Toronto House Prices Defying Gravity

09/05/20

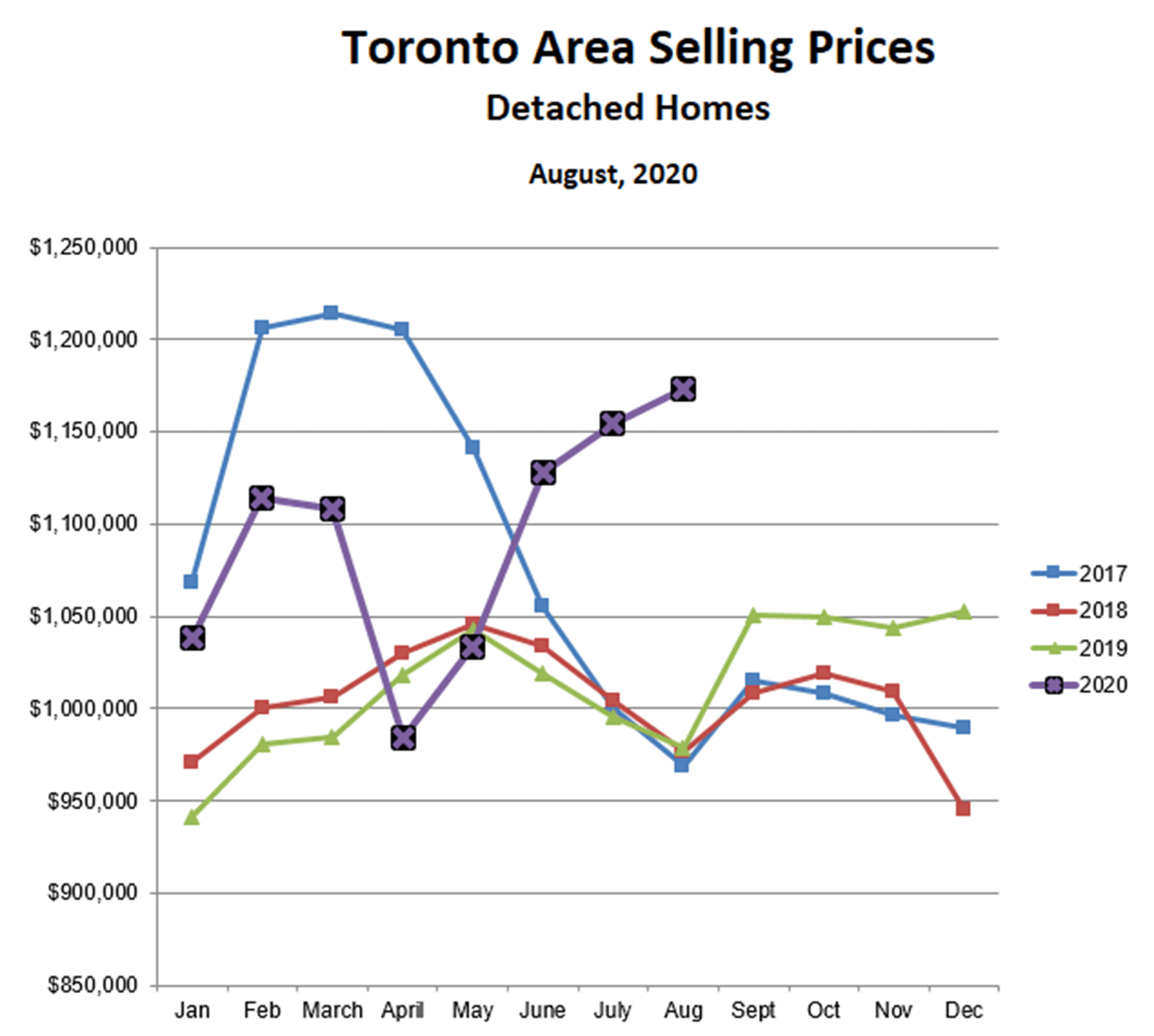

Another month, another gain in Toronto area house prices. Ever since the disruption in April due to the COVID-19 lockdowns, the market for houses has been on a tear, with prices for detached homes increasing every month and now almost 20% above the April low. The ‘delayed spring market’ meme is starting to wear a bit thin, as prices have continued to rise right through the traditionally slow summer months. Nothing traditional at all about this year.

The fall season, which starts after Labour Day, has seen a significant boost in house prices every single year for at least the past 20 years, and maybe that will again be the case this year. Or maybe this isn’t a year to bet on the continuation of long term trends. It does seem reasonably safe to assume that, as long as both interest rates and the inventory of homes for sale stay low, the present trend will continue at least until flu season starts in October/November. After that, depending on COVID-19 vaccines, the severity of this year’s influenza strain, and even US election politics, all bets are off.

It’s interesting to note that house prices are now within 3% of the all-time high reached during the 2017 bubble, and we may well surpass that record before the end of this year. All in the context of a major recession or even depression. Go figure.

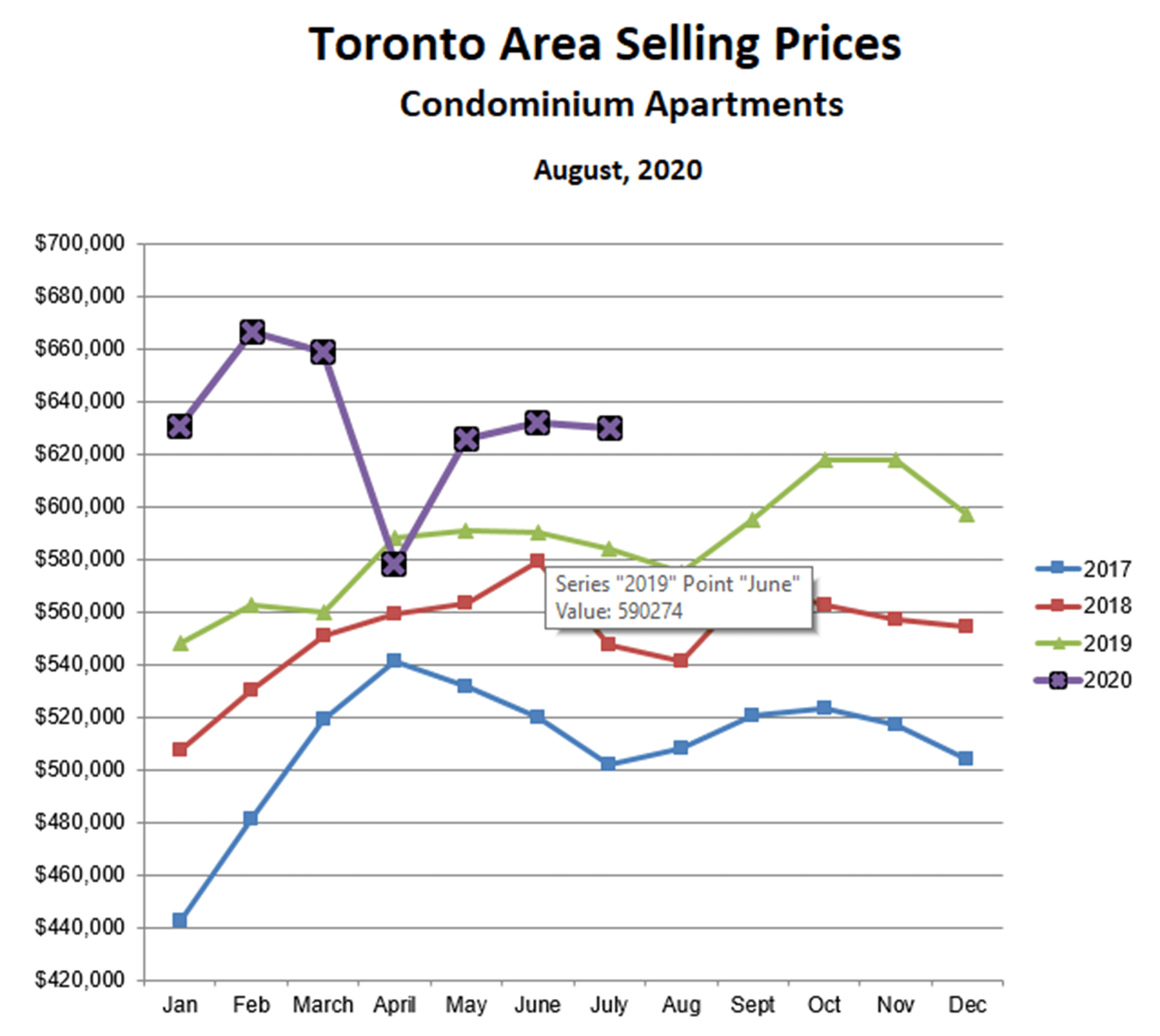

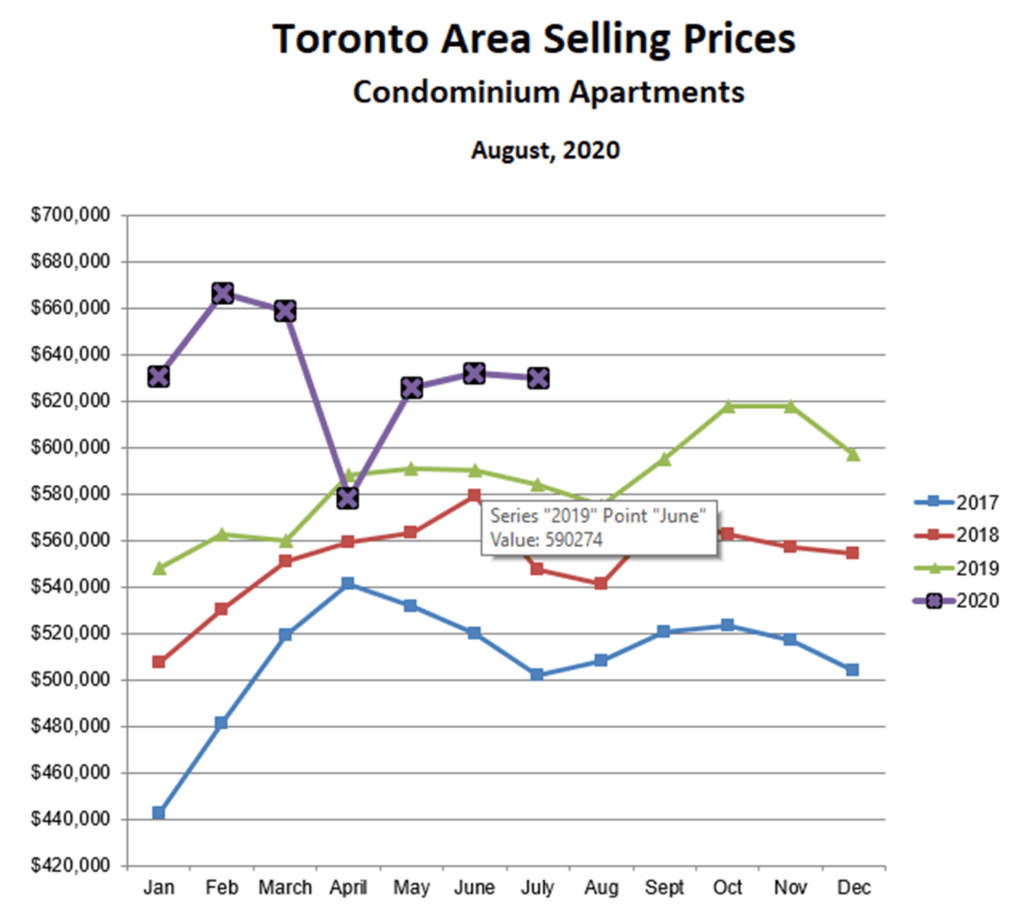

The trend in condominium apartment prices, on the other hand, has been quite different. After the bubble in 2017, condo prices fell slightly but never collapsed the way house price did, and have been setting new all-time highs ever since… until COVID-19.

The SARS-COV2 virus, and especially government’s response to the virus, has been a game changer for the condo market. Most notable has been the work-from-home (WFH) revolution that has been accelerated by the COVID crisis. While WFH and the technology supporting it is nothing new, the COVID crisis has forced its rapid adoption out of necessity, and many organizations are coming to realize that WFH is surprisingly productive and cost-effective. This makes a house a much more attractive option for a condo owner, both because of the additional space available for a home office and also because an affordable house outside the city makes much more sense if little or no commuting to the office is required. A further benefit of a house is outside space (AKA a back yard), which is much more desirable now that eating out and public events are more restricted and likely to continue so for some time.

All of this has resulted in a recovery of the condo market from the initial COVID shock that has been much more muted than that of the house market. Prices have increased by 9% from the April low, but are still 6% below the February peak, and have gone no-where over the past four months.

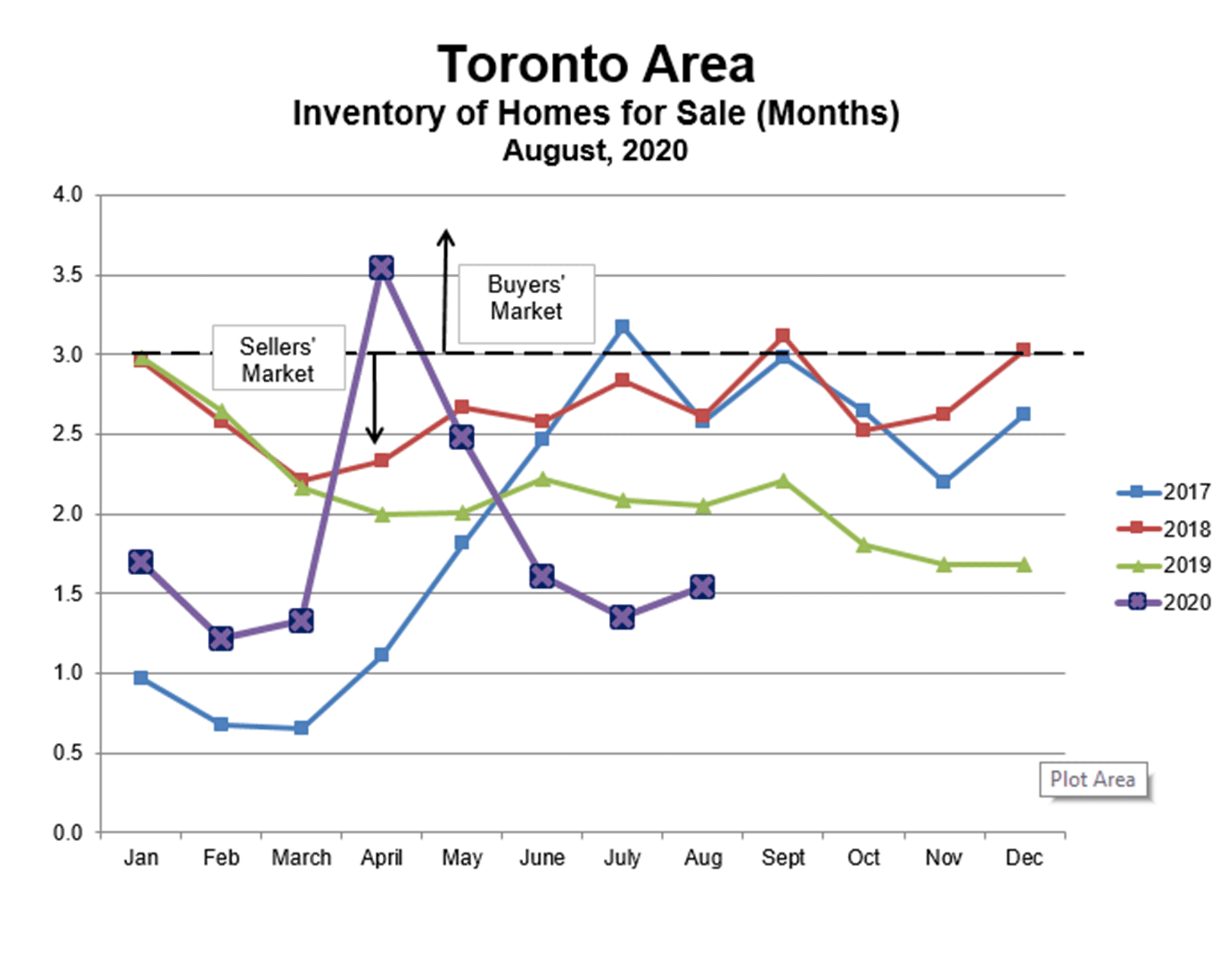

A strong driver, as well as a result, of the recent increase in house prices has been the declining inventory of homes for sale. This is because:

- A lower number of homes for sale means more competition among buyers – simple supply and demand; and

- The difficulty of finding a home to buy means that many buyers will choose to purchase a home before putting their own home on the market. This further reduces the supply of homes for sale, which feeds a viscious cycle where falling inventory leads to even less inventory.

This cycle could be reversed as sellers become less fearful of COVID and more interested in taking advantage of the hot market, and as the higher prices make houses more and more unaffordable. The small uptick in inventory in August suggests that this process may already have begun, and could moderate further price increases. Time will tell.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!