Author: Dave Proulx

Am I Ready to Downsize to a Smaller House?

08/08/23

Choosing the right time to downsize your home is a personal process. Not only does it impact your lifestyle and everyday responsibilities, but there are unique financial and logistical considerations too.

At the end of the day, making the leap to a smaller home can help you make the most out of the next chapter of your life – whatever that may look like to you.

In this blog, we’ll look at some of the things you (and your family) should consider when thinking about downsizing.

Thinking about downsizing from your family home? Click here to read our list of five reasons downsizing in West Toronto is easier than you think.

Do I Have Too Much Space?

In West Toronto, one of the most common reasons that homeowners downsize is because they simply no longer need the space.

Having extra rooms, greater square footage, and a larger yard is great in theory, but it also means there’s more to clean and maintain. These responsibilities can be stressful and aren’t always necessary – especially if you have fewer people living in the home than before.

Empty nesters, for example, often find themselves with more space than they need once their children have grown and moved out. Downsizing to a smaller place gives them the opportunity to cut back on chores, repairs, and other duties. If you’re in a similar situation, downsizing to a smaller home can help you spend more time doing the things you enjoy by cutting back on home maintenance.

Looking for more resources about downsizing in West Toronto? Check out these blog posts.

- 3 Great West Toronto Neighbourhoods For Downsizers

- Selling After a Divorce: Options & Pathways

- How Buying a Condo in West Toronto is Different Than Buying a House

What’s My Financial Plan For Retirement?

Because many downsizers are also empty nesters, it’s no surprise that this kind of move often aligns with homeowners entering retirement. Retirement is an amazing and exciting time in one’s life, however, it also requires careful financial planning.

Because your home is probably your largest financial asset, downsizing can be a major part of how you build your budget. Put simply, a smaller house usually comes with a smaller price tag – and making the switch can offer significant financial benefits.

Speaking generally, downsizing presents an opportunity to unlock equity tied up in a larger home and use those funds to plan for and enjoy your next chapter. You can use the returns from your current home to bolster retirement savings, travel, or pursue other passions.

On top of this, downsizing in West Toronto can also lead to reduced property taxes, utility bills, and maintenance costs, freeing up more of your budget for whatever is important to you.

Am I Ready For a Change in Lifestyle?

Another thing to consider when thinking about downsizing is what your ideal lifestyle will look like as you enter the next chapter of your life. Downsizing to a smaller house can be the fresh start you’ve been looking for. You may be looking for a lot of change, or just a little. Luckily, there are options for everyone.

In a diverse real estate landscape like West Toronto, downsizing opens up the possibility of exploring new neighbourhoods and communities, meeting new people and discovering new ways to enjoy your life. Or if you’re looking to relocate to a new city, or province, or even become a snowbird, downsizing can be an opportunity to make that dream a reality.

Successfully selling your home is the foundation for a smooth downsizing process. To learn more about maximizing the sale of your home, explore these blog posts.

- What Should Sellers Know About Exclusive Listings

- The Power of Staging a Home to Sell

- How to Sell Your Toronto Home in a Balanced Market

Is My Home Current Home Accessible Enough?

One of the challenges that can come with a larger home is accessibility. During your golden years, your health and wellness needs may evolve, which can impact how well-suited you are to your home. Downsizing to a more manageable space can help you find or create a living space that’s better suited to your changing needs. Your real estate agent can help you find homes with high-priority features like single-level living, accessibility modifications, or a low-maintenance yard.

Looking for a seamless downsizing process that can help you enter the next chapter of your life with ease? We’re here to help. Send us an email or call 416-769-6050 to get started.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

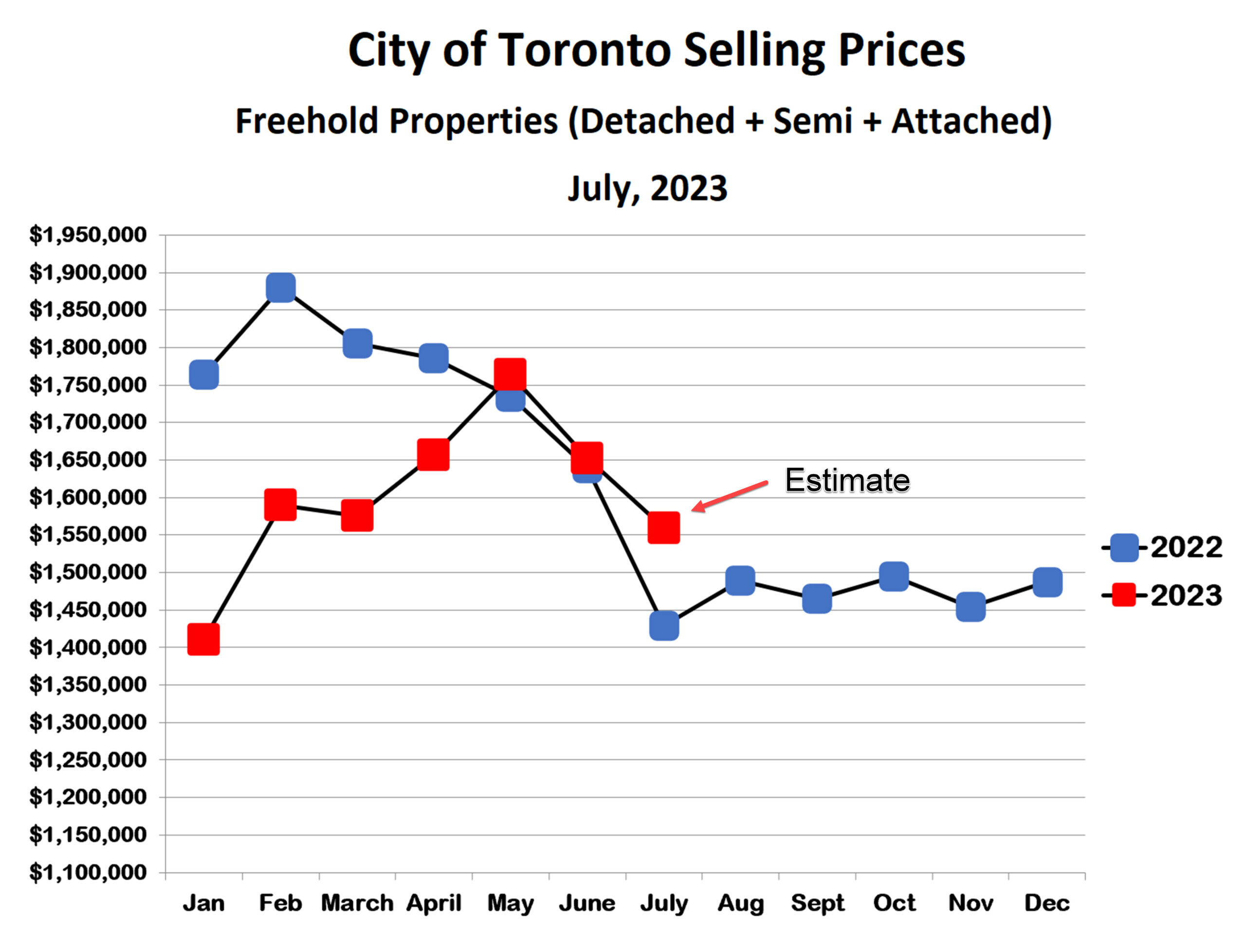

The Summer Slowdown Continues

07/20/23

Houses (detached, Semi-detached and attached homes)

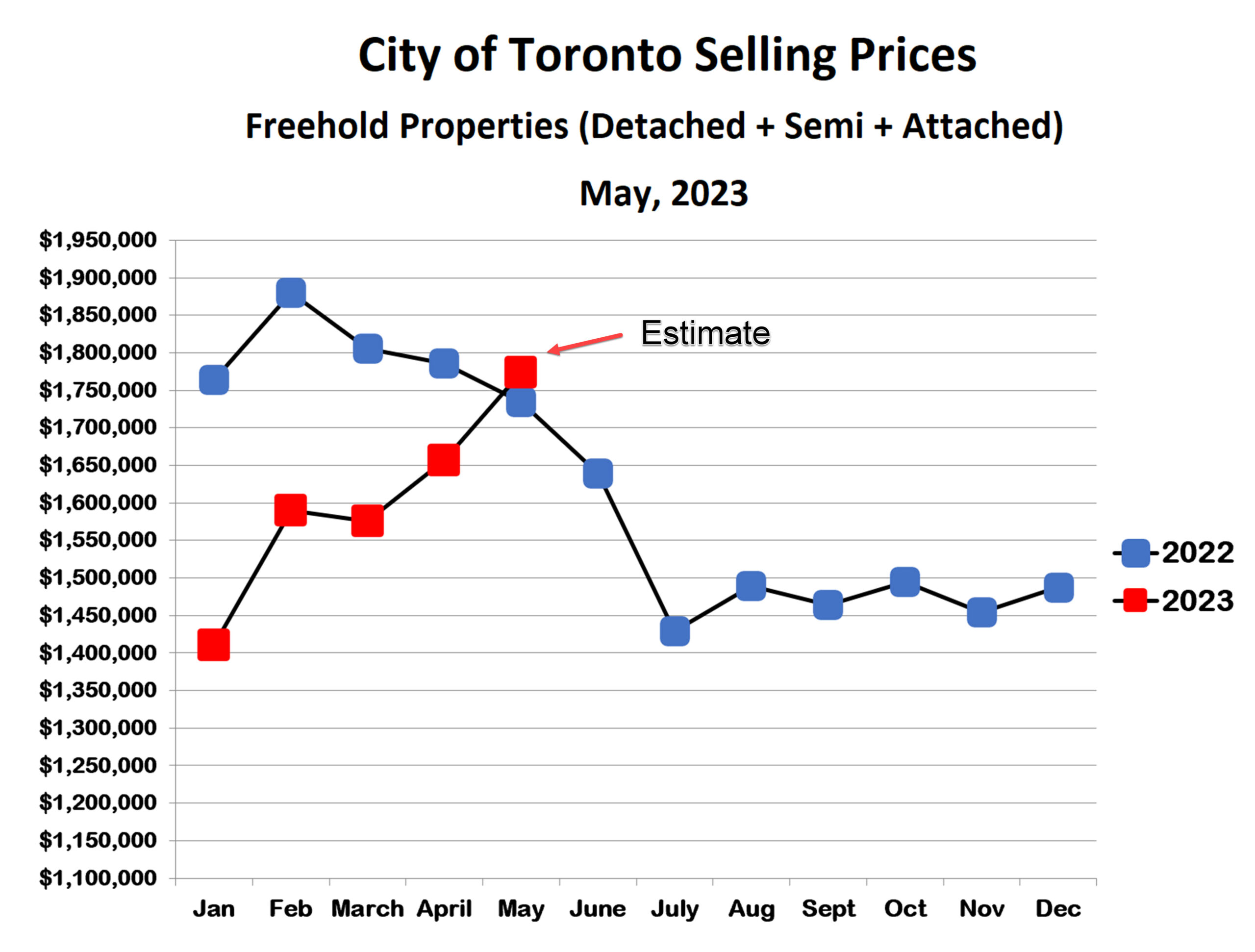

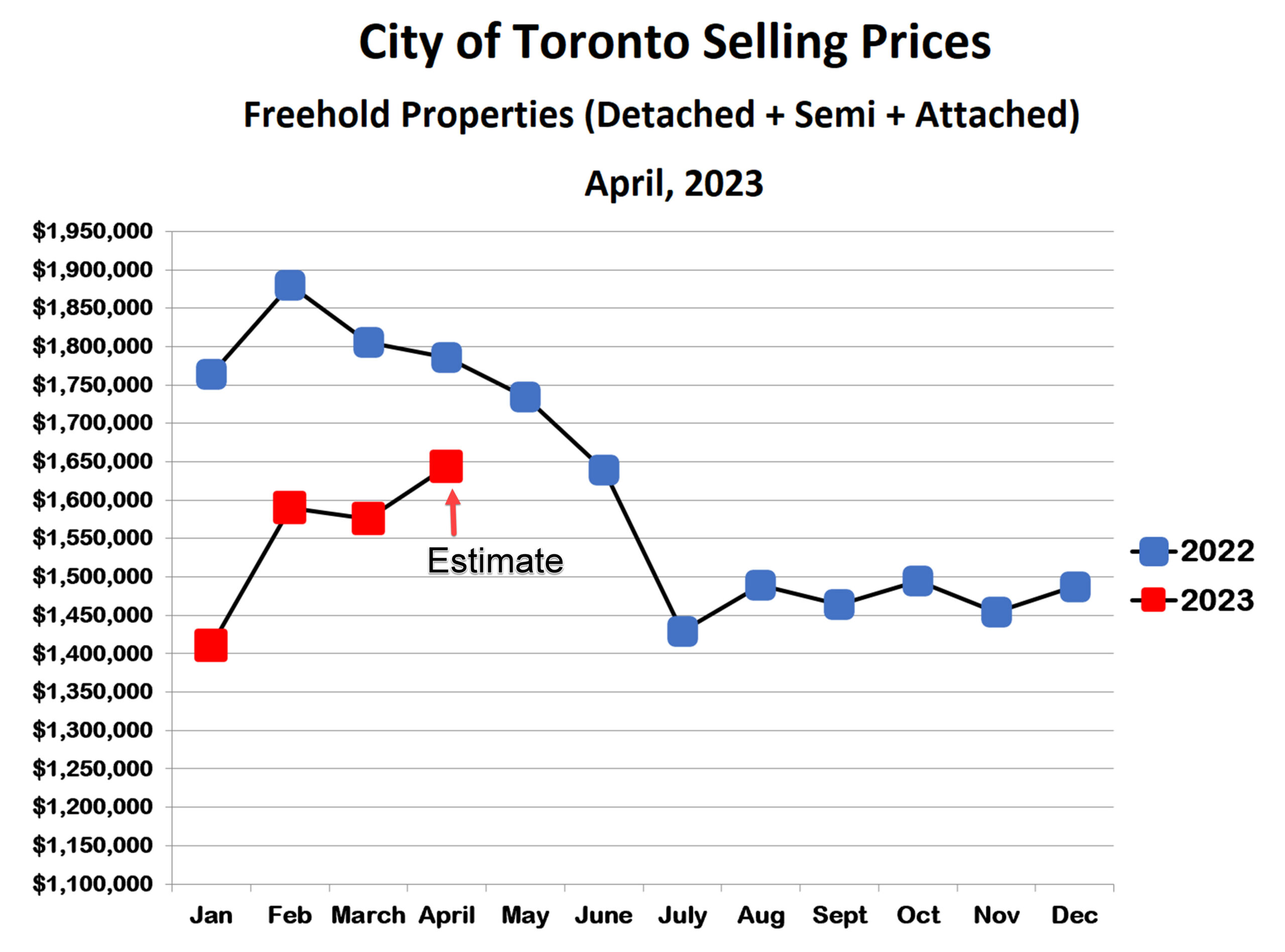

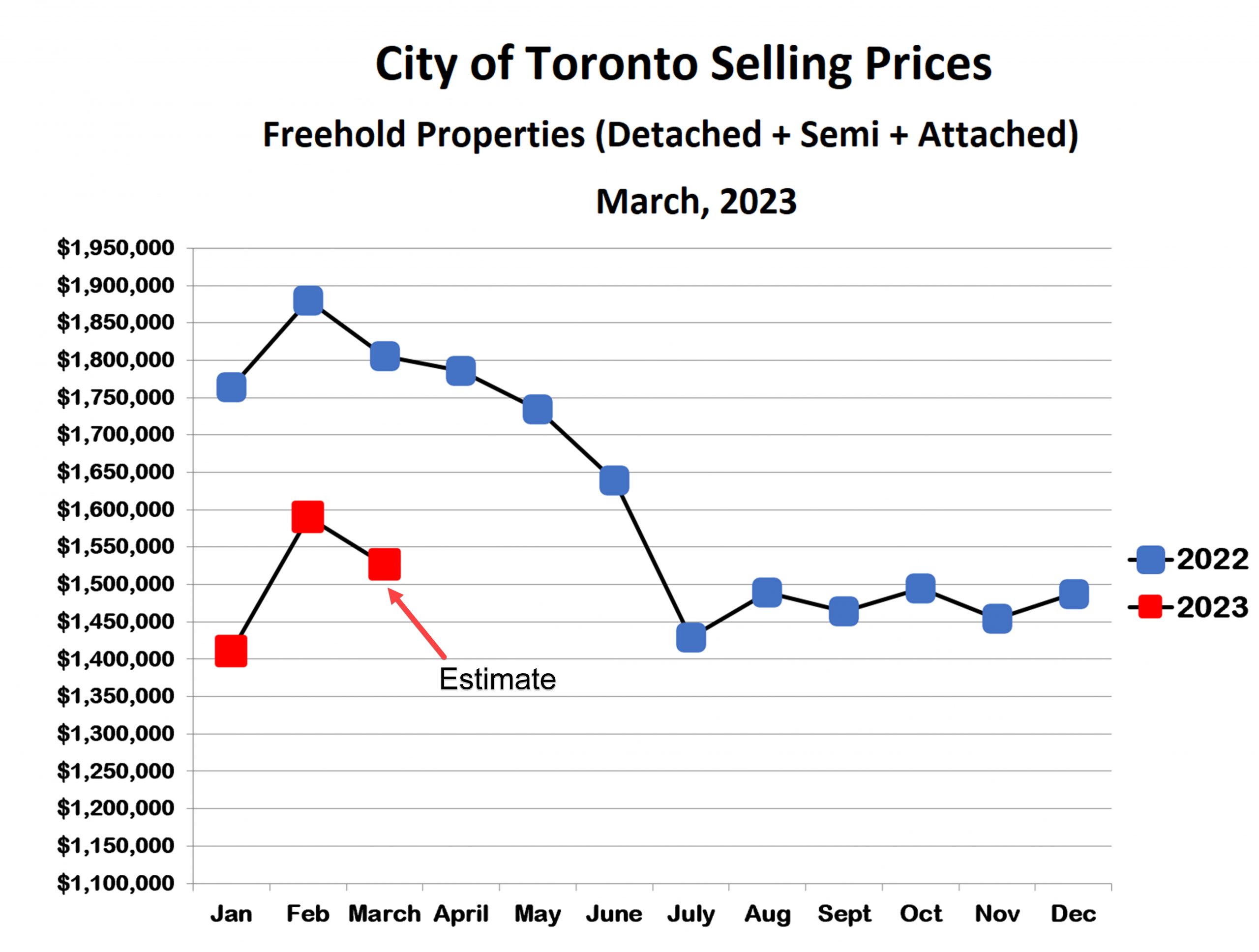

Prices for freehold houses in the City of Toronto continue to trend lower in July, although they remain higher than last year.

Last year the Bank of Canada began increasing interest rates in March, and ultimately raised the bank rate from 0.25% to 4.25% in a series of 8 hikes ending in January of this year. House prices started falling soon after the first rate increases, bottomed out in July, and were more or less unchanged for the next 6 months. Immediately after the final rate hike in January, prices started moving up again very strongly. Prices peaked in May, not far below the 2022 high, and then turned lower in June. It can’t be a coincidence that the Bank of Canada resumed their rate hikes at the same time, with 0.25% increases in both June and July.

Looking for home-buying advice? Start with these related blog posts.

- Why You Should Buy Instead of Renting

- Incentives & Tax Breaks First-Time Buyers Should Know About

- 3 Reasons Real Estate Transactions Fall Through and How to Avoid Them

It seems that there is a strong negative correlation between interest rate increases and house prices. Not surprising, perhaps, as mortgage interest rates obviously affect affordability very directly. What is intriguing, however, is that it appears to be changes in interest rates, not their actual level, that is weighing on prices. Early this year, once it was understood that there would be no further rate hikes, prices took off. It was as if buyers were always ready to jump in, but were waiting until they were confident that the correction was over. With the recent resumption of rate increases, perhaps buyers are once again hesitating.

If this theory is correct, always assuming that there will be no further interest rate changes this year (the current consensus), then we can hope for a strong fall market with prices once again increasing. The wild post-Covid market gyrations continue.

Condominium Apartments

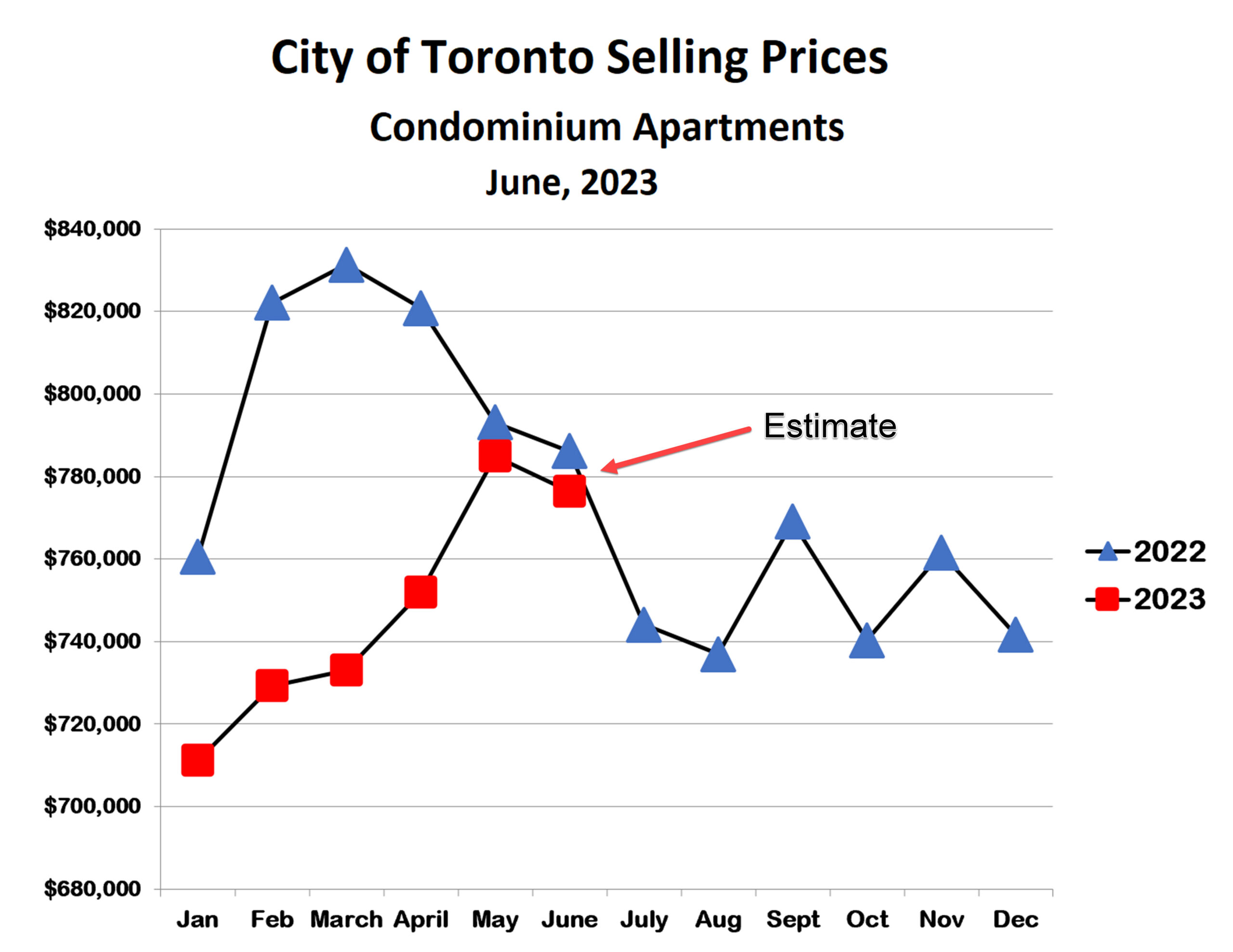

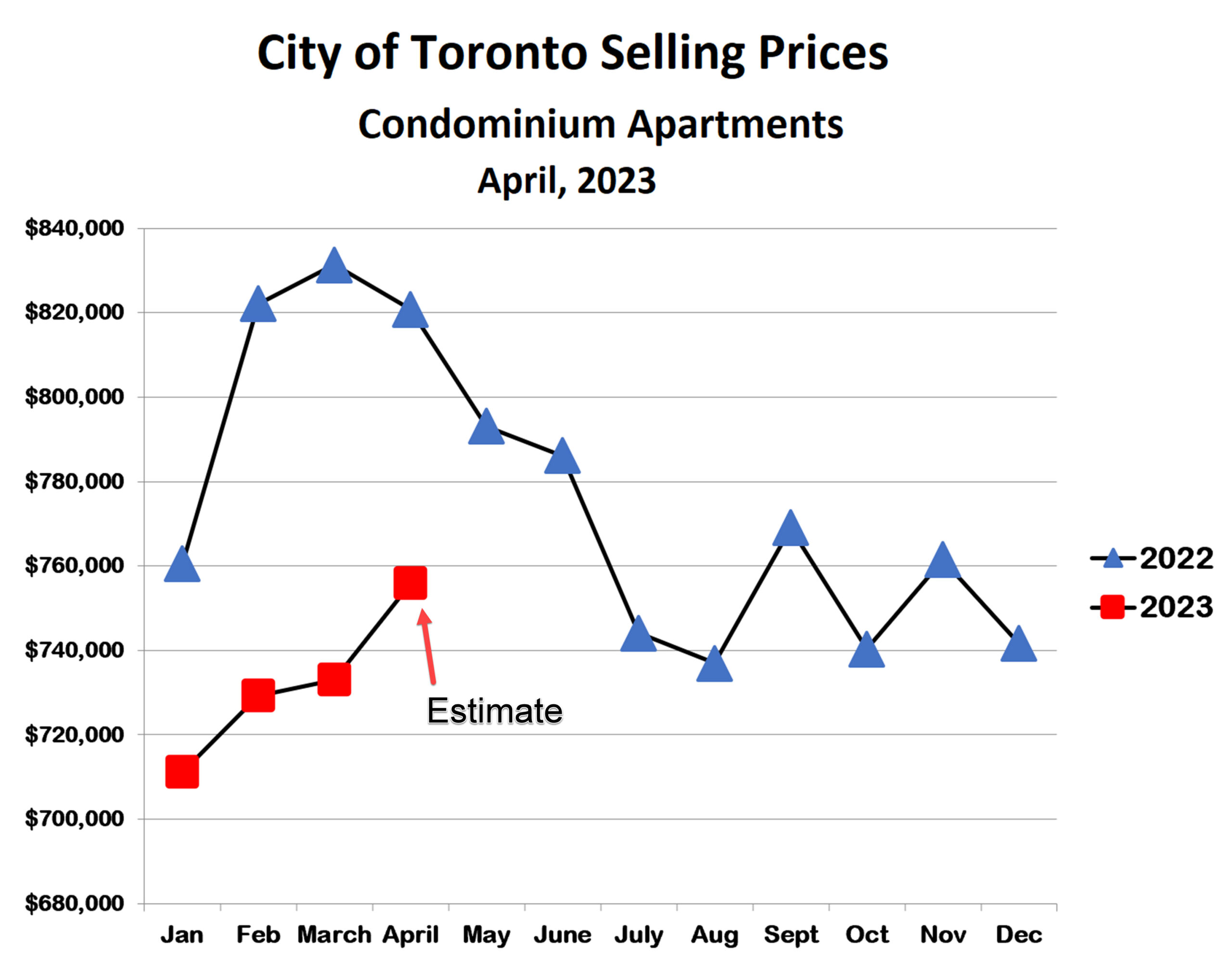

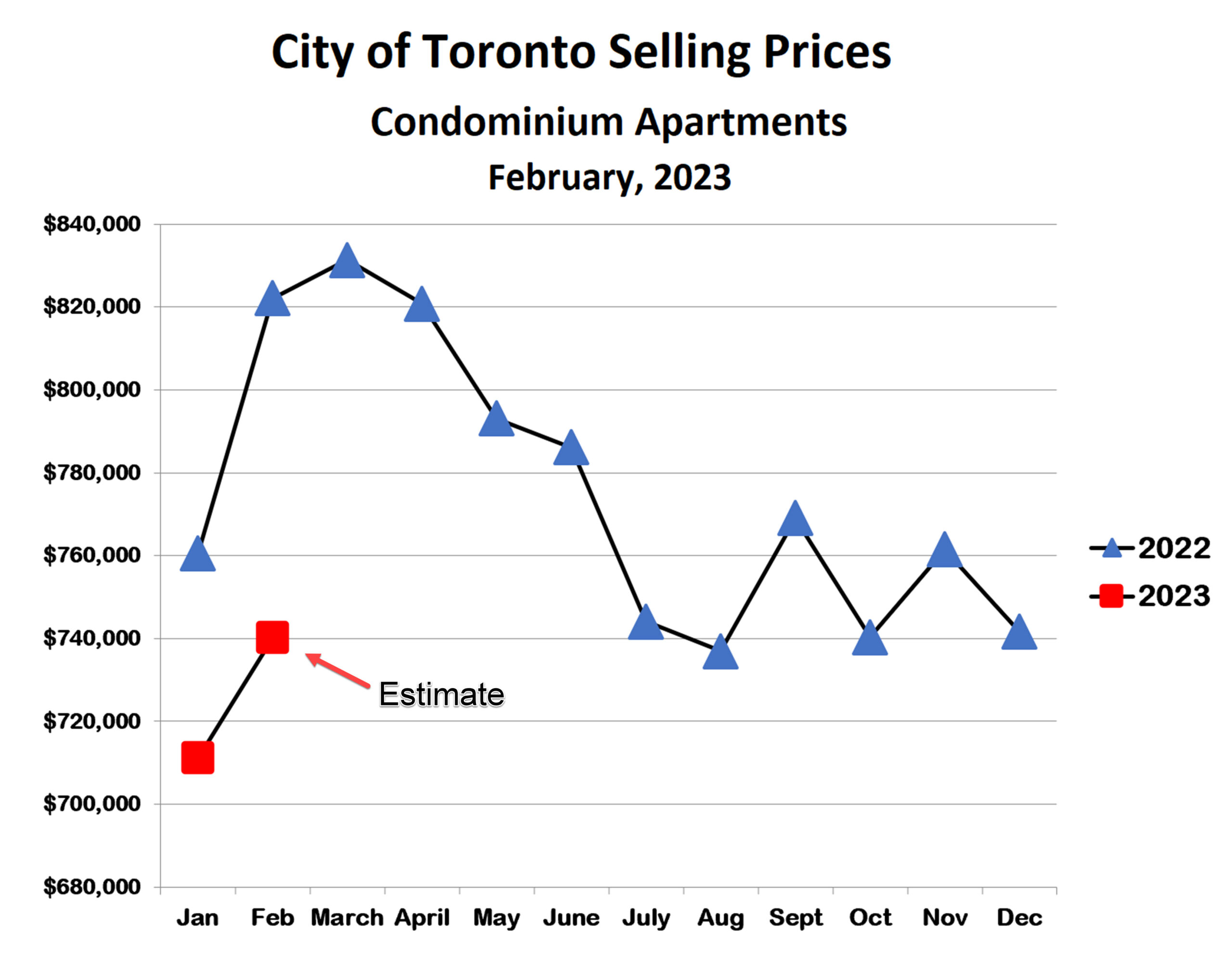

As for houses, condo prices have fallen since interest rate hikes resumed in June, however, they are actually somewhat higher so far in July than they were in June.

Toronto condo prices have been more resilient than house prices in the face of rising interest rates. For example, the peak-to-trough correction in house prices last year (from February to July) was 24%, while the condo correction (from March to August) was less than half of that, about 11%. This further supports the idea that changes in interest rates are impacting prices more than the rates themselves. Otherwise we’d expect condo prices to be hit harder than house prices, since affordability is generally a bigger factor in the lower price ranges.

Bottom Line

We have a housing crisis in Canada, and especially in the GTA, with the growth in population greatly exceeding the growth in available housing. Resale and rental markets for houses and condos are tight, with generally low inventory in both. Upward price pressure on both markets is likely to continue in the medium to longer term, with short term fluctuations in the resale market due, in part, to buyers hoping to ‘time the market’. If we get a recession in the next year, this may also weigh on prices though, again, this is likely to be only a temporary blip in the longer term uptrend.

Looking to get into the market? We can help you reach your goals. Send us an email or call 416-769-6050 to get started.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Should I Buy A Multi-Family Home in Toronto?

07/12/23

If you’re looking to buy a home in West Toronto, you may have noticed a few listings that include secondary suites or apartments. These are known as multi-family homes. As a unique property type, these homes offer a wide range of perks.

If you’re in the market for a new home, purchasing a multi-family property could work within your personal or financial vision for the future. Let’s take a closer look.

What Exactly is a Multi-Family Home?

The term Multi-Family Home can be somewhat broad. However, in the case of West Toronto real estate, it typically refers to a specific type of residential property (most often a detached home) that has been modified to include separate living units that can accommodate multiple families or residents.

The general idea with multi-family homes is that some or all of these units (also referred to as suites or apartments) are rented to tenants on a short or long-term basis. The homeowner may live on-site or use the home as a dedicated investment property.

Looking for general home-buying advice? Start with these related blog posts.

- Why You Should Buy Instead of Renting

- Incentives & Tax Breaks First-Time Buyers Should Know About

- 3 Reasons Real Estate Transactions Fall Through and How to Avoid Them

Why Are There So Many in West Toronto?

Understanding why multi-family homes are so prominent in West Toronto begins by taking a look at their advantages.

Toronto’s west end is home to some of the most sought-after neighbourhoods for renters in all of the GTA. Many homeowners have capitalized on this demand by adding for-rent units to their property, earning a healthy volume of passive income each month.

Another reason for the prominence of multi-family homes is a local uptick in multi-generational living. With separate living spaces in one shared building, multi-family homes provide unique opportunities for families to live close together – without feeling like roommates.

Want to get a sense of what’s available in today’s market? Click here to browse our current selection of listings.

Are They a Good Fit For You?

A somewhat unique type of property, multi-family homes have plenty of advantages. However, they’re not for everyone. Let’s weigh the pros and cons.

The Perks

Extra Income: One of the biggest perks of owning a multi-family home is the potential for earning passive income. With separate units already built into the property, you can live in the one that best suits your needs, and then rent out the remaining ones. Given the red-hot state of West Toronto’s rental market, property owners are able to bring in some pretty impressive returns.

Given the elevated costs of housing faced by today’s generation, many first-time home buyers in particular have found it helpful to have an additional stream of income to use towards their mortgage.

If this appeals to you, buying a multi-family property could be a good fit.

Multi-generational Living: As the costs of housing continue to rise in Toronto, multi-generational living has become a reality for many families. With that in mind, multi-family properties can make a great fit for these kinds of living arrangements.

If hosting parents, inlaws, or other family members on your property is part of your long-term goals, buying a multi-family home could work well.

In addition to hosting family members, having a smaller suite on your property could make for the perfect place for you to downsize. Down the line, having a smaller living space to move into already lined up can make it much easier to transition into your next chapter.

Searching for a home for you and your family? Check out these related blogs.

- What to Look for in a Family Neighbourhood

- Can you Raise a Family in a Condo?

- How to Build a Nursery That Doesn’t Break the Bank

Potential Drawbacks

While there are plenty of advantages to owning a multi-family home, there are a few things to consider before you buy.

For example, if you intended to rent out one (or more) of the suites, you’ll take on certain landlord responsibilities. This could include finding and vetting tenants, collecting rent, looking after repairs and maintenance, and staying up to date on the various legalities of being a landlord. Additionally, hosting tenants will also add a few extra steps if you choose to sell down the line.

Speaking generally, these duties are far from a full-time job. With the right coaching from a real estate agent or professional property manager, you can enjoy an easy, stress-free landlord experience.

Looking for the right home to begin your next chapter? We can help you find it. Send us an email or call 416-769-6050 to get started.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

4th Annual Summer Ice Cream Event

06/26/23

Once again, on Saturday June 24, the Smith Proulx Team visited 5 west Toronto parks with free ice cream for all.

Bow Tie Ice Cream

The classic Bow Tie Ice Cream Truck started at Vine Park in the Junction at noon and then continued to Lithuania Park at 1:00, Ravina Park at 2:00, Beresford Park at 3:00 and finally to Rennie Park from 4:00-5:00.

Panda Photos

The iconic Panda was of course on hand at each location to meet all the kids, and many cell phone photos were taken by proud parents. More than 550 visitors enjoyed the delicious chocolate, vanilla & twist ice cream cones as well as refreshing slushies in many fruit flavours. The ice cream man even remembered to bring tiny ice cream cones for the babies!

We had wonderful weather despite the forecast of rain early in the day, and everyone had a great time!

The Smith Proulx Team would like to thank our wonderful community members in High Park, Bloor West Village, Swansea and The Junction for coming out to enjoy our 4th annual ice cream event.

We had so much fun. Looking forward to seeing everyone again next year!

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

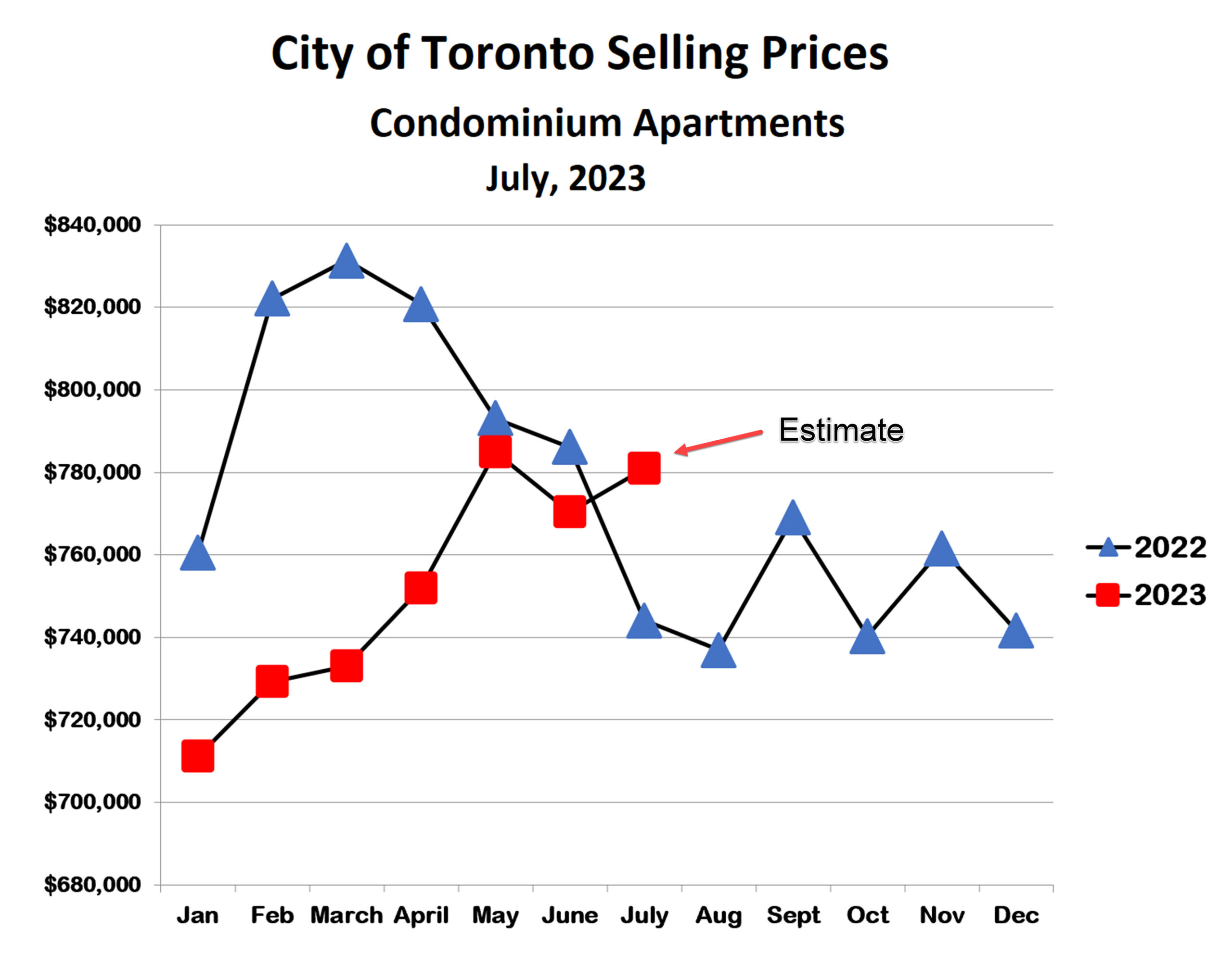

Summer Comes To The Toronto Market

06/18/23

Prices for both freehold and condo properties are falling in June, marking the beginning of a typical summer slowdown.

There are three reasons for the slower summer market:

- Our summer season is pretty short, and many buyers and sellers like to take a break to enjoy the weather and some vacation time;

- “Everyone knows” that summer is not a good time to sell your house – so many sellers prefer to wait until the fall; and

- Among those who are both buying and selling, most prefer to buy first. They’d rather not buy in late spring or summer so they can avoid listing their home at an inopportune time.

It is true that the summer market is ‘thinner’ than the spring or fall, meaning both fewer buyers and fewer sellers. However, it can still be a great time to buy or sell, as both buyers and sellers face less competition.

Freehold Homes (detached, semi-detached and attached)

So far in June, house prices in Toronto are about 5% lower than in May, and about the same as they were in April. The decline precisely matches the May/June fall in prices last year, however, it’s unlikely that we’ll see another summer ‘waterfall’ decline. Last year the rapid increase in interest rates caused the correction. This year, interest rates have been relatively steady, the most recent small hike notwithstanding. Prices could certainly fall a bit further, as they usually do in the summer. Once we get to early September, though, I expect that prices will reverse higher into a normal fall market (if indeed anything can be said to be ‘normal’ post Covid)

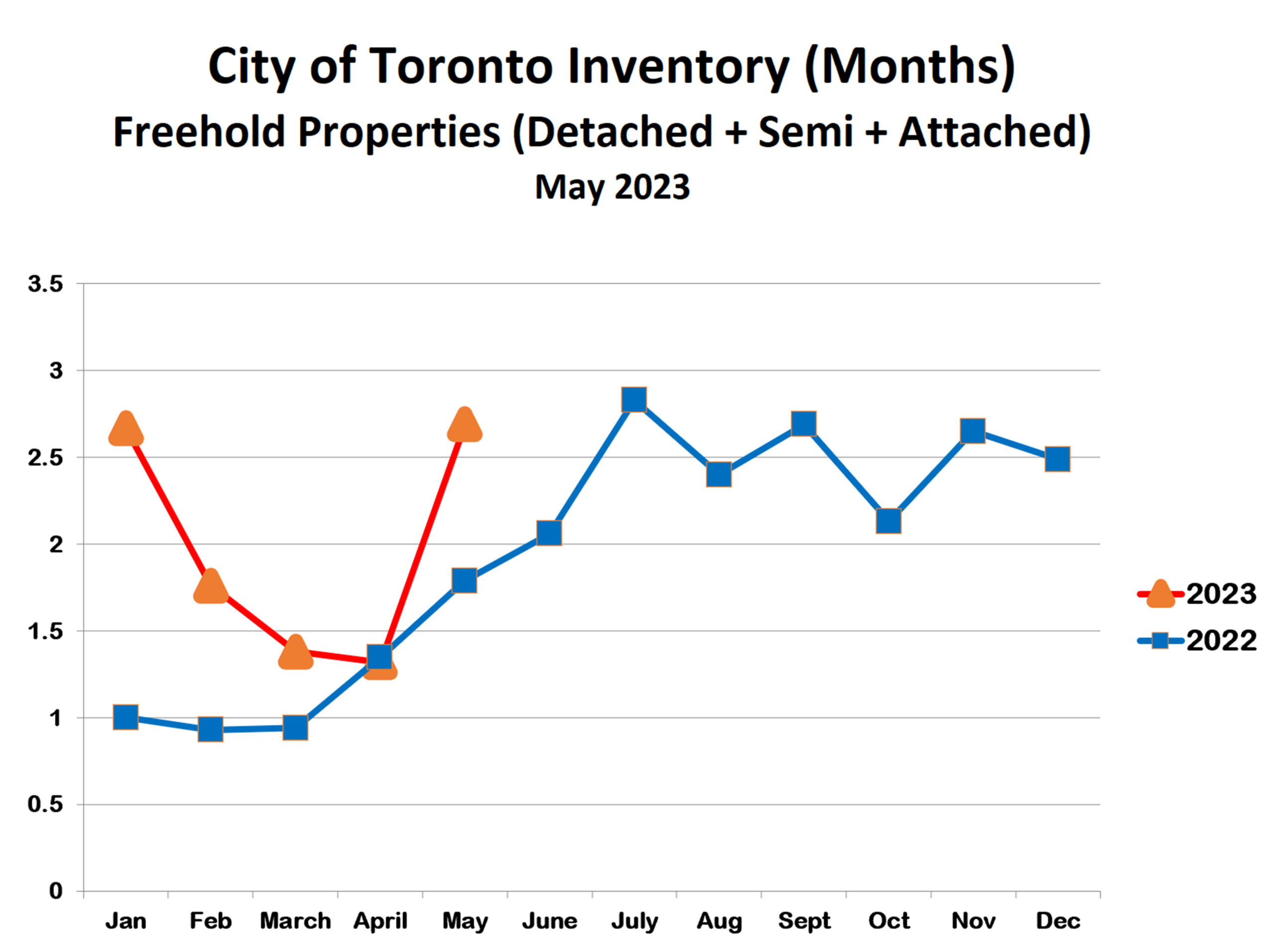

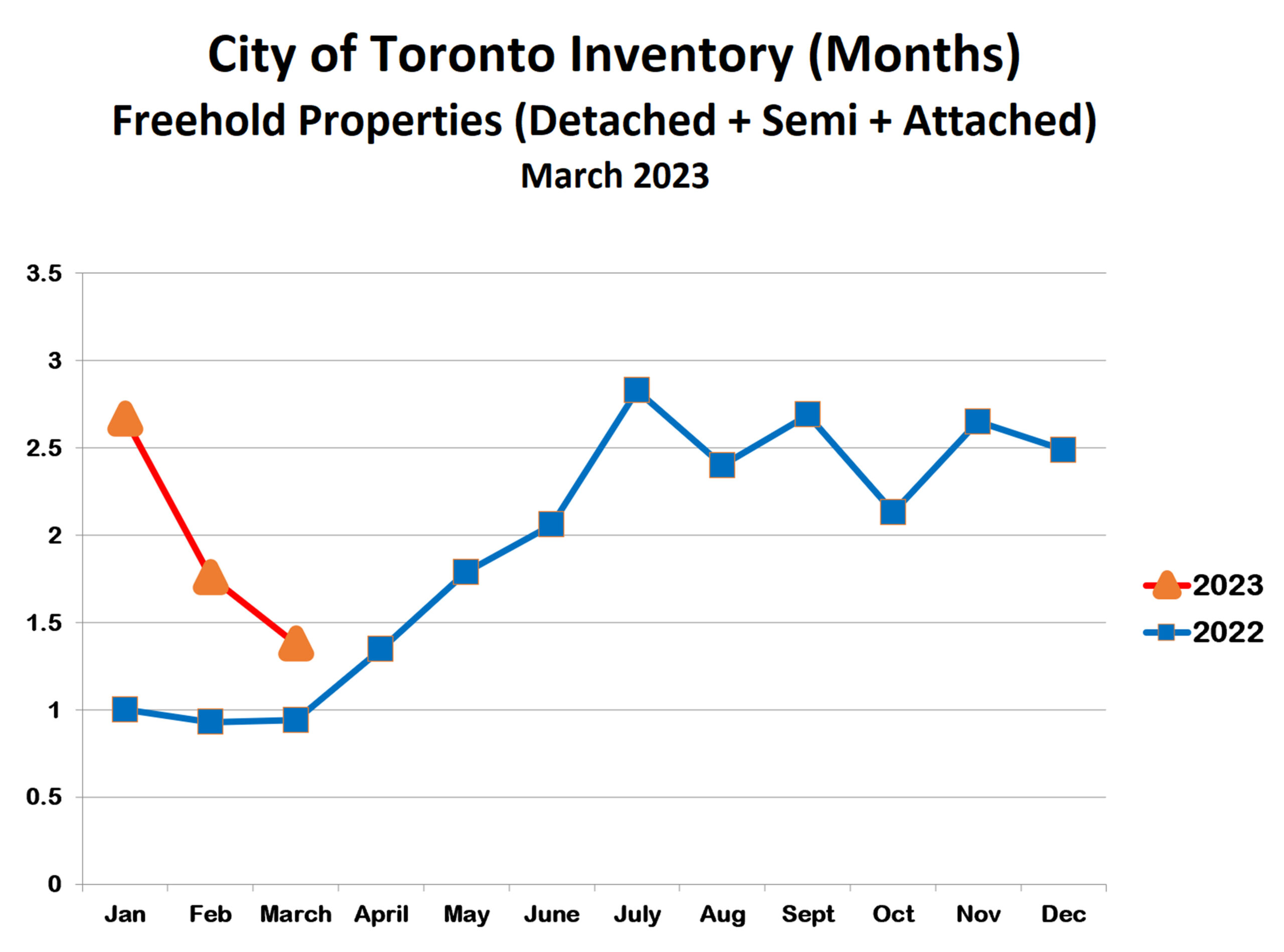

The inventory of freehold houses in Toronto increased sharply in May. This was a harbinger of the moderation in prices to come in June. From less than 1.5 months’ supply (extreme sellers’ market), inventory increased to over 2.5 months’ supply. This is still in sellers’ market territory, though close to being balanced.

Condominium Apartments

Condo prices in Toronto are also falling in June, although to a lesser extent than houses. As for houses, the decline matches the one in May/June last year. Once again, a steep summer decline as in 2022 seems unlikely and a fall recovery probable.

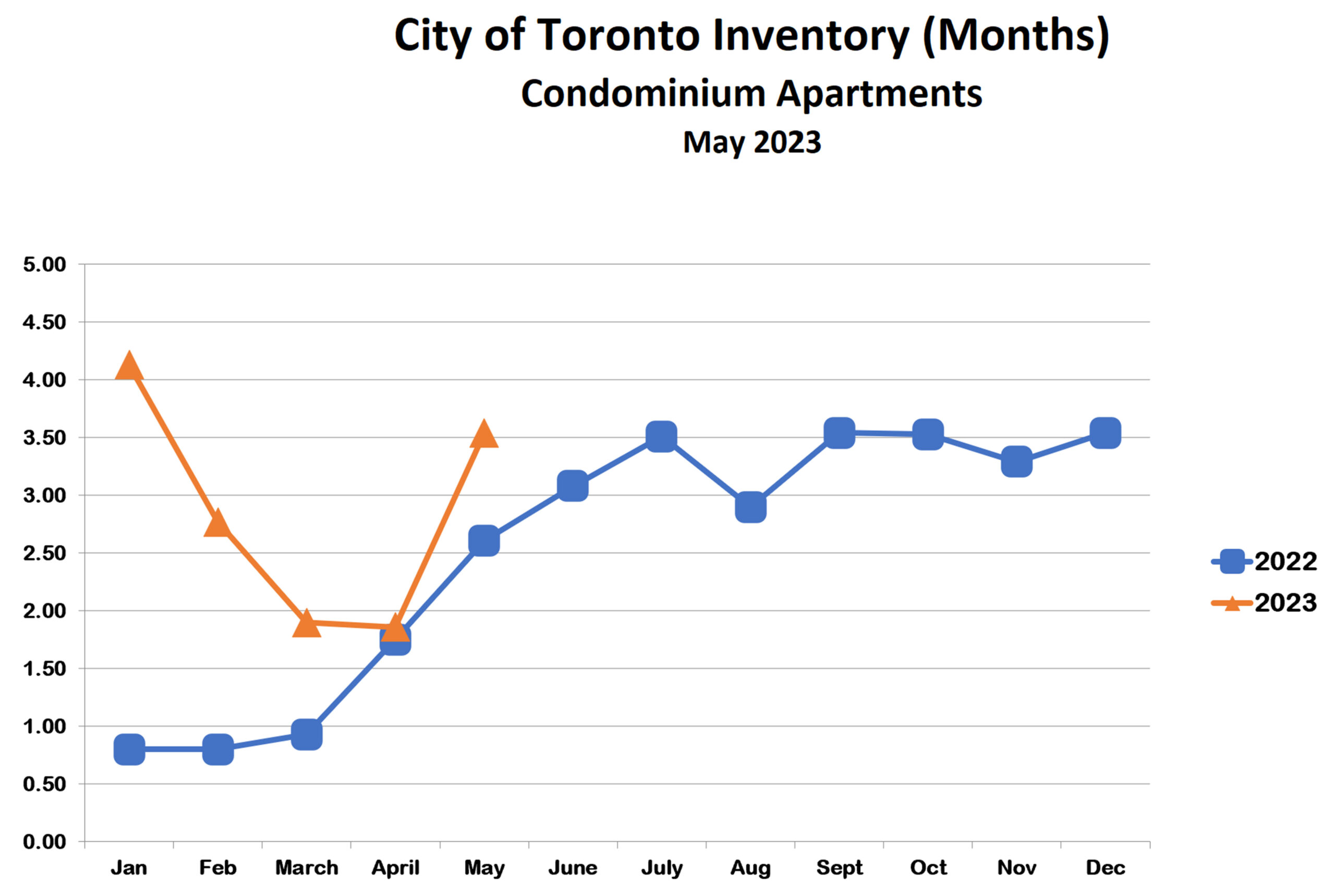

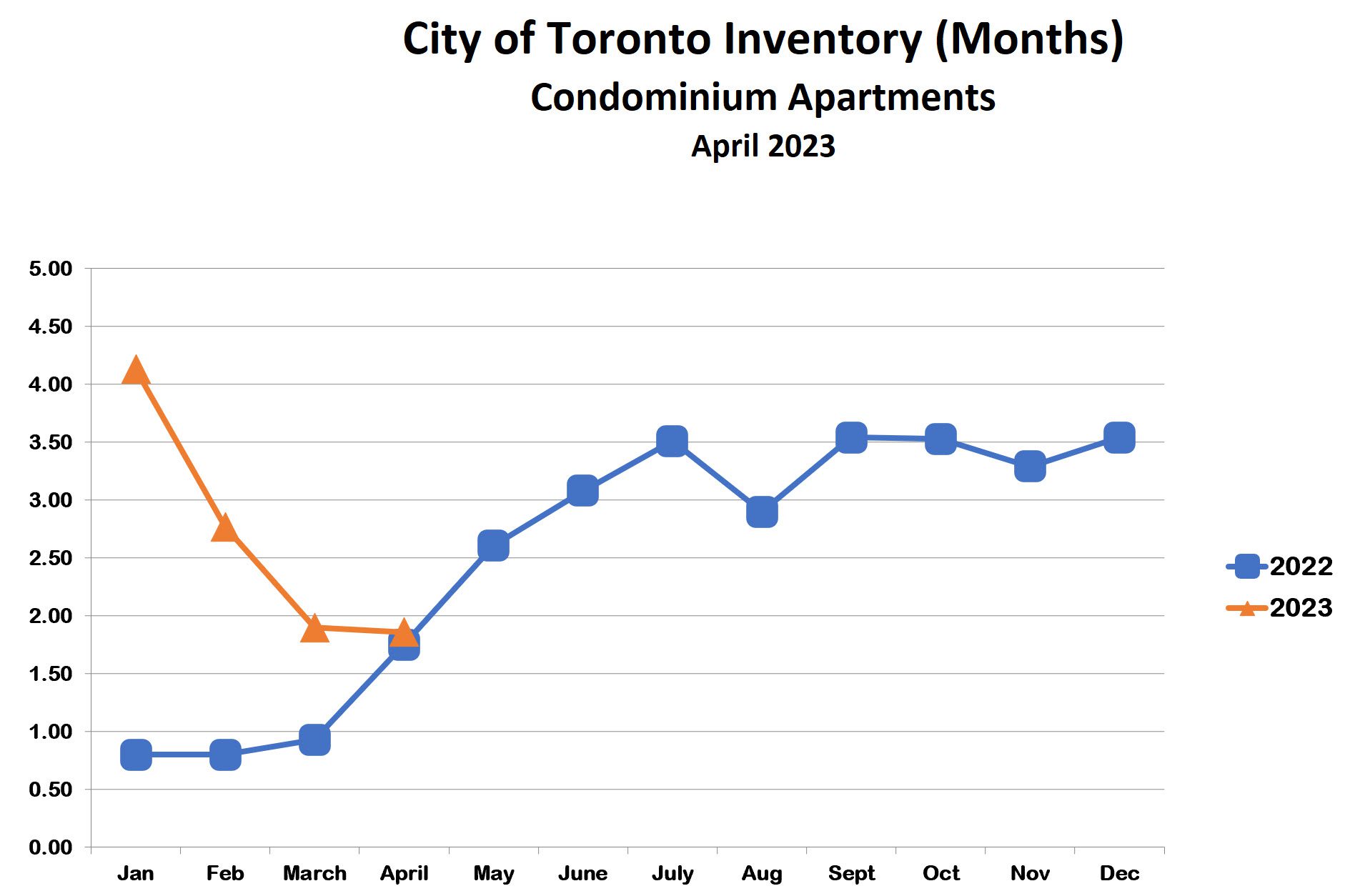

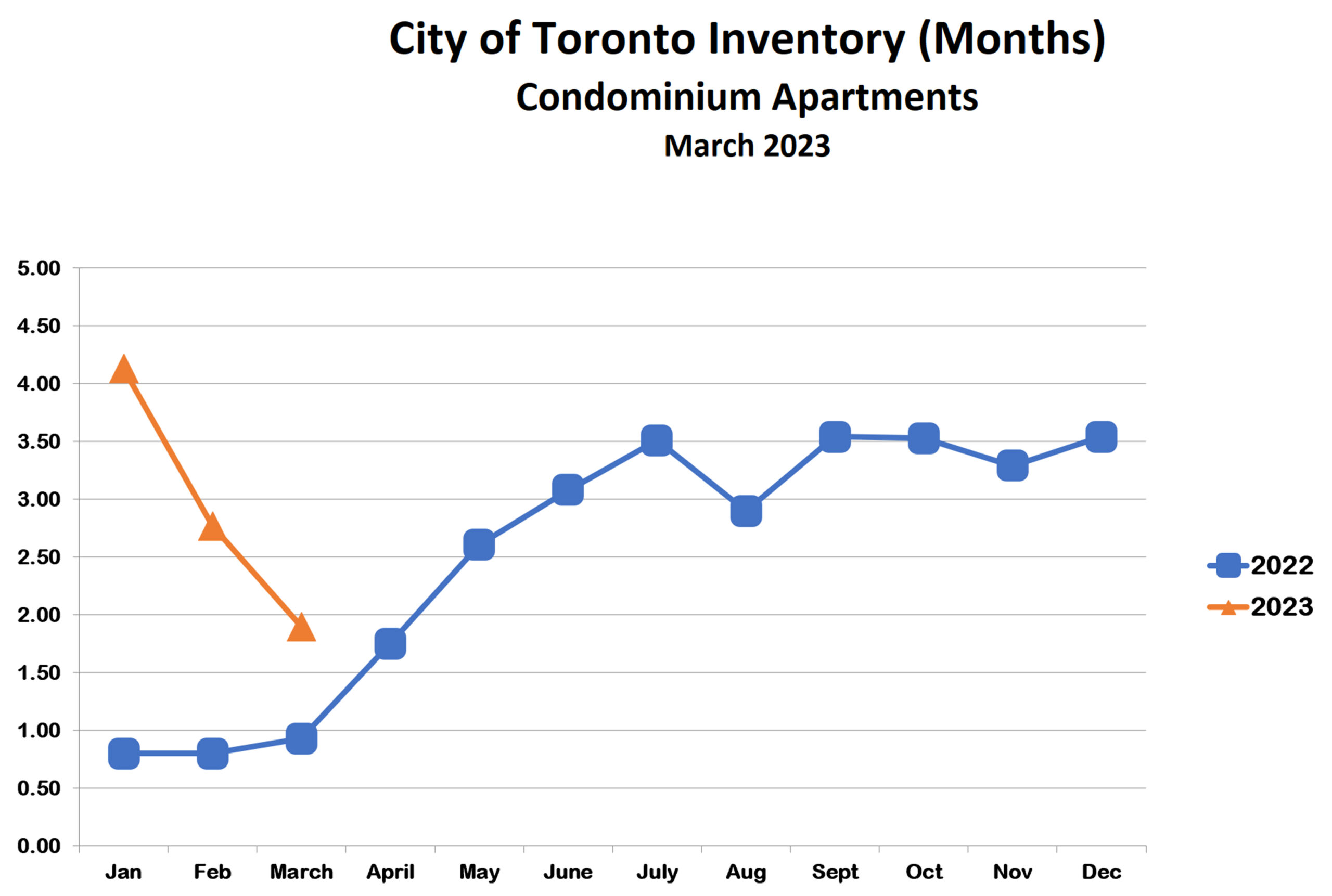

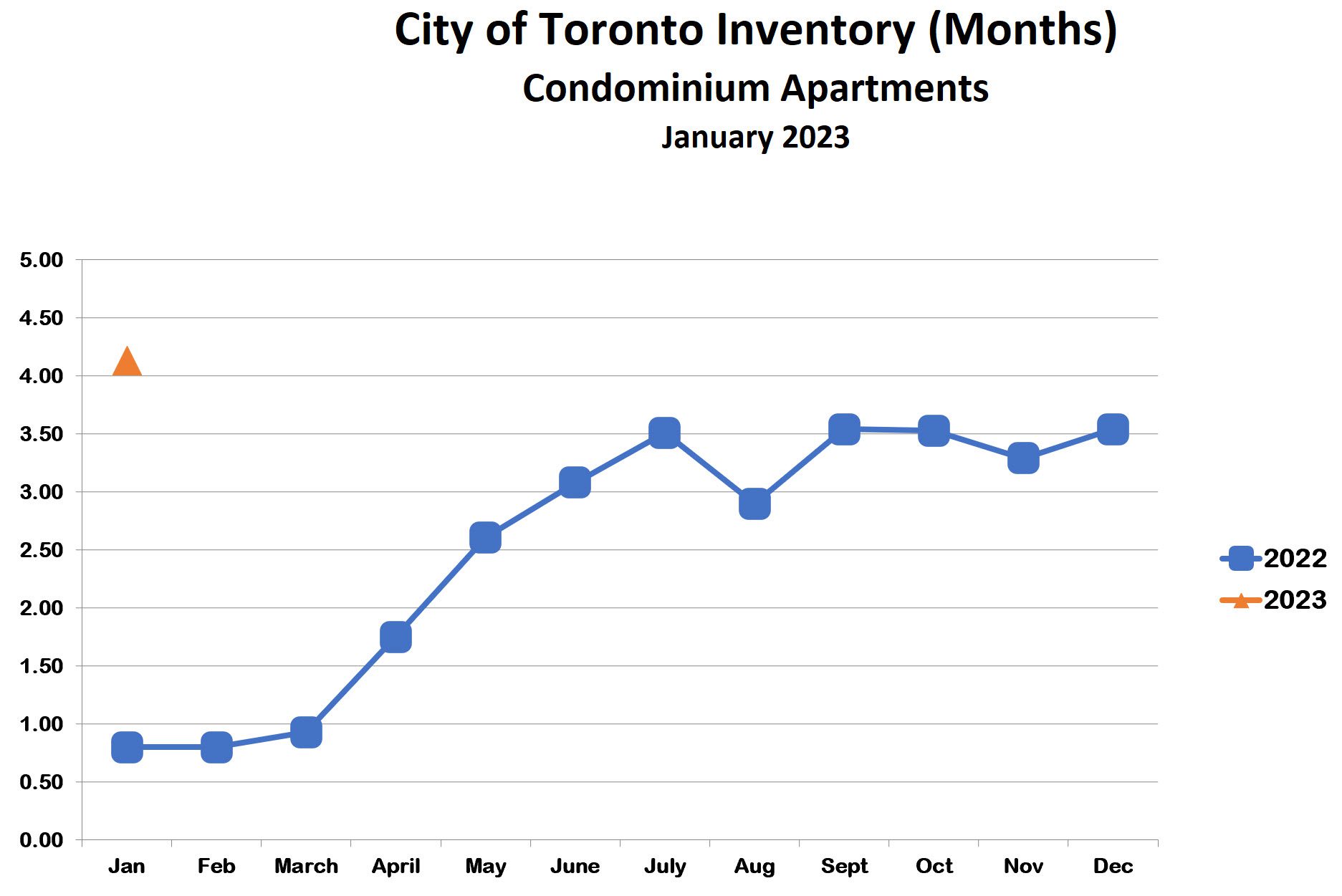

The inventory of condos for sale rose in May, foreshadowing the June moderation in prices as it did for houses. At 3.5 months’ supply, this indicates a roughly balanced market, favouring neither buyers nor sellers.

Bottom Line

For the first time since the beginning of Covid, the Toronto market is (so far) following a more or less ‘normal’ seasonal pattern. Assuming this continues, we can expect to see a bit more moderation in prices over the summer followed by a recovery in the fall starting after Labour Day.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

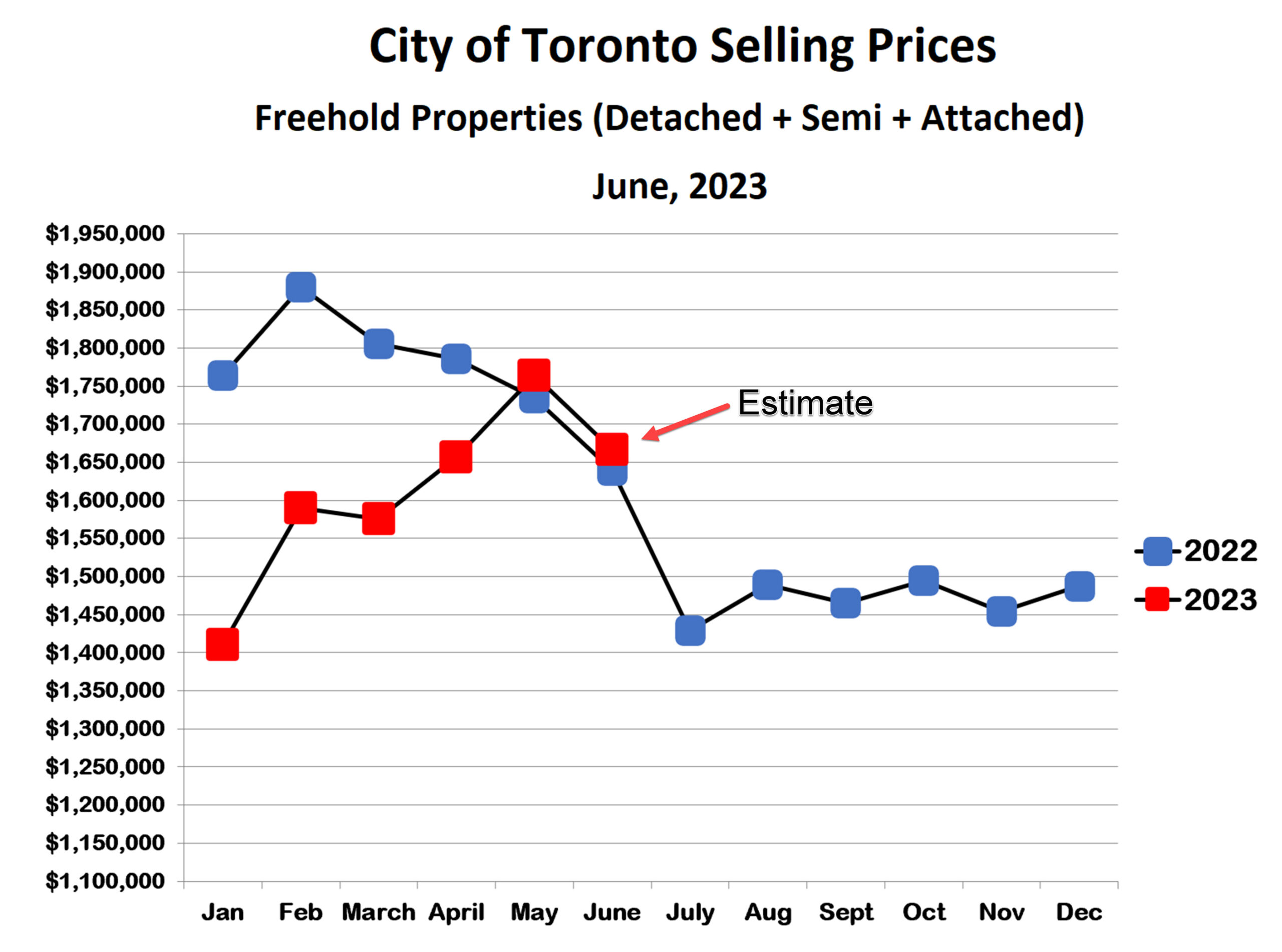

Toronto Market Heating Up Further in May

05/25/23

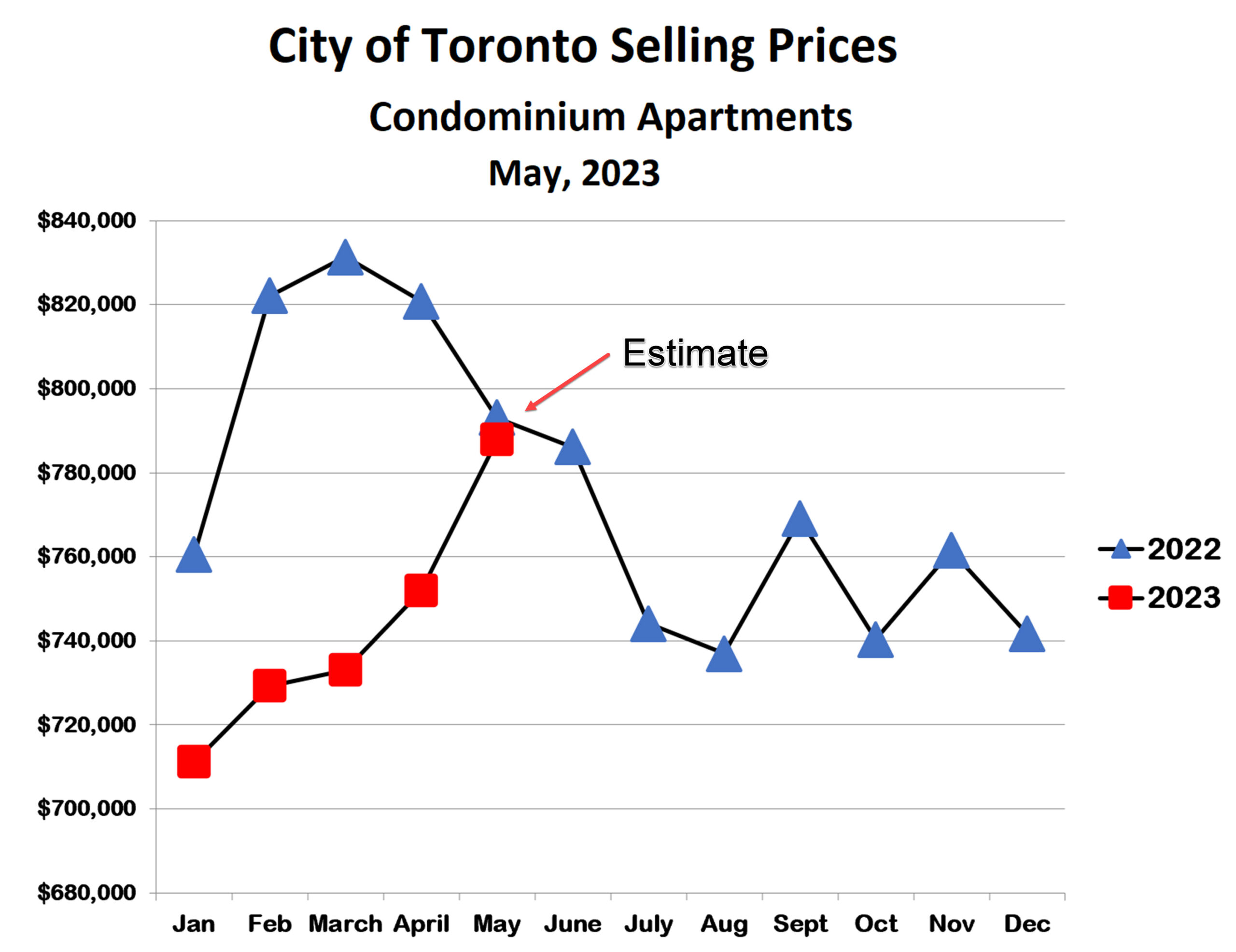

Prices for both houses and condos are continuing to accelerate upward in May as the very strong spring market continues in Toronto. Summer is right around the corner and, if past is prologue, we may see some leveling off over the next month or so followed by a somewhat slower market in July and August.

Houses (detached/semi-detached/attached)

The rising prices this year have caught up with the falling prices at this time last year. By next month, 2023 prices will probably be ahead of last year, and the gap should continue to widen for at least the next 2-3 months. This sort of ‘crossover’ in the price trend is, of course, extremely rare. It’s symptomatic of the volatility that’s been with us since Covid began.

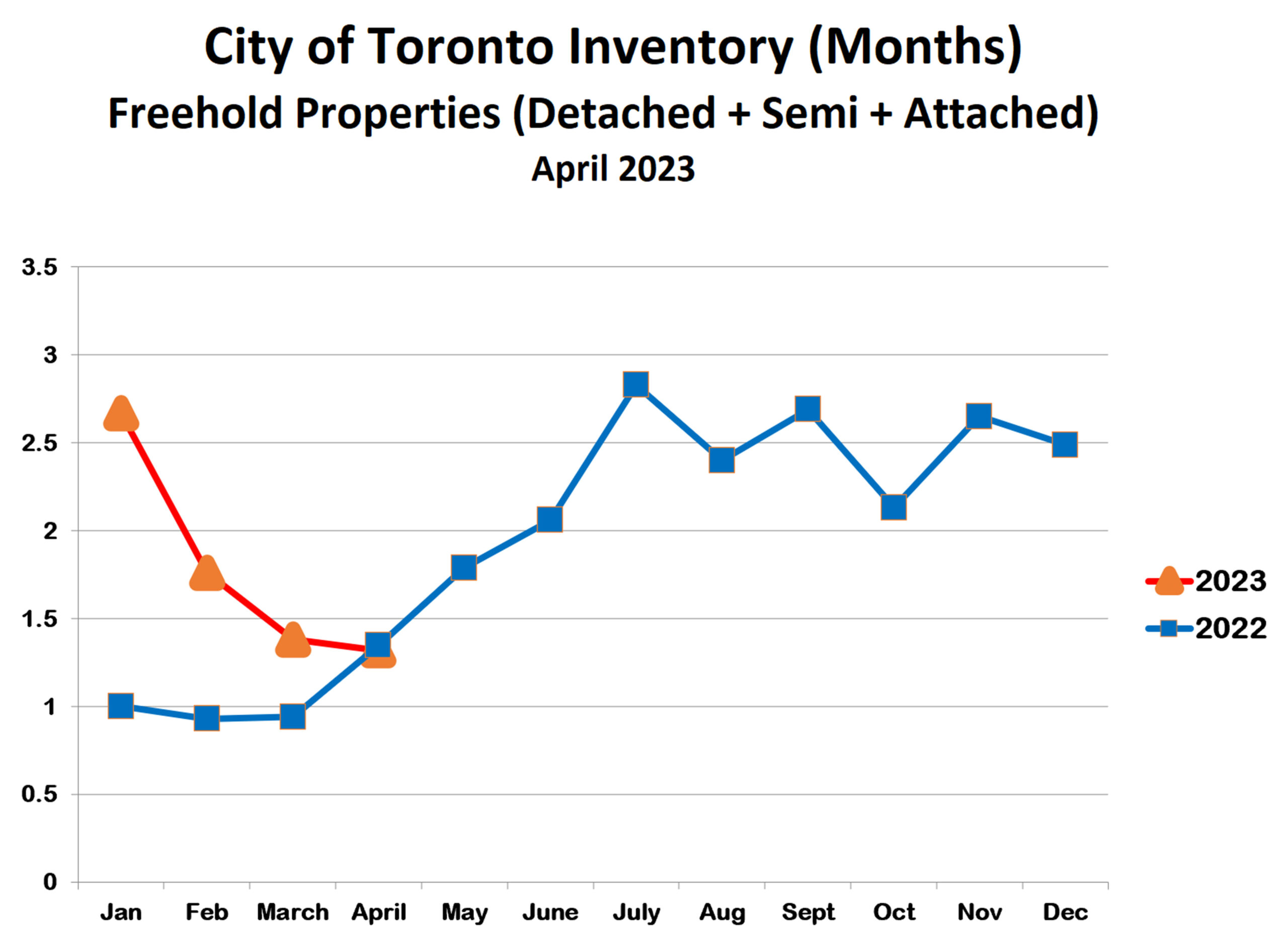

The inventory of houses for sale was about the same in April as it was in March. This hints once again that we are nearing peak activity for this year and may see a bit of a slowdown over the next 2-3 months. Curiously, the inventory in March was almost exactly the same as last March, mirroring the price chart.

Condominium Apartments

The trend for condos is similar to houses. As for houses, condo prices in May have caught up with last May, and a similar ‘crossover’ will probably keep condo prices above last year for at least a few months. The normal summer slowdown may keep prices from going much higher, however.

The inventory of condos for sale is following the same trend as houses. The inventory for April is about the same as in March, and exactly equal to last March. This is more evidence that a ‘leveling off’ of the condo market is in the cards for the next few months, similar to houses.

Bottom Line

The Toronto market has been getting stronger every month since January. However, we will probably see some slowing and leveling off over the next few months.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Toronto Prices Rising in April

04/24/23

April prices are higher than in March for both freehold and condo properties. Inventories are trending lower, and the Bank of Canada is no longer increasing interest rates, and so the strong market will likely continue through the rest of the spring.

Freehold Homes

House prices are about 4% higher in April as compared to March, and have recovered about 50% of the drop from last year’s peak to the second half plateau. If past is prologue, we can expect this trend to continue until early to mid June. After that, a somewhat slower market in July and August would be perfectly normal.

The inventory of homes for sale continues to fall steeply, and was under 1.5 months’ supply as of the end of March. This is deep in sellers’ market territory and closing in on last year’s low. This further supports the contention that the strong market has some staying power.

Condominium Apartments

Condo prices are up for the third straight month and are now back to where they were during the second half of last year. After a slow start this year, condo prices are now on a solid uptrend. As for houses, the condo market should remain strong through the rest of the spring.

Condo inventory is also falling steeply and is under 2 months’ supply as of the end of March. This isn’t quite as low as for houses, but is still well within sellers’ market territory. We should expect continued strength in condos at least until early/mid June, as for houses.

Bottom Line

The Toronto market has been gaining strength since the beginning of this year. While not as frenetic as early 2022, it’s very healthy and will probably remain so for some time.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Can You Raise a Family in a Condo?

04/03/23

While condos have become a popular option for many first-time home buyers in Toronto thanks to their relative affordability, not everyone is sure that a condo will be able to meet their needs. This is especially true among young families and buyers who are thinking about welcoming children in the near future.

Not only can a condo be a comfortable and convenient place for your family’s early years, but it can also be a helpful asset in landing a larger home down the line.

Here’s everything you need to know about family-friendly condo living in West Toronto.

Searching for the perfect condo to raise your family? Check out these posts from our blog for helpful tips.

- How Buying a Condo in West Toronto is Different Than Buying a House

- 3 Reasons Real Estate Transactions Fall Through and How to Avoid Them

- What to Look for in a Family Neighbourhood

Condos as a Stepping Stone

Getting into the housing market isn’t always easy – especially in Toronto. One of the great things about condos is that they provide an accessible gateway to homeownership.

Some buyers may wonder why they should consider buying a condo if their long-term goal is to own a full-sized house. It’s important to remember that a condo doesn’t necessarily need to be your forever home. Rather, it can make for a comfortable and enjoyable living space for you and your kids while you make your way up to something bigger.

Breaking the cycle of renting and building long-term equity for yourself is an essential step in charting your financial path – especially if you’ve got a family on the way. When the time comes to upsize to something bigger, your condo will be a high-value piece of real estate that you can leverage to get more from your next purchase.

Want to know more about the advantages of buying over renting? Click here to read our blog post on the topic.

Family Life Meets Condo Life

Regardless of how many kids you have (or are planning on having), one thing that all families will need from their home is space. With this in mind, it’s natural for prospective parents to be uncertain about whether or not a condo can meet their needs. While yes, condos are typically smaller in size compared to detached or semi-detached homes, they’re far more spacious than many buyers realize.

When it comes to finding the right home for you and your family, it’s all about your unique needs and aspirations. Luckily, condos aren’t designed to be one-size-fits-all. Across West Toronto, there is a wide selection of condo developments, each offering a vast range of floor plans and layouts. Whatever your “must haves” are in your first family home, there’s a good chance you’ll find a condo that checks off the boxes.

Options in West Toronto

Toronto’s west end features countless family-friendly neighbourhoods, many of which feature a range of spacious condo developments. With amazing schools, easy access to amenities, and a true sense of community, families can find everything they’re looking for and more in this part of the city. Neighbourhoods with a strong selection of family-friendly condo options include High Park, Mimico, and The Junction.

One of the benefits of raising a child in West Toronto is the proximity to parks and green spaces. With the city’s rapid growth, access to nature has become increasingly important for families. High Park, which is one of Toronto’s largest and most popular outdoor areas offers a wide range of activities for families, including hiking and walking trails, outdoor swimming pools, playgrounds, and even a zoo.

Want to know more about our favourite family-oriented communities in West Toronto? Check out these neighbourhood guides!

Finding a Condo That Works For You

Can you raise a family in a condo? Absolutely! That said, when it comes time to head to the market, there will be a lot to consider in ensuring the condo you buy actually meets your needs. Like any home purchase, you’ll want to work with an expert.

Smith Proulx Real Estate can help you find the perfect condo for your family’s early years. With decades of experience working in West Toronto, we know the local market like the back of our hands. After getting to know you, your family, and what you’re looking for in a home, we put our knowledge to work – helping you discover the perfect community and property.

Looking for the perfect condo to begin your next chapter? We can help you find it. Send us an email or call 416-769-6050 to get started.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Toronto Market Continues Strong in March

03/26/23

Freehold Houses (Detached/Semi-Detached/Attached)

Prices for houses in the City of Toronto are slightly lower in March than in February. If you think this looks like an echo of 2022, fear not. Prior to Covid, and all the ensuing volatility and unpredictability, it was normal to see a price dip in March during a hot spring market. Last year, prices might well have continued upward in April but for the onset of a steep rise in interest rates. The higher rates triggered a correction that took prices down by about 20% over 3 months. This year, the market has adjusted to the higher rates and so the spring market should remain strong over the next couple of months. And, based on pre-Covid history, prices could well resume their rising trend. It’s unlikely that we will revisit last year’s high, but we could retrace at least half of the loss in the second half.

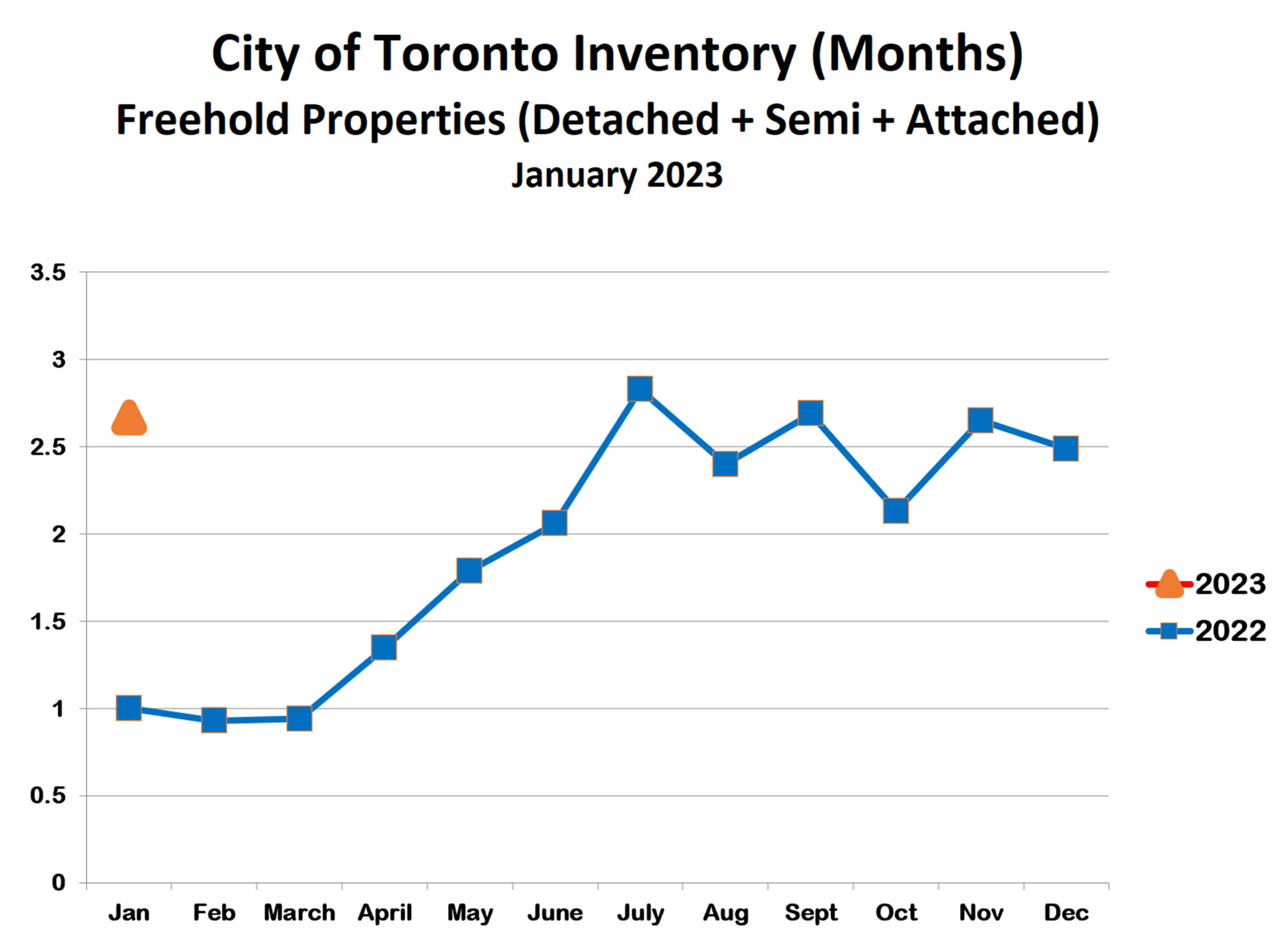

The strong market for houses is being supported by continued low inventory of homes for sale. Inventory in February was under 2 months’ supply, well into sellers’ market territory (though still higher than the crazy low inventory last spring). The preliminary estimate for March is for a slight increase as compared with February, consistent with the “March lull”.

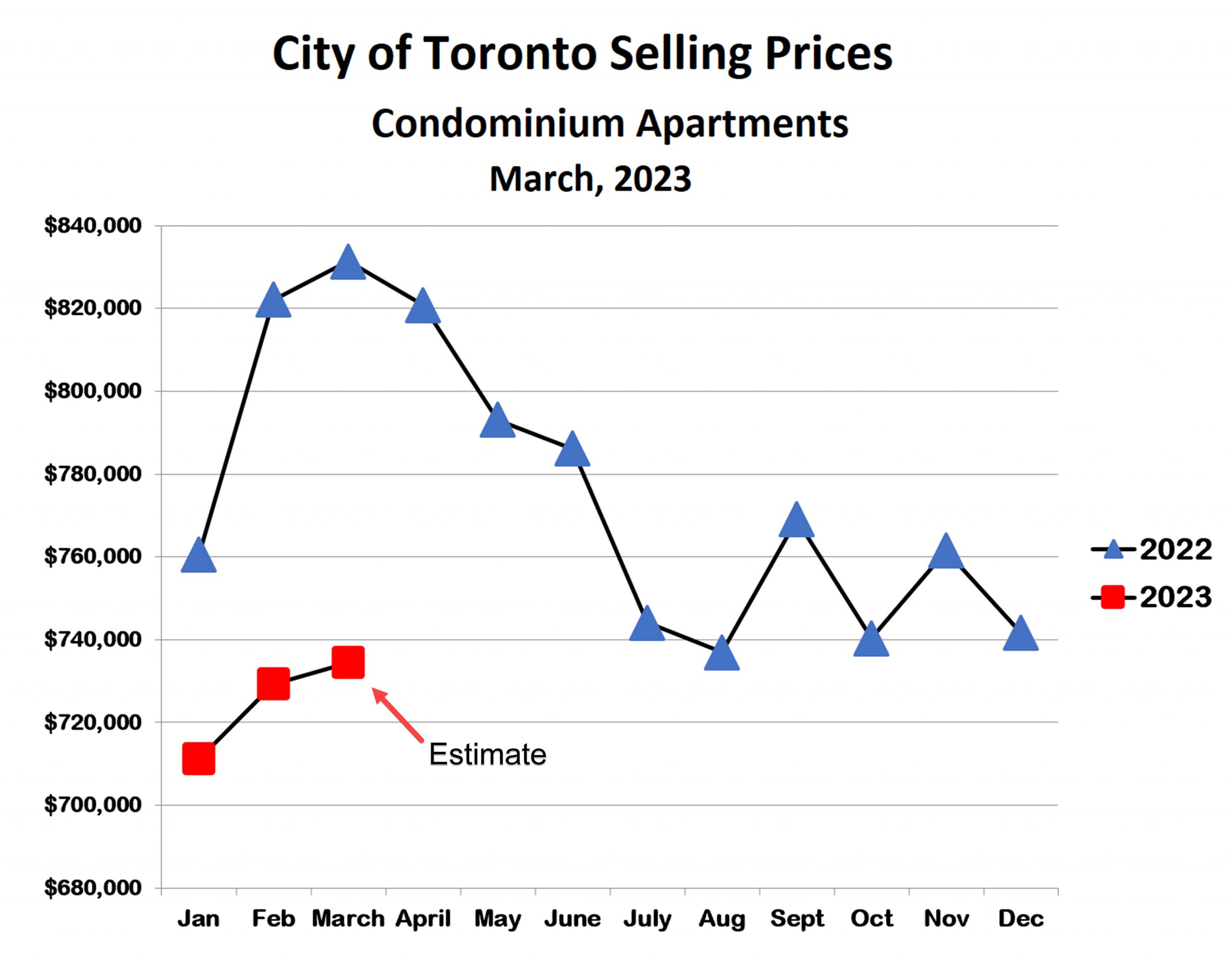

Condominium Apartments

Prices for condo apartments are continuing to improve in March. Like houses, condo prices fell between April and July of last year due to rising interest rates, and remained steady until the end of 2022. Prices fell again in January, and have recovered since then almost to last year’s lows.

Inventory levels have been a bit higher for condos than for houses since the middle of last year. This explains why the condo market, while healthy, is not quite as strong as for houses.

Bottom Line

We are enjoying a strong real estate market in the City of Toronto, and this strength should continue for the next couple of months.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Toronto Market Springs Back To Life

02/24/23

After a very quiet seven months, the Toronto market has become reinvigorated in February. After the bubble burst late last spring, prices bottomed out in July and remained essentially flat through January. This month, however, prices are rising and bidding wars are back.

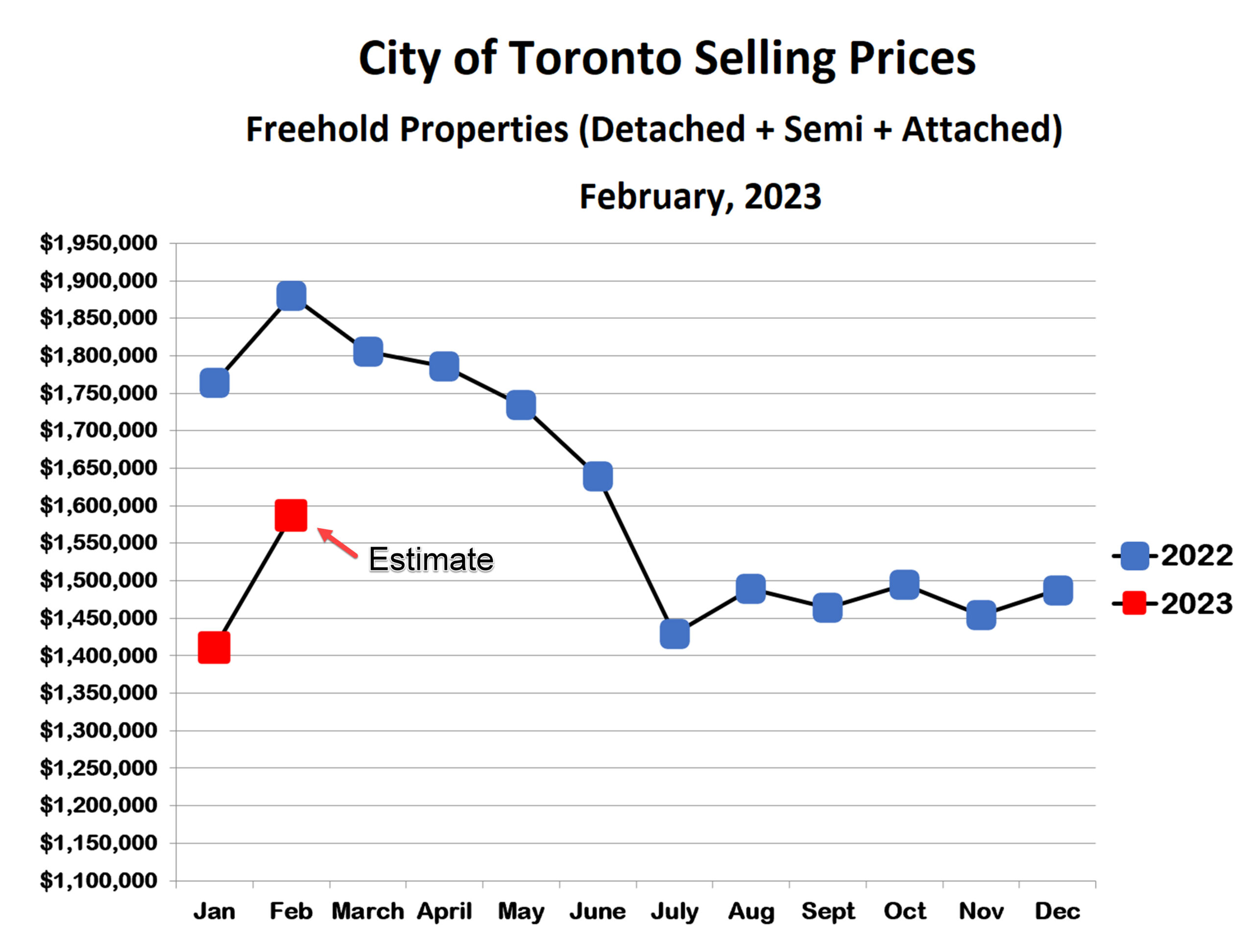

Freehold Houses (detached, semi-detached and attached)

After falling from a peak of almost $1.9 million last February, average freehold prices in Toronto fluctuated between $1.4 million and $1.5 million from July through January. This month, however, prices have broken above that narrow range. So far, average prices in February are up about 7% and will likely go a bit higher by the end of the month. Bidding wars are back, with selling prices often several hundred thousand dollars over asking. Even so, the prices are not crazy high like they were last year, it’s just that asking prices are being set very far below value. Clearly there is a ton of pent-up demand for houses. Buyers were somewhat hesitant over the past few months, concerned that prices might fall further. Now, however, they seem to feel that the correction is truly over.

The inventory of freehold houses for sale mirrored selling prices over the past year. From about 1 month of supply early last year, inventory rose as the bubble broke, reaching almost 3 months’ supply in July. From July through January, inventory fluctuated between 2 and 3 months’s supply, reflecting a balanced market. Inventory is almost certainly falling in February given the strong uptick in prices.

Condominium Apartments

Average condo prices in Toronto also fell last spring, from a high of about $830,000 in March to a low of just under $740,000 in August. After bouncing around in the $740,000-$770,000 range from August through December, prices then fell to about $710,000 in January. February prices have bounced back strongly, however, and are now back inside the July-December range.

Condo inventory levels increased from under one month early last year to over 3 months as the bubble collapsed. Inventory remained in the 3.0-3.5 month range from July through December, somewhat higher than freehold but still a balanced market. In January, inventory increased to more than 4 months, which is buyers’ market territory. No doubt inventory is falling in February as prices rise.

I can think of two possible reasons for the relative weakness of the condo as compared with houses. First, higher interest rates are likely having a larger impact on buyers in the lower price ranges. Many of these are first time buyers struggling to save a down payment and to meet the tougher-than-ever mortgage stress test rules. Second, many condos are rental properties purchased by homeowners investing in a second property. Rising interest rates are putting a lot of financial pressure on many of them and, if push comes to shove, they will sell the rental condo before they will sell their home. This could be contributing to the higher inventory of condos for sale.

Bottom line: the Toronto real estate market is strong right now, and the momentum should continue through the spring. The forecast for later this year is more uncertain. The lagging effects of higher interest rates on the economy may be more strongly felt in the second half, and it’s unclear how this will impact the real estate market.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

5 Reasons Downsizing is Easier Than You Think

02/09/23

Downsizing is a big decision, especially if you’re moving on from a home you’ve spent many years in. Like any home sale, it’s an often emotional process, but that doesn’t mean it doesn’t also have a ton of advantages.

If you’re thinking about downsizing your home but feel nervous or hesitant about the process, you’re not alone. As long-serving real estate agents, we’ve worked with our fair share of clients who aren’t sure where to start with downsizing. Thankfully, we have the experience, know-how, and resources, to make the process fun and straightforward.

Here are five reasons why downsizing in West Toronto is easier than you think.

Thinking about downsizing from your family home? Stay up-to-date on local market activity by signing up for our monthly newsletter! Click here to subscribe.

1. You Can Work With a Full-Service Agent

Downsizing is a big life change with a lot of moving parts. However, you don’t need to go at it alone. Like any real estate goal, the best place to start is with an experienced agent. Even better, look for an agent who specializes in supporting downsizers and can provide a full-service, end-to-end experience.

At Smith Proulx, we’ve got downsizing down to a science. We believe in providing compassionate, full-service support from beginning to end. Whether you are looking to begin your downsizing journey today or are thinking about the future, our team can help you achieve a smooth process with great results.

2. There Are Countless Options For Your Next Home

One of the best parts of downsizing in West Toronto is the wide range of options you will have for your next home. In addition to the area’s amazing neighbourhoods, great walkability, and strong transit access, there is also an abundance of housing options for buyers seeking a small yet comfortable living space.

You’ll find everything from sophisticated townhomes to existing condo buildings with generously-sized units and modern, amenity-rich pre-construction developments. Or, if you’re thinking about renting in the next chapter of your life, many historic homes in West Toronto have been converted to two and three-unit apartments.

Looking for helpful resources that may support your downsize? Check out these blog posts.

- 3 Great West Toronto Neighbourhoods For Downsizers

- Selling After a Divorce: Options & Pathways

- How Buying a Condo in West Toronto is Different Than Buying a House

3. Decluttering is Already Part of The Process

One factor of downsizing that homeowners can feel nervous about is decluttering. At a glance, the process of sorting through belongings and deciding what to keep, what to donate, sell or throw away, and what to move into storage can seem overwhelming. However, it’s typically an easier process than most people realize – and it can also feel cathartic!

One of the nice parts of decluttering is that you can start as early as you like, even before you’ve listed your home. Each month, take some time to go through your home and make note of items that you know won’t be coming with you to your next one. As you begin the process of reducing your belongings, you’re actually making your move easier as you’ll have less to bring with you on moving day.

4. You’ll Have Greater Buying Power

Downsizing is typically a two-step process. First, selling your existing home, then finding and buying your next space. One of the unique advantages that downsizers have during the buying process is greater buying power.

In most cases, your existing home will carry a higher market value than your next home simply because it’s larger. This price gap provides you with a stronger buying budget after you sell. As a result, you’ll have more flexibility in buying a smaller space than you would if you bought a home with similar square footage to yours. This can make the process of finding the perfect space for your next chapter much easier.

Successfully selling your home is the foundation for a favourable downsizing process. For more insights about optimizing the sale of your home, explore these blog posts.

- The Power of Staging a Home to Sell

- How to Sell Your Toronto Home in a Balanced Market

- Selling in West Toronto: Our Philosophies

5. You Save Time (and Money) Long-Term

Nine times out of ten, strategically downsizing your home is about improving your lifestyle. With less space to maintain and clean, downsizing allows you to free up more time in your schedule for the things that you enjoy. Additionally, smaller homes typically have less carrying costs. Whether it’s home insurance, repairs, upgrades, utilities or other home expenses, downsizing can help you cut down on costs organically.

Looking for a seamless downsizing process that can help you enter the next chapter of your life with ease? We’re here to help. Send us an email or call 416-769-6050 to get started.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!

Incentives & Tax Breaks First Time Buyers Should Know About

01/27/23

Is buying a house in Toronto one of your goals for the upcoming year? If so, it’s hard to imagine a more exciting milestone! Not only will you have made an excellent investment in your financial future, but you’ll have a place of your own in one of Canada’s top cities. As thrilling as the idea may be, a great deal of planning is needed to make it happen.

While the cost of homeownership in Toronto is above average, both the federal and provincial governments have several incentives in place to help first-time buyers achieve their goals. In this article, we’ll take a deep dive into these programs, what they mean, and how to qualify for them.

What Stops First-Time Buyers?

First, let’s consider what stops people from buying their first home. For many, the biggest deterrent is the ability to come up with a down payment. On any property over $1 million, you need at least 20%, or $200,000 upfront. At that amount, it’s easy to see why so many people have put off buying a house!

However, coming up with that down payment is much easier now that housing prices are down. The moment a property drops below the $1 million mark, the rules change, and you need less upfront for your purchase. Here’s how it works:

The required down payment is now 5% of the first $500,000, which works out to $25,000. Then, you need 10% of the remaining amount.

For example, imagine buying a $700,000 condo. You need $25,000 on the first $500,000. The remainder works out to $200,000, of which you need 10%, or $20,000.

When all is said and done, your down payment becomes more accessible at $45,000 ($25,000 + $20,000). And by taking advantage of government incentives, buying your first house becomes even easier.

The more information you have before buying your first house, the better prepared you’ll be. Here are some other posts you may find useful:

- How Buying a Condo in West Toronto is Different Than Buying a House

- How to Maximize Your First Home Without Going Over Budget

- 3 Reasons Real Estate Transactions Fall Through (and How to Avoid Them)

The First-Time Home Buyer’s Incentive

Under this plan, the federal government puts up as much as 5% of your down payment on a resale property. If you decide to buy a new build, they will pay as much as 10% towards your purchase. Of course, there is a catch. The government is not giving away money for the sake of being generous.

Participating in the First Time Home Buyer’s Incentive gives them part ownership in your home. Eventually, you will have to repay the original amount of the loan plus a maximum of 8% of the increase in the property value per year.

If the house drops in value, you will repay the principal minus a maximum of 8% of the loss.

To qualify for this program in Toronto, you must:

- Have a qualifying income of no more than $150,000.

- Your loan cannot be more than 4.5 times your qualifying income, which works out to a maximum of $675,000. As you can imagine, this stipulation limits your purchasing options, unless you have significant funds for a down payment.

- You must be a Canadian citizen or a permanent resident.

- The home must be your primary residence and not an investment property.

Finding the right home that fits all these guidelines can be challenging. However, it’s worth the search because this incentive can significantly lower the barrier to entry of buying your new home. In addition, by having more funds for your down payment, your monthly carrying costs will also be lower.

Home Buyer’s Plan

Have you been diligently saving money into a registered retirement savings plan (RRSP)? If so, you may already have access to a down payment or at least a significant part of it. Under the Home Buyer’s Plan, you can withdraw as much as $35,000 to put toward your purchase. As long as you repay this amount within 15 years, there will be no tax penalty.

How do you qualify for this program?

- You must be a Canadian citizen or resident.

- You must have a written agreement to purchase a qualifying home.

- The home must be your primary residence.

- You have not lived in a home you or a partner owned for four years or more.

If you’re buying a home with a partner who is also a first-time buyer, this plan gets even better. Both of you can apply, which means you can pull a total of $70,000 as your down payment.

So many neighbourhoods, so many choices! How do you decide on the location for your first home in Toronto? A few of our community posts might help. You’ll find them all right here.

Land Transfer Tax Refund for First-Time Buyers

Aside from the down payment, the provincial and municipal land transfer tax is another expense that makes buying a home challenging for first-time buyers. Unlike other closing costs, you cannot roll this tax into your mortgage, meaning you must have the funds upfront. Fortunately, first-time buyers can apply for both a municipal and provincial Land Transfer Tax Refund. Together, these can save you up to $8,475, making the barrier to entry much easier to overcome.

What do you need to plan a successful purchase? You’ll find a few helpful tools and resources below:

First-Time Home Buyer’s Tax Credit

Lastly, you can find some relief with the First Time Home Buyer’s Tax Credit. Under the new budget, this $10,000 credit could result in a $1,500 reduction in your total tax owing after purchasing a home. It may not seem like much, considering how much it costs to buy a house in Toronto. Still, an extra $1,500 could go a long way towards recouping your moving expenses or helping you decorate your brand-new home.

Ready to find your dream home in West Toronto? Our end-to-end buying services can help you reach your goals. Send us an email or call 416-769-6050 with any questions you have today.

Sign Up For Our Newsletter

Looking for more great real estate content? Get it delivered to your inbox with our newsletter!