hardwood flooring, a cozy fireplace, an exposed brick accent wall and pot lighting throughout. The renovated kitchen features stainless steel appliances, granite counters, reverse osmosis water tap, and a breakfast bar with pendant lighting. What a wonderful space for entertaining with family and friends!

Upstairs there are three bedrooms, a renovated five piece bathroom with heated floors and glass double sinks, and newly refinished hardwood flooring throughout. There are also updated casement windows throughout the main floor and upper level.

The finished lower level has a three piece bathroom with a soaker tub, a rec room or fourth bedroom, and new laminate flooring throughout.

Situated in a safe and sought after neighbourhood, this home is just a short walk away from subway and UP stations, less than 30 minutes from downtown, and just down the street from High Park, the jewel of Toronto’s park system, with more than 1 million visitors each year to its 400 acres of walking trails and attractions. It’s also close to three popular shopping districts: Roncesvalles Village; The Junction; and Bloor West Village. Each has its own distinct personality and its own varied collection of cafes, shops, restaurants, fruit & vegetable markets and flower shops.

This home is in the catchment area for top rated public schools: Howard Jr PS; Fern Avenue Jr/Sr PS; and Bloor CI. Access to the excellent French Immersion programs at Howard and Fern is available to residents in this catchment area, and can be continued through High School at Humberside CI, another top rated school. Also, the highly regarded High Park Gardens Montessori School is only a 10 minute walk away.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Just Sold – Renovated Etobicoke Townhome

02/28/20

Welcome to 102 Resurrection Road, a two bedroom + den townhome in an ideal location close to subway & GO stations, Islington Village shops & restaurants, great schools, parks, and with easy access to major highways, airport and downtown.

This tastefully renovated three level townhome has an open plan living room/dining room/kitchen on the 2nd floor with a walk-out to a balcony (gas BBQ’s allowed!) and pot lighting throughout. There are custom built-in cabinets & entertainment centre in the living/dining area, and the renovated white kitchen has granite counters, a breakfast bar, and pendant lighting.

The upper level has two spacious bedrooms, each with plenty of closet space, and a spa-like bathroom with a soaker tub and a separate shower.

The main floor has a den with custom built-in cabinetry (potential 3rd bedroom), a renovated 2 piece bathroom, and access to the built-in garage.

There are hardwood floors and custom California shutters throughout all three levels.

What a great opportunity for investors or first time buyers!

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Changes Coming To The Mortgage Stress Test

02/22/20

The ‘stress test’ for mortgage qualification in Canada requires that homebuyers must qualify for a mortgage as if the mortgage interest rate were higher than the actual rate they will get. The idea is to determine that the applicant will be able to keep up with the payments if interest rates should rise. That ‘higher rate’ is either the actual interest rate + 2% or the governments “Mortgage Qualification Rate” (MQR), whichever is greater.

Until now, the MQR has been equal to the mode of the chartered banks’ posted rates, however, as of April 6, the MQR will be the weekly median 5-year fixed insured mortgage rate from mortgage insurance applications, plus 2%. This will make the MQR more directly responsive to changes in actual mortgage rates, as the rates posted by the chartered banks are largely for show and do not closely follow the ‘real’ rates they charge to mortgage lenders.

For now, the change in the MQR only applies to insured mortgages, though it seems likely that it will be extended to uninsured mortgages as well.

This is a pretty small tweak to the stress test, and won’t make a significant difference to how much a lender can qualify for. The biggest impact will be on responsiveness – the new MQR will change on a weekly basis as mortgage rates change, not just whenever the banks decide to change their posted rates.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Toronto Market Continues to Accelerate

02/08/20

It’s beginning to look a lot like 2017.

Three years ago we had an insane spring market, with house prices rocketing upward by 20% and then crashing back down to where they started. The entire process only took about five months from beginning to end. The bubble was driven primarily by extremely low inventory of homes for sale and ended because of Ontario government legislation aimed (very successfully) at cooling off the market.

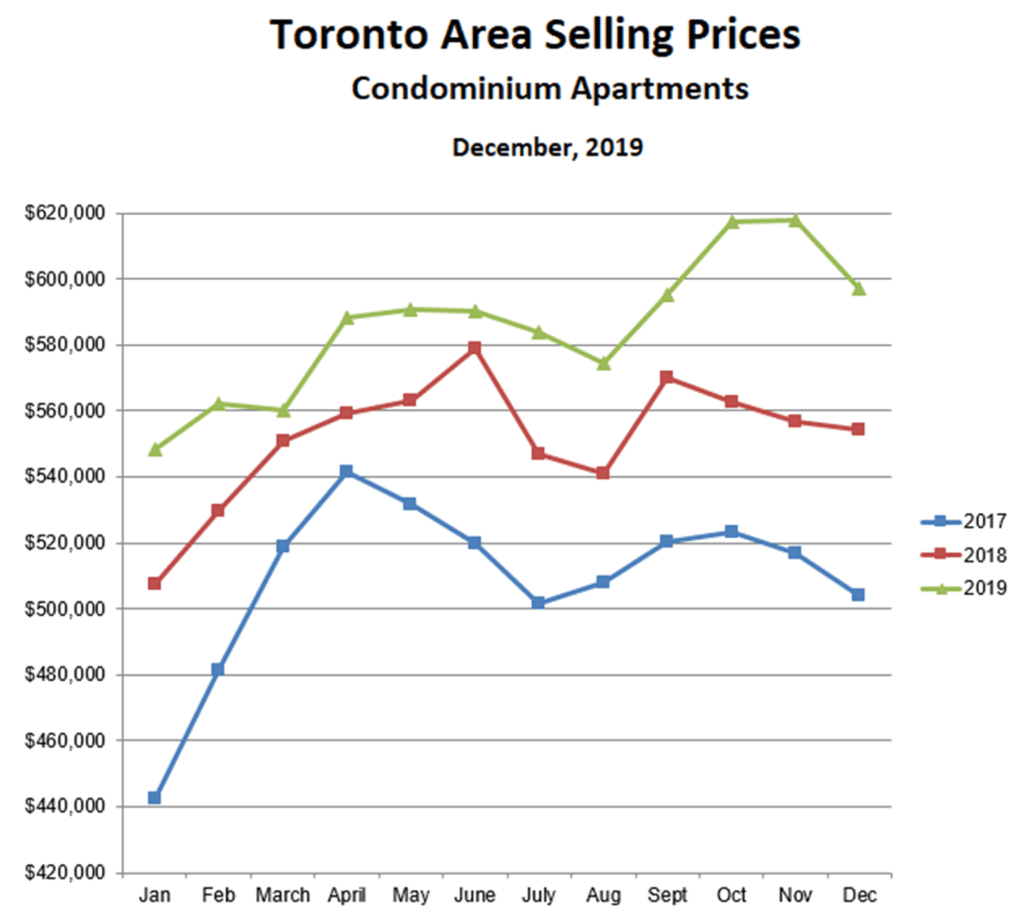

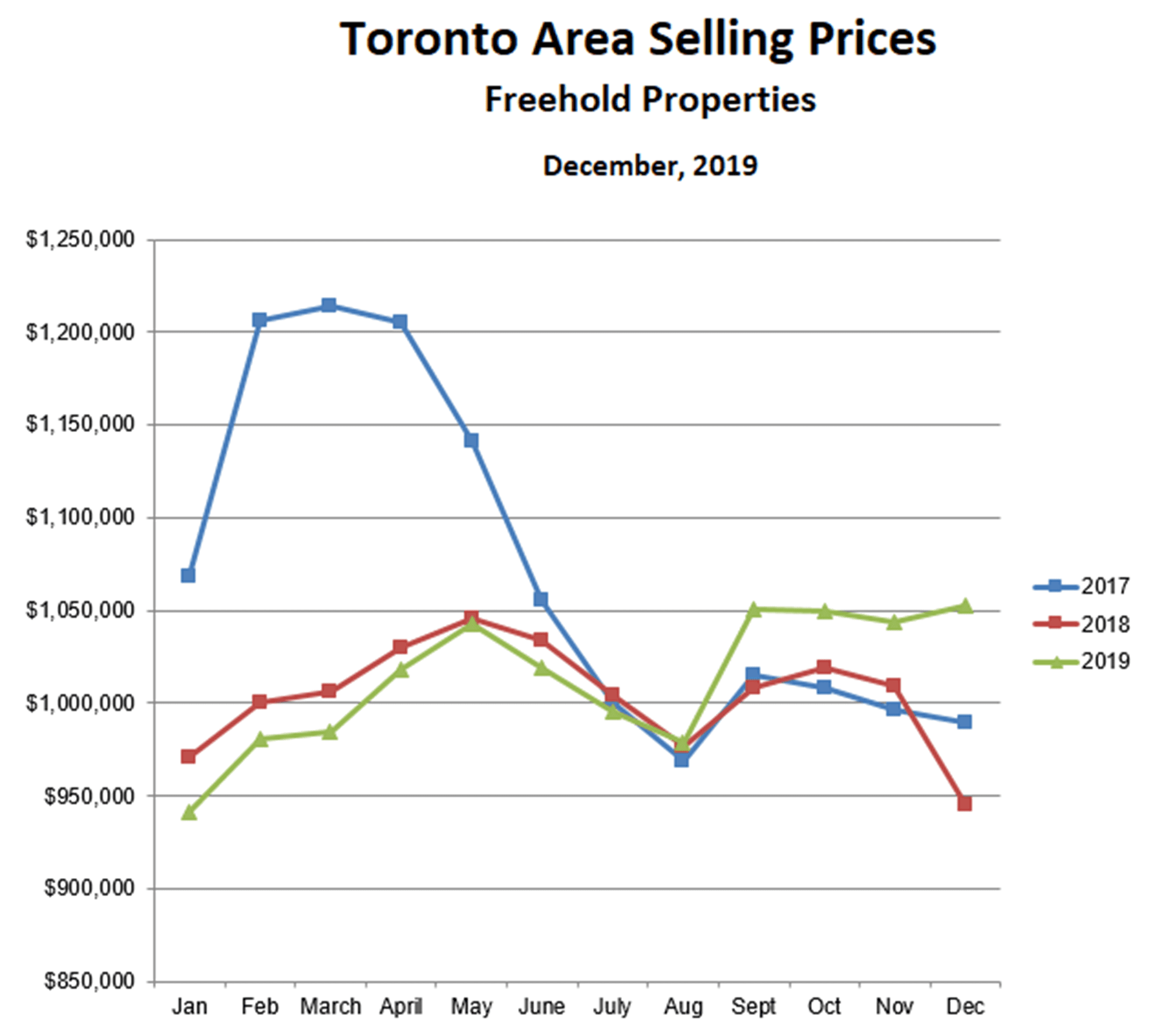

Following the collapse of the 2017 bubble, prices for freehold properties remained flat to slightly declining for the next two years. Then, last September, house prices increased sharply and continued to strengthen right through December, when normally the market sags a bit. The trend is continuing this year. Although January house prices are slightly below December, they are 10% higher than last January, and not far from the average price in January 2017.

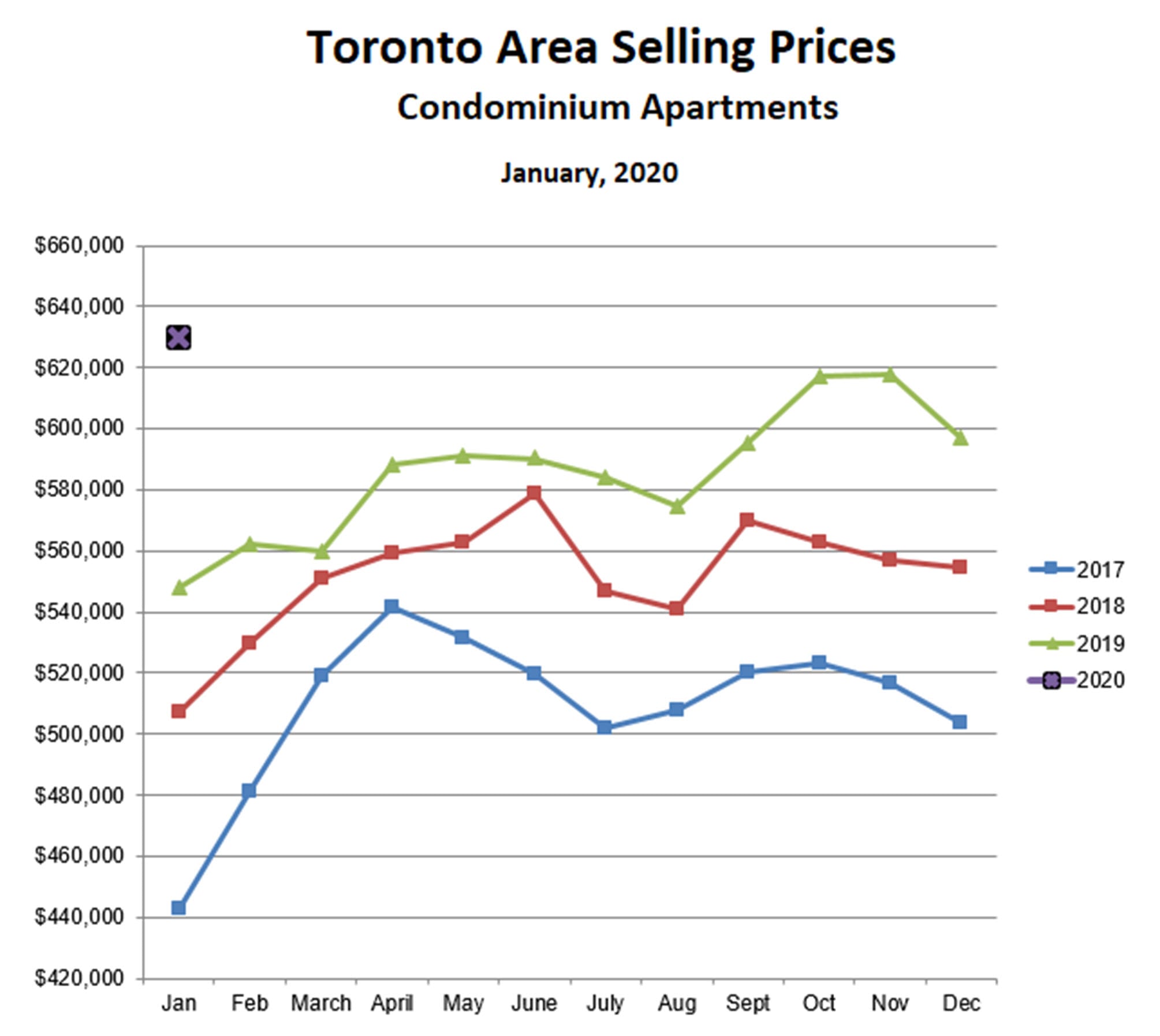

The market for condominium apartments in the GTA is even stronger than for houses. Back in 2017, condo prices also increased dramatically in the spring (by more than 20%) and also pulled back after April. However, condo prices did not collapse all the way back to where they started, and have continued to push higher ever since. Condo prices in January were 5% higher than December, 15% higher than last January, and 16% higher than the ‘bubble peak’ in April of 2017. While affordability (vs houses) is obviously one reason why the condo market is so strong, it is perhaps not the most important reason. The rental market in the GTA is extraordiarily tight and in fact could be described as a crisis situation. There simply aren’t enough rental units available to satisfy the steadily increasing demand. The primary source of new rental units is condominium apartments, and so condos have become very attractive to investors, to the point where they are starting to ‘crowd out’ end users. Also, many move-up buyers who bought condos a few years ago and now want a house are deciding to keep the condo for the rental income instead of putting it up for sale. The bottom line is that the demand for condos is growing faster than the supply.

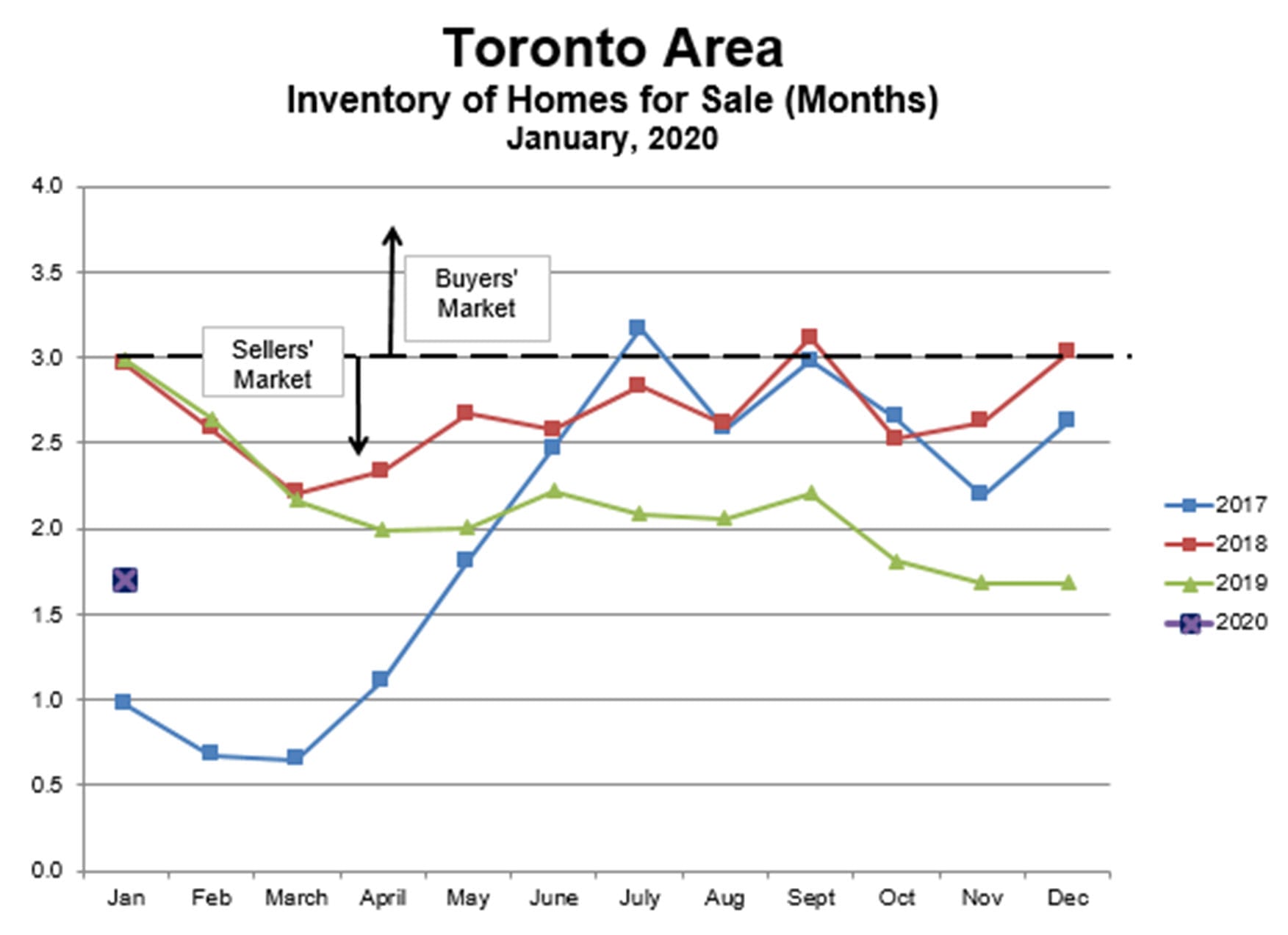

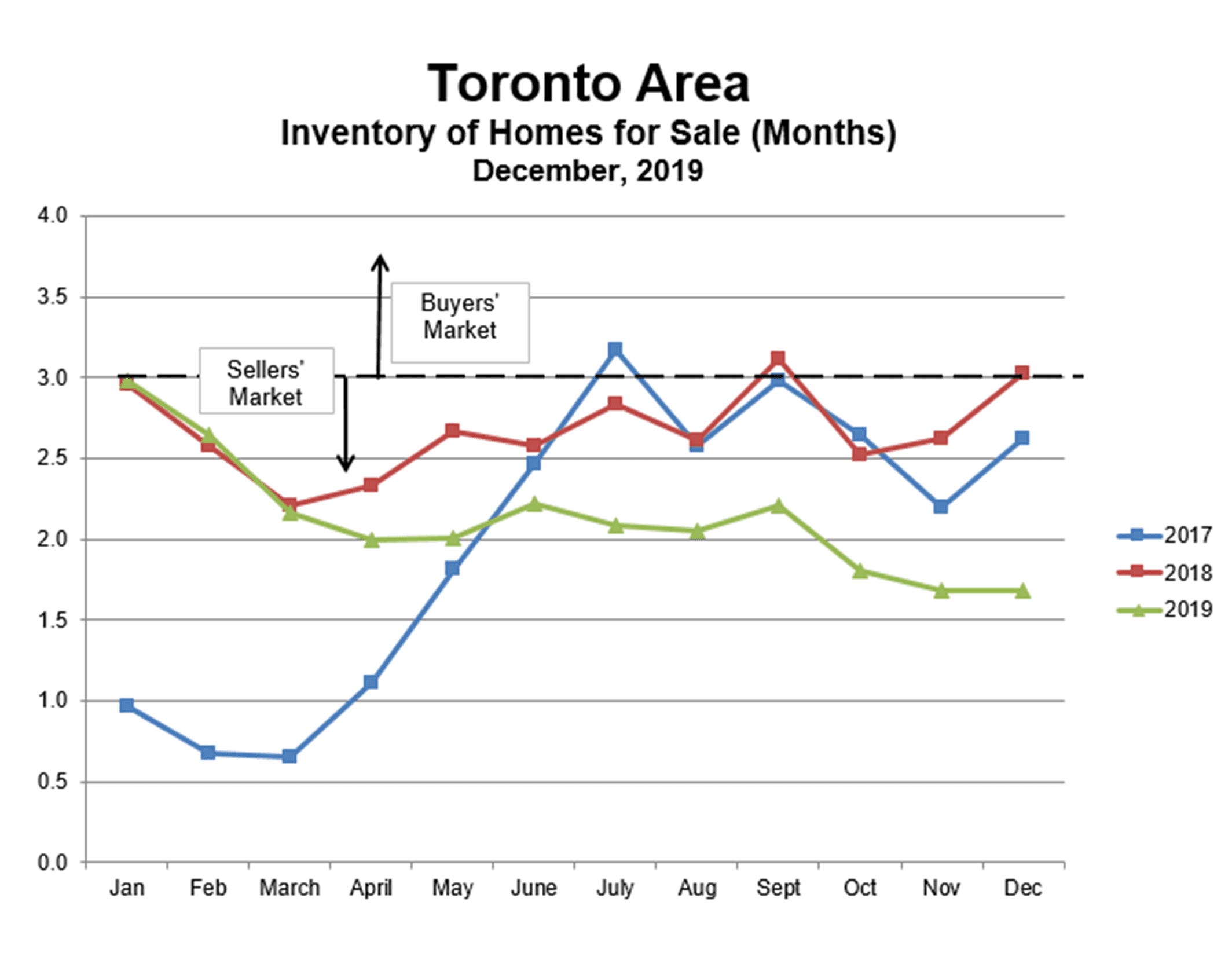

The increasing demand for both houses and condos relative to supply is reflected in the steadily declining inventory of homes for sale. For the past four months, overall inventory has been at less than 2 months’ supply, very deep in ‘sellers’ market’ territory, and lower than at any time since the 2017 bubble. While we still have a ways to go to match the extremely low (less than 1 month’s supply) levels seen in early 2017, we are definitely trending in that direction. We are getting close to the point where the increases in the market become self-reinforcing, if we aren’t already there. As inventory falls, it gets harder to find a house to buy and easier to sell the house you’ve got. So more and more move-up buyers decide to buy first before they put their house up for sale and, since a high proportion of homes for sale belong to move-up buyers, this means that the tighter the market gets, the more it tends to get even tighter.

Unless the government once again decides to intervene to cool off the market… and as long as the coronavirus outbreak soon comes under control… and as long as there are no dramatically negative financial, economic or geopolitical events, the spring market should continue to be very strong for at least the next 3-4 months.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Spacious High Park Detached

02/08/20

Welcome to 280 Keele Street, a spacious three storey home in Toronto’s trendy Junction neighbourhood. This generous property would make a wonderful single-family home, and could also easily be turned into a three-unit residence.

Step into the grand foyer, which boasts beautiful, original wood trim and a massive front hall closet. French doors lead to the living area with a working fireplace and custom, original hardwood flooring in a unique pattern. A second set of French doors open to a large dining room with soaring ceilings. The main floor also features a conveniently located four-piece bathroom, an airy kitchen with a double sink and ample storage, and a bright sunroom that walks out to a deck and a large backyard, perfect for entertaining.

The expansive second level has four bedrooms, including a roomy master with a large closet and a triptych bay window. The second bedroom has a large closet as well. This level also features original hardwood flooring and trim throughout and another four-piece bathroom. The third level has two large, additional rooms with lots of closet space. The third level has rough-in plumbing for a potential kitchen, and it would be easy to convert the 2nd and 3rd floors into a very spacious two level apartment. The main floor could, in turn, serve as a separate one bedroom apartment.

The lower level is already designed as its own unit with a separate entrance. It features a kitchen, four-piece bathroom, living/dining area, bedroom, laundry, and ample storage.

A licensed parking pad at the front of the house makes it easy to park your vehicle, and this home is also steps from the TTC (41 Keele, 89 Weston, and 26 Dupont buses), a short ten-minute walk to Keele station, and is close to the Go and UP Transit’s Bloor Station and the West Toronto Railpath. 280 Keele is in a sought-after school district, falling in the catchment for Annette St. Jr. and Sr. Public, Humberside CI, and Western Tech. The vibrant Junction strip on Dundas is steps away, with its robust collection of restaurants, bars, and shopping.

With its terrific location, ample space, and adaptable layout, this spacious home is just waiting for you to move in!

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Mortgage Rates Are Falling, But This May Not Affect Prices

02/07/20

Largely because of the Novel Coronavirus and the resultant ‘flight to safety’ among investors, Government of Canada bond prices are being bid up, and this means that the corresponding interest rates are falling (bond prices and interest rates move in opposite directions). The major banks’ fixed mortgage rates are tied to these bond rates, and so they are falling too. However, these lower rates don’t automatically mean that homebuyers will be able to qualify for larger mortgages. Here’s why.

The federal government introduced new lending rules two years ago. These rules require that all mortgage lenders qualify based upon either the government of Canada’s ‘benchmark’ rate or the actual mortgage rate plus 2%, whichever is higher. This means that lower mortgage rates will not change lenders’ ability to qualify unless the government’s benchmark rate is also reduced.

Recently TD Canada Trust reduced it’s posted 5 year rate from 5.43% to 4.99%, in line with the reductions in it’s ‘actual’ fixed mortgage rates, and this could lead other major banks to follow suit. If all the major banks lower their posted rates, this could induce the government to reduce it’s benchmark rate by a similar amount. Then, and only then, will homebuyers be able to qualify for larger mortgage loans.

The GTA real estate market has been heating up steadily over the past few months without any change in the benchmark rate, and so it is quite possible that the government will decide to leave the benchmark rate where it is to avoid adding fuel to the fire and potentially causing or facilitating another 2017-like price bubble. It’s also possible that bond prices will retreat once the coronavirus crisis has passed, and the government may want to avoid “yo-yoing” their benchmark rate. For both of these reasons, I’m not expecting a quick reduction in the mortgage qualification rate. It’s even possible that the government rate could be increased if they feel this is needed to cool down the market.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Airbnb Bylaw Is Now In Effect in Toronto

01/15/20

Early in 2018, the City of Toronto approved the regulation of short-term rentals in Toronto. However, the resulting zoning bylaw amendments were immediately appealed to the Local Planning Appeal Tribunal (LPAT). Almost 2 years later, on November 18, 2019, the LPAT issued a ruling dismissing the appeal and upholding the bylaw amendments. The new bylaw is therefore now in effect, and the City of Toronto is moving forward with it’s implementation.

The bylaw defines short-term rentals as:

“all or part of a dwelling unit in the City of Toronto used to provide sleeping accommodations for any rental period that is less than 28 consecutive days in exchange for payment.”

This includes existing bed and breakfast’s but excludes hotels, motels, and accommodations where there is no payment (for example, staying with friends and family, and couch-surfing).

The key details are:

- Short-term rentals are permitted across the city in all housing types in residential and the residential component of mixed-use zones.

- People can host short-term rentals in their principal residence only – both homeowners and tenants can participate.

- People can rent up to three bedrooms in a unit for an unlimited number of nights per year (less than 28 consecutive days) or their entire home for a maximum of 180 nights per year.

- People who live in secondary suites and laneway suites can also participate, as long as the secondary suite/laneway suite is their principal residence.

Short-term rental companies will be required to be licensed with the City of Toronto. A short-term rental company is any company facilitating or brokering short-term rental reservations online and receiving payment for this service.

- Applicants will be required to pay a one-time licence application fee of $5,000 and an ongoing fee of $1.00 for every night booked through the company.

- Licensees will be required to ensure that all listings have valid registration numbers.

- Upon licensing, short-term rental companies will be required to provide a process for removal of listings that do not have valid registration numbers, and a procedure for dealing with problematic operators and responding to complaints.

- Short-term rental companies will be required to keep records of short-term rental activity and provide them to the City as requested.

Short-term rental operators (people renting their homes on a short-term basis) will be required to register with the City of Toronto.

- Operators will be required to pay registration fee of $50 per year and post their City-issued registration number in all advertisements.

- People renting their homes on a short-term basis will be required to pay a 4 per cent Municipal Accommodation Tax (MAT) on all rentals that are less than 28 consecutive days.

- Operators will need to provide the City with information, including:

- contact information and address

- details of the short-term rental

- name and telephone number of an emergency contact person who will be available 24 hours a day during rental periods.

- Government-issued identification is required to demonstrate that the short-term rental is the operator’s principal residence and that they are over the age of 18.

- Operators will also be required to keep records of short-term rental activity and provide to the City upon request.

The City is planning to implement the licensing and registration rules for short-term rentals in phases. This page will be updated as more details are available.

Phase 1: Complaint-based investigation – ongoing

As the licensing and registration system is being put in place, the City will respond to issues on a complaint basis. Residents can contact 311 to report issues related to short-term rentals, such as noise, waste and zoning infractions and the City will investigate accordingly.

Phase 2: Licensing and registration – Spring 2020

Licensing of short-term rental companies and registration of operators will begin in spring 2020. Current and prospective short-term rental operators will have three months to register. During this time, the City will educate the public on short-term rental rules, encourage operators to register their short-term rentals, and work with companies to ensure compliance with the licensing rules.

Phase 3: Enforcement and MAT – Summer 2020

All current short-term rental operators will need to be registered by the end of phase 2. The City will take enforcement actions against short-term rental operators that are not registered or are not following the rules. As of the end of phase 2, registered short-term rental operators will also be required to start paying the four per cent Municipal Accommodation Tax (MAT) on a quarterly basis.

Enforcement action will also be taken against companies that allow unregistered operators to list on their platform or contravene the bylaw. Anyone currently involved in Airbnb rentals or thinking about doing so would be wise to familiarize themselves with all the new rules.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Strong December Bodes Well For Toronto Homes In 2020

01/11/20

The breakout trend for Toronto area freehold properties continued in December. Prices were a stunning 11% higher than last December and sales were 25% higher. Even more surprising, prices in December were actually higher than in November, which almost never happens. Despite the relative weakness in the first 8 months of 2019, total year sales of freehold properties were up 20% over 2018, and total year prices were almost exactly the same, so the last 4 months made up for the first 8. The consistent strength over the past 4 months hints at a hot spring market in 2020. Expect both sales and prices to increase significantly, although probably not to the extent that we saw in the bubble three years ago.

Prices and sales for condo apartments also continued to be healthy in December though, for once, not as strong as freehold properties. December condo prices were up 8% over last December, and sales were up 6%, though prices were 10% lower than the all-time-high reached in the previous month. Total year condo sales were up 3% while prices were up 7%. For 2020, the expect more of the same for condos, with continued growth in sales and prices, though probably not accelerating like freehold properties.

The main drivers of this strong market are continued low interest rates (with even lower rates likely to come) together with steadily declining inventory – there are steadily fewer homes for sale with steadily increasing buying pressure. Inventory has been less than 2 months’ supply for the past three months, very deep in ‘sellers’ market’ territory, though still nowhere close to the extreme that we saw in early 2017. Here also we can see the unusual strength in the market in December, as inventory almost always rises at the end of the year.

Hold on to your hats, it’s probably going to be wild ride over the next few months!

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!