Toronto Market Builds Energy For Spring

01/26/23

It’s normal for the real estate market to start off very slowly in early January, and this year is no different. Sales and prices were well below last month in the first two weeks of the year, but both are accelerating as we get closer to February. This augurs well for a healthy spring market notwithstanding all the doom and gloom that’s in the air.

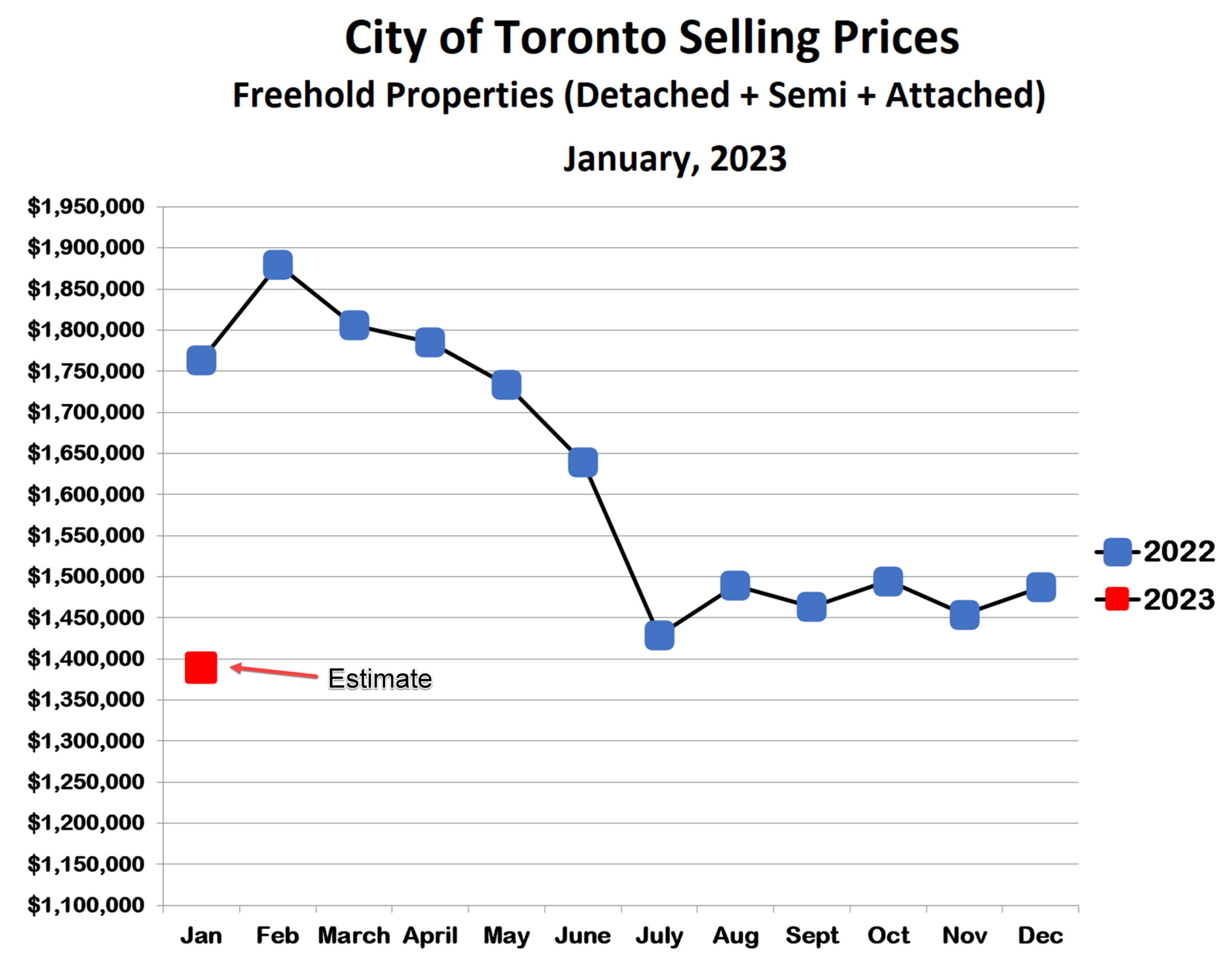

Freehold (detached, semi-detached and attached homes)

As of late January, prices for freehold properties were slightly below the $1.4-$1.5 million range that we saw throughout the second half of 2022. However, prices are increasing steadily, from an average of $1,336,278 in the first two weeks, to an average of $1,437,396,396 since then. So prices are already back to 2022 levels and likely to rise further in February.

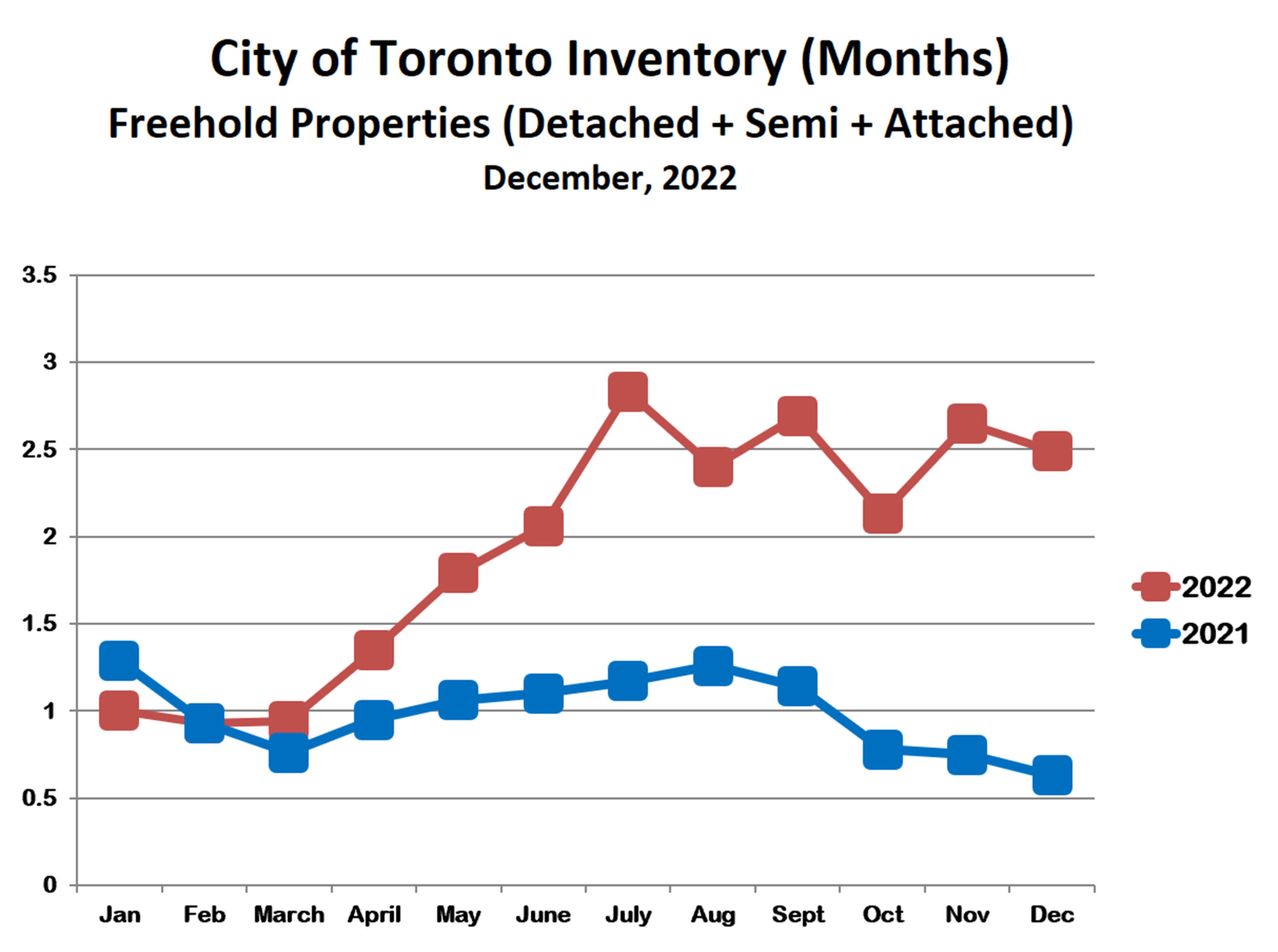

The inventory of freehold properties for sale rose in the second half of 2022 and remained steady between 2 and 3 months’ supply over the past 7 months. This was further evidence that the correction from the 2021/2022 bubble was complete and the market had stabilized. So far in 2023, sales have declined significantly while active listing fell only slightly. This means that January inventory will likely clock in much higher than last year. The fact that prices are remaining relatively steady is another encouraging sign for the spring market.

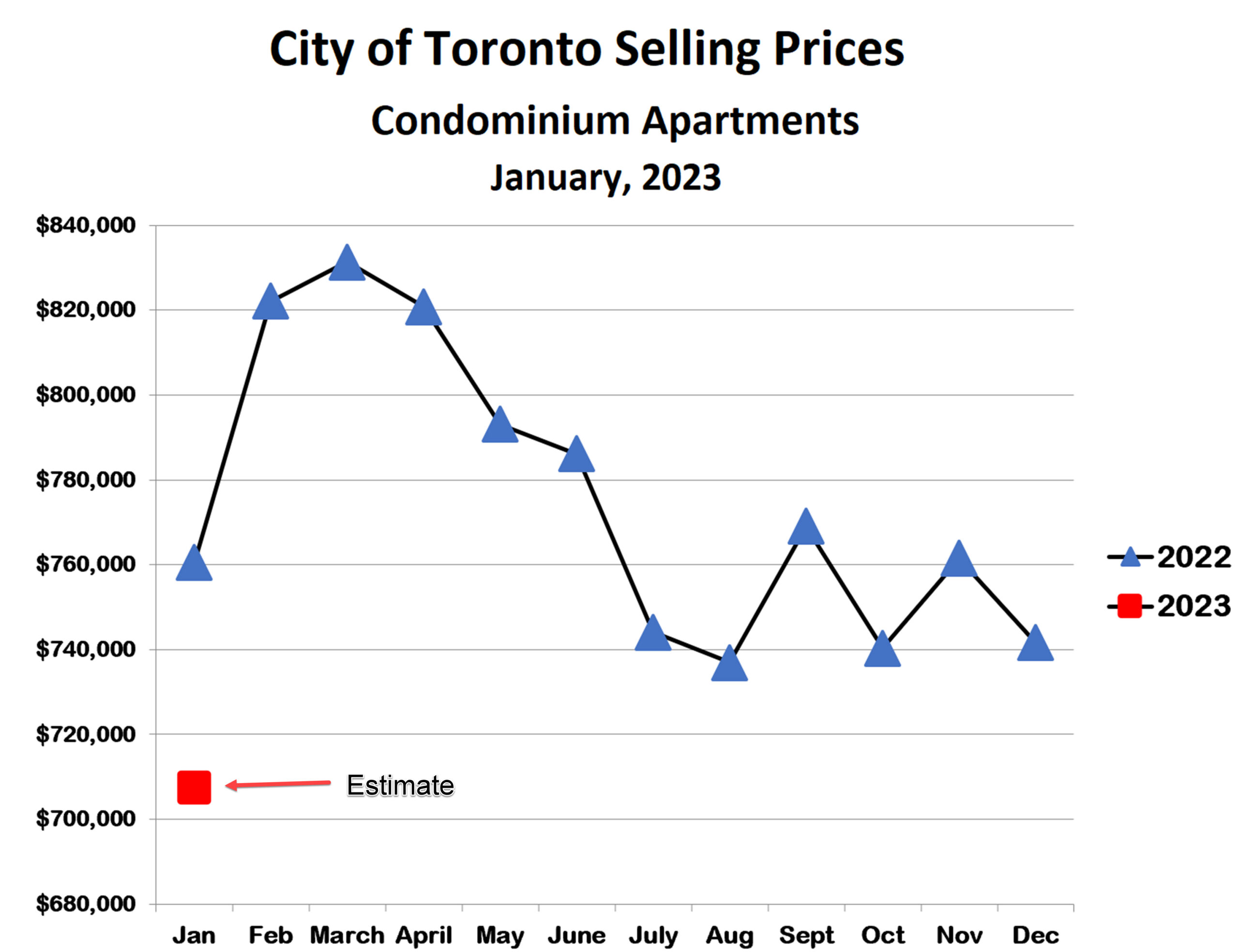

Condominium Apartments

Condo prices in the City of Toronto remained in a narrow range throughout the last 6 months of 2023, much like freehold properties. Prices in January were quite low in the first two weeks (average $691,630), and have increased since then to $725,731. While this is still lower than last year, it does point toward further improvement next month, with prices likely reaching or exceeding last fall.

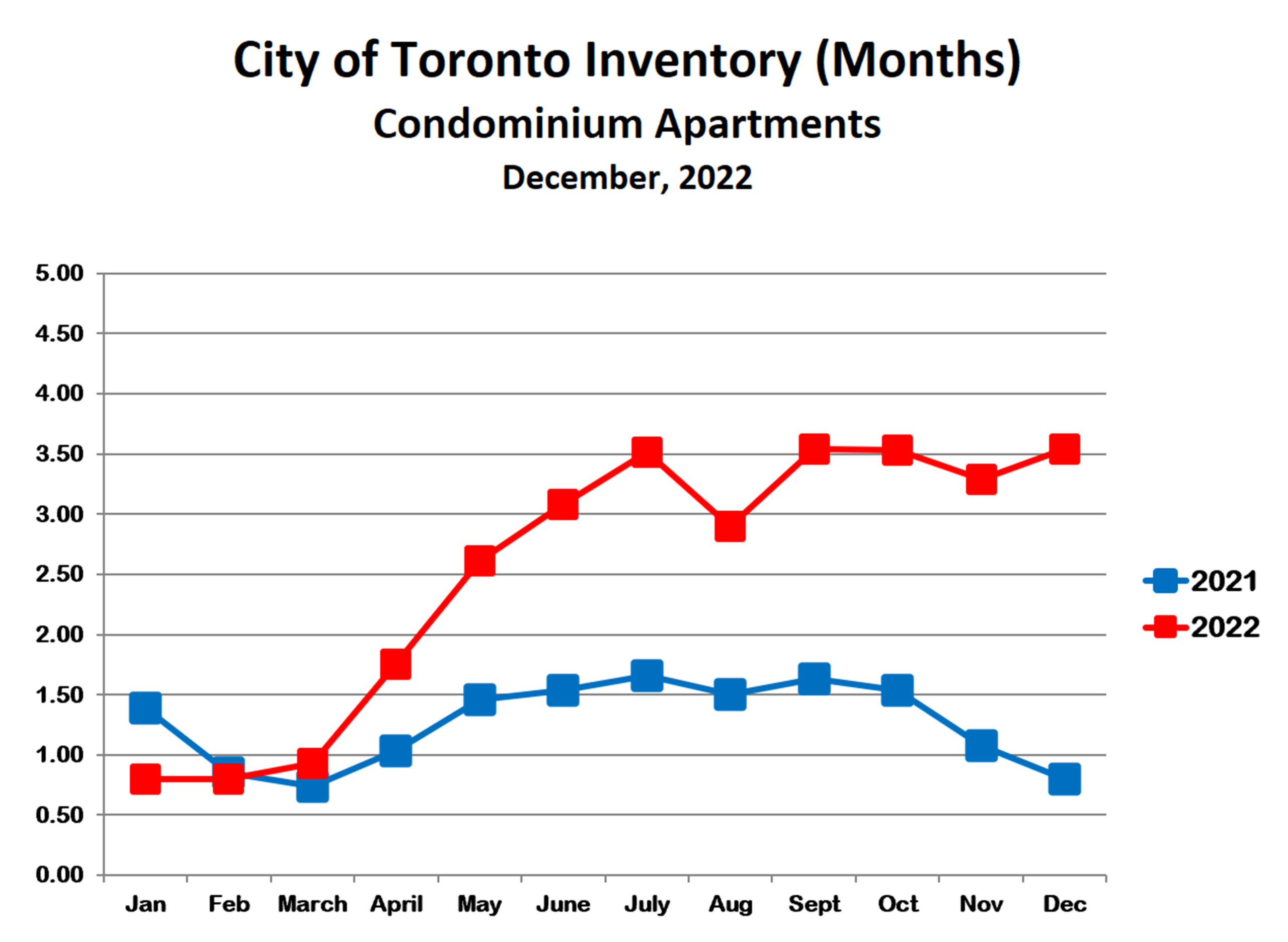

Condo sales have been very slow so far this month. Active listings, however, are actually higher than in December. The January inventory of condos for sale will therefore print significantly higher than the 3.0-3.5 months’ supply that we saw over the last 7 months. Once again, given the rising prices, this is a positive sign for the spring market.

The Bank of Canada recently announced another 0.5% bump in the bank rate, hopefully the final hike in this cycle of interest rate increases. While this will obviously not help the real estate market, it’s unlikely that it will lead to a further decline in prices. Most likely we will see a healthy, balanced spring market this year, with prices rising modestly above last year. What happens later in the year will depend whether the economy falls into a recession in the second half, as well as how deep and long the recession will be if it does arrive. Let’s hope our central bank gets it right and is able to tame inflation without sinking the economy!

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!