Toronto Market Continues To Follow The 2023 Script

03/23/24

Prices for all property types are again almost exactly the same this month as they were in the same month last year. The ‘hoping for lower interest rates’ meme is continuing to drive the market, as prices are continuing to rise. While the odds of interest rate cuts seem a lot higher than they were last year, they are not yet a lock. Persistent inflation and/or persistent economic strength could once again delay any cuts. On the other hand, should lower rates arrive as expected, we could see a very strong market throughout this year.

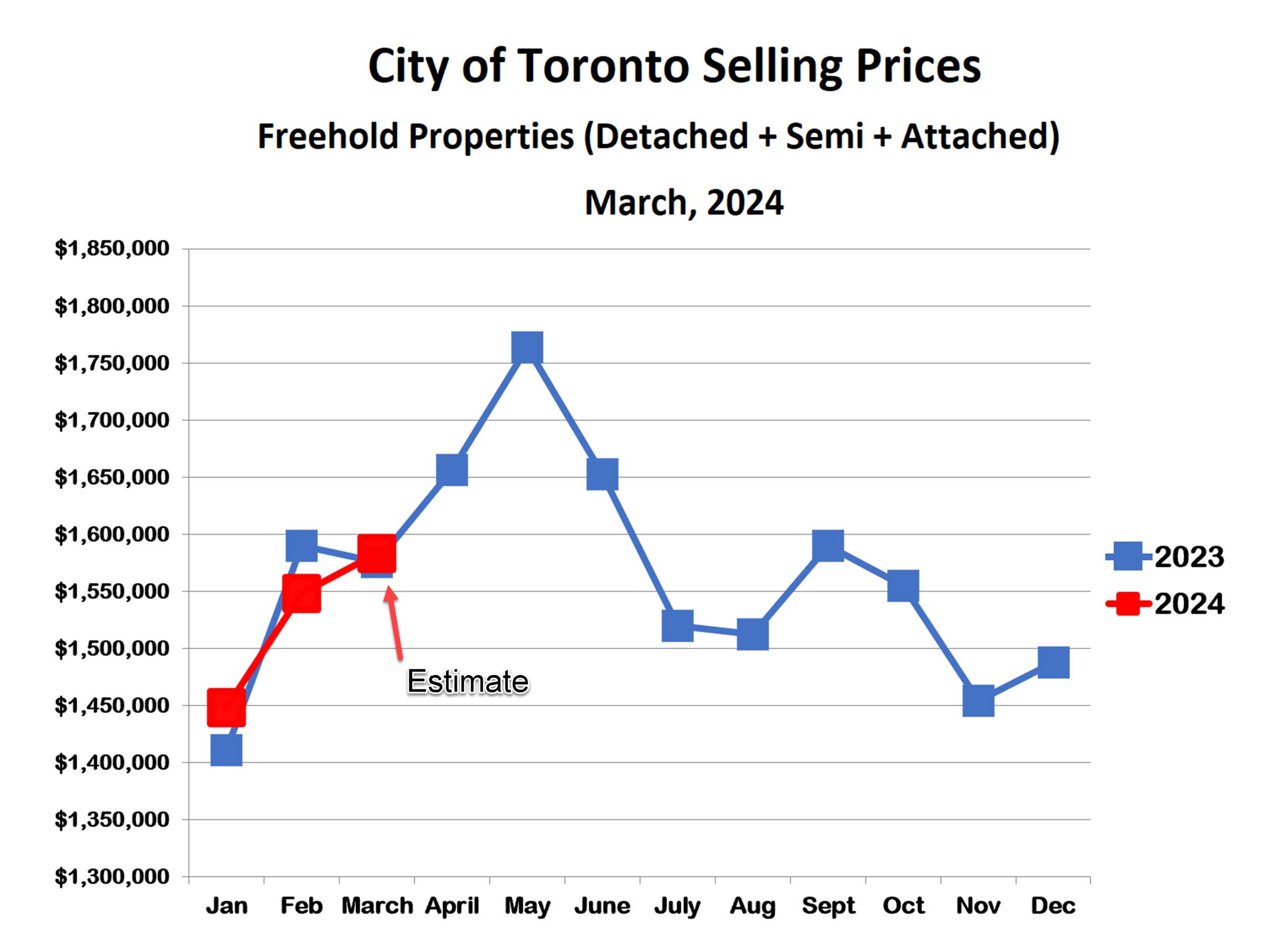

Houses

So far in March, house prices are within a rounding error of matching last March. Also, while the rate of price increase has slowed a bit this much, we haven’t seen an actual March-Break-induced drop in prices like we did last year. This sets the stage for even higher prices in April and May, perhaps accelerating after Easter weekend at the end of March.

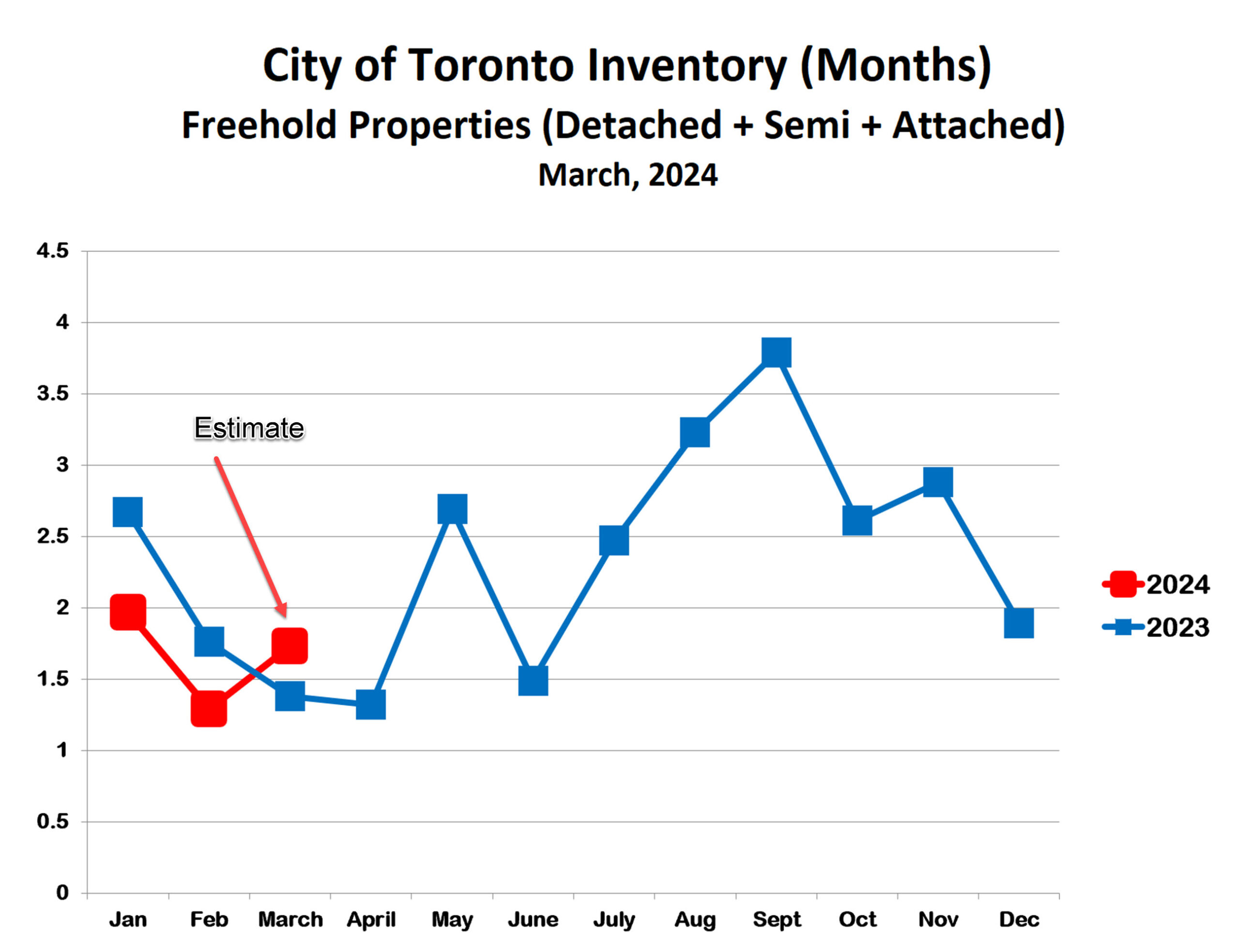

The inventory of houses for sale ticked up slightly in March, though it remained deep in sellers’ market territory at less than 2 months’ supply. House sales in March are almost exactly the same as last March, but listings are somewhat higher. We we probably see even more listings in April and May, however, we’ll probably see a lot more buyers also as long as the interest rate outlook stays positive. The low inventory has led to the resurgence of bidding wars, with extreme underpricing once again becoming common (if not the norm).

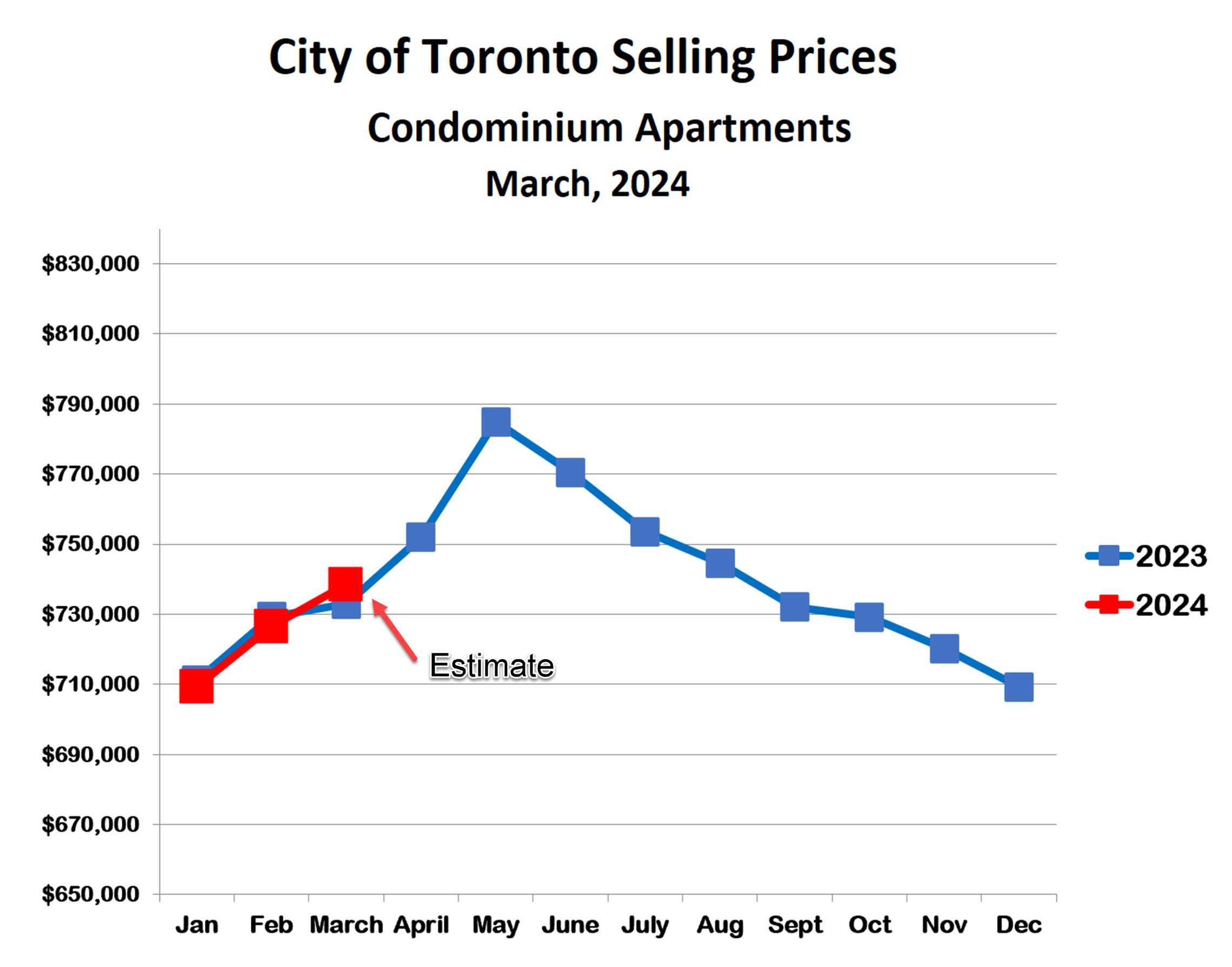

Condos

Prices for condo apartments continue to follow last year’s increasing trend line very closely. As for houses, the prospect of lower interest rates is the main driving force for higher prices.

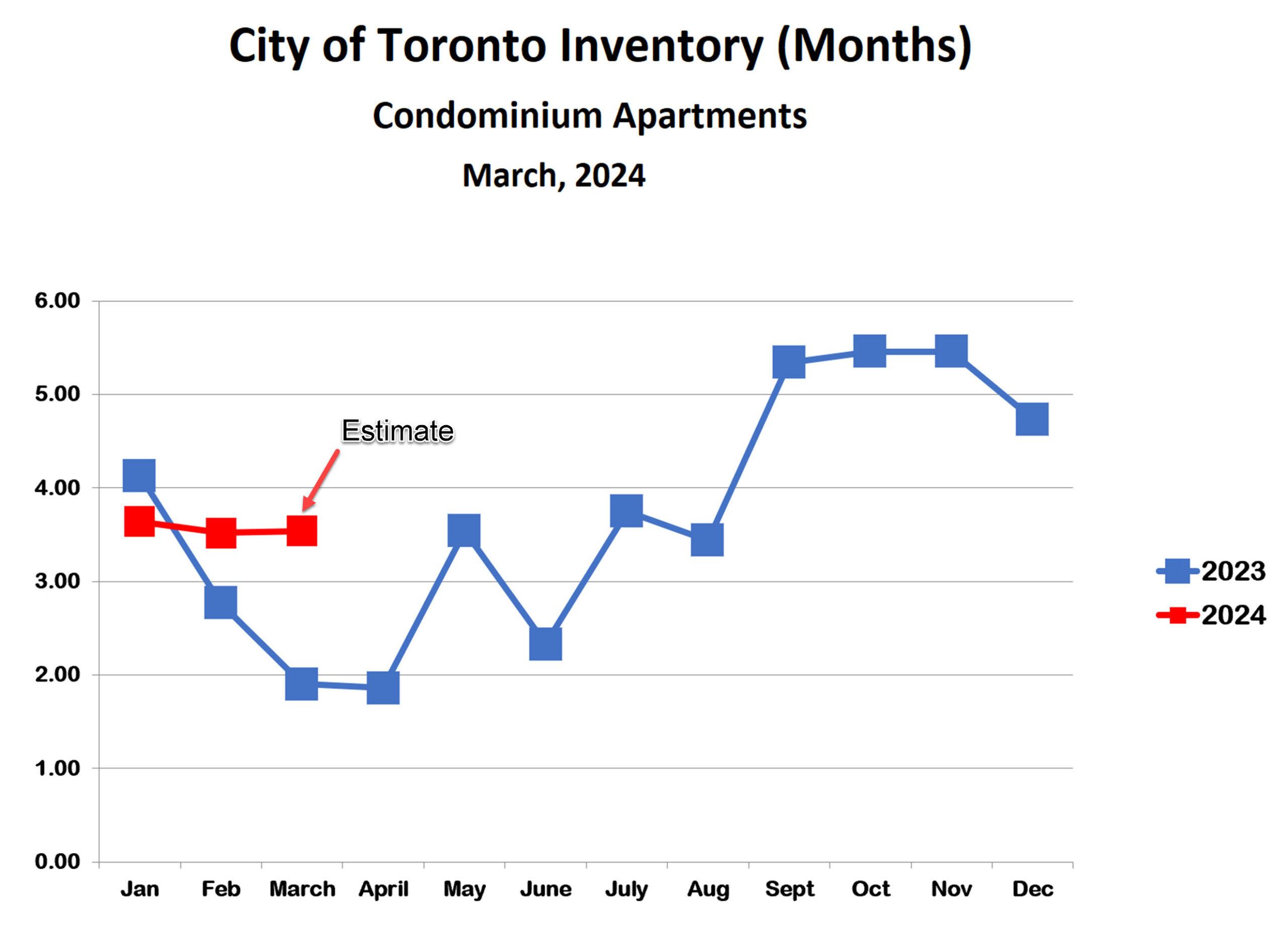

The inventory of condos for sale has come down from last fall but remains high. Delayed offers and bidding wars are rare, consistent with a balanced market. Even more than houses, the condo market is being driven by interest rate optimism, and is quite vulnerable to any change in interest rate sentiment.

Bottom Line

The Toronto market is continuing to improve in March and is closely following the 2023 trend line. As long as hopes for lower interest rates remain high, this pattern will likely continue for at least the next couple of months. Almost certainly there will be a summer slowdown from mid June until mid August. The strength of the fall market will depend on whether interest rates actually come down.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!