Author: Dave Proulx

Valentine’s Day Draw To Support Local Businesses

01/10/22

Once again the Smith Proulx team, together with Valentine Panda, will be holding a Valentine’s Day draw to support our West Toronto local businesses.

The pandemic has been difficult for many small businesses and we wanted to help out in some small way, so we created an event last year to support local businesses in the Bloor West Village, High Park, Junction, and Swansea neighbourhoods. We purchased gift cards from various local businesses and gave them away to winners of a Valentine’s Day draw.

Valentine Panda delivered the prizes to the winners in person. The recipients said hello to the Panda and took (socially distanced) photos with Panda.

The event was a great success and so we are doing it again this year. Eight local businesses will be involved and we will be purchasing and giving away $100 gift cards from each of these businesses to the draw winners. Once again, Valentine Panda will personally deliver the prizes to the winners. The businesses are:

The draw will be held on February 11 on Facebook Live. Here’s how to enter:

- Submit your full name, address, email & phone number to info@smithproulx.ca;

- Call/text 416-258-9605; or

- Scan the QR code below and enter online.

Please submit your entry by no later than 8 pm on February 10.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

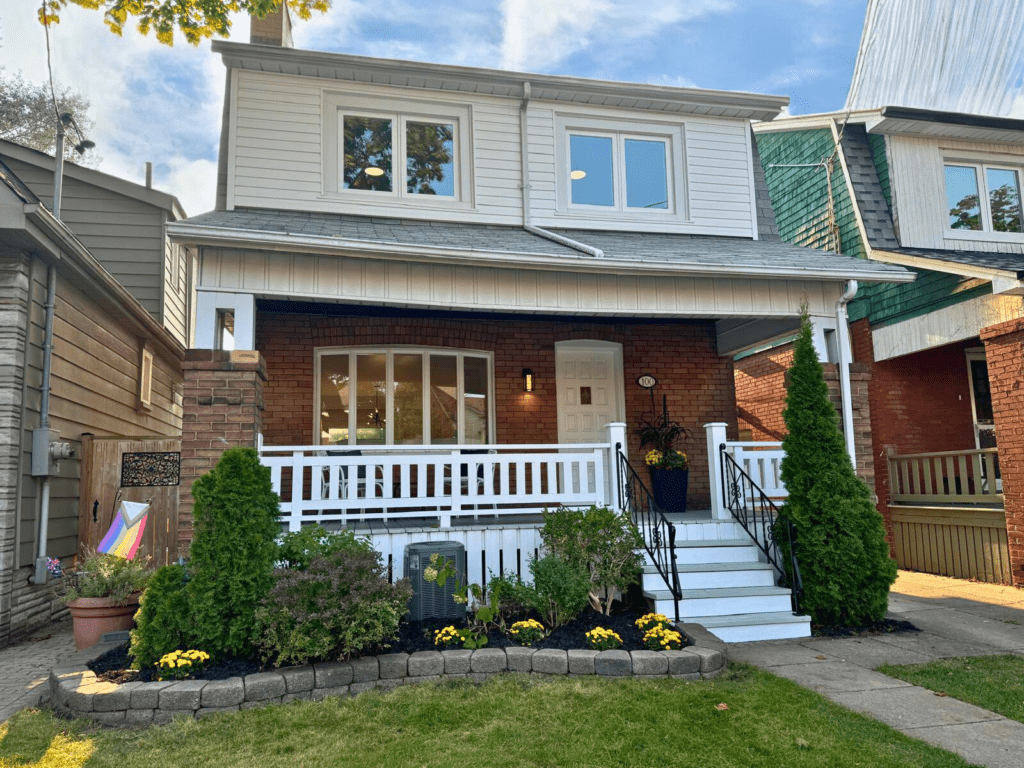

Five Tips For Buyers In A Hot Sellers’ Market

12/14/21

If you are a buyer looking to purchase a house in Toronto, you know that the market has become extremely competitive over the last several months. Bidding wars and bully offers are rampant, the inventory of homes for sale is near an all-time low, and it’s common for buyers to lose out several times in competition before finally getting an offer accepted.

Here are some tips that can increase your chances of getting the home you love… and can afford.

Figure Out Exactly What You Want

Get crystal clear on the type of home you’re looking for, including size, location, old vs new, number of bedrooms, garage, parking and so on. This will help narrow your focus on listings that are a good fit for you.

Buying a home in West Toronto? Explore these helpful posts from our blog for tips and advice.

- Is it Better to Buy or Rent?

- Incentives & Tax Breaks For First Time Buyers

- How to Win a Bidding War in Toronto

Get Your Financing Pre-Approved

In a competitive market, getting your financing pre-approved will give you an advantage at offer time, as it will reduce the risk of making an offer without a financing condition. Don’t leave this to the last minute, do this now.

Be Prepared to Act Fast

When the market is hot, good listings don’t last long. You don’t want to miss out! When you see a listing you like, review everything available online first, then schedule a viewing right away if you think it could be ‘the one’. Even if the listing says that offers will be reviewed in a week, don’t wait, because there could be a bully offer long before the offer date!

Determine Your ‘No Regrets’ Price

Great homes in a sellers’ market will typically receive multiple offers and sell well above the asking price. For each home you are interested in you need to know, first of all, what the ‘fair market value’ is; and then you need to decide the highest price that you are willing to pay for it. Be aware that the fair market value is very often higher than the asking price, sometimes much higher; and also be aware that great homes often sell above even the fair market value. Your ‘no regrets’ price needs to be one that you can live with whether you win or lose the bidding war. Once you’ve determined that price, then stick to it — don’t allow emotion and competitive urges to tempt you to bid more than you are truly comfortable with. And don’t forget to run your price by your lender before the offer date, especially if you are planning to make an unconditional offer.

Consider Telling the Sellers How Much You Love Their House

Homeowners are very attached to their homes. They take great pride in every room, every upgrade and feature, and they want their home to go to someone who will love it as much as they do. If your bid is in close competition with one or more other bids, a heartfelt letter or video can make the difference between winning and losing.

It’s definitely not fun to be a buyer in a hot sellers’ market, but patience, persistence, and a disciplined approach will get you the house you want at a price you can afford!

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

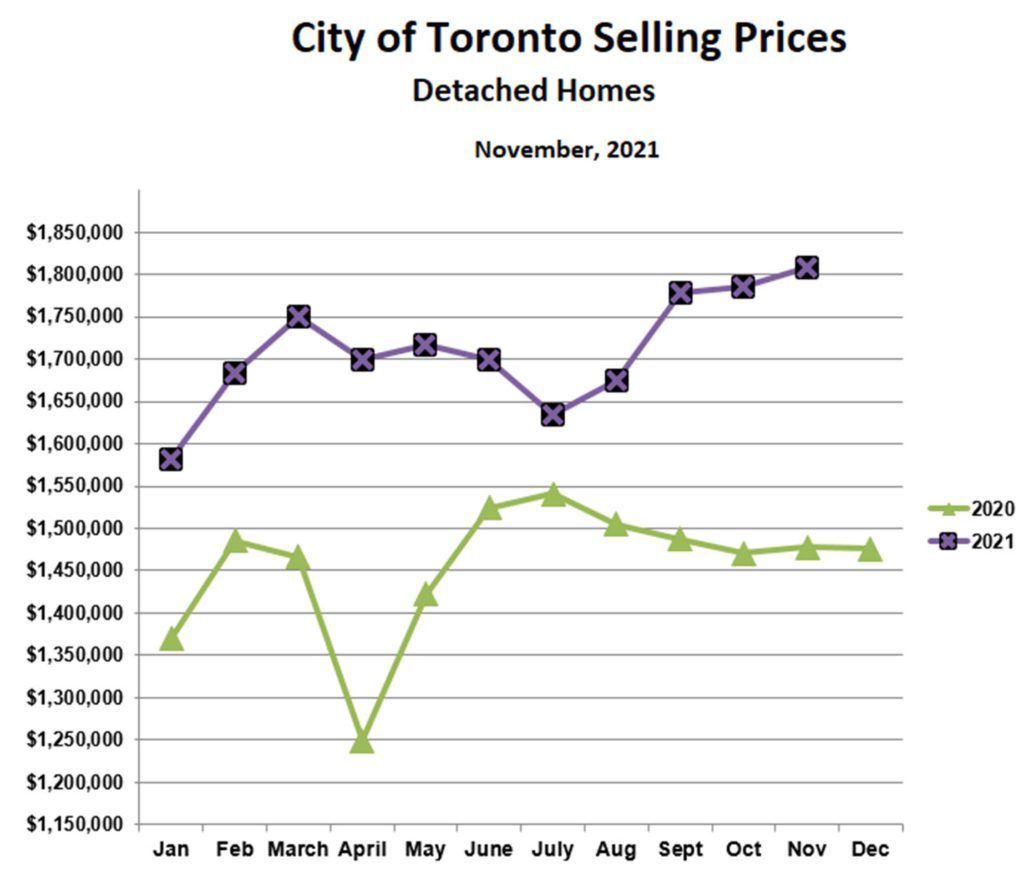

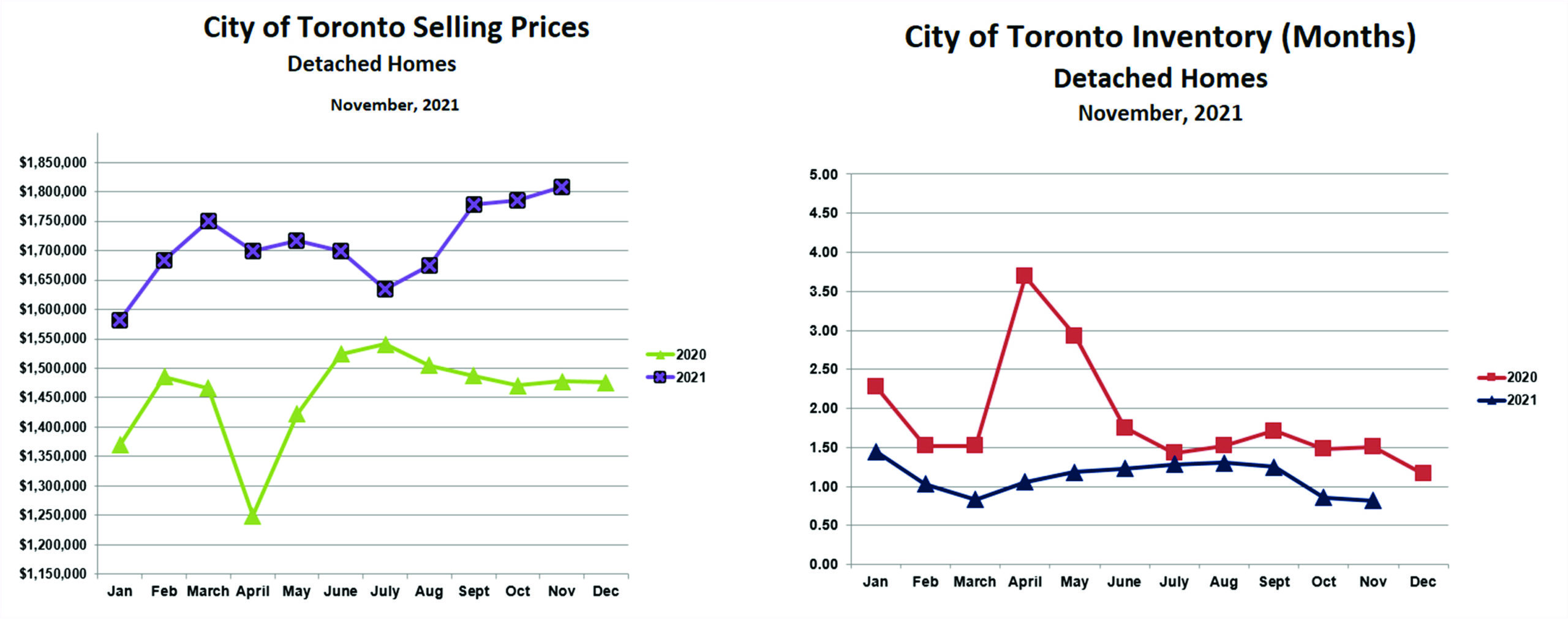

Hot Toronto Market Continues in November

12/08/21

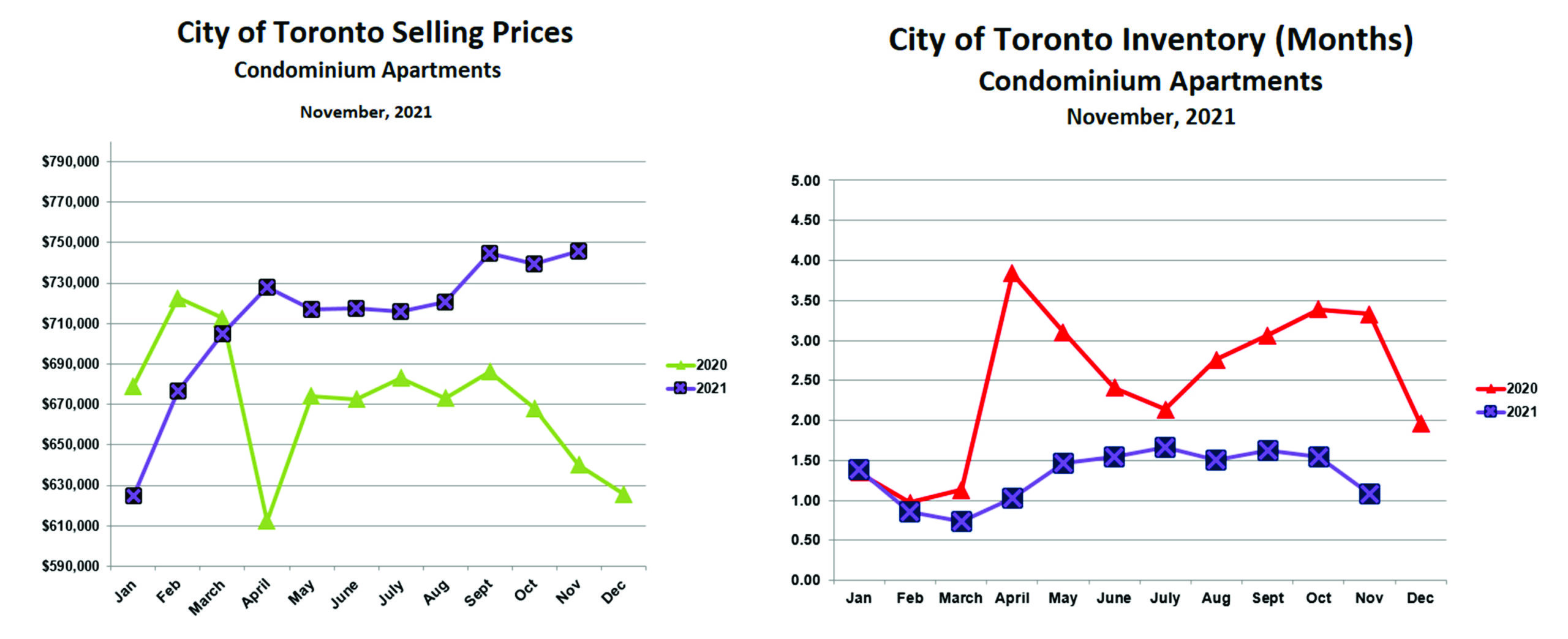

Prices continued to rise in November across all property types in the City of Toronto. This is unusual: with rare exceptions over the past 20 years or so, prices have fallen in November as the holiday season approaches.

Detached homes notched all-time high prices in each of the last three months, with an average price of $1,807,983 in November. The increase in prices corresponds to a decline in the inventory of homes for sale, down to just 0.82 months’ supply in November. This is the second month in a row that inventory has been less than one month. In effect, this means that houses are selling faster than they come on the market!

The same pattern is evident in condominium apartment sales in the City of Toronto. Prices increased to another all-time high of $745,941 in November, narrowly beating the previous high of $744,730 reached in September. The inventory of condos for sale fell sharply in November to 1.1 months’ supply from 1.5 months in October.

The relentless upward climb in prices of all property types in Toronto is being driven largely by low inventory. This is creating massive bidding wars. Generational lows in mortgage rates have also been pushing the market higher for some time. Now that the Bank of Canada is hinting at interest rate hikes beginning early next year, many buyers are focused on getting in before it’s too late. This extra layer of ‘FOMO’ could keep the market boiling right through the holiday season.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Support the Toronto Fire Fighters Toy Drive!

12/06/21

Once again Santa Panda and the Smith Proulx Team are excited to collect toys for donation to the annual Toronto Fire Fighters Toy Drive. The event was a great success last year, over 300 toys were collected – click here to see what happened!

Pick Up Dates

On Tuesday, December 14, and Thursday, December 16, Santa Panda and the Smith Proulx Team will pick up toy donations from your doorstep between 3:00 and 5:00 pm.

To sign up for toy pickup, please call or text Renee at 416-826-4787. We will pick up from homes in Bloor West Village, Swansea, Roncesvalles Village, The Junction, High Park and Old Mill/Baby Point.

Drop Off Date

On Saturday, December 18, between 2:00 and 4:00 pm, Santa Panda will accept your toy donations in front of the Re/Max office at 2234 Bloor St. West (between Beresford and Runnymede).

New, unwrapped toys only, please, for infants to age 16

Help us bring holiday cheer to families in need! Together we can make a difference!

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Mortgage Brokers vs Banks – Which is Best?

12/05/21

Buying a home is the biggest single purchase most people will ever make. You should choose carefully when deciding who will help you finance that purchase.

Your simplest option is to work with a mortgage specialist at your bank. This may be your best choice, however, you should also consider the mortgage broker alternative.

Let’s have a closer look at the pros and cons of using a mortgage broker vs a bank to finance your home purchase.

What is a mortgage broker?

A mortgage broker is an intermediary between you and a mortgage lender. His or her job is to search for lenders who best fit your needs and will offer you the best interest rate and terms. Experienced mortgage brokers have a wide network of lenders to choose from, including but not limited to banks.

Why should you work with a mortgage broker?

- One-stop shopping You don’t need to make the rounds to several lenders; your broker will do that for you. This makes it easy to compare lenders.

- It’s free Your mortgage broker will be paid by the lender, not by you.

- Expertise Mortgage brokers are specialists and understand what different lenders can offer. They live and breathe mortgages.

- Better rates Very often a broker can get a lower interest rate than your bank offers.

- Flexibility If you are self-employed or have credit issues, a broker can source multiple options.

- Licensed Mortgage brokers are licensed under the Financial Services Commission of Ontario. You can visit their website here to learn more about the mortgage broker industry.

- On your side Your broker is legally obligated to work in your best interest.

What are the cons of working with a mortgage broker?

- Due Diligence Choosing a broker online doesn’t automatically guarantee good results. You need to shop around and/or seek referrals to find the best broker for your situation.

- No access to some lenders Not all lenders work with mortgage brokers.

Why you might want to work with your bank

- Convenience Your bank already has your accounts and personal information. It’s comfortable dealing with people who already know you and your family.

- Leverage If you have all your accounts at your bank, you may be able to negotiate better mortgage terms or other ‘perks’.

Why your bank may not be the best choice

- Limited choice Your bank can only sell you its own mortgage products. Often the rate and terms offered are not the best options available. You can shop around to several banks, but that means lots of legwork and multiple credit checks (which may damage your credit rating).

- Stringent requirements Banks are tough on mortgage approvals. If you have a lot of debt, or if you have credit issues, or if you are self-employed, you may have better luck finding a lender through a mortgage broker.

In 2017, CMHC conducted a Mortgage Consumer Survey and found that mortgage brokers are increasing their share of the market:

- First-time buyers – 55%

- Repeat buyers – 40%

- Mortgage refinancing – 40%

- Mortgage renewals – 35%

If you are looking for help to finance a mortgage, explore both the mortgage broker and bank options carefully and make the choice that’s best for you!

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Garden Suites Coming To Toronto

11/08/21

The City of Toronto is developing regulations to permit ‘Garden Suites’ in most residential areas. These regulations should be in place by mid-2022.

What is a Garden Suite?

A garden suite is a detached accessory dwelling unit located in the back yard of a detached, semi-detached, or attached house. It is smaller than the main house and serves as a separate rental housing unit. Garden Suites are similar to Laneway Suites, which are already permitted in most areas of the city.

Several other Canadian cities already have approved planning frameworks for Garden Suites, including: Kitchener, Ottawa, Edmonton, Calgary, Whitehorse, Halifax, Victoria, Maple Ridge, Saanich, Windsor, and Peterborough.

What are the requirements for Garden Suites?

Draft regulations for Garden Suites have been prepared and are being reviewed through public consultations. These regulations specify such things as:

– Location in the back yard;

– Maximum lot coverage, height, and building footprint;

– Minimum setbacks from side and back lot lines;

– Minimum ‘soft landscaping’;

– Protection of mature trees;

– Prohibition of severances; and

– Requirements for emergency services access, especially fire services

Once the Garden Suites bylaw and regulations are in place, most homes in Toronto will be able to have two ‘accessory units’ in addition to the main building. The first would be a rental unit inside the building, such as a basement apartment. The second would be a rental unit detached from the main building, either a Laneway Suite or a Garden Suite.

Garden Suites will give homeowners another way to produce rental income and will also increase the value of their property. More importantly, they will increase the stock of low-rise rental units within the city.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Home Inspections – Why They Are Worth It

11/08/21

Before 1970, home inspectors did not exist. Buyers might bring a relative or friend to take a look at the house, but these ‘inspections’ were informal and often missed expensive problems.

By the mid-1970s the home inspection industry began to take shape. At first, buyers hired general contractors to check out the home before making an offer. As the industry grew, it became clear that ‘contractor’s inspections’ were not thorough or detailed enough. Standards for home inspection procedures and training were developed and, by the mid-1980s, home inspections moved into the mainstream of the real estate buying process.

What is a home inspection?

During a home inspection, which costs $300-$700 and takes about 2-3 hours, the following are visually evaluated:

1. Roof surfaces;

2. Exterior of the home as well the surrounding land;

3. Structure of the building;

4. Electrical system;

5. Heating system;

6. Cooling system;

7. Insulation and ventilation;

8. Plumbing; and

9. Interior of the home

The inspector evaluates everything that is readily accessible. He provides a report on problems that need attention as well as ongoing maintenance items. The inspector cannot see behind walls or under floors, so not everything can be inspected. Nevertheless, the report gives the prospective buyer a good idea as to what the problems are, roughly how much money will be required, and how soon the work needs to be done.

How home inspections fit into the homebuying process

Typically, a buyer includes a condition on home inspection in his offer. Once the offer is accepted, the buyer has 3-5 days to complete the inspection. If the inspection report is satisfactory, the condition is removed and the deal ‘firms up’. Otherwise, the buyer has three choices:

1. Walk away from the deal;

2. Ask the seller to fix the problem(s); or

3. Ask the seller for an adjustment in the price to reflect the cost of the repairs.

What about bidding wars?

In the Toronto market, multiple offers have become very common, even normal. This has changed the landscape as far as home inspections are concerned.

Sellers obviously prefer offers with as few conditions as possible. As a result, it became common for buyers to have inspections done before the offer date so no inspection condition would be required. This often led to multiple inspections being done by different buyers on the same property. Sometimes the same inspector would even do inspections for multiple buyers!

Obviously, this was unsatisfactory as the money spent on the inspection was wasted if the buyer didn’t get the deal. The buyer had only two alternatives:

1. Include a home inspection condition in the offer (and likely lose the competition); or

2. Make an offer without a home inspection condition (and risk buying a lemon).

Sellers’ pre-inspection reports

In recent years, it has become common practice for sellers to provide a pre-inspection report available to all prospective buyers. This is beneficial for sellers as it encourages both more offers and unconditional offers.

For the buyer, the seller’s pre-inspection report is also beneficial for obvious reasons. However, buyers need to be aware that the inspector is working for the seller. This isn’t a big concern as long as the inspector is well known and highly qualified. However, if the buyer and the buyer’s agent are not familiar with the inspector and/or if the inspection report is poor quality, the buyer might want to conduct their own pre-inspection report.

A home inspection report is extremely valuable, regardless of who provides it. Not only does it identify potential ‘deal breaker’ issues, but it also gives the buyer a road map for future improvements, repairs, and general maintenance.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

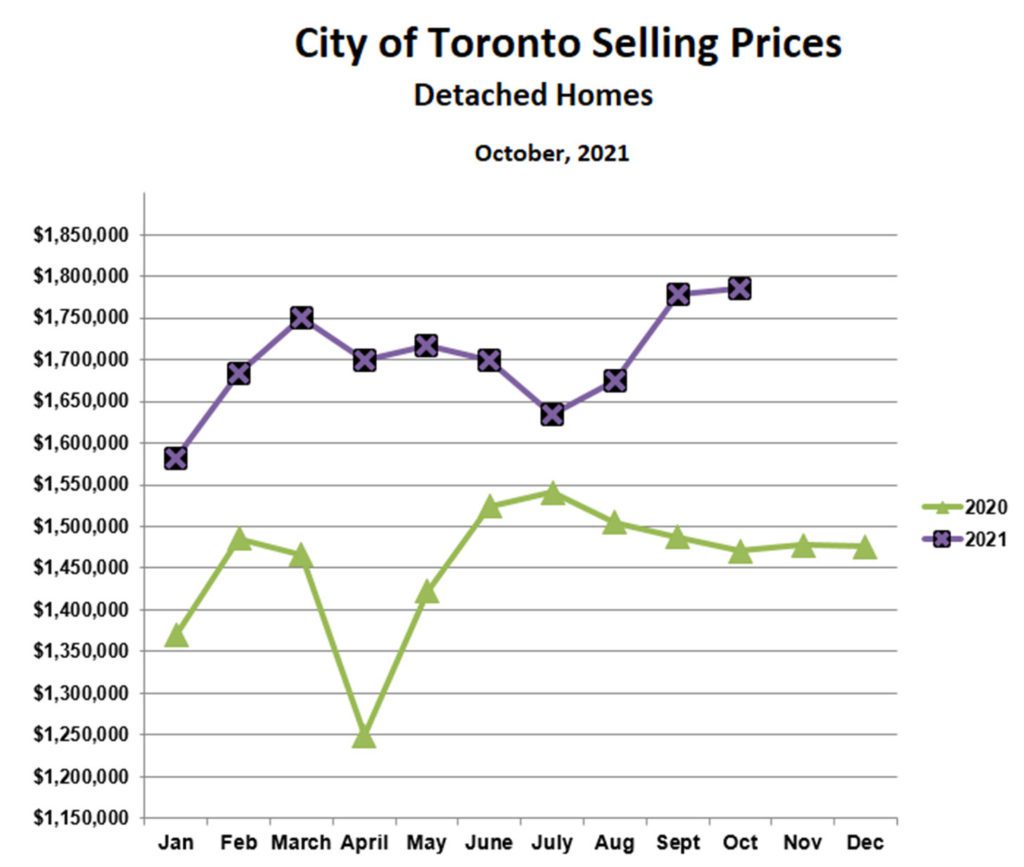

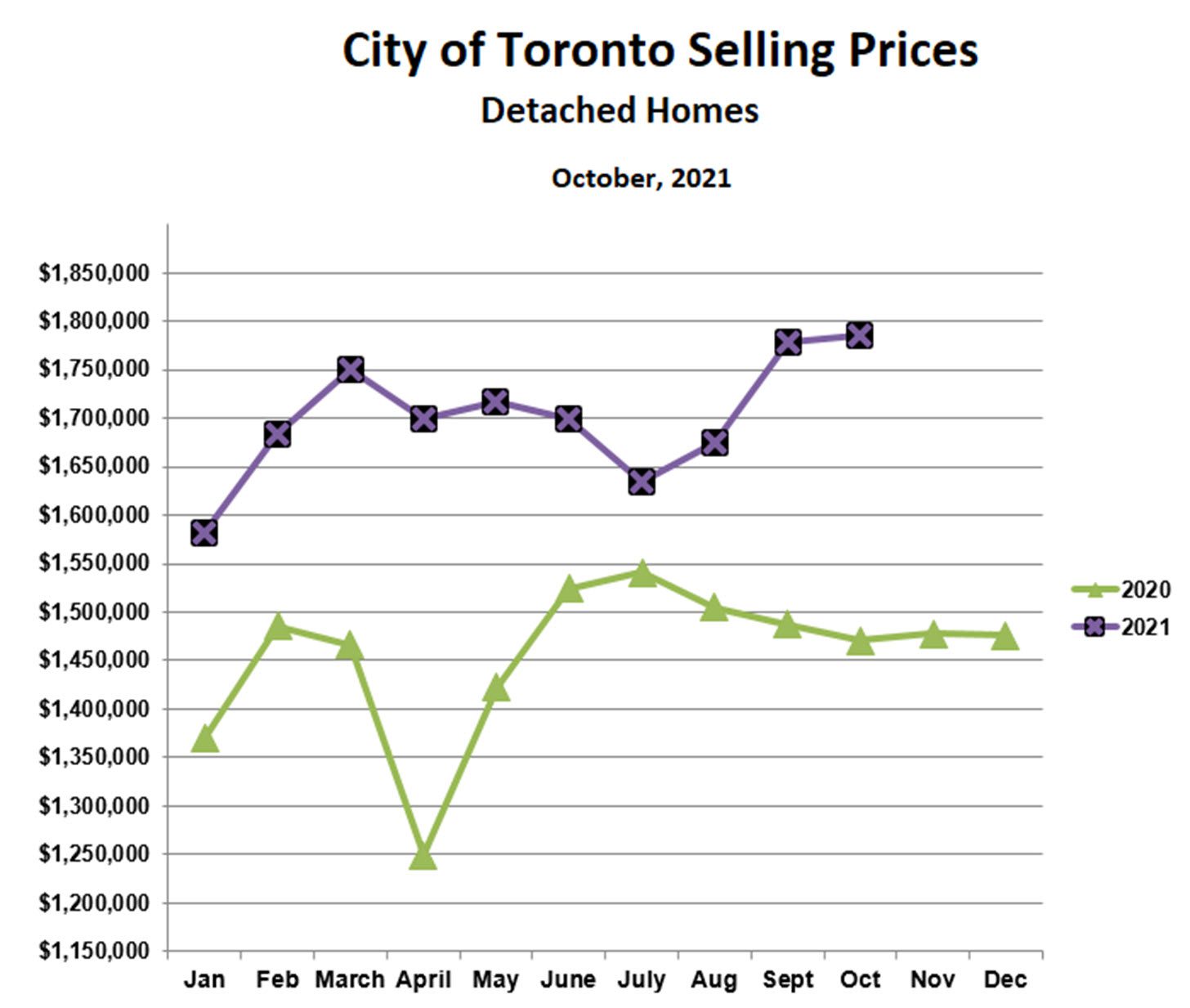

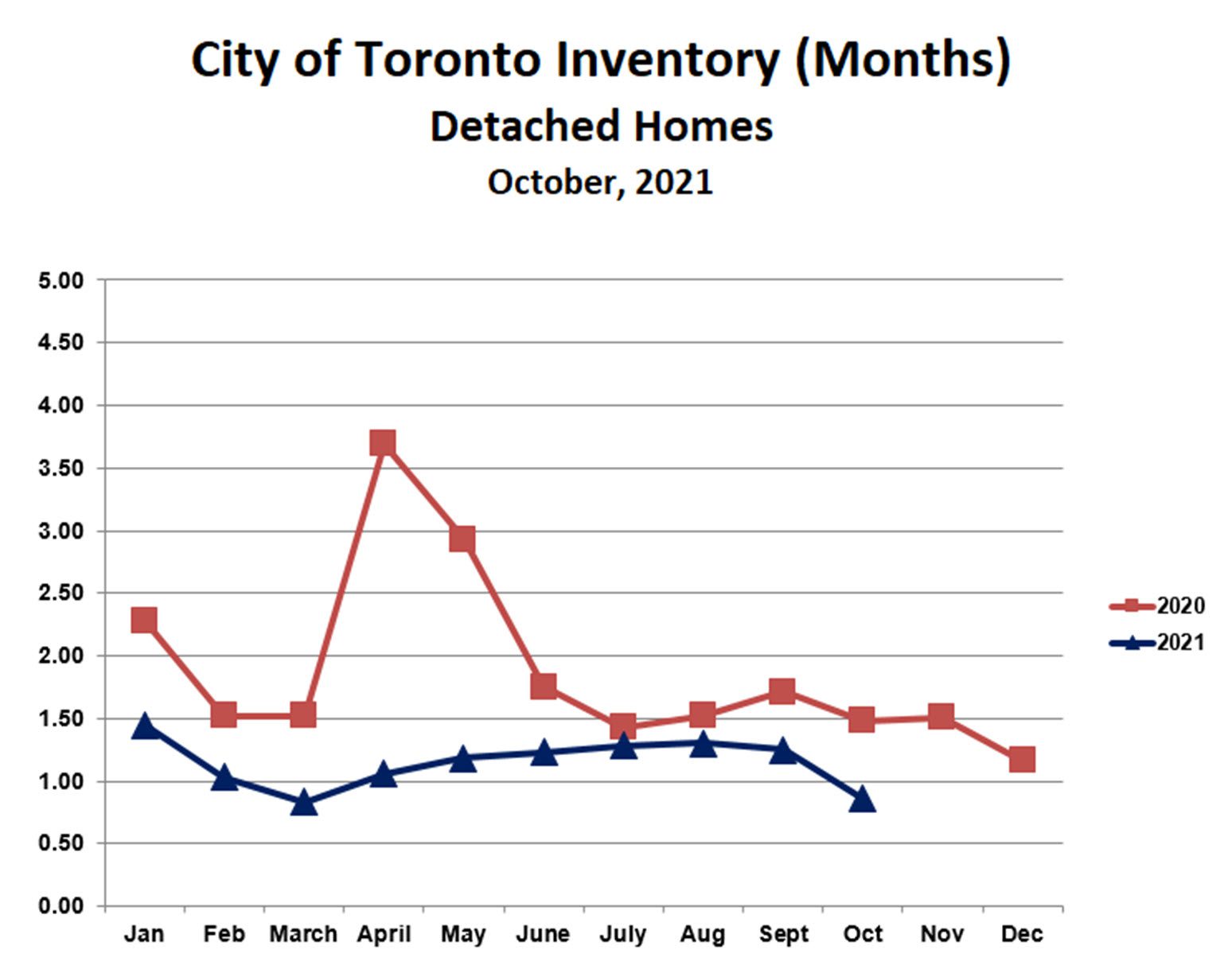

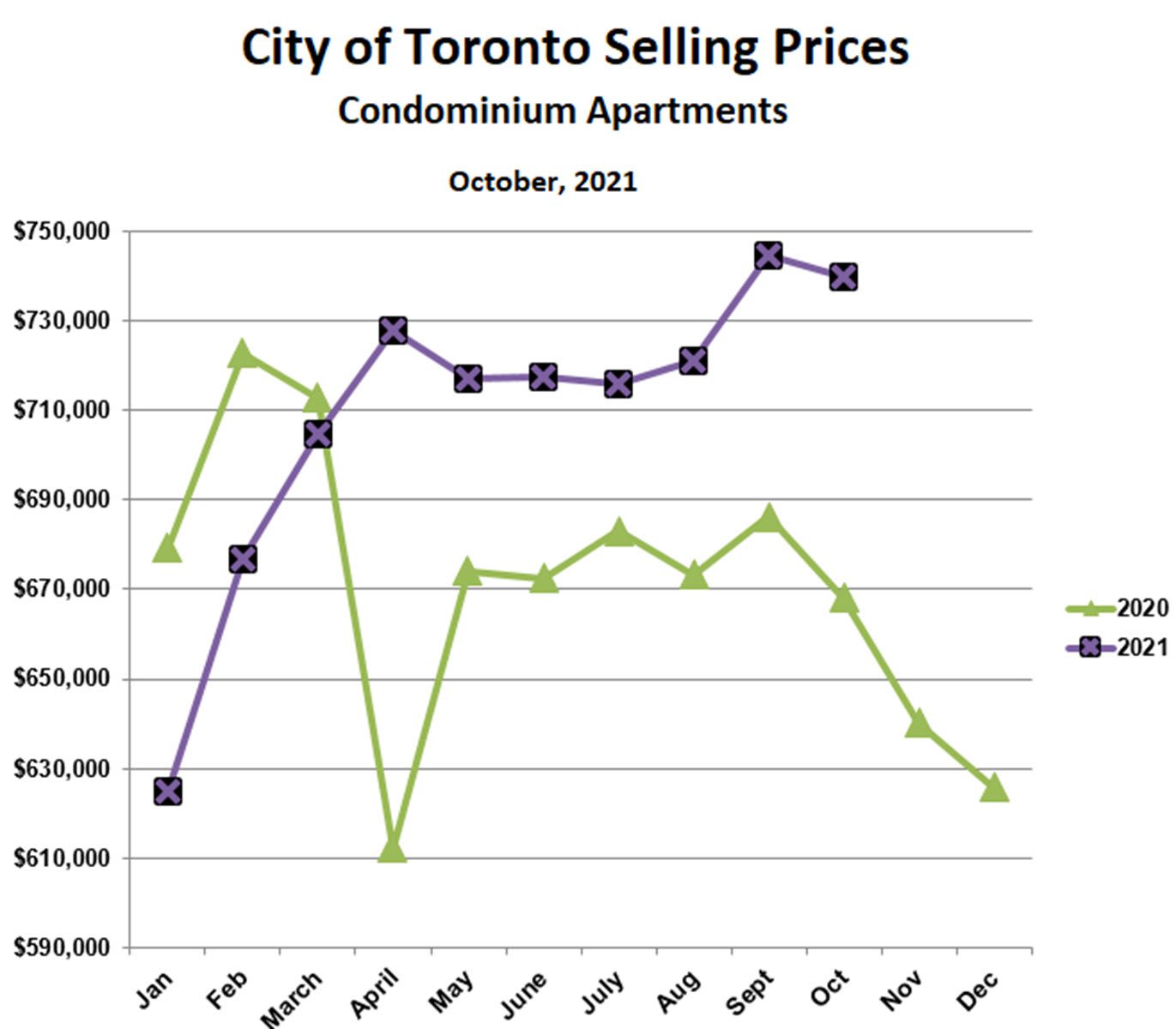

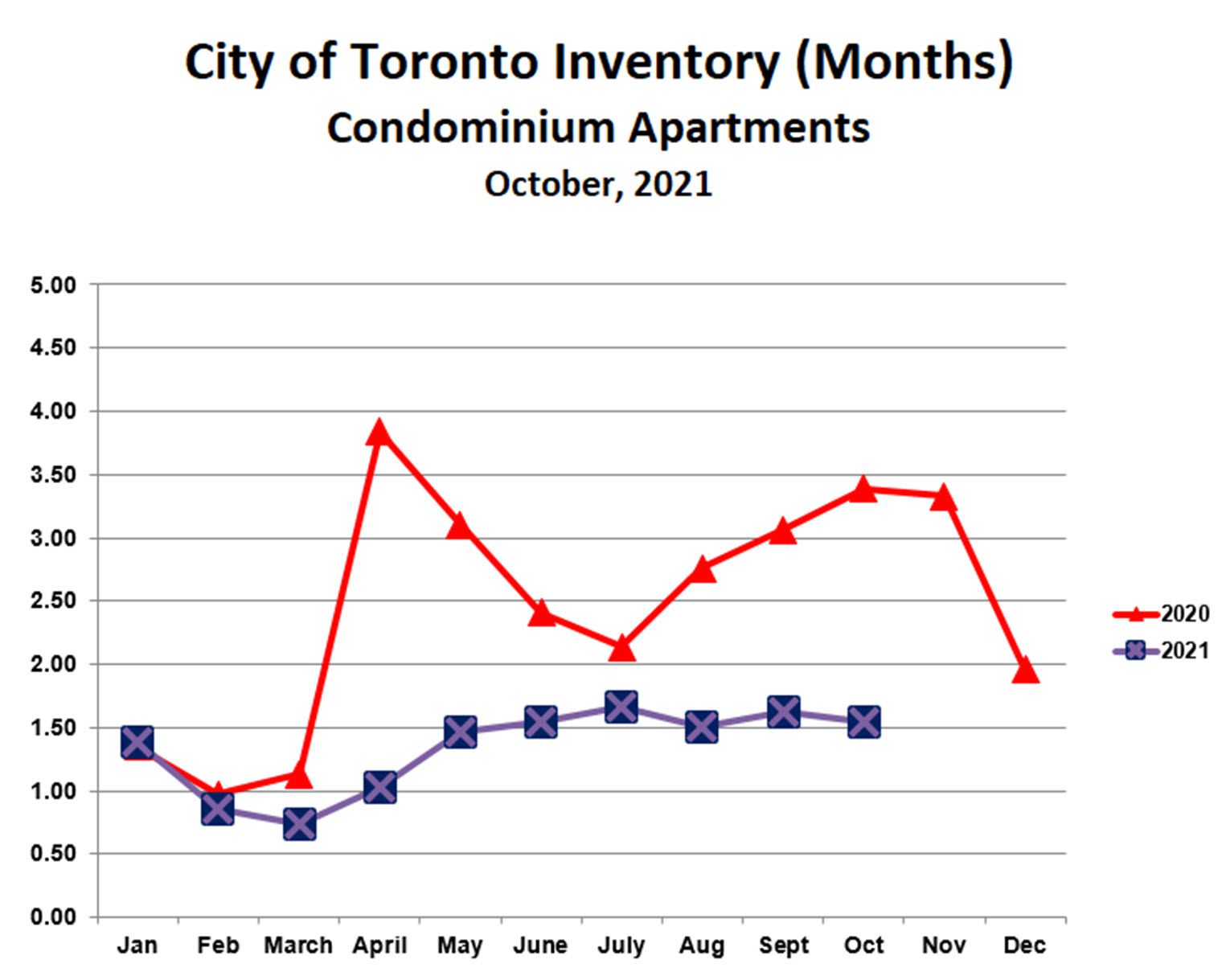

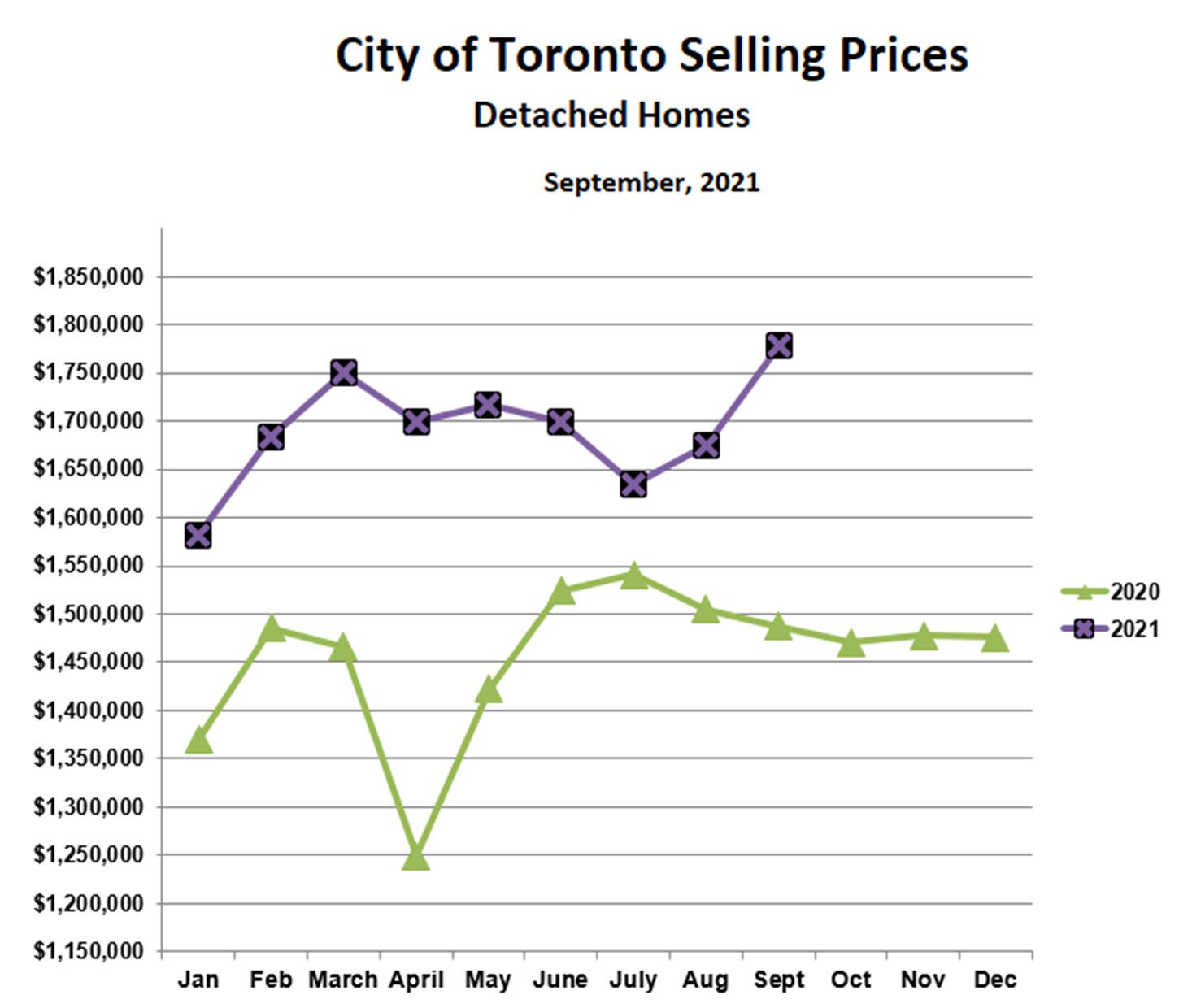

Toronto Market Continues Strong in October

11/07/21

Prices for detached homes in the City of Toronto hit an all-time high of $1,784,979 in October. This was slightly higher than September and 21% above last October. The strong market is being driven by ultra-low mortgage rates in combination with a declining inventory of homes for sale. Inventory dropped to 0.86 months’ supply in October, signalling an extreme sellers’ market. This is very close to the level we saw in the height of the crazy ‘spring fever’ earlier this year. With inventory so low, and with many buyers anticipating even higher prices next year, it’s likely that the market will remain strong through the holiday season.

The condo market in the City of Toronto also remained strong in October. Prices declined slightly from September’s all-time high but remained above the spring peak that we saw in March. As for detached homes, the inventory of condos for sale remained very low at 1.5 months’ supply. This was slightly lower than in September and about the same as it has been for the last 6 months. The sellers’ market continues for condos and is also likely to continue strong through the Christmas/New Years period.

To add some perspective, consider what has happened over the past two years since Covid began. Average prices for all property types have increased by 20% in the City of Toronto since 2019. This seems hardly believable during a serious pandemic, however, the numbers outside the City of Toronto are staggering. Prices in the GTA areas surrounding Toronto increased by 40% over the past two years. We are all familiar with the ‘exodus narrative’, work-from-home city dwellers leaving Toronto in droves for bigger and less expensive homes. Even so, the magnitude of the change is absolutely amazing.

As we put the worst of the pandemic behind us, we can probably expect to see immigration accelerate and some degree of return to the city as companies call their employees back to the office. These factors will almost certainly add fuel to the fire that is the Toronto real estate market.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Get Better Credit With The 5 C’s

10/14/21

Buying your first home is an incredible step in life, but it is not without its hurdles! One of these hurdles is demonstrating that you are creditworthy, and this all comes down to your ability to manage credit. This is how lenders and credit agencies determine the interest rate you pay. A higher credit rating could mean a lower interest rate and save you thousands of dollars over the life of your mortgage.

There are several attributes that lenders consider before granting credit, and these are commonly referred to as the “Five C’s” of credit. These consist of: Character, Capacity, Capital, Collateral and Conditions. Let’s take a closer look at each:

Character: The first C is focused on YOU and your personal habits. This comes down to whether or not it is in your nature to pay debts on time. The determining factors for your credit character include the following:

- Whether you habitually pay your bills on time

- Whether you have any delinquent accounts

- Your total outstanding debt

- How you use your available credit:

o Quick Tip: Using all or most of your available credit is not advised. It is better to increase your credit limit versus utilizing more than 70% of what is available each month. For instance, if you have a limit of $1000 on your credit card, you should never go over $700.

o If you need to increase your credit score faster, a good place to start is using less than 30% of your credit limit.

o If you need to use more, pay off your credit cards early so you do not go above 30% of your credit limit.

Capacity: The second component relating to your credit rating is your capacity. This refers to your ability to pay back the loan and factors in your cash flow versus your debt outstanding, as well as your employment history.

- How long have you been with your current employer?

- If you are self-employed, for how long?

Don’t be confused, as capacity is not what YOU think you can afford. Rather, capacity is based on what the LENDER has determined that you can afford depending on your debt service ratio. This ratio is used by lenders to take your total monthly debt payments divided by your gross monthly income. In turn, this will determine whether or not you are able to pay back the loan.

Capital: Capital is the amount of money that a borrower puts towards a potential loan. In the case of mortgages, the starting capital is your down payment. A larger contribution often results in better rates and, in some cases, better mortgage terms. For instance, a mortgage with a down payment of 20% does not require default insurance, which is an added cost. When considering this component, it is a good idea to look at how much you have saved and where your down payment funds will be coming from. Is it a savings account? RRSPs? Or maybe it is a gift from an immediate family member.

Collateral: Collateral is what is pledged against a loan for security of repayment. In the case of auto loans, the loan is typically secured by the vehicle itself. This is because the vehicle would be repossessed and re-sold in the event that the loan is defaulted on. In the case of mortgages, lenders typically consider the value of the property you are purchasing and other assets. They want to see a positive net worth; a negative net worth may result in being denied for a mortgage. Overall, loans with collateral backing are typically more secure and generally result in lower interest rates and better terms.

Conditions: The conditions of the loan can also influence the lender’s desire to provide financing. Conditions can include: interest rate, terms, length of loan and amount of principle needed. Typically lenders are more likely to approve specific-loans, such as a car loan or home improvement loan or mortgage as these have a specific purpose, as opposed to a signature loan.

There is no better time than now to recognize the importance of your credit score and check if you are on track with the Five C’s and your debt habits. A misstep in any one of these areas could be detrimental to your efforts to get a mortgage. If you are not sure or want more information, please don’t hesitate to reach out to me today to determine your current credit score and if there are areas for improvement to help you get a better interest rate and mortgage.

Written by:

Annette Hutcheon, Mortgage Agent, Neighbourhood Dominion Lending Centres

Email: annette@ndlc.ca

Phone: 416-802-4760

annettehutcheon.ca

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

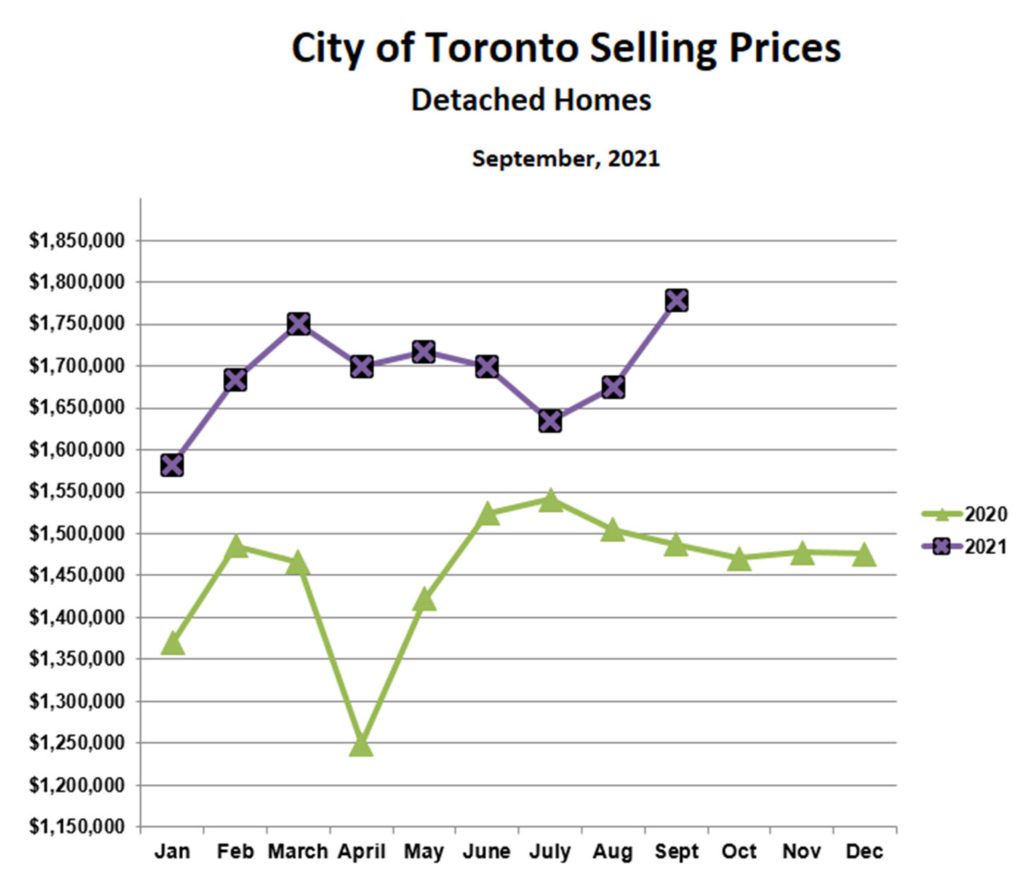

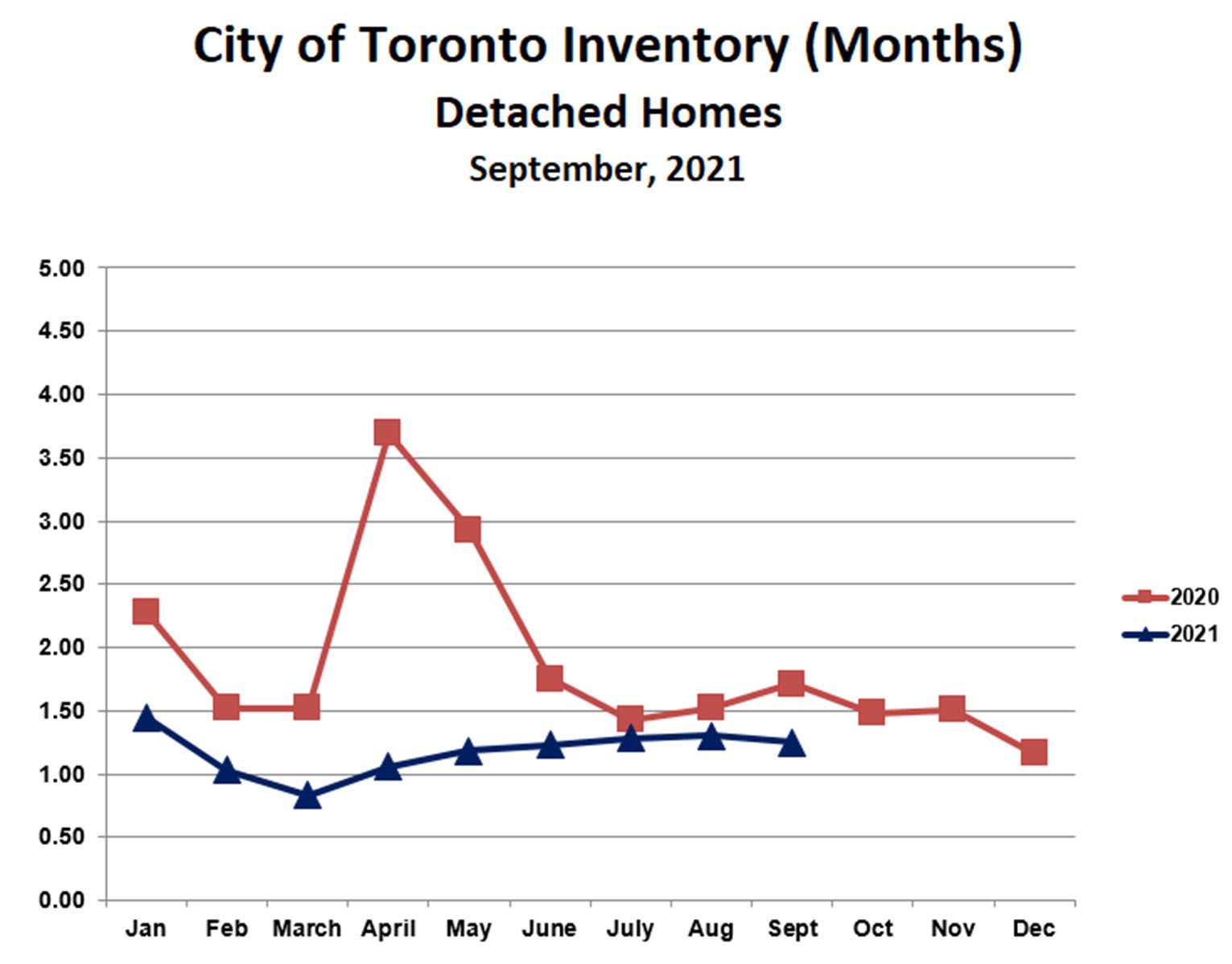

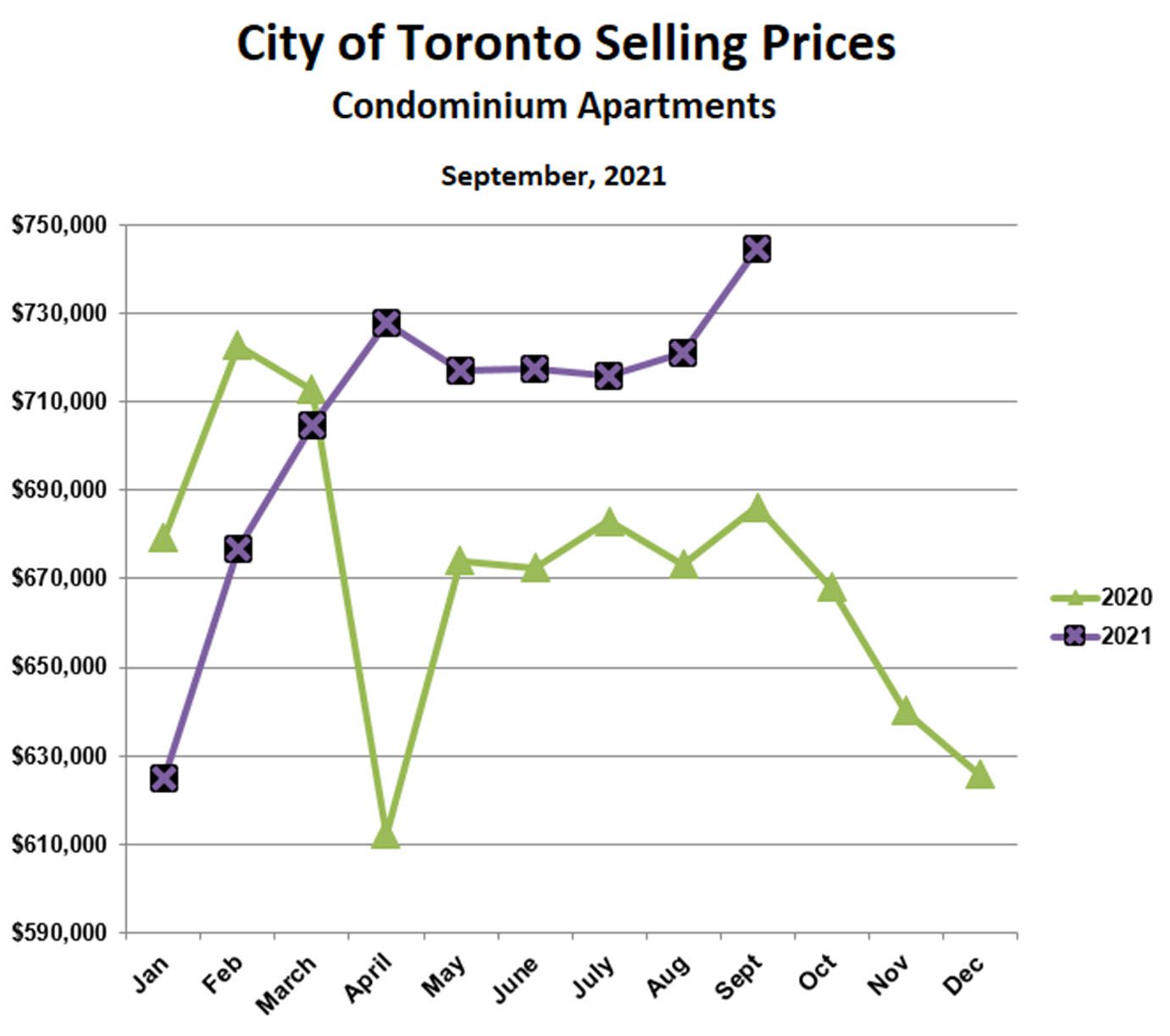

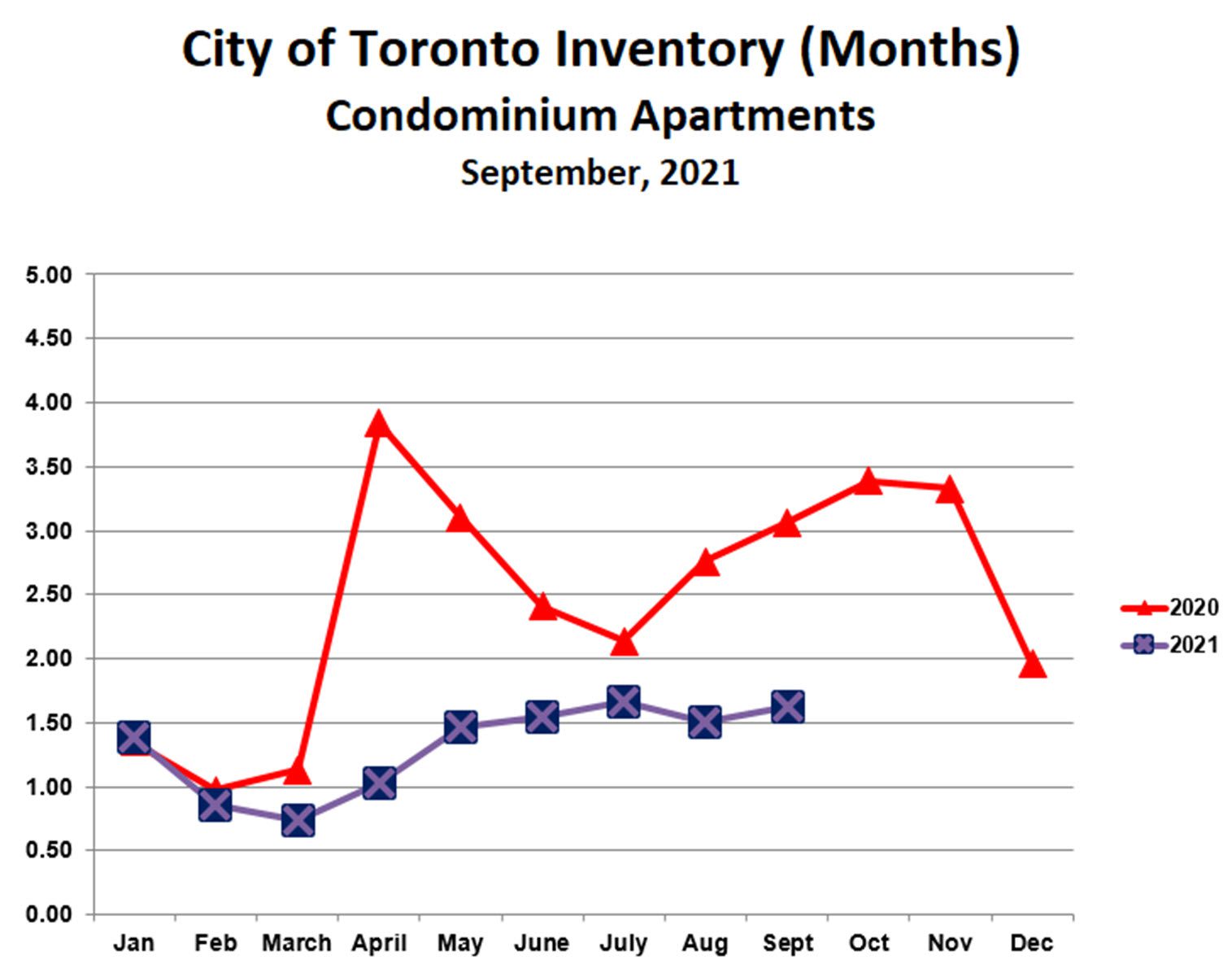

Toronto Market Heats Up In September

10/10/21

After a quiet summer, prices for both detached homes and condominium apartments in the City of Toronto moved sharply higher in September.

For detached homes, prices hit a new all-time high of $1,778,928, exceeding the previous high reached this spring. This was 8% higher than last month, and 20% above last September. This is one of the few times in recent history that prices in the fall have surpassed the spring.

The upward spike in prices was not accompanied by a surge in sales, however. Sales were higher than a (very slow) August, but only slightly higher than June. Total detached sales for July, August and September were 2,349, 27% lower than the same three months last year, and almost 60% lower than the peak spring months this year.

There were only 1,116 active listings for detached homes in September, slightly higher than August but 44% below last September. With both sales and listings relatively low in September, inventory remained in the same narrow 1.0-1.5 months range as it has been for most of this year. The strong sellers’ market for detached homes persists.

Condominium apartments in the City of Toronto told a similar story in September. Condo prices set a new all-time high of $744,730, passing the previous high reached this April and 9% above last September. As for detached homes, the condo market is doing better this fall than in the spring, a rare occurrence. Condo prices slumped badly during the last quarter of 2020, and so we are experiencing a massive year-over-year divergence. What a difference a year makes.

Sales and active listings for condo apartments have changed very little since the summer, so the jump in prices is not a result of a change in inventory, which held steady at close to 1.5 months’ supply, where it has been for the past 5 months. As for detached homes, the sellers’ market continues and seems to be kicking into an even higher gear.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

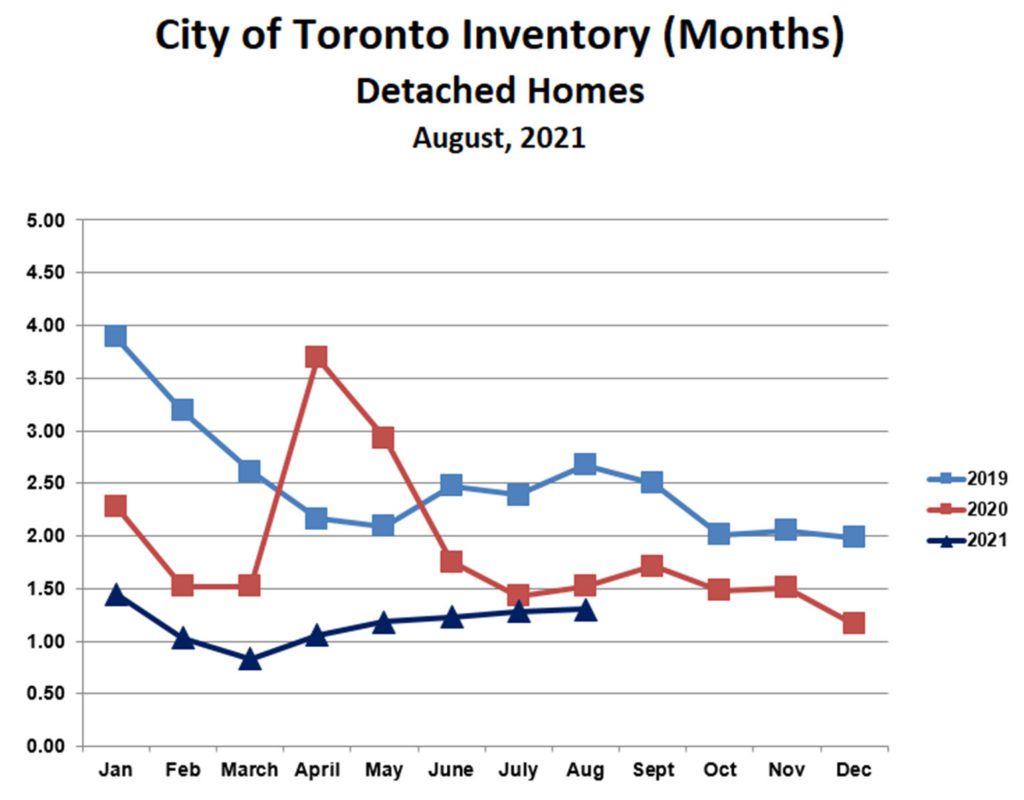

Toronto Market Steady In August

09/13/21

Prices and inventory for both homes and condos remained steady in August, while sales and listings continued to decline.

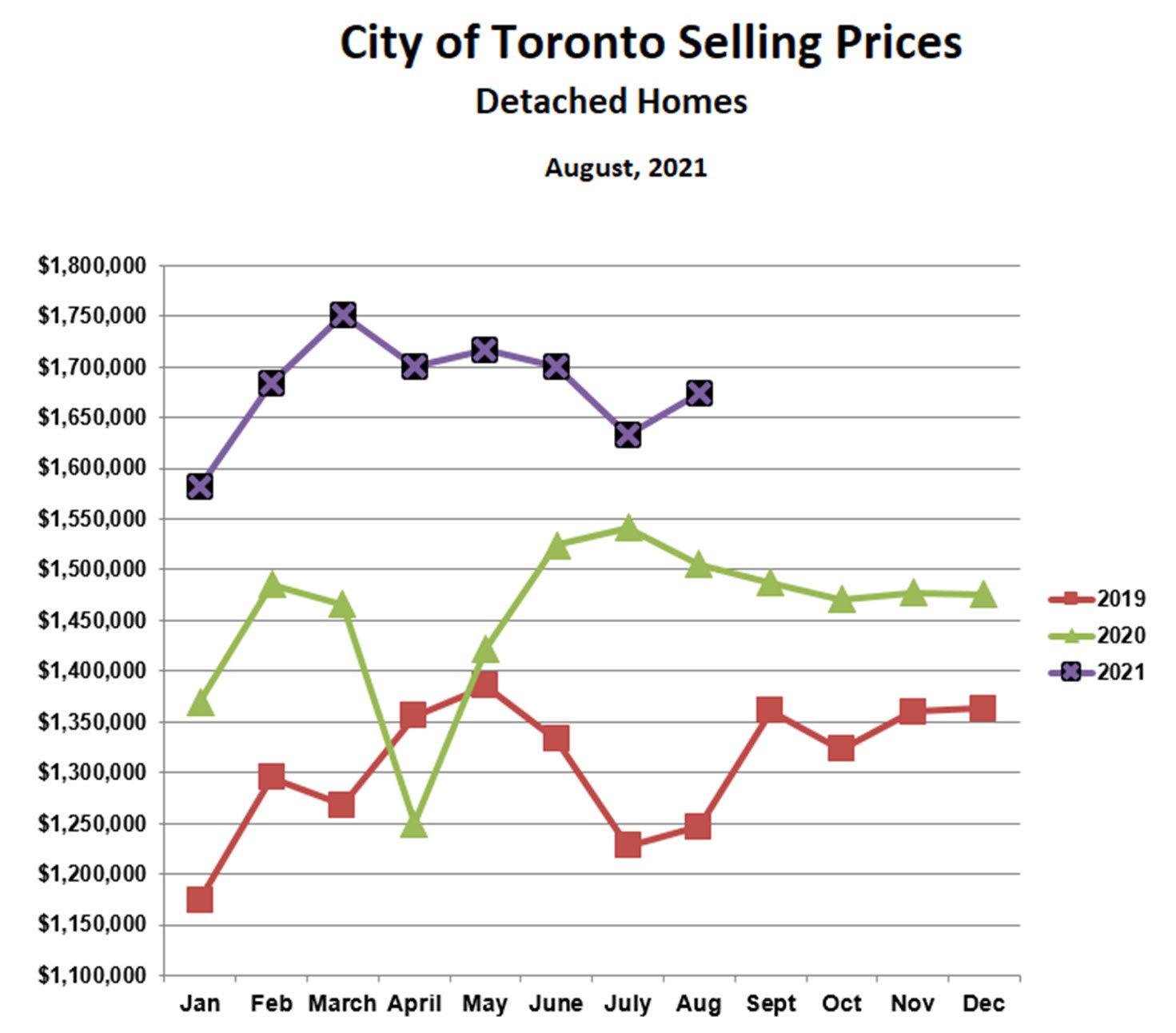

Detached Homes

The average price for detached homes in the City of Toronto was $1,674,641 in August. This was 3% higher than last month and 11% higher than last year. Sales fell by 18% versus July while listings fell by 17%, so the inventory of homes for sale remained constant. Even though the market is much ‘thinner’ than it was earlier this year (both sales and listings are lower), inventory has remained under 1.5 months for the entire year. We are still in a strong sellers’ market.

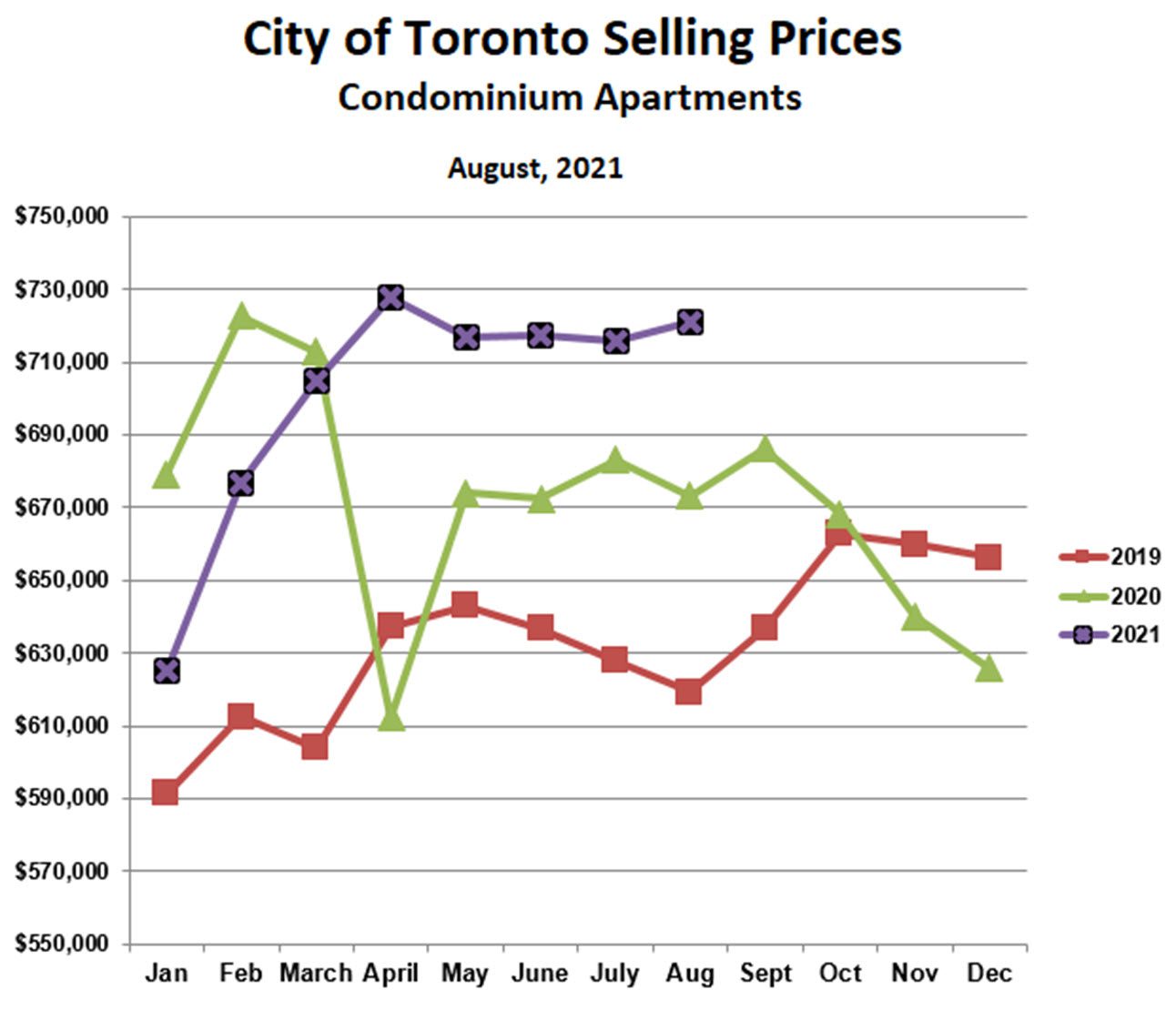

Condominium Apartments

Condo prices in the City of Toronto have fluctuated in a narrow range since May. The average selling price in August was $720,832, up about 1% as compared with last month, and up 7% versus last year. Sales and listings were down versus July (-8% and -5%, respectively), and inventory was virtually unchanged at 1.5 months. The condo market has slowed over the summer, though not by as much as the market for detached homes. And, like homes, condos remain in a strong sellers’ market.

Buyers and sellers are now returning from their summer sojourns and the level of activity will undoubtedly increase over the next couple of months. Will this translate into higher prices? That will depend on whether buyers continue to out-number sellers as they have all year.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

How Do Home Showings Work?

09/09/21

Before there was COVID, sellers’ mostly wanted to know such things as ‘How much should I list my home for?” and “How long will it take to sell?”. COVID has added an extra dimension to the home selling process, especially about how the home can be shown safely and conveniently.

Showings versus Open Houses

Open houses are scheduled for a fixed period of time, for example, Saturday and Sunday from 2-4 pm. Your listing agent is present at all times, and buyers are free to drop in without appointments to view your home. Open houses were been banned at the start of the pandemic and have only recently been allowed once again (with lots of safety measures).

Showings are completely different from open houses. Each showing is for a definite pre-scheduled time period, usually 30 or 60 minutes. During this time the buyer can view the home with his agent. Because of COVID, rules and procedures have been established to ensure safety.

Here’s what home sellers can expect when their home is being shown.

The Anatomy of a Home Showing

The showing gets scheduled

When a buyer finds a great house online, he will usually want to see it as quickly as possible. This is especially so in a strong sellers’ market like we have now. The best houses often sell very quickly, and buyers don’t want to miss out. If you are living in the home during the selling process, make sure that you are readily available to approve showings quickly. You don’t want to miss out on potential buyers, and a showing appointment that isn’t confirmed may not get re-scheduled. If necessary, ask your agent to give you some notice, say an hour or two. This will give you time to do some quick clean-up before the showing.

How will you know when there’s a showing?

Before your home goes on the market, discuss with your agent the best way(s) to communicate with you, for example, text vs email vs phone call. Make sure that you have easy access to messages and are able to check often so that showings can be confirmed promptly.

Who is present at home showings?

An agent will always accompany the buyer. This can either be the buyer’s own agent or, if the buyer doesn’t have an agent, your own agent will conduct the showing. While it’s completely up to you, most sellers will leave the home while the showing is going on. This makes it easier for the buyer to imagine himself living in the home and to discuss it freely with his agent. If the market is very hot and you expect a lot of showings and a quick sale, you might want to move out altogether while your home is on the market. This makes it easier for buyers to access the home at short notice and ensures that your home remains in tip-top condition during the entire process. Constantly ‘prepping’ your home for showings can become very tiring and annoying!

What happens during the showing?

The buyer and his agent will be allowed to view your home during their scheduled time period (30-60 minutes). It’s expected that they will arrive and leave during that time window. The buyer’s agent will tour them through the home, make sure they remove their shoes, and ask him to follow the COVID protocols (for example, wear a mask and touch as little as possible). You might want to turn on the lights before showings or ask your agent to do so if you are moving out. This way, your house will show at its best, and the agent won’t have to fumble around looking for light switches. It will also minimize the touching of surfaces. You could also leave closet doors open to further minimize physical contact.

Make sure you have a clear plan for showing before your home goes on the market. You will get more showings, more offers, and a better price!

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!