Author: Dave Proulx

Is Tenant Insurance Necessary?

05/16/22

You just rented your first apartment, do you need to have insurance? You don’t need to insure the home or condo, that’s the landlord’s responsibility. However, there are three areas where insurance is very useful for tenants:

Contents insurance

The Landlord’s insurance does not cover your own possessions such as furniture, appliances, artwork, jewelry and electronics. You can insure either the actual cash value or, for a higher premium, the replacement cost (with no allowance for depreciation). A standard policy will protect against normal risks, and you can pay a bit extra to cover less common risks.You might think that if your possessions are damaged or destroyed by someone else’s action, for example a flood from another apartment, you would be covered by their insurance. But you’d be wrong – you’d have to sue them to get compensation. Contents insurance solves that problem.

Personal liability insurance

If you accidentally hurt someone, or if someone gets injured on your property you can be liable for damages and legal costs if you get sued. Liability insurance is designed to protect you legally; a typical policy will cover up to $1 million and you can increase that to $2 million with many insurers. While liability insurance isn’t mandatory in Ontario, most landlords will require it as a condition of renting from them. This protects the landlord from being sued if someone is injured in your apartment.

Additional living expenses insurance

If your apartment is flooded or significantly damaged, you may have to move out until the repairs are completed. With an insurance policy that includes additional living expenses, you can often get coverage for meals and a hotel or temporary rental. Even if the problem came from another apartment, but affected your apartment, the coverage will generally apply.

How much does tenant insurance cost?

The cost of your tenant insurance will depend on a number of factors, including:

- The deductible level you choose. The higher the deductible, the lower the premium, but the more you will pay out of pocket for each claim.

- Your credit score

- The amount of contents coverage you need

- The amount of liability coverage you want

- The location and construction of your unit (concrete vs wood frame, etc)

- Whether you have a home security system

- Your claims history – the fewer claims you make, the lower your premium

Typically, your insurance policy will cost somewhere around $20-$25/month. You can get coverage from most insurance companies, and can often save money by bundling your tenant insurance with other policies.

Is tenant insurance mandatory?

Tenant insurance isn’t mandatory in Ontario, although most landlords will require liability insurance as a condition of renting from them. This protects the landlord from being sued if someone is injured in your apartment. As for contents and living expenses insurance, even though they aren’t required, it definitely makes sense to get them!

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

10 Tips On How To Win A Bidding War In Toronto

05/16/22

If you are even casually interested in buying a home in Toronto, you are well aware that most homes are selling in ‘bidding wars’ and for well above the asking price.

Just what exactly is a bidding war anyway? Here’s how it typically works:

Bidding War Breakdown

- Someone lists his house for sale at a price that is obviously well below its fair market value.

- The listing information advises that the seller will consider offers in several days. Usually, the offer date will be about one week after listing.

- On the ‘offer date’, all interested buyers submit their offers to the listing agent by a pre-determined deadline.

- The seller reviews all of the offers and then either accepts the best one or, more commonly, offers each buyer an ‘opportunity to improve’.

- Once each buyer has improved his offer (or not), the seller will then accept the best offer or, potentially, offer the buyers yet another chance to improve.

- In principle, this process can continue as long as the seller pleases, though it rarely goes beyond one round of improvements.

- In many cases, the seller is willing to consider offers in advance of the ‘offer date’. These are called ‘pre-emptive’ (or ‘bully’) offers. If this happens, the offer presentation proceeds as above, and other competing offers can still be submitted. However, the time frame is accelerated, and the stress level is increased for all involved.

Looking for more home-buying advice? Explore these other helpful posts from our blog.

- Is it Better to Buy or Rent?

- Can You Raise a Family in a Condo?

- Incentives & Tax Breaks For First Time Buyers

So, if you are aiming to buy a house, how do you give yourself the best chance to win a bidding war? Here are 10 tips to help keep you sane.

Be Realistic

Get educated as to what you can get for what you can afford, and be prepared to do what it takes to win. No buyer in his right mind enjoys competing in a bidding war, however, if you aren’t prepared to do so, you might as well wait on the sidelines until the market cools down.

Also, don’t count on winning the first bidding war you participate in – you may have to try several times before you get that dream home. Do your best not to get too emotionally attached to the properties you are bidding on (this is a tough one!)

Get Fully Pre-Approved

It’s not enough to go online and use a mortgage calculator to find out how much you can afford. You need to get properly pre-approved through an experienced mortgage specialist. This way you can make certain there won’t be any unexpected hitches in the mortgage approval process after you buy the house. Also, you should consider including your pre-approval documents with your offer to reassure the seller that you are ‘good’ financially.

Be Prepared to Make an Offer Without a Financing Condition

Most sellers will avoid accepting conditional offers when there are multiple bids on the table. After all, if the condition is not satisfied a week later, and the deal falls apart, the seller may ultimately be forced to accept a much lower price. Many buyers believe that, if they are pre-approved, they don’t need a financing condition, but this isn’t true.

The bank is not just approving your ability to pay, they also need to confirm that the property is worth what you are paying. If the appraised value turns out to be lower than the selling price, you will either have to come up with more cash to make up the difference or be able to finance the property with a lower down payment. Have a heart-to-heart talk with your mortgage lender about the risks involved in not including a financing condition.

You may also wish to explore emergency backup options to obtain additional cash (e.g., from the bank of Mom & Dad) should the worst happen. If, in the end, you decide that it’s simply too risky, you will probably not be able to compete effectively in a bidding war.

Be Prepared to Make an Offer Without an Inspection Condition

Just as sellers are unwilling to accept an offer with a financing condition, they are also unwilling to accept an offer with an inspection condition. Fortunately, there are more options here to reduce the risk:

- Many sellers will provide an inspection report for you to review before making an offer;

- You can have your own inspection done prior to making an offer. This will cost about $500, a relatively small price to pay for ensuring there are no serious issues with the house;

- If you want to save the cost of an inspection, you can have a contractor friend check out the house before making an offer;

- You can ask the seller for information about the roof, furnace, wiring, plumbing, etc. to see how recently they have made improvements in the mechanical systems;

- You can include a seller’s warranty in your offer that all mechanical systems will be working properly on closing. The seller is more likely to accept a clause like this than an inspection condition; or

- You can include a very short inspection condition, where you have an inspector lined up to do the inspection the next morning. This will allow the seller to quickly invite the other buyers back to the table if you don’t release the condition. This would still be an undesirable option, however, as other buyers would wonder what is wrong with the property.

View the Property as Soon as it Comes on the Market

If a bully offer is submitted by another buyer, you will not be in a position to make a competing offer if you haven’t yet seen the property, Some listings say that there will be ‘no pre-emptive offers’ but, even then, the seller has the right to change his mind and look at a bully offer anyway. If you like the look of the house online, go and see it as soon as you can.

Include a Large Deposit With Your Offer

Ideally, you should have a bank draft ready to hand in as soon as your offer is accepted. The deposit should be at least 5% of the price you are offering, and you should consider an even larger deposit if you can. A big deposit gives the seller some assurance that the deal will close, and a bank draft ensures that the buyer won’t get cold feet and decide not to bring in the deposit the next day. You could even go one step further.

If you see a house as soon as it comes on the market and decide you want to make an offer on the offer date, you could get a bank draft immediately. This way, if there is a bully offer, you can make a competing offer and will have a bank draft ready to hand in if you win. A bit extreme, perhaps, but sometimes this is what it takes.

Consider Making a Bully Offer

If you do this very soon after the property comes on the market, and if your bid is aggressive (well above asking, no conditions, big deposit), you may be able to catch other buyers flat-footed. You might not avoid competing offers altogether, but hopefully, there will be fewer than on the offer date. Worst case, you can always re-submit your offer on the offer date.

Get an Accurate Evaluation of the Fair Market Value of the Property

These days, asking prices are all over the map and bear no resemblance whatsoever to the value of the property. You should hire an experienced realtor to determine what the property is actually worth so that your bid will be in line with what the property will eventually appraise for.

Give the Seller What He Wants

Find out the seller’s ‘perfect’ closing date, and give that to him if you can. Also, limit your inclusions to what is on the listing – don’t ask for stuff that the seller wants to take with him.

Write a Personal Letter to the Seller

While price is most often the deciding factor, if your offer is very close to another offer, a personal note (including a photo) that describes who you are and why you want to be the next owner of the house can sometimes make all the difference. If the seller has been there for many years, it could be important to him to ‘pass the baton’ to someone who will be a good steward.

Ready to find your new home? As West Toronto real estate agents with decades of experience, we can help you accomplish your dreams! Click here to send us an email or call 416-769-6050.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Reverse Mortgages Becoming Popular

05/15/22

Many Canadians who are looking to retire but are facing high debt load and ongoing expenses, as well as reduced income. This can be a great challenge, and this is where the reverse mortgage can help!

This product is also a great option for anyone wanting to assist their elderly parents.

Instead of selling the home and moving them to a care home or assisted living, a reverse mortgage is a terrific way to access the equity in the home, month by month, to pay for in-home and ongoing care costs.

The goal of the reverse mortgage is to allow Canadians over 55 years to tap into the equity of their home to assist in comfortable financial living. With a reverse mortgage, however, borrowers are not required to make regular payments. This allows them a considerable inflow of cash, without having to pay off what they owe! The only time payment will be required is when you sell or move out of your home.

Reverse mortgages are designed to allow you to access up to 55% of your home’s equity, thereby allowing you to convert your home equity into cash. This can be done as either a one-time lump sum payment, or you can choose to structure it to receive monthly payouts. Beyond being able to cash in on your home’s equity, a reverse mortgage has additional benefits, including:

- No monthly mortgage payments;

- No income or credit qualifications;

- Very low/little paperwork required;

- Title and ownership of property remain in the homeowner’s name;

- Flexible options to break term early if needed; and

- Penalty waived in the event of death or care home placement to preserve the estate.

If you are struggling financially, or want to have a little extra equity on hand to pay off existing debts, gift money to family, expand your quality of life or simply increase your investment portfolio, contact me today! I would be happy to discuss the possibility of a reverse mortgage in further detail with you and ensure it is the best product to suit your needs.

Annette Hutcheon

Mortgage Agent

Neighbourhood Dominion Lending Centres

416-802-4760

annette@ndlc.ca

annettehutcheon.ca

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Toronto Market Continues To Moderate

04/19/22

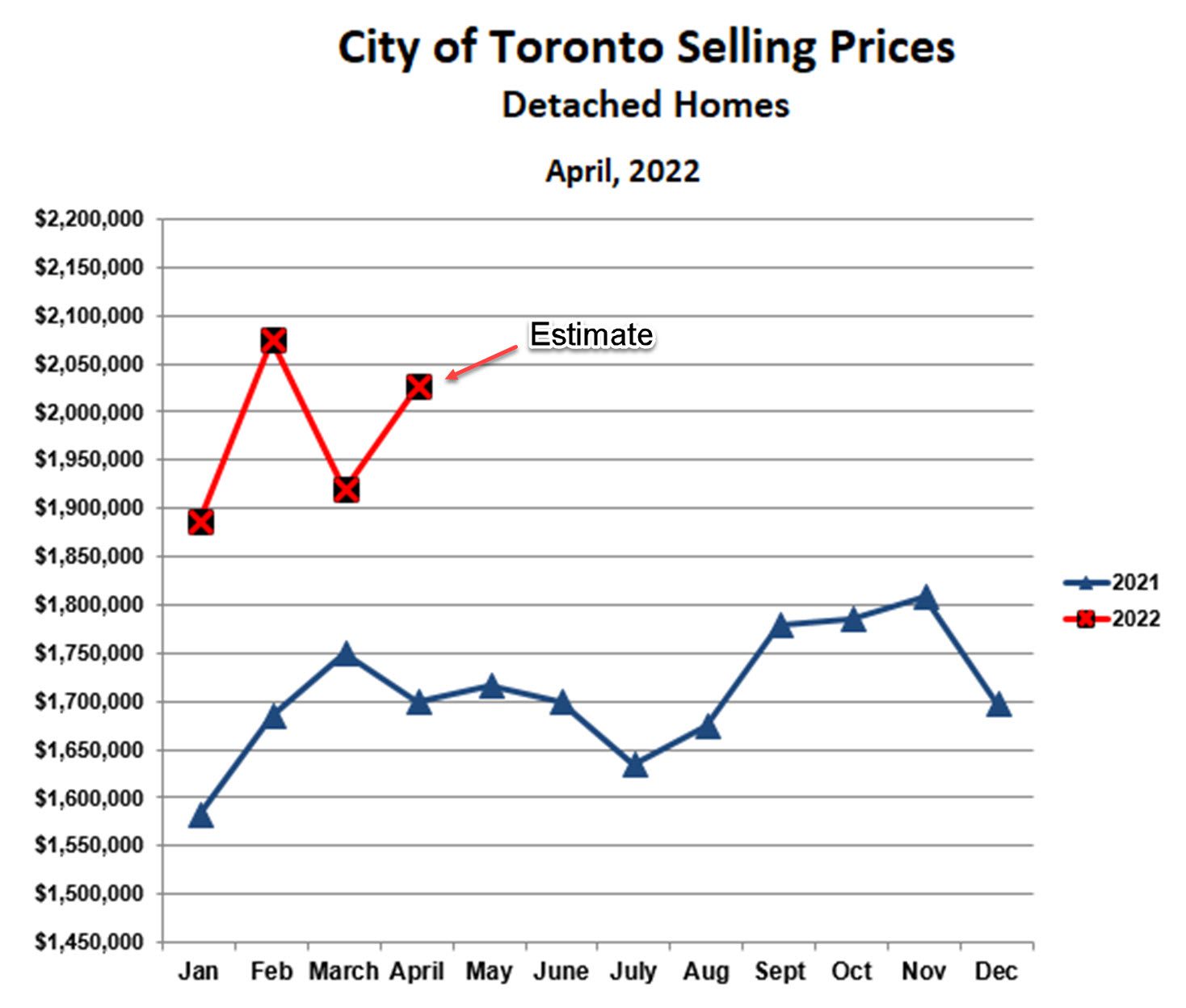

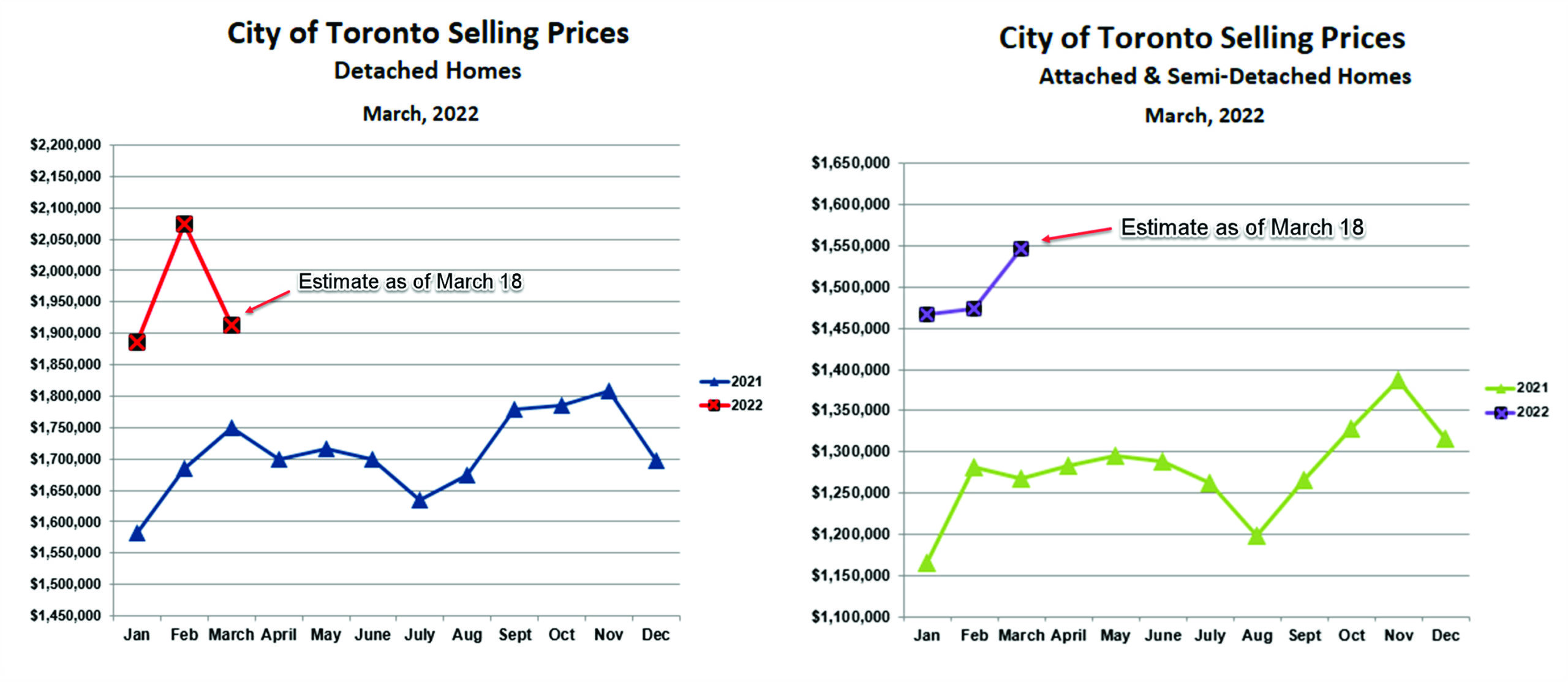

Detached Homes

As reported last month, the Toronto market began to show signs of ‘topping’ by the middle of March, as prices for detached homes fell as compared with February. At that time, it did not appear that this was the start of a downtrend, and the trend so far in April seems to be confirming this. As shown in the chart below, detached prices did, indeed, fall in March, and they are bouncing back in April. While this is welcome news, it’s probably not signaling a return to rising prices. More likely, it means that the market has reached a plateau. For perspective, detached prices are still more than 15% higher than this time last year, and last spring was no slouch. So we still have an amazingly strong market for detached homes in Toronto.

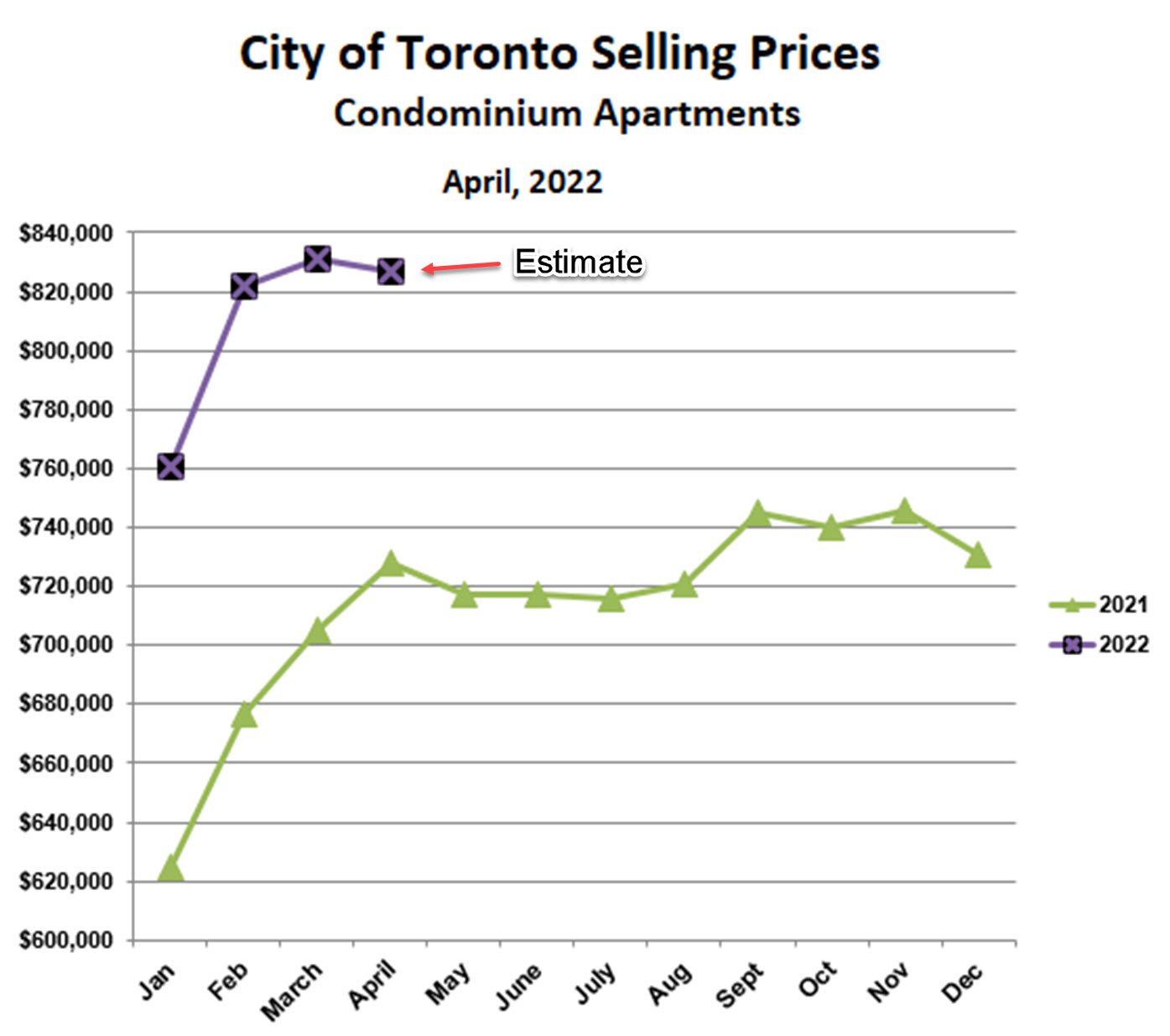

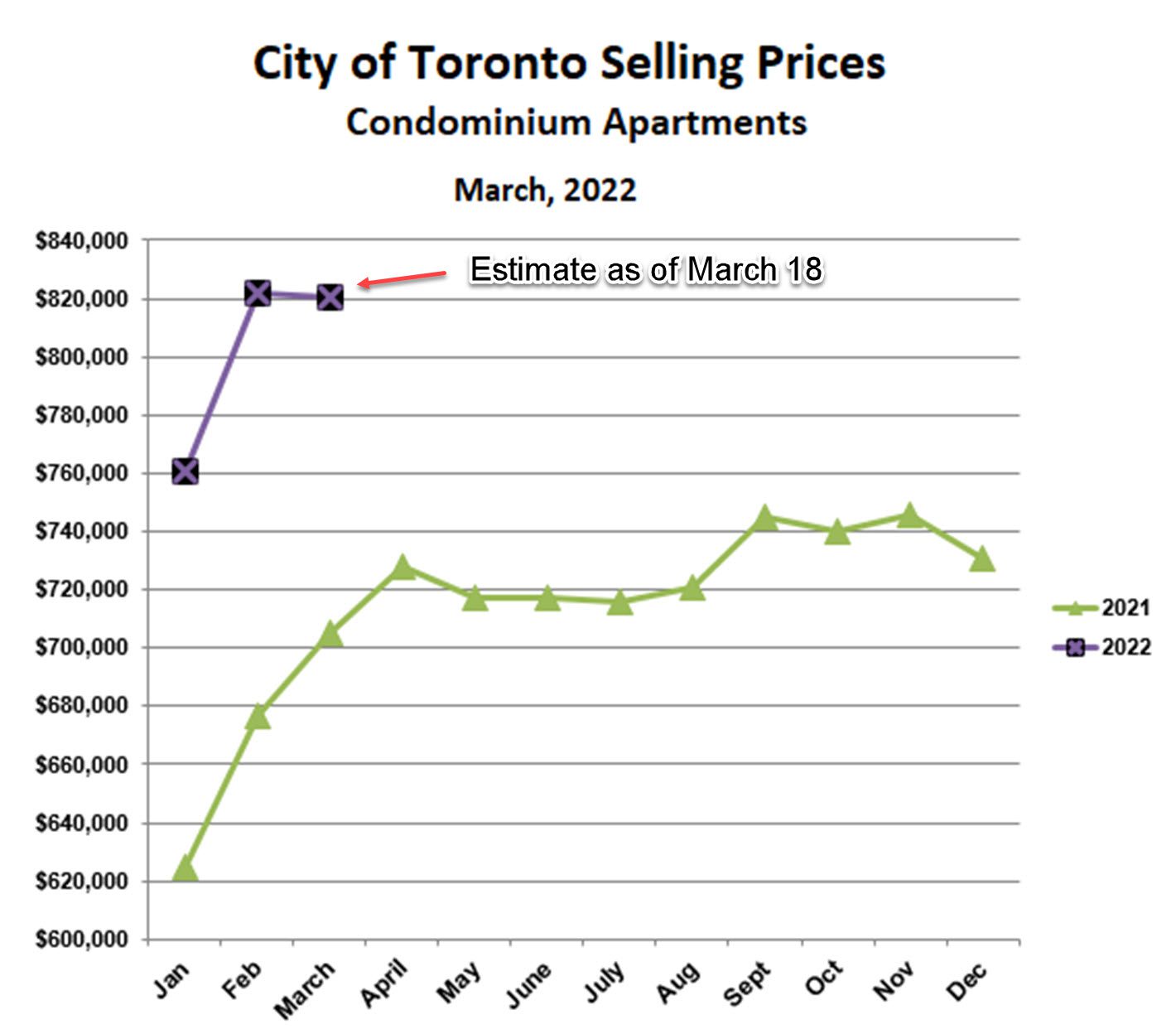

Condominium Apartments

Similar to detached homes, condominium apartments are continuing to display a moderating trend through the first half of April. After increasing slightly in March, condo prices are decreasing slightly so far in April. So prices have stopped going up quickly but aren’t falling either; basically another plateau. Condo prices are about 15% higher than last April, and about 30% higher than at the beginning of 2021, so we’ve had a pretty good run.

As inflation continues to rage and interest rates continue to rise, we will definitely see some downward pressure on prices over the coming months, though perhaps not in the immediate future. With any luck, inflation will start to ease later this year and interest rates won’t have to go as high as they did in the 80’s. The best-case scenario would be a gradual decline in prices over the second half of the year followed by a return to growth (albeit much slower) next year.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Purchase Plus Improvements Mortgage Product

04/17/22

When it comes to shopping for your perfect home, it can be hard to find the exact one ready to go! In fact, most homes come with flaws, whether it is old paint or flooring, outdated fixtures or perhaps more extensive repairs are needed. While some buyers have no issues dealing with these deficiencies in a home or perhaps do not consider them dealbreakers, other house hunters might.

If you are looking into a home that requires improvements, there is a mortgage product known as Purchase Plus Improvements (PPI). This type of mortgage is available to assist buyers with making simple upgrades, not to conduct a major renovation where structural modifications are made. Simple renovations include paint, flooring, windows, hot-water tank, new furnace, kitchen updates, bathroom updates, new roof, basement finishing, and more.

Depending on whether you have a conventional or high-ratio mortgage, if it is insured or uninsurable, and which insurer you use, the Purchase Plus Improvements (PPI) product can allow you to borrow between 10% and 20% of the initial property value for renovations.

The main difference between a regular mortgage and a Purchase Plus Home Improvements program is the need for quotes. As part of the verification process, your mortgage professional and the lender will need to see quotes for the work that is planned for the improvements. The quotes will provide us with the cost and plan details required to secure the final approval.

The lender will release the full funds directly to the lawyer with instructions to hold onto the portion for improvement costs until the renovations are completed. Note that you will need to pay the contractor and then, once the renovations are complete, and the lender has approved and waived the holdback, the lender will allow the lawyer to release the additional funds.

In some cases, you may be able to arrange with the contractor to accept partial payment until the work is complete and the lender releases the funds. Otherwise, you might find yourself in a sort of Catch-22 situation where you need the funds from the lender to afford the improvements, but you cannot get the funds until the work is complete and paid for.

To get started with this type of mortgage program, the first step is reaching out to myself to understand how this mortgage product would apply to your application and specific situation, as based on your existing mortgage. Understanding what you qualify for and the types of improvements that can be included in the financing, will help you better understand which potential houses might work great for you and how much financial room you have for improvements.

Written by

Annette Hutcheon

Mortgage Agent

Neighbourhood Dominion Lending Centres

Email: annete@ndlc.ca

Website: annettehutcheon.ca

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Will New Government Initiatives Make Housing More Affordable?

04/17/22

The 2022 Federal budget contains a number of housing related items aimed at improving the affordability of housing. Let’s have a look at how well they might work:

A Home Buyer’s Bill of Rights. This includes a number of measures:

- A ban on ‘blind bidding’. In Ontario, legislation forbids realtors from disclosing the content of competing offers. We may only reveal how many offers are in play. Sometimes this can lead to a winning offer that is significantly higher than the next highest offer. The winners (and their realtors) don’t know this, of course, since they don’t know what was in the other offers. The losers know how far they fell short, but only after the deal is done and the selling price is made known. The winners might like to know by how much they “overpaid”, and the losers might wish they had known what price they had to beat. An open bidding process would solve these problems. For example, the seller/listing realtor could make known the highest price on the table and give all bidders a chance to match or beat it. It wouldn’t be quite that simple, since there is more to the strength of an offer than the price, for example: are there conditions on financing, or inspection; what is the closing date and does it match what the seller wants; how big is the deposit and does the buyer already have a bank draft; does the buyer have pre-approved financing; and are there seller warranties or other stipulations. Will the disclosure requirement extend beyond price to these other considerations? Also, how & when will the bidding end? In my view, an approach like this might solve the transparency problem but could make the process even more stressful for buyers. Also, it seems unlikely to improve affordability. Competing buyers will bid the price up no matter how transparent the process. In any case, if the federal government bans blind bidding, our provincial regulating body must re-write the rules both to permit open bidding and to define the rules for the new bidding process. I wonder if buyers will be happy with the end result. Be careful what you wish for.

- A legal right to conduct a home inspection. When there are competing offers, it is rare that the winning offer has a home inspection condition. Many sellers/listing realtors provide inspection reports for buyers to review ahead of time. When this isn’t the case, most buyers do not conduct their own inspection, but this isn’t because the seller won’t allow it. Rather, it’s usually because the buyer doesn’t want to spend the money, as money is wasted if they don’t win the competition. I don’t see how the right to conduct an inspection will change anything.

- Increased transparency about sale prices of comparable properties. This information is readily available at no cost to both buyers and their realtors. I can’t see any value in this.

- The right to know when realtors are involved in multiple representation. These are situations where, for example, the same realtor is representing both the buyer and the seller. Our provincial legislation already requires this; it’s hard to see what an identical federal rule would add.

- A publicly available beneficial ownership registry. At present, corporations buying real estate are not required to disclose the corporation’s officers. This has made Canada a haven for money laundering, and this change is long overdue. I’m not sure it belongs on a ‘Buyer’s Bill of Rights’ list, however…

- Require mortgage lenders to fully disclose the range of options available, including the First Time Home Buyer Incentive (FTHBI). The FTHBI has been a failure, and this will give the feds a chance to force lenders to promote it to homebuyers. Again, it’s hard to see this as a ‘right’.

- Stop ‘renovictions’ by preventing rent increases beyond a normal change. This might seem to benefit tenants, however, it will certainly discourage landlords from making improvements when they cannot recoup their cost. Deteriorating rental stock and increased landlord/tenant disputes seem likely.

- Require lenders to offer up to 6 months’ mortgage deferrals in the event of job loss or other major life event. This is a horrible idea. It will probably lead to higher mortgage rates for everyone as well huge legal bills. After all, what is a ‘major life event’?

- The bottom line is that very little in the ‘Buyer’s Bill of Rights’ could lead to improved affordability for buyers. The title sounds great but the content is greatly lacking.

A First Home Savings Account (FHSA)

This new program will allow first-time buyers under the age of 40 to make tax-deductible contributions up to a total of $40,000, and to withdraw this money tax-free to use toward the purchase of their first home. The FHSA will combine the best features of an RRSP and a TSFA, and will definitely help first-time buyers to make that first step onto the real estate ladder. Unfortunately the maximum annual contribution of $8,000, will greatly limit the impact on affordability in the short run.

The Housing Accelerator Fund

The Canadian Mortgage and Housing Corporation (CMHC) will administer a $4 billion fund to encourage municipalities to cut red tape and encourage densification as well as public transit-oriented developments. The feds project that this will lead to 100,000 new housing units over the next 5 years. Even if successful, which is questionable, this is a drop in the bucket. The government itself estimates that we will need 3.5 million new homes by 2031, mainly because of forecasted immigration. Also, $4 billion is only $40,000 for each new housing unit, which may not even cover the increase in construction costs, given the inflation trend.

A 2 Year Ban on Foreign Purchases

We already have a foreign buyer tax in Ontario that has recently been extended from the GTA to all of Ontario and increased from 15% to 20%. Also, there have been few foreign purchases during the past 2 pandemic years, and that certainly hasn’t kept prices from increasing at a historically high rate. It’s hard to see how an outright ban on foreign purchases will have any significant effect on affordability.

A New ‘Flippers’ Tax

Starting next January, anyone who sells a property they have owned for less than 12 months (with some exceptions) will have the profits taxed as business income. Normally such profits would be considered capital gains, and only half of the profit would be taxed. If it’s business income the full amount of the gain would be taxed. This is actually not a bad idea: if someone is in the business of flipping homes for profit, the profit should be taxed as business income. The 12-month time frame may prove to be too easy for flippers, however.

Assignment Sales To Be Subject to HST

When someone buys a pre-construction condo, they are subject to HST when the sale eventually closes. If they sell the purchase contract prior to closing (this is called an ‘assignment sale’), the new buyer ‘steps into the shoes’ of the original buyer, and will also be subject to HST on the original purchase price. However, no HST is payable on the difference between the original purchase price and the higher price paid by the new buyer. The new rule will change that. This is another overdue change and may reduce speculative ‘churning’ as well as provide another source of tax revenue for the feds. Again, however, this seems unlikely to have much impact on affordability overall.

Tweak and Extend the First Time Home Buyer’s Incentive to 2025

The FTHBI has been a total flop, and it needs more than just tweaking. It needs to be cancelled and completely reimagined.

$1.5 Billion for Affordable Housing and $4 Billion for Indigenous Communities

Depending on the details of how the money is to be allocated, this could actually create some new housing.

A $7,500 Tax Credit For Homeowners Who Create Second Suites for Family Members

This isn’t a bad idea, but why limit use of the second suite to family members if the goal is to create more living units? This will only lead to more red tape and government cost for enforcing compliance.

Overall, there’s quite a bit of ink and noise among all these initiatives… but probably very little actual impact on our housing affordability crisis. That’s a good thing, since the real estate market is already moderating and will continue to do so as inflation drives up interest rates. The last thing we need right now is an aggressive, late-to-the-party government program that jolts the market into a steep correction.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

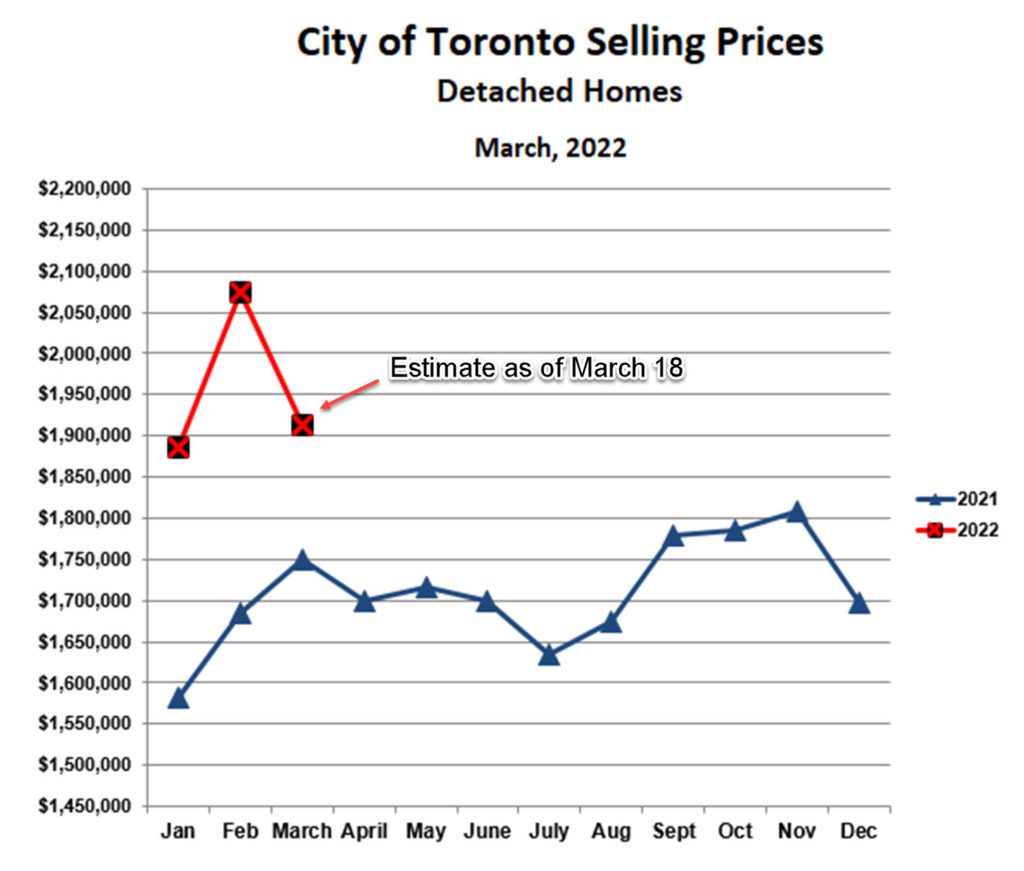

Toronto Market Super Hot in February, Moderating in March

03/20/22

The month of February was insane, a ‘perfect storm’ combining very low interest rates and low numbers of homes for sale with large numbers of eager buyers wanting to buy something, anything, before prices rose even further. The month of March has so far been a different story, however. Let’s look at the numbers.

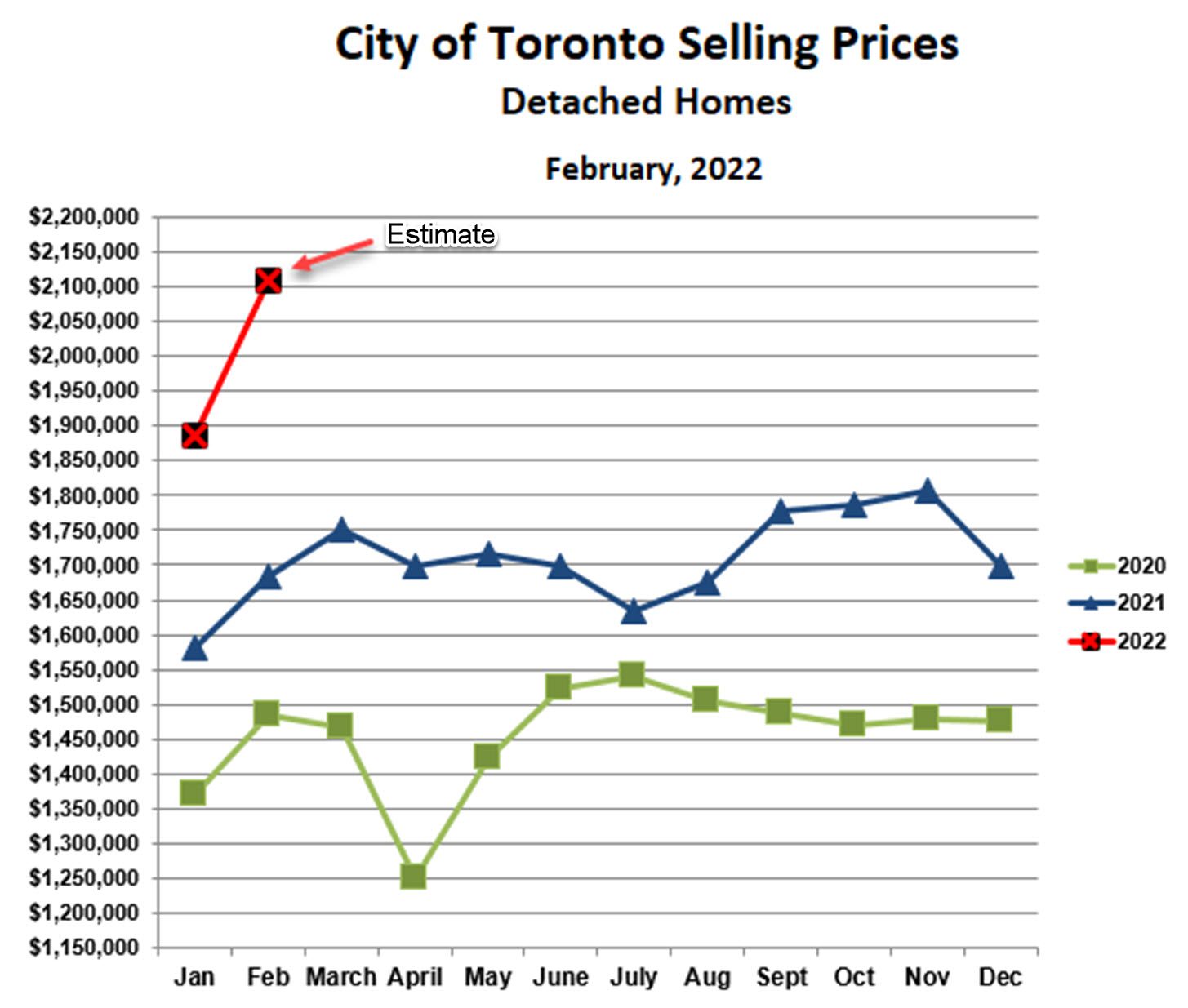

Freehold Properties

The average price for detached homes in February was $2,073,989, cracking the $2 million mark for the first time. This was 23% higher than February, 2021, which itself wasn’t too shabby. Bidding wars were rampant, and selling prices more than $500,000 over asking were common. (Though, it must be said that properties were often being priced more than $500,000 under value.) Crazy times.

Based on estimated average prices as of March 18, however, the market seems to be changing. While bidding wars are still the norm, the average selling price for detached homes has fallen by about 8%. Curiously, the same is not true of semi-detached and attached homes, where the average price in March is so far about 5% higher than in February. So what is going on here?

Overall, these data suggest that we are seeing some moderation; perhaps we have passed ‘peak insanity’ and can look forward to a more steady market over the next few months. Remember that the pattern was similar last year: rising prices and jaw-dropping bidding wars early in the year, and then flat to slowly falling prices until the fall. We are hitting the peak about a month earlier this year, and there are good reasons for this:

- Both the Bank of Canada and the Federal Reserve have raised interest rates for the first time in years;

- Inflation has risen to levels not seen in decades, stoking fears that interest rates will accelerate upward;

- The Ukraine conflict has introduced a lot of uncertainty, and buyers tend to hesitate in uncertain times; and

- Affordability is being strained, especially at higher price points.

None of this means that the market is going to correct strongly, at least not in the short term. More likely we will see a continued strong sellers’ market through the rest of the spring, just a bit more balanced than it’s been for the past few months. This will be good news for buyers suffering from bidding war fatigue.

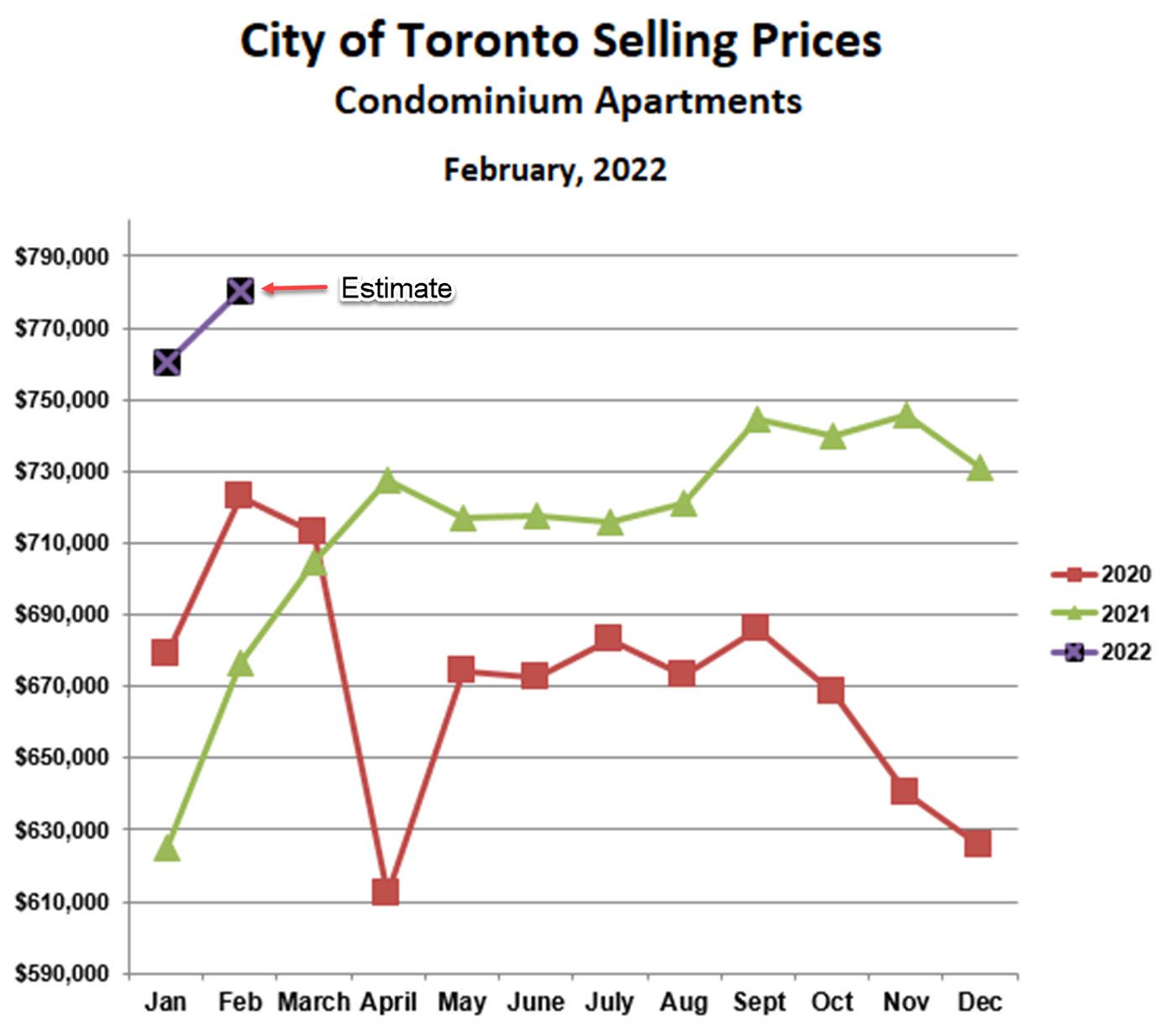

Condominium Apartments

Prices for condo apartments in the City of Toronto increased to an average of $822,090 in February, up 8% over January and 21% over last February. This was very similar to freehold properties and also represented another all-time high. Also like freehold properties, prices are not, so far, increasing further in March. As of the middle of the month, condo prices are virtually flat as against February, again suggesting that the early year craziness in the Toronto market is subsiding. The pattern of an early upward thrust in prices, followed by a more even, steady market over the rest of the spring, seems to be in store for condos as well.

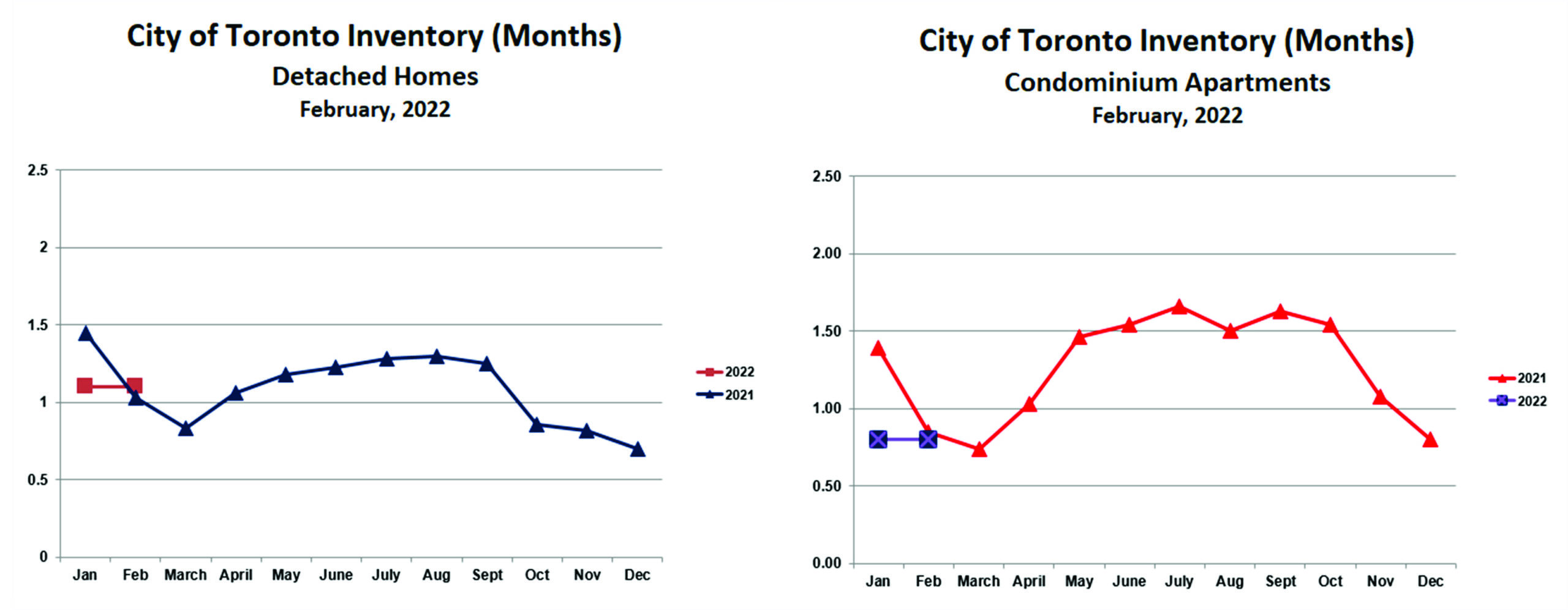

Inventory

Inventory (months of supply of homes for sale) was very low for both freehold and condo properties in February. This isn’t at all surprising given how strong the market has been. It’s basic supply and demand. We will have inventory numbers for March after the end of the month, and, given the mid-month price trends, a rise in inventory should be expected. Last year inventories rose after the January-March craziness subsided. This year it looks as if everything has been moved up by one month. If so, we can look forward to a strong, but not feverish, market for the next 2-3 months or so.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

How To Gift A Down Payment

03/05/22

The Increasing Importance of Gifting

Over the past several years, and especially since the beginning of Covid, house prices have increased dramatically. While this is putting homeownership out of reach for many Torontonians, we are still seeing lots of young families buying homes in the $1-$2 million price range. How is this possible?

The first part of the answer is interest rates. Mortgage rates have been historically low for quite some time (though that could change this year), This means that a young couple with two incomes can afford a very large mortgage, even when subjected to the ‘stress test’ which requires them to prove that they can afford a mortgage rate 2% higher than their actual rate.

The second part has to do with down payments. To purchase a home with a price over $1 million, the minimum down payment is 20%. For example, if the price is $1.5 million (which isn’t that high for a house in Toronto), the minimum down payment would be $300,000. To add insult to injury, the double land transfer tax on this house would be $44,475 for a first-time buyer. How do they manage to accumulate so much money?

For move-up buyers, the answer is simple. These young families bought a starter home or condo a few years ago, and have enjoyed rapid value appreciation since then. This accumulated equity becomes the foundation of their down payment on their next house.

For first-time buyers, it’s not so simple. This is where ‘the bank of Mom & Dad’ comes in. More and more, these buyers are turning to their parents to gift them money towards their down payment. According to Benjamin Tal at CIBC, about 30% of first-time homebuyers received help from family members in 2021, up from 20% in 2015. The average size of the gift was $52,000 in 2015 and $82,000 in 2021. In Toronto the amount was even higher, averaging $180,000 in 2021. The urban myth is that many parents are going into debt to come up with this money Yet, Mr. Tal says the evidence indicates that only 5-6% of gifting parents use debt to finance the gifts. It’s estimated that gifting accounted for about $10 billion in Canada last year, which is about 10% of total down payments.

Rules for Gifting

Gifting for down payments has obviously become very significant and so it’s important to understand how gifting works. Here are the key things to know about gifting down payments in Canada:

- Anyone can give money to whomever they want. However, if the gift is to be part of a downpayment, it must come from an immediate family member. This means parents, grandparents, or siblings. Lenders might accept a more distant relative as a giftor if there are special circumstances, but this is rare. Friends cannot gift down payments.

- The giftor must provide a ‘gift letter’ to the lender. Each lender will have a pre-written gift letter template that the giftor will be required to use.

- The lender doesnt usually require the giftor to disclose the details of their bank account or financial situation. They just need to see proof that the funds have been transferred to the homebuyer’s account.

- The gift letter will make it clear that the money is a gift and doesn’t need to repaid. Any hint that the gift is a loan will seriously damage the mortgage application.

- Timing is important. Lenders will usually want to see the gift in the homebuyer’s account at least 2 weeks before closing. However, the gift letter itself should be submitted no more than 90 days in advance.

- There is no limit to the amount that can be gifted, and the gift is not taxable.

- If the lender feels that the source of the gifted funds is questionable, they may ask for proof of where the money came from. This is especially true if the money is coming from overseas.

- Gifted money cannot be used for closing costs such as land transfer tax, legal fees, home inspections, etc. Even if the gift covers 100% of the down payment, the homebuyer must be able to cover these costs out of their own pocket.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Refinancing – What You Should Know

03/01/22

Refinancing your mortgage refers to the process of renegotiating your current mortgage agreement for a variety of reasons. Essentially, it allows you to pay off your existing loan and replace it with a new one that better suits your needs.

When done properly, mortgage refinancing can result in a host of great benefits to further your financial success.

Some reasons you might consider refinancing include but are not limited to, the following:

- You want to leverage large increases in property value

- You want to get equity out of the home for upgrades or renovations

- You are looking to consolidate your debt

- You have kids headed off to college

- You are going through a divorce

- You want a better interest rate

- You want to convert your mortgage from fixed to variable (or vice-versa)

Refinancing can not only help to reduce financial stress and help get you back on track for your financial future, but additional benefits include:

- Access a Lower Interest Rate: One reason to refinance your mortgage is to get a better interest rate. While a low-interest rate isn’t everything (you also want to consider your mortgage terms, penalties, etc.), there is no harm in looking around! As your dedicated mortgage professional, I have access to dozens of lenders and can shop the market for you to see if there is a better mortgage product to fit your needs!

- Consolidate Your Debt: There are many different types of debt from credit cards and lines of credit to school loans and mortgages. But, did you know that most types of consumer debt have much higher interest rates than those you would pay on a mortgage? Refinancing can free up cash to help you pay out these debts. While it may increase your mortgage, your overall payments could be far lower and would be a single payment versus multiple sources. Keep in mind, you need at least 20 percent equity in your home to qualify

- Modify Your Mortgage: Life is ever-changing and sometimes you need to pay off your mortgage faster or change your mortgage type. Maybe you came into some extra money and want to put it towards your mortgage, or maybe you are weary of the market and want to lock in at a fixed rate for security. It is always best to do this when your mortgage term is up but talk to a mortgage specialist about potential penalties if waiting is not possible.

- Utilize Your Home Equity: One of the biggest reasons to buy in the first place is to build up equity in your home. Consider your home equity as the difference between your property’s market value and the balance of your mortgage. If you need funds, you can refinance your mortgage to access up to 80% of your home’s appraised value in cash!

While refinancing can help you tap into 80% of your home value, it does come with a price. If you opt to refinance during your term, it is considered to be breaking your mortgage agreement and it could end up being quite costly. It is always best to wait until the end of the mortgage term before any refinancing is conducted, but make sure you’ve planned several months in advance so you have to time to weigh your options before you need to renew.

In addition, refinancing can prevent you from qualifying for default insurance which in turn can limit your lender choice. Lastly, you’ll be required to re-qualify under the current rates (including passing the ‘stress test’ again) to ensure you can carry the refinanced mortgage.

If you are stuck or wondering if mortgage refinancing is right for you, please don’t hesitate to reach out to me today! I would be happy to review your current mortgage, financial goals, and future plans to help determine the best solution to fit YOUR needs.

Written by:

Annette Hutcheon

Mortgage Agent

Neighbourhood Dominion Lending Centres

Email

Website

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Toronto Market Runs Hot In January

02/06/22

Prices in the City of Toronto jumped to new all-time highs in January as the real estate market continued to heat up.

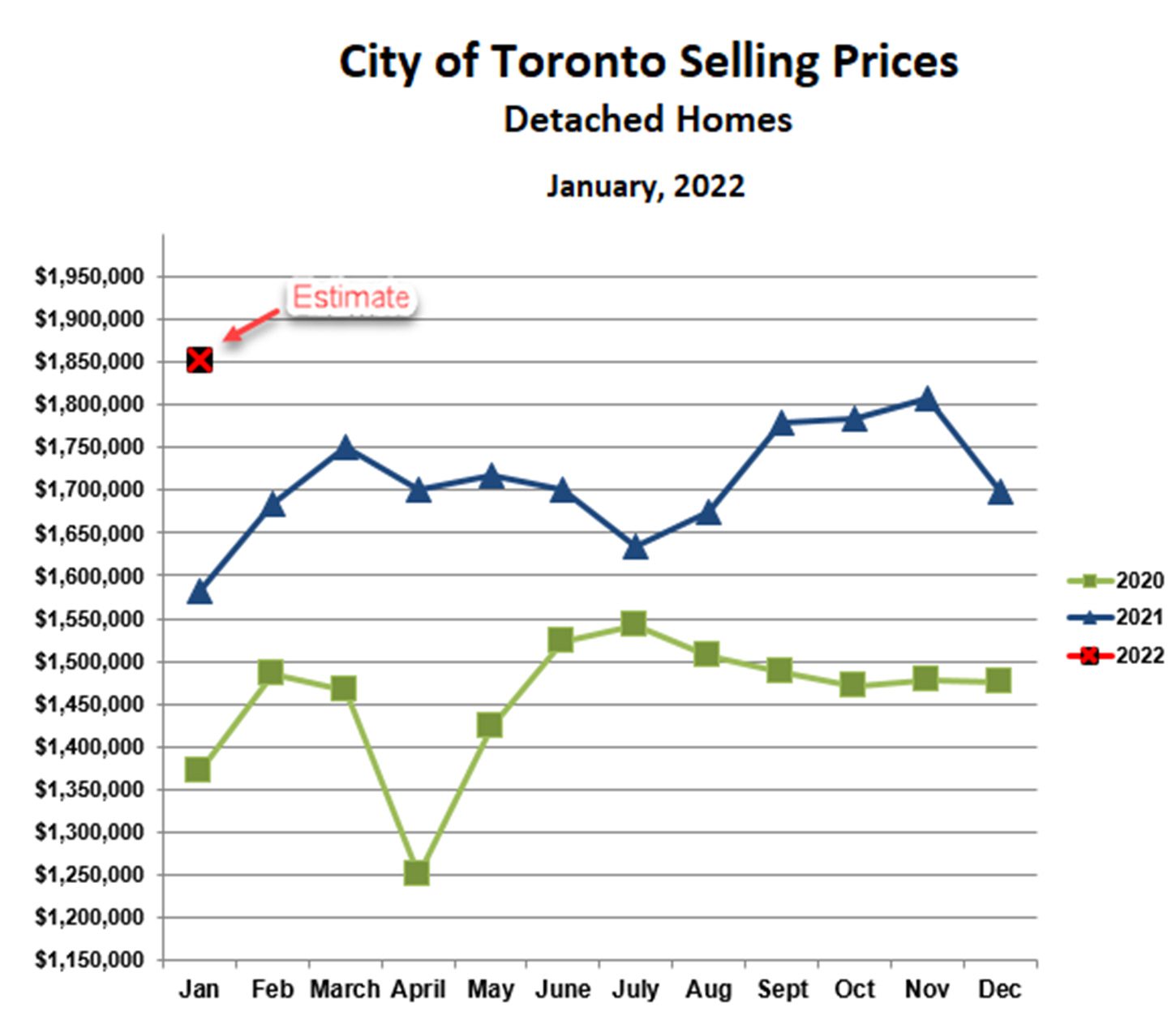

Detached Homes

The average price for detached homes in the City of Toronto was $1,886,413 in January, up 11% vs December, up 19% vs last January, and yet another all-time high. This pattern was echoed in all of the GTA regions surrounding Metro Toronto, with month-over-month increases ranging from 6% in York region to 12% in Durham region. As reported last month, the pandemic has driven average prices for detached homes above $1 million in all parts of the GTA.

For the first week of February, prices for detached homes are even higher, just over $2.1 million. So the momentum is continuing unabated, at least for now.

We saw a similar increase in the City of Toronto from December to January last year. The ‘spring fever’ in 2021 lasted about three months and then cooled off somewhat from April through August before igniting again in the fall.

An even more extreme example came 5 years ago, when prices took off in February through April of 2017, and then fell 20% over the following 4 months. As we recall vividly, this resulted in chaos. Many buyers who bought in the spring were unable to close because the value of the home had fallen and their lenders were only willing to finance the purchase based upon the new value. The sudden drop in prices in 2017 was, in large part, a result of government intervention. Startled by the rapid increase in home prices, the Ontario Government introduced, among other things, a 15% foreign buyer tax intended to curb speculation. They definitely succeeded in cooling the market. Be careful what you wish for.

The cooling of the market in the spring of 2021 was more organic, a natural rebalancing. Perhaps we will see something similar this year. Let’s hope the government doesn’t intervene this time.

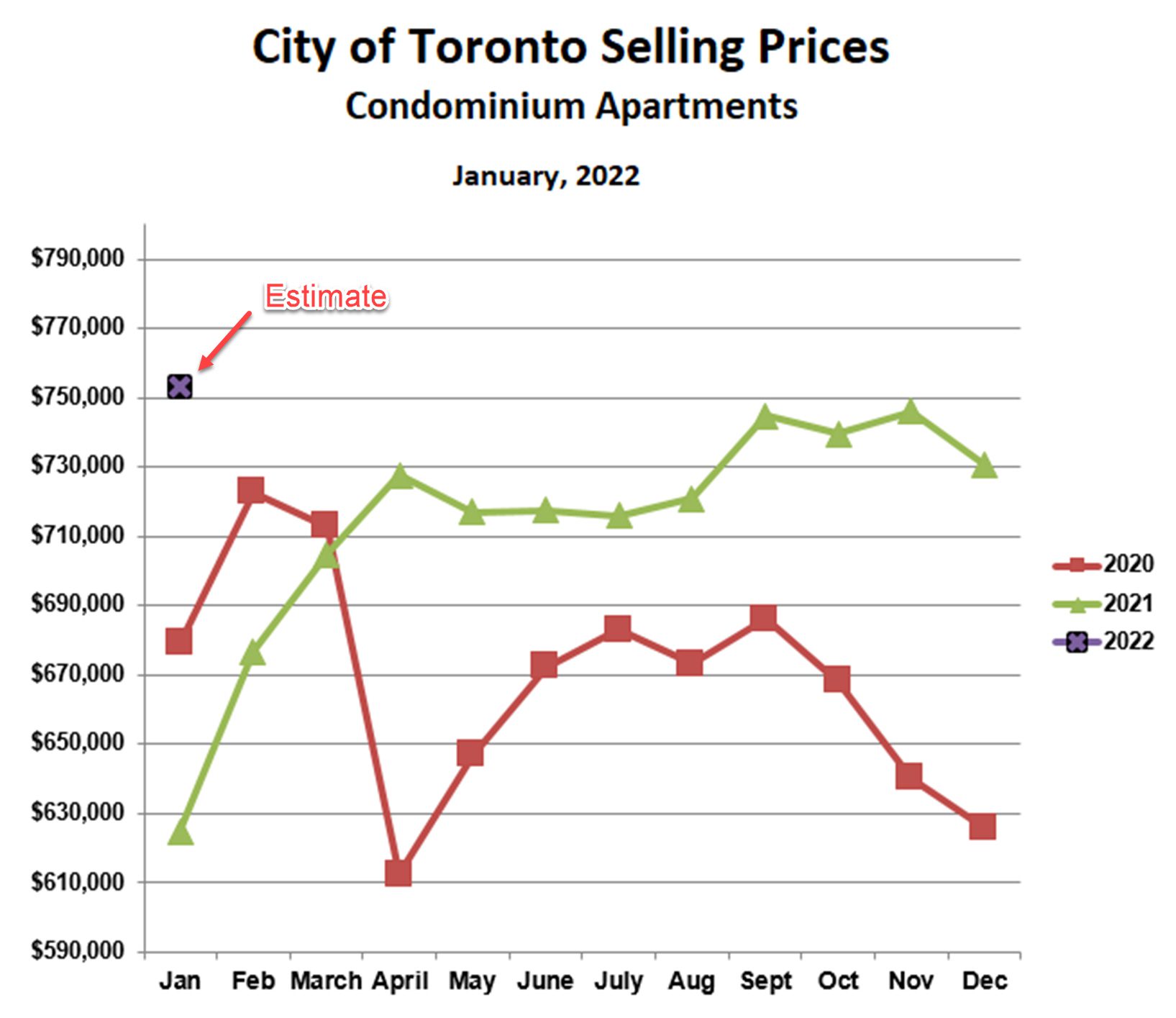

Condominium Apartments

As for detached homes, condo prices increased over the past month, and in the process set another all-time high. The average price for condo apartments in the City of Toronto in January was $760,643, 4% higher than December and 18% above last January. And the trend is continuing in early February, as for detached homes.

The seasonal pattern for condos last year was also similar to detached homes. Prices increased relentlessly until April, softened until late summer, then spiked again in the fall to new highs. This year’s early frenzy suggests we could see the same sort of pattern this year.

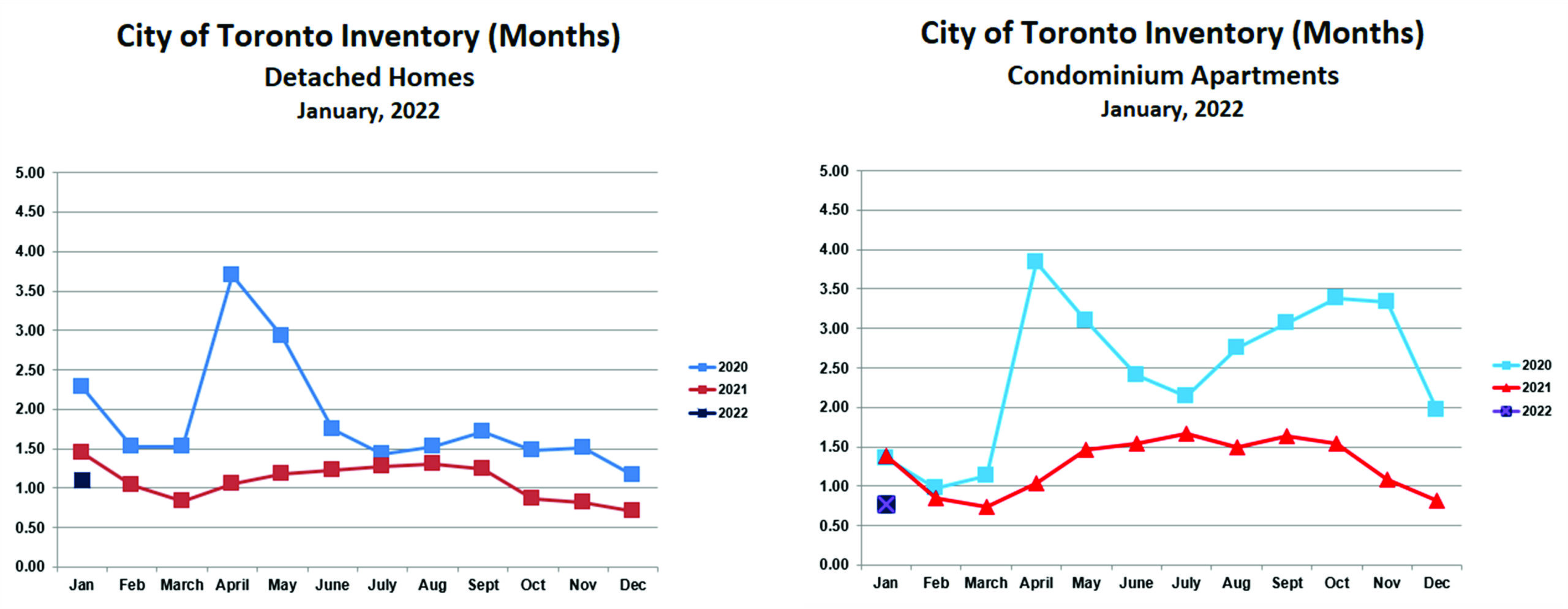

The Supply of Homes for Sale

One of the key factors driving the ups and downs in the market is the supply of homes for sale, also called inventory. We define inventory as the ratio of homes for sale to homes sold. For example, if 100 homes were sold last month, and there are 100 homes presently for sale, then it will take about one month for all of those homes to sell if no other homes come on the market. So the inventory is one month’s supply.

Inventory is both a cause and a result of the oscillations in the market. Basic supply and demand says that if inventory is low, buyers will compete for the limited supply. This will push prices upward, all else being equal.

The result part is a bit more subtle. When inventory is low, it is hard to buy and easy to sell. This encourages many move-up buyers to buy first before putting their homes up for sale. The majority of people selling are also buying, most of their homes won’t come on the market until they buy. This leads to a self-reinforcing pattern of ever-tightening inventory, leading to ever-higher prices.

The pattern breaks for at least three reasons. First, successful early buyers put their homes up for sale; second, many homeowners who have been thinking about selling see the rising prices and decide to accelerate their plans; and, third, buyer fatigue sets in after losing bidding wars over and over again, and the buyer pool shrinks. All three of these factors cause increased inventory and less price pressure.

The charts below show inventory for detached homes and condos in the City of Toronto over the past two years. For perspective, we consider 3 months’ supply to represent a balanced market, where neither buyers nor sellers have the upper hand.

Detached homes have been in a sellers’ market (under two months’ supply) for most of the past 24 months. The exception was in the spring of 2020, when the first lockdowns were imposed and it seemed the world was coming to an end. Late last year, inventory dipped below one month meaning, in effect, that homes were selling faster than they were coming on the market.

January inventory has improved to just over one month, though it’s too early to call this a trend.

Condos were much more volatile, spending much of 2020 in buyers’ market territory. Condo owners took advantage of work-from-homes to sell their condos and buy homes outside the city.

The condo market gained momentum in 2021, and inventory has dropped below one month for the past two months in a row.

Looking Ahead

As both prices and interest rates rise, many buyers will give up, either because of affordability or simply because they are discouraged. Others will shift (reluctantly) to condos.

Combined with the seasonal pattern discussed above, this suggests that the frenzy in the freehold (detached, semi-detached and attached) market will subside over the next 2-3 months. Prices will likely moderate and possibly decline somewhat. Barring government intervention, a ‘crash’ is very unlikely.

Condos will probably continue to be hot through the next few months. They will benefit from the “affordability shift” away from freehold properties.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Toronto Market Takes a (Very Brief) Christmas Break

01/20/22

Detached Homes

Prices for detached homes dipped by 6% in December as compared with November, though they were still 15% above the same time last year. This was despite a continued fall in inventory to just 0.7 month’s supply. Normally we’d expect such extremely low inventory to drive prices even higher, but I guess everyone was ready for a bit of a Christmas break. And a brief break it was: the market has come out of the gate very fast in January, with detached prices already an estimated 3% higher than the all-time high reached just 2 months ago. Buyers are out in force, with bidding wars rampant, and 15+ offers on homes commonplace. Most homes are selling for more than recent comparable sales would justify, and then these sales become the benchmark for the next round. So prices are ratcheting up very quickly.

This is a familiar pattern. We saw something similar early last year, with massive bidding wars early in the year, and then prices eased somewhat in the spring as the inventory of homes for sale gradually increased. We may be in for the same sort of experience this year, especially if mortgage interest rates increase as they are forecast to do.

Condo Apartments

Condo apartments followed a similar pattern, though not quite so extreme. December prices fell by 2% versus November, despite sub-one-month inventory in December but were still 17% ahead of last year. Prices are increasing sharply in just the first three weeks of January, similar to houses, and are already above the highs reached last fall.

For the first time since 2008, we are facing the prospect of rising interest rates. Already bond rates are creeping up, and this is impacting fixed mortgage rates. Variable mortgage rates remain very low, however, the Bank of Canada is indicating that they may increase the bank rate in the near future. If this happens, prime and variable rate increases will soon follow. We are greatly in debt, at government, corporate and individual levels, so it seems likely that the central banks will limit interest rate increases as much as possible. If inflation gets out of hand, however, this could prove difficult. This year promises to be quite volatile.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

The Pandemic in Perspective – Toronto Area Real Estate 2020-2021

01/10/22

The Beginning of the Pandemic

When the government first announced lockdowns in early 2020, the real estate market in Toronto shut down almost completely. Buyers, sellers, and real estate agents alike had no idea as to how or even whether to show properties or transact offers. “Virtual” became the order of the day, and agents encouraged buyers to make offers, sight unseen, based upon virtual tours. Sales plummeted and it seemed as if the entire market might grind to a halt.

Just one month later, however, the market bounced back strongly. Real estate agents worked out how to show properties safely, as masks, sanitizer, and minimal touching of surfaces became standardized. We banned in-person open houses and devised ways to conduct ‘virtual’ open houses. Also, we learned how to connect with our clients via Zoom, and to present offers online.

The Beginning of Work From Home

By late spring of 2020, the market was again booming. Prices and sales volumes recovered quickly, and then something else happened. The Covid restrictions had facilitated the rapid expansion of work-from-home, an idea that had been around for a while but had been resisted by many in corporate management. As more and more employees spent much of their working time in a home office, it dawned on them that this was a perfect opportunity to improve their quality of life. Without the need for a long daily commute to the city, they could buy a bigger house on a bigger lot in one of the surrounding areas, close enough for occasional commuting downtown. Thus began a sort of diaspora to the east (Durham region), west (Halton region), and north (York and Simcoe regions). The mass exodus has increased real estate prices much more quickly outside the City versus downtown.

Low Mortgage Rates Goose the Market

There was more, however. Mortgage interest rates have stayed extremely low throughout the pandemic, and this has provided jet fuel for buyers to enter the market or move up to a bigger home. Also, some homeowners hesitated to sell, uncomfortable with strangers coming into their homes and potentially spreading the virus. This led inexorably to a surge in demand combined with a contraction in supply which, unsurprisingly, has pushed up prices very quickly.

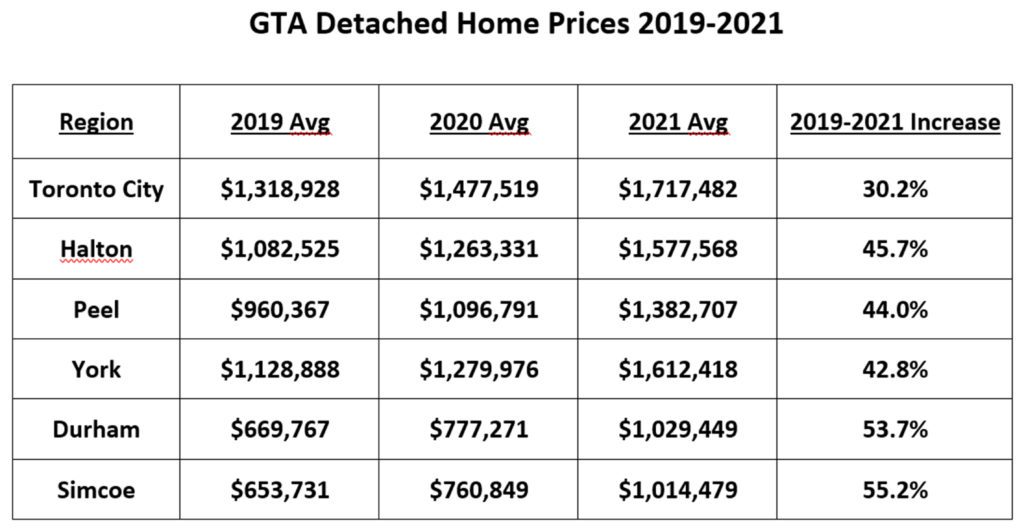

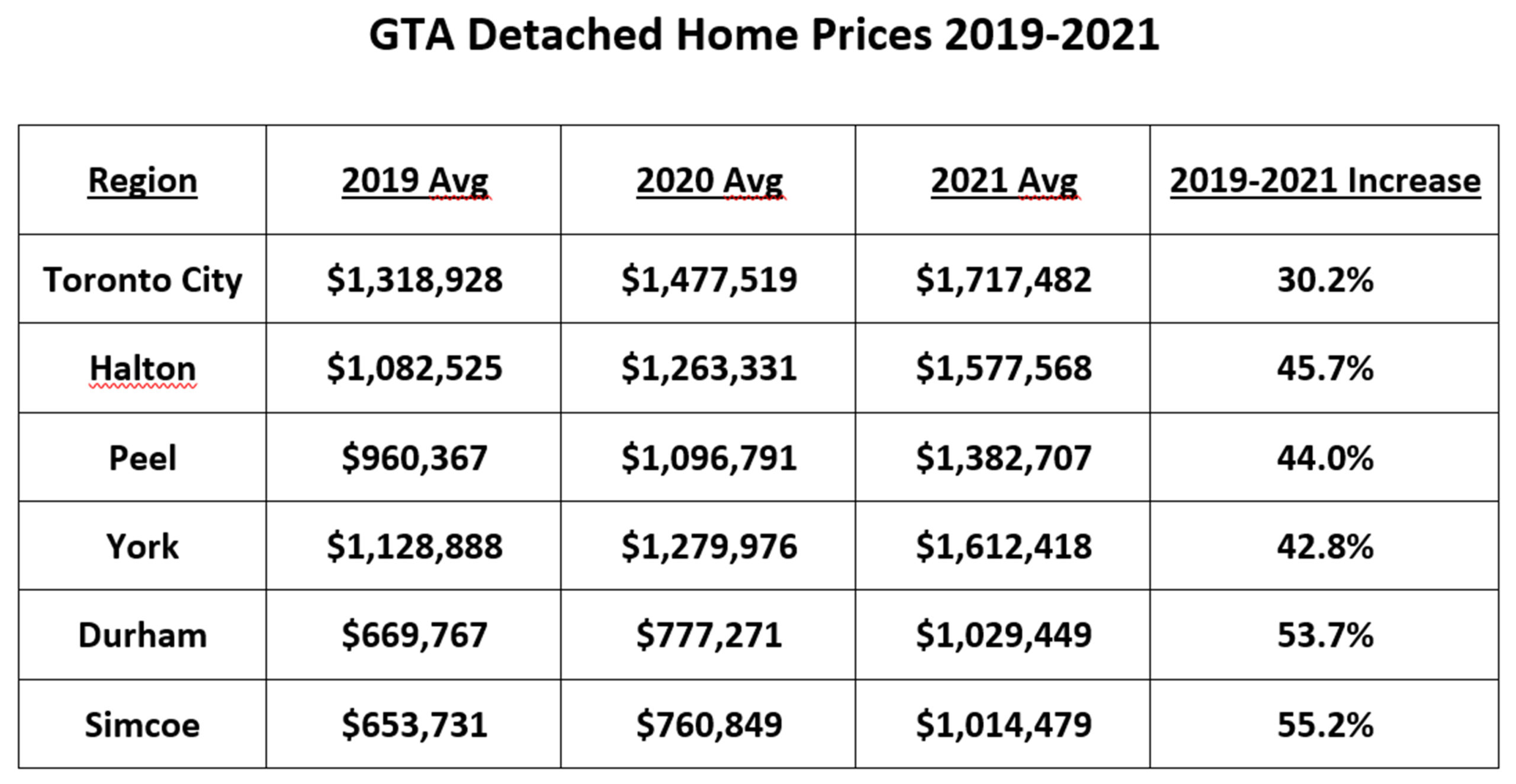

Prices for Detached Homes in the GTA

The chart below shows average prices for detached homes in the City of Toronto and surrounding areas:

Halton – Oakville, Burlington, Milton, Halton Hills

Peel – Mississauga, Brampton and Caledon

York – Richmond Hill, Markham, Aurora, Newmarket, Vaughan, King

Durham – Pickering, Ajax, Whitby, Oshawa

Simcoe – Innisfil, Bradford, New Tecumseth, Essa

These numbers are jaw-dropping, to say the least. The average price in the surrounding areas, over the past two years, has been almost 50%. Further, every one of these areas now has an average price of more than $1 million. The City of Toronto has also done well, but outside the City has done 60% better.

Nor is this the end of the story. All areas have also dramatically increased total sales over the past two years. The outside areas increased sales by an average of 38%, while City of Toronto sales went up by 23%. Once again, the outside areas were stronger but the City also did well.

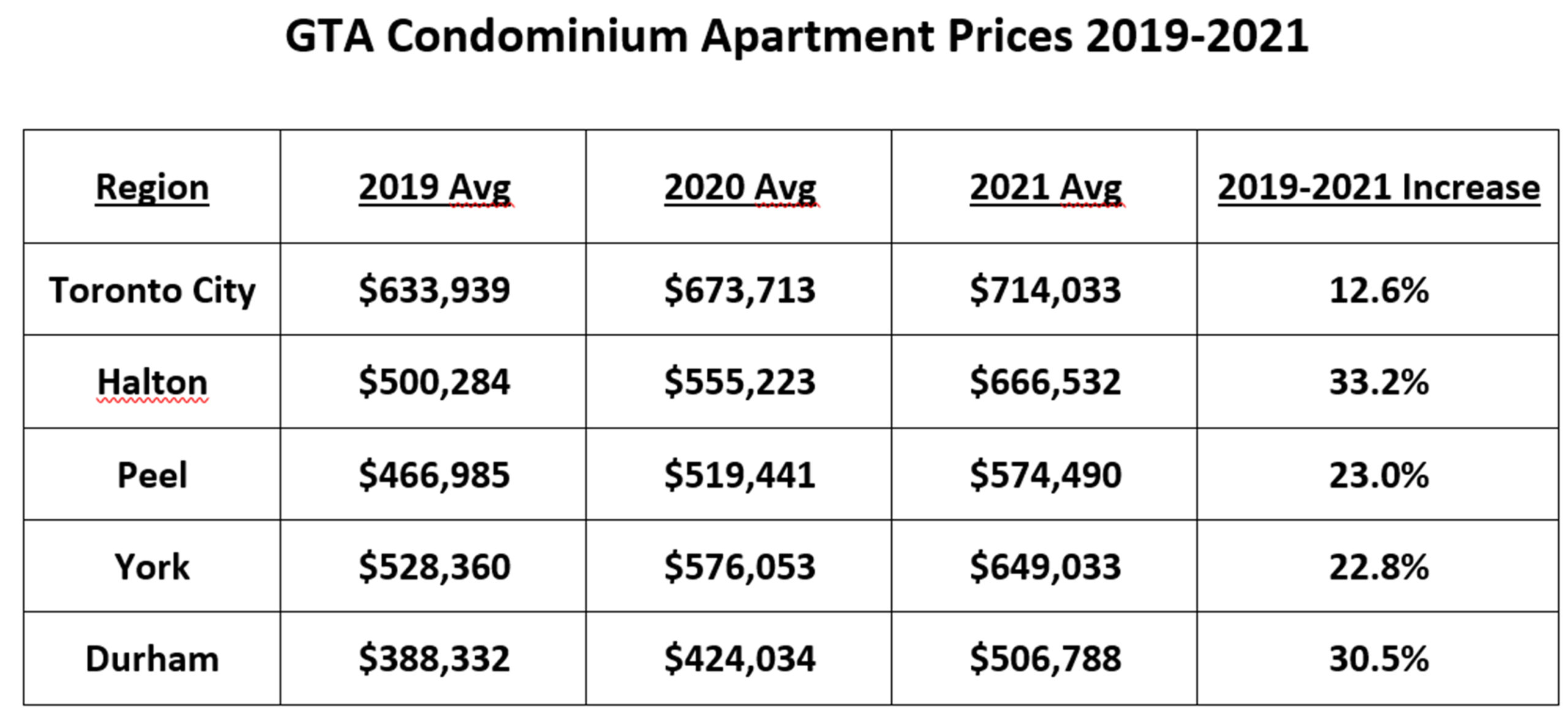

Prices for Condominium Apartments in the GTA

The story for condos is similar but dramatic in a different way. Prices for condos outside the City increased by an average of 28% over the past two years, while City of Toronto condo prices increased by “only” 13%.

Sales, on the other hand, increased by a whopping 48% on average outside the City, and by 41% inside the City.

The Bottom Line

The biggest price increases, for both detached homes and condos, happened in 2021, and there was a general acceleration of the price increases during the latter half of last year. Will we see a continuation of the trend this year? Or will higher interest rates, as are being generally forecast, finally put a damper on the market? 2022 will be interesting, to say the least.

The Pandemic in Perspective - Toronto Area Real Estate 2020-2021

Prices and sales for both detached homes and condominium apartments have increased dramatically during the Pandemic