Author: Dave Proulx

Toronto Area House Prices On Rocket Fuel

02/15/21

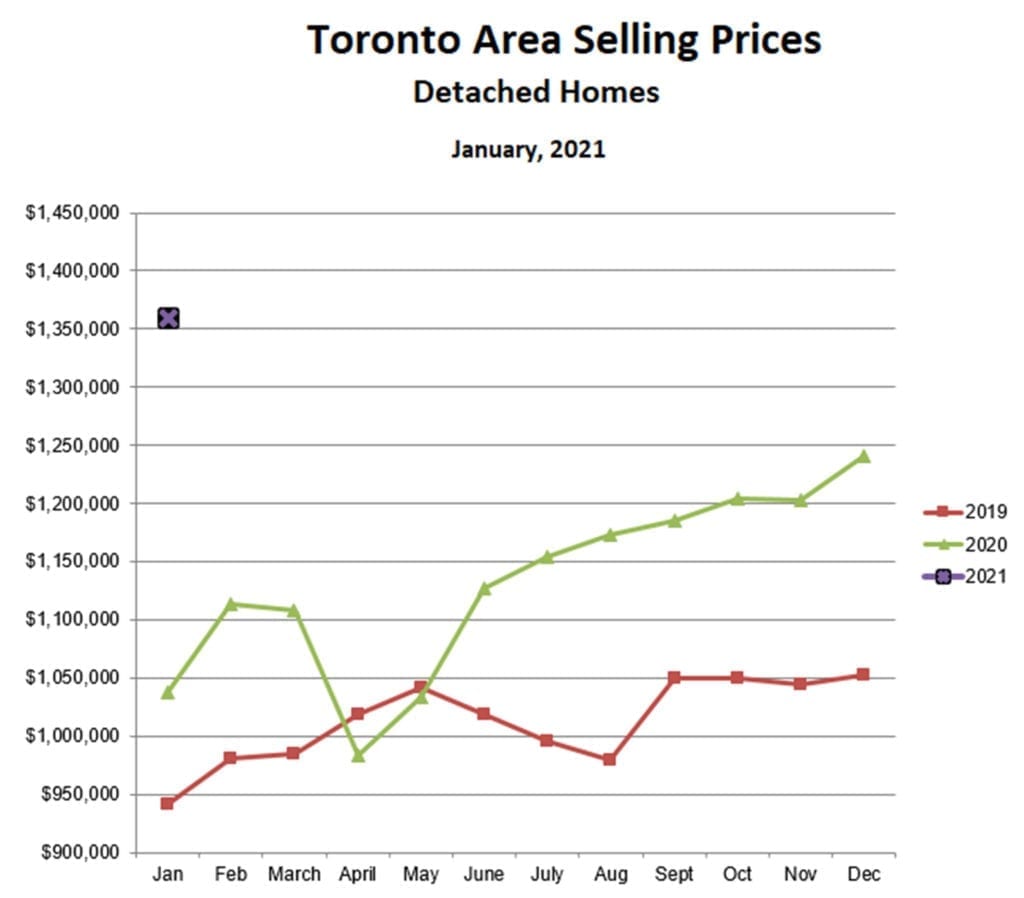

House prices in the Toronto area have been on a tear since the temporary dip last April caused by the initial Covid lockdown. Over the next 8 months, from May through December, prices for detached homes increased by 26%, but then the market shifted into an even higher gear and prices went parabolic.

In the month of January alone, detached prices in the GTA increased by 10% to $1,359,915, blasting past the all-time record high of $1,214,422 reached in March, 2017. Preliminary data suggest that prices will increase by another 6% or so in February, not quite as much as January but still huge.

Year-over-year, prices have increased by a whopping 37% since last January.

Prices in the areas surrounding Metro Toronto to the west, north and east are actually going up faster than the city proper: the average increase in Halton (west), York (north) and Durham was 11% for January vs December, as compared with “only” a 7% increase in the City of Toronto. This is, of course, because of the Covid-driven diaspora of families seeking larger houses at lower prices and able (or required) to work from home. This difference in the rate of price escalation may shrink as outside-Toronto prices catch up with prices in the city – in fact, York and Halton are already there.

What is driving prices up so quickly? Two things:

- Interest rates are unbelievably low, with five year fixed mortgages available at under 1.5%, and it’s unlikely rates will increase over the next couple of years. If anything they may drift even lower.

- The inventory of houses for sale is approximately 1 month’s supply, meaning that homes are selling as fast as new listings come on the market. The only time that inventory has been lower was in the spring of 2017, just before the bubble burst. the low inventory is due, in part, to higher-than-normal market activity in December and January. Usually these are slow months because of seasonal celebrations, but because of Covid this didn’t happen and homebuying continued apace.

As more and more new listings come on the market over the next few months, inventory levels should increase and the rate of price increases should slow, however, we should expect a strong sellers’ market to continue for most if not all of 2021.

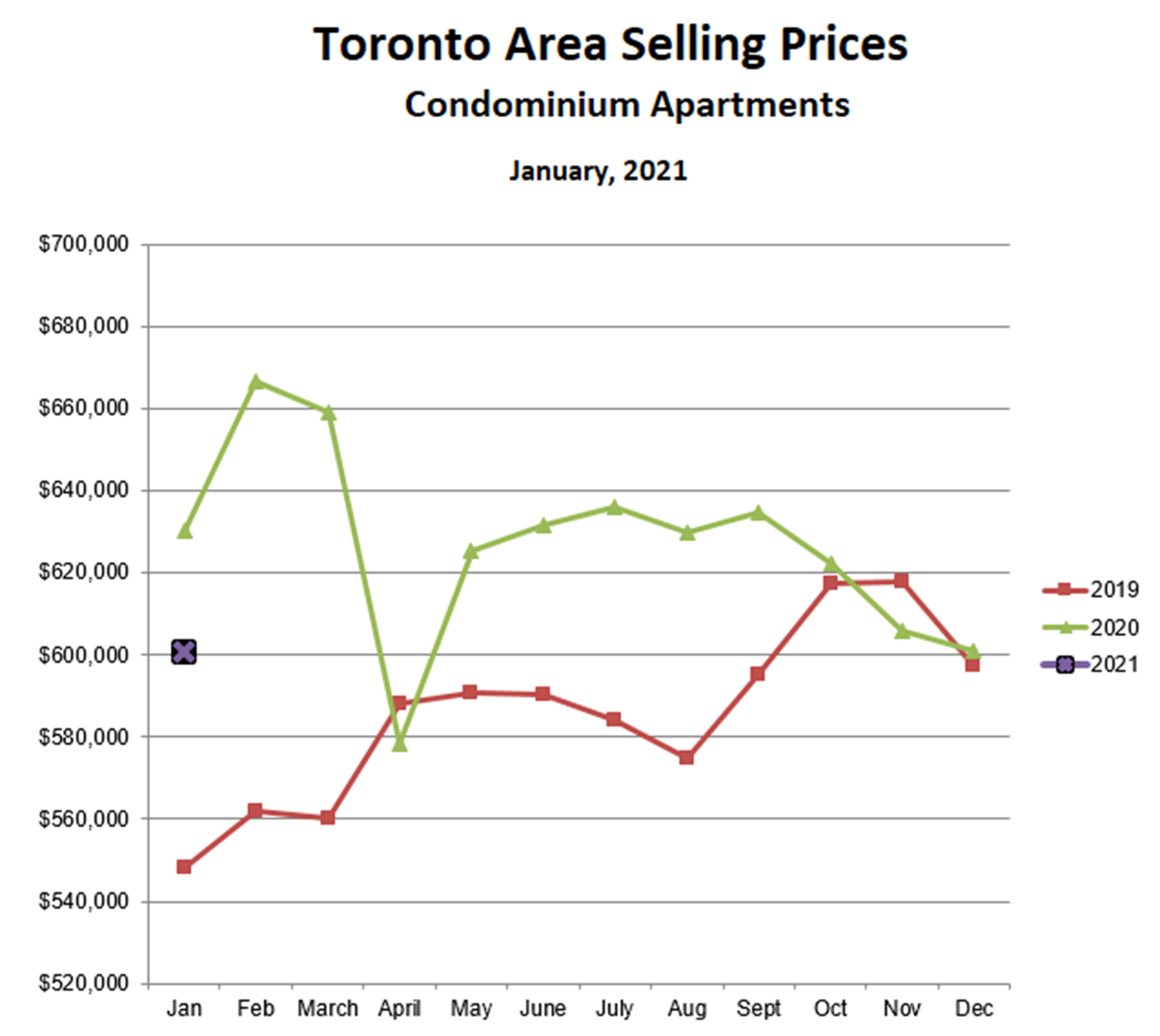

The Toronto area condo market continues to be a completely different story. Condo prices were extremely volatile throughout 2020, increasing quickly in the first quarter; then falling steeply in April following the Covid lockdown; then bouncing back and remaining stable from May until September; then falling again in the fourth quarter. Prices in January 2021 were almost exactly the same as in the previous month, suggesting that the market has stabilized once again and may bounce back, if weakly, through the rest of this year. It’s encouraging that sales of condos were higher in January than in December, and close to double the sales in January 2020. What has been ailing the condo market isn’t lack of demand, it’s Covid-related factors such as the collapse of the rental market.

So far it seems that the market in 2012 will be much stronger than in 2020, and much less of a roller coaster ride.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

We Love Local Businesses!

02/14/21

The Smith Proulx team, along with Valentine Panda, wanted to support our West Toronto local businesses this Valentine’s Day!

We know that times are very difficult for restaurant owners and their employees particularly, so we wanted to see if we could help out in some small way. We created an event to support the local businesses in the Bloor West Village, High Park, Junction and Swansea neighbourhoods: we purchased gift cards from various local businesses to give away to residents in West Toronto in a Valentine’s Day draw.

We selected eight local businesses and ended up with eleven amazing gift card prizes to give away! Residents of the Bloor West Village, Junction, High Park, and Swansea neighbourhoods received flyers in their mail with the logos of all the restaurants involved and were invited to enter into a draw to win one of the $100 gift cards from each local business. We also promoted the events on social media to get the word out about the draw and about all the amazing businesses involved. Over two hundred West Toronto residents entered, and many tuned in on Facebook and Instagram Live as we drew the winners. Eleven happy neighbours won prizes.

Valentine Panda went around Bloor West Village, Junction, High Park and Swansea to deliver the prizes to the winners in person. The recipients said hello to Valentine Panda and took a socially distanced photo with Panda and their prize. We would like to thank all the businesses that participated in this event, as well as all the residents who entered the draw. We wouldn’t have been able to hold this event in support of our local businesses without you. We encourage everyone to keep supporting our local businesses during this difficult time, and to continue supporting small, local businesses in the future!

The local businesses involved in the draw were

– Thorn Floral

– Botham’s

– Annette St Food Market

– Delight Chocolate

– The Alpine

– Queens Pasta

– Gatto

– Nodo

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Radon Gas Is The Second Leading Cause of Lung Cancer

01/20/21

Ongoing research into the presence and effects of radon gas has produced some disturbing results – the gas is in almost twice as many Canadian homes as previously estimated. Health Canada estimates that radon exposure causes the deaths of about 3,200 Canadians every year. That makes it the second leading cause of lung cancer, representing 16 per cent of all lung cancer deaths.

“Fortunately these deaths are preventable – if all Canadian homeowners test their houses for radon and take action if radon levels are high,” says Mary-Pat Shaw, acting president and CEO of the Canadian Lung Association.

Radon is odourless and colourless. It is produced naturally by the breakdown of uranium in rocks and soils. When the gas is released outside it is diluted by the air and is harmless, but radon seeps into homes through basement walls and floors and into dirt-floor crawlspaces. In a confined area the radon can accumulate to high levels and become a health hazard.

Health Canada’s most recent study found that seven per cent of Canadian homes have levels of radon above 200 becquerels per cubic meter of air, the level at which the agency says remedial action should be taken. Earlier estimates said that only three to five per cent of Canadian homes were at risk. Manitoba, New Brunswick, Saskatchewan and the Yukon had the highest percentages of homes that tested above the guideline, but localized areas in all parts of the country showed high radon levels.

“Canadians should test for radon no matter where they live,” says Shaw. “Although some provinces have higher than average radon levels, levels of this dangerous gas can vary from house to house, even within the same neighbourhood.”

Health Canada says radon seeps into homes easily through concrete block walls because they are so porous. It also comes into the home through cracks in foundation walls and floors, sumps, gaps around pipes and basement drains. The amount of radon present in the house depends on the amount of uranium in the ground, the entry points to the home and the way the house is ventilated.

To test for radon in the home, there are do-it-yourself kits available at home improvement stores that cost from about $25 to $75. The kits include instructions on how to use them and then send them to a lab for analysis.

All measurements should be made in the lowest lived-in parts of the home, says Health Canada. “That means the lowest level that is used or occupied for more than four hours per day,” says the agency. “For some, this may be a basement with a rec room, for others it will be the ground floor. If you only use your basement once a week to do laundry, for example, there is no need to test on that level – your exposure time will not be long enough to create health effects.”

However, if you are aware of high radon levels in your home and do not remediate them, at resale time it could become an issue if you don’t disclose this fact to potential purchasers.

You can also hire a professional to test for radon. Health Canada says make sure the service provider is a certified radon professional and that they are providing a long-term test. To find a certified radon professional in Canada, call 1-800-269-4174 or visit the Canadian National Radon Proficiency Program.

Health Canada says the standard method for remediating radon problems is by active soil depressurization, where a pipe is installed through the foundation floor and connected to the outside. A fan attached to the pipe draws radon from under the home before it gets inside, and releases the gas outside. It usually costs from $1,500 to $3,000, says Health Canada.

Some other ways to reduce radon include increasing the mechanical ventilation with a heat recovery ventilator, and sealing all the cracks and openings in the foundation walls and floors and around drains and pipes.

National Building Codes introduced in 2010 require new homes to have vapour barriers to reduce the entry of radon, and they must have a rough-in for a radon reduction system.

The Lung Association says it is important to note that exposure to radon gas is even more dangerous for people who smoke.

“People who smoke and are also exposed to high radon levels have a one-in-three chance of dying from lung cancer, versus a one-in-20 risk for people who are exposed to radon but do not smoke,” says the association.

Written by Jim Adair

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

I Want To Sell My Home – How Much Work Should I Do?

01/15/21

You’ve started looking for a new house, and you’ve seen a couple that you like. Your present house has served you well, but the last major renovations were done almost 20 years ago. How much work should you do to get the house ready to put on the market as soon as you buy the new one? There are four types of improvements that you should think about:

- Fix obvious problems. If your roof needs to be replaced soon, think about replacing it yourself. If the new owner is a first time buyer, chances are they won’t have a lot of extra cash available for immediate repairs, so you could lose out on a large pool of potential buyers. Also, buyers will automatically deduct the cost of replacing the roof from the price they are prepared to pay… and the cost they assume will almost always be higher than the actual cost. The same reasoning applies to other problems that the buyer will need to deal with immediately, for example a very old furnace that could die at any time, or malfunctioning plumbing fixtures. If your home has active knob and tube wiring, that’s another “fix” that you should think about. While there is nothing inherently wrong or unsafe about knob and tube wiring, most insurance companies will not cover it, and many buyers (and buyers’ agents) think that it must be replaced. This one isn’t black and white, as it is certainly possible to get insurance with knob and tube wiring, and at least one company will insure it at very reasonable rates; it depends on how much it will cost and how disruptive it will be to get the job done while you are still living there. The bottom line is that these repairs are a great investment: you will get back more, in the form of a better selling price for your house, than the repairs cost.

- Make low cost/high impact improvements. A fresh coat of paint makes an enormous difference to a house’s value in buyers’ eyes, far more than the cost of painting. You might think, because many new owners will repaint anyway to suit their taste, that this is a waste of money; that buyers can “see past” the old paint and imagine the possibilities. Sadly, this isn’t the case. Buyers make purchase decisions emotionally, and will respond positively to an attractively painted house even though they know at some level that they will probably change it. The next most important area to look for low cost/high impact improvements is the front of the house. It is trite but true that first impressions are critically important when selling your house, so invest a bit of money in fixing the cracked front step, the broken railing, the spalling foundation and so forth. In general, take a walk around your house and try to look at it through buyers’ eyes to see the little defects that have become invisible to you over the years. Like fixing obvious problems, these improvements will return much more, in terms of a better selling price, than they cost.

- Stage your home. In many cases, a home that is properly staged will not look much like a home that people actually live in. That’s OK, it may seem a bit artificial, but staging works! Invest in a consultation from a professional stager, to identify what needs to be done (as well as what does not need to be done!), and then invest in the stager’s time to set everything up and add some strategically placed props like pictures, occasional tables, lamps, etc. In some cases you may even want to rent a couple of pieces of furniture. Whatever it takes, it will be worth it; staging is another investment, like the two above, that consistently returns more, in the form of a higher selling price, than it costs.

- Think carefully before committing to major renovations. A new kitchen or a new bathroom will certainly increase the value of your home, and may also help it to sell faster, but the real question is whether you will get back as much as you put in. Unlike the three categories above, major renovations in most cases don’t add as much value as they cost, and sometimes even less. Add to that the disruption and mess of a big renovation (especially a kitchen!) and you have to ask yourself if it’s really worth it. For example, if the kitchen cabinets are still in decent condition, you may want to just paint them, add some contemporary style knobs, and maybe change the countertops – changes like these will significantly improve the appearance without a huge investment. Similarly, a new vanity can spruce up a bathroom quite nicely at a very reasonable cost. Flooring is another area where you should think carefully before making big changes. Upgrading from carpet to hardwood, like renovating a kitchen, is expensive and disruptive, and may not return much more than it costs, if that. Unless the carpet is hideous, you may just want to get it professionally cleaned, place the furniture strategically, and call it a day. In general, try not to get carried away with wonderful but pricey renovations – you may get more money for your home, but it will be a pyrrhic victory if the investment is greater than the additional money you get!

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Financial Don’ts When Getting Ready To Buy A Home

01/13/21

If you’re in the process of buying a home, you’ve probably already met with a lender who advised you on what to do and what not to do during the escrow process. But if you’re just getting ready to buy or plan on doing so in the near future, following a few financial tips can mean the difference between qualifying…and not, and also getting a decent rate. These are a few universal “don’ts” that will help you stay on track, even before you get a lender involved.

Don’t take out more credit

If you’re thinking you’re going to buy a house in a matter of a few months, forget that new laptop on the Best Buy card, forget that new car, and forget that Old Navy card. Sure, it’s only a $30 pair of pants. But, taking out more credit can harm your debt-to-income ratios, which can make you look like a credit risk. And that’s not worth it, no matter how cute the pants are.

Don’t pay off all your current credit cards

Your lender will tell you specifically what you should pay down and what you should leave alone, but banks tend to like responsible credit management. In some cases, that may mean carrying a small balance on one or more cards.

Don’t charge up all your cards to the limit

“Responsible credit management” does not mean running every available card up to the limit and/or only making minimum monthly payments. Banks will not look kindly on this when you go to get approved for a loan.

Be careful with old debts

You may think that in order to qualify for a mortgage or get the best possible rate you have to pull your credit and go back through every single entry to identify and take care of anything negative. You’re right about the first part. Pulling your credit so you know what you’re working with is critical, and financial experts recommend doing it annually, regardless of what you’re planning (or not planning) to buy. But be careful with old debts. It doesn’t hurt to ask a lender what should and should not be taken care of. But, in general, you’ll want to:

Pay in full instead of making settlement arrangements – It’s not uncommon for debt collection companies to send out settlement offers that allow you to settle debts for less than the total amount. While this can sound tempting, it likely won’t yield the results you’re looking for. Yes, it’ll stop the harassing phone calls and persistent letters. But if your goal is to get the debt to disappear from your credit report, you’ll be disappointed.

“When you settle your debt, the activity usually shows up on your credit report as ‘debt settled’ or ‘partial payment’ or ‘paid in settlement.’ You can talk to the settlement company about the specific language they use, but the bottom line is: this is a red flag on your report,” said clearpoint. “FICO doesn’t reveal how much your score will drop, exactly, and your report doesn’t indicate how much of the original debt was forgiven; it simply shows you settled. Either way, it still points to the fact that you may be a credit risk.”

Stick to newer debts – Older debts that are getting close to falling off your report should be the last thing you pay. “You also want to consider the statute of limitations on your debt,” they said. “Most past debts remain on your credit report for seven years, so if you’re close to the time frame when the debt falls off, settling it may not make much of a difference. There’s an ethical argument to be made here, but practically, you might just be settling a debt that was about to disappear anyway.”

Be careful with debt consolidation

If you have a lot of outstanding debt, are in over your head with credit cards and store cards, and can only manage the minimum monthly payment on all your existing loans, you’re likely going to have a hard time qualifying for a mortgage. You may be tempted to lump your debt together into one payment through a credit consolidation company, but beware the consequences. There may be startup fees, interest rates on the consolidation loan could skyrocket after an initial teaser rate expires, and, in some cases, an improvement in credit is years away.

Don’t get lax with your payments

Your lender will reinforce this, but it bears repeating that even after you’ve been prequalified, you need to keep your payments current on your car, your Visa, etc. Your lender will do a recheck before closing just to make sure nothing has changed in your credit report, and if you have new issues, it could impact your loan.

Don’t move money around

“We know a story of one homebuyer who almost lost his home because he had stated on his application that the down payment was coming from a mutual fund account. Then, two days before closing, he decided to sell a baseball card collection instead,” said HSH.com. “The loan had to be underwritten all over, his ownership of the collection, its value and its sale had to be verified, the closing was delayed and the fees increased.”

Don’t change jobs before you buy your home

This is a big no-no don’t if you’re in the process of buying a home or are about to. Among all the other financial information your lender will be collecting in consideration of your loan, they will also be asking about your employment history. You’re obviously less likely to be approved if you’re unemployed (unless you’re independently wealthy, and, in that case, Congratulations!). A recent job change may also be problematic if the bank is feeling jumpy about your job security.

Written by Jaymi Naciri

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Uber-Strong Finish For 2020 Toronto Market

01/07/21

Well, 2020 is finally behind us, and what a roller coaster ride it was!

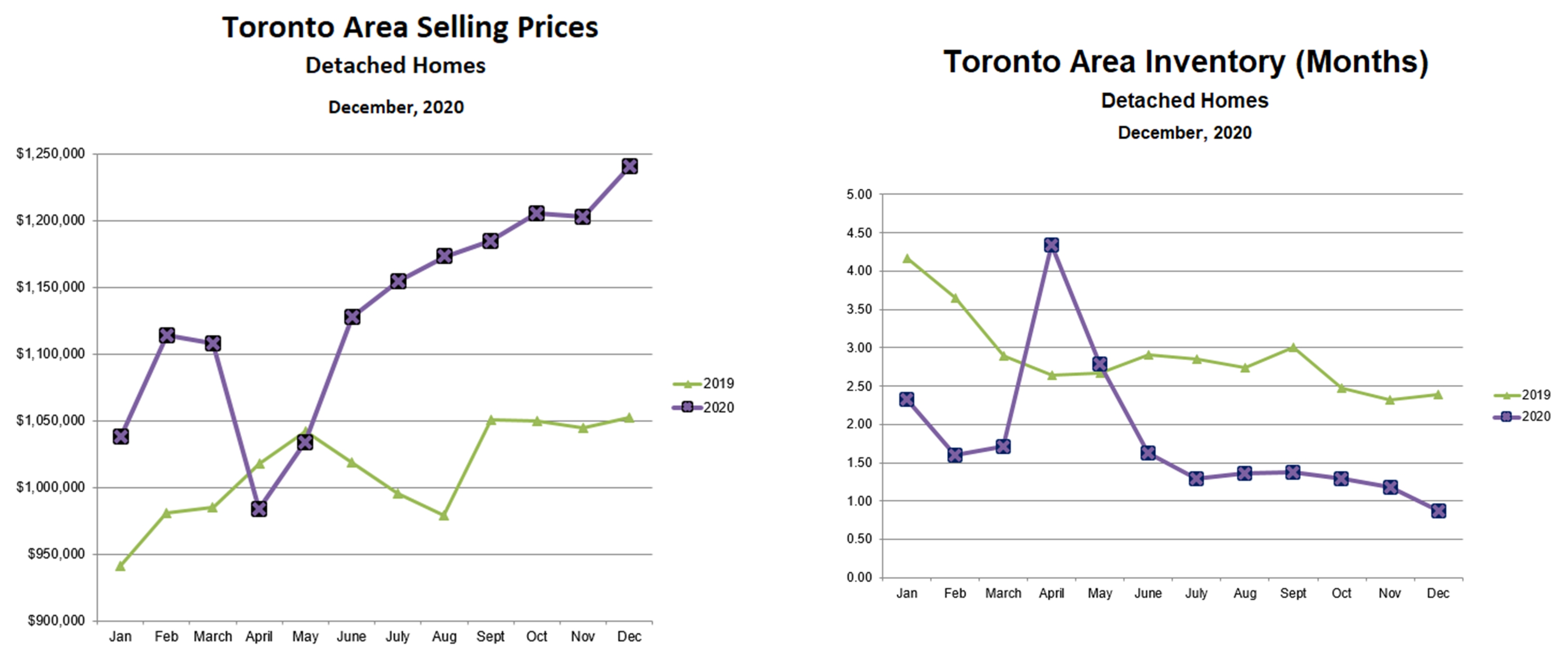

Houses and condo apartments followed very different trajectories through 2020.

House prices rose steeply in the first quarter, and then collapsed in the second quarter in the wake of COVID restrictions. Throughout the second half of the year, prices rose steadily and ended up 15% above 2019 and a jaw-dropping 26% higher than the April low.

Sales of houses were up 15% over last year, despite the second quarter crash, and the inventory of houses for sale has been falling steadily since April. December sales were an astonishing 53% higher than a year earlier, and inventory was an insanely low 0.9 months’ supply.

Clearly, houses are in an extreme sellers’ market in the Toronto area, suggesting a very hot spring market in 2021.

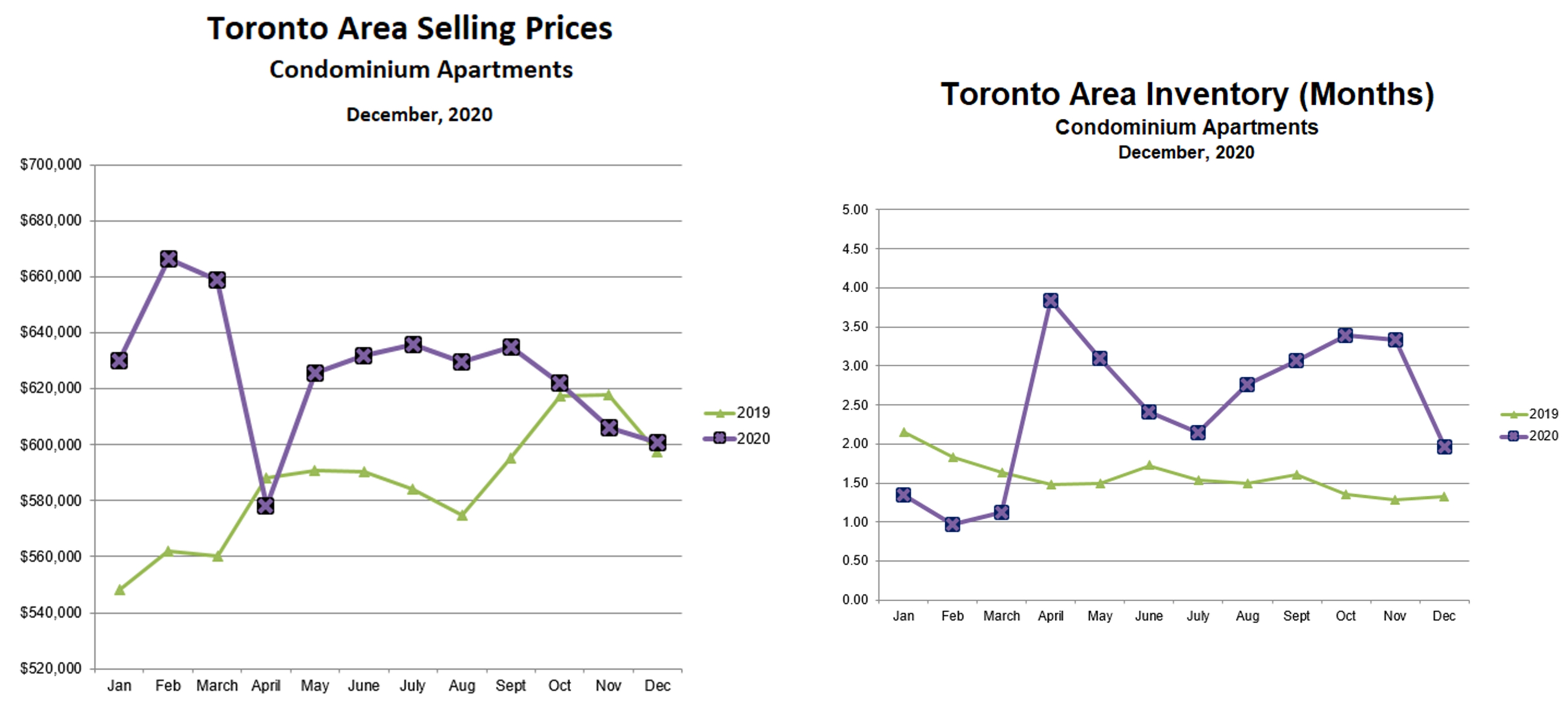

The Toronto condo market in 2020 was a completely different story.

Like houses, condo apartments started the year very strong, and then both prices and sales collapsed in April. The condo market also bounced back in May, but then prices went flat for five months and ended the year with four down months in a row. For the year as a whole condo prices were up 7% over 2019, but by December prices were almost exactly the same as last year.

Sales of condo apartments were 5% lower than 2019 for the full year, however, sales improved dramatically over the past four months and December condo sales were actually 75% higher than last year!

Condo apartment inventory was up and down all year: low in the first quarter, very high in April, falling from May through July, increasing during the summer, and then plummeting in December.

Strong sales of condo apartments demonstrated that demand for condos has held up in spite of COVID: people still want to own real estate, and condos remain affordable alternative to houses. What was different in 2020 was the supply of condos for sale. COVID restrictions hammered the rental market, encouraging many investors to dump their rental condos. Coincidentally, a new Toronto bylaw basically banned short term (Airbnb) rentals, except for your principal residence, and this led even more investors to sell their (very profitable) Airbnb condo units. The bottom line is that the volatility in the condo market was driven by increased supply of condos for sale, not by lower demand. The fact that inventory dropped steeply in December suggests that the supply surge may be ending, and this bodes well for the condo market in 2021.

So, all signs are pointing toward a robust Toronto market in early 2021, despite the COVID 2nd wave and severe lockdown restrictions. What a strange world.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

City of Toronto To Begin Enforcing New Airbnb Rules

12/27/20

In late 2019, following a lengthy appeal by the Local Planning Appeal Tribunal, a new bylaw governing short-term (less than 28 consecutive days) rentals in Toronto came into effect. The most significant provision in the bylaw is that people can host short term rentals only in their principal residence – no more investment properties or ‘ghost hotels’.

All ‘short term rental operators’ (people renting their homes on a short term basis) are required to register with the City, pay a $50/year registration fee, and pay a 4% Municipal Accommodation Tax.

In addition, all short term rental companies (like Airbnb) must pay a one-time $5,000 license fee as well as an ongoing fee of $1.00 for every night booked through the company.

The original plan was for registration to begin in early 2020, with a requirement that registrations be completed within 3 months. Enforcement action was to begin after the 3 month deadline. COVID-19 threw a large monkey wrench into this plan, as all short term rentals were banned in April as part of the pandemic restrictions. The ban was lifted in June, and the deadline for registration was extended to December 31.

As of early December, only a small fraction of the estimated 20,000 short term rental properties in the City had been registered. The City says it is serious about enforcement action, and that they have the tools to go after operators who are not licensed. Every short term rental listing must include the registration number, and if the City sees a listing without a registration number, both the operator and the rental company (if there is one) will be issued a fine, staring at $1,000 for the first offence.

The City is also going after short term rental platforms like Airbnb, who will be expected to ensure that all advertisers on their site have a registration number. They will also be fined if listings without registration numbers are found.

The new bylaw has caused large numbers of short term rental properties, mainly small condo apartments, to be added to the long term rental pool, and this added rental supply contributed to the softening of the rental market in 2020.

Also, many investors who own short term rental condos have been dumping these properties, since ‘normal’ rentals are not nearly as profitable, and this has contributed to the softening of the condo resale market in 2020.

The demand for resale condos has been surprisingly resilient, despite COVID and the related restrictions, and there were actually more condos sold in 2020 than in 2019. The huge surge in supply of resale condos, partly due the new bylaw, caused condo prices to fall in 2020, however, this trend may reverse later in 2021 once the pandemic is (hopefully) receding in the rear-view mirror, and the short term disruptions due to the new bylaw work their way through the system.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Holiday Toy Drive

12/25/20

The Smith Proulx Team, along with Santa Panda, organized a successful Toy Drive this holiday season in West Toronto!

We teamed up with the Toronto Fire Fighters and donated all the toys we collected to the Toronto Fire Fighters’ Annual Toy Drive,

which distributes them to families in need. We wanted to find a way to make a small difference to those who need it during the holidays, especially during these difficult times.

On Tuesday, December the 15th and Thursday, December 17th , local residents in the Bloor West, Junction, High Park, and Swansea neighbourhoods signed up to have Santa Panda—yes, that’s Panda dressed as Santa!—come to their house and pick up toys for donation. On these two days, Renee Proulx adopted her alter ego, Panda, who wore a Santa suit, to share a little joy with the generous residents who made toy donations. Santa Panda would pop in and out of a toy drive cargo van as we went from house to house, collecting donations. West Toronto residents were at their doorstep to say a nice hello to Santa Panda and take a quick, socially distanced photo.

On Saturday, December 19th , the Smith Proulx Team and Santa Panda set up a station at the Bloor West Village Re/Max office where people could come by at their convenience and drop off the toys. Santa Panda was there, dancing to Christmas songs and sharing holiday joy with the Bloor West Village residents as they passed by on the street or dropped by with toys. The West Toronto residents were so kind and generous with their donations! We received a wide variety of really amazing toys, suitable for all ages, that undoubtedly made Christmas for families in need just a little bit brighter.

We are proud to announce that we collected over 300 toys to donate to the Toronto Fire Fighters’ Annual Toy Drive! We want to thank all our friends and neighbours in the Bloor West Village, Junction, High Park, and Swansea neighbourhoods who participated and kindly donated to the toy drive. We couldn’t have done it without you!

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

The Best Home Renovations For The Biggest ROI

12/21/20

Preparing your house for sale can often require an investment to bring it up to current standards and help it compete in the hot real estate market. Especially if you’ve lived in the house for several decades, you may be blind to your home’s shortcomings. Here, we examine the top home renovations to ensure your return on investment.

Paint

Painting is the most under-appreciated home improvement. Nothing provides a higher ROI than quality, professionally done painting. When putting your home on the market, consider a professional painter who can help select the right palette, skim the walls, seal trim and repair minor damage before applying top quality paint that’s appropriate for each surface (matte for living areas, egg shell or semi-gloss for trims and doors and proper ceiling paint.) It doesn’t seem like the most glamorous of renovations, or promise the most dramatic before-and-after, but it instills freshness and can flatter your home in ways you’ve never imagined. It’s like dressing for your body type, a colour expert can help select the perfect shades to work with the lighting in your home and ensure it puts its best face forward!

ROI: A fresh coat of paint typically garners a 60% return on your investment.

By the Numbers: Budget for a 2,000-sq.-ft. home: approximately $10,000-$15,000

Good ‘Bones’

When contemplating a profitable renovation, nothing “sinks” a sale price quicker than a house that’s taking on water. Especially in this market, where strong sale prices are being paid for homes with “good bones,” ensuring that the roof and windows are in good shape, gutters and drains are functioning properly and the foundation is dry is crucial to realizing the potential value in a home. Consider items like vinyl windows, a new roof or even waterproofing the foundation. Buyers are wise to structural issues, and learning that a homeowner has done their homework and made the proper investments to prevent flooding and leaks will go a long way in a buyer’s eyes (and offer!).

ROI: Renovations that will save home owners money in the long run will draw a higher return, around 75 per cent, depending on the scale of the reno.

By the Numbers: All new, good quality vinyl windows for a 2,000-sq.-ft. home: approximately $15,000

Stripping and replacing the roof with quality asphalt shingles: $8,000 to $10,000

Proper waterproofing of the exterior of a foundation: approximately $60-$80/linear foot

Doors & Hardware

Investing in new interior doors and hardware; replacing the front door and adding a quality lock-set; and adding baseboard, door trim, crown mouldings and wainscoting are all examples of relatively inexpensive and non-invasive improvements that can immediately punch up the appeal of a home. It really comes down to the quality of the finish though. This is not a time to skimp on materials or workmanship. Hire someone you know and trust, or ask for referrals from friends who you know share similar standards.

ROI: Smaller projects that have less of a “wow” factor, and may even go unnoticed in an open house, draw a smaller return, around 50 per cent of your initial investment.

By the Numbers: Solid wood front door with quality lock-set: $2,500

Solid core interior doors with hardware: $250/per door

Countertops

Since kitchen renovations can easily snowball, consider a quick counter-top refresh and appliance-swap as options for a great return on investment. Instead of shelling out upwards of $25-50,000, expect to pay about $3,000 for a quality stone, like granite or quartz, and between $5-10,000 for quality slide-in or a stand-alone set of kitchen appliances with a pro-look like stainless steel.

ROI: Kitchen renovations have the best return on investment, typically garnering a 75-100% return.

Bathroom

Creating one luxury space in a home can have a great effect and return on investment. Focus your attention to items like a frameless glass shower enclosure, marble-topped vanity or a gorgeous tile backsplash. Analyze your bathroom, pinpoint its strengths and weaknesses and ask yourself, “Where is my eye drawn when I enter this room?” Is the bathtub the focal point? The vanity? A window? This is where your renovations should begin.

ROI: Bathroom renovations, when done well, have a return of 62%, on average.

By the Numbers: Budgets vary but typically range between $5,000 to $15,000

Flooring

Flooring is the hardest wearing element in any home and for many homeowners, replacing aging flooring is a must. However, the quality of the installation is essential. Expensive hardwood floors can look terrible if they are lifting or there are gaps between planks. While inexpensive laminate from a big box store can look great when laid properly. Carpeting, however, is rarely a good idea, especially when you’re planning to sell. While some people love the warmth and feel of carpeting in a bedroom or basement, buyers will see carpet and think one thing: carpet cleaners, STAT! Carpets tend to lovingly hold on to memories of previous homeowners, memories that buyers would sooner rather forget. Spare buyers the cleaning fee, or worse, all-out removal, and skip carpeting, or remove it yourself.

ROI: Depending on the flooring you choose, the return is generally 100-150% of your investment.

By the Numbers: Typical hardwood floor: $4 to $6 per sq. ft., plus $2 installation fee per sq. ft.

Typical laminate floor: $1 to $3 per sq. ft., plus $1.50 installation fee per sq. ft.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

15 Tips To Make Working From Home Productive and Enjoyable

12/16/20

The COVID lockdowns last spring forced many businesses to send their employees home to work in order to slow the spread of the virus. For many companies, this was done with great reluctance, as executives believed that productivity would suffer. Surprisingly, however, work from home (WFH) has turned out very well. Not only has the impact on productivity been limited, but there have been significant side benefits:

- For employers, less office space is needed, resulting in significant overhead savings; and

- For employees, there is little or no need to be physically close to the office. This has opened up the opportunity to move away from major cities to smaller communities where real estate is less expensive.

While some employees may move back to the office once the pandemic is behind us, the above benefits mean that WFH is most likely here to stay in a big way.

For those who have never worked from home, it can be a huge adjustment and a major challenge to establish and maintain some boundaries between personal and business life at home. Here are 15 tips to help you make it work:

- Establish a separate work area

The first step in separating work life from personal life is to identify a space in your home that will be dedicated to work. Whether it’s a spare bedroom, den, or an unused nook in the basement, the key is to make this a ‘work only’ space and commit to working there every day.

- Don’t scrimp on technology

To work efficiently at home, you’ll need a fast computer with a big monitor, appropriate software, a reliable high-speed internet connection and, depending on the nature of your work, a good quality printer. Don’t go cheap – you’ll be working with this equipment every day, and you don’t need the hassles of unreliable technology.

- Invest in quality office furniture

A comfortable and ergonomic office chair is a must, and you should consider buying a large desk, bookshelves and filing cabinet. You want this to be a space that you enjoy working in.

- Set a definite work schedule

Because you are working from home, you have the flexibility to establish a schedule that suits your personality and life-style. For example, if you are a morning person, you might want to work from, say, 7 am to 3 pm. Whatever your schedule, however, stick to it as closely as possible. Avoid letting your work life creep into your personal like or vice versa.

- Have a well-defined morning routine

While it’s nice to not have to commute to the office, you still need a morning routine that gets you to work on time. This means getting up at the same time every day, and performing the same series of activities, such as showering, getting dressed in your ‘business clothes’ and having breakfast. Don’t work in your PJ’s, it will ruin your ‘work mind set’ and make you less productive!

- Keep your to-do list up-to-date

When you are working by yourself at home, it’s easy to lose track of priorities and due dates and lose track of what needs to get done today. Start every day by reviewing what needs to get done, make or update your to-do list, and then cross off each task as you complete it. Not only will this keep you focused on what’s important, it will help to avoid overwhelm.

- Exercise!

Morning exercise gets you moving, and also increases endorphins, which improves enjoyment interest level. You should also get up and stretch regularly to improve posture and fend off stiffness and soreness.

- Be careful what you eat

Working at home, the kitchen is always handy, and it’s tempting to indulge in the usual unhealthy snacks. Ideally you should eliminate the temptation by filling your fridge with fruits, vegetables and healthy snacks, and avoid buying the unhealthy stuff altogether. Not only will this keep your weight down, it will also give you more energy and make you more productive.

- Take short breaks

It may seem that you can get more done if you don’t take any breaks but, in fact, the opposite is true. Frequent short breaks will re-energize you and make you more productive. In the long run, it will help to avoid burnout. Set timers or alarms to make sure you stop for regular breaks.

- Have a scheduled time to stop working

Just as you need a habitual morning routing to get you started at the right time every day, you need a regular ‘stop work routine’ to help you transition to your personal life. For example, you could set an alarm for quitting time and, as soon as the alarm goes off, put your work files away, clean up your desk, do a quick review of what was accomplished that day and list the top priorities for tomorrow.

- Avoid social media

This is a big one. Enormous amounts of time can be wasted on social media if you aren’t careful. Try logging out of all of your social media accounts before start work in the morning and the logging back in after you finish work. If you can make this part of your daily routine it will become a habit and you’ll accomplish a lot more.

- Listen to music

Listening to lyric-free music (at low volume) and actually help to focus and be less subject to distractions. You can pick music that matches your energy at the moment and the task you are working on. Consider investing in some good quality headphones (with a mic so you can take phone calls with them) to help you focus even more.

- Don’t stay inside all day

Take some time throughout the day to get outside for fresh air and sunshine, go for a short walk or just hang out in the back yard. Social distancing rules apply of course…

- Schedule errands and appointments around you lunch break

This is what you would do if you were working at the office, so why not do this at home as well. This will fight the tendency to take time off during the working day and blur the boundary between work and personal life.

- Avoid family, friends & pets while working

If you have your spouse, children and or pets at home during working hours, it can be very difficult to avoid getting distracted. It’s important for them to understand that you can’t be interrupted while at work (unless there’s an emergency of course). On the flip side, you must be 100% present for them when you aren’t working – put your business phone away!

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

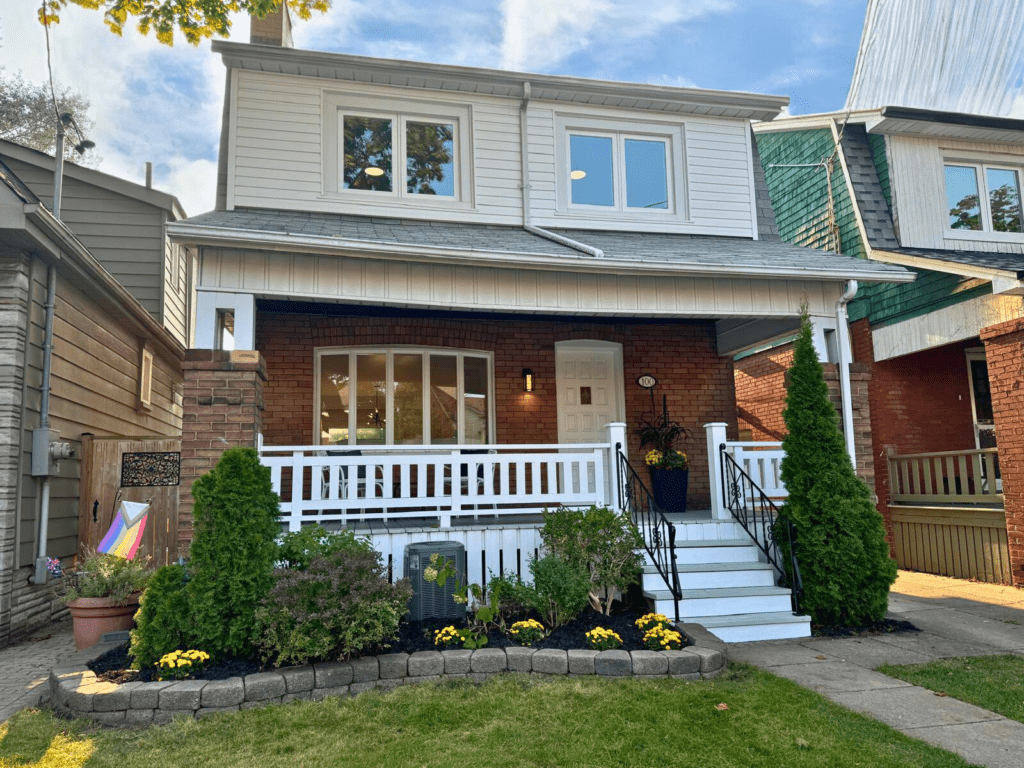

Prime Sunnylea

12/14/20

854 Royal York is an ideal fit for the conscientious homeowner who values sustainability, serenity, and balance. This home has been designed with a singular purpose: to blend seamlessly with its natural surroundings. Each element of this special home is deliberate, and nothing is wasted—neither energy nor space. Each component has been constructed in service to meaningful, ethical living.

The exterior of this home, clad in rich, dark wood treated with the Shou Sugi Ban method, immediately catches your eye and beckons you inside. Shou Sugi Ban is a Japanese technique that involves burning the surface of cedar planks, then sanding, cleaning, and finishing them with a dark stain for uniform colour and enhanced protection. The benefits of Shou Sugi Ban are clear: not only is cedar a renewable natural resource that doesn’t require any chemical finishes, the Shou Sugi Ban treatment makes it extremely durable. The home’s exterior is resistant to fire, water, mold, insect infestation, warping and shrinkage – the Shou Sugi ban wood surfaces will last at least eighty years with only minimal maintenance.

Natural light is essential for synthesis with one’s surroundings, and as you enter the bright foyer and walk through to the living area, you’ll feel the sense of calm that comes from being close to nature. Forty percent of the walls and ceilings are composed of energy-efficient glass, with awning windows for natural ventilation, creating an airy indoor space that is bathed in natural light. As you relax in this tranquil living space, enjoying the warmth of the wood burning fireplace, you’ll immediately feel composed and restful. You can further soothe the stress of your day by unwinding in the sauna in the spa-like lower level bathroom.

As you make your way upstairs, you are struck by the multiple skylights and the vaulted, wood-paneled ceilings that lend a sense of airy spaciousness to the entire upper level.

You realize that the rich dark Shou Sugi Ban flooring you saw on the main floor has been continued all through the upper level, and you can see how this serves to tie all the areas of the home into a harmonious whole.

Wandering into the sumptuous master suite, you’ll find wall-to-wall built-in closets and a luxurious ensuite bathroom. The master bedroom’s tall wide windows draw your eye to a large balcony that features an extensive green roof for added cooling effect, energy savings, reduced greenhouse gas emissions, and improved air quality.

As you gaze down through the bedroom windows, you realize that one of the most alluring characteristics of this home is its immersive green space: the lot itself has mature, undisturbed trees, creating a sense of peaceful nature with low maintenance. Also, you notice that the large deck that connects to the kitchen and extends into the yard is made with the same beautiful and long-lasting Shou Sugi Ban wood that you have seen on home’s exterior walls and throughout the interior flooring.

Continuing further into the upper level, you discover two more bedrooms, another full bathroom, and a second large green roof balcony at the opposite end of the house.

Efficiency, durability and elegance are interwoven in this home. The kitchen features sleek, stainless steel appliances and quartz countertops, and the bathrooms are fitted with top quality contemporary fixtures.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

There’s A Chill In The Air – But NOT in the Real Estate Market!

12/14/20

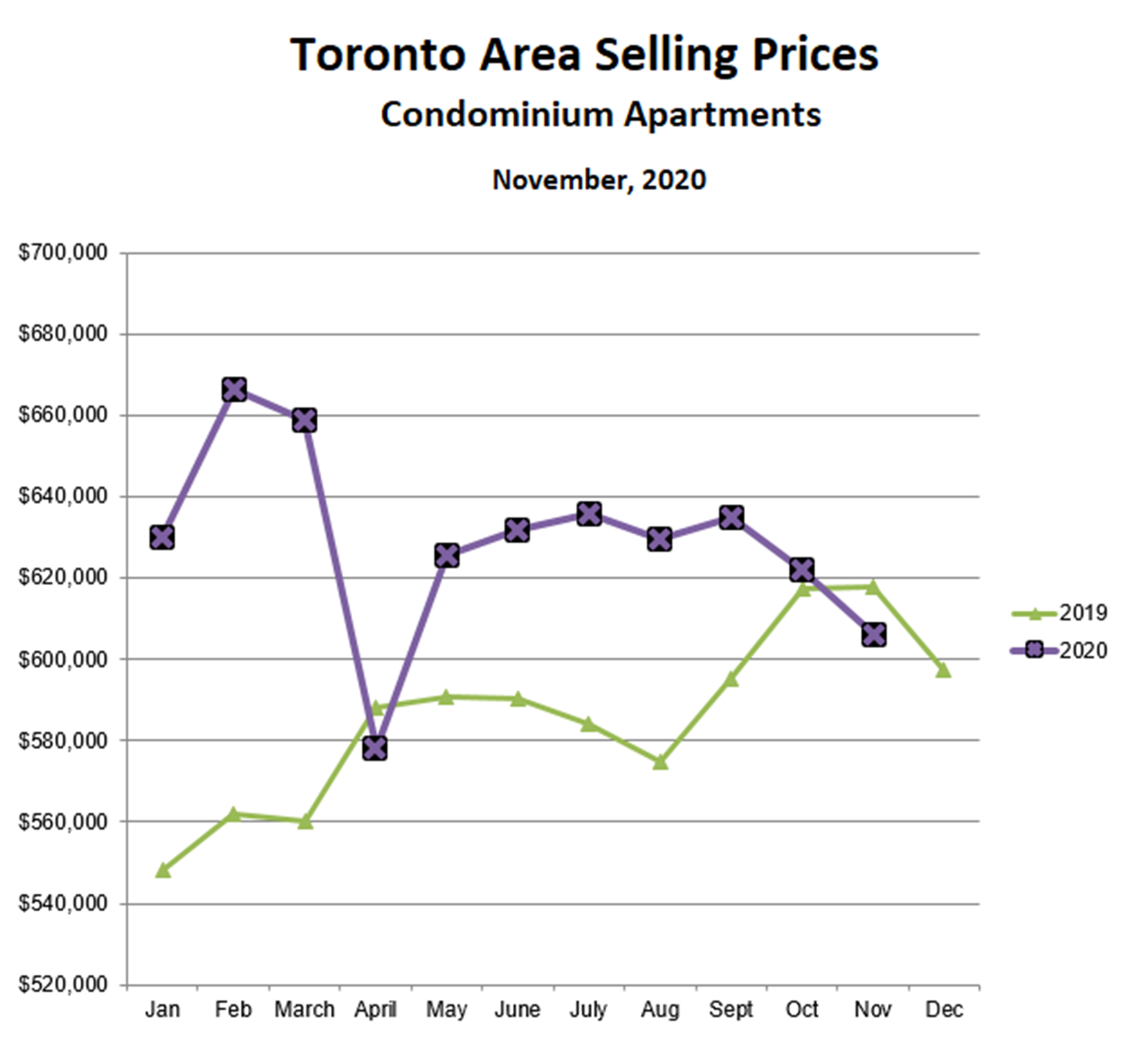

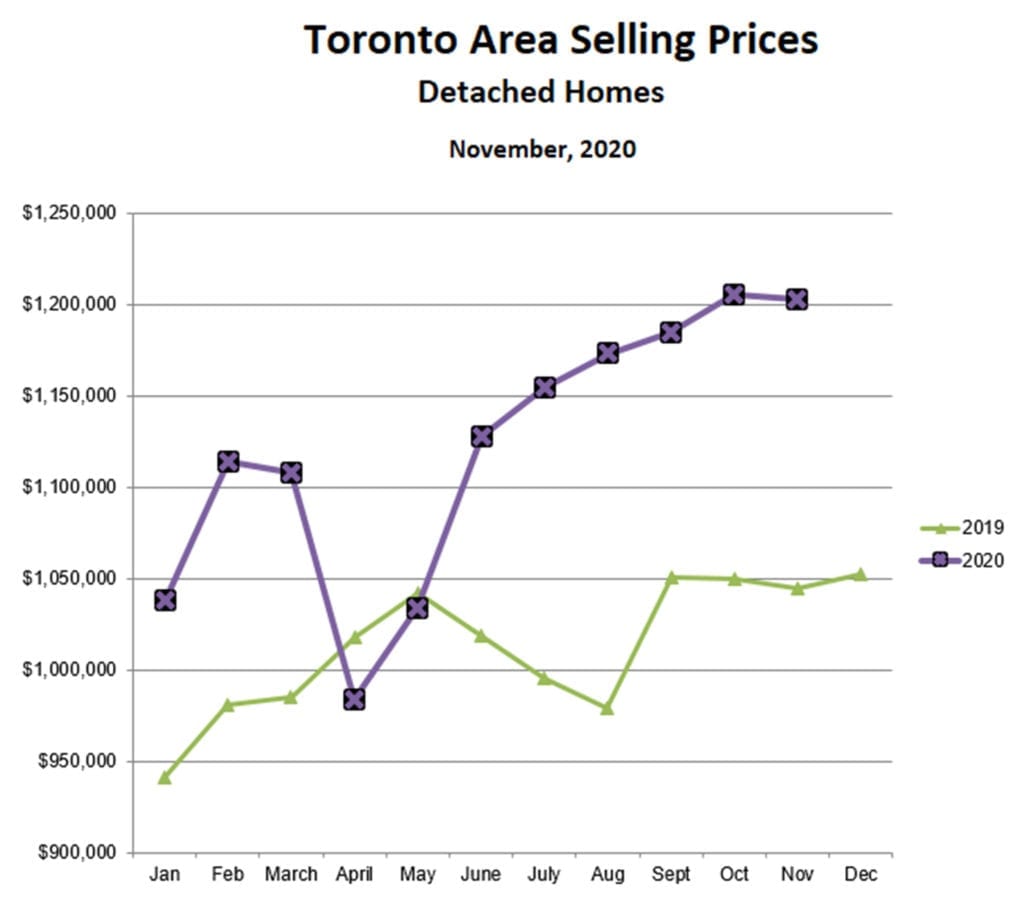

Sales and prices for houses in the Toronto area continued their torrid pace in November. The average price for a detached home slipped very slightly from October, but was still 15% higher than last November. Sales were lower than October, which is normal for this time of year, but almost 30% above last November, and year-to-date sales were 13% above 2019.

The inventory of detached homes for sale continued to drift lower, and was just above one month’s supply in November. There’s no sign of a let-up in this intensely hot sellers’ market.

The Toronto area condo market is a very different story, as it has been since the spring. Prices fell for the second month in a row, and are now 2% lower than last November.

On the other hand, it’s encouraging that sales of condo apartments remain strong, about 7% higher than last November, and the inventory of condos for sale seems to be leveling off at just over 3 months’ supply.

Clearly, demand for condos remains strong; the weakness is due to over-supply, both because of COVID and also because of the record number of condo completions this year. This suggests that the condo market should return to good health once COVID is behind us.

This is the time of year for predictions, so I offer the following for Toronto area prices in 2021:

- Re/Max is forecasting a 6% price increase;

- Royal LePage is forecasting a 5.8% price increase;

- A recent survey of economists predicts a 5% price increase;

- Moody’s expects prices to fall by 9%; and

- CMHC continues to stand by the prediction they made last May for prices to fall by 7-18%.

The differences among these forecasts trace mainly to the relative emphasis placed on the current momentum in the economy and the real estate market, as against the risk of economic weakness if/when the reality of the damage done by COVID restrictions catches up with us.

Obviously, forecasting the real estate market (not to mention almost every other market) has become a mug’s game in the days of COVID. We’ll just have to wait and see how the future unfolds.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!