Toronto Market Takes a (Very Brief) Christmas Break

01/20/22

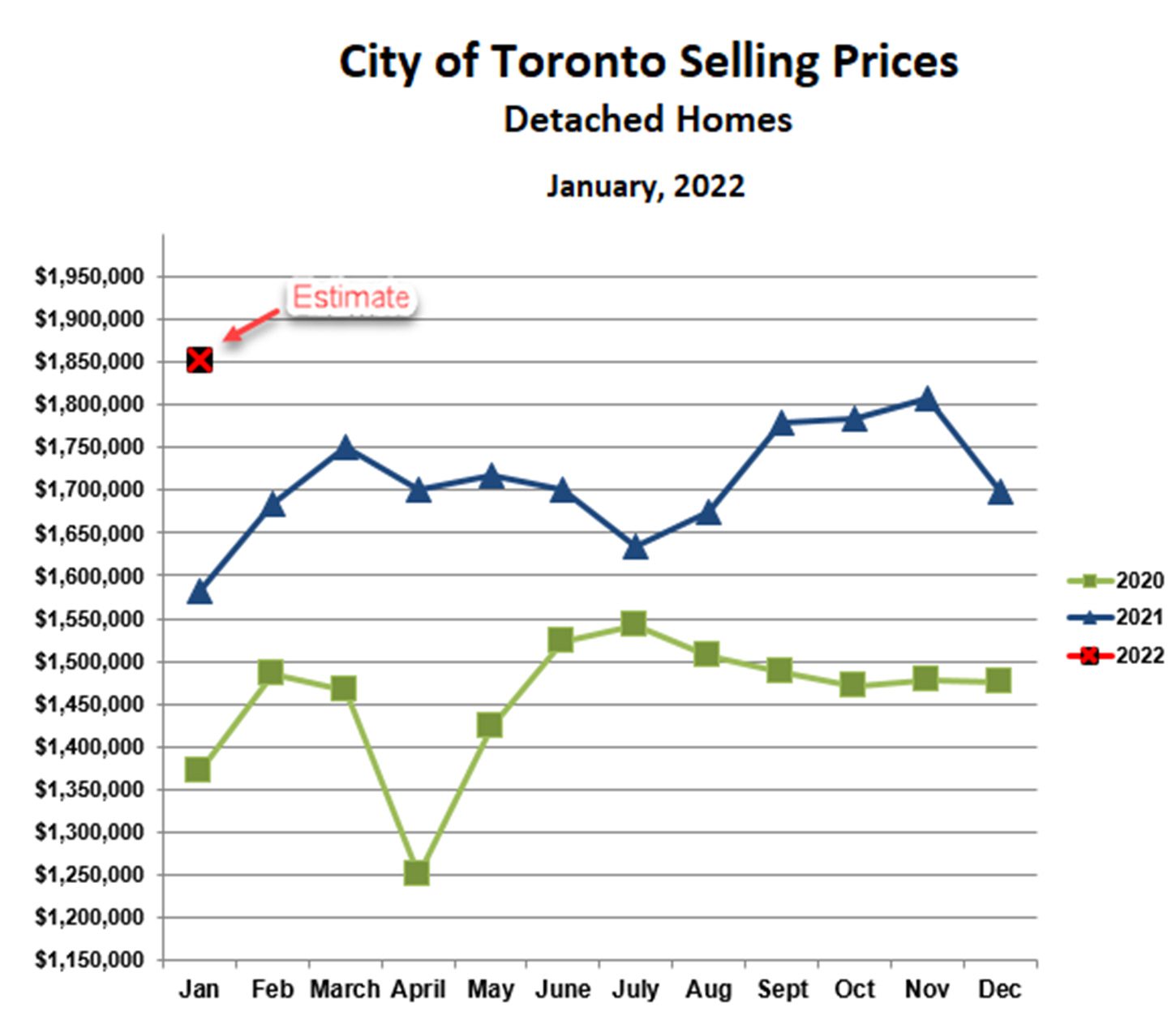

Detached Homes

Prices for detached homes dipped by 6% in December as compared with November, though they were still 15% above the same time last year. This was despite a continued fall in inventory to just 0.7 month’s supply. Normally we’d expect such extremely low inventory to drive prices even higher, but I guess everyone was ready for a bit of a Christmas break. And a brief break it was: the market has come out of the gate very fast in January, with detached prices already an estimated 3% higher than the all-time high reached just 2 months ago. Buyers are out in force, with bidding wars rampant, and 15+ offers on homes commonplace. Most homes are selling for more than recent comparable sales would justify, and then these sales become the benchmark for the next round. So prices are ratcheting up very quickly.

This is a familiar pattern. We saw something similar early last year, with massive bidding wars early in the year, and then prices eased somewhat in the spring as the inventory of homes for sale gradually increased. We may be in for the same sort of experience this year, especially if mortgage interest rates increase as they are forecast to do.

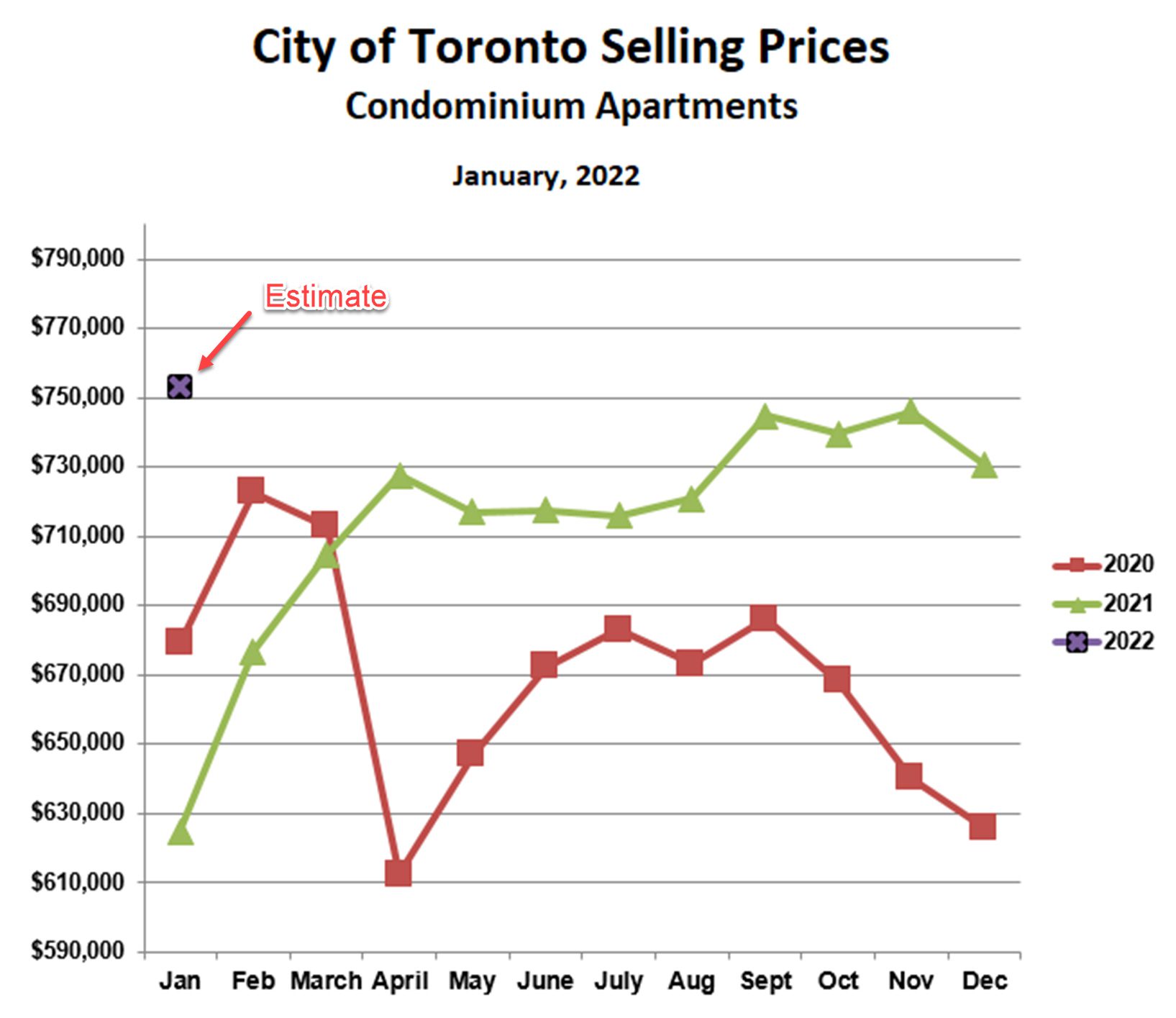

Condo Apartments

Condo apartments followed a similar pattern, though not quite so extreme. December prices fell by 2% versus November, despite sub-one-month inventory in December but were still 17% ahead of last year. Prices are increasing sharply in just the first three weeks of January, similar to houses, and are already above the highs reached last fall.

For the first time since 2008, we are facing the prospect of rising interest rates. Already bond rates are creeping up, and this is impacting fixed mortgage rates. Variable mortgage rates remain very low, however, the Bank of Canada is indicating that they may increase the bank rate in the near future. If this happens, prime and variable rate increases will soon follow. We are greatly in debt, at government, corporate and individual levels, so it seems likely that the central banks will limit interest rate increases as much as possible. If inflation gets out of hand, however, this could prove difficult. This year promises to be quite volatile.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!