Author: Dave Proulx

Title Insurance – What It Is And Why You Need It

09/06/21

What Is Title Insurance?

For most of us, our home is our single biggest purchase. You have legal ownership of the property when the title to your home is registered on the government’s land registration system. Just because the title title to your home is registered, however, that doesn’t automatically guarantee that have clear and unencumbered ownership.

When you bought your home, your lawyer performed several checks and searches to determine whether the title was ‘clear’. Sometimes, however, things get missed either because the lawyer missed them or because the information wasn’t available. These can include:

- No survey available;

- Encroachment issues (e.g., part of your neighbour’s garage is on your property);

- Existing liens against the property (e.g., the previous owner had unpaid utility bills or property taxes);

- Unregistered easements or rights-of-way; or

- Unknown title defects or other title issues that may affect your ability to sell, mortgage or rent your home in the future.

Title insurance is an insurance policy that protects you against losses related to problems like these. There is a one-time fee (premium) based on the value of the property and the title insurance company you choose. You purchase the policy through your lawyer and the fee is generally a few hundred dollars.

The title insurance policy remains in effect as long as you own the home. It will cover losses up to the maximum set out in the policy and may also cover most legal expenses.

Is Title Insurance Required?

It is not mandatory to purchase title insurance in Ontario. However, most lenders require title insurance and so, if you need a mortgage, you will probably need title insurance. If you own a home and do not presently have title insurance, you can purchase it at any time.

What If There Is No Survey?

Before there was title insurance, lenders required an up-to-date survey of the property to approve mortgage financing. In the City of Toronto, however, an up-to-date survey is a rare commodity, and so the buyer or seller was forced to pay for a survey for the deal to close. Fortunately, most lenders accept title insurance as an alternative to a survey.

What Does A Title Insurance Policy Cover

In addition to the survey coverage described above, your title insurance policy can provide:

- Comprehensive insurance coverage against losses related to the property’s title;

- Coverage for your lawyer’s negligence or errors related to title risks;

- Coverage for most legal expenses involved in defending the title; and

- Money savings, as fewer checks need to be done by your lawyer. These savings can often be as much or more than the cost of the insurance premium.

What Is Not Covered By Title Insurance

Title insurance policies may have certain exclusions and exceptions that you need to be aware of. For example, your policy might not cover:

- Title defects that you knew about before you purchased the home;

- Environmental issues such as soil contamination;

- Native land claims;

- Problems that could only be uncovered by a new survey (i.e., no ‘survey clause’);

- Unrecorded liens and encroachments; and

- Zoning bylaw violations that you are responsible for creating.

You should review your title insurance policy carefully to ensure that you understand any such exclusions or exceptions.

What About Title Fraud?

Title fraud happens when a fraudster uses stolen or forged information to transfer title of your home The crook then mortgages the home and takes off with the money. If you are a title fraud victim, you may be able to receive compensation through the government’s Land Titles Assurance Fund – click here for more information.

Bottom line — you should definitely purchase title insurance for your home whether you need to or not!

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

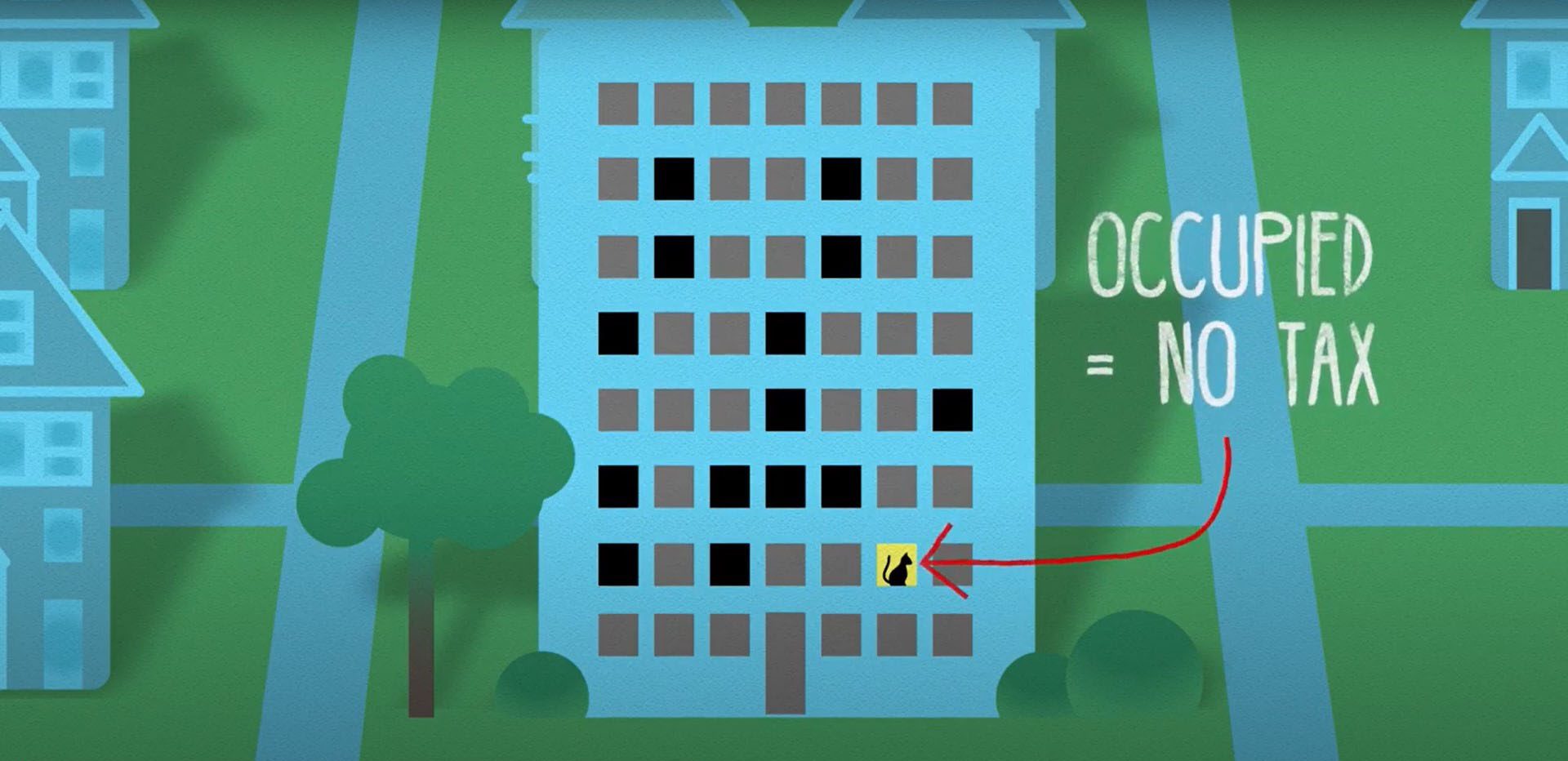

Vacant Property Tax Is Coming To Toronto

08/09/21

The City of Toronto plans to implement a vacant home tax effective January 1, 2022. Here’s how it will work:

- 2022 will be the ‘reference year’ for determining the vacancy status of the property.

- Starting in 2023, property owners will have to declare the vacancy status of their properties during the previous year.

- If the property was vacant in 2022, a tax of 1% of the assessed value will be assessed. For example, if the assessed value is $1,000,000, the tax will be $10,000. This tax rate is 64% higher than the property tax, which is 0.611% in 2021 for single-family homes!

There will be exemptions from the tax. For example, properties being renovated, properties owned by ‘snowbirds’, and properties where the homeowner passes away or is in medical care will not be considered vacant. The tax will be payable on properties that are unoccupied for more than six months or for which an exemption applies. A bylaw to be implemented later this year will spell out the details.

Vancouver Vacant Property Tax

Vancouver implemented a similar tax in 2017. The vacant property tax rate in Vancouver is currently 1.5% and will be increased to 3% in 2022 (payable in 2023 on properties vacant in 2022). So the Toronto tax is a bargain!

Federal Vacant Property Tax

The federal government is also implementing a 1% vacant property tax, effective January 1, 2022. This tax will apply to non-resident owners only. Non-residents thinking about purchasing a property in Toronto will potentially be subject to both a 15% tax on purchase as well as a 2%/year tax if they don’t rent the property for at least 6 months each year.

Ontario Vacant Property Tax?

Even our provincial government wants a vacant property tax. If this happens will it be in addition to the Toronto tax? Talk about piling on!

What Will The Vacant Property Tax(es) Accomplish?

The stated intention is to encourage owners to make vacant properties available for rent or for sale. This would improve the supply of both rental and resale properties.

The limited supply of resale homes has been one factor feeding the rapid increase in prices this year. Increased supply should slow the rate of price appreciation.

The limited supply of rental housing was a serious issue pre-Covid. While this hasn’t been the case for the past 16 months, the tight rental market will probably return once Covid is behind us.

Let us not forget the law of unintended consequences, however. This law states that intervention in complex systems can result in unexpected and often undesirable outcomes. For example, the implementation of the foreign buyers’ tax in early 2017 (part of the 16-point Ontario Fair Housing Plan), caused a very rapid 20% crash in house prices. Four years later, prices have finally returned to 2017 levels. Obviously, the framers of the plan did not desire or anticipate such a violent reaction. Why did it happen? The most credible theory is that buyers and sellers expected that the legislation would cause prices to fall. Buyers, therefore, held off on purchasing while sellers rushed in to sell before prices fell. This caused an overnight shift from an extreme sellers’ market with insane bidding wars to an extreme buyers’ market with too many listings. The market went into freefall.

Fast forward to 2021 and the impending vacant property tax(es). What could go wrong?

First of all, let’s consider that there may be good reasons why an owner would not want to rent out their vacant property. After all, why not enjoy the extra income? For owners like these, the vacant tax might lead the owner to sell rather than rent. Second, investors may well anticipate that the tax will reduce the value of income properties (not an unreasonable assumption). This could encourage them to cash in rather than continue to rent.

The vacant tax might therefore cause a large price correction (a la 2017) while tightening the supply of rental properties. I submit that the government doesn’t expect or desire either of these outcomes.

Time will tell how this will actually play out.

Toronto vacant tax coming in 2022. Owners will pay 1% in 2023 on properties that were vacant in 2022.

Toronto will implement a 1% vacant home tax in 2022. The tax will be paid in 2023 on homes that were vacant in 2022.

Toronto Market Takes A Summer Break

08/07/21

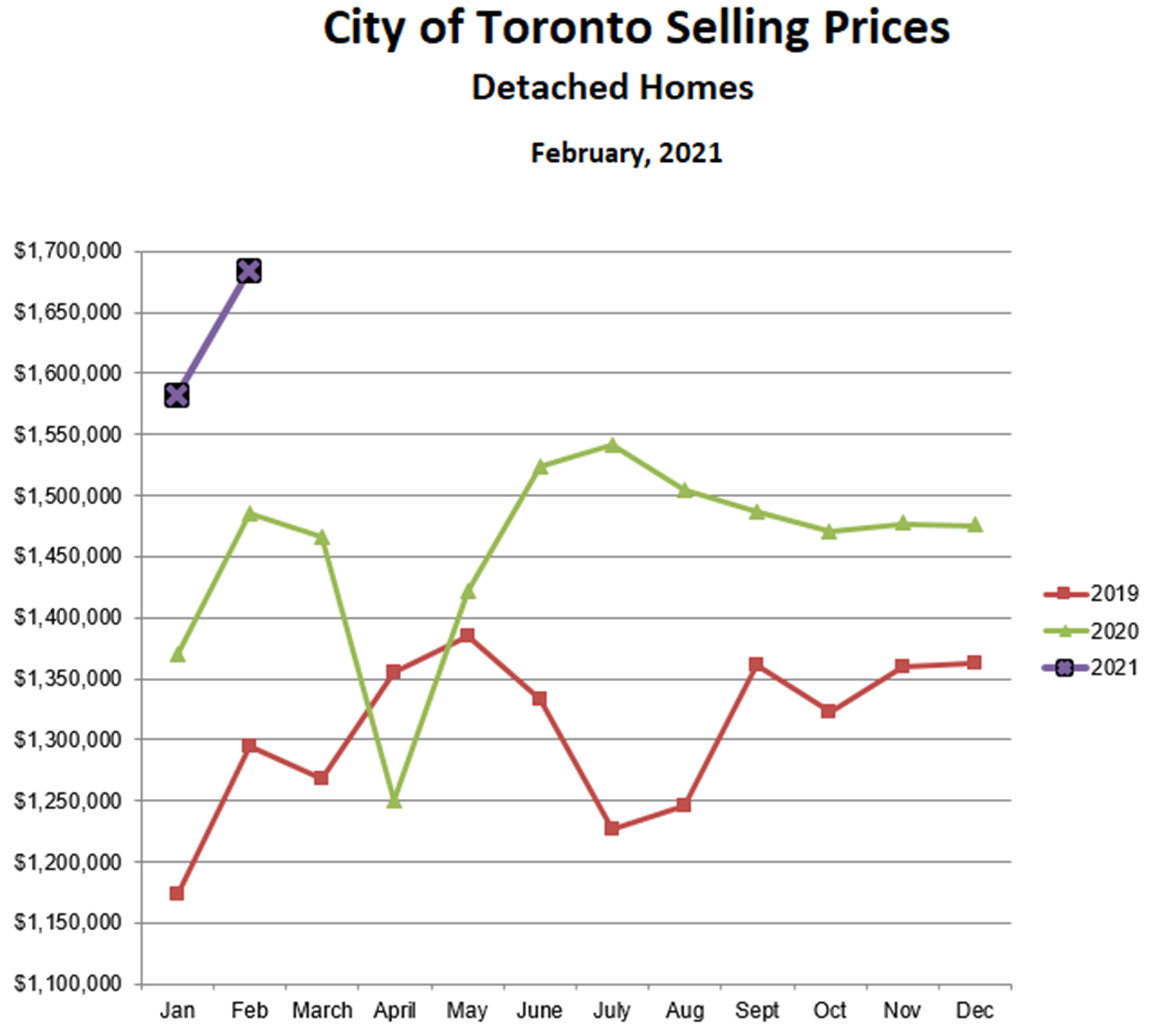

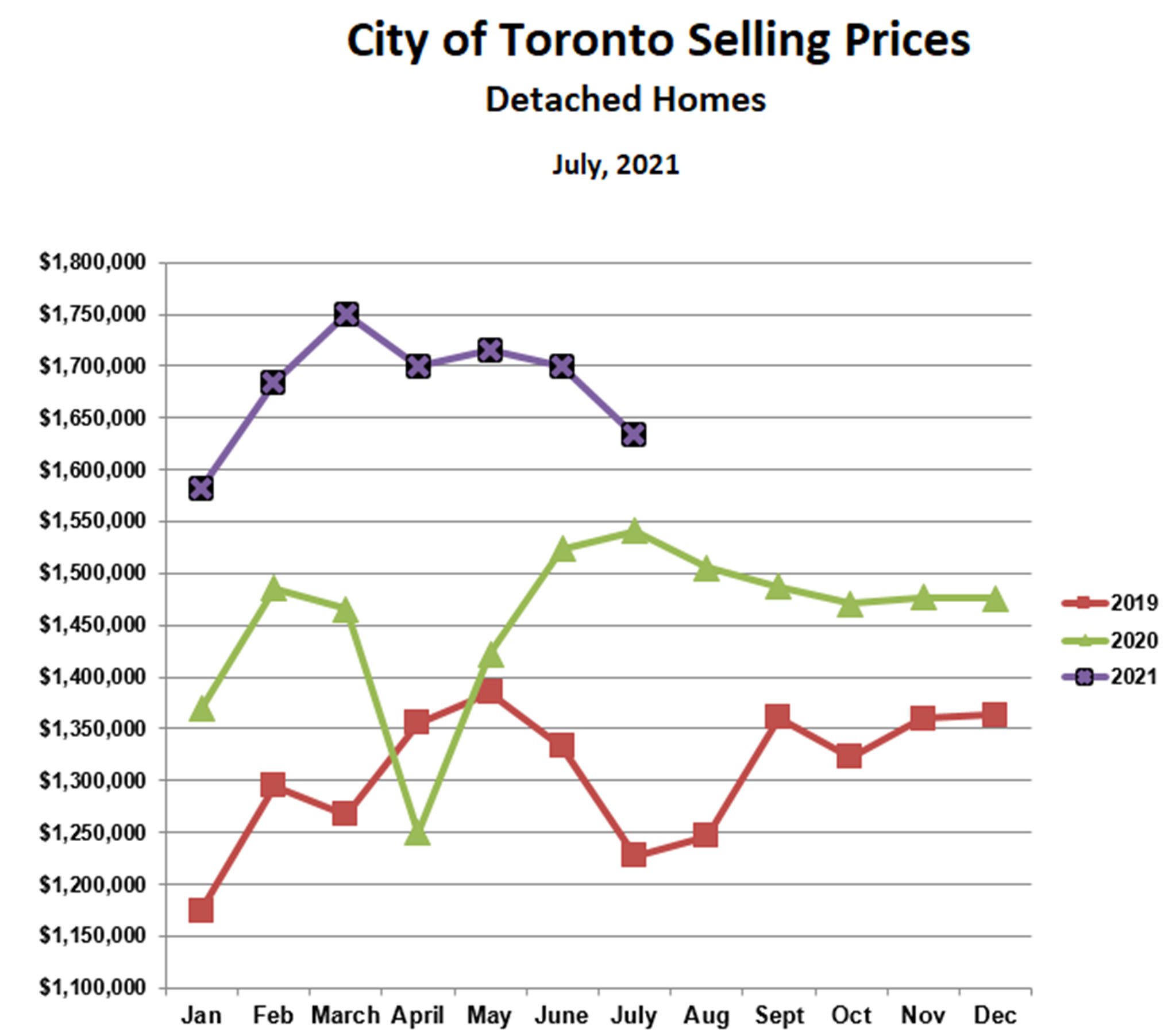

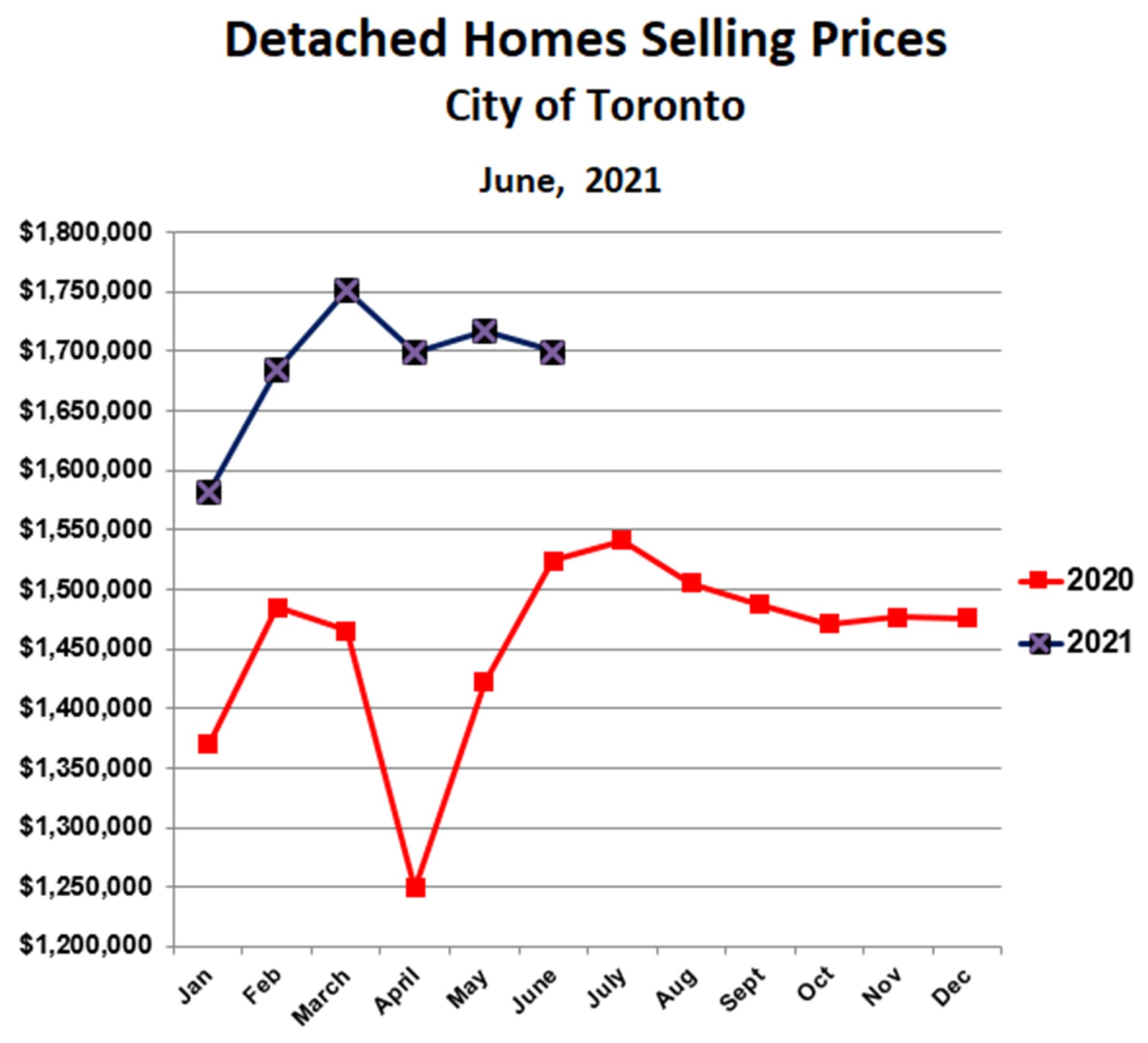

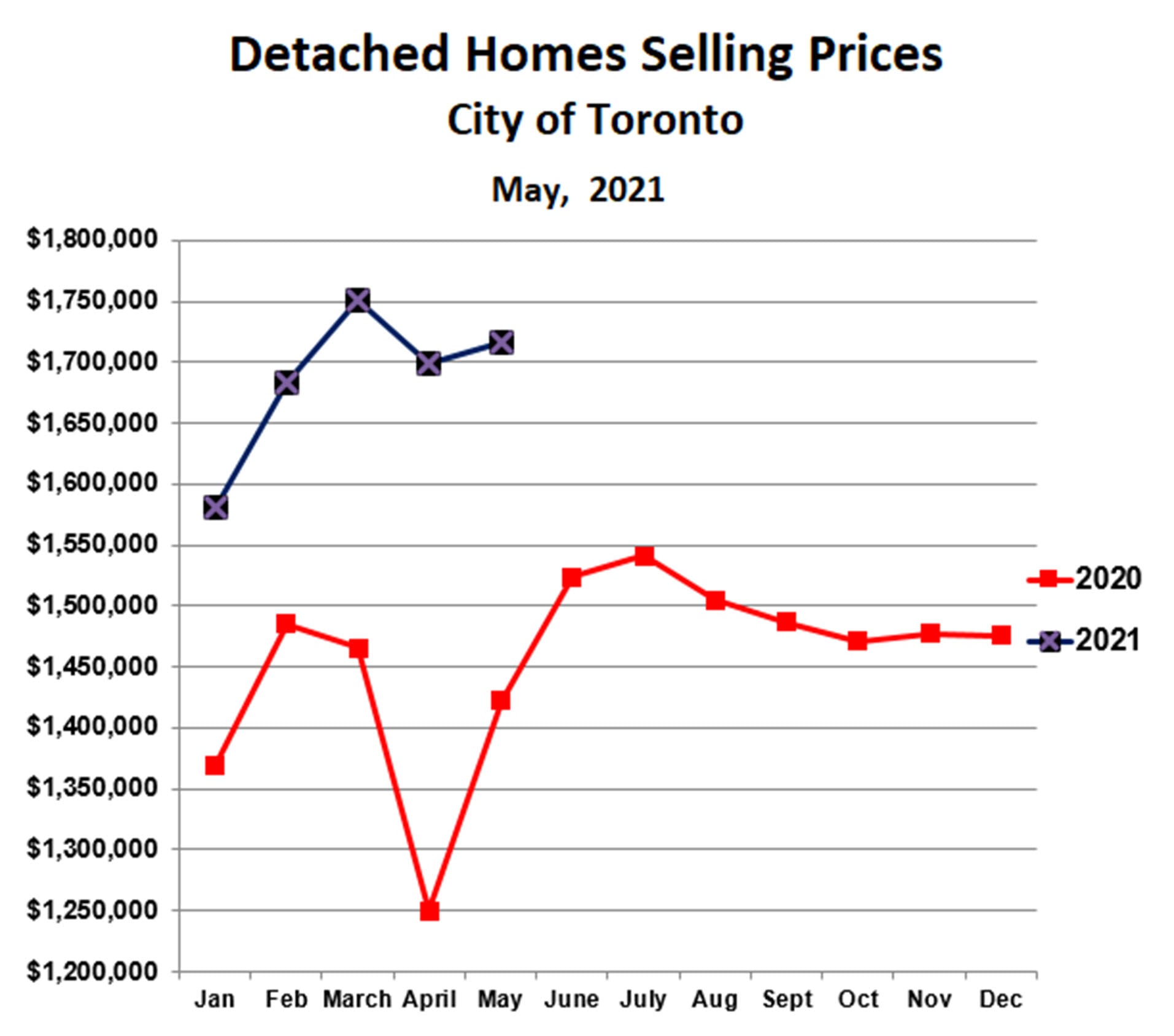

Detached Homes

The Toronto market is experiencing a summer slowdown. Prices for detached homes in the City of Toronto fell 4% in July, from $1,699,881 to $1,633,649. A summer slowdown is normal, as both buyers and sellers take a break from real estate to enjoy the warm weather. The break is more exaggerated this year. It coincides with the loosening of Covid restrictions and a greater-than-normal desire to get away from the city. For perspective, prices are still 6% higher than the 2021 peak, and 3% higher than the ‘bubble peak’ in 2017.

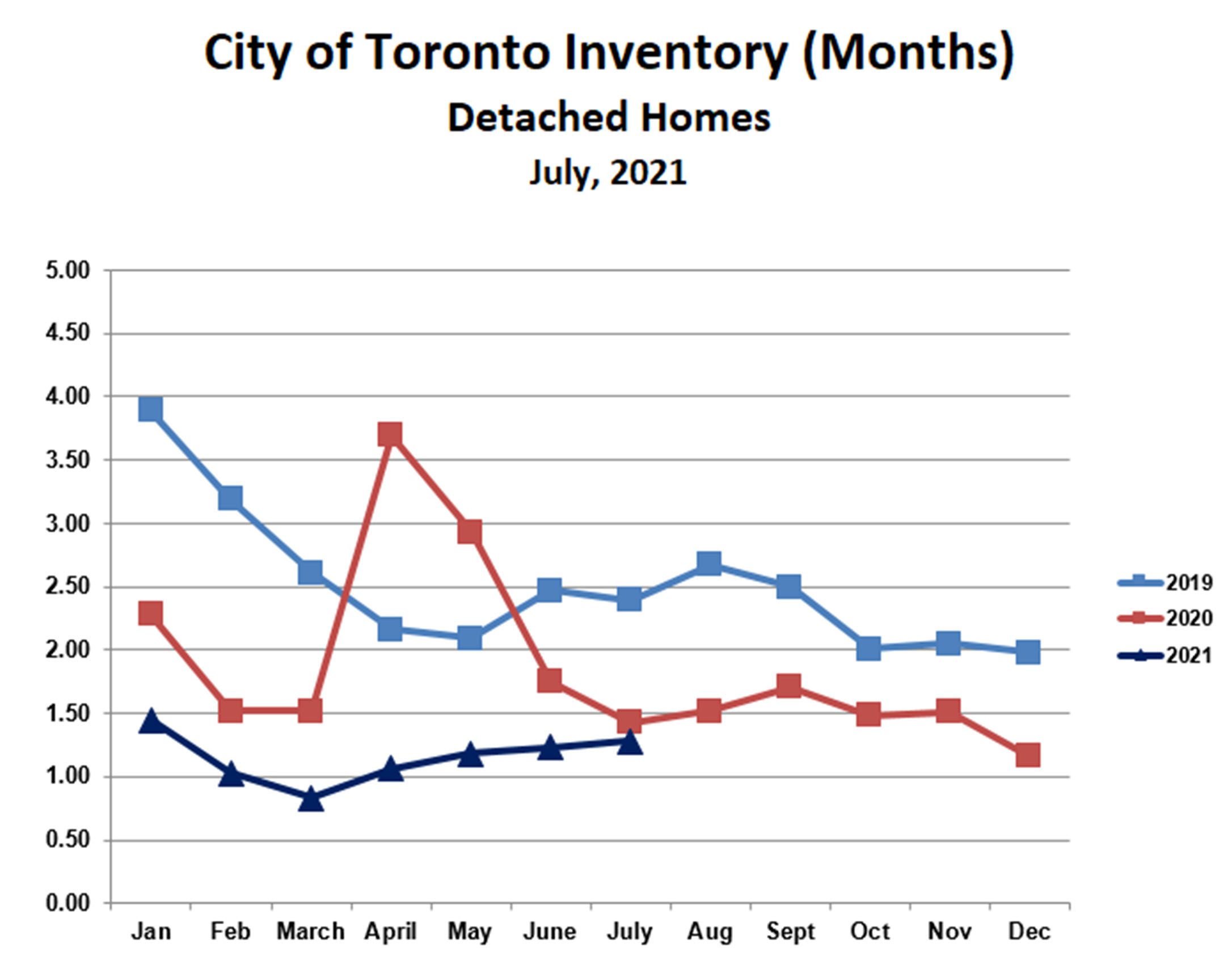

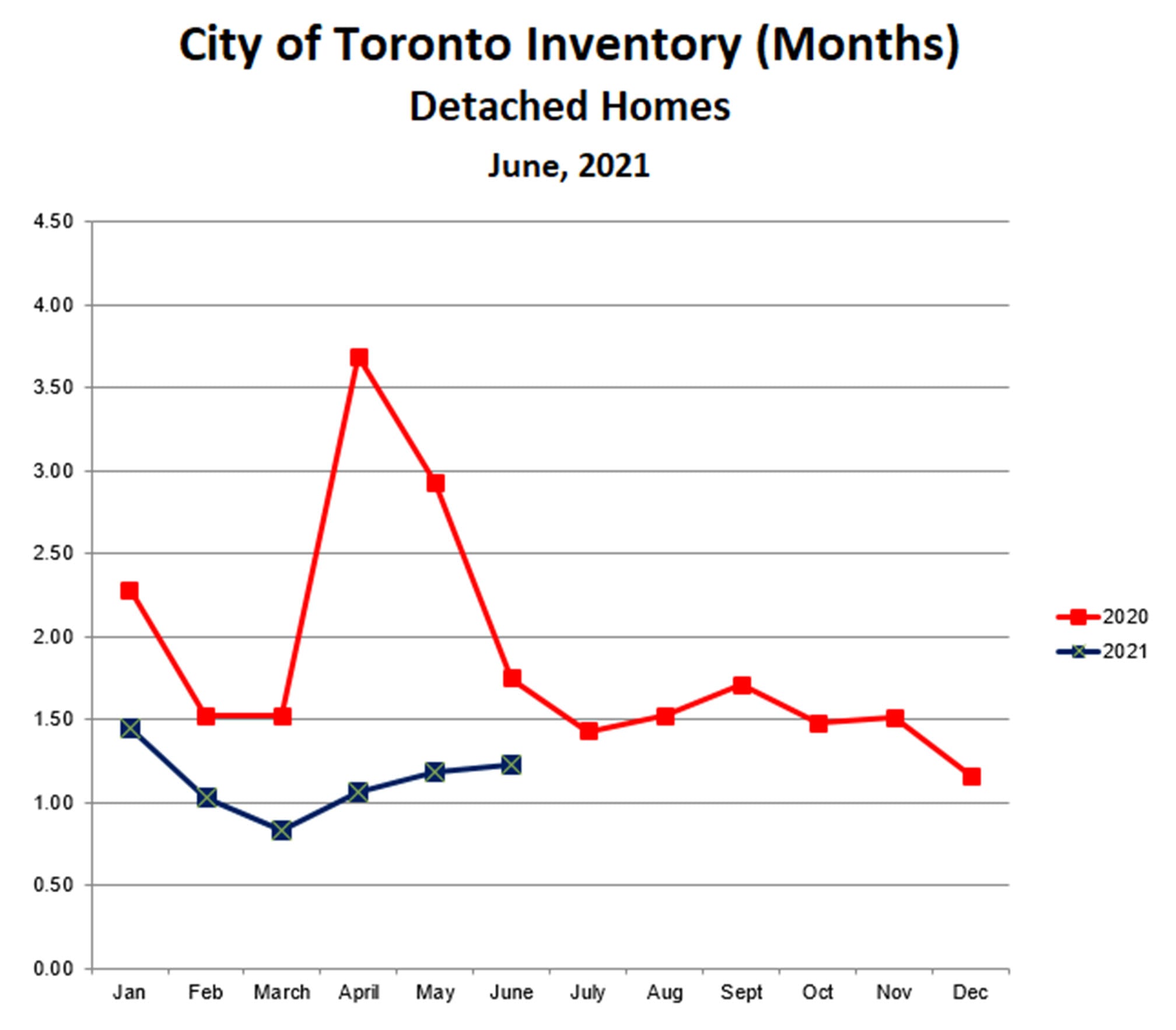

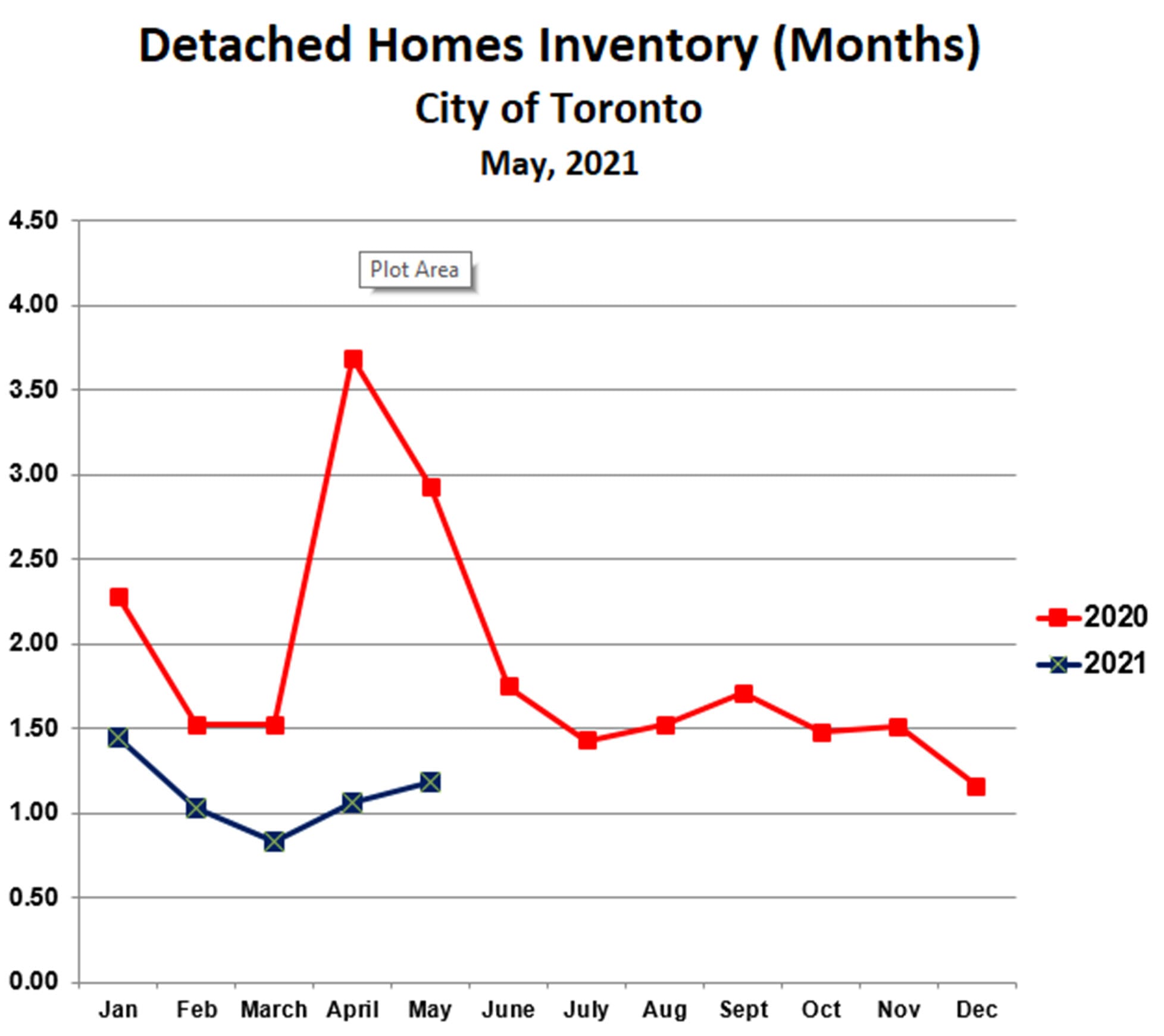

In July, sales of detached homes were down by 37% from the spring months, and active listings were down by 20%. The inventory of homes for sale was, therefore, higher — but still under 1 1/2 months’ supply and still deep in seller’s market territory. With fewer buyers, bidding wars were less frequent and price adjustments were more common. Many of those price adjustments were upward, following unsuccessful attempts to elicit multiple bids via underpricing.

The Toronto market for houses will probably remain slow through August and then pick up once buyers return from the summer break in September. Prices will likely increase in the fall, though perhaps not as high as the spring.

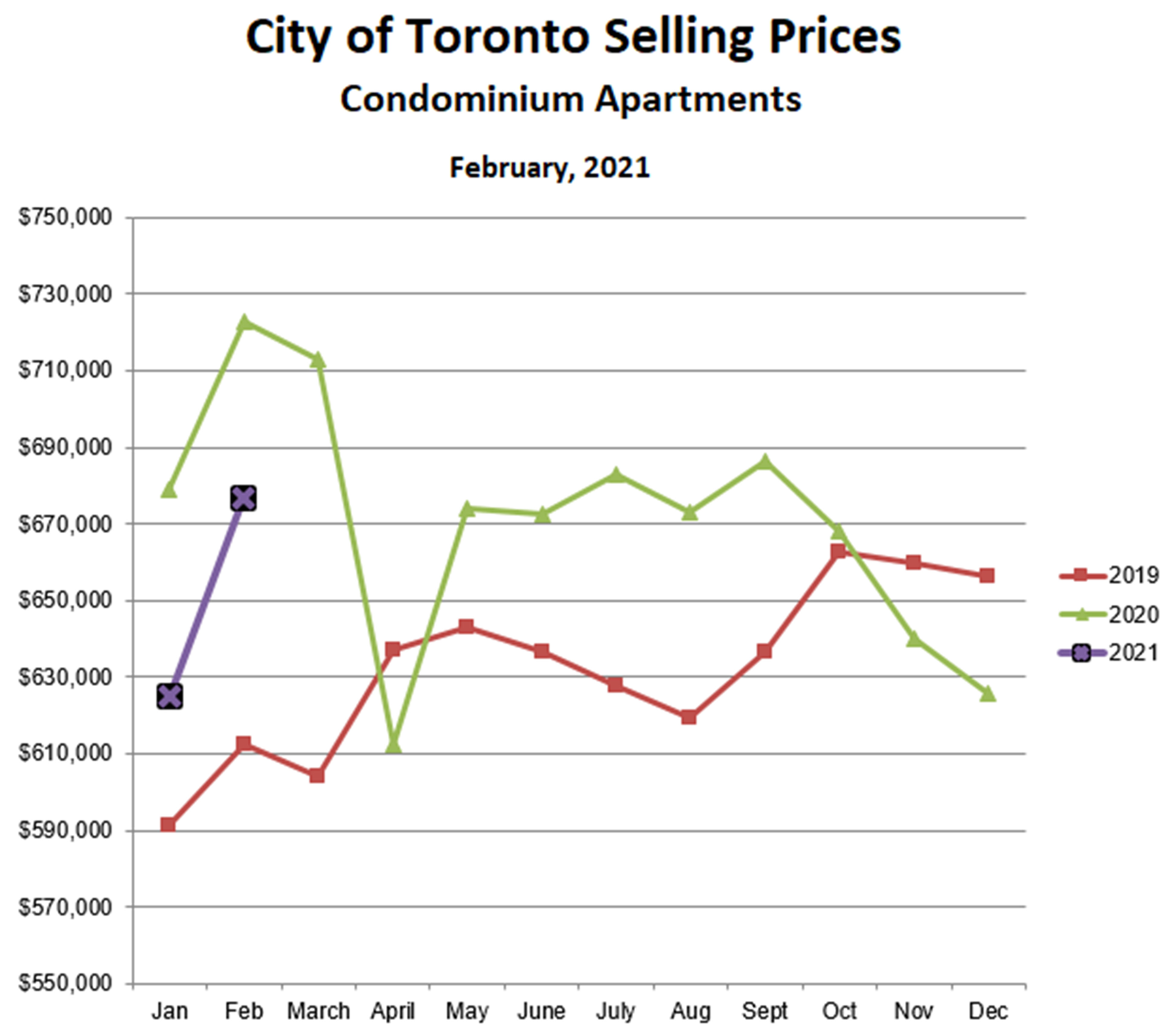

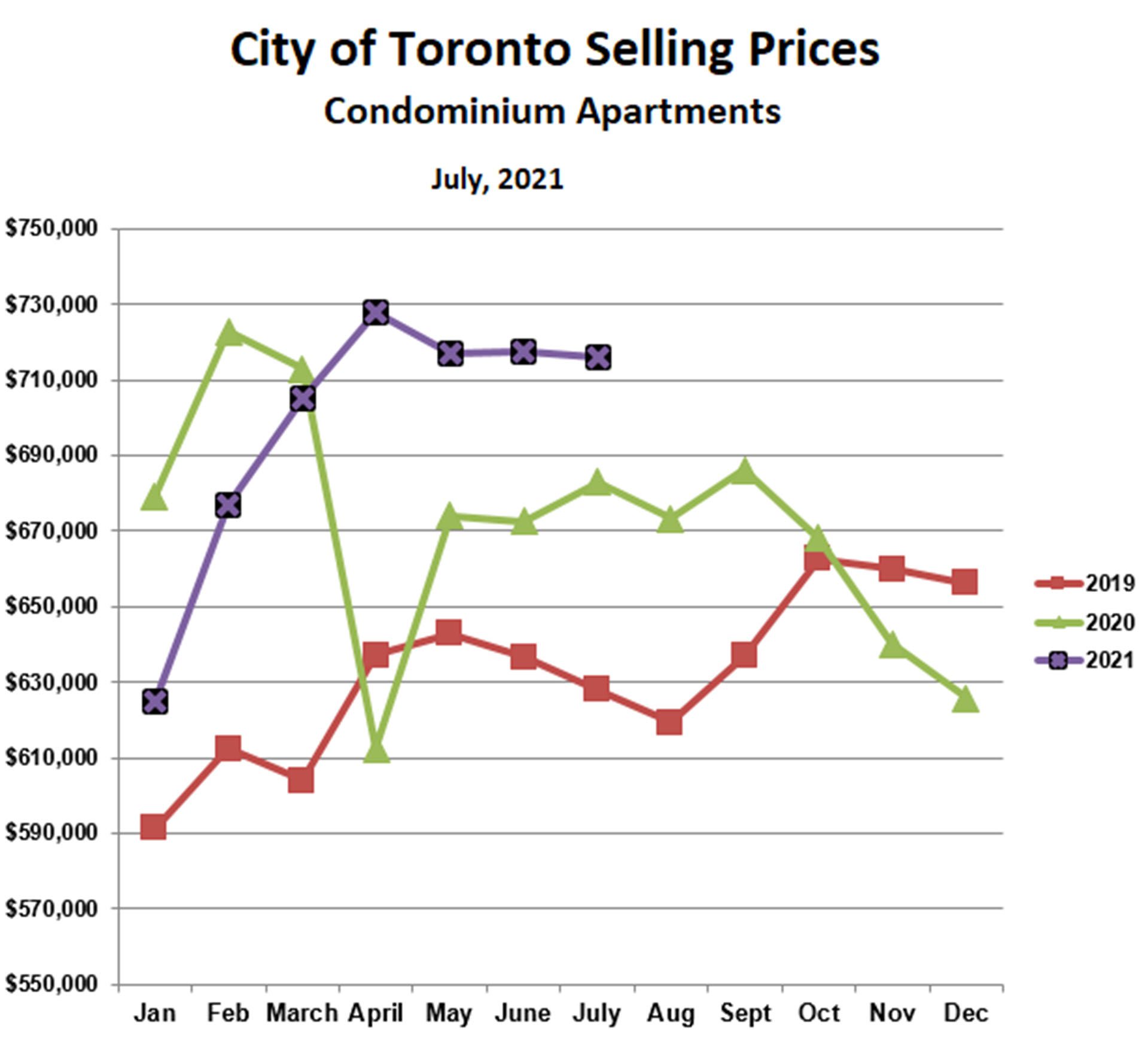

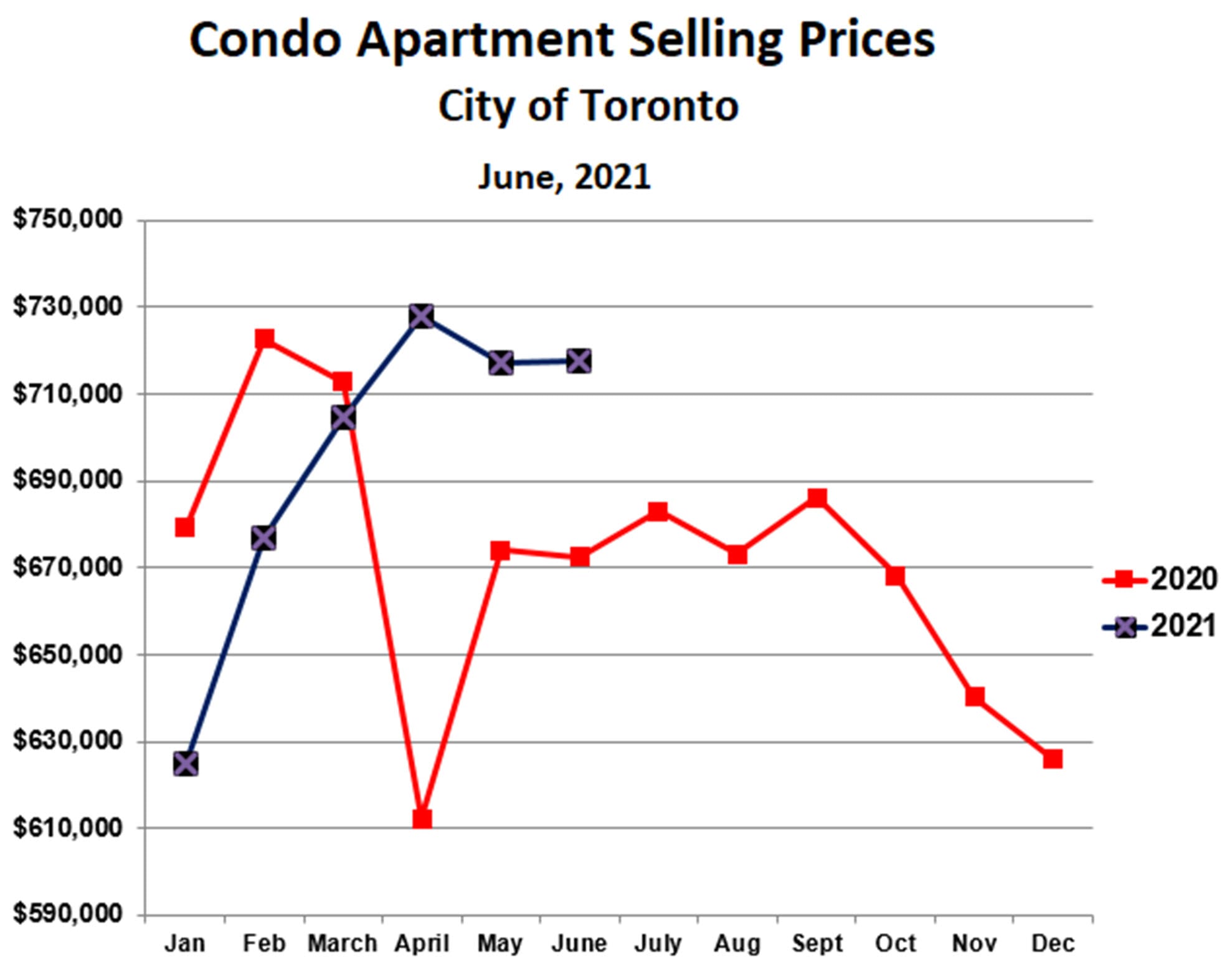

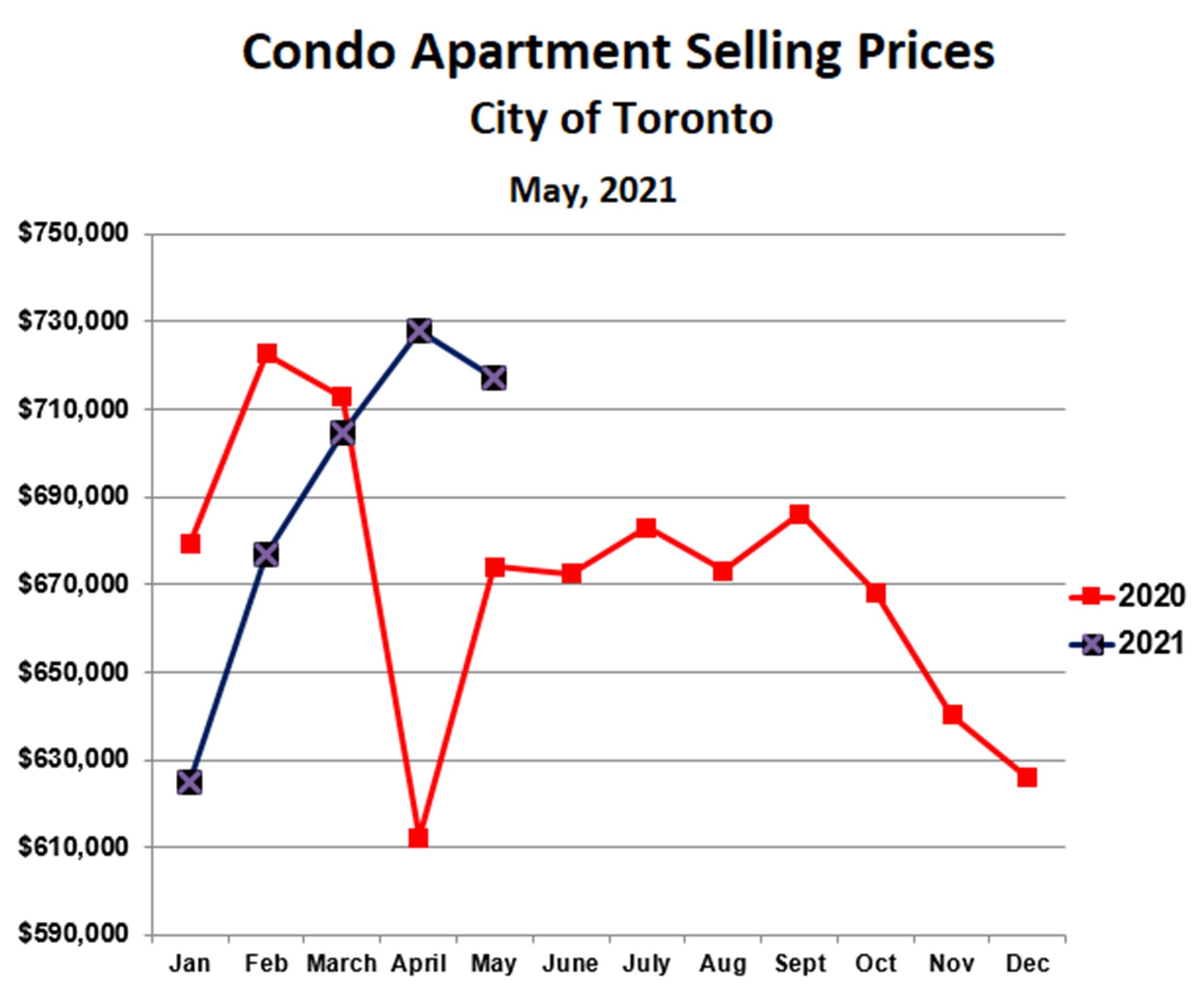

Condominium Apartments

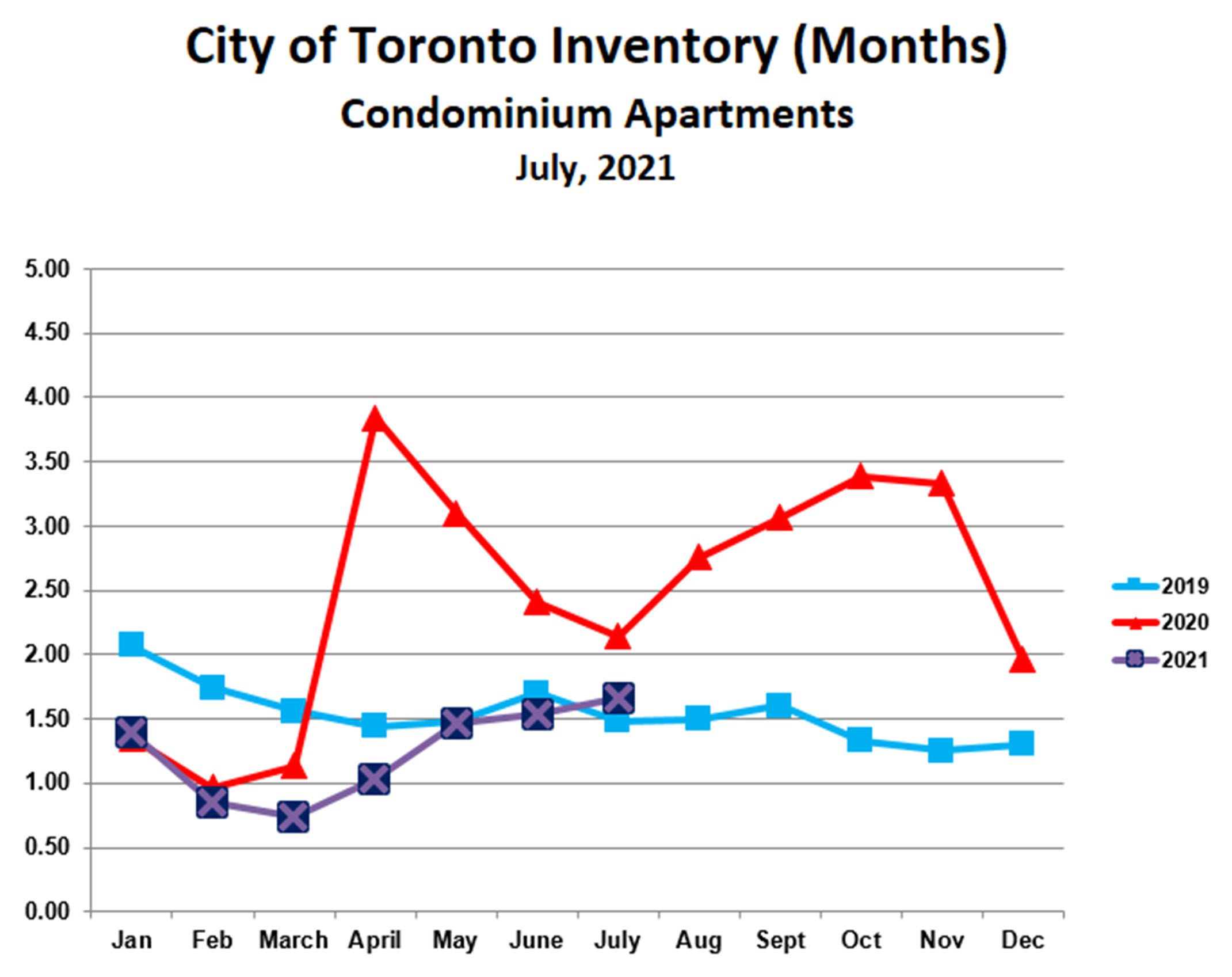

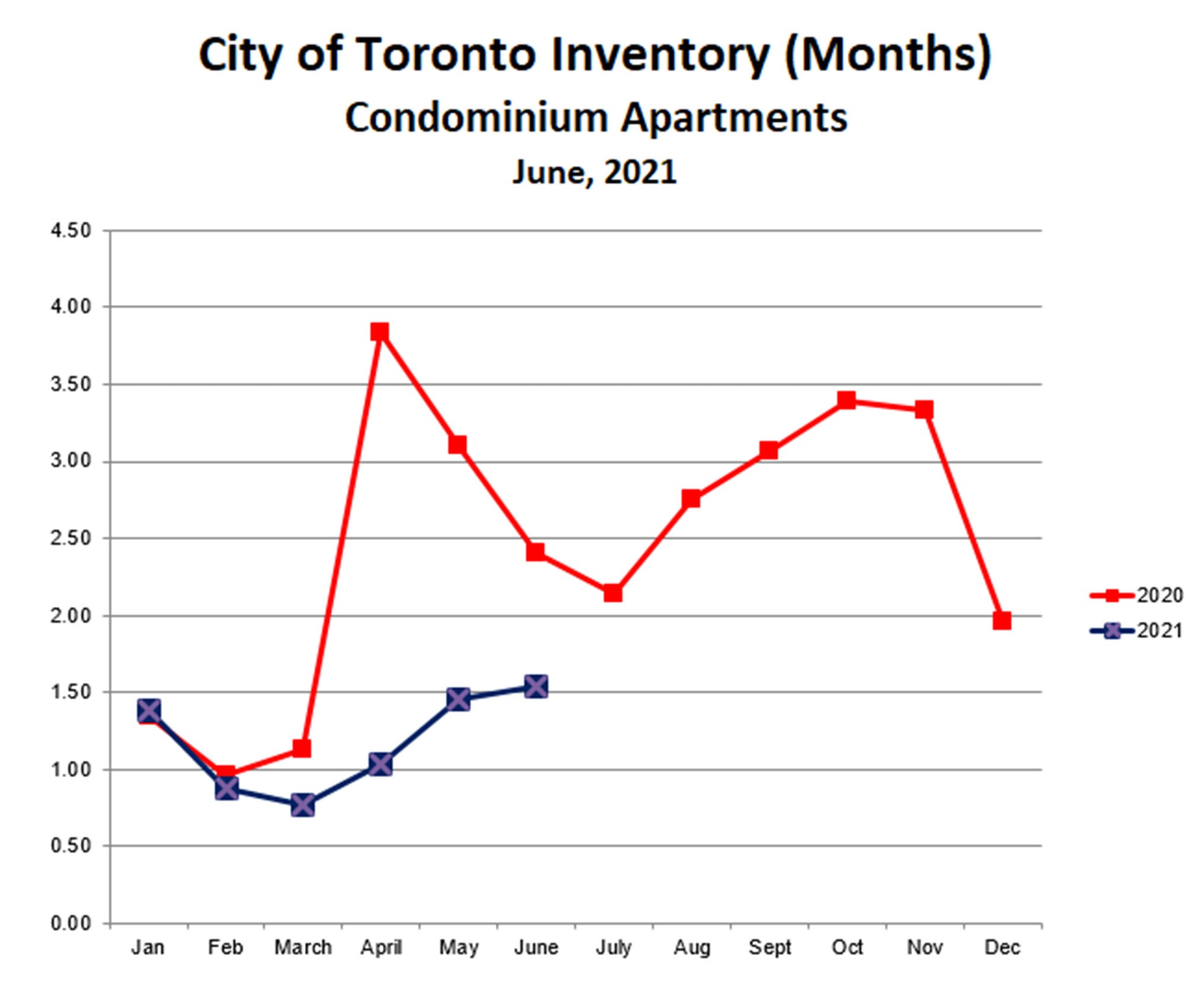

The condo market in the City of Toronto has shown more resilience than the market for detached homes. Prices in July were almost the same as in May & June, and only 1.6% below the all-time high reached four months ago.

Sales and active listings for condos were lower in July than they were in the spring, but not as much as for detached homes. Sales were down by 22% and listings by 11%. The inventory of condos for sale was thus higher than June, but still under 2 months’ supply. Condos, like houses, are still in a seller’s market.

As for detached homes, I expect that the slower market will continue for condos in August. Prices may dip a little next month but should rebound in September. Covid easing is likely helping first-time buyers disproportionately, as they were hardest hit by lockdowns. This could explain, in part, why condo prices have held up better. Also, this points to a strong market for condos in the fall. Always assuming, of course, that another Covid wave doesn’t cause renewed business restrictions.

Toronto Market Takes A Summer Break

Prices for detached homes in the City of Toronto fell 4% in July, while condo prices were steady.

Still A Seller’s Market In Toronto

07/09/21

The Toronto market continued to moderate in June. However, inventory remains very low and sellers are still firmly in control.

Detached Homes

The average price for detached homes in the City of Toronto slipped by a slim 1%, from $1,716,272 in May to $1,699,881 in June. Detached prices have been in a narrow range, from $1.68 million to $1.75 million, for the past four months. Furthermore, prices remain far above last year.

It appears that home prices may have peaked in March. Nevertheless, prices are unlikely to fall significantly any time soon. On the contrary, while the inventory of homes for sale crept up slightly in June, it is still extremely low at just over one month’s supply. This is very deep in seller’s market territory.

Condo Apartments

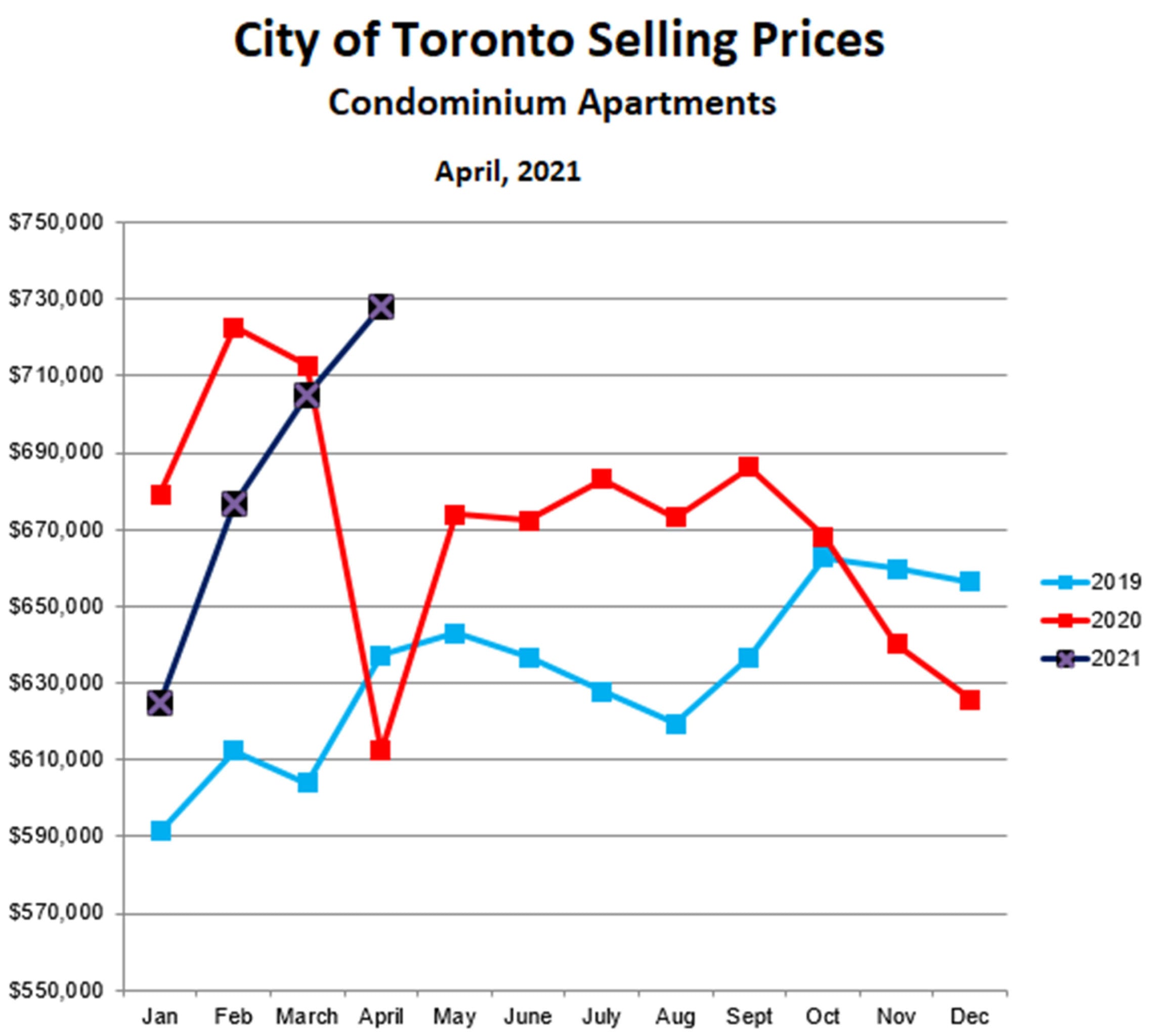

Condo apartments are following a similar pattern. Prices played catch-up for the first four months of this year, following a steep decline in Q4 2020. However, prices peaked in April and have been relatively flat since then. Prices for condo apartments in the City of Toronto were almost exactly the same in June ($717,476) as they were in May ($716,976).

The inventory of condos for sale remains very low at about 1.5 months’ supply. This is slightly higher than for detached homes, but still deep in seller’s market territory. As for detached homes, condo prices aren’t likely to fall any time soon.

Prognosis

Historically, summer has always been a slower time, as many buyers and sellers take time off from real estate to enjoy our relatively short warm weather season. This summer could be even more so, as Covid restrictions are being lifted and freedom is being restored. Even so, prices won’t necessarily fall. The important thing is the balance between buyers and sellers: if both flee the city in similar numbers, the market will be ‘thinner’ but not weaker.

What is already changing, though, is the prevalence and virulence of bidding wars. We experienced what can only be described as a crazy buying frenzy early this year. Now, the frenzy has passed, and we have ‘only’ a solid sellers’ market. Back in March, virtually every home that came on the market sold in a week or less, and bully offers were rampant. Most received many offers and the selling price was often several hundred thousand dollars above the asking price. This was a game that both buyers and sellers understood well, as the asking price was known to be far below the ‘nominal’ of the home. The eventual selling price was often higher than this nominal value (causing prices to ratchet upward), but not that much higher.

Now, however, the game is changing. Buyers are no longer lining up to submit multiple bids for every new listing. Instead, more and more homes are failing to sell on their ‘offer dates’. Sellers must then adjust their asking prices upward to more closely reflect the ‘true’ value of their home. Most of these home eventually sell for close to this value, however, it’s an awkward process. Buyers, of course, are taking notice. They are becoming more reluctant to bid aggressively on each new listing that comes along.

Sellers need to accept that we’re not in March any more and to adjust their expectations accordingly. Pricing strategies must be re-assessed. In many cases sellers should adopt the more ‘conventional’ approach of pricing at value without an offer date (gasp!). Prices won’t necessarily fall, the market will simply be more calm and orderly. In my view this will be a welcome change.

Looking beyond the summer, volume and prices may surge again in the fall. As the government continues to ease Covid restrictions, the borders could be re-opened to immigration. This will increase the demand for both resale and rental properties. With no significant increase in supply in sight, another frenzied resale market may emerge. An increase in immigration could also enable a recovery in the beaten-down rental market. All depending on the virus and the political reactions to it, of course.

Still A Sellers' Market In Toronto

The Toronto market continued to moderate in June. However, inventory remains very low and sellers are still firmly in control.

Summer Celebration Free Ice Cream!

07/07/21

Our ice cream truck is coming back on July 17 with free ice cream for all!

Just like last year, the truck will be visiting 5 parks in the High Park, Junction, Bloor West Village and Swansea neighbourhoods:

12:00-12:45 –> Vine Park – Junction (Vine & McMurry)

1:00-1:45 –> Lithuania Park – High Park (Glenlake & Oakmount)

2:00-2:45 –> Ravina Park – High Park (Clendenan & Glendonwynne)

3:00-3:45 –> Beresford Park – Bloor West Village (Beresford & Ardagh)

4:00-5:00 –> Rennie Park – Swansea (Rennie Terrace & Waller)

Birthday Panda will make a special guest appearance at each stop.

Come & join us on July 17 to enjoy the cool treats and warm weather!

Along with the free ice cream, the Smith Proulx team is holding a draw for neighbours & friends in support of local businesses. Enter the draw for a chance to win one of four $100 gift cards from these local businesses:

Two ways to enter the draw:

- Click on this link and fill in the entry form; or

- Submit full name, address, email and phone number to info@smithproulx.ca or call/text 416-826-4787

Draw entries must be submitted by 8 pm on Monday July 19. The draw will be held July 21 on Facebook Live.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Toronto Market Cools Ever So Slightly

06/06/21

The strong sellers’ market in Toronto continued for both houses and condos in May, though there are early signs of cooling.

For houses in the City of Toronto, there were 1,255 sales as compared with 1,322 in April, and the number of active listings increased from 1,398 to 1,479. The inventory of houses for sale thus increased from 1.1 to 1.2 months, still extremely low. The average selling price for houses went up slightly, from $1,699,756 to $1,716,272. Overall, then, the market for houses remained steady in May, with a small tilt toward higher inventory.

For perspective, sales of houses in May were higher than any month in 2020, and the average selling price remains within spitting distance of the all-time high of $1,750,518 reached two months ago. So we remain in a very strong sellers’ market, notwithstanding these early signs of cooling.

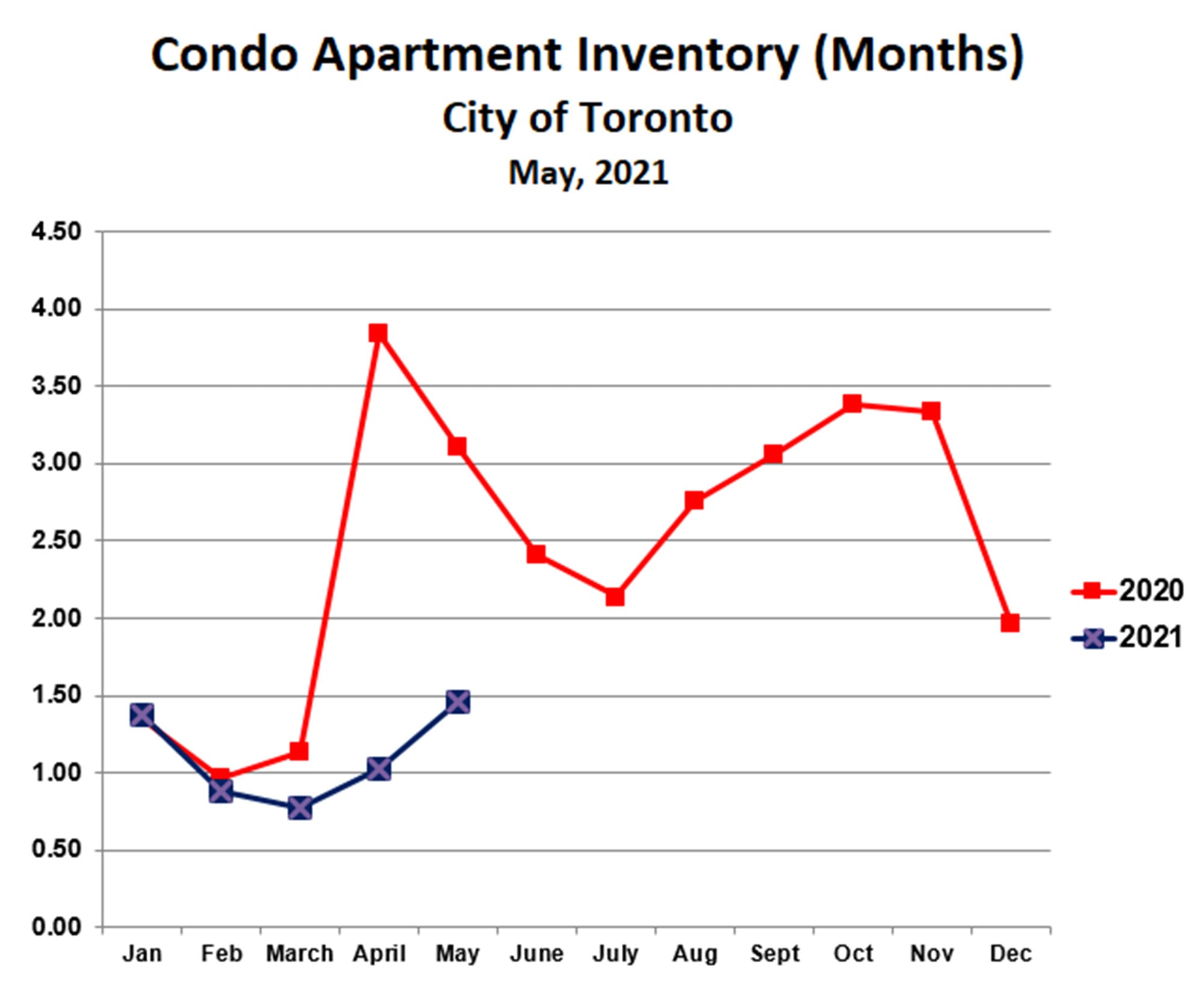

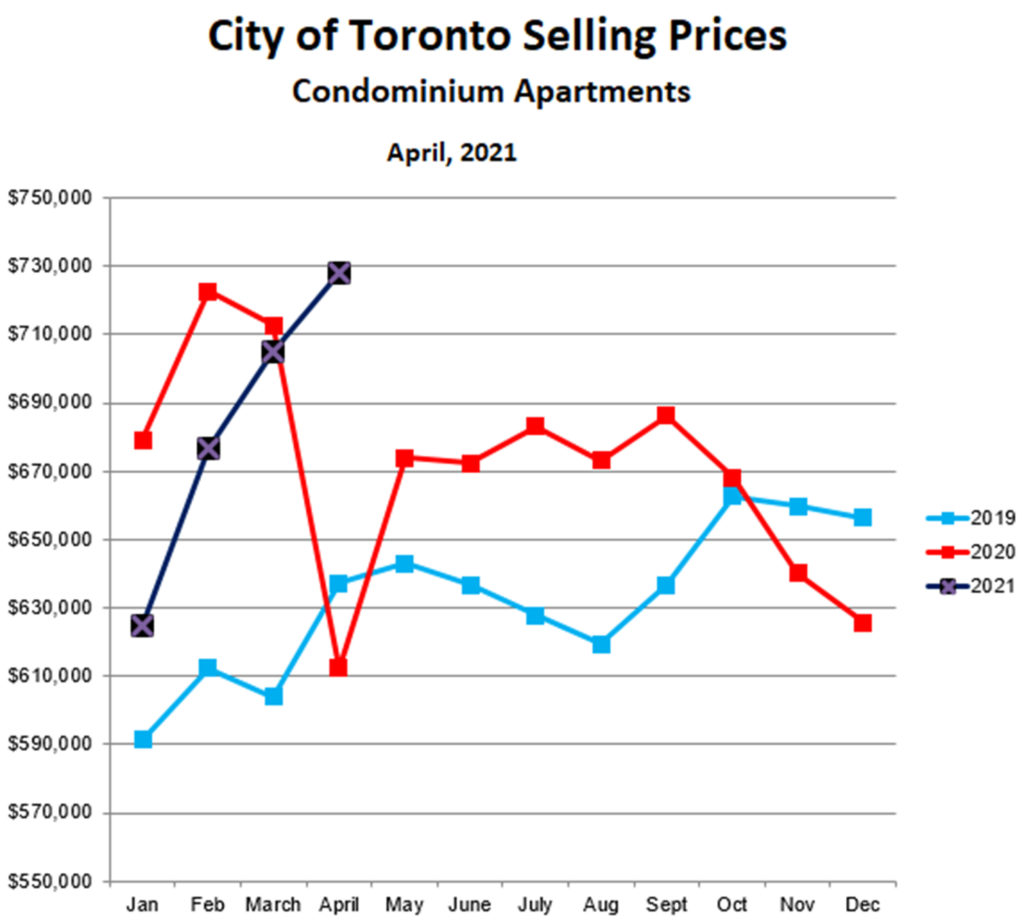

For condos, the story is similar, though with a somewhat stronger hint of cooling. The average selling price for condos in the City of Toronto was $716,976 in May, only slightly lower than the all-time high of $727,737 reached last month. As for houses, sales of condos were down (1,881 versus 2,277) and listings were up (2,754 versus 2,351), Inventory thus increased from 1.0 to 1.5 months, still very low and definitely still in sellers’ market territory.

What will happen to the Toronto market as we head into summer? Prior to COVID, we could count on a ‘summer slowdown’ beginning in late June and continuing until early September. Our summers are short, after all, and buyers and sellers alike would often take some time off from house-hunting and home-selling to enjoy the weather.

This year, the summer slowdown might be longer and stronger than we have seen in the past, for three reasons:

- COVID restrictions are (hopefully) coming to an end soon, and folks are eager to get away to cottages, resorts, etc, after being cooped up for such a long time;

- Children are still schooling remotely, so there is no need to wait until the end of the school year to head out from the city – the kids can do their remote schooling at the cottage if need be; and

- Warm summer weather has arrived ahead of schedule, further fueling the desire to escape.

All of this will probably mean fewer sales and fewer listings over the next few months. The impact on prices is harder to predict, and will depend on whether buyers or sellers are, overall, more inclined to wait until fall.

For example, if listings fall steeply, while buyers, by and large, decide to continue searching, prices could remain steady or even increase. On the other hand, if large numbers of sellers decide that it’s safer to sell now rather than risk a market correction by the fall, prices could fall.

Whatever happens to prices over the summer, the fall will probably bring a renewed surge in sales, listings and prices, as both buyers and sellers return. Always assuming, of course, that mortgage interest rates remain close to their present levels. Once mortgage rates begin to rise, things will change.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Home Transformations

06/05/21

Once upon a time, ‘getting your home ready to sell’ meant removing some clutter, rearranging the furniture and maybe doing a bit of painting and some minor repairs. Home staging back them amounted to little more than adding some decorations, a few paintings and maybe a lamp or two.

Not any more. Now, the goal is to ‘transform’ to the point where the home is often barely recognizable as compared with the starting point. For example:

- Repainting all or most of the home in light colours is almost always recommended. This not only makes the home brighter but also neutralizes the colour scheme. Light grey walls go with everything and offend no-one. Without question, painting is the highest-leverage change that can be made, yielding the largest increase in value at the lowest cost.

- Repairing or replacing anything that isn’t working or that is unsightly (for example an old bathroom vanity with a cracked sink and leaky taps) is another example of a high leverage change that increases value more than it costs.

- Many sellers are also undertaking more significant improvements. For example, an older kitchen can be revitalized at relatively modest cost by installing a new quartz kitchen countertop, combined with a new backsplash and repainted cabinets. New flooring can also make sense if the existing floors are in poor shape.

- Most or all of the seller’s furniture is packed up and put in storage until the house is sold. The house is then filled with rented staging furniture, artwork and decorations designed to maximize the appeal of the house to the broadest possible range of potential buyers. The aim is stylish and contemporary, but not controversial.

Once the house has been transformed, the next step is photography. Great photos help to catch the eye of buyers shopping on the internet, where attention spans are pretty low. A well staged home, properly captured in top notch pictures, will have buyers 75% sold on the home before they even walk in the front door, which is of course the objective.

Here are some ‘before and after’ examples of homes that we have helped to transform and obtained excellent prices as a result:

Before

After

Before

After

Before

After

The bar has been permanently raised for sellers in the City of Toronto. No longer is it enough to do a bit of de-cluttering and painting, add some artwork and hope for the best. Buyers now expect a ‘model home’ experience when they view a house for sale, and anything less can deduct thousands or even tens of thousands of dollars from the eventual sale price. The cost of upgrading the home to meet buyers’ expectations is much smaller than this discount, and so more and more sellers are embracing the transformation experience.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Mortgage Rates Will Determine Toronto Price Trends

06/03/21

Extreme volatility has buffeted the Toronto area real estate market over the past 15 months, ever since the initial Covid lockdowns last March. Despite the ups and downs, however, the market has been very strong overall. Since the beginning of 2021, prices for both houses and condos are up by more than 15%. While several factors have been instrumental, by far the most important factor is mortgage rates. Five year variable mortgages, for example, are available at under 1.5%, and likely to stay low for some time to come.

Let’s have a quick look at what is driving mortgage rates, and how rates might move over the next year or so.

First, you need to understand that fixed and variable mortgage rates are subject to different factors.

Variable Mortgage Rates

Variable mortgage rates are closely linked to the Bank of Canada’s Overnight Rate, which the BOC reviews 8 times per year. Changes in the Overnight rate are typically reflected very quickly in their variable mortgage rates. Our central bank has kept the overnight rate at 0.25% for more than one year, and has said that they are unlikely to increase it before the second half of 2022. In other words, variable mortgage rates will probably remain more or less where they are for another year or so.

Fixed Mortgage Rates

Fixed mortgage rates are a different story. Unlike variable rates, fixed rates are closely tied to bond yields, especially government bonds. The price of a bond is inversely proportional to market interest rates, that is, as interest rates go up, the value of an existing bond (with a fixed coupon rate) goes down. Central banks around the world (including Canada) have been keeping interest rates low by purchasing government bonds to bolster demand and thus keep bond prices up. (This is called Quantitative Easing, or QE.)

Inflation Fears

Many fear that this ‘money printing’ will mean persistent inflation, which would lead to higher interest rates. This has caused some downward pressure on bond prices and hence upward pressure on bond yields. So far, bond rates (and thus fixed mortgage rates) have not increased that much, and only about 1% above variable rates. If the gap continues to widen, it may compel the Bank of Canada to bring the bank rate more in line with ‘prevailing’ rates. This would cause higher variable rates and would almost certainly put a damper on the market.

Is the inflation we are now seeing temporary, or is it the start of of a larger trend? Among experts on the subject one can find roughly equal numbers that project increasing inflation versus decreasing inflation or outright deflation in the longer term. The outcome will determine whether fixed mortgage rates will continue to rise or will reach a peak and fall back over the coming months. In turn, this will have a huge impact on whether house and condo prices continue to rise or pull back later this year or in 2022.

Government of Canada bond prices tend to follow US Treasury prices very closely. This means that trends in the US bond market may well be our best indicator as to the direction of Canadian real estate prices.

My best guess? Our economy will not bounce back as quickly as many expect, and this will mean higher bond prices and lower fixed mortgage rates over the next year or so. So, I suspect we’ll see a continued uptrend in real estate prices through the rest of 2021 and into the first half of 2022, with perhaps some seasonal ups and downs along the way.

Mortgage Rates Will Determine Toronto Price Trends

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

House Prices Moderate, Condo Prices Surge Again

05/12/21

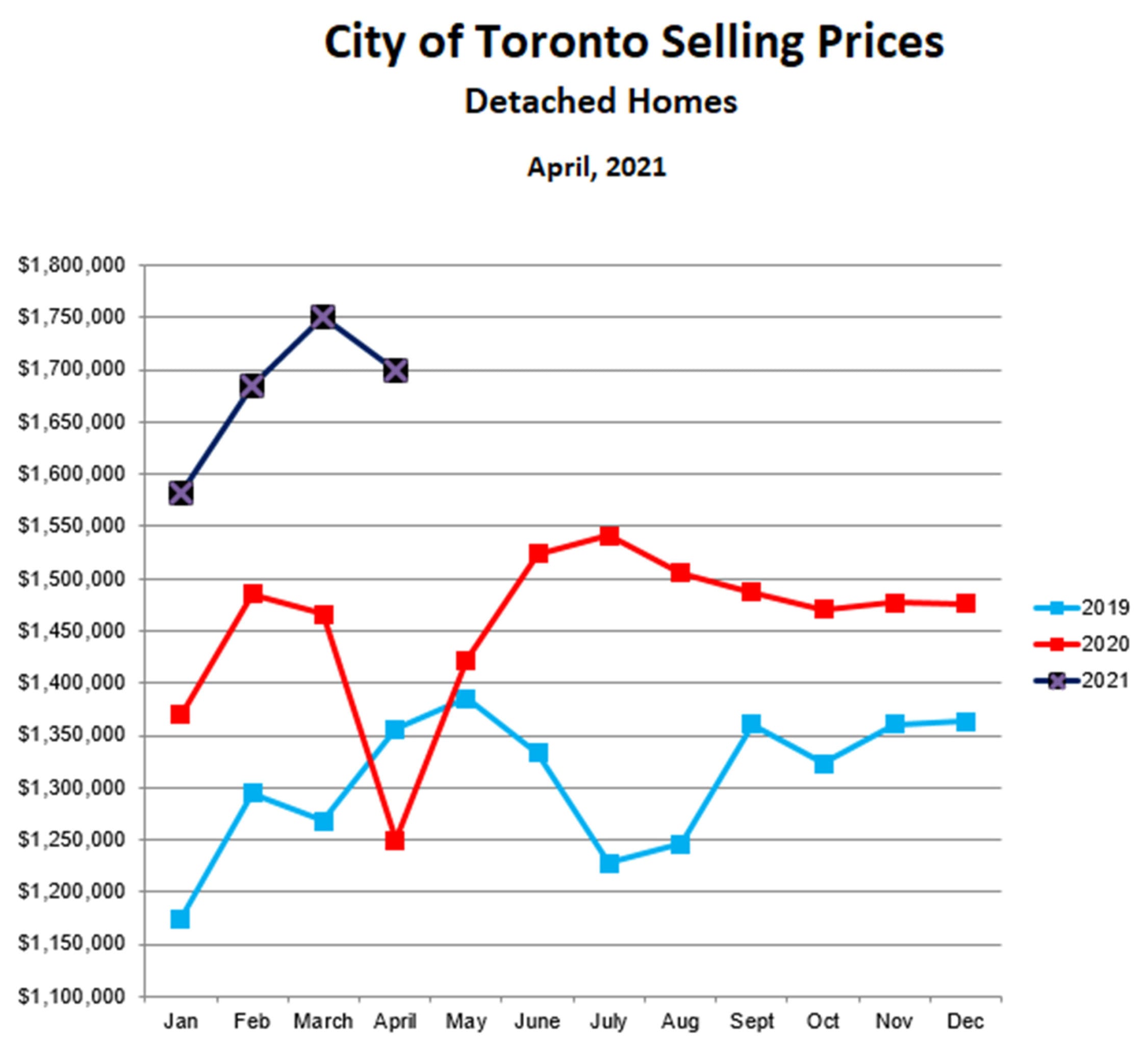

Prices for detached homes in the City of Toronto slipped 3% in April after rising by 19% over the previous three months. It’s very unlikely, however, that this is the beginning of a downtrend. It’s much more likely to be a brief pause in the strong uptrend that began in January. Why do I say this?

First, we have seen this movie before, that is, a brief sag in prices in the middle of the spring market, followed by a resumption in rising prices. In years past, this always happened in March, and we blamed it on March Break, folks taking a breather from real estate to flock to Florida beaches. But perhaps it was just a natural process of consolidation, the market ‘taking a breath’ during an otherwise unbroken rise in prices from February to June. So maybe we are just seeing a brief period of consolidation before prices again move higher.

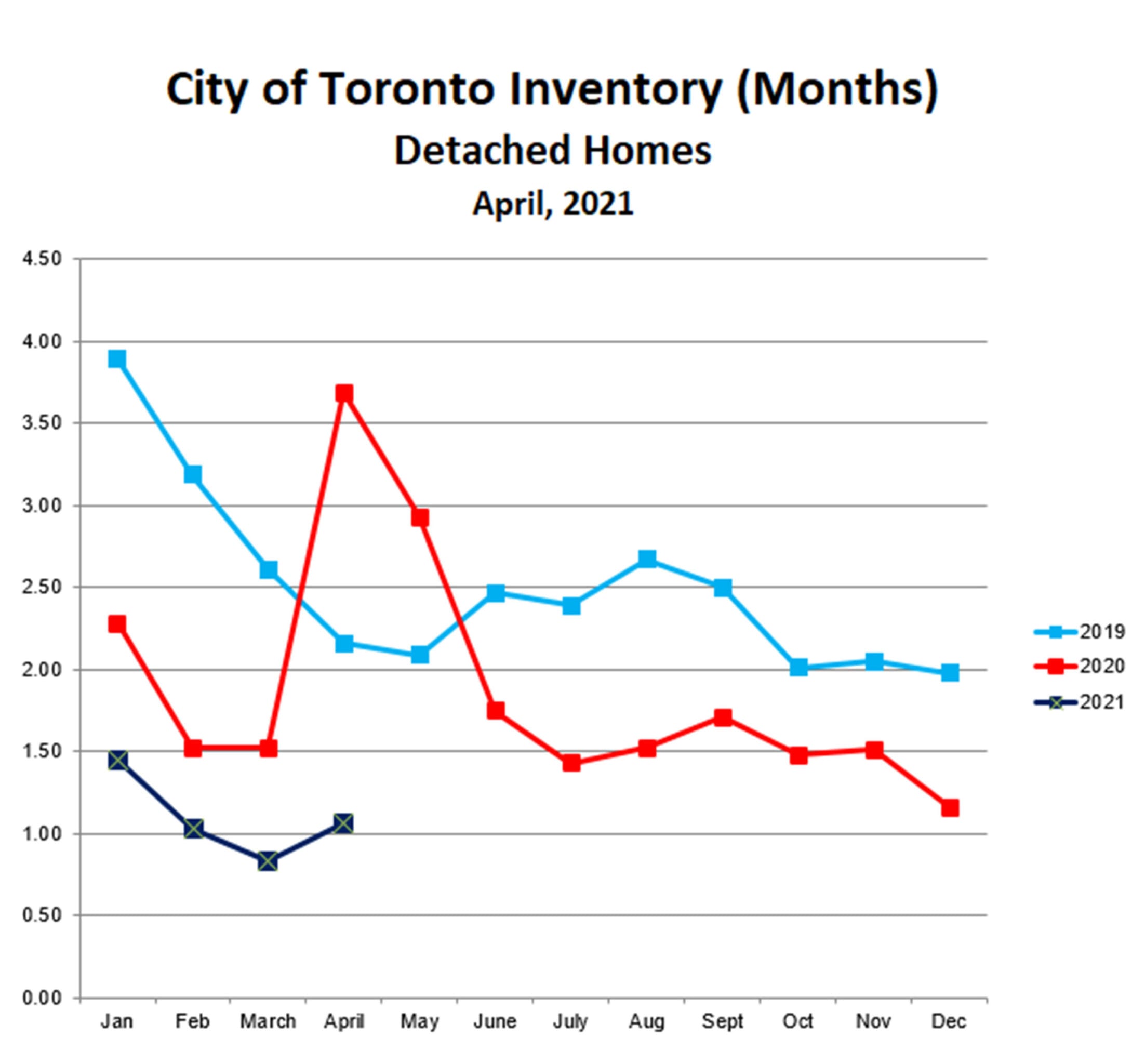

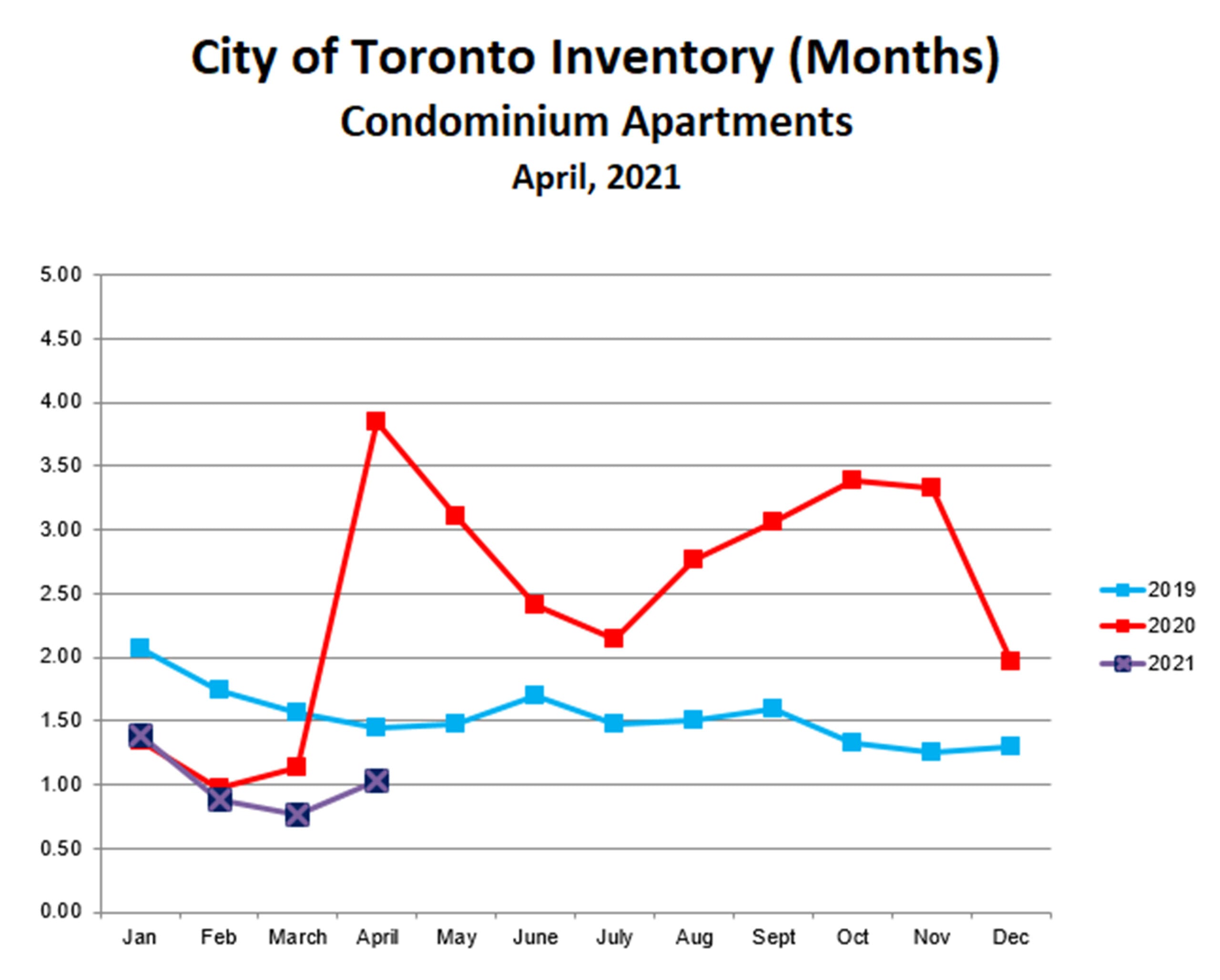

The second reason to believe that this may only be a temporary drop in prices is inventory. We measure inventory as the number of months of supply of homes on the market. For example, if there are 2,000 homes for sale, and homes are selling at the rate of 1,000 homes per month, then the present supply of 2,000 homes would last two months if no other homes came on the market. Hence the inventory is 2,000 homes for sale divided by 1,000 homes sold per month, or 2 months’ inventory.

The chart above shows price trends for detached homes in the City of Toronto over the past three years, while the chart below shows inventory trends over the same time period. There is a very strong inverse relationship between the two, that is, as inventory goes down, prices go up, especially when inventory drops to one month’s supply or lower.

This isn’t surprising; an inventory of one month or below basically means that homes are selling as fast as they come on the market or even faster. Bidding wars are a natural consequence of this dearth of supply of homes for sale.

Inventory isn’t the only driver of prices, of course. Historically low interest rates have been the primary enabler of sales, making it possible for homebuyers to afford astronomical prices at surprisingly low monthly carrying cost. However, low inventory is the driver that is creating bidding wars, which tend to ratchet prices ever higher.

In that context, have a look at the inventory level for detached homes in April. While slightly higher than in March, inventory is still extremely low, and such low levels of inventory often tend to be self-sustaining. This is because, with homes for sale so scarce, and with homes selling before the ink on the listing agreement is even dry, most move-up buyers choose to buy first before putting their homes on the market. Since move-up buyers represent the majority of the inventory of homes for sale, it’s easy to see how very low inventory sets up a self-reinforcing pattern.

The bottom line is that a return to rising prices for detached homes over the next few months is very likely.

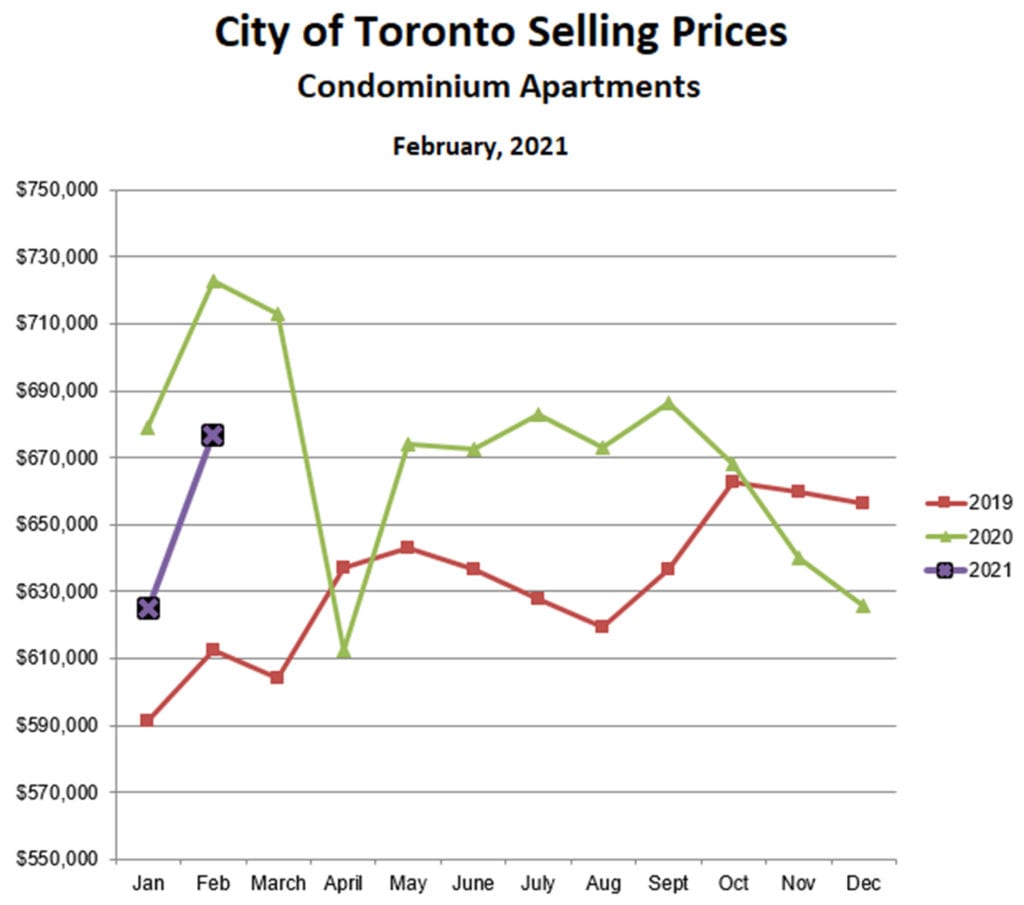

Let’s now turn to the condo market, which has followed a similar but more volatile path than houses during the Covid journey. Early last year, condo prices were increasing quickly, and reached an all-time high in February. Then came Covid, and prices fell steeply, recovered for a few months, and they fell steeply again as owners of investment condos dumped their units in the face of a declining rental market.

Then something changed. The tide of condo listings receded late in the year, and so inventory declined and prices stabilized. Inventory continued to fall early this year, and prices took off in February as inventory dipped to the one month level. While inventory increased slightly in April, it remained close to one month’s supply. Prices continued to surge higher and are now 16% higher than they were at the beginning of the year. As for houses, the low inventory level for condos will tend to be self-sustaining over the next few months. While we could see a brief consolidation period similar to houses, condo prices will probably keep rising.

Bottom line? The hot Toronto market will probably be with us for a while longer… unless something completely unexpected happens, of course.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Panda Bunny Shares Easter Joy

04/07/21

The Smith Proulx Team and Easter Panda were in the West Toronto neighbourhood sharing some Easter joy to the neighbours and their kids! We recognize that everyone, including kids, have had a hard time this year, so Panda dressed up as the Easter Bunny and handed out Easter chocolates to kids playing in West Toronto parks. Easter Panda danced up to the parks and said hello to all the kids, who couldn’t wait to tell stories about their Easter egg hunts and all the chocolate they’d eaten.

Easter Panda visited Vine Park in the Junction, Beresford Park in Bloor West Village, and Lithuania Park in the High Park neighbourhood.

All the kids and their parents were so happy to see Easter Panda appear in the park, and many of the parents said it made their day. Thank you to all the kids and their parents who came to say hello to Easter Panda—you made Easter Panda’s day too!

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

The Power of Staging A Home To Sell

03/26/21

Some of these homes have had improvements beyond just basic staging—in fact, some have actually had a substantial facelift. Either way, it’s important to know how staging can elevate your home in Toronto’s competitive market.

Today’s post is called the power of staging, because our team really does feel that staging is a powerful marketing tool. If you want to sell your home fast, and for top dollar, you need to understand the way buyers think. Since human beings are typically visual creatures—and because buyers tend to see a lot of properties in a short timeframe—it’s important to make your home stand out from the crowd. Even if the market is super hot and your house has good bones, you’ll still be able to demand a higher price if it’s staged properly.

Over the years, our team has helped a lot of West Toronto homeowners market and sell their houses for well over the initial asking price. Lucky for you, we also work with plenty of buyers and know exactly what they’re looking for when they search for a home.

We know buyers are trying to visualize themselves in any home they tour—and of course, since they’re hoping to upgrade, they expect the property to be to be clean, beautifully organized, and immaculately decorated.

To emphasize how powerful staging can be when you market your West Toronto home, we’ve put together a few of our favourite before and after images. Take a look to see how impactful these transformation can be!

Before:

Since colour and floral prints won’t appeal to every buyer, we wanted to create a more neutral aesthetic.

After:

New floors, new paint, new furniture—whole new room!

Before:

Traditional decor, in dark colours tends to make the room look smaller.

After:

Light, bright, and ready for a young family.

Thinking Of Selling Your West Toronto Home?

We can help. Contact us today for a one-on-one marketing consultation.

Toronto House Prices Continue To Surge – And Condos Join The Party

03/07/21

Prices for detached homes in Toronto jumped by 7% in February, for a total increase of 14% since December (!). Bidding wars are of course rampant, with selling prices routinely several hundred thousand dollars over asking. This rapid price escalation continues to be driven by very low inventory (less than one month’s supply) as well as extremely low mortgage interest rates. It would also seem that there is a psychological component at work – the fear of missing out (FOMO).

Interest rates have recently been creeping up because of inflation fears (which isn’t exactly surprising), and this could slow the market down a bit once buyers’ current guaranteed mortgage rates expire. Also, inventory could increase as more and more prospective sellers get wind of the hot market. It’s hard to miss in the media.

On the other hand, the government will be tweaking the mortgage ‘stress test’ rules in April to make it easier for buyers to pass. The stress test forces buyers to show that they could qualify for a mortgage if the interest rate were equal to the “Benchmark Qualification Rate”, which is higher than the actual rate they would have to pay. The idea is to make sure the buyer will be OK financially if mortgage rates should rise. This is fine in principle, however, the benchmark rate has remained very high as mortgage rates have fallen, making it more and more difficult for buyers to qualify. The change in April will allow the benchmark rate to float on a weekly basis, remaining 2% above actual market rates, and this will make it easier for buyers to pass the test.

The bottom line is that prices will likely continue to move higher over the next few months, although perhaps at a slowing rate.

Condo apartment prices also surged higher in February, after languishing through 2020 and actually falling rather steeply in the fourth quarter. The weakness in late 2020 was due to a large spike in condo listings, tracing mainly to owners of rental condos dumping their units because of weakness in the rental market.

Condo prices leveled off in January and then increased by 8% in just the last month. As for houses, low inventory is also a big part of the story here, as there was less than one month’s supply of condos in February. Bidding wars have returned to condos after a long absence, though with less ferocity than houses. Clearly the 2020 glut of condo listings is behind us, and condo prices should continue to increase as rising house prices force many buyers to turn to condos as the only affordable alternative.

COVID has certainly created immense volatility in the Toronto real estate market. Last Spring, the CMHC confidently forecast that Toronto prices would drop 18% by the end of 2020. They have recently apologized for getting it so wrong, but this underlines just how capricious the market has become. According to an old Danish proverb (also attributed to Yogi Berra and Mark Twain, among others), ‘prediction is very difficult, especially about the future’. And so it is.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!